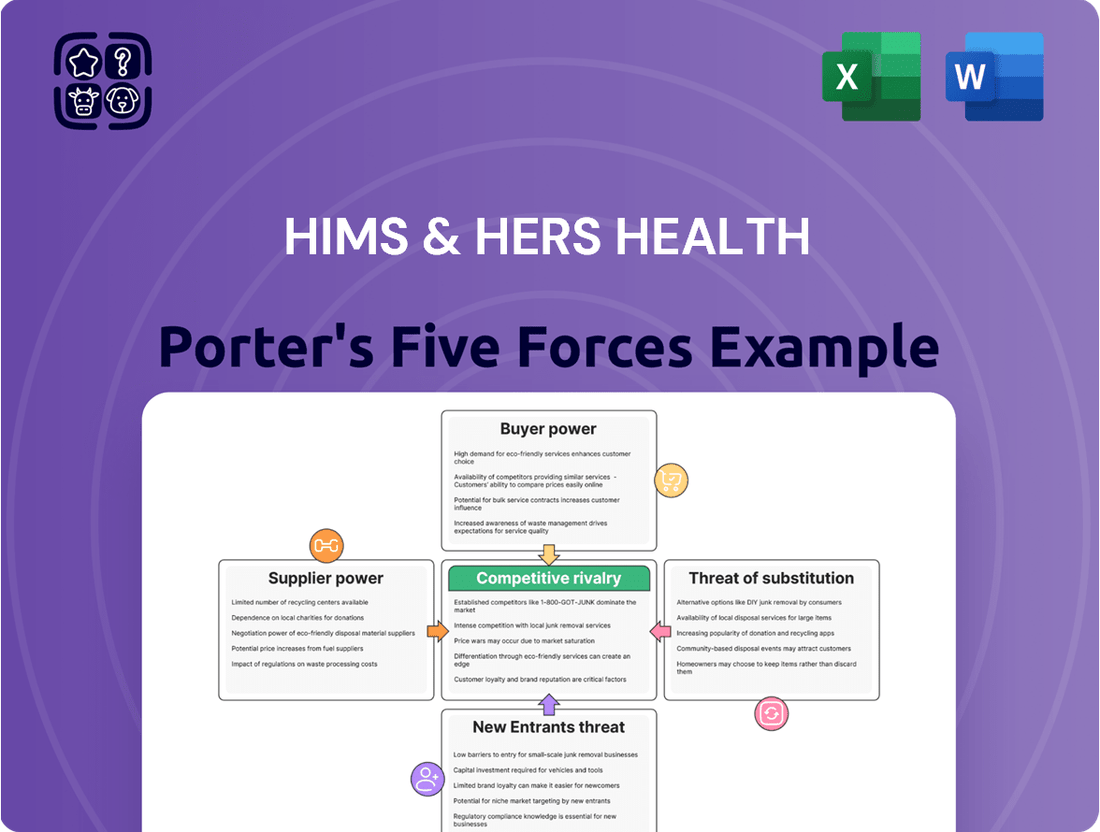

Hims & Hers Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hims & Hers Health Bundle

Hims & Hers Health navigates a dynamic telehealth landscape, facing moderate threats from new entrants and substitutes in the wellness and prescription markets. Buyer power is significant due to readily available alternatives, while supplier power remains relatively low given the commoditized nature of many health products.

The complete report reveals the real forces shaping Hims & Hers Health’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hims & Hers Health's reliance on pharmaceutical manufacturers and compounding pharmacies for its prescribed medications places significant bargaining power in the hands of these suppliers. This is particularly evident with high-demand specialized treatments, such as GLP-1 agonists, where supply chain constraints or exclusive manufacturing agreements can directly affect Hims & Hers' ability to fulfill patient needs.

For example, Hims & Hers experienced a notable disruption in its GLP-1 supply chain when its partnership with Novo Nordisk was terminated. This was reportedly due to concerns surrounding compounded versions of Wegovy, highlighting how supplier decisions and regulatory interpretations can impact Hims & Hers' operational capacity and product availability.

Hims & Hers Health relies on a network of licensed healthcare professionals, including doctors, nurses, and therapists, to provide virtual consultations and prescribe medications. The accessibility and pricing of these specialized providers, particularly in areas like mental and sexual health, directly affect the company's operational costs and service delivery. In 2023, telehealth services continued to grow, with an estimated 37% of Americans having used telehealth services, indicating a robust demand for virtual care providers.

The bargaining power of these healthcare professionals can be influenced by factors such as the demand for their specific expertise and the regulatory landscape governing telehealth. For instance, changes in state-specific licensing requirements for telehealth providers could potentially restrict the available pool of professionals, thereby increasing their leverage. As of early 2024, the debate around interstate medical licensing for telehealth continues, with various proposals aiming to streamline the process, which could impact provider availability.

Hims & Hers' reliance on technology and software providers is significant, as its digital-first model depends heavily on robust telehealth infrastructure, secure data handling, and a user-friendly interface. Specialized healthcare technology platforms, particularly those integrating advanced AI, could wield considerable bargaining power due to the unique demands of the digital health sector.

The company's strategic emphasis on technology, evidenced by its investments in AI-powered tools and the recent appointment of a Chief Technology Officer, signals a commitment to leveraging technological advancements. This focus might necessitate partnerships with providers offering cutting-edge solutions, potentially increasing the bargaining power of those suppliers who can deliver critical innovation and specialized capabilities.

Logistics and Delivery Services

Hims & Hers relies heavily on logistics and delivery partners to get its prescribed medications and over-the-counter products directly to consumers. The effectiveness, expense, and dependability of these delivery services are absolutely vital for the company's operational success.

If there's a scarcity of dependable logistics providers, or if these providers experience a surge in demand, their leverage over Hims & Hers could grow. This situation is especially pertinent given Hims & Hers' direct-to-consumer model, which places a premium on efficient shipping. For instance, the overall market for last-mile delivery services in the US saw significant growth, with estimates suggesting it could reach over $200 billion by 2027, indicating a competitive but also potentially concentrated landscape for specialized healthcare delivery.

- Dependence on Third-Party Logistics: Hims & Hers' direct-to-consumer model necessitates strong relationships with logistics providers, making them a key factor in service delivery.

- Potential for Increased Costs: A concentrated market or high demand for delivery services could lead to higher operational costs for Hims & Hers if suppliers can dictate terms.

- Impact on Customer Experience: The reliability and speed of delivery directly affect customer satisfaction, giving logistics partners indirect influence.

- Market Dynamics: The growing e-commerce and telehealth sectors are increasing demand for specialized healthcare logistics, potentially shifting bargaining power.

Marketing and Advertising Platforms

Hims & Hers Health heavily relies on marketing and advertising platforms to fuel its subscriber growth. This dependence gives these platforms considerable leverage. For instance, the cost of acquiring a customer through digital channels can fluctuate significantly based on platform algorithms and competition.

The effectiveness of advertising spend on platforms like Meta (Facebook/Instagram), Google, and even traditional media channels directly impacts Hims & Hers' customer acquisition costs. In 2023, digital advertising spending in the US was projected to reach over $300 billion, highlighting the competitive landscape and the potential for price increases by these platforms.

- Platform Dependency: Hims & Hers' growth strategy hinges on its ability to reach consumers through various advertising channels.

- Cost Volatility: Advertising costs on popular platforms can be unpredictable, directly affecting Hims & Hers' marketing budget and profitability.

- Effectiveness Measurement: The return on investment for advertising on these platforms is crucial for Hims & Hers' financial health.

The bargaining power of suppliers for Hims & Hers Health is a critical factor, especially concerning pharmaceutical ingredients and specialized medications. When specific active pharmaceutical ingredients (APIs) are sourced from a limited number of manufacturers, or if there are significant regulatory hurdles to producing them, these suppliers can command higher prices and dictate terms. This was evident in the market for GLP-1 agonists, where supply chain constraints in 2023 and early 2024 led to increased costs and limited availability for many companies, including those in the telehealth space.

Furthermore, the company's reliance on compounding pharmacies for certain customized medications also introduces supplier leverage. If these pharmacies face their own supply chain issues or if regulatory scrutiny increases on compounded products, it can directly impact Hims & Hers' ability to offer a full range of treatments. The overall pharmaceutical wholesale market in the US is substantial, with revenues in the hundreds of billions, indicating the scale of these supplier relationships.

Additionally, the bargaining power of technology providers, particularly those offering specialized telehealth platforms or AI-driven diagnostic tools, is growing. As digital health becomes more integrated, companies that can offer unique, compliant, and scalable solutions gain significant influence. The global digital health market was valued in the hundreds of billions in 2023 and is projected for continued strong growth, underscoring the importance of these tech suppliers.

Finally, the logistics sector, crucial for Hims & Hers' direct-to-consumer model, can exert considerable power, especially in periods of high demand or limited capacity. The increasing volume of e-commerce and healthcare delivery means that reliable and efficient logistics partners are in high demand, potentially allowing them to negotiate favorable terms. The US parcel delivery market alone is a multi-billion dollar industry, highlighting the significant role these suppliers play.

What is included in the product

This analysis dissects the competitive forces shaping the telehealth and wellness market for Hims & Hers Health, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly visualize competitive pressures, from supplier power to substitutes, to strategically navigate the telehealth landscape.

Gain clarity on industry dynamics, empowering informed decisions to mitigate threats and capitalize on opportunities in the online health market.

Customers Bargaining Power

Customers in the telehealth and direct-to-consumer healthcare space, like those Hims & Hers serves, have a growing array of options. Platforms offering treatments for hair loss, sexual health, and mental wellness are plentiful, leading to a highly competitive environment. This abundance of choice directly empowers consumers.

The low switching costs associated with these services are a significant factor. It’s generally simple for a customer to move from one telehealth provider to another, perhaps for a better price or a more appealing service package. For instance, many platforms operate on a subscription model, allowing for easy cancellation and re-enrollment elsewhere. This ease of transition means customers aren't locked in, amplifying their ability to negotiate or seek out the best deals.

This dynamic directly increases the bargaining power of customers. When providers know consumers can easily find alternatives, they are incentivized to offer competitive pricing and superior service to retain their user base. In 2024, the telehealth market continued its expansion, with many new entrants vying for market share, further intensifying this customer-driven dynamic.

Price sensitivity is a significant factor for Hims & Hers, particularly for treatments targeting non-urgent conditions or requiring ongoing prescriptions. Customers often compare prices for services like compounded GLP-1 medications, seeking the most cost-effective solutions available in the market.

The competitive landscape, featuring numerous telehealth providers and the availability of generic drug options, further amplifies this customer price sensitivity. For instance, in 2024, the average out-of-pocket cost for a 30-day supply of a common generic prescription could range from $10 to $50, influencing customer choices for comparable Hims & Hers offerings.

Consumers today possess unprecedented access to health information, treatment alternatives, and pricing details from various telehealth platforms. This wealth of knowledge, readily available through online reviews, comparison sites, and social media, empowers individuals to make well-informed choices. For instance, a 2024 survey indicated that over 70% of consumers research healthcare options online before making a decision, directly impacting their negotiation power.

This heightened transparency compels companies like Hims & Hers to consistently offer competitive services and pricing. The ease with which customers can compare offerings means providers must actively demonstrate value to retain and attract clientele. In 2024, the telehealth market saw an average of 15% price variation for similar services across providers, a key factor influencing consumer choice.

Subscription-Based Model and Retention

While Hims & Hers Health leverages a subscription model to foster predictable revenue and encourage customer loyalty, the inherent ability of customers to cancel or pause their subscriptions signifies ongoing bargaining power. This flexibility allows consumers to directly influence the company's recurring revenue streams.

Hims & Hers actively works to mitigate this by enhancing subscriber retention and maximizing lifetime value. Their strategy includes a strong emphasis on personalized care, consistent follow-up, and the expansion of their service offerings across various specialties. For instance, by Q1 2024, Hims & Hers reported a net revenue of $205.6 million, a 47% increase year-over-year, demonstrating the success of their retention efforts, though the churn rate remains a critical metric to monitor.

- Customer Retention Focus: Hims & Hers invests in personalization and follow-up care to reduce churn and increase customer lifetime value.

- Subscription Flexibility: Customers retain the power to cancel or pause subscriptions, directly impacting predictable revenue.

- Revenue Growth Context: In Q1 2024, Hims & Hers achieved $205.6 million in net revenue, highlighting the importance of maintaining subscriber engagement in a competitive market.

Regulatory Impact on Patient Choice

Changes in telehealth regulations significantly influence patient choice in healthcare. For instance, shifts in rules regarding the prescription of controlled substances via telehealth, or mandates for in-person visits, can directly limit or expand how patients access care, thereby affecting their bargaining power.

While many pandemic-era telehealth flexibilities were extended into 2024, the potential for future regulatory adjustments remains. For example, ongoing discussions and potential changes to Medicare coverage for telehealth services could reshape patient access and, consequently, their ability to choose providers or services, impacting their overall bargaining leverage.

- Telehealth Prescribing Rules: Regulations on prescribing controlled substances via telehealth, a key service for many digital health platforms, directly impact patient access and choice.

- In-Person Visit Requirements: Mandates for in-person visits can reduce the convenience and accessibility of telehealth, potentially limiting patient options and their bargaining power.

- Medicare Coverage: Changes in Medicare's reimbursement policies for telehealth services in 2024 and beyond will significantly influence provider participation and patient access to these digital options.

The bargaining power of customers in the telehealth sector, including Hims & Hers, is amplified by the sheer volume of available providers and the ease with which consumers can switch between them. This competitive environment, particularly evident in 2024 with numerous new entrants, forces companies to offer attractive pricing and superior service to retain clients.

Customers are highly price-sensitive, especially for ongoing treatments, and readily compare costs for services like compounded medications. The widespread availability of online information and price comparison tools in 2024 means consumers are well-informed, directly influencing their choices and demanding value.

Subscription models, while beneficial for revenue predictability, also grant customers the power to cancel or pause services, impacting recurring income for companies like Hims & Hers. Their Q1 2024 net revenue of $205.6 million underscores the need for strong customer engagement to counter this inherent power.

Regulatory changes also play a crucial role, influencing patient access to telehealth services and their ability to choose providers. For example, shifts in rules for prescribing controlled substances via telehealth in 2024 can directly impact patient options and their bargaining leverage.

Same Document Delivered

Hims & Hers Health Porter's Five Forces Analysis

This preview showcases the complete Hims & Hers Health Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the telehealth and wellness market. The document you see here is the exact, professionally written analysis you'll receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The telehealth landscape is a crowded space, with many companies offering similar online medical services and prescription fulfillment. Hims & Hers faces intense competition from established players like Roman (Ro), Teladoc, Amwell, and Nurx. These companies directly target the same customer segments, offering solutions for sexual health, hair loss, and mental well-being, creating a constant need for Hims & Hers to stand out.

Telehealth providers are increasingly branching out into new health areas, a significant driver of competitive rivalry. For instance, the burgeoning market for weight management solutions, particularly with the rise of GLP-1 medications, has seen numerous telehealth companies launch specialized programs. This expansion isn't limited to one niche; chronic condition management is another rapidly growing segment attracting new entrants and existing players alike.

Hims & Hers Health is a prime example of this diversification strategy. The company has actively broadened its service portfolio, moving beyond its initial focus on men's and women's wellness. Their acquisition of ZAVA, a European telehealth provider, not only expanded their international footprint but also opened doors to new service verticals, including at-home lab testing. This aggressive growth and diversification by Hims & Hers and its competitors significantly intensifies the competitive landscape.

The telehealth market, particularly in areas like weight management with GLP-1 medications, is intensely competitive. This rivalry forces companies like Hims & Hers to engage in aggressive pricing and promotional activities to capture and hold onto market share. For instance, Hims & Hers has been noted for its competitive pricing on GLP-1 prescriptions, aiming to be a more accessible option for consumers.

These strategies often involve offering attractive discounts, creating bundled subscription packages that might include consultations and medication, or enhancing service features to differentiate themselves. Hims & Hers’ marketing efforts, including prominent campaigns, are direct responses to this dynamic, as they work to establish a strong presence and attract a broad customer base within a rapidly expanding and crowded sector.

Focus on Brand Awareness and Customer Experience

In the crowded telehealth landscape, Hims & Hers is heavily investing in brand awareness and customer experience to stand out. They recognize that with numerous similar services available, building a strong brand identity and ensuring a positive user journey are crucial for retaining customers. This focus on differentiation is key to combating the intense competitive rivalry.

Hims & Hers actively cultivates its brand by highlighting its user-friendly digital platform, offering personalized treatment plans, and ensuring discreet service delivery. These elements are designed to create a memorable and trustworthy experience for consumers seeking health solutions. The company understands that a seamless interaction, from initial sign-up to ongoing care, is a significant competitive advantage.

The ability to provide a consistently high-quality, digital-first experience, coupled with effective follow-up care, serves as a critical differentiator for Hims & Hers. For instance, in 2023, Hims & Hers reported a significant increase in customer retention, with approximately 75% of its subscription revenue coming from repeat customers, demonstrating the success of their customer experience initiatives.

- Brand Building Investment: Hims & Hers allocates substantial resources to marketing and brand development to increase recognition in a competitive market.

- User Experience Focus: Emphasis on a simple, intuitive online platform and personalized digital interactions aims to enhance customer satisfaction and loyalty.

- Discreet Service Delivery: Offering private and confidential services is a core part of their brand promise, addressing a key customer concern in telehealth.

- Customer Retention: Hims & Hers’ strategy aims to foster long-term customer relationships through superior service and consistent care, as evidenced by their strong repeat customer base.

Regulatory Environment and Compliance

The competitive rivalry within the telehealth sector, particularly for companies like Hims & Hers, is significantly shaped by the evolving regulatory environment. Navigating complex rules around prescription guidelines, especially for controlled substances, and managing interstate licensing requirements are critical hurdles. For instance, as of early 2024, the Drug Enforcement Administration (DEA) continues to grapple with permanent telehealth prescribing rules post-pandemic, creating uncertainty for providers and patients alike. This dynamic landscape means that firms demonstrating agility in compliance and robust data privacy measures, such as HIPAA adherence, can differentiate themselves and attract a larger customer base.

Furthermore, recent regulatory attention on compounded medications presents a notable risk. In 2023, the U.S. Food and Drug Administration (FDA) continued its focus on ensuring the safety and efficacy of compounded drugs, impacting companies that offer such services. This scrutiny can affect market perception, operational costs due to increased compliance demands, and even product availability. Companies that proactively address these regulatory shifts, perhaps by investing in stricter quality control or transparent sourcing, are better positioned to mitigate these risks and maintain a competitive advantage.

- Evolving Telehealth Regulations: Prescription guidelines and interstate licensing requirements continue to be a complex area for telehealth providers, impacting how services can be offered across different states.

- Data Privacy and Security: Strict adherence to data privacy laws, such as HIPAA, is paramount and acts as a differentiator for companies that invest in robust security infrastructure.

- Compounded Medication Scrutiny: Increased regulatory oversight of compounded medications, as seen in 2023 and continuing into 2024, poses a risk that requires careful management and compliance strategies.

- Competitive Advantage through Compliance: Companies that can effectively adapt to and comply with these changing regulations are likely to gain a competitive edge by demonstrating reliability and trustworthiness.

The competitive rivalry in telehealth is fierce, with Hims & Hers facing numerous direct competitors offering similar services. This intense competition drives companies to innovate and differentiate through pricing, service expansion, and enhanced customer experience. For instance, the market for weight management solutions, particularly with the advent of GLP-1 medications, has seen a surge of new entrants and aggressive marketing from established players.

Hims & Hers actively combats this rivalry by investing heavily in brand building and customer experience, aiming to foster loyalty and stand out. Their strategy includes a user-friendly digital platform, personalized care, and discreet service delivery. In 2023, approximately 75% of Hims & Hers' subscription revenue came from repeat customers, highlighting the effectiveness of their customer retention efforts.

| Competitor | Key Service Offerings | 2023/2024 Focus Areas |

|---|---|---|

| Roman (Ro) | Sexual health, hair loss, smoking cessation | Expanding into primary care, chronic condition management |

| Teladoc Health | General medical, chronic care, mental health | Integration of services, employer partnerships |

| Amwell | Virtual visits, chronic care management, telebehavioral health | Focus on hospital and health system partnerships |

| Nurx | Women's health, birth control, STI testing | Expanding into dermatology and mental wellness |

SSubstitutes Threaten

Despite the rise of telehealth, traditional in-person healthcare services continue to be a strong substitute for Hims & Hers. Many patients still value a physical examination, direct interaction with a doctor, or the immediate access to prescribed medications from a local pharmacy. For instance, in 2024, a significant portion of healthcare spending, estimated to be hundreds of billions of dollars, is still allocated to in-person visits and services, reflecting this persistent preference for traditional care models.

The threat of substitutes for Hims & Hers is significant, particularly from over-the-counter (OTC) medications and wellness products. For many of the conditions Hims & Hers addresses, like hair loss or certain skin issues, consumers have a broad selection of readily available, often less expensive alternatives that don't require a prescription or online consultation. The consumer healthcare market, heavily influenced by these accessible OTC options, saw substantial growth in 2024, with many consumers opting for these convenient solutions.

Individuals often turn to lifestyle adjustments like improved diet, increased exercise, or home remedies as substitutes for professional medical care, particularly for less severe or chronic conditions. This trend poses a threat as it bypasses the need for Hims & Hers' core offerings. For instance, a significant portion of the population actively seeks natural wellness solutions, with the global market for natural and organic personal care products projected to reach over $54 billion by 2027, indicating a strong preference for alternatives.

Specialty Clinics and Niche Providers

Specialty clinics and niche providers present a significant threat of substitution for Hims & Hers. For instance, dedicated hair restoration clinics offer advanced surgical and non-surgical treatments that go beyond the scope of Hims & Hers' general telehealth offerings. Similarly, specialized sexual health clinics provide in-person consultations and treatments for conditions that may require more hands-on medical attention than can be offered remotely.

These focused alternatives can attract customers seeking a perceived higher level of expertise or specific, advanced procedures. For example, while Hims & Hers offers treatments for erectile dysfunction, dedicated urology clinics might provide a wider array of diagnostic tools and treatment options, including more invasive procedures or specialized therapies. The market for these niche services is substantial; the global hair restoration market alone was valued at over $8.8 billion in 2023 and is projected to grow significantly.

- Specialized Treatments: Niche providers often focus on specific conditions like hair loss, dermatology, or sexual health, offering more targeted and potentially advanced treatments than a broader telehealth platform.

- Perceived Expertise: Customers may view specialized clinics as having deeper expertise and more comprehensive diagnostic capabilities for their particular concerns.

- Market Size: The growing demand for specialized health services, such as the expanding market for hair restoration and sexual wellness treatments, indicates a strong customer base for these substitutes.

Direct Purchase from Pharmacies and Online Retailers

Customers can bypass Hims & Hers' integrated model by directly purchasing many health and wellness products. This includes over-the-counter medications and supplements available at traditional pharmacies, large retailers, and general online marketplaces like Amazon. In 2024, the global online pharmacy market was valued at over $100 billion, indicating a significant existing channel for direct purchases.

This direct access to products, without the necessity of a telehealth consultation or prescription, presents a clear substitute. For instance, consumers seeking basic skincare or vitamins can easily find these items through numerous established retail channels, diminishing the unique value proposition of Hims & Hers' bundled service for these particular needs.

The convenience and often lower price points offered by these direct purchase channels are key drivers for consumers. A 2024 survey found that 65% of consumers prioritize convenience when purchasing health products online, a factor that direct retailers excel at providing.

- Direct purchase channels offer a wide array of health and wellness products.

- These substitutes bypass the need for telehealth consultations and prescriptions.

- The global online pharmacy market exceeded $100 billion in 2024.

- Consumer preference for convenience in online health purchases is a significant factor.

The threat of substitutes for Hims & Hers is considerable, encompassing traditional healthcare, over-the-counter products, lifestyle changes, and specialized clinics. Many consumers still prefer in-person doctor visits, which remain a dominant force in healthcare spending, estimated in the hundreds of billions of dollars in 2024. Additionally, readily available OTC medications and wellness products offer less expensive alternatives that bypass the need for consultations, a trend amplified by the significant growth in the consumer healthcare market during 2024.

Lifestyle adjustments like diet and exercise, alongside home remedies, also serve as substitutes, particularly for less severe conditions, reflecting a growing interest in natural wellness solutions with a global market projected to exceed $54 billion by 2027. Furthermore, specialized clinics focusing on specific issues like hair restoration or sexual health provide advanced treatments that go beyond Hims & Hers' general telehealth scope, tapping into a substantial market, with the hair restoration sector alone valued at over $8.8 billion in 2023.

Direct purchase channels for health and wellness products, including online pharmacies valued at over $100 billion in 2024, present another significant substitute. These channels allow consumers to bypass telehealth consultations, driven by a strong preference for convenience, with 65% of consumers prioritizing it for online health purchases in 2024. This direct access to items like skincare and vitamins diminishes the unique value proposition of Hims & Hers' integrated model for certain needs.

| Substitute Category | Examples | Key Drivers | Market Relevance (2023/2024 Data) |

|---|---|---|---|

| Traditional Healthcare | In-person doctor visits, local pharmacies | Patient preference for physical examination, direct interaction | Hundreds of billions in healthcare spending |

| Over-the-Counter (OTC) Products | Readily available medications, wellness supplements | Lower cost, accessibility, convenience | Significant growth in consumer healthcare market |

| Lifestyle & Home Remedies | Dietary changes, exercise, natural remedies | Desire for natural solutions, self-care | Global natural/organic personal care market projected >$54B by 2027 |

| Specialized Clinics | Hair restoration clinics, urology clinics | Perceived expertise, advanced/specific treatments | Hair restoration market >$8.8B (2023) |

| Direct Purchase Channels | Online pharmacies, large retailers | Bypassing consultations, convenience, price | Global online pharmacy market >$100B (2024) |

Entrants Threaten

The technological barrier to entry for a basic telehealth platform is quite low. Companies can leverage readily available software and online tools to quickly establish virtual consultation services. This ease of setup means new players can emerge rapidly, potentially targeting specific underserved markets or competing on price.

The ever-changing regulatory environment presents a significant factor influencing the threat of new entrants in the telehealth sector. While intricate rules concerning cross-state licensing, the prescription of controlled substances, and varying reimbursement policies can act as substantial deterrents for potential new competitors, any move towards streamlining or standardizing these regulations could significantly lower the barrier to entry.

For instance, the potential for further extensions of certain COVID-19 era telehealth flexibilities, which eased some of these regulatory burdens, could indeed encourage new players to enter the market. In 2024, the debate around permanent telehealth regulations continues, with policymakers weighing the benefits of expanded access against concerns about patient safety and oversight, directly impacting how easy or difficult it will be for new companies to establish themselves.

While it might seem straightforward to launch a telehealth platform, truly competing with Hims & Hers requires a deep pocket. Their significant investments in things like in-house prescription fulfillment, developing their own branded products, and expanding internationally mean new players need substantial capital to even get close.

For instance, building out a vertically integrated supply chain, from sourcing ingredients to direct-to-consumer delivery, demands millions. Consider that in 2023, Hims & Hers reported $937.9 million in net revenue, showcasing the scale of operations and the capital needed to support that. New entrants must be prepared for these high capital requirements to achieve meaningful scale and offer comparable services.

Brand Building and Customer Trust

Building a trusted brand in healthcare requires substantial and sustained investment in marketing and rigorous quality control. Hims & Hers has strategically allocated significant resources towards enhancing brand recognition and optimizing the user experience, aiming to cultivate deep customer loyalty.

New competitors entering the telehealth market would face a considerable hurdle in establishing credibility and earning the trust of consumers who are entrusting them with their personal health. This trust deficit is a significant barrier, as demonstrated by Hims & Hers' focus on building a reputation for reliability and efficacy.

- Brand Loyalty: Hims & Hers has cultivated a loyal customer base through consistent marketing and positive user experiences, making it difficult for new entrants to capture market share.

- Marketing Investment: The company's substantial marketing spend in 2023, reported at $207.4 million, highlights the significant capital required to build brand awareness and compete effectively.

- Trust as a Barrier: Consumers are hesitant to switch healthcare providers without strong assurances of quality and safety, a trust factor that new entrants must painstakingly build.

- Customer Acquisition Cost: The high cost associated with acquiring new customers in the competitive telehealth space further deters potential new entrants.

Access to Licensed Professionals and Specialized Expertise

New entrants face significant hurdles in building a robust network of licensed healthcare professionals, particularly when aiming for multi-state operations where diverse and evolving licensure regulations create complexity. Hims & Hers has already cultivated this essential infrastructure, giving them a distinct advantage.

The ability to quickly replicate Hims & Hers' established network and deep expertise across specific health categories is a considerable barrier for newcomers. This existing clinical breadth and depth represent a significant competitive moat.

- Network Development: Building a compliant network of licensed physicians and specialists across various states requires substantial investment and time.

- Specialized Expertise: Acquiring and retaining professionals with niche expertise, crucial for specialized telehealth services, is a challenge for new entrants.

- Regulatory Navigation: Understanding and adhering to the patchwork of state-specific telehealth and professional licensing laws is a complex undertaking.

- Brand Trust: New entrants must invest heavily in building trust and credibility with both patients and healthcare providers, a process Hims & Hers has already navigated.

While the initial setup of a telehealth platform can be technologically straightforward, the threat of new entrants is significantly mitigated by Hims & Hers' established scale and brand recognition. The company's substantial marketing investments, such as spending $207.4 million in 2023, create a high barrier, as new players need considerable capital to build comparable brand awareness and customer trust. Furthermore, navigating the complex and evolving regulatory landscape, which saw continued debate on telehealth flexibilities in 2024, requires significant expertise and resources that established players like Hims & Hers have already mastered.

| Factor | Hims & Hers Position | Impact on New Entrants |

|---|---|---|

| Brand Recognition & Marketing Spend | High, with $207.4 million spent on marketing in 2023 | Requires substantial capital for new entrants to build awareness and compete. |

| Regulatory Navigation | Established expertise in complex state-by-state regulations | Significant hurdle for new entrants unfamiliar with evolving telehealth laws. |

| Capital Requirements for Scale | Vertical integration and international expansion demand significant investment | New entrants must secure substantial funding to achieve competitive scale. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hims & Hers Health is built upon a foundation of diverse data, including company financial reports, industry-specific market research, and analyses from leading healthcare consulting firms.

We leverage publicly available information such as SEC filings, investor presentations, and news articles, alongside proprietary market data and expert interviews to comprehensively assess the competitive landscape.