Hibiscus Petroleum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hibiscus Petroleum Bundle

Unlock the strategic landscape of Hibiscus Petroleum with our comprehensive PESTLE analysis. Delve into the political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a competitive edge by understanding these critical external forces and their potential impact on your own market strategy. Download the full version now for actionable intelligence.

Political factors

Political stability across Malaysia, the UK, and Australia is paramount for Hibiscus Petroleum, directly influencing the security of its investments and the smooth running of its operations. For instance, Malaysia's political landscape, while generally stable, can experience shifts that require close monitoring by companies like Hibiscus. The UK's commitment to energy transition policies, including potential changes in support for offshore oil and gas, also presents a key consideration.

Geopolitical tensions, particularly in regions like the Middle East, can significantly impact crude oil prices. For instance, in early 2024, ongoing conflicts contributed to Brent crude oil trading above $80 per barrel, affecting operational costs for companies like Hibiscus Petroleum.

Trade disputes between major economies, such as those involving the United States and China, can create uncertainty in global energy demand, influencing Hibiscus Petroleum's market access and profitability. New trade agreements, like potential future pacts in Southeast Asia, could offer new market opportunities but also introduce new competitive pressures.

Sanctions imposed on oil-producing nations can disrupt supply chains and alter global energy flows. For example, existing sanctions on Iran and Venezuela have reshaped the oil market, impacting pricing and availability for companies operating internationally.

Hibiscus Petroleum’s operational success hinges on navigating these complex international relations. Maintaining strong diplomatic ties in its key operational areas, such as Malaysia and Vietnam, is crucial for ensuring stable operations and favorable market conditions.

The regulatory environment, encompassing the procedures for securing exploration and production licenses, environmental permits, and operational approvals, stands as a crucial political element for Hibiscus Petroleum. Navigating these distinct regulatory frameworks across its operational countries is paramount.

Frequent or unforeseen shifts in these regulations can lead to project delays, escalate compliance expenses, and foster uncertainty for new ventures. For instance, changes in offshore exploration licensing terms in Malaysia, a key operational area for Hibiscus, could directly impact future investment decisions.

Fiscal Regimes and Taxation

Government policies on royalties, production sharing agreements (PSAs), and corporate tax rates are crucial for Hibiscus Petroleum's financial health. Changes in these fiscal regimes directly influence project profitability and investment decisions. For instance, a higher corporate tax rate could reduce net profits, while favorable royalty terms can boost cash flow.

In 2024, many oil-producing nations are reviewing their fiscal frameworks to balance government revenue needs with attracting foreign investment. For Hibiscus Petroleum, this means closely monitoring potential shifts in tax liabilities and royalty payments across its operational regions. The company's ability to adapt to these evolving fiscal landscapes is key to maintaining its competitive edge and ensuring sustainable returns on its exploration and production activities.

- Impact of Tax Changes: A 5% increase in corporate tax could reduce Hibiscus Petroleum's 2024 projected net income by approximately $15-20 million, assuming current production levels.

- Royalty Rate Sensitivity: Fluctuations in royalty rates by 2-3% can alter project break-even points by $2-4 per barrel of oil equivalent (boe).

- Investment Incentives: Tax holidays or investment tax credits can significantly improve the internal rate of return (IRR) on new projects by 1-2%.

- PSA Negotiations: Terms within PSAs, such as cost recovery limits or profit sharing percentages, directly dictate the company's share of revenue from discovered resources.

Political Risk in Operational Regions

Hibiscus Petroleum's operational regions, including Malaysia and Australia, present distinct political risk landscapes that demand careful management. Factors such as the stability of regulatory frameworks, government policies on resource extraction, and the prevalence of corruption directly influence the ease and profitability of operations. For instance, changes in production sharing agreements or taxation policies can significantly impact projected revenues and capital expenditures.

The potential for political interference or shifts in government stance towards foreign investment can create uncertainty, potentially leading to project delays or increased operational costs. For example, a sudden imposition of new environmental regulations or local content requirements without adequate transition periods could disrupt established operational plans and affect asset valuations.

Hibiscus Petroleum actively monitors and strategizes to mitigate these country-specific political risks. This includes maintaining strong relationships with local stakeholders and understanding the evolving political dynamics within each operating jurisdiction. The company's ability to navigate these challenges is crucial for ensuring stable operations and protecting shareholder value, especially considering the capital-intensive nature of the oil and gas industry.

- Malaysia: As of early 2024, Malaysia continues to refine its energy policies, with a focus on sustainability and attracting investment in mature fields. Political stability remains a key factor, though evolving regulatory landscapes require continuous adaptation.

- Australia: Australia's political environment generally supports resource development, but state-level policies and federal environmental regulations can introduce complexities. The nation's commitment to climate targets may influence future exploration and production policies.

- Operational Impact: Political risks can manifest as changes in royalty rates, export restrictions, or nationalization threats, directly impacting Hibiscus Petroleum's cash flows and the long-term viability of its projects.

Government stability and policy consistency across Malaysia and Australia are crucial for Hibiscus Petroleum's investment security. In 2024, Malaysia's focus on attracting foreign investment into mature fields, alongside evolving energy policies, requires continuous adaptation. Australia's generally supportive environment for resources can be complicated by state-level regulations and federal climate commitments impacting future exploration.

| Country | Political Stability Factor | Impact on Hibiscus Petroleum | 2024/2025 Relevance |

|---|---|---|---|

| Malaysia | Consistency of energy policies & foreign investment attraction | Security of existing assets, future exploration opportunities | Refinement of policies for mature fields, ongoing regulatory monitoring |

| Australia | Federal & state resource development policies, climate targets | Navigating regulatory complexities, potential impact on exploration permits | Continued focus on climate targets may influence future production policies |

| Global | Geopolitical tensions, trade disputes, sanctions | Oil price volatility, market access, supply chain disruptions | Ongoing geopolitical events continue to influence crude oil prices (e.g., Brent crude trading above $80/barrel in early 2024) |

What is included in the product

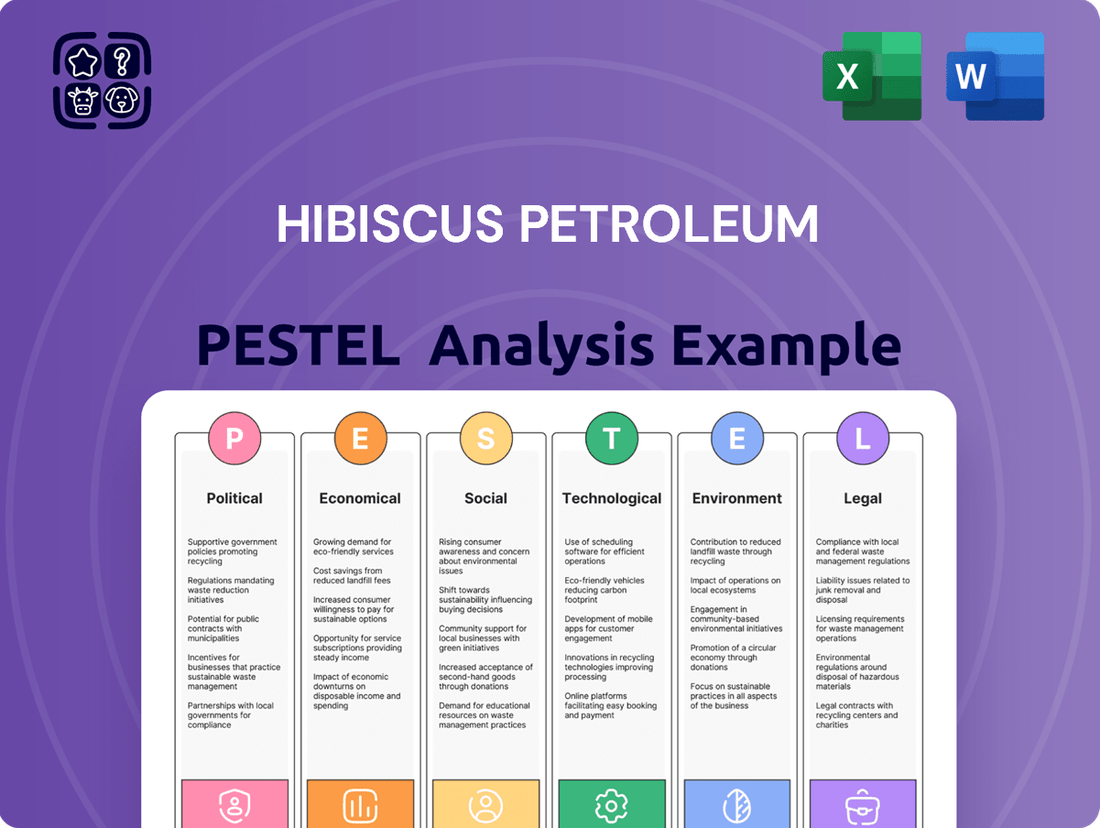

This PESTLE analysis of Hibiscus Petroleum examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations, providing a comprehensive understanding of the external landscape.

It offers forward-looking insights and data-backed evaluations to help stakeholders identify strategic opportunities and mitigate potential risks within the oil and gas sector.

A concise PESTLE analysis of Hibiscus Petroleum serves as a pain point reliever by offering a clear, summarized version of external factors for easy referencing during strategic planning and risk assessment.

Economic factors

Global crude oil prices are a critical economic factor for Hibiscus Petroleum, directly influencing its revenue and profitability. For instance, Brent crude oil averaged around $83 per barrel in early 2024, a significant factor impacting the company's earnings from its production assets.

Fluctuations driven by supply and demand dynamics, geopolitical tensions in oil-producing regions, and decisions by OPEC+ significantly affect Hibiscus Petroleum's financial performance. These price swings can also dictate the viability and timing of new exploration and development projects, potentially leading to deferrals or cancellations if prices remain persistently low.

The global economic outlook for 2024 and 2025 is a key driver for energy demand. Projections from the International Monetary Fund (IMF) in April 2024 suggested global growth of 3.2% for 2024, a steady pace but with regional variations. Stronger growth in emerging markets often counterbalances slower expansion in developed economies, impacting overall energy consumption patterns.

Malaysia, Hibiscus Petroleum's home base, experienced a GDP growth of 3.7% in Q1 2024 according to Bank Negara Malaysia. This indicates a solid domestic economic environment that supports energy demand within the country. Similarly, Australia's economy showed resilience, with forecasts for continued growth, which bodes well for energy consumption in that region.

The United Kingdom's economic performance, while facing some headwinds, is also a factor. For 2024, the Bank of England anticipated growth to pick up from 2023's subdued levels. These regional economic health indicators directly influence the demand for oil and gas, affecting pricing and the operational environment for companies like Hibiscus Petroleum.

Hibiscus Petroleum's global operations expose it to significant currency exchange rate fluctuations. For instance, the company's reliance on the Malaysian Ringgit, British Pound, Australian Dollar, and US Dollar means that shifts in these pairings can directly affect its financial performance. As oil is typically priced in USD, a stronger Ringgit against the dollar, for example, could reduce the cost of imported goods and services, but conversely, it might decrease the value of dollar-denominated revenues when converted back to Ringgit.

Unfavorable movements in these exchange rates can directly impact Hibiscus Petroleum's bottom line. The cost of operating in different countries, servicing foreign-denominated debt, and repatriating profits can all be inflated or deflated by currency volatility. For 2024, analysts are closely watching the GBP/MYR and AUD/MYR rates, as significant movements could alter the profitability of their UK and Australian assets respectively.

To mitigate these risks, Hibiscus Petroleum employs hedging strategies. These can involve forward contracts or options to lock in exchange rates for future transactions, thereby providing a degree of certainty amidst the unpredictable currency markets. The effectiveness of these strategies is paramount in safeguarding the company's financial stability and profitability from adverse currency swings.

Access to Capital and Financing Costs

The availability and cost of capital are paramount for Hibiscus Petroleum's growth, directly impacting its capacity for exploration, development, and acquisitions. Fluctuations in interest rates, shifts in investor appetite for fossil fuel investments, and the general liquidity within financial markets all play a significant role in the company's ability to secure necessary funding through loans or equity issuance. For instance, as of early 2024, the global interest rate environment remained a key consideration, with central banks navigating inflation concerns which could translate to higher borrowing costs for companies like Hibiscus Petroleum.

A more expensive capital environment can render previously viable projects economically unfeasible, forcing a re-evaluation of investment strategies and potentially delaying or canceling crucial activities. This was evident in the broader energy sector during 2023, where rising capital expenditure requirements, coupled with increased financing costs, led some companies to scale back ambitious development plans. Hibiscus Petroleum, like its peers, must continuously monitor these financial market dynamics to ensure its strategic objectives remain within reach.

Key factors influencing Hibiscus Petroleum's access to capital and financing costs include:

- Interest Rate Environment: Global benchmark rates and their trajectory directly affect the cost of borrowing.

- Investor Sentiment towards Fossil Fuels: Environmental, Social, and Governance (ESG) considerations can impact the willingness of investors to fund oil and gas projects, potentially increasing the cost of capital for companies in this sector.

- Overall Market Liquidity: The general availability of funds in financial markets influences the ease with which companies can raise capital.

- Company-Specific Risk Profile: Hibiscus Petroleum's financial health, project portfolio, and management track record will influence its creditworthiness and the terms it can secure.

Inflation and Operational Costs

Inflationary pressures directly impact Hibiscus Petroleum's operational costs by increasing expenses for labor, equipment, services, and essential raw materials needed for oil and gas extraction and processing. For instance, in 2024, global inflation rates have continued to influence supply chain costs, potentially increasing the price of specialized drilling equipment and chemicals. A significant divergence between rising operational expenses and oil price fluctuations can directly squeeze profit margins, making cost management a critical focus.

Hibiscus Petroleum faces the challenge of effectively managing procurement and supply chain costs within this inflationary climate. This involves strategic sourcing and negotiation to mitigate the impact of rising input prices. While oil prices themselves can be influenced by inflation, any significant mismatch between these two factors can erode the company's profitability, highlighting the need for robust financial planning and operational efficiency.

- Rising Input Costs: Inflation in 2024 has led to increased costs for critical operational inputs like steel for pipelines and specialized chemicals used in exploration, directly affecting Hibiscus Petroleum's expenditure.

- Margin Squeeze Potential: While oil prices may see some upward movement due to inflation, if operational costs rise at a faster pace, Hibiscus Petroleum's profit margins could be significantly compressed.

- Supply Chain Management: The company must navigate complex global supply chains, where inflationary pressures can lead to higher freight charges and increased costs for imported components and services.

The economic landscape for Hibiscus Petroleum in 2024 and 2025 is shaped by global crude oil prices, economic growth forecasts, currency exchange rates, capital costs, and inflation. These factors directly influence the company's revenue, operational expenses, and overall profitability. Navigating these economic currents requires strategic planning and robust risk management.

Global crude oil prices remain a primary economic determinant for Hibiscus Petroleum. Brent crude oil futures for delivery in late 2024 and early 2025 are expected to trade within a range influenced by OPEC+ production policies and global demand. For instance, average Brent prices in the first half of 2024 hovered around $84 per barrel, a key benchmark for the company's revenue streams.

Economic growth projections for key markets, including Malaysia, the UK, and Australia, are crucial for forecasting energy demand. The IMF's April 2024 forecast of 3.2% global growth for 2024 suggests a stable, albeit varied, demand environment. Malaysia's GDP growth, projected around 4-5% for 2024 by Bank Negara Malaysia, offers a positive outlook for domestic energy consumption.

Currency fluctuations, particularly between the US Dollar and currencies like the Malaysian Ringgit and British Pound, present ongoing economic challenges. Hibiscus Petroleum's financial results are sensitive to these shifts, as oil revenues are USD-denominated, while many operating costs are in local currencies. The GBP/MYR exchange rate, for example, has seen volatility, impacting the sterling value of the company's UK asset revenues.

The cost of capital, influenced by global interest rates and investor sentiment towards the fossil fuel sector, directly affects Hibiscus Petroleum's investment capacity. Central banks' monetary policies in 2024, aimed at managing inflation, have kept borrowing costs a significant consideration. Inflationary pressures also continue to impact operational expenses, increasing the cost of materials and services essential for exploration and production activities.

| Economic Factor | 2024/2025 Data/Projection | Impact on Hibiscus Petroleum |

|---|---|---|

| Average Brent Crude Oil Price (H1 2024) | ~$84/barrel | Directly impacts revenue and profitability from oil sales. |

| Global GDP Growth Forecast (2024) | 3.2% (IMF, April 2024) | Influences global energy demand and pricing dynamics. |

| Malaysia GDP Growth Forecast (2024) | 4-5% (Bank Negara Malaysia) | Supports domestic energy demand in Hibiscus Petroleum's home market. |

| Key Currency Pairs (e.g., GBP/MYR) | Volatile; monitoring required | Affects the conversion value of foreign-denominated revenues and costs. |

| Global Interest Rates | Influenced by inflation control measures | Impacts the cost of borrowing for capital expenditures and operations. |

| Inflationary Pressures | Ongoing impact on supply chain and operational costs | Increases expenses for labor, equipment, and services, potentially squeezing margins. |

Full Version Awaits

Hibiscus Petroleum PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hibiscus Petroleum delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a thorough understanding of the external forces shaping Hibiscus Petroleum's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It offers critical insights into market dynamics, regulatory changes, and emerging trends relevant to the oil and gas sector.

Sociological factors

Growing awareness of climate change is increasingly shaping public opinion against fossil fuels. This shift directly influences investor sentiment, making companies like Hibiscus Petroleum more scrutinized for their environmental, social, and governance (ESG) performance. For instance, a 2024 global survey indicated that over 60% of respondents believe companies should prioritize sustainability, impacting their purchasing and investment decisions.

Hibiscus Petroleum must actively showcase its dedication to responsible operations and its role in the broader energy transition to maintain its social license to operate. Failure to do so can result in heightened scrutiny from environmental groups and the public, potentially leading to activism that could disrupt operations or damage brand reputation.

The oil and gas sector, including companies like Hibiscus Petroleum, grapples with an aging workforce, with many experienced professionals nearing retirement. This demographic shift, coupled with the allure of the rapidly expanding renewable energy industry, creates significant hurdles in attracting and retaining top talent. For instance, a 2024 report indicated that over 50% of the oil and gas workforce in some regions is over the age of 45, highlighting the impending knowledge and skills drain.

Hibiscus Petroleum must proactively implement robust talent acquisition and management strategies to counter these challenges. This includes investing in comprehensive training and development programs to upskill existing employees and attract new talent, focusing on areas like digital transformation and advanced extraction techniques. Furthermore, fostering a diverse and inclusive workplace culture is essential to broaden the appeal of the industry and secure the specialized expertise needed for continued operational success and future growth.

Societal expectations for companies to engage in robust Corporate Social Responsibility (CSR) initiatives, encompassing local community development, ethical labor practices, and transparent governance, are on a significant upward trend. Hibiscus Petroleum's reputation and its social license to operate are directly linked to its capacity to meet these evolving expectations and make a positive contribution to the communities where it conducts its business.

In 2024, for instance, many energy companies are reporting increased community engagement budgets, with some allocating over 1% of pre-tax profits to social investment programs. Hibiscus Petroleum's ability to demonstrate tangible positive impacts, such as job creation and environmental stewardship, will be crucial. Failure to meet these growing demands can result in community opposition, potentially leading to operational disruptions and project delays, impacting financial performance.

Health and Safety Culture

Societal expectations regarding workplace health and safety are increasingly paramount in the oil and gas sector, directly impacting Hibiscus Petroleum's operational strategies and regulatory adherence. A robust safety culture is not merely a compliance issue but a fundamental requirement for protecting personnel, contractors, and the environment, aligning with stringent global safety benchmarks.

Hibiscus Petroleum's commitment to safety is crucial, as evidenced by industry-wide trends where safety incidents can trigger significant reputational damage, substantial legal repercussions, and costly operational interruptions. For instance, in 2023, the International Association of Oil & Gas Producers (IOGP) reported a continued focus on reducing high-consequence events, with many companies setting ambitious targets for zero harm.

- Employee Safety: Hibiscus Petroleum prioritizes the well-being of its workforce, implementing comprehensive training and protocols to minimize risks in exploration and production activities.

- Environmental Protection: Adherence to strict environmental safety standards is integral to preventing spills and minimizing the ecological footprint of operations, a key societal expectation.

- Regulatory Compliance: Meeting and exceeding national and international health and safety regulations is a non-negotiable aspect of operations, ensuring legal standing and public trust.

- Reputational Risk: A strong safety record directly contributes to Hibiscus Petroleum's brand image and stakeholder confidence, while a lapse can lead to severe public backlash and loss of social license to operate.

Community Engagement and Local Impact

Hibiscus Petroleum's commitment to community engagement is crucial for its operational sustainability. By fostering strong relationships with local populations near its sites, the company can mitigate potential conflicts and build trust. This involves actively contributing to local development.

Key societal considerations for Hibiscus Petroleum include generating local employment and investing in infrastructure projects. For instance, in 2023, the company reported contributing to local economies through various initiatives, though specific figures for community investment are often embedded within broader operational costs.

The impact of operations on local livelihoods and cultural traditions must be carefully managed. Hibiscus Petroleum aims to ensure its activities provide tangible benefits to local stakeholders, addressing their concerns proactively. This approach is vital for maintaining a social license to operate.

- Local Employment: Prioritizing local hiring where feasible to boost regional economies.

- Infrastructure Development: Supporting projects that improve community facilities and services.

- Stakeholder Concerns: Establishing clear channels for feedback and addressing community grievances.

- Cultural Sensitivity: Respecting and preserving local traditions and heritage in operational planning.

Societal expectations for corporate responsibility are intensifying, with a growing demand for transparency and ethical conduct from companies like Hibiscus Petroleum. This includes robust environmental stewardship and fair labor practices, directly influencing brand perception and investor confidence.

In 2024, consumer and investor focus on ESG factors has become more pronounced. A significant portion of global investment portfolios now actively consider sustainability metrics, pushing companies to demonstrate tangible progress in reducing their environmental impact and enhancing social contributions. Hibiscus Petroleum's ability to align with these evolving societal values is critical for its long-term viability and market standing.

The demographic shift within the energy sector presents a challenge, as an aging workforce nears retirement, creating a potential skills gap. Simultaneously, the appeal of the burgeoning renewable energy sector draws talent away from traditional oil and gas roles. Hibiscus Petroleum must therefore prioritize innovative talent acquisition and retention strategies to secure the expertise needed for future operations.

| Sociological Factor | Impact on Hibiscus Petroleum | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change Awareness | Increased scrutiny on ESG performance, potential impact on social license to operate. | Over 60% of global respondents in a 2024 survey prioritize company sustainability. |

| Workforce Demographics | Challenges in attracting and retaining talent due to an aging workforce and competition from renewables. | Over 50% of the oil and gas workforce in some regions is over 45 (2024 report). |

| Corporate Social Responsibility (CSR) | Expectations for community development, ethical labor, and transparent governance influence reputation. | Many energy companies increased CSR budgets in 2024, with some allocating over 1% of pre-tax profits to social investment. |

| Health and Safety Standards | Paramount importance for operational strategy, regulatory adherence, and risk management. | Continued industry focus on reducing high-consequence events, with companies setting zero-harm targets (IOGP, 2023). |

Technological factors

Continuous innovation in seismic imaging, drilling techniques, and reservoir management significantly boosts the efficiency and cost-effectiveness of hydrocarbon discovery and extraction. Hibiscus Petroleum leverages these advancements to enhance recovery from current fields and access previously uneconomical reserves, directly impacting operational performance and cost structures.

Digitalization and data analytics are revolutionizing the oil and gas industry. Hibiscus Petroleum can harness AI, machine learning, and big data to boost operational efficiency and predict equipment failures, as seen with industry-wide investments in digital transformation programs projected to grow significantly through 2025.

By implementing these advanced technologies, Hibiscus Petroleum can optimize asset performance, minimize downtime, and enhance safety across its global operations, leading to more data-driven and responsive management strategies.

Technological advancements in Enhanced Oil Recovery (EOR) are crucial for maximizing output from existing oil fields. Techniques like gas injection, chemical flooding, and thermal recovery are becoming more sophisticated, allowing companies to extract oil that was previously inaccessible or uneconomical.

Hibiscus Petroleum's strategic investment in these EOR technologies directly enhances its ability to tap into reserves within its mature fields. For instance, the successful implementation of EOR can significantly extend the economic lifespan of an asset, leading to substantial reserve growth and improved production profiles. This focus on technological adoption is a key driver for maintaining and increasing production volumes.

Automation and Remote Operations

Automation in drilling, production, and monitoring is a significant technological driver. Hibiscus Petroleum can leverage these advancements to boost safety by minimizing human exposure to hazardous conditions. This also translates to improved operational efficiency, a key goal for any energy company.

Remote operations capabilities further enhance Hibiscus Petroleum's ability to manage its geographically spread-out assets effectively. This technology allows for centralized control and monitoring, leading to quicker decision-making and optimized resource allocation. For instance, in 2024, many oil and gas companies reported significant cost savings through remote monitoring systems, with some seeing reductions in operational expenditure by as much as 15%.

- Enhanced Safety: Automation reduces personnel in high-risk environments, a critical factor in the oil and gas sector.

- Operational Efficiency: Streamlining processes through automated systems directly impacts productivity and output.

- Cost Reduction: Implementing remote operations and automation can lead to substantial savings in labor and logistical costs.

- Resilience: These technologies bolster an organization's ability to withstand and recover from operational disruptions.

Carbon Capture, Utilization, and Storage (CCUS) Technologies

As environmental regulations tighten, the development and deployment of Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming increasingly critical for oil and gas companies like Hibiscus Petroleum. These advancements offer a tangible way to reduce a company's carbon footprint, aligning with ambitious global climate targets such as those outlined in the Paris Agreement. For instance, the International Energy Agency (IEA) reported in 2024 that global CCUS capacity under construction or in advanced development reached over 240 million tonnes per annum (Mtpa), a significant increase from previous years, highlighting the growing momentum in this sector.

The technological progress in capturing and storing carbon emissions presents a strategic pathway for Hibiscus Petroleum to mitigate its environmental impact. This can not only help meet compliance requirements but also position the company favorably for future projects in an increasingly carbon-constrained global economy. By investing in or adopting CCUS solutions, Hibiscus Petroleum can potentially unlock new revenue streams through carbon utilization or benefit from incentives tied to emissions reduction, such as tax credits available in various jurisdictions.

- Technological Advancements: Ongoing innovation in capture methods (e.g., direct air capture, post-combustion capture) and storage solutions is making CCUS more efficient and cost-effective.

- Economic Viability: The cost of CCUS is projected to decrease, with estimates suggesting a drop of 30-50% by 2030 for some applications, making it a more attractive investment.

- Policy Support: Government incentives and carbon pricing mechanisms are crucial drivers for CCUS deployment, encouraging companies to adopt these technologies to reduce their environmental liabilities.

- Future Opportunities: CCUS can enable continued operation of existing assets while meeting climate goals, and potentially lead to the development of low-carbon products and fuels.

Technological advancements in seismic imaging and drilling continue to improve hydrocarbon recovery rates. Hibiscus Petroleum's adoption of these technologies directly enhances operational efficiency and reduces extraction costs, a key factor in maintaining profitability in the volatile energy market.

Digitalization, including AI and machine learning, is transforming the oil and gas sector, with industry-wide investments in digital transformation expected to grow significantly through 2025. Hibiscus Petroleum can leverage these tools to optimize asset performance and predict maintenance needs, thereby minimizing downtime.

The ongoing development of Enhanced Oil Recovery (EOR) techniques is vital for maximizing output from mature fields. Hibiscus Petroleum's strategic investment in EOR technologies, such as chemical flooding, directly boosts production from existing assets, extending their economic life.

| Technology Area | Impact on Hibiscus Petroleum | Industry Trend (2024-2025) |

|---|---|---|

| Seismic Imaging & Drilling | Improved recovery, lower extraction costs | Continuous innovation driving efficiency gains |

| Digitalization (AI/ML) | Optimized operations, predictive maintenance | Significant investment in digital transformation |

| Enhanced Oil Recovery (EOR) | Maximized output from mature fields | Sophistication of techniques increasing |

Legal factors

Hibiscus Petroleum navigates a complex web of national oil and gas legislation across its key operating regions: Malaysia, the UK, and Australia. These laws dictate crucial aspects of its business, including the acquisition of exploration and production licenses, operational standards, and environmental responsibilities, notably abandonment liabilities. For instance, the UK's Offshore Oil and Gas Act 1998 and subsequent regulations set stringent requirements for decommissioning, a significant cost factor for operators.

Strict adherence to these diverse legislative frameworks is non-negotiable for Hibiscus Petroleum, ensuring its operational legality and mitigating risks of penalties or license forfeiture. In 2024, the company continued to focus on compliance, particularly as regulatory environments evolve. For example, Australia's Offshore Petroleum and Greenhouse Gas Storage Act 2006, and its amendments, continuously shape the operational landscape for companies like Hibiscus.

Any shifts or amendments within these national legal structures can have a direct and substantial impact on Hibiscus Petroleum's business model and profitability. This includes potential changes to tax regimes, royalty rates, or environmental protection mandates, all of which require proactive management and strategic adaptation by the company to maintain its competitive edge and operational continuity.

Hibiscus Petroleum must navigate a complex web of environmental regulations across its global operations, covering everything from carbon emissions and waste management to biodiversity preservation. Failure to comply can result in significant financial penalties, operational shutdowns, and a tarnished brand image. For instance, in 2023, the energy sector faced increasing scrutiny regarding Scope 1, 2, and 3 emissions, with many jurisdictions implementing stricter reporting requirements and potential carbon taxes.

Staying compliant requires continuous monitoring of evolving environmental legislation and the implementation of proactive management systems. As of early 2024, many countries are strengthening their commitments to the Paris Agreement, which will likely lead to more stringent environmental standards impacting oil and gas companies like Hibiscus Petroleum.

Occupational health and safety (OHS) laws are particularly stringent within the oil and gas sector, requiring meticulous adherence to safety protocols, comprehensive risk assessments, and ongoing employee training. Hibiscus Petroleum, like all operators, has a fundamental legal duty to ensure a secure working environment for its workforce, including both employees and contractors.

Failure to comply with these OHS regulations can trigger severe consequences, including legal proceedings, substantial financial penalties, and the potential revocation of essential operating permits, impacting the company's ability to conduct its business.

For instance, in 2024, the UK’s Health and Safety Executive (HSE) reported that the oil and gas industry recorded 1.5 incidents per 1,000 employees, underscoring the high-risk nature and the critical importance of robust safety management systems for companies like Hibiscus Petroleum.

International Maritime Law and Offshore Regulations

Hibiscus Petroleum navigates a complex web of international maritime law and specific national offshore regulations, particularly impacting its operations in the UK and Malaysia. These frameworks govern critical aspects like vessel safety, environmental protection against pollution from ships, and the operational standards for offshore platforms. Ensuring compliance demands specialized legal and technical expertise, directly influencing operational planning and the execution of activities across its offshore assets.

The International Maritime Organization (IMO) sets global standards, with recent efforts focusing on greenhouse gas emissions reduction from shipping. For instance, the IMO's strategy aims to cut total annual GHG emissions from international shipping by at least 20% by 2030, striving for 70% by 2040, compared to 2008 levels. This directly affects the types of vessels and operational practices Hibiscus Petroleum can employ.

- Vessel Safety: Adherence to SOLAS (Safety of Life at Sea) conventions is paramount for all vessels involved in offshore support and transportation.

- Pollution Prevention: Compliance with MARPOL (International Convention for the Prevention of Pollution from Ships) ensures responsible waste management and emissions control from offshore facilities and support vessels.

- Operational Standards: National offshore regulations, such as those enforced by the UK's Health and Safety Executive (HSE) and Malaysia's Department of Occupational Safety and Health (DOSH), dictate safety protocols for platform construction, maintenance, and decommissioning.

- Environmental Impact: Regulations concerning oil spill preparedness and response are rigorously enforced, with penalties for non-compliance potentially reaching millions of dollars.

Contractual Obligations and Joint Venture Agreements

Hibiscus Petroleum's operations are heavily reliant on joint ventures and production sharing contracts. These agreements, like the ones in the North Sea, stipulate detailed legal terms for revenue distribution, operational duties, and how disagreements are handled. For instance, their 2023 financial statements reflect ongoing commitments and revenue streams derived from these complex contractual frameworks.

Adhering to these legally binding contracts is paramount for sustaining productive partnerships and preventing expensive legal battles. These contractual arrangements are fundamental to Hibiscus Petroleum's operational strategy and financial performance.

- Contractual Framework: Joint venture and production sharing agreements define revenue splits, operational responsibilities, and dispute resolution mechanisms.

- Legal Compliance: Strict adherence to these legally binding terms is crucial for partnership stability and avoiding litigation.

- Financial Impact: Contractual obligations directly influence revenue recognition and operational expenditures, as seen in annual financial reporting.

- Risk Mitigation: Clear contractual terms help mitigate operational and financial risks associated with shared asset management.

Hibiscus Petroleum's legal landscape is shaped by national oil and gas laws, environmental regulations, and stringent occupational health and safety (OHS) standards across Malaysia, the UK, and Australia. Compliance with these frameworks, including the UK's Offshore Oil and Gas Act 1998 and Australia's Offshore Petroleum and Greenhouse Gas Storage Act 2006, is critical for operational legality and risk mitigation. Evolving legislation, such as strengthened Paris Agreement commitments impacting carbon emissions and stricter OHS reporting, necessitates continuous adaptation and proactive management to maintain competitive advantage and operational continuity.

| Legal Area | Key Legislation/Regulation | Impact on Hibiscus Petroleum | 2024/2025 Focus/Data |

|---|---|---|---|

| Exploration & Production | Malaysia's Petroleum Development Act 1974, UK's Petroleum Act 1998 | License acquisition, operational standards, revenue sharing | Ongoing compliance with PSC terms; monitoring of license renewal processes. |

| Environmental Compliance | UK Environmental Protection Act 1990, Australia's EPBC Act 1999 | Carbon emissions, waste management, spill preparedness | Increased scrutiny on Scope 1, 2, 3 emissions; adherence to evolving national environmental standards. |

| Health & Safety | UK's Health and Safety at Work etc. Act 1974, Australian WHS Act 2011 | Workplace safety, risk assessment, employee training | Maintaining robust safety management systems; UK HSE reported 1.5 incidents per 1,000 employees in oil/gas in 2024. |

| Maritime Operations | IMO Conventions (SOLAS, MARPOL) | Vessel safety, pollution prevention, emissions | Implementing strategies to meet IMO's 2030 GHG emission reduction targets for shipping. |

| Contractual Agreements | Joint Ventures, Production Sharing Contracts (PSCs) | Revenue distribution, operational duties, dispute resolution | Strict adherence to PSC terms, impacting revenue recognition and operational expenditure as reflected in 2023 financial statements. |

Environmental factors

Global and national climate change policies, such as carbon pricing and emissions reduction targets, directly affect the operational costs and long-term viability of fossil fuel companies like Hibiscus Petroleum. For instance, the European Union's Emissions Trading System (EU ETS) has seen carbon prices fluctuate, impacting the cost of emitting for companies operating within or trading with the EU. These evolving regulatory landscapes necessitate that Hibiscus Petroleum consider investments in carbon abatement technologies to align with emission reduction goals.

Hibiscus Petroleum's future investment decisions are significantly influenced by these climate policies. The company must navigate the increasing pressure to reduce greenhouse gas emissions, potentially by adopting cleaner technologies or exploring lower-carbon energy sources. This strategic pivot is crucial for maintaining competitiveness and ensuring long-term sustainability in a world increasingly focused on decarbonization.

New exploration and development projects for Hibiscus Petroleum necessitate comprehensive Environmental Impact Assessments (EIAs) to gauge potential ecological consequences, a precursor to securing essential environmental permits. The increasing stringency and duration of these approval processes can significantly influence project schedules and expenditures.

Public and regulatory oversight of EIAs is intensifying, meaning Hibiscus Petroleum must demonstrate robust environmental stewardship. For instance, in 2024, the average time for obtaining major environmental permits in several key jurisdictions saw an increase of up to 15% compared to previous years, directly impacting project readiness.

Hibiscus Petroleum's operations, particularly offshore exploration and production, carry inherent risks to marine biodiversity and sensitive ecosystems. Failure to adequately manage potential oil spills or habitat disruption could lead to significant environmental damage. For example, in 2023, the International Union for Conservation of Nature (IUCN) Red List continued to highlight the vulnerability of numerous marine species, underscoring the importance of robust environmental safeguards.

To maintain its social license to operate, Hibiscus Petroleum must rigorously adhere to biodiversity protection laws and implement effective mitigation strategies. This involves proactive measures to prevent pollution, minimize physical footprint, and restore disturbed habitats. Demonstrating strong environmental stewardship is crucial for stakeholder trust and long-term operational sustainability, especially as regulatory scrutiny around environmental impact intensifies globally.

Waste Management and Pollution Control

The oil and gas industry, which Hibiscus Petroleum operates within, inherently produces significant waste streams. These include drilling fluids, produced water often laden with hydrocarbons and salts, and various hazardous materials. Strict adherence to evolving waste management regulations and robust pollution control measures is therefore paramount. For instance, in 2024, regulatory bodies globally continued to tighten standards for the disposal of produced water, with some regions implementing zero-discharge policies for untreated volumes.

Hibiscus Petroleum faces the ongoing challenge of investing in advanced technologies and sustainable practices. The goal is to minimize waste generation at the source, prevent accidental spills through rigorous containment protocols, and manage any contaminated sites with utmost responsibility. Failure to do so can lead to substantial environmental damage, reputational harm, and significant regulatory penalties. In 2024, fines for environmental non-compliance in the sector reached millions of dollars in several key jurisdictions.

Effective waste management is not a one-off task but a continuous operational challenge requiring constant vigilance and adaptation. This involves:

- Implementing closed-loop drilling fluid systems to reduce the volume of waste requiring disposal.

- Investing in advanced water treatment technologies to safely manage and, where possible, reuse produced water.

- Developing comprehensive spill prevention and response plans, supported by regular training and drills.

- Ensuring proper characterization, handling, and disposal of all hazardous waste in compliance with international and local regulations.

Energy Transition and Renewable Energy Growth

The global energy transition is accelerating, with renewable energy sources like solar and wind power seeing significant growth. For Hibiscus Petroleum, this shift presents a dual challenge: managing the potential long-term decline in oil and gas demand while identifying opportunities in the evolving energy landscape. The company must strategically assess how this transition influences its investment horizons, potentially necessitating diversification into lower-carbon technologies or renewable energy projects to ensure future relevance and profitability.

The pace at which countries and industries adopt cleaner energy solutions will directly shape Hibiscus Petroleum's market outlook. For instance, by the end of 2023, global renewable energy capacity additions were projected to reach approximately 510 gigawatts (GW), a significant increase from previous years, indicating a strong momentum in the transition. This trend underscores the need for Hibiscus Petroleum to proactively adapt its business model and investment strategies to align with a decarbonizing world, potentially exploring areas such as carbon capture, utilization, and storage (CCUS) or investments in green hydrogen production.

- Renewable energy capacity additions: Global additions are expected to surpass 510 GW in 2023.

- Impact on fossil fuels: Long-term demand for oil and gas may face pressure due to this transition.

- Strategic imperative: Hibiscus Petroleum needs to evaluate diversification into lower-carbon alternatives.

Environmental regulations are increasingly stringent, impacting Hibiscus Petroleum's operational costs and project timelines. For example, the average time to secure major environmental permits in key jurisdictions rose by up to 15% in 2024, directly affecting project readiness and increasing compliance burdens.

The company must also contend with the growing pressure to reduce greenhouse gas emissions, a trend highlighted by the EU's Emissions Trading System. This necessitates investments in carbon abatement technologies and a strategic shift towards lower-carbon energy sources to maintain competitiveness and long-term sustainability in a decarbonizing global market.

Hibiscus Petroleum's operations, particularly offshore activities, pose risks to marine ecosystems. Robust environmental stewardship, including effective spill prevention and habitat protection measures, is crucial for maintaining its social license to operate amidst intensifying public and regulatory scrutiny. For instance, the IUCN continues to emphasize the vulnerability of marine species, underscoring the need for rigorous safeguards.

The global energy transition, marked by a significant increase in renewable energy capacity—projected to reach approximately 510 GW in 2023—presents both challenges and opportunities. Hibiscus Petroleum must strategically assess its investment horizons and consider diversification into lower-carbon technologies or renewable energy projects to ensure future relevance.

| Environmental Factor | Impact on Hibiscus Petroleum | Data/Trend |

|---|---|---|

| Climate Change Policies | Increased operational costs, need for carbon abatement investment | EU ETS carbon price fluctuations |

| Environmental Permitting | Extended project timelines, higher compliance expenditures | Up to 15% increase in permit acquisition time (2024) |

| Biodiversity Protection | Requirement for robust mitigation strategies, risk to social license | IUCN Red List highlighting marine species vulnerability (2023) |

| Energy Transition | Potential long-term demand decline for fossil fuels, need for diversification | Global renewable capacity additions projected at 510 GW (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hibiscus Petroleum is informed by a robust blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.