Hibiscus Petroleum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hibiscus Petroleum Bundle

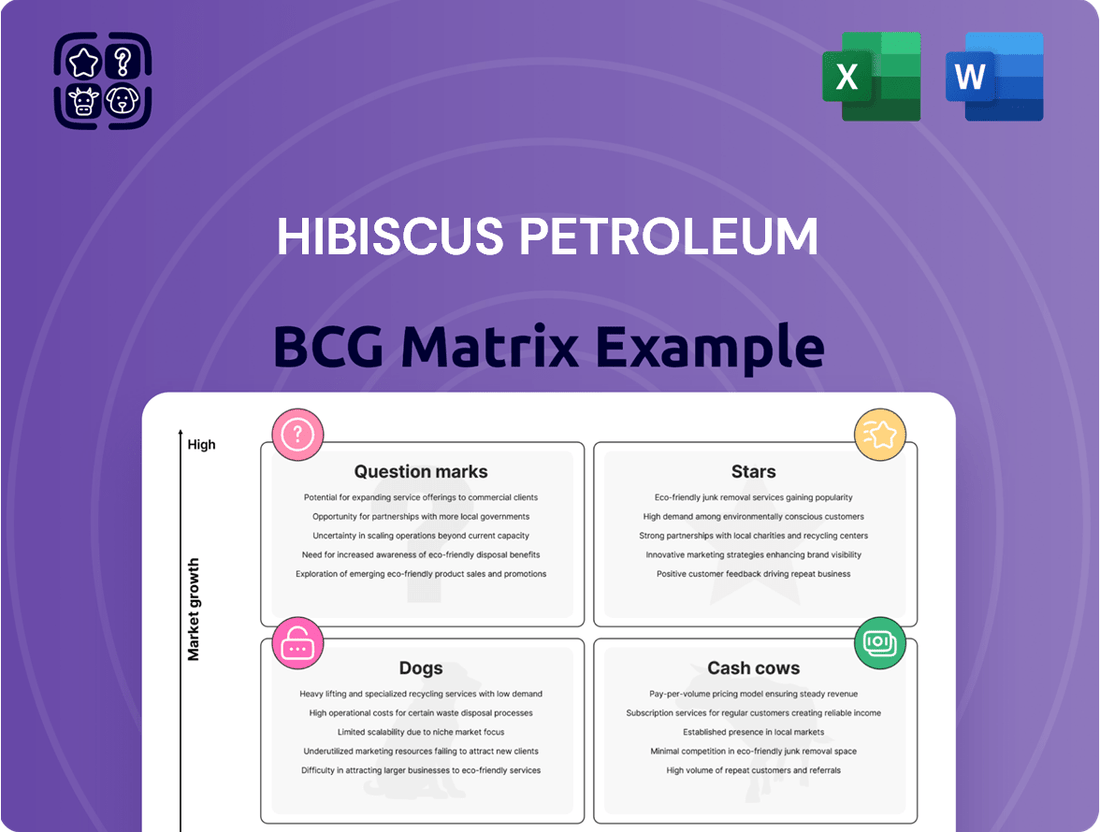

Curious about Hibiscus Petroleum's market standing? Our BCG Matrix analysis reveals which ventures are fueling growth and which might need a strategic rethink. Understand their position as Stars, Cash Cows, Dogs, or Question Marks.

Don't miss out on the full picture. Purchase the complete Hibiscus Petroleum BCG Matrix for detailed quadrant placements, actionable insights, and a clear roadmap to optimize your investment and product portfolio.

Gain a competitive edge with our comprehensive report. The full BCG Matrix provides a quadrant-by-quadrant breakdown and strategic recommendations specifically for Hibiscus Petroleum, empowering you to make informed decisions.

Stars

The acquisition of TotalEnergies' 37.5% stake in Brunei's MLJ field, finalized in October 2024, marks a significant Star for Hibiscus Petroleum. This move is projected to boost Hibiscus's daily production by 34%, reaching around 28,000 barrels of oil equivalent per day, and is anticipated to positively impact earnings starting in FY2025.

This gas-focused asset is highly profitable and strengthens Hibiscus's strategic shift towards gas production, boasting a concession period extending to 2029 with a potential 10-year extension. The MLJ field is a prime example of a high-quality, cash-generating asset that fits perfectly within Hibiscus Petroleum's growth objectives.

The PM3 CAA PSC is a strong contender for a Star in Hibiscus Petroleum's BCG Matrix. The recent 20-year extension of the Production Sharing Contract until January 1, 2048, provides long-term operational stability and visibility.

New oil discoveries, such as Bunga Aster-1 in April 2024 and Bunga Lavatera in 2023, are significant growth drivers. Bunga Aster is projected to deliver its first oil in May 2024, utilizing existing infrastructure for rapid monetization.

These discoveries are expected to boost reserves and production, signaling high growth potential and an expanding market share within the PM3 CAA region.

The Teal West development, a key component of the Anasuria Cluster in the UK, is progressing well with first oil anticipated by the close of 2025. This project represents a significant expansion for Hibiscus Petroleum in the UK, poised to substantially increase output from the Anasuria field.

This development is expected to bolster Hibiscus Petroleum's standing in the UK North Sea, contributing significantly to the company's future earnings. The project's success is vital for enhancing the overall value and production profile of the Anasuria asset.

PKNB Cluster Development

The PKNB Cluster, a collection of four gas fields—Pertang, Kenarong, Noring, and Bedong—holds approximately 47.3 million barrels of oil equivalent in discovered gas resources.

The development of these significant untapped resources is facilitated by the extension of the PM3 CAA Production Sharing Contract (PSC), which permits the utilization of existing infrastructure, thereby reducing development costs and timelines.

Although currently in the initial phases of development, the PKNB Cluster is poised for substantial growth and is categorized as a Star in the BCG Matrix due to its considerable resource base and long-term commercialization potential.

- Resource Base: 47.3 million barrels of oil equivalent (MMboe) in discovered gas fields.

- License Expiry: 2048, providing a long operational runway.

- Development Enabler: Extension of the PM3 CAA PSC, allowing infrastructure leverage.

- BCG Matrix Classification: Star, indicating high growth potential and market share.

North Sabah SF30 Waterflood Phase 2 Project

The North Sabah SF30 Waterflood Phase 2 Project is a key initiative for Hibiscus Petroleum, aiming to boost production from its largest Malaysian asset. This project, which saw its first oil production on October 31, 2024, is designed to counter the natural decline in a mature field. It represents a strategic investment in a high-growth area, focused on maintaining and expanding market share.

The project's core activities involve drilling six new water injection wells, with water injection scheduled to commence in mid-2025. This enhanced oil recovery technique is crucial for maximizing output from the North Sabah fields. By injecting water, the reservoir pressure is maintained, pushing more oil towards the production wells, thereby increasing overall recovery rates.

- Project Name: North Sabah SF30 Waterflood Phase 2 Project

- First Oil: October 31, 2024

- Key Activity: Drilling six water injection wells

- Injection Commencement: Mid-2025

- Strategic Goal: Increase oil production and avert natural decline in Hibiscus's largest Malaysian asset.

Hibiscus Petroleum's Stars are assets with high growth potential and significant market share, demanding substantial investment to maintain their leading position. The MLJ field acquisition, boosting production by 34%, and the PM3 CAA PSC extension with new discoveries like Bunga Aster-1 exemplify this category. The Teal West development and the PKNB Cluster, with its substantial gas resources, also represent Stars poised for significant future contributions.

| Asset | Status/Key Development | Projected Impact | BCG Classification |

|---|---|---|---|

| MLJ Field (Brunei) | Acquired 37.5% stake in Oct 2024 | +34% daily production (to ~28k boepd), earnings boost in FY2025 | Star |

| PM3 CAA PSC | PSC extended to Jan 2048 | Long-term operational stability, supports new discoveries | Star |

| Bunga Aster-1 / Bunga Lavatera | New oil discoveries (April 2024 / 2023) | Boost reserves/production, high growth potential | Star |

| Teal West (Anasuria Cluster, UK) | First oil anticipated by end of 2025 | Substantial increase in UK output | Star |

| PKNB Cluster | ~47.3 MMboe discovered gas resources | Long-term commercialization potential leveraging existing infrastructure | Star |

| North Sabah SF30 Waterflood Phase 2 | First oil Oct 31, 2024; water injection mid-2025 | Maintain/expand market share in largest Malaysian asset | Star |

What is included in the product

Hibiscus Petroleum's BCG Matrix offers a strategic overview of its energy assets, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis informs investment decisions, guiding resource allocation towards growth opportunities and away from underperforming segments.

A clear BCG Matrix visualizes Hibiscus Petroleum's portfolio, easing the pain of strategic uncertainty.

This BCG Matrix offers a pain-free way to identify and prioritize growth opportunities.

Cash Cows

The North Sabah Production Sharing Contract (PSC) in Malaysia is Hibiscus Petroleum's most significant production asset, contributing the largest share to its current output. This mature field is a reliable cash generator, underpinning the company's financial stability.

As of the first half of fiscal year 2024, North Sabah averaged approximately 10,000 barrels of oil equivalent per day (boepd). The asset's consistent performance, supported by ongoing production optimization, solidifies its position in a stable, albeit low-growth, market segment.

The Anasuria Cluster, Hibiscus Petroleum's inaugural UK North Sea asset, stands as a prime example of a mature cash cow. This collection of producing oil and gas fields, co-operated by Hibiscus, reliably generates substantial revenue and operating cash flow.

Its established production profile means that ongoing investment needs are relatively modest, ensuring consistent profitability. For the financial year ended June 30, 2023, the Anasuria Cluster contributed significantly to Hibiscus Petroleum's overall performance, reflecting its status as a stable income generator.

The established gas sales from the PM3 CAA Production Sharing Contract (PSC) are a prime example of a cash cow for Hibiscus Petroleum. This segment benefits from existing, efficient gas pipelines connecting to Peninsular Malaysia and Vietnam, ensuring consistent and reliable revenue generation.

This mature operation demonstrates a high market share within a stable market, thanks to its well-developed export infrastructure. For instance, in the financial year ended June 30, 2023, Hibiscus Petroleum reported that the PM3 CAA PSC contributed significantly to its overall revenue, highlighting its role as a stable income generator.

Existing Oil Export Operations (FSO Orkid and FSO PM3 CAA)

Hibiscus Petroleum's existing oil export operations, specifically the Floating Storage and Offloading (FSO) units Orkid and FSO PM3 CAA, are firmly positioned as cash cows within its business portfolio. These operational assets are instrumental in the efficient export of crude oil from the PM3 CAA Production Sharing Contract (PSC). Their established presence ensures consistent monetization of produced oil, directly contributing to stable and reliable cash flow generation for the company.

These FSO units are critical infrastructure for Hibiscus Petroleum's revenue generation from its existing oil assets. They facilitate the smooth and continuous export of crude oil, thereby securing a steady stream of income. The operational efficiency and reliability of FSO Orkid and FSO PM3 CAA underscore their status as key contributors to the company's financial stability.

- FSO Orkid and FSO PM3 CAA are vital for crude oil export from the PM3 CAA PSC.

- These units ensure efficient monetization of produced oil volumes.

- They are critical for generating consistent and reliable cash flow for Hibiscus Petroleum.

Malaysia-Kinabalu and Other Producing Assets

Beyond its North Sabah operations, Hibiscus Petroleum's other Malaysian producing assets, notably the Kinabalu field, are crucial for the company's revenue and production stability. These mature assets are reliable cash generators, bolstering Hibiscus's financial standing. In 2024, these fields continued to represent a significant portion of Hibiscus's regional production, demonstrating a strong market presence within its Malaysian portfolio.

The Kinabalu field, in particular, has been a consistent contributor to Hibiscus's cash flow. Its mature nature means lower exploration risk and more predictable output, which is vital for maintaining a stable financial base. This stability allows Hibiscus to fund other ventures and manage its overall financial health effectively.

- Kinabalu Field Contribution: The Kinabalu asset is a key revenue driver for Hibiscus Petroleum within Malaysia.

- Mature Asset Benefits: As a mature field, Kinabalu offers stable production and predictable cash flow, reducing operational uncertainties.

- Market Share: These Malaysian producing assets, including Kinabalu, hold a substantial market share within Hibiscus's regional operational footprint.

- Financial Stability: The consistent positive cash flow generated by these assets significantly supports the company's overall financial health and investment capacity.

Hibiscus Petroleum's cash cows are its mature, stable producing assets that consistently generate significant revenue with minimal reinvestment. These include the North Sabah PSC, the Anasuria Cluster in the UK North Sea, and the PM3 CAA PSC in Malaysia, all benefiting from established infrastructure and market positions.

The FSO Orkid and FSO PM3 CAA units are critical for oil export from the PM3 CAA PSC, ensuring efficient monetization and reliable cash flow. Similarly, fields like Kinabalu in Malaysia, as mature assets, provide predictable output and bolster the company's financial stability.

| Asset | Region | Contribution Type | Fiscal Year 2023 Significance |

|---|---|---|---|

| North Sabah PSC | Malaysia | Production Output | Largest share of current output, stable cash generator |

| Anasuria Cluster | UK North Sea | Revenue & Cash Flow | Substantial revenue and operating cash flow generation |

| PM3 CAA PSC | Malaysia | Gas Sales & Revenue | Consistent and reliable revenue generation |

| FSO Orkid & FSO PM3 CAA | Malaysia | Oil Export & Monetization | Ensures continuous export and steady income stream |

| Kinabalu Field | Malaysia | Revenue & Cash Flow | Consistent contributor to cash flow, supports financial health |

What You See Is What You Get

Hibiscus Petroleum BCG Matrix

The Hibiscus Petroleum BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared for strategic insights, offers an exact replica of the final deliverable, ready for your immediate use in business planning and decision-making.

Dogs

The South Furious Ungu well, a component of Hibiscus Petroleum's North Sabah near-field exploration efforts, serves as a clear example of a 'Dog' in the BCG matrix. This well, despite consuming significant investment, failed to reach commercially viable economic thresholds for hydrocarbon extraction. This outcome signifies a low market share coupled with negligible growth prospects, a defining characteristic of this category.

Within Hibiscus Petroleum's mature fields, some wells are becoming marginal. These might be older wells facing natural decline or facing higher operational costs. For example, in 2024, Hibiscus continued its focus on optimizing production from its established assets, which inherently includes managing wells that are past their peak performance.

These marginal wells, characterized by low output and high per-barrel costs, can tie up valuable capital. Their contribution to overall production might be minimal, making them a poor use of resources in a low-growth, mature market segment. This aligns with the 'Dog' category in the BCG matrix, where low growth and low market share signify underperformers.

Hibiscus Petroleum's ongoing exploration activities, like the Rosebay-1 well which encountered minor gas sands, highlight investments that haven't yet yielded commercially viable discoveries. These ventures, while crucial for future potential, currently represent investments with low market share and uncertain growth prospects. For instance, exploration and appraisal expenditure in the fiscal year ended June 30, 2023, was $26.4 million, a significant portion of which may not immediately translate into revenue-generating assets.

Underperforming Legacy Assets Not Targeted for Enhancement

Hibiscus Petroleum's portfolio might include legacy assets or smaller fields that are not slated for production upgrades or expansion. These are assets that are naturally declining and not a strategic focus for growth. In 2024, for instance, if a particular smaller field within their portfolio, like one of their older producing assets in Malaysia, showed a consistent decline in output and had minimal reinvestment planned, it would fit this category. Such assets, characterized by low market share and limited future growth prospects, could be considered for divestment if their profitability continues to erode.

These 'Dog' category assets represent a challenge for portfolio management. They consume resources without contributing significantly to future growth.

- Legacy Assets: Older fields with declining production profiles.

- Low Market Share: Limited competitive positioning or output volume.

- Limited Growth Potential: No current plans for significant investment or expansion.

- Potential Divestiture: May be considered for sale if economic viability diminishes further.

Ineffective Early-Stage Project Development

Ineffective early-stage project development describes ventures that, despite initial promise, encounter insurmountable obstacles. These hurdles, such as unexpected technical complexities or adverse market changes, can quickly transform a potential success into a liability. For Hibiscus Petroleum, such projects would exhibit a low market share and dim growth prospects, even after significant capital outlay.

While specific Hibiscus projects aren't publicly categorized as such, the principle applies broadly. For instance, a hypothetical offshore exploration project in 2024 that faced a sudden, drastic drop in oil prices or discovered uneconomical reserves would fit this description. Such a scenario would lead to a negative return on investment and a shrinking potential market for its output.

- Low Market Share: Projects failing to gain traction due to unforeseen issues typically capture minimal market share.

- Poor Growth Prospects: Significant technical or regulatory barriers stifle any potential for expansion or increased profitability.

- Economic Viability: Challenges render the project uneconomic, leading to potential write-downs or abandonment.

- Capital Misallocation: Early-stage failures represent a drain on resources that could be better deployed elsewhere.

Hibiscus Petroleum's portfolio may contain 'Dogs' in the form of legacy assets or exploration projects that haven't met commercial viability. These are typically older fields with declining output or new ventures that encountered significant challenges, leading to low market share and limited growth prospects. For example, the South Furious Ungu well is noted as a 'Dog' due to its failure to reach commercially viable thresholds.

These underperforming assets, such as marginal wells in mature fields or exploration efforts that did not yield significant discoveries, consume capital without contributing substantially to future growth. In fiscal year 2023, Hibiscus Petroleum's exploration and appraisal expenditure was $26.4 million, a portion of which could represent investments in potential 'Dogs' if they fail to materialize into revenue-generating assets.

Managing these 'Dogs' involves recognizing their low market share and poor growth potential, often leading to considerations for divestment if their economic viability continues to decline. For instance, a smaller, older producing asset in Malaysia, if experiencing consistent output decline with minimal planned reinvestment in 2024, would exemplify such a 'Dog' category asset.

Ineffective early-stage project development, where initial promise is hampered by technical or market hurdles, also creates 'Dogs'. Hypothetical 2024 exploration projects facing drastic oil price drops or uneconomical reserves would fall into this category, representing capital misallocation.

| Asset Type | BCG Category | Characteristics | Example within Hibiscus | Relevant Data Point |

| Legacy Fields | Dog | Declining production, high operating costs, low market share | Older producing assets in Malaysia | Fiscal Year 2023 E&A expenditure: $26.4 million |

| Exploration Projects | Dog | Uncommercial discoveries, technical challenges, low growth prospects | South Furious Ungu well | Exploration and appraisal expenditure |

Question Marks

The Marigold and Sunflower fields, acquired in 2018 in the UK North Sea, represent Hibiscus Petroleum's potential future growth drivers. These assets are categorized as question marks due to their substantial 2C resource potential, indicating high future growth prospects.

Despite the promising resource base, first oil is not anticipated until the end of 2028, with a Field Development Plan (FDP) submission targeted for mid-2026. This timeline suggests a low current market share, necessitating significant upfront investment to bring these fields online and realize their value.

The Rosebay-1 exploration well on the PM327 Block is categorized as a Question Mark within Hibiscus Petroleum's portfolio. Minor gas sands were identified in late 2024, indicating potential but uncertain commercial viability.

A farm-in agreement for this block was finalized in September 2024, with the ongoing assessment of commerciality crucial for future exploration strategies. This project exhibits high growth potential, but its current market share is minimal, necessitating continued investment and appraisal.

Hibiscus Petroleum, an active independent oil and gas exploration and production company, consistently assesses new opportunities. These early-stage exploration ventures or undeveloped discoveries, not yet publicly disclosed, represent potential future growth engines. They currently hold no market share but require substantial investment for appraisal and development, carrying inherent high risk and high reward.

Potential Collaboration for 13MW Solar Facility in Brunei

Hibiscus Petroleum is exploring a partnership with TotalEnergies Brunei for a 13MW solar facility, a move into the burgeoning renewable energy market. This project, while currently representing a small market share for Hibiscus, is positioned as a strategic growth opportunity within the energy transition landscape.

- Strategic Alignment: The collaboration aligns with Hibiscus Petroleum's diversification efforts into renewable energy, aiming to leverage TotalEnergies' expertise in solar development.

- Market Position: As a new venture into solar, Hibiscus likely holds a nascent market share in this specific segment, classifying it as a potential ‘Question Mark’ in the BCG matrix.

- Growth Potential: The 13MW facility signifies a commitment to a high-growth sector, with substantial potential for expansion and increased market penetration in Brunei’s renewable energy market.

- Investment Consideration: The project requires careful evaluation of investment needs versus potential returns, typical for ‘Question Mark’ assets that need significant capital to grow.

Future Near-Field Prospects in PM3 CAA PSC

Hibiscus Petroleum intends to focus on exploring additional near-field prospects within the PM3 CAA PSC over the next three years. These are targeted, high-potential exploration opportunities in a proven region, currently holding no market share.

Successful development of these prospects will necessitate significant capital investment for production, potentially elevating them to Star or Cash Cow status within the BCG framework.

- Exploration Focus: Next three years in PM3 CAA PSC.

- Prospect Type: Specific, high-potential, near-field targets.

- Market Share: Currently zero for these prospects.

- Investment Requirement: Substantial for production, leading to potential Star/Cash Cow classification.

Hibiscus Petroleum's Question Marks represent opportunities with high growth potential but currently low market share, requiring significant investment. These include the Marigold and Sunflower fields in the UK North Sea, with first oil expected by late 2028, and the Rosebay-1 exploration well, which identified minor gas sands in late 2024. The company's venture into a 13MW solar facility in Brunei, in partnership with TotalEnergies, also falls into this category, aiming for growth in the renewable sector.

| Project/Asset | Status/Potential | Current Market Share | Investment Needs | Expected First Production/Commerciality |

|---|---|---|---|---|

| Marigold & Sunflower Fields (UK North Sea) | High 2C resource potential, future growth driver | Minimal | Substantial for development | Late 2028 |

| Rosebay-1 (PM327 Block) | Minor gas sands identified, uncertain commerciality | Minimal | Continued appraisal and investment | TBD (dependent on commerciality assessment) |

| Brunei Solar Facility (13MW) | Entry into renewable energy, strategic growth | Nascent | Capital for development and expansion | TBD |

| Near-field prospects (PM3 CAA PSC) | Targeted, high-potential exploration | Zero | Significant for production | TBD (next three years focus) |

BCG Matrix Data Sources

Our Hibiscus Petroleum BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.