Hisense Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisense Bundle

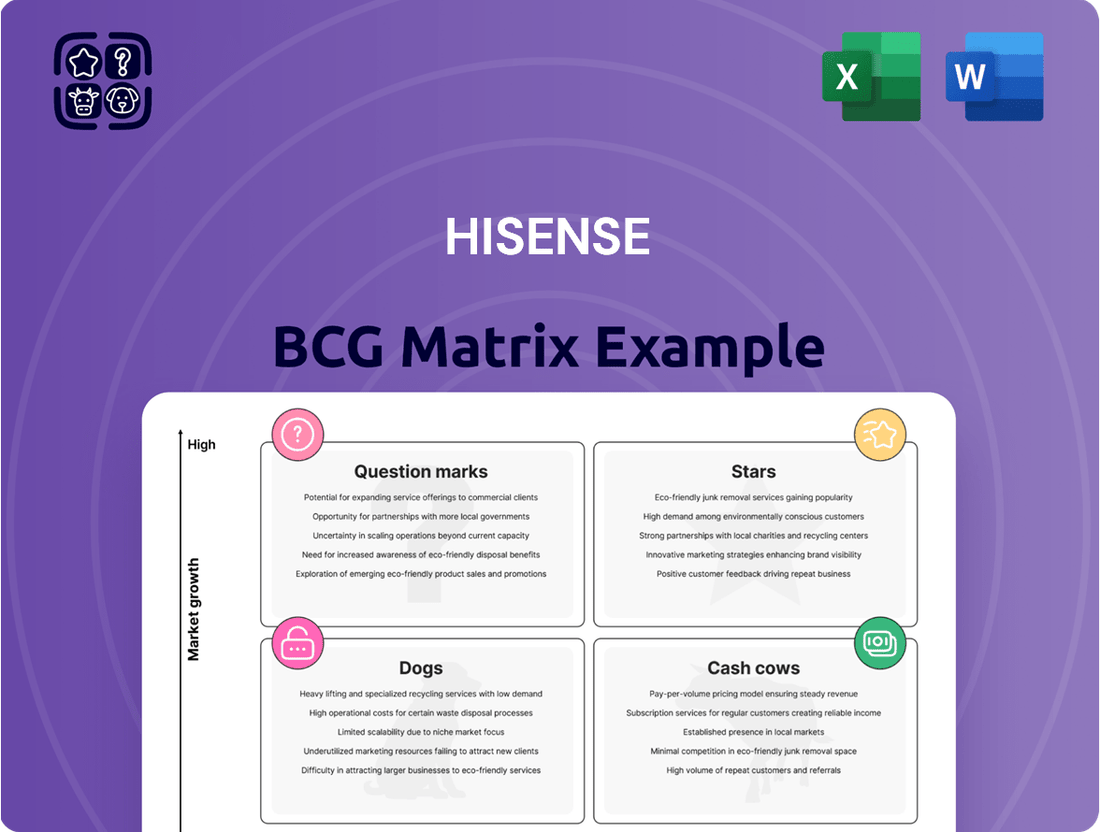

Uncover the strategic positioning of Hisense's product portfolio with our insightful BCG Matrix preview. See which products are market leaders and which require careful consideration.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

The complete BCG Matrix reveals exactly how Hisense is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Hisense dominates the ultra-large screen TV market, boasting a commanding presence in the 100-inch and above segment. This leadership is underscored by its impressive market share, capturing 63.4% of global 100-inch TV shipments in Q3 2024 and a significant 56.7% of the 100-inch+ market in Q1 2025.

This strong performance highlights Hisense's strategic positioning in a high-growth, high-value market. The demand for immersive viewing experiences, coupled with Hisense's advanced ULED Mini-LED and AI technologies, fuels this segment's expansion and Hisense's continued success.

Hisense's Laser TVs are a clear Star in its BCG Matrix. The company has held the top global spot for six consecutive years, a testament to its innovation and market penetration in this premium segment.

In 2024, Hisense secured an impressive 65.8% global market share for Laser TVs, a figure that climbed even higher to 69.6% in the first quarter of 2025. This dominance in a rapidly expanding niche highlights the product's strong growth potential and Hisense's commitment to maintaining leadership in ultra-large screen entertainment solutions.

Hisense's MiniLED TVs are a clear star in their product portfolio. The company achieved a remarkable 29.3% global volume share in the MiniLED TV market during the first quarter of 2025. This strong performance highlights significant consumer confidence and Hisense's commitment to advancing backlight technology.

The MiniLED TV sector is experiencing robust expansion, making Hisense's products well-positioned for continued market penetration. This segment represents a key growth driver for the company within the premium television market.

Overall Global TV Market Position

Hisense's TV division is a shining example of a Star in the BCG Matrix. The company has consistently held the second spot globally for total TV shipments from 2022 right through the first quarter of 2025. This impressive streak represents seven consecutive years of growth, highlighting their expanding influence in a competitive market.

In 2024 alone, Hisense captured a significant 14% share of the global TV shipment market. This robust performance indicates they are actively closing the distance with the leading competitor, solidifying their position as a major player. Their sustained growth and strong market share firmly place their TV business in the Star category.

- Global TV Shipment Ranking: Consistently No. 2 from 2022 to Q1 2025.

- Growth Trajectory: Seven consecutive years of increasing shipments.

- 2024 Market Share: Achieved 14% of the global TV shipment market.

- Competitive Positioning: Actively narrowing the gap with the market leader.

AI-Powered Premium TVs

Hisense is significantly boosting its premium TV offerings by embedding sophisticated AI, exemplified by their ULED Mini-LED 100-inch models featuring the Hi-View AI Engine. This strategic push into AI-enhanced visuals aims to captivate consumers seeking superior picture quality and intelligent viewing experiences. The company's investment in AI for high-end televisions aligns with market trends favoring advanced smart home entertainment solutions.

These AI capabilities translate into tangible benefits for users, such as heightened picture realism and dynamic optimization tailored to diverse viewing scenarios, including sports and gaming. This focus on delivering an elevated user experience in the premium segment is crucial for maintaining and growing market share. Hisense's commitment to AI innovation in its top-tier products solidifies their position in the 'Star' category of the BCG matrix.

- AI Integration: Hisense's ULED Mini-LED TVs leverage the Hi-View AI Engine for enhanced performance.

- Enhanced Viewing: AI optimizes picture realism, sports, and gaming for a superior experience.

- Market Demand: Targets the growing consumer interest in smart, high-performance entertainment.

- BCG Status: This focus on AI in premium TVs firmly places them in the 'Star' quadrant.

Hisense's Laser TVs are a clear Star in its BCG Matrix, demonstrating high market share in a growing category. The company has led the global market for six consecutive years, solidifying its dominance. In 2024, Hisense achieved a 65.8% global market share for Laser TVs, which rose to 69.6% in Q1 2025, indicating strong growth and continued leadership in this premium segment.

Hisense's MiniLED TVs also shine as Stars, capturing a significant 29.3% global volume share in Q1 2025. This strong performance reflects increasing consumer trust and Hisense's dedication to advancing backlight technology, positioning these products for sustained market penetration in the expanding premium TV sector.

The overall Hisense TV division is a standout Star, consistently holding the second global position for total TV shipments from 2022 through Q1 2025. This streak of seven consecutive years of growth, including a 14% global market share in 2024, shows Hisense actively closing the gap with the market leader and reinforcing its status as a major player.

Furthermore, Hisense's strategic integration of AI, such as the Hi-View AI Engine in its ULED Mini-LED TVs, further solidifies its Star status. This focus on advanced features caters to consumer demand for superior, intelligent entertainment, driving growth in the premium TV market.

| Product Category | BCG Matrix Status | Key Performance Indicators (2024-Q1 2025) | Growth Drivers |

| Laser TVs | Star | 65.8% global market share (2024), 69.6% (Q1 2025); 6 consecutive years of global leadership | Innovation, premium segment demand |

| MiniLED TVs | Star | 29.3% global volume share (Q1 2025) | Advanced backlight technology, consumer confidence |

| Overall TV Business | Star | No. 2 global TV shipments (2022-Q1 2025); 7 consecutive years of growth; 14% global market share (2024) | Market share gains, consistent growth |

| AI-Enhanced Premium TVs | Star | Integration of Hi-View AI Engine | Superior picture quality, intelligent viewing experiences, smart home trends |

What is included in the product

This BCG Matrix overview provides strategic insights for Hisense's product portfolio, highlighting units to invest in, hold, or divest.

A clear, visual representation of Hisense's product portfolio, the BCG Matrix simplifies complex business unit performance, easing the burden of strategic decision-making.

Cash Cows

Hisense's refrigerator division, especially in established markets like the Americas and Europe, is performing exceptionally well.

In the first half of 2024, sales in the Americas jumped a remarkable 97.3%, while European revenue saw a healthy 16.9% increase. These figures highlight Hisense's strong footing in mature markets, translating into consistent and significant cash generation.

Hisense's washing machine division is a strong Cash Cow, holding the third spot globally for shipments originating from China and demonstrating impressive growth among the top 10 international brands.

This segment's success is further evidenced by a substantial rise in overseas revenue, with the European white goods sector alone experiencing a 35% surge in 2024.

This performance indicates a solid market share within a mature but highly profitable industry, consistently generating stable financial returns for Hisense.

Hisense's central air conditioner division stands as a prime example of a Cash Cow within its business portfolio. Despite a somewhat tough domestic market, this segment demonstrated consistent sales increases in China.

Remarkably, in 2024, Hisense's domestic market share for multi-split systems surpassed 20%, solidifying its leadership. This robust position in a well-established market guarantees a stable and predictable generation of funds for the company.

Conventional Mid-Range TVs

Conventional mid-range TVs represent a significant portion of Hisense's business, contributing steadily to its overall performance. In 2024, Hisense shipped a total of 29.14 million TV units globally, with a substantial volume falling into this category.

These models benefit from Hisense's strong brand recognition and extensive distribution channels, ensuring reliable sales in a mature market. This consistent demand translates into predictable cash flow for the company.

- Consistent Revenue: Mid-range TVs provide a stable revenue stream due to their broad appeal and established market presence.

- Brand Leverage: Hisense's established brand equity allows it to effectively compete and maintain sales volumes in this segment.

- Distribution Network: The company's robust distribution network ensures these products reach a wide customer base, driving consistent sales.

- Cash Flow Generation: The predictable demand and established market position make these models reliable cash cows, funding other business areas.

Core Home Appliances in Domestic China

Hisense Home Appliances Group saw its domestic revenue climb by 9.83% in 2024, a strong performance that significantly bolstered its financial health.

Core home appliances, particularly household air conditioners and refrigerators, dominate the domestic Chinese market for Hisense. This segment enjoys a substantial market share, translating into consistent and reliable profit generation for the company.

- Domestic Revenue Growth: Hisense's domestic revenue increased by 9.83% in 2024.

- Key Products: Household air conditioners and refrigerators are the primary drivers.

- Market Position: These products hold a high market share in China.

- Profitability: The segment provides a stable and significant profit stream.

Hisense's established product lines, such as conventional mid-range TVs and core home appliances like air conditioners and refrigerators in the domestic Chinese market, function as its Cash Cows. These segments benefit from strong brand recognition and extensive distribution networks, ensuring consistent sales and predictable cash flow. For instance, Hisense shipped 29.14 million TV units globally in 2024, with a significant portion in the mid-range category, while domestic revenue for Home Appliances grew by 9.83% in the same year, driven by these key products with substantial market share.

| Product Segment | 2024 Performance Highlight | BCG Matrix Role |

| Conventional Mid-Range TVs | 29.14 million units shipped globally | Cash Cow |

| Household Air Conditioners (Domestic) | High market share, stable profit generation | Cash Cow |

| Refrigerators (Domestic) | High market share, stable profit generation | Cash Cow |

Full Transparency, Always

Hisense BCG Matrix

The preview you're currently viewing is the identical, fully finalized Hisense BCG Matrix document you will receive immediately after your purchase. This means no watermarks, no incomplete sections, and no demo content; just the comprehensive, professionally formatted report ready for your strategic analysis and decision-making.

Dogs

Hisense's older model mobile phones likely fall into the 'Dog' category of the BCG Matrix. Despite Hisense's presence in the mobile market, these devices struggle to capture significant global market share or experience substantial growth. The mobile phone sector is intensely competitive and saturated, making it difficult for older models to gain traction.

These older Hisense phones are expected to generate minimal revenue. Consequently, they require very little strategic investment from the company. Their low market share and low growth prospects firmly place them in the 'Dog' quadrant, suggesting they are not a strategic focus for future development.

Hisense's basic feature phones, often referred to as non-smart mobile devices, are positioned within a market segment that is experiencing significant decline. These devices cater to a shrinking consumer base, with global shipments of feature phones projected to continue their downward trend, falling below 100 million units annually in the coming years. Their limited functionality and the widespread adoption of smartphones make them increasingly irrelevant, leading to minimal revenue generation and low profit margins for Hisense.

Producing these legacy devices presents a challenge for Hisense, as they require ongoing investment in manufacturing and distribution without offering substantial growth potential. The returns on these products are likely to be very low, and they could even be considered cash traps. This is due to the lack of a competitive edge and diminishing market relevance, diverting resources that could be better allocated to more promising product categories within Hisense's portfolio.

Legacy, non-smart home appliances in saturated markets, like traditional refrigerators or washing machines, are often Hisense's Dogs. These products, lacking modern connectivity and advanced energy-saving features, face intense competition in developed economies where consumers increasingly demand smarter, more efficient options. Their appeal is diminishing, leading to slower sales and reduced profitability.

In 2024, the global home appliance market, while growing, sees a significant shift towards smart and energy-efficient models. For instance, the market for smart home appliances was projected to reach over $100 billion globally by 2024, indicating a strong consumer preference for innovation. This trend directly impacts legacy products, which may see their market share shrink as they fail to keep pace with technological advancements and evolving consumer expectations.

Specific Niche Products with Limited Global Appeal

Specific niche products with limited global appeal within Hisense's extensive offerings likely reside in the Dogs quadrant of the BCG matrix. These are products that haven't received substantial investment in innovation or global market penetration, leading to minimal market share and stagnant growth.

These niche items, while potentially profitable on a small scale, represent a drag on resources without significant future potential. Their low market share and low growth rate are characteristic of this category.

- Low Market Share: These products likely capture a very small fraction of their respective niche markets.

- Low Growth Rate: Demand for these items is not expanding significantly, indicating a mature or declining market.

- Minimal Profitability: They may break even or generate only marginal profits, requiring careful cost management.

- Resource Drain: Continued investment in these products might divert resources from more promising areas of Hisense's portfolio.

Underperforming Domestic Product Segments

While Hisense's international operations are a significant growth engine, its domestic performance in China presents a different picture. In 2024, Hisense Home Appliances experienced a slight dip of 2.12% in domestic transaction income.

This suggests that some product segments within the intensely competitive Chinese market may be struggling. These underperforming areas could be consuming valuable resources without generating proportionate returns, fitting the description of a 'Dog' in the BCG matrix.

- Domestic Income Decline: Hisense Home Appliances reported a 2.12% decrease in Chinese domestic transaction income for 2024.

- Competitive Pressure: The Chinese market is highly competitive, making it challenging for all product segments to maintain strong growth.

- Resource Allocation: Underperforming segments may tie up capital and management attention that could be better utilized elsewhere.

Hisense's older mobile phones, particularly basic feature phones, are firmly in the 'Dog' category. These devices operate in a declining market segment, with global feature phone shipments expected to fall below 100 million units annually by 2025, making them a low-growth, low-revenue product. Their limited functionality and the dominance of smartphones render them increasingly irrelevant, leading to minimal profit margins.

Legacy home appliances that lack smart features or advanced energy efficiency also fall into this quadrant. In 2024, the smart home appliance market's projected over $100 billion global valuation highlights the consumer shift away from traditional models. These older Hisense appliances face intense competition and diminishing appeal, potentially becoming cash traps.

Niche products with limited global reach and minimal investment in innovation also characterize Hisense's Dogs. These items, while perhaps break-even, offer little growth potential and can divert resources from more promising ventures. This is further evidenced by Hisense Home Appliances' 2.12% dip in Chinese domestic transaction income in 2024, suggesting some domestic segments are struggling under competitive pressure.

| Product Category | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Older Model Mobile Phones | Low | Declining | Minimal | Divest or minimize investment |

| Legacy Feature Phones | Low | Declining | Minimal | Divest or minimize investment |

| Non-Smart Home Appliances | Low | Stagnant/Declining | Low | Divest or minimize investment |

| Niche Products (Limited Appeal) | Low | Stagnant/Declining | Minimal | Divest or minimize investment |

Question Marks

Hisense's foray into smart automotive technology, exemplified by innovations like laser holographic HUDs and panoramic projection displays showcased at CES 2025, positions it within a high-growth emerging market. This segment is characterized by rapid technological advancements and increasing consumer demand for connected and immersive in-car experiences.

As a relatively new entrant in this dynamic space, Hisense likely holds a low market share, characteristic of a 'Question Mark' in the BCG matrix. The company will need to invest heavily in research and development, strategic partnerships, and market penetration to capture a significant portion of this burgeoning market, which is projected to see substantial growth in the coming years.

Hisense's smart medical display solutions are positioned within the question marks category of the BCG matrix. This reflects the company's entry into a high-growth market driven by healthcare digitalization, a sector projected to see substantial expansion in the coming years.

While the potential is significant, Hisense's current market penetration in the specialized medical technology sector is likely minimal. This necessitates substantial investment in research and development, alongside dedicated market development strategies, to establish a competitive presence.

Hisense's 136-inch MicroLED display, showcased at CES 2025, signifies a bold move into the ultra-premium segment. This technology, while boasting immense growth potential for unparalleled viewing experiences, currently faces significant hurdles due to its infancy and high manufacturing expenses.

The extremely limited market penetration of these advanced MicroLED displays, despite their technological prowess, places them firmly in the question mark category. Hisense must commit substantial capital for research, development, and scaling production to drive down costs and foster wider consumer adoption.

Broader Smart City/Urban Governance Platforms

Hisense is actively building sophisticated urban governance platforms, leveraging its AI chipsets and big data capabilities. This strategic move targets the burgeoning smart city market, a sector poised for substantial long-term growth.

The company's focus on AI chipsets and big data analytics positions it to address complex urban challenges, from traffic management to public safety. This B2B sector represents a significant opportunity for Hisense, driven by increasing global urbanization and the demand for efficient city management solutions.

While the potential is immense, Hisense's current market share in this highly competitive and intricate arena is still in its nascent stages. Success will necessitate substantial strategic investments and the formation of key partnerships to navigate the complexities of urban governance systems.

- Market Growth: The global smart city market was valued at approximately $483.9 billion in 2023 and is projected to reach $1.17 trillion by 2028, growing at a CAGR of 19.5%.

- Hisense's Investment: Hisense has committed significant R&D resources to its AI and big data divisions, crucial for developing these advanced platforms.

- Competitive Landscape: Key competitors include companies like Huawei, Cisco, and IBM, which have established presences in the smart city infrastructure and governance space.

- Strategic Partnerships: Hisense is actively seeking collaborations with local governments and technology providers to integrate its solutions and gain traction.

New Market Entry for Core Appliances (e.g., Egypt facility)

Establishing a new facility in Egypt for core appliances positions Hisense to tap into the burgeoning North African and Levant markets. These regions present significant growth potential, with a combined population exceeding 200 million and increasing disposable incomes driving appliance demand.

While the long-term outlook is promising, Hisense's initial market share in these new territories will likely be low, characteristic of a 'Question Mark' in the BCG matrix. This necessitates considerable upfront investment in building brand awareness, establishing robust distribution networks, and adapting products to local preferences.

- Market Potential: North Africa and the Levant represent a substantial untapped market for consumer durables.

- Investment Required: Significant capital expenditure is needed for market entry, including manufacturing setup and marketing campaigns.

- Market Share Growth: Initial market share is expected to be low, with a strategic focus on aggressive growth to move towards 'Star' status.

- Risk Factor: High investment coupled with uncertain initial market acceptance places these ventures in the 'Question Mark' category.

Hisense's ventures into emerging high-growth areas like smart automotive technology and advanced medical displays represent classic 'Question Mark' scenarios. These segments, while offering substantial future potential, are characterized by low initial market share for Hisense and require significant investment in R&D and market development.

The company's strategic push into the smart city market and expansion into new geographical regions for core appliances also fall under the 'Question Mark' classification. These initiatives demand substantial capital and strategic partnerships to navigate competitive landscapes and build market presence.

Success in these 'Question Mark' areas hinges on Hisense's ability to effectively allocate resources, foster innovation, and execute market penetration strategies to convert potential into market leadership.

Hisense's strategic focus on these 'Question Mark' areas, such as smart city solutions and new market entries in North Africa, highlights a deliberate approach to capturing future growth opportunities despite the inherent risks and investment requirements.

| Initiative | Market Growth Potential | Hisense Market Share | Investment Requirement | BCG Category |

| Smart Automotive Technology | High (e.g., connected car market growth) | Low | High (R&D, market penetration) | Question Mark |

| Smart Medical Displays | High (healthcare digitalization) | Low | High (R&D, market development) | Question Mark |

| Ultra-Premium MicroLED Displays | High (premium entertainment) | Very Low | Very High (manufacturing, cost reduction) | Question Mark |

| Urban Governance Platforms | High (smart city market growth) | Low | High (AI, big data, partnerships) | Question Mark |

| North Africa Appliance Market | High (growing disposable income) | Low | High (CAPEX, marketing) | Question Mark |

BCG Matrix Data Sources

Our Hisense BCG Matrix is informed by comprehensive market data, including sales figures, market share reports, and industry growth projections, ensuring accurate strategic positioning.