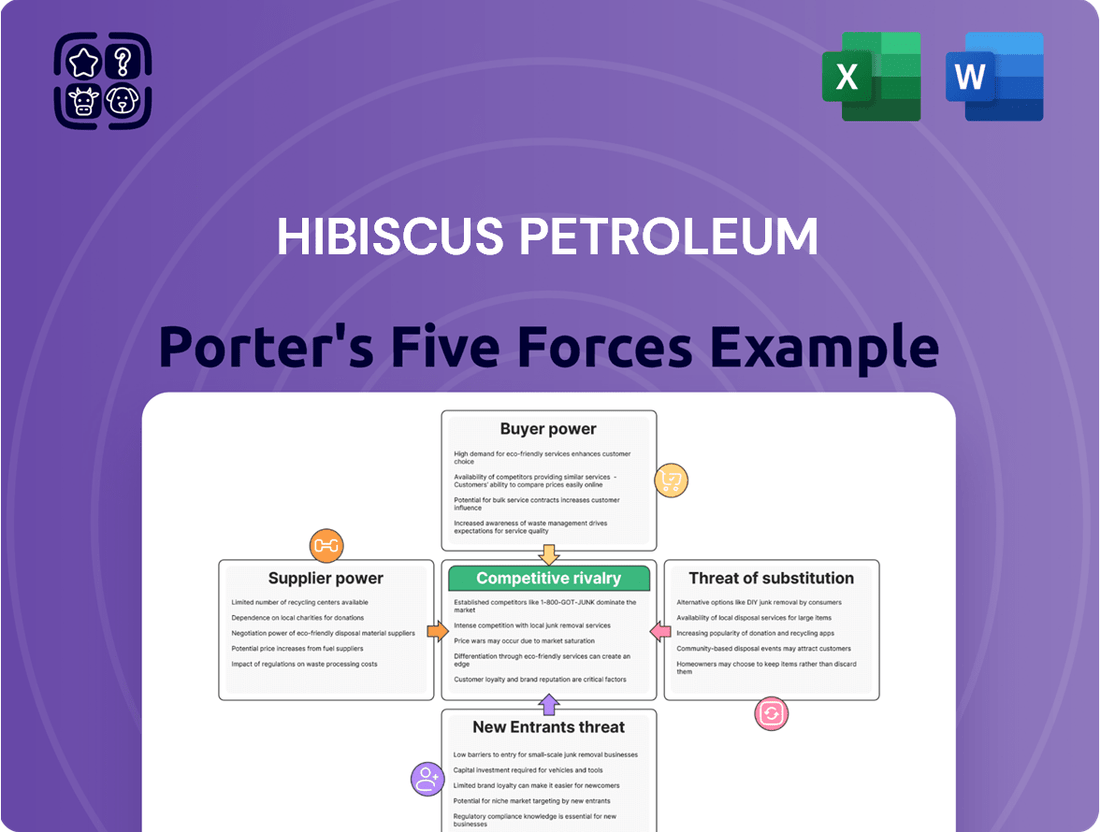

Hibiscus Petroleum Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hibiscus Petroleum Bundle

Hibiscus Petroleum navigates a dynamic energy landscape where the threat of new entrants is moderate, yet the bargaining power of buyers, particularly large oil companies, demands careful consideration. Supplier power is also a key factor, influencing operational costs and project timelines.

The complete report reveals the real forces shaping Hibiscus Petroleum’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and gas sector, including companies like Hibiscus Petroleum, is heavily dependent on specialized equipment, advanced technology, and essential services. When the number of companies providing these critical inputs is small, and a few dominate the market, their ability to dictate terms to buyers like Hibiscus Petroleum grows substantially.

For instance, in 2024, the market for certain subsea drilling components or specialized seismic survey technology might be controlled by a handful of global players. If these key suppliers face limited competition, Hibiscus Petroleum could find itself paying premium prices for essential materials or services, thereby reducing its profit margins and operational flexibility.

Switching suppliers in the oil and gas industry, particularly for specialized services like drilling or seismic surveys, presents significant hurdles for Hibiscus Petroleum. These can include the expense of retooling, recertification processes, and the disruption to ongoing operations. For example, a typical offshore drilling contract can run into millions of dollars, making a mid-contract switch prohibitively expensive.

These high switching costs inherently strengthen the bargaining power of Hibiscus Petroleum's suppliers. When it's difficult and costly for Hibiscus to change providers, existing suppliers can often command higher prices or dictate more favorable terms. This leverage is amplified for suppliers offering unique or proprietary technologies essential for exploration and production.

The uniqueness of Hibiscus Petroleum's supplier offerings significantly influences supplier bargaining power. When suppliers provide proprietary drilling technology or specialized geological software, they gain leverage. For instance, if a supplier offers a unique extraction method that Hibiscus Petroleum cannot replicate or easily substitute, that supplier can dictate terms and pricing, increasing their bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into oil and gas exploration and production significantly amplifies their bargaining power over companies like Hibiscus Petroleum. If a supplier can credibly move into Hibiscus Petroleum's core business, they gain the ability to bypass the company and compete directly. This competitive pressure forces Hibiscus Petroleum to negotiate more favorable terms, potentially accepting lower prices or less advantageous contract conditions to avoid direct competition from their own suppliers.

This forward integration threat is particularly potent in sectors where suppliers possess critical technological expertise or control over essential raw materials. For instance, a specialized drilling equipment manufacturer could, in theory, acquire or develop its own exploration assets. In 2024, the oil and gas industry saw continued consolidation and strategic partnerships, highlighting the potential for such vertical integration moves. Companies that can leverage their existing infrastructure and technical know-how to enter upstream operations pose a direct challenge to established E&P players.

- Increased Supplier Leverage: Suppliers capable of forward integration can dictate terms more aggressively.

- Direct Competition Risk: Hibiscus Petroleum faces the prospect of its suppliers becoming direct competitors.

- Impact on Profitability: Unfavorable terms due to this threat can directly reduce Hibiscus Petroleum's profit margins.

- Strategic Response Needed: Hibiscus Petroleum must consider strategies to mitigate this risk, such as securing long-term supply contracts or diversifying its supplier base.

Importance of Supplier's Input to Hibiscus Petroleum's Cost or Quality

The bargaining power of suppliers for Hibiscus Petroleum is significantly influenced by how critical their inputs are to the company's overall cost structure and the quality of its output. When a supplier's product or service represents a substantial portion of Hibiscus Petroleum's expenditures, or is essential for maintaining the quality of its oil and gas production, that supplier gains considerable leverage.

For example, the cost of specialized offshore drilling equipment and the availability of highly skilled geologists and engineers are crucial for Hibiscus Petroleum's exploration and production activities. If these specialized resources are scarce or provided by only a few dominant firms, these suppliers can command higher prices and more favorable terms, directly impacting Hibiscus Petroleum's profitability and operational efficiency.

- Specialized Equipment: The cost of advanced drilling rigs, seismic survey vessels, and subsea equipment can represent a significant capital outlay for Hibiscus Petroleum, giving suppliers of these niche assets substantial bargaining power.

- Skilled Labor: Access to experienced petroleum engineers, geoscientists, and specialized technicians is vital for exploration success and efficient production. Suppliers of these human resources, particularly those with niche expertise, can influence project costs.

- Key Raw Materials: While less dominant in upstream oil and gas compared to downstream refining, the cost and availability of certain specialized chemicals or components used in extraction or processing can still impact operational expenses.

The bargaining power of suppliers for Hibiscus Petroleum is elevated by the critical nature of their inputs and the concentration within supply markets. In 2024, the demand for specialized offshore drilling technology and experienced geological expertise remained high, with a limited number of providers. This scarcity, coupled with the substantial costs and operational disruptions associated with switching vendors, grants these suppliers significant leverage over Hibiscus Petroleum.

| Factor | Impact on Hibiscus Petroleum | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | Increases supplier leverage; fewer alternatives mean less negotiation power for Hibiscus. | A few global firms dominate the market for advanced subsea drilling components. |

| Switching Costs | Strengthens supplier position; high costs deter Hibiscus from seeking new providers. | Repurposing specialized drilling equipment or recertifying new service providers can cost millions. |

| Uniqueness of Input | Grants suppliers pricing power; proprietary technology is difficult to substitute. | Exclusive rights to a novel seismic imaging software crucial for exploration. |

| Threat of Forward Integration | Creates competitive pressure; suppliers could become direct rivals. | A drilling services company with significant capital could acquire exploration assets. |

| Criticality of Input | Enhances supplier influence; essential inputs command higher prices. | Scarcity of highly skilled petroleum engineers can drive up labor costs. |

What is included in the product

Tailored exclusively for Hibiscus Petroleum, this analysis evaluates the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its oil and gas operations.

Instantly understand strategic pressure with a powerful spider/radar chart, simplifying Hibiscus Petroleum's competitive landscape.

Customers Bargaining Power

Customer concentration for Hibiscus Petroleum is a key factor in their bargaining power. If a few major refineries or utility companies represent a significant portion of Hibiscus Petroleum's sales, these large buyers can wield considerable influence. They might leverage their purchasing volume to negotiate lower prices for crude oil and natural gas, or demand more favorable contract terms.

Customer switching costs for crude oil and natural gas are generally low for buyers, especially when the product is a commodity. This ease of switching suppliers significantly enhances buyer bargaining power against Hibiscus Petroleum.

When oil and gas products are undifferentiated, customers can readily shift to competitors offering more favorable pricing. This lack of differentiation means buyers can easily find alternatives, giving them leverage to negotiate better terms with Hibiscus Petroleum.

Customers with readily available information on market prices, production costs, and alternative suppliers gain significant leverage. In the energy sector, for instance, major buyers frequently possess this data, enhancing their negotiation power. For Hibiscus Petroleum, this means that sophisticated clients can more easily compare offerings and demand better terms, directly impacting profitability.

Threat of Backward Integration by Customers

The threat of backward integration by customers significantly impacts Hibiscus Petroleum's bargaining power. If major customers, like large refining companies, possess the capability or a credible threat to develop their own oil and gas exploration and production assets, their leverage over Hibiscus increases. This reduces their dependence on external suppliers, enabling them to negotiate more favorable pricing and contract terms.

For instance, a refinery with substantial capital and technical expertise could potentially invest in upstream operations, bypassing the need for companies like Hibiscus. This scenario would directly challenge Hibiscus Petroleum's market position and profitability.

- Customer Capability: Assess if key customers have the financial and technical resources to engage in exploration and production.

- Industry Trends: Monitor for any industry-wide movements where refiners are diversifying into upstream activities.

- Contractual Safeguards: Review existing contracts for clauses that might mitigate the risk of customer backward integration.

- Hibiscus's Differentiation: Evaluate how Hibiscus Petroleum differentiates its offerings to reduce customer incentive for integration.

Price Sensitivity of Customers

The price sensitivity of customers significantly impacts Hibiscus Petroleum's bargaining power. In the oil and gas sector, where products are largely commoditized, buyers are acutely aware of price differences. This heightened sensitivity means that even small price increases can lead customers to seek alternative suppliers. For instance, in 2024, global oil prices experienced volatility, influenced by geopolitical events and supply-demand dynamics, directly affecting the cost of energy for consumers and businesses alike. This environment forces Hibiscus Petroleum to remain highly competitive on pricing.

Hibiscus Petroleum faces pressure to align its pricing with market benchmarks, limiting its pricing flexibility. When customers have numerous choices and the product is undifferentiated, their power to negotiate lower prices increases. This dynamic is evident as major oil-producing nations and large corporations often compete to offer the most attractive rates, especially during periods of oversupply. The company must therefore carefully manage its production costs and operational efficiencies to maintain profitability while offering competitive prices.

The bargaining power of customers in the oil and gas industry is further amplified by the availability of substitutes and the scale of purchases. Large industrial consumers, such as power generation companies or airlines, can exert considerable leverage due to the volume of their orders. Furthermore, the growing interest in and investment in renewable energy sources by some customer segments represents a long-term shift that could reduce reliance on traditional fossil fuels, thereby increasing customer bargaining power over time.

- Customer Price Sensitivity: Customers in the oil and gas market are highly responsive to price changes, as oil and gas are treated as commodities.

- Competitive Pricing Pressure: This sensitivity forces Hibiscus Petroleum to maintain competitive pricing, constraining its ability to charge premium rates.

- Market Volatility Impact: Global oil price fluctuations in 2024, driven by supply and demand factors, directly influence customer purchasing decisions and Hibiscus Petroleum's pricing strategy.

- Limited Pricing Flexibility: The commoditized nature of the product and the availability of numerous suppliers restrict Hibiscus Petroleum's power to dictate higher prices.

Customers in the oil and gas sector, like those Hibiscus Petroleum serves, often have significant bargaining power due to the commodity nature of the products. This means buyers can easily switch suppliers if prices are not competitive, and their large purchase volumes allow them to negotiate favorable terms. For example, in 2024, global energy markets saw price volatility, forcing producers to remain highly competitive.

Hibiscus Petroleum must contend with customers who are price-sensitive and well-informed about market rates. The threat of customers integrating backward into exploration and production also strengthens their negotiating position. This means Hibiscus faces continuous pressure to offer attractive pricing and efficient operations to retain its customer base.

| Factor | Impact on Hibiscus Petroleum | 2024 Relevance |

|---|---|---|

| Customer Concentration | High concentration increases buyer leverage. | Key refineries' purchasing power remains significant. |

| Switching Costs | Low switching costs empower customers. | Buyers can easily shift to alternative oil and gas suppliers. |

| Product Differentiation | Lack of differentiation aids customer choice. | Commoditized oil and gas offer little differentiation for pricing power. |

| Information Availability | Informed buyers negotiate better terms. | Market transparency in 2024 allowed buyers to leverage price data. |

| Backward Integration Threat | Potential for customers to produce their own supply. | Large energy consumers may explore upstream investments to reduce reliance. |

| Price Sensitivity | Customers are highly responsive to price changes. | Volatile oil prices in 2024 amplified customer focus on cost. |

Preview the Actual Deliverable

Hibiscus Petroleum Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, offering a comprehensive Porter's Five Forces analysis of Hibiscus Petroleum. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry, all presented in a ready-to-use format.

Rivalry Among Competitors

The oil and gas sector is inherently competitive, featuring a vast array of global giants, national oil companies, and smaller independent operators. Hibiscus Petroleum's operational footprint, spanning Malaysia, the UK, and Australia, places it directly against both established supermajors and agile E&P companies.

This broad spectrum of competitors, differing significantly in scale, capital, and strategic focus, creates a dynamic and often intense competitive landscape. For instance, in the UK North Sea, Hibiscus competes with companies like Shell and BP, alongside other independents such as Harbour Energy.

The oil and gas industry's growth rate is a critical factor influencing competitive rivalry. As the global energy transition progresses, the long-term growth prospects for traditional oil and gas are becoming less certain, potentially intensifying competition among companies for existing market share and resources.

Crude oil and natural gas are fundamentally undifferentiated commodities, making price the paramount driver of competition. This inherent lack of product distinction forces companies like Hibiscus Petroleum to vie for market share primarily through cost leadership, operational efficiency, and consistent delivery. For instance, in 2024, global oil prices fluctuated significantly, highlighting how sensitive the market is to supply and demand dynamics rather than product attributes.

High Fixed Costs and Storage Costs

The oil and gas sector, including companies like Hibiscus Petroleum, is inherently capital-intensive. This means massive upfront investments in exploration, drilling, and infrastructure are necessary, resulting in extremely high fixed costs. For instance, a single offshore platform can cost billions of dollars to construct and maintain.

These substantial fixed costs create a powerful incentive for companies to operate at maximum capacity. To spread these costs over the largest possible output, firms are compelled to produce as much oil and gas as they can. This drive to maintain high production volumes, even when market demand is weaker, can lead to increased supply and put downward pressure on prices, intensifying competition among players.

- High Capital Expenditure: The energy sector requires significant investment in exploration and production assets, often running into billions of dollars per project.

- Operational Efficiency Drive: Companies focus on maximizing output to cover fixed costs, which can lead to price competition.

- Storage Cost Impact: While not always the primary driver, the cost of storing unsold or excess inventory can also add to the financial burden, further encouraging production to meet demand rather than storage.

Exit Barriers

Hibiscus Petroleum, like many in the oil and gas sector, faces significant exit barriers. These aren't just about selling off equipment; they're deeply embedded in the operational and financial fabric of the industry.

Specialized assets, such as offshore drilling platforms or complex refining machinery, are notoriously difficult to repurpose or sell quickly, especially at a favorable price. This illiquidity means that even if a company like Hibiscus Petroleum wanted to exit a particular venture, the cost and time involved in divesting these assets could be substantial. For instance, the decommissioning of offshore platforms alone can cost hundreds of millions of dollars, a significant deterrent to leaving.

Furthermore, environmental liabilities and long-term contractual obligations, such as leases for exploration blocks or supply agreements, can further trap companies in unprofitable operations. These commitments can extend for years, forcing continued investment and operational expenditure even when market conditions are unfavorable. This reluctance to incur the costs of exiting can lead to prolonged periods of overcapacity in the market, intensifying competitive pressures for all players, including Hibiscus Petroleum.

- Illiquid Assets: Specialized oil and gas equipment, like FPSOs (Floating Production Storage and Offloading units), often have limited resale markets, making them hard to exit quickly.

- Decommissioning Costs: The expense of safely dismantling and removing offshore infrastructure can run into hundreds of millions, acting as a major disincentive to leave.

- Long-Term Contracts: Commitments for exploration licenses, pipeline access, or supply agreements can bind companies to specific regions or projects for many years, even if they become unprofitable.

- Environmental Responsibilities: Remediation of sites, pollution control, and compliance with regulations create ongoing liabilities that must be addressed upon exit, adding to the cost of leaving the industry.

Competitive rivalry in the oil and gas sector, where Hibiscus Petroleum operates, is fierce due to the commodity nature of oil and gas, leading to price-based competition. Companies like Hibiscus must focus on cost efficiency to maintain market share, especially as global oil prices saw significant fluctuations in 2024, driven by supply and demand shifts. The industry's high capital intensity and substantial fixed costs also compel firms to maximize production, potentially leading to oversupply and intensified price wars.

The presence of numerous global players, national oil companies, and smaller independents creates a dynamic competitive environment. For example, in the UK North Sea, Hibiscus competes with giants like Shell and BP, as well as other independents such as Harbour Energy. The ongoing energy transition also introduces uncertainty, potentially increasing competition for dwindling or slower-growing market segments.

High exit barriers, including specialized illiquid assets, significant decommissioning costs (potentially hundreds of millions for offshore platforms), long-term contracts, and environmental responsibilities, further entrench existing players. These factors make it difficult and costly for companies to leave the market, contributing to sustained competitive pressure.

| Competitor Type | Examples | Impact on Rivalry |

| Global Supermajors | Shell, BP | High capital, established infrastructure, broad market reach |

| National Oil Companies | Saudi Aramco, PetroChina | State backing, significant reserves, often lower cost base |

| Independent E&P Companies | Harbour Energy, smaller regional players | Agility, niche focus, can be price-sensitive |

SSubstitutes Threaten

The primary threat of substitutes for Hibiscus Petroleum stems from the growing availability and competitiveness of alternative energy sources. Renewables like solar and wind power, alongside nuclear energy and biofuels, are increasingly viable options. As of early 2024, global investment in renewable energy continued its upward trajectory, with the International Energy Agency reporting record additions to renewable capacity, signaling a clear shift away from traditional fossil fuels.

The economic viability of substitutes for Hibiscus Petroleum's oil and gas products hinges significantly on their price competitiveness. For instance, as of early 2024, the cost of renewable energy sources like solar and wind power has continued to decrease, making them increasingly attractive alternatives, especially in regions with supportive government policies and infrastructure development.

Fluctuations in global oil and gas prices directly impact the appeal of these substitutes. When crude oil prices, like Brent crude, surged past $90 per barrel in late 2023 and early 2024, the economic case for investing in and adopting alternative energy solutions strengthened considerably for consumers and industries alike.

Consequently, if oil and gas prices persist at elevated levels, the incentive for customers to transition to substitutes will likely grow. This trend is already evident in the automotive sector, where electric vehicle sales saw a notable increase in 2023, driven in part by higher gasoline prices in many key markets.

Customer willingness to switch to alternatives is increasingly shaped by environmental consciousness and supportive government policies for clean energy. For Hibiscus Petroleum, this means that as public perception favors decarbonization, the demand for their oil and gas products could see a decline.

The global push towards sustainability is a significant factor. For instance, by the end of 2023, renewable energy sources accounted for over 30% of new power capacity additions globally, a trend that is expected to continue and potentially accelerate the transition away from fossil fuels.

Performance and Quality of Substitutes

As renewable energy technologies like solar and wind continue to advance, their performance and quality are rapidly improving. This makes them increasingly competitive substitutes for traditional petroleum products across various sectors. For instance, the efficiency of solar panels has seen significant gains, with some commercially available panels now exceeding 22% efficiency, up from around 15% a decade ago.

The growing viability of electric vehicles (EVs) directly impacts the demand for refined petroleum. By 2024, global EV sales are projected to reach over 16 million units, a substantial increase from just over 10 million in 2023, according to industry forecasts. This shift signifies a direct substitution for gasoline and diesel, reducing the market for Hibiscus Petroleum's core products.

Furthermore, advancements in battery storage technology are addressing the intermittency issues often associated with renewables. Improved energy density and faster charging capabilities make renewable energy sources more reliable for grid-scale power generation and even for transportation, further solidifying their position as potent substitutes.

- Improving Efficiency: Renewable energy technologies are becoming more efficient, offering comparable or superior performance to petroleum-based solutions in many applications.

- Growing EV Market: The accelerating adoption of electric vehicles directly displaces demand for gasoline and diesel fuels. Global EV sales are expected to surpass 16 million units in 2024.

- Enhanced Reliability: Breakthroughs in battery storage are making renewable energy sources more dependable, reducing their perceived risk as substitutes.

- Cost Competitiveness: The levelized cost of electricity from solar and wind has fallen dramatically, making them increasingly cost-effective alternatives to fossil fuels.

Government Regulations and Incentives for Substitutes

Government policies, subsidies, and regulations that favor renewable energy and discourage fossil fuel consumption significantly bolster the threat of substitutes. For instance, the UK, where Hibiscus Petroleum has operations, has ambitious decarbonization targets, such as achieving net-zero emissions by 2050. This regulatory environment, including measures like carbon taxes and increasingly stringent emissions standards, makes alternative energy sources more competitive and attractive.

These government actions directly impact the cost-effectiveness and adoption rates of substitute products and services. As policies evolve to promote cleaner energy, the economic viability of fossil fuels is challenged, thereby increasing the pressure from substitutes. In 2023, the UK government continued to implement policies aimed at accelerating the transition to renewable energy, including significant investments in offshore wind and hydrogen technologies.

- Government Support for Renewables: Policies such as feed-in tariffs and tax credits make renewable energy sources like solar and wind more cost-competitive against traditional fossil fuels.

- Carbon Pricing Mechanisms: The introduction or strengthening of carbon taxes or emissions trading schemes increases the operational costs for fossil fuel producers, making substitutes more appealing.

- Emissions Standards: Stricter emissions regulations for vehicles and industrial processes drive demand for cleaner alternatives, impacting the market for petroleum products.

- Decarbonization Targets: National and international commitments to reduce carbon emissions, like the UK's 2050 net-zero target, create a long-term policy environment that favors substitutes.

The threat of substitutes for Hibiscus Petroleum is substantial and growing, driven by advancements in alternative energy and shifting market preferences. The increasing efficiency and declining costs of renewables like solar and wind power present a direct challenge. For instance, by early 2024, the levelized cost of electricity from solar PV had fallen significantly, making it competitive with fossil fuels in many regions. Furthermore, the rapid expansion of the electric vehicle market, with global sales projected to exceed 16 million units in 2024, directly displaces demand for gasoline and diesel, impacting Hibiscus Petroleum's core products.

| Substitute Energy Source | Key Advancement/Trend | Impact on Hibiscus Petroleum |

|---|---|---|

| Solar & Wind Power | Decreasing LCOE, improving efficiency | Direct competition for electricity generation, reducing demand for natural gas |

| Electric Vehicles (EVs) | Rapid sales growth, improving battery tech | Displacement of gasoline and diesel demand in transportation |

| Battery Storage | Enhanced reliability, grid integration | Supports renewable intermittency, further enabling their role as substitutes |

Entrants Threaten

The oil and gas exploration and production sector demands immense capital. New companies entering this arena must be prepared for significant upfront investments in exploration, drilling, and essential infrastructure, often running into billions of dollars. For instance, a single offshore exploration project can easily cost hundreds of millions, if not billions, before any production even begins.

Hibiscus Petroleum's own growth strategy, which heavily relies on acquiring and developing existing oil and gas assets, underscores these substantial financial barriers. These acquisitions themselves require considerable capital outlay, making it exceptionally difficult for smaller, less-funded entities to compete or even enter the market effectively.

New companies entering the oil and gas sector face significant hurdles in gaining access to critical distribution channels. Securing space on existing pipelines, processing capacity at refineries, and berths at export terminals is often difficult for new players. These established networks are typically controlled by incumbent firms, including Hibiscus Petroleum, which leverage their long-term relationships and contractual agreements to limit new entrants' reach.

Government policy and regulations present a substantial barrier to entry in the oil and gas sector, directly impacting Hibiscus Petroleum. The industry is characterized by stringent environmental, safety, and operational mandates, demanding significant upfront investment and ongoing compliance from any new player. For instance, in 2023, the UK government continued its focus on net-zero targets, introducing new licensing rounds for offshore oil and gas exploration while also emphasizing carbon capture and storage technologies, adding layers of complexity for potential entrants.

Economies of Scale and Experience Curve

Existing players like Hibiscus Petroleum leverage significant economies of scale, particularly in areas like exploration equipment, drilling services, and refinery operations. This scale translates into lower per-unit production costs, making it harder for new entrants to compete on price. For instance, in 2024, major oil and gas producers often operate fields with production capacities exceeding 100,000 barrels of oil equivalent per day, benefiting from bulk purchasing power and optimized asset utilization.

Furthermore, the experience curve plays a crucial role. Companies with decades of operational history have refined their processes, developed proprietary technologies, and built robust supply chains. This accumulated expertise, gained through learning-by-doing, reduces inefficiencies and minimizes costly mistakes that new entrants would likely face. Hibiscus Petroleum, for example, has a track record of successful asset acquisitions and development, demonstrating its ability to navigate complex operational challenges.

- Economies of Scale: Major oil producers in 2024 benefit from large-scale operations, reducing per-unit costs in exploration, production, and procurement.

- Experience Curve: Established companies possess invaluable expertise and refined processes, leading to greater efficiency and lower initial investment hurdles for newcomers.

- Capital Intensity: The high capital expenditure required for exploration and development in the oil and gas sector serves as a significant barrier, favoring established firms with access to capital.

- Technological Advancement: Existing firms often have proprietary technologies or deep understanding of advanced extraction techniques, which new entrants would need to replicate or acquire at a premium.

Proprietary Technology and Expertise

Established oil and gas companies like Hibiscus Petroleum benefit from significant barriers to entry due to their proprietary technology and deep expertise. These firms have invested for years in developing specialized exploration techniques and production processes that are difficult and costly for newcomers to replicate. For instance, advanced seismic imaging and enhanced oil recovery methods are often protected by patents or are simply the result of accumulated operational knowledge.

New entrants face the daunting task of matching this technological sophistication and human capital. The capital expenditure required to acquire or develop cutting-edge drilling equipment, sophisticated geological modeling software, and to train a workforce with the necessary specialized skills is immense. In 2024, the average cost for a single deepwater exploration well can easily exceed $100 million, highlighting the substantial financial commitment needed to even begin competing.

- Proprietary Technology: Companies like Hibiscus Petroleum leverage patented drilling technologies and advanced data analytics for resource discovery, creating a significant hurdle for new players.

- Specialized Expertise: Access to geoscientists, reservoir engineers, and operational managers with decades of experience is a crucial, non-replicable asset.

- High R&D Investment: The ongoing need for innovation in areas like carbon capture and storage (CCS) requires continuous, substantial investment in research and development, a challenge for startups.

- Data Advantage: Decades of accumulated geological and production data provide invaluable insights that new entrants lack, impacting the accuracy of exploration and development plans.

The threat of new entrants for Hibiscus Petroleum is generally low, primarily due to the immense capital required to enter the oil and gas sector. Establishing operations, from exploration to production, demands billions of dollars, a significant barrier for most potential competitors. Furthermore, established players benefit from economies of scale and experience curves, making it difficult for newcomers to match their cost efficiencies and operational expertise.

Access to distribution channels and the complex regulatory environment also deter new companies. Existing infrastructure is often controlled by incumbents, and navigating stringent government policies, including environmental and safety regulations, requires substantial resources and knowledge. For instance, in 2024, the ongoing global push towards energy transition, coupled with existing licensing regimes, adds layers of complexity for any new entrant seeking to establish a foothold.

| Barrier Type | Description | Impact on New Entrants |

| Capital Intensity | Oil and gas exploration and production require massive upfront investment, often in the billions. | Very High Barrier - Limits the number of potential entrants. |

| Economies of Scale | Established firms benefit from lower per-unit costs due to large-scale operations. | High Barrier - New entrants struggle to compete on price. |

| Distribution Channels | Access to pipelines, refineries, and export terminals is controlled by incumbents. | High Barrier - New entrants face difficulties in getting products to market. |

| Government Regulations | Stringent environmental, safety, and operational mandates increase compliance costs. | High Barrier - Requires significant investment and expertise to navigate. |

| Proprietary Technology & Expertise | Incumbents possess advanced techniques and accumulated operational knowledge. | High Barrier - Difficult and costly for new entrants to replicate. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hibiscus Petroleum leverages data from annual reports, investor presentations, and industry-specific market research reports to assess competitive intensity and strategic positioning.