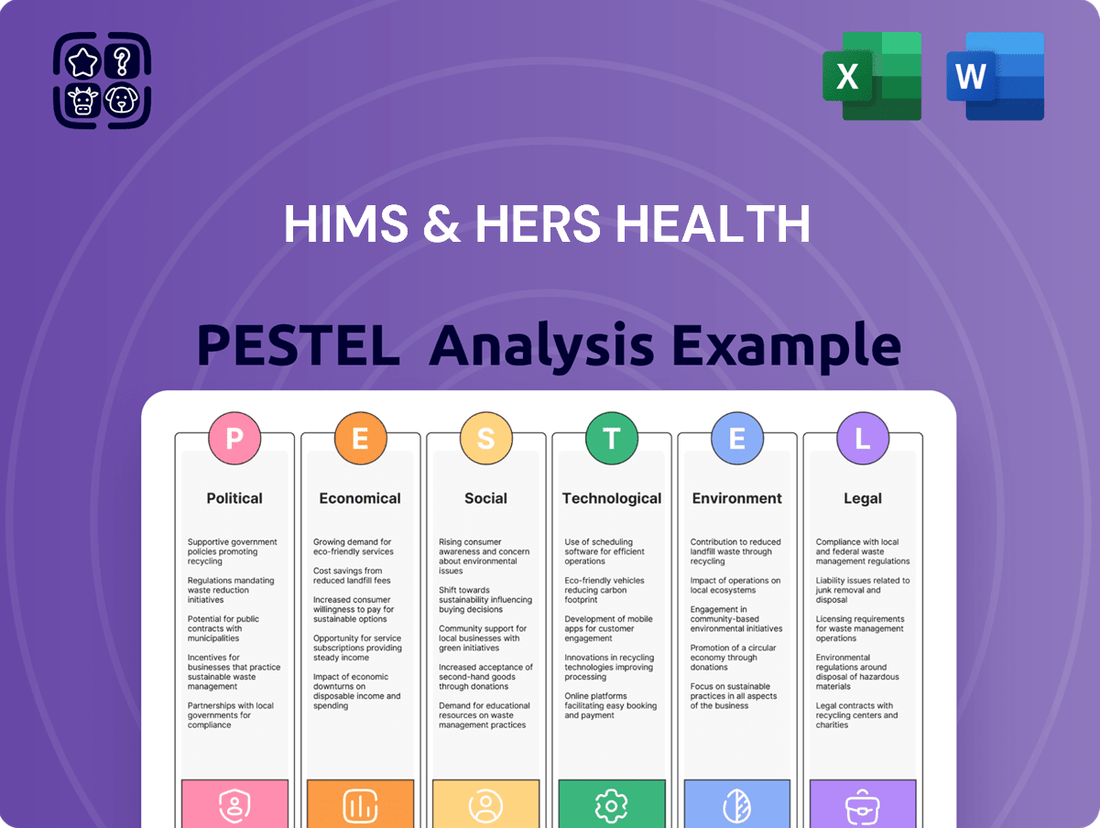

Hims & Hers Health PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hims & Hers Health Bundle

Navigate the complex external forces shaping Hims & Hers Health's trajectory. Our PESTLE analysis delves into political, economic, social, technological, legal, and environmental factors, offering a comprehensive view of the opportunities and challenges ahead. Understand how these shifts could impact your investment or competitive strategy. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government regulations are a critical factor for Hims & Hers, directly shaping how they can deliver telehealth services and manage prescriptions. The evolving landscape of telehealth, especially post-pandemic, means companies like Hims & Hers must constantly adapt to new rules.

The expiration of certain pandemic-era telehealth waivers, particularly for Medicare, could affect reimbursement and patient access for Hims & Hers. This creates uncertainty regarding the financial viability of serving a broader patient base through virtual care.

The Drug Enforcement Administration's (DEA) decision to extend flexibilities for prescribing controlled substances via telehealth until the end of 2025 is a significant positive for Hims & Hers. This extension allows them to continue offering treatment for a wider range of conditions that may require such prescriptions, directly impacting their service offerings and revenue potential.

The U.S. Food and Drug Administration's (FDA) evolving stance on compounded medications, particularly for high-demand treatments like GLP-1 drugs for weight management, represents a substantial political and regulatory hurdle for companies like Hims & Hers Health. The FDA has made it clear that mass compounding is generally prohibited unless specific authorization is granted, creating uncertainty for business models reliant on such practices.

Hims & Hers has encountered direct scrutiny and legal challenges concerning its distribution of compounded versions of already FDA-approved medications. This regulatory pressure was underscored by the termination of a key partnership with Novo Nordisk, a move attributed to concerns over what Novo Nordisk termed illegal mass compounding, directly impacting Hims & Hers' operational strategy and market access.

Data privacy legislation significantly impacts Hims & Hers' operations. The Health Insurance Portability and Accountability Act (HIPAA) is foundational, requiring secure handling of patient health information, crucial for their telehealth services. This means robust data encryption and secure communication channels are non-negotiable.

Beyond HIPAA, a growing number of states are enacting their own health data privacy laws. For example, Washington, Nevada, and Connecticut have introduced legislation that extends privacy protections to consumer health data not explicitly covered by federal regulations. These laws often mandate explicit consent for data sharing and demand stringent data security measures, adding complexity for companies like Hims & Hers that operate across multiple states.

Healthcare Reform Initiatives

Broader healthcare reform discussions, particularly those focusing on universal access and affordability, present a dual-edged sword for telehealth providers like Hims & Hers. Policies designed to expand care into underserved regions, such as rural areas, could significantly boost demand for their services.

For instance, the 2024 Medicare Physician Fee Schedule proposed adjustments that could impact telehealth reimbursement, signaling ongoing shifts in how these services are valued. These changes, while not directly targeting Hims & Hers' model, reflect a broader political landscape influencing the healthcare reimbursement environment.

- Increased Telehealth Adoption: Government initiatives promoting telehealth, especially in response to public health needs, can accelerate patient and provider adoption.

- Reimbursement Model Scrutiny: Political debates around healthcare costs and government spending may lead to closer examination and potential changes in how telehealth services are reimbursed.

- Regulatory Landscape Evolution: Evolving regulations concerning data privacy, cross-state licensing for healthcare providers, and prescription delivery directly affect Hims & Hers' operational capacity and reach.

International Regulatory Landscape

As Hims & Hers expands internationally, navigating varied telehealth regulations is key. For instance, its planned entry into Canada and the acquisition of ZAVA for European expansion mean adapting to distinct rules for online prescriptions and patient data. These differences can significantly impact operational models and compliance costs.

The global regulatory environment presents a complex patchwork for telehealth providers. Hims & Hers must contend with varying data privacy laws, such as GDPR in Europe, which has strict requirements for handling personal health information. Prescription laws also differ widely, affecting how medications can be dispensed and delivered across borders.

- GDPR Compliance: Hims & Hers must adhere to General Data Protection Regulation standards for data handling in its European operations, impacting data storage and transfer protocols.

- Prescription Legality: Regulations on prescribing medications online vary by country, requiring Hims & Hers to ensure its medical professionals comply with local laws for each market.

- Telehealth Frameworks: Each nation has its own licensing and operational frameworks for telehealth services, necessitating tailored approaches for market entry and service delivery.

The political landscape significantly influences Hims & Hers Health's operational framework, particularly concerning telehealth regulations and prescription practices. The extension of DEA flexibilities for prescribing controlled substances via telehealth through the end of 2025 is a direct benefit, enabling continued service for conditions requiring such medications.

However, the FDA's stance on compounded medications, especially for weight loss drugs, presents a challenge, as mass compounding without specific authorization is generally prohibited, impacting business models reliant on these practices.

Government scrutiny and legal actions, such as the termination of a partnership due to concerns over illegal mass compounding, highlight the direct impact of political and regulatory pressures on Hims & Hers' strategic partnerships and market access.

Data privacy laws, including HIPAA and emerging state-specific regulations like those in Washington and Connecticut, mandate stringent data security and explicit consent for data sharing, adding layers of compliance for Hims & Hers' cross-state operations.

| Regulatory Factor | Impact on Hims & Hers | Key Data/Event |

|---|---|---|

| DEA Telehealth Prescribing Flexibilities | Continued ability to prescribe controlled substances via telehealth. | Extended to end of 2025. |

| FDA Stance on Compounded Drugs | Potential restriction on compounded medications, especially for weight loss. | FDA prohibits mass compounding without authorization. |

| State Data Privacy Laws | Increased compliance burden for handling consumer health data. | Laws in Washington, Nevada, Connecticut require explicit consent. |

| International Telehealth Regulations | Need to adapt to varied rules for international expansion. | GDPR in Europe, differing prescription laws globally. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hims & Hers Health, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, equipping stakeholders with the knowledge to navigate opportunities and mitigate threats.

The Hims & Hers Health PESTLE analysis serves as a pain point reliever by offering a clear, summarized version of external factors for easy referencing during meetings or presentations, enabling quick interpretation and informed strategic decisions.

Economic factors

The telehealth market is booming, with projections indicating it will reach $393 billion by 2027, up from $104.4 billion in 2022. This growth is fueled by patient desire for accessible and convenient healthcare, alongside rapid technological innovation. Hims & Hers is well-positioned to capitalize on this trend, as more consumers embrace virtual health services.

Hims & Hers Health's revenue is significantly tied to how much discretionary money consumers have available. In 2024, the US personal saving rate hovered around 3.9%, down from previous years, indicating consumers may have less disposable income for non-essential services like telehealth subscriptions.

Economic slowdowns or rising inflation can directly affect Hims & Hers. For instance, if inflation continues to impact everyday costs, consumers might cut back on services not deemed critical, potentially leading to subscription cancellations or slower new customer acquisition, impacting the company's growth trajectory.

The telehealth landscape is intensifying, with major corporations like Amazon's One Medical, CVS Health, and Walgreens entering the fray, alongside numerous nimble startups. This surge in competition puts pressure on pricing and escalates marketing expenses for companies like Hims & Hers.

For Hims & Hers, this competitive environment necessitates ongoing innovation to keep subscribers engaged and attract new ones. For instance, the telehealth market was projected to reach $191.1 billion by 2025, indicating significant growth but also attracting substantial investment and competition.

Cost-Effectiveness of Telehealth

Telehealth services offer a significant cost advantage, making them an attractive option for both patients and providers like Hims & Hers. This efficiency is particularly beneficial for ongoing conditions, as it reduces overhead associated with physical locations and staff. For instance, a study in 2024 indicated that telehealth visits can be up to 40% less expensive than in-person consultations, a key driver for patient adoption.

This economic benefit directly translates to Hims & Hers' growth strategy. By offering more affordable care, the company can tap into a broader market segment, including those who might otherwise forgo treatment due to cost. In 2023, Hims & Hers reported a 45% year-over-year increase in total revenue, partly fueled by the accessibility and cost-effectiveness of their telehealth platform.

- Reduced Overhead: Telehealth eliminates many costs associated with brick-and-mortar clinics, such as rent, utilities, and extensive administrative staff.

- Patient Affordability: Lower operational costs allow for more competitive pricing, attracting price-sensitive consumers.

- Chronic Care Efficiency: Managing ongoing conditions via telehealth is often more economical than frequent in-person visits.

- Increased Patient Volume: Cost-effectiveness can lead to higher patient acquisition and retention rates.

Investment and Funding Landscape

The telehealth sector remains a hotbed for investment, with companies like Hims & Hers benefiting from this trend. In 2024, the digital health market continued its robust growth, attracting venture capital and private equity. For instance, Hims & Hers successfully raised $150 million in convertible senior notes in early 2024, signaling strong investor confidence in their expansion plans and technological development, particularly in AI.

This influx of capital is crucial for companies in the telehealth space. It enables them to scale operations, enhance their technology platforms, and pursue strategic growth opportunities. Hims & Hers' use of these funds to accelerate global expansion and AI integration highlights how favorable investment conditions directly translate into tangible business advancements.

The investment landscape for telehealth is characterized by:

- Continued Venture Capital Inflows: Digital health startups, including telehealth providers, are consistently attracting significant VC funding.

- Strategic Investor Interest: Established healthcare and technology companies are also investing, seeking to capitalize on the growing telehealth market.

- Debt Financing Options: Companies like Hims & Hers are leveraging debt instruments, such as convertible senior notes, to fuel growth without immediate dilution.

- Focus on Scalability and Technology: Investors are prioritizing companies with clear paths to scalability and those investing in cutting-edge technologies like AI.

Economic stability directly impacts consumer spending on discretionary services like telehealth. While the telehealth market is projected for substantial growth, reaching an estimated $393 billion by 2027, factors like inflation and consumer saving rates are critical. The US personal saving rate in 2024 was around 3.9%, a decrease that suggests consumers may have less disposable income, potentially affecting subscription-based models.

The cost-effectiveness of telehealth is a significant economic driver, with virtual visits estimated to be up to 40% less expensive than in-person consultations in 2024. This advantage allows companies like Hims & Hers to attract a broader customer base. Indeed, Hims & Hers reported a 45% year-over-year revenue increase in 2023, partly attributed to the affordability of their platform.

Investment in the digital health sector remains strong, with Hims & Hers securing $150 million in convertible senior notes in early 2024. This capital infusion supports expansion and technological development, crucial for navigating a competitive landscape where numerous players are vying for market share.

| Economic Factor | Impact on Hims & Hers | Supporting Data (2023-2024) |

| Consumer Disposable Income | Directly influences subscription rates and service utilization. Lower income may lead to reduced spending on non-essential health services. | US Personal Saving Rate: ~3.9% (2024) |

| Inflation and Cost of Living | Can pressure consumers to cut back on discretionary spending, potentially impacting customer acquisition and retention. | General increase in consumer prices impacting household budgets. |

| Telehealth Cost-Effectiveness | Provides a competitive advantage by offering more affordable healthcare solutions compared to traditional in-person visits. | Telehealth visits up to 40% less expensive than in-person (2024 estimate). Hims & Hers 2023 revenue growth: 45% YoY. |

| Investment and Funding | Access to capital is crucial for scaling operations, innovation, and market expansion in a competitive environment. | Hims & Hers raised $150M in convertible senior notes (early 2024). Digital health market continues robust VC funding. |

Same Document Delivered

Hims & Hers Health PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hims & Hers Health PESTLE analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into market trends and potential challenges.

Sociological factors

Societal expectations are increasingly prioritizing convenience and personalization in healthcare. Consumers now want services that fit their busy lives, often preferring digital access over traditional in-person visits. This shift means healthcare providers need to be more adaptable and patient-focused.

Hims & Hers is well-positioned to capitalize on this trend. Their telehealth model, offering virtual consultations and direct-to-consumer prescription delivery, directly meets the demand for accessible and tailored health solutions. For example, in the first quarter of 2024, Hims & Hers reported a 42% year-over-year increase in net revenue, reaching $218.9 million, demonstrating strong market adoption of their consumer-centric approach.

Hims & Hers strategically targets health conditions like sexual dysfunction, hair loss, and mental health, areas that have historically been shrouded in social stigma. The company's growth is directly linked to society's evolving attitudes towards these issues.

As conversations around mental health and sexual wellness become more open, more people feel comfortable seeking professional help. This societal shift, evident in increased online searches and public discourse, directly translates into a larger addressable market for Hims & Hers' telehealth services.

For instance, the U.S. mental health market alone was valued at approximately $227 billion in 2023 and is projected to grow significantly. This expanding acceptance fuels demand for accessible solutions, benefiting companies like Hims & Hers.

The societal shift towards telehealth, propelled by events like the COVID-19 pandemic, has dramatically increased public acceptance of virtual healthcare. This growing familiarity means more individuals are comfortable receiving care remotely, which is a significant tailwind for companies like Hims & Hers.

By 2024, studies indicated that over 70% of consumers had used telehealth services, a stark contrast to pre-pandemic figures. This widespread adoption signifies a lasting change in healthcare consumer behavior, making telehealth a mainstream option for millions.

Focus on Personalized Health and Wellness

Societal trends are increasingly prioritizing individualized health and wellness journeys, a perfect match for Hims & Hers' business. People are actively seeking out personalized treatments and proactive health management, areas where Hims & Hers excels by using its digital platform to deliver customized solutions, often enhanced by data analytics and artificial intelligence.

This focus on personalization is reflected in consumer behavior. For instance, the global digital health market, which includes telehealth and personalized wellness platforms, was valued at approximately $200 billion in 2023 and is projected to grow significantly. Hims & Hers taps into this by offering:

- Customized treatment plans for various health concerns, from hair loss to mental wellness.

- Convenient access to healthcare professionals through online consultations.

- Data-driven insights to help users understand and manage their health more effectively.

- A growing demand for preventative care and holistic approaches to well-being.

Mental Health Awareness and Access

The increasing awareness of mental health issues is a major societal shift. More people are recognizing that mental well-being is just as important as physical health, and this trend is driving demand for related services. For Hims & Hers, this translates into a larger potential customer base actively seeking solutions.

Hims & Hers is well-positioned to capitalize on this by offering accessible and discreet mental health care through its telehealth platform. This approach directly addresses the societal need for convenient and private support, especially for conditions that can carry stigma. The company’s telehealth model makes it easier for individuals to seek help without the barriers often associated with traditional in-person appointments.

Consider these points:

- Growing Demand: Reports indicate a significant rise in mental health diagnoses. For instance, the National Institute of Mental Health (NIMH) noted in its 2024 updates that anxiety disorders affect approximately 40 million U.S. adults annually, a figure that has seen sustained growth.

- Telehealth Adoption: The use of telehealth for mental health services surged during and after the pandemic. A 2024 survey by the American Psychological Association found that over 75% of psychologists reported offering telehealth, and patient satisfaction remained high.

- Hims & Hers' Role: The company's integrated approach, offering both prescription medications and therapy sessions online, directly meets this growing need for accessible, destigmatized mental health support.

Societal expectations increasingly favor convenience and personalization in healthcare, driving demand for accessible digital solutions. Hims & Hers' telehealth model directly addresses this by offering virtual consultations and discreet prescription delivery for conditions like hair loss and mental health. This aligns with growing openness around previously stigmatized health topics, expanding the market for such services.

Technological factors

Ongoing advancements in telemedicine platform technology are critical for Hims & Hers. Improvements in video conferencing, secure messaging, and intuitive user interfaces directly impact the quality and accessibility of their virtual consultations. These enhancements are essential for a company built on a telehealth-first model, ensuring a smooth and effective patient experience.

By the end of 2024, the global telehealth market was projected to reach over $250 billion, with user adoption continuing to climb. Hims & Hers benefits directly from this growth as better platforms facilitate more patient engagement and retention, making virtual care increasingly convenient and reliable for a wider audience.

Hims & Hers is significantly integrating AI and machine learning to refine its telehealth offerings. This includes AI-powered diagnostic tools and a 'MedMatch' system designed to efficiently route patients to the most suitable care providers and treatment plans.

The company anticipates that these AI advancements will boost operational efficiency by automating repetitive administrative tasks and enabling highly personalized patient treatment strategies. This focus on AI is expected to solidify Hims & Hers' position as a leader in innovative, AI-driven healthcare solutions.

Hims & Hers leverages advanced data analytics to personalize its offerings, a significant technological edge. By analyzing patient data, they can tailor treatments and wellness plans, which directly boosts subscriber retention and revenue. For instance, in Q1 2024, the company reported a 47% increase in net revenue year-over-year, partly fueled by this data-driven personalization strategy.

Remote Monitoring and Wearable Technology

The growing adoption of wearable devices and the Internet of Things (IoT) for continuous health data tracking offers Hims & Hers a significant opportunity to broaden its service portfolio into remote patient monitoring.

This technological advancement allows for proactive health interventions and can significantly boost the efficacy of virtual care management, especially for individuals managing chronic health conditions.

For instance, the global wearable technology market was valued at approximately $116 billion in 2022 and is projected to reach over $340 billion by 2029, indicating substantial growth and user engagement with these devices.

- Expanded Service Offerings: Hims & Hers can integrate wearable data into its telehealth platform to offer more personalized and continuous care, potentially leading to better patient outcomes.

- Proactive Health Management: Real-time data from wearables can enable early detection of health issues, allowing for timely interventions and reducing the severity of conditions.

- Enhanced Virtual Care: By leveraging wearable technology, Hims & Hers can provide more data-driven insights to healthcare providers, improving the quality and effectiveness of virtual consultations.

Cybersecurity and Data Infrastructure

Hims & Hers, as a digital health platform, places immense importance on cybersecurity and its data infrastructure. Safeguarding sensitive patient information is not just a best practice but a fundamental requirement for maintaining user trust and adhering to stringent privacy laws. The company's commitment to robust security measures directly impacts its ability to operate and grow in the competitive telehealth market.

The healthcare industry, in general, experienced a significant surge in cyberattacks. For instance, in 2023, the U.S. Department of Health and Human Services reported that over 133 million healthcare records were compromised. This highlights the critical need for platforms like Hims & Hers to invest heavily in advanced cybersecurity protocols and continuously update their defenses against emerging threats.

A scalable data infrastructure is equally vital. As Hims & Hers expands its services and user base, its ability to manage and process vast amounts of data efficiently and securely becomes paramount. This includes ensuring compliance with regulations such as HIPAA, which mandates specific security standards for electronic protected health information.

- Data Breach Costs: The average cost of a healthcare data breach in 2023 reached $10.93 million, underscoring the financial imperative for strong cybersecurity.

- Regulatory Compliance: Failure to comply with data privacy regulations like HIPAA can result in substantial fines and reputational damage for digital health providers.

- Customer Trust: Patients entrust digital health platforms with highly personal information; a breach erodes this trust, potentially leading to customer attrition.

- Infrastructure Scalability: A robust and scalable data infrastructure ensures the platform can handle increased user traffic and data volume without compromising performance or security.

Technological advancements are central to Hims & Hers' telehealth model. Innovations in AI and machine learning, like their 'MedMatch' system, are streamlining patient care and personalizing treatment plans, aiming to boost efficiency and patient outcomes.

The company's strategic use of data analytics for personalized offerings is a key differentiator, contributing to subscriber retention and revenue growth, as evidenced by a 47% year-over-year net revenue increase in Q1 2024.

The integration of wearable technology and IoT presents a significant opportunity for Hims & Hers to expand into remote patient monitoring, enhancing proactive health management and the overall efficacy of virtual care.

Robust cybersecurity and a scalable data infrastructure are paramount for Hims & Hers to protect sensitive patient data and maintain user trust in an era of increasing healthcare cyber threats, with healthcare data breaches costing an average of $10.93 million in 2023.

Legal factors

Hims & Hers must navigate a complex web of state and federal telehealth practice standards and professional licensure rules. These regulations dictate how healthcare services can be delivered virtually, impacting everything from prescribing authority to patient record management.

The legal framework for telehealth is constantly evolving. Discussions around interstate licensure compacts, like the Interstate Medical Licensure Compact, aim to streamline cross-state practice, but their adoption and effectiveness vary, potentially affecting Hims & Hers' operational reach. For instance, as of early 2024, over 30 states have joined the IMLC, but not all have fully implemented telehealth-specific provisions.

Furthermore, the scope of practice for virtual care providers is a subject of ongoing debate and legislative action. Changes in these definitions could expand or contract the services Hims & Hers can offer, directly influencing its business model and growth potential across different states.

The legal landscape for drug compounding and prescription services is a significant consideration for Hims & Hers. This is particularly true as the company offers personalized medications, which often involve compounding.

Recent legal challenges and increased regulatory attention, especially concerning compounded GLP-1 drugs, underscore the potential risks of non-compliance. Hims & Hers must ensure strict adherence to regulations set forth by the FDA and state pharmacy boards.

For instance, the FDA has issued warning letters to compounding pharmacies regarding the marketing of unapproved drugs, impacting the supply chain for some compounded medications. Navigating these evolving regulations is crucial for maintaining operational integrity and patient safety.

Hims & Hers must navigate a complex web of patient data privacy and security regulations, with the Health Insurance Portability and Accountability Act (HIPAA) being a cornerstone. This federal law dictates stringent standards for the protection of Protected Health Information (PHI), covering everything from how data is stored to how it's communicated securely. Failure to comply can result in significant fines and reputational damage.

Adding to this complexity, an increasing number of states are enacting their own comprehensive health data privacy laws. For instance, Washington's My Health My Data Act, effective in 2023, imposes even stricter consent requirements and grants consumers greater control over their health data. Hims & Hers needs to stay abreast of these evolving state-level regulations to ensure ongoing legal adherence and build patient trust.

Advertising and Marketing Regulations

Hims & Hers operates under stringent advertising and marketing regulations, particularly given its focus on healthcare. These rules mandate truthfulness and prohibit deceptive claims, ensuring consumers receive accurate information. Failure to comply can lead to significant legal challenges and harm the company's reputation.

The healthcare advertising landscape is particularly sensitive. For instance, the recent allegations of deceptive marketing by Novo Nordisk against Hims & Hers highlight the critical need for meticulous adherence to these standards. Such disputes can result in costly litigation and damage brand trust.

- Truthfulness in Advertising: Hims & Hers must ensure all marketing claims, especially regarding health outcomes and product efficacy, are substantiated and not misleading.

- Regulatory Scrutiny: The company faces oversight from bodies like the Federal Trade Commission (FTC) and potentially the Food and Drug Administration (FDA) depending on product claims.

- Competitive Disputes: Allegations from competitors, such as Novo Nordisk, can trigger investigations and necessitate robust defense of marketing practices.

- Reputational Risk: Non-compliance can lead to severe reputational damage, impacting customer acquisition and retention in a trust-sensitive industry.

Product Liability and Malpractice Laws

Hims & Hers operates within a stringent regulatory landscape concerning product liability and medical malpractice, particularly given its telehealth model for medical consultations and prescription fulfillment. The company must ensure its digital consultations adhere to established standards of care, a critical factor as telehealth adoption surged, with a significant portion of consumers reporting increased use for prescription refills and chronic condition management in 2024. Failure to maintain these standards can lead to costly litigation and reputational damage.

The risk of medical malpractice claims is amplified by the remote nature of consultations. Ensuring proper diagnosis, treatment, and patient follow-up through digital channels requires robust protocols. For instance, the FDA's scrutiny of direct-to-consumer prescription drug advertising and telehealth services continues to evolve, impacting how companies like Hims & Hers can market and deliver services, with increased focus on patient safety and efficacy in 2025.

- Telehealth Standards: Adherence to evolving medical board guidelines for remote patient care is paramount to avoid malpractice suits.

- Medication Safety: Ensuring the safe dispensing and delivery of prescription medications, including proper handling and patient education, mitigates product liability risks.

- Regulatory Compliance: Staying abreast of FDA regulations and state-specific telehealth laws is crucial for legal operation and risk management.

- Patient Data Security: Protecting patient health information (PHI) is a legal imperative, with significant penalties for breaches under HIPAA and similar regulations.

Hims & Hers must navigate a complex legal landscape, including state and federal telehealth regulations and professional licensure. These rules impact virtual healthcare delivery, prescribing, and patient data management, with over 30 states adopting the Interstate Medical Licensure Compact by early 2024 to facilitate cross-state practice. The evolving scope of practice for virtual care providers also directly influences the services Hims & Hers can offer.

The company faces scrutiny regarding compounded medications, particularly GLP-1 drugs, and must adhere to FDA and state pharmacy board regulations to avoid issues like warning letters issued to compounding pharmacies for marketing unapproved drugs. Strict compliance with HIPAA and emerging state health data privacy laws, such as Washington's My Health My Data Act (effective 2023), is crucial for protecting patient data and maintaining trust.

Truthful advertising is paramount, especially after facing allegations from competitors like Novo Nordisk, highlighting the risk of litigation and reputational damage from non-compliance with FTC and FDA oversight. Furthermore, Hims & Hers must uphold standards of care in telehealth consultations to mitigate medical malpractice risks, a critical consideration as consumer use of telehealth for prescriptions and chronic conditions increased significantly in 2024.

Environmental factors

While Hims & Hers is primarily a digital platform, environmental factors impact its operations through its supply chain for physical products. This includes the sourcing and manufacturing of medications and personal care items, as well as their packaging and delivery.

In 2023, the pharmaceutical industry faced increasing scrutiny regarding its carbon footprint, with a significant portion attributed to manufacturing and distribution. Hims & Hers, like its peers, must consider the environmental impact of its partners' production processes and logistics.

The company's commitment to sustainability could involve evaluating the eco-friendliness of its packaging materials and exploring more energy-efficient shipping options to reduce its overall environmental impact.

The direct-to-consumer model employed by Hims & Hers, which involves shipping prescription medications and over-the-counter items, inherently generates significant packaging waste. This includes plastic bottles, cardboard boxes, and various protective materials. As environmental consciousness grows, the company may face increased regulatory pressure or consumer demand for more sustainable packaging solutions and take-back programs.

In 2024, the global healthcare packaging market was valued at approximately $100 billion, with a significant portion attributed to pharmaceutical and medical product packaging. Projections indicate continued growth, underscoring the scale of materials involved. Hims & Hers' commitment to responsible waste management, including exploring biodegradable or recyclable packaging options, could become a key differentiator and mitigate potential future environmental liabilities.

The digital infrastructure powering Hims & Hers, like servers and data centers, contributes to a carbon footprint. While telehealth is often more eco-friendly than traditional healthcare, optimizing energy efficiency in IT operations and cloud services is crucial for Hims & Hers to meet its environmental sustainability targets.

Climate Change Impact on Health Needs

Climate change, while not a direct driver of Hims & Hers’ core business, can indirectly shape public health needs and, consequently, the demand for certain telehealth services. For example, worsening air quality and increased pollen seasons, linked to climate shifts, could lead to a higher incidence of respiratory issues and allergies.

This trend might subtly increase the demand for telehealth consultations related to managing these conditions, potentially benefiting Hims & Hers if they offer relevant services. Data from the World Health Organization (WHO) in 2024 highlighted that climate change is already a significant threat to human health, impacting everything from infectious disease patterns to mental well-being.

- Increased Allergies: Warmer temperatures and altered precipitation patterns can extend allergy seasons, potentially boosting demand for allergy-related telehealth consultations.

- Respiratory Issues: Higher levels of air pollution and allergens can exacerbate conditions like asthma, creating a greater need for accessible respiratory care.

- Mental Health: Environmental disasters and the stress associated with climate change can negatively impact mental health, potentially increasing demand for mental health support services.

Regulatory Pressure for Environmental Reporting

As environmental, social, and governance (ESG) considerations become more critical, Hims & Hers, like many companies, may encounter heightened expectations for environmental reporting. This pressure often stems from investors and other stakeholders who are increasingly focused on a company's ecological impact and sustainability initiatives. Even for a largely digital service, there's a growing demand for transparency regarding carbon footprint and strategies for reduction.

The push for greater environmental disclosure is a significant trend. For instance, in 2024, the Securities and Exchange Commission (SEC) proposed rules that would require public companies to disclose climate-related risks and greenhouse gas emissions, signaling a broader regulatory shift. While Hims & Hers' direct physical footprint might be smaller than traditional manufacturing firms, indirect impacts, such as those from data centers and shipping for any physical products, are still under scrutiny.

- Investor Demand: A significant percentage of institutional investors, often exceeding 70% in major markets, now integrate ESG factors into their investment decisions, driving the need for robust environmental data.

- Regulatory Landscape: Evolving regulations, such as the SEC's climate disclosure proposals and similar initiatives in Europe, are setting new standards for environmental reporting.

- Stakeholder Expectations: Consumers and employees are also increasingly vocal, demanding that companies demonstrate a commitment to environmental responsibility.

- Digital Footprint: While Hims & Hers operates primarily online, the energy consumption of its digital infrastructure and any associated physical product distribution are areas of potential environmental impact requiring disclosure.

Environmental factors significantly influence Hims & Hers through its supply chain for physical products, including medication and personal care item manufacturing and distribution. The pharmaceutical sector's 2023 carbon footprint, largely from production and logistics, highlights the need for Hims & Hers to assess its partners' environmental practices.

The company's direct-to-consumer model generates packaging waste, with the global healthcare packaging market valued around $100 billion in 2024. Exploring sustainable packaging options and energy-efficient shipping can mitigate environmental impact and meet growing consumer and regulatory demands for eco-friendly practices.

Hims & Hers' digital infrastructure also has a carbon footprint. While telehealth is generally greener than in-person care, optimizing energy efficiency in IT operations is vital. Climate change can indirectly affect demand for services related to respiratory issues and mental health, as noted by the WHO in 2024 regarding climate's threat to human health.

Increased ESG scrutiny means Hims & Hers faces expectations for environmental reporting, even for its digital operations. The SEC's 2024 climate disclosure proposals exemplify a broader regulatory trend, pushing companies to be transparent about their carbon footprint and reduction strategies.

PESTLE Analysis Data Sources

Our Hims & Hers Health PESTLE Analysis is informed by a comprehensive review of government health regulations, economic indicators from reputable financial institutions, and technological advancements reported by leading industry analysts. We also incorporate insights from consumer behavior studies and environmental impact assessments.