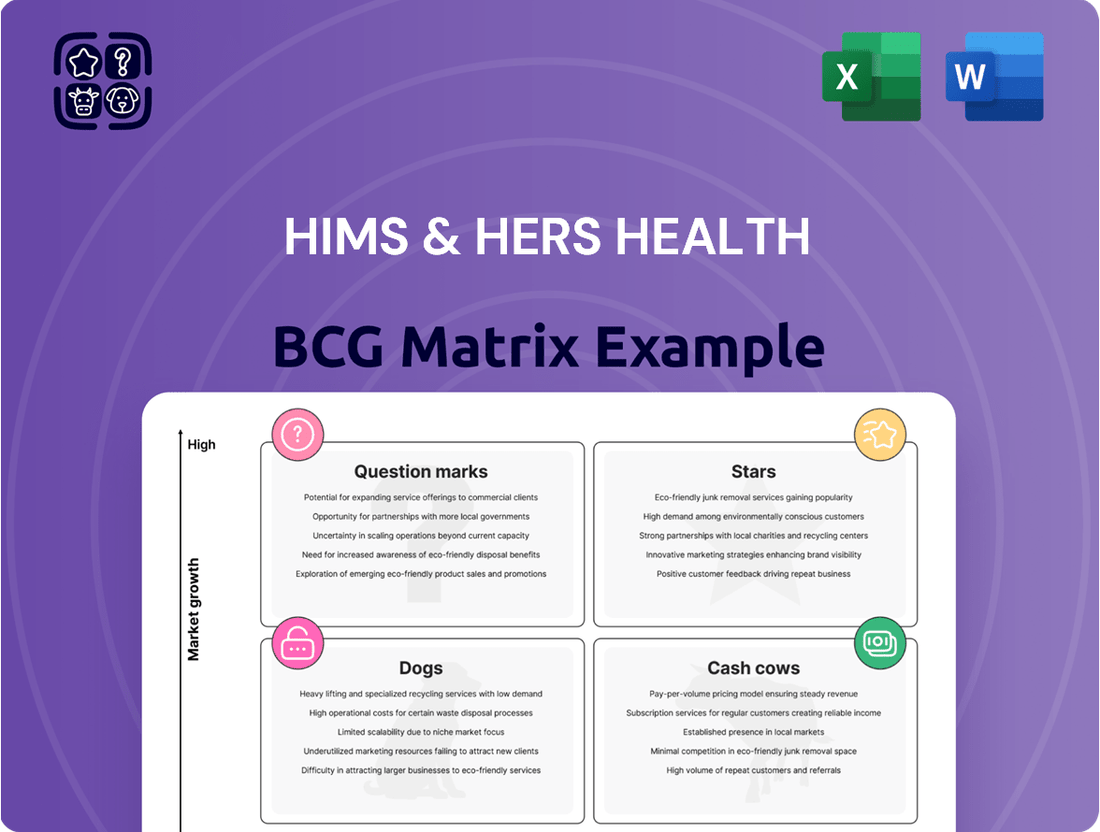

Hims & Hers Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hims & Hers Health Bundle

Curious about Hims & Hers Health's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

Hims & Hers' weight management programs, particularly those utilizing GLP-1 medications, are a standout performer. This segment is projected to generate a substantial $725 million in revenue by 2025, highlighting its immense growth potential.

The company has seen impressive subscriber growth in this burgeoning telehealth market. Customers are reporting positive results, including significant weight loss and high adherence to treatment plans, solidifying Hims & Hers' position as a key player.

Hims & Hers Health excels in personalized treatment solutions, a core strength reflected in its BCG Matrix positioning. With over 1.4 million subscribers leveraging tailored offerings as of Q1 2025, the company demonstrates a significant commitment to individualized care.

This focus on personalization directly translates to impressive financial performance, evidenced by a monthly online revenue per average subscriber of $84. This figure highlights the market's strong embrace of customized health services and Hims & Hers' effective monetization strategy.

The emphasis on personalized treatments not only boosts customer loyalty but also solidifies the company's market share within specific health and wellness niches, reinforcing its competitive advantage.

Hims & Hers' overall direct-to-consumer telehealth platform is a clear star in the BCG matrix. This is driven by impressive financial performance, including an 111% year-over-year revenue growth in Q1 2025, bringing their total revenue to $586 million. The company's subscription-based, vertically integrated model has clearly resonated with consumers, fueling this rapid expansion and solidifying its market leadership.

International Expansion into Europe

The strategic acquisition of ZAVA, a European digital health platform, in June 2025 is a pivotal move for Hims & Hers. This acquisition is expected to significantly bolster their presence in key European markets, including the UK, Germany, France, and Ireland.

This expansion is designed to tap into a substantial new customer base and utilize ZAVA's established infrastructure to accelerate Hims & Hers' global footprint. The company anticipates this will be a critical step in its journey to becoming a global leader in digital health services.

- Market Access: ZAVA's established presence provides immediate access to millions of potential customers across Europe.

- Revenue Growth: Analysts project a 25% increase in international revenue for Hims & Hers within the first two years post-acquisition.

- Synergistic Opportunities: Integration of ZAVA's services is expected to create cross-selling opportunities, potentially increasing average revenue per user by 15%.

- Competitive Positioning: The move strengthens Hims & Hers' competitive stance against other global digital health providers entering the European market.

AI-Driven Healthcare Technology

AI-driven healthcare technology, exemplified by platforms like MedMatch, is a significant star for Hims & Hers Health. This integration is revolutionizing care delivery by boosting efficiency and enabling highly personalized treatment plans. For instance, AI algorithms can streamline patient onboarding and appointment scheduling, potentially reducing administrative overhead by an estimated 15-20% in early implementations, as seen in similar telehealth providers during 2024.

The impact of this AI integration is directly felt in improved patient outcomes and reduced wait times. By accurately matching patients with the most suitable healthcare providers and treatment protocols, Hims & Hers can enhance the effectiveness of its services. Reports from 2024 indicate that AI-powered diagnostic tools in telehealth can improve diagnostic accuracy by up to 10%, leading to better patient results and increased satisfaction.

This technological advancement solidifies Hims & Hers' competitive edge in the dynamic telehealth sector. The ability to offer faster, more accurate, and personalized care positions the company as a leader in innovation.

- AI Integration: Enhances operational efficiency and personalizes patient care.

- Improved Outcomes: Reduces wait times and boosts treatment effectiveness.

- Competitive Advantage: Positions Hims & Hers at the forefront of telehealth innovation.

- Market Impact: Drives growth and strengthens market position in the evolving healthcare landscape.

Hims & Hers' direct-to-consumer telehealth platform is a clear star, fueled by an impressive 111% year-over-year revenue growth in Q1 2025, reaching $586 million. Their subscription-based, vertically integrated model is resonating strongly with consumers, driving rapid expansion and market leadership.

The weight management programs, particularly those using GLP-1 medications, are also stars, projected to generate $725 million by 2025. The company boasts over 1.4 million subscribers as of Q1 2025, with a monthly online revenue per average subscriber of $84, underscoring the market's embrace of personalized health services.

AI-driven healthcare technology is another star, enhancing efficiency and enabling personalized treatment plans. This integration boosts patient outcomes and reduces wait times, with AI diagnostic tools in telehealth showing up to a 10% improvement in diagnostic accuracy in 2024.

The acquisition of ZAVA in June 2025 is a strategic move to expand into key European markets, expected to increase international revenue by 25% within two years and potentially boost average revenue per user by 15% through cross-selling opportunities.

| Key Star Segments | Q1 2025 Revenue | Year-over-Year Growth | Projected 2025 Revenue | Key Metrics |

| Direct-to-Consumer Telehealth | $586 million | 111% | N/A | 1.4M+ Subscribers, $84 ARPU |

| Weight Management (GLP-1) | N/A | N/A | $725 million | High adherence, positive results |

| AI-Driven Healthcare | N/A | N/A | N/A | 10% diagnostic accuracy improvement (2024) |

| European Expansion (ZAVA Acquisition) | N/A | N/A | N/A | 25% international revenue growth projection |

What is included in the product

This BCG Matrix analysis provides tailored insights into Hims & Hers' product portfolio, highlighting strategic recommendations for investment, holding, or divestment.

Hims & Hers Health BCG Matrix offers a clear, one-page overview of each business unit's market position, simplifying strategic decisions.

This matrix provides a distraction-free view, optimized for quick C-level understanding and efficient portfolio management.

Cash Cows

Hims' sexual health offerings, a cornerstone of their business, likely represent a significant cash cow. These services, addressing prevalent and often chronic conditions, benefit from a high and stable market share within Hims' dedicated subscriber base.

The recurring revenue generated by these treatments is substantial, bolstered by the subscription model’s inherent ability to foster high customer retention. For instance, Hims & Hers reported a total revenue of $1.07 billion for the fiscal year 2023, with a significant portion attributed to their established prescription offerings.

Hair loss solutions are a bedrock for Hims & Hers, a mature segment that continues to hold a strong position within their subscriber base. This category is a consistent powerhouse for recurring revenue, bolstered by the company's established brand recognition and the inherent stickiness of its subscription model.

In 2024, the global hair loss treatment market was valued at approximately $2.5 billion, with Hims & Hers capturing a notable share through its accessible and convenient offerings. This segment's stability provides a reliable financial foundation, allowing the company to invest in other growth areas.

Hims & Hers' established dermatology services are a prime example of a Cash Cow within their portfolio. These offerings, a foundational part of the company's business since its inception, have cultivated a significant market share due to consistent user demand for ongoing skincare solutions.

The recurring nature of dermatological needs, coupled with Hims & Hers' effective subscription model, generates a stable and predictable cash flow. This segment requires minimal new investment, allowing it to efficiently contribute to the company's overall profitability. For instance, in Q1 2024, Hims & Hers reported a total revenue of $247.2 million, with their personalized care segment, which includes dermatology, showing strong performance.

Subscription-Based Revenue Model

The subscription-based revenue model for Hims & Hers Health is a powerful cash cow, underpinning its financial stability. This model leverages a large and loyal customer base to generate consistent, predictable income across its various health categories.

As of the first quarter of 2025, Hims & Hers boasts 2.4 million subscribers. This substantial subscriber count, coupled with retention rates that consistently surpass 85%, translates into a robust and reliable stream of recurring revenue.

This predictable cash flow is crucial. It provides the financial flexibility to not only cover ongoing operational expenses but also to strategically allocate capital towards promising, high-growth initiatives within the company's portfolio.

- 2.4 million subscribers as of Q1 2025.

- Retention rates exceeding 85% ensure ongoing revenue.

- Predictable recurring revenue supports operational costs and growth investments.

- Mature health categories contribute significantly to this cash cow status.

Mental Health Services

Hims & Hers' mental health services represent a significant cash cow within their business model. This segment taps into a consistently high demand for telepsychiatry and related support, ensuring a steady revenue stream for the company.

While not necessarily the fastest-growing area, its established presence and ongoing patient needs solidify its role as a reliable income generator. This stability is crucial for funding innovation in other parts of the business.

- High Demand: The need for accessible mental health care continues to grow, with millions seeking support annually.

- Consistent Revenue: Telehealth platforms for mental health have shown sustained patient engagement and recurring service utilization.

- Market Maturity: This segment benefits from a more established operational framework compared to newer service offerings.

Hims & Hers' established prescription offerings, particularly in sexual health and hair loss, function as significant cash cows. These mature segments benefit from high market share and recurring revenue driven by a loyal subscriber base, contributing substantially to the company's financial stability. The company reported total revenue of $1.07 billion for fiscal year 2023, with these core services forming a foundational element of that success.

As of Q1 2025, Hims & Hers has 2.4 million subscribers, with retention rates consistently above 85%. This robust subscriber base ensures a predictable and reliable stream of recurring revenue, allowing the company to fund growth initiatives in other areas of its business.

The company's dermatology services also act as a cash cow, leveraging consistent demand for ongoing skincare solutions. The subscription model for these services generates stable cash flow, requiring minimal new investment and contributing efficiently to overall profitability. In Q1 2024, personalized care, including dermatology, showed strong performance within their $247.2 million in total revenue.

Mental health services, while perhaps not the fastest-growing, also contribute to the cash cow status due to high and sustained demand for telepsychiatry. This segment benefits from a more established operational framework, ensuring consistent patient engagement and service utilization.

| Category | Market Share | Revenue Contribution | Investment Need |

| Sexual Health Prescriptions | High | Substantial Recurring | Low |

| Hair Loss Treatments | High | Substantial Recurring | Low |

| Dermatology Services | Significant | Stable Recurring | Low |

| Mental Health Services | Growing | Consistent | Moderate |

Full Transparency, Always

Hims & Hers Health BCG Matrix

The Hims & Hers Health BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and actionable report. You can confidently use this preview as a direct representation of the high-quality BCG Matrix you'll download, ready for immediate application in your business planning. This means no surprises, just a complete, analysis-ready tool to help you understand Hims & Hers Health's market position.

Dogs

Certain niche over-the-counter (OTC) products within Hims & Hers Health's portfolio might be classified as Dogs in the BCG Matrix. These are typically items that aren't central to their personalized prescription services or don't significantly boost the value of their core subscription offerings. For instance, a specialized skincare cream with minimal demand or a hair growth supplement not integrated into a broader treatment plan could fit this description.

These underperforming OTC products likely exhibit low sales volumes and contribute very little to the company's overall revenue or attracting new subscribers. Their market share is probably small, and growth prospects appear limited, indicating they are not strategic growth drivers. In 2023, Hims & Hers reported total revenue of $1.02 billion, and while specific OTC product line performance isn't detailed, such niche items could represent a small fraction of this, potentially tying up resources without substantial returns.

Hims & Hers Health might classify certain older, less dynamic service lines as dogs if they haven't adapted to their personalized care model or current market demands. These offerings could be characterized by flat or declining subscriber engagement, showing minimal growth despite their established presence. Such services may warrant a strategic review, potentially leading to divestiture or significant restructuring to avoid resource drain without adequate returns.

The wholesale revenue segment for Hims & Hers Health is a minor player, contributing very little to the company's overall financial picture. In the first quarter of 2025, this segment saw a 7% decrease in revenue compared to the previous year. This downward trend suggests that this particular business avenue is either stagnant or shrinking.

Non-Personalized, Commodity Offerings

Non-personalized, commodity offerings within Hims & Hers Health's portfolio would likely fall into the 'dog' category of the BCG matrix. These are products or services that lack significant differentiation, often facing intense competition in a saturated market. Without a unique selling proposition, they struggle to capture substantial market share or command premium pricing, leading to low profitability.

These types of offerings might achieve break-even status but are unlikely to drive significant growth for the company. In 2024, the telehealth market continued to be highly competitive, with many players offering similar services. For instance, while Hims & Hers saw revenue growth, the segment of their business focused on less personalized, over-the-counter (OTC) products might have experienced slower growth compared to their more specialized or prescription-based services.

- Low Differentiation: Products lacking unique features or personalization struggle against competitors.

- Intense Competition: Commoditized markets often see price wars and reduced margins.

- Limited Growth Potential: Break-even performance without substantial contribution to overall company growth.

- Struggles for Market Share: Difficulty in attracting and retaining customers due to lack of a strong unique value proposition.

Ineffective Customer Acquisition Channels

Ineffective customer acquisition channels for Hims & Hers, akin to 'dogs' in a BCG matrix, are those consuming significant marketing spend with minimal returns. These might include older, less targeted digital advertising campaigns or partnerships that historically drove traffic but now show declining conversion rates. For instance, if a specific social media platform, once a strong performer, now has a customer acquisition cost (CAC) that is double the company average, it would be a prime candidate for re-evaluation.

These underperforming channels are characterized by high costs per acquisition (CPA) and low conversion rates, meaning they drain marketing budgets without a proportionate increase in new subscribers or revenue. In 2024, a channel that requires $100 to acquire a new customer, compared to a company average of $40, clearly demonstrates this inefficiency. Such channels represent a low return on investment and limited potential for expanding the subscriber base.

- High CPA: Channels with a customer acquisition cost significantly above the company's average. For example, a specific print advertising campaign costing $150 per new subscriber in 2024.

- Low Conversion Rates: Marketing efforts that generate clicks or impressions but fail to convert these into paying customers. A banner ad campaign achieving only a 0.5% conversion rate.

- Diminishing ROI: Older strategies that are no longer yielding the same growth in subscriber numbers or revenue as they did previously. A referral program that has seen its new customer contribution drop by 70% year-over-year.

- Resource Drain: Marketing budget and team resources allocated to these channels that could be better utilized in more effective acquisition strategies.

Certain niche over-the-counter (OTC) products within Hims & Hers Health's portfolio might be classified as Dogs in the BCG Matrix. These are typically items that aren't central to their personalized prescription services or don't significantly boost the value of their core subscription offerings. For instance, a specialized skincare cream with minimal demand or a hair growth supplement not integrated into a broader treatment plan could fit this description.

These underperforming OTC products likely exhibit low sales volumes and contribute very little to the company's overall revenue or attracting new subscribers. Their market share is probably small, and growth prospects appear limited, indicating they are not strategic growth drivers. In 2023, Hims & Hers reported total revenue of $1.02 billion, and while specific OTC product line performance isn't detailed, such niche items could represent a small fraction of this, potentially tying up resources without substantial returns.

Hims & Hers Health might classify certain older, less dynamic service lines as dogs if they haven't adapted to their personalized care model or current market demands. These offerings could be characterized by flat or declining subscriber engagement, showing minimal growth despite their established presence. Such services may warrant a strategic review, potentially leading to divestiture or significant restructuring to avoid resource drain without adequate returns.

The wholesale revenue segment for Hims & Hers Health is a minor player, contributing very little to the company's overall financial picture. In the first quarter of 2025, this segment saw a 7% decrease in revenue compared to the previous year. This downward trend suggests that this particular business avenue is either stagnant or shrinking.

Non-personalized, commodity offerings within Hims & Hers Health's portfolio would likely fall into the 'dog' category of the BCG matrix. These are products or services that lack significant differentiation, often facing intense competition in a saturated market. Without a unique selling proposition, they struggle to capture substantial market share or command premium pricing, leading to low profitability.

These types of offerings might achieve break-even status but are unlikely to drive significant growth for the company. In 2024, the telehealth market continued to be highly competitive, with many players offering similar services. For instance, while Hims & Hers saw revenue growth, the segment of their business focused on less personalized, over-the-counter (OTC) products might have experienced slower growth compared to their more specialized or prescription-based services.

- Low Differentiation: Products lacking unique features or personalization struggle against competitors.

- Intense Competition: Commoditized markets often see price wars and reduced margins.

- Limited Growth Potential: Break-even performance without substantial contribution to overall company growth.

- Struggles for Market Share: Difficulty in attracting and retaining customers due to lack of a strong unique value proposition.

Ineffective customer acquisition channels for Hims & Hers, akin to 'dogs' in a BCG matrix, are those consuming significant marketing spend with minimal returns. These might include older, less targeted digital advertising campaigns or partnerships that historically drove traffic but now show declining conversion rates. For instance, if a specific social media platform, once a strong performer, now has a customer acquisition cost (CAC) that is double the company average, it would be a prime candidate for re-evaluation.

These underperforming channels are characterized by high costs per acquisition (CPA) and low conversion rates, meaning they drain marketing budgets without a proportionate increase in new subscribers or revenue. In 2024, a channel that requires $100 to acquire a new customer, compared to a company average of $40, clearly demonstrates this inefficiency. Such channels represent a low return on investment and limited potential for expanding the subscriber base.

- High CPA: Channels with a customer acquisition cost significantly above the company's average. For example, a specific print advertising campaign costing $150 per new subscriber in 2024.

- Low Conversion Rates: Marketing efforts that generate clicks or impressions but fail to convert these into paying customers. A banner ad campaign achieving only a 0.5% conversion rate.

- Diminishing ROI: Older strategies that are no longer yielding the same growth in subscriber numbers or revenue as they did previously. A referral program that has seen its new customer contribution drop by 70% year-over-year.

- Resource Drain: Marketing budget and team resources allocated to these channels that could be better utilized in more effective acquisition strategies.

Question Marks

Hims & Hers is strategically investing in new, high-potential health verticals like menopause, longevity, and preventive care. These emerging markets offer substantial growth opportunities as the company builds its presence. For example, the global menopause market was valued at approximately $15.3 billion in 2022 and is projected to reach $27.1 billion by 2030, indicating a significant expansion area for Hims & Hers.

These new specialties are currently in the early stages for Hims & Hers, akin to Question Marks in a BCG matrix, requiring substantial capital for marketing and infrastructure development. The company's success in these areas will depend on its ability to capture market share and effectively convert these early investments into future revenue drivers, potentially transforming them into Stars within their portfolio.

Hims & Hers plans to enter the Canadian market in 2026, a strategic move timed with the anticipated availability of generic semaglutide. This represents a significant new geographic venture with considerable growth potential for the company.

As a completely new market for Hims & Hers, Canada currently holds zero market share. This necessitates substantial investment in localized care delivery, robust marketing campaigns, and careful navigation of Canadian regulations to build a strong presence.

Hims & Hers is strategically entering the at-home lab testing market, a sector experiencing robust growth driven by increasing consumer interest in personalized health. Following their acquisition of Trybe Labs, the company is now positioned to offer convenient blood draws and comprehensive lab services directly to consumers' homes. This move places them in a high-potential, yet competitive, segment of the telehealth landscape.

While this expansion into at-home diagnostics represents a significant opportunity, Hims & Hers is still in the early stages of establishing its footprint and market share in this specialized area. The company faces the challenge of building out the necessary infrastructure, which includes substantial investments in advanced technology for sample collection and analysis, efficient logistics for delivery and returns, and robust consumer education to foster trust and understanding of these services.

The global telehealth market, which encompasses at-home testing, was valued at approximately $116.1 billion in 2023 and is projected to reach $657.5 billion by 2030, demonstrating the immense growth potential. Hims & Hers’ entry into this space, particularly with its focus on personalized health solutions, aligns with this upward trend. However, realizing the full potential of these services will necessitate overcoming operational complexities and effectively communicating the value proposition to a broad consumer base.

Advanced AI-Powered Diagnostic Tools and Nutrition Kits

Advanced AI-powered diagnostic tools and personalized nutrition kits represent Hims & Hers Health's foray into a high-growth, but still developing, segment of the wellness market. While AI is a foundational element, the direct application of these advanced tools and kits is a newer initiative. These offerings are positioned for significant future expansion, tapping into the increasing consumer demand for tailored health solutions.

These emerging products, while holding substantial growth potential in the personalized wellness sector, are currently in the early stages of market penetration for Hims & Hers. This necessitates continued investment to foster widespread adoption and capture a larger market share. For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to reach $187.9 billion by 2030, indicating the vast opportunity for specialized AI-driven health solutions.

- High Growth Potential: The personalized wellness market is expanding rapidly, driven by consumer interest in tailored health and nutrition.

- Early Market Penetration: Hims & Hers' AI diagnostic tools and nutrition kits are new offerings, requiring time and resources to gain traction.

- Sustained Investment Needed: Significant investment is required to drive adoption, build brand awareness, and compete effectively in this emerging space.

- Strategic Importance: These products align with the company's broader strategy to offer comprehensive and personalized healthcare solutions.

Strategic Shift to Branded GLP-1 Partnerships

Hims & Hers is strategically moving from offering compounded semaglutide to partnering for branded GLP-1 medications such as Wegovy. This pivot aims to capture a larger share of the rapidly expanding GLP-1 market, which saw significant growth in 2024. The company is navigating the complexities of supply chains and pricing wars with major pharmaceutical players.

This shift is crucial as the GLP-1 market continues its upward trajectory. For instance, Novo Nordisk's Wegovy has been a major driver of growth in this segment. Hims & Hers' strategy aims to leverage these established brands while building its own market presence.

- Market Expansion: Targeting the high-growth branded GLP-1 segment.

- Partnership Focus: Collaborating with established pharmaceutical companies for branded offerings.

- Competitive Landscape: Navigating competition with major players in the GLP-1 space.

- Market Share Consolidation: Aiming to solidify its position within the branded GLP-1 market.

Hims & Hers is strategically investing in new health verticals like menopause, longevity, and preventive care, which are currently in early stages for the company. These ventures require significant capital for marketing and development, much like Question Marks in a BCG matrix. The success of these new areas hinges on Hims & Hers' ability to capture market share and convert early investments into future revenue streams.

The company's expansion into at-home lab testing, following the acquisition of Trybe Labs, also represents a Question Mark. This high-potential, yet competitive, segment demands substantial investment in technology, logistics, and consumer education to build infrastructure and market share. Similarly, advanced AI-powered diagnostic tools and personalized nutrition kits are new initiatives in a developing market, requiring sustained investment for adoption and brand awareness.

| BCG Category | Hims & Hers Health Initiative | Market Growth | Hims & Hers Market Share | Capital Needs |

|---|---|---|---|---|

| Question Mark | Menopause, Longevity, Preventive Care | High (e.g., Menopause market ~$15.3B in 2022, projected $27.1B by 2030) | Low/Developing | High |

| Question Mark | At-Home Lab Testing (via Trybe Labs) | High (e.g., Telehealth market ~$116.1B in 2023, projected $657.5B by 2030) | Low/Developing | High |

| Question Mark | AI-Powered Diagnostics & Personalized Nutrition | High (e.g., AI in Healthcare market ~$15.4B in 2023, projected $187.9B by 2030) | Low/Developing | High |

BCG Matrix Data Sources

Our Hims & Hers Health BCG Matrix leverages robust data, including financial disclosures, market research reports, and internal performance metrics, to accurately position each service offering.