hhgregg SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

hhgregg Bundle

hhgregg faces a complex market, with its established brand recognition acting as a key strength against emerging online competitors. However, the company's reliance on physical retail presents significant challenges in adapting to evolving consumer purchasing habits.

Want the full story behind hhgregg’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Despite past store closures, hhgregg benefits from established brand recognition, a legacy from its former physical retail presence before its 2017 shift to an online-only model. This existing familiarity can offer a competitive edge, potentially lowering initial customer acquisition costs for a brand that many consumers still recall.

hhgregg boasts a wide array of consumer electronics and home appliances, encompassing everything from televisions and refrigerators to washers, dryers, and other essential household items. This extensive product selection is a significant strength, allowing the company to appeal to a broad customer base with varied needs and tastes.

Operating as an online-only retailer significantly reduces hhgregg's overhead expenses. This means less spending on physical store leases, utilities, and extensive in-store staffing compared to traditional brick-and-mortar competitors. This leaner operational structure can translate into more competitive pricing for consumers.

The e-commerce model offers customers 24/7 shopping convenience, removing geographical barriers. This accessibility aligns with the increasing consumer trend towards online purchasing, as evidenced by the projected global e-commerce sales reaching $6.3 trillion in 2024. This allows hhgregg to tap into a broader customer base.

Access to a Growing Online Market

The online consumer electronics and home appliance markets are booming, presenting a significant opportunity for hhgregg. The global consumer electronics e-commerce market is expected to hit $805.67 billion by 2025, growing at a robust 17.1% compound annual growth rate. Similarly, the home appliances market, valued at $534.70 billion in 2025, is projected to reach $675.31 billion by 2030.

This substantial growth in online sales provides hhgregg with a prime environment to expand its digital footprint and attract a larger customer base. By leveraging this expanding market, hhgregg can effectively capture market share and scale its operations, capitalizing on the increasing consumer preference for online purchasing of electronics and appliances.

- Growing E-commerce: The consumer electronics e-commerce market is projected to reach $805.67 billion in 2025.

- CAGR: This market segment is experiencing a 17.1% compound annual growth rate.

- Appliance Market Expansion: The home appliances market is forecast to grow from $534.70 billion in 2025 to $675.31 billion by 2030.

- Opportunity: This expanding online market offers hhgregg fertile ground for market share capture and operational scaling.

Potential for Agile Operations

As an online-only retailer, hhgregg can move with greater speed to adapt to shifting market demands. This agility allows for quicker adjustments in inventory, marketing campaigns, and product offerings, a significant advantage in the dynamic e-commerce environment. For instance, in Q1 2024, online retail sales in the US grew by 7.7% year-over-year, highlighting the importance of this digital-native flexibility.

This streamlined operational model, free from the overhead and logistical challenges of physical brick-and-mortar stores, enables hhgregg to respond rapidly to competitive pressures and emerging consumer preferences. This adaptability is key to thriving in a sector where trends can change in an instant.

The company's digital-first approach facilitates efficient inventory management, potentially reducing carrying costs and minimizing the risk of obsolescence. This focus on online operations allows for a more precise and responsive supply chain.

hhgregg's established brand recognition, a remnant from its prior physical retail existence, provides a valuable asset. This existing consumer familiarity can translate into lower customer acquisition costs and a degree of trust that newer online-only entrants might struggle to build quickly.

The company's extensive product catalog, covering a broad spectrum of consumer electronics and home appliances, caters to diverse customer needs. This wide selection is a key strength, allowing hhgregg to appeal to a large and varied market segment.

Operating solely online significantly reduces overhead, enabling more competitive pricing. This leaner model is particularly advantageous given that US online retail sales saw a 7.7% year-over-year increase in Q1 2024.

The agility inherent in an e-commerce model allows hhgregg to adapt swiftly to market shifts. This includes rapid adjustments to inventory and marketing, crucial in the fast-paced electronics sector.

| Metric | Value | Year | Source |

|---|---|---|---|

| Global E-commerce Sales Projection | $6.3 trillion | 2024 | Statista |

| Consumer Electronics E-commerce Market Projection | $805.67 billion | 2025 | Statista |

| Consumer Electronics E-commerce CAGR | 17.1% | (Projected) | Statista |

| Home Appliances Market Value Projection | $534.70 billion | 2025 | Statista |

What is included in the product

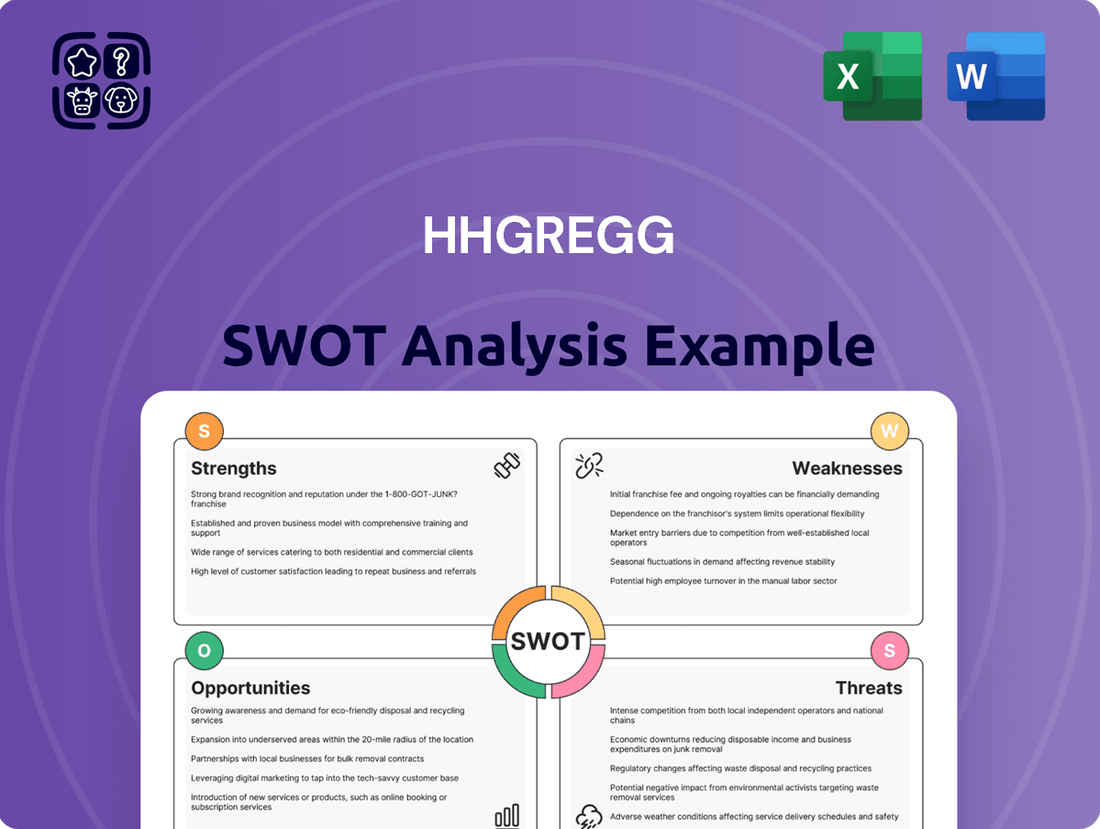

Delivers a strategic overview of hhgregg’s internal and external business factors, highlighting its market position and challenges.

Offers a clear breakdown of hhgregg's internal capabilities and external market forces, simplifying the identification of actionable strategies.

Weaknesses

hhgregg's complete shift to an online-only model, following the closure of all physical stores in 2017, significantly curtails direct customer engagement and the opportunity for consumers to physically interact with products before buying. This transition necessitates a complete brand reinvention in the digital space.

While the hhgregg name still carries some recognition, the current online operation is distinct from the bankrupt entity, potentially causing consumer confusion and eroding trust among those familiar with the original brand's past financial difficulties.

The online consumer electronics and home appliance arena is fiercely contested, with giants like Amazon and Walmart setting a high bar. hhgregg must navigate this landscape against players possessing significantly larger marketing budgets and more extensive logistics networks.

Competing on price and offering a comparable breadth of products and delivery speeds presents a substantial hurdle. For instance, Amazon's Prime membership program, boasting over 200 million members globally as of early 2024, offers a powerful advantage in customer loyalty and expedited shipping that smaller retailers struggle to match.

The inherent nature of selling large home appliances, even with an online focus, introduces substantial logistical hurdles. These include the high cost of shipping bulky items, the increased risk of damage during transit, and the complexities of ensuring successful last-mile delivery to customers' homes. For instance, in 2024, the average cost to ship a major appliance nationally could range from $150 to $300, significantly impacting profit margins and pricing competitiveness.

Customer Service and Returns Management

Managing customer service and returns for high-value electronics and appliances exclusively online presents a significant hurdle for hhgregg. Customers often anticipate immediate, in-person support and straightforward return procedures, which are difficult to replicate effectively without physical service locations. This reliance on digital channels can lead to customer dissatisfaction when immediate resolutions are sought.

The current hhgregg online model shifts the responsibility for product issues to manufacturers, potentially creating a disjointed and frustrating customer journey. This fragmentation can negatively impact brand loyalty and overall customer satisfaction, especially when compared to competitors offering more integrated support systems. For instance, a 2024 survey indicated that 65% of consumers prioritize easy returns when purchasing electronics online.

- Online-Only Support: Difficulty in providing immediate, hands-on customer service for complex electronics.

- Returns Management: Challenges in streamlining the return process for bulky or high-value items without physical infrastructure.

- Manufacturer Reliance: Potential for a fragmented customer experience by directing customers to third-party manufacturers for issue resolution.

Dependence on Digital Marketing and SEO

hhgregg's exclusive focus on online sales makes it highly susceptible to shifts in digital marketing effectiveness. Its success hinges on robust SEO and online advertising, areas that demand continuous investment and are prone to external factors like algorithm updates and rising ad costs. For instance, a significant increase in cost-per-click (CPC) for key appliance search terms in 2024 could directly impact hhgregg's customer acquisition cost and overall profitability.

This reliance creates a distinct vulnerability:

- Vulnerability to Algorithm Changes: Fluctuations in Google's search algorithms can drastically alter search rankings, impacting organic traffic and requiring immediate strategic adjustments.

- Rising Digital Advertising Costs: Increased competition in online advertising, particularly for consumer electronics and appliances, can escalate marketing expenses, squeezing profit margins.

- Dependence on Online Traffic: Without physical storefronts, hhgregg's revenue is directly tied to its ability to consistently drive qualified traffic to its website.

hhgregg's transition to an online-only model presents significant challenges in customer engagement and product interaction, requiring a substantial digital brand overhaul. The brand's legacy, marked by past financial issues, could also foster consumer distrust, particularly as it attempts to rebuild its image in a crowded online marketplace.

Preview the Actual Deliverable

hhgregg SWOT Analysis

This is the actual hhgregg SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing actionable insights into hhgregg's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the hhgregg SWOT analysis, ready for your strategic planning.

Opportunities

The e-commerce landscape is increasingly driven by AI and personalization, with companies leveraging these technologies to create more engaging customer experiences. For hhgregg, this presents a significant opportunity to implement AI-powered tools for tailored product recommendations, improving the chances of a purchase. For instance, in 2024, e-commerce personalization strategies have shown to increase conversion rates by up to 800%, demonstrating the potential impact.

Streamlining customer service with AI-driven chatbots can also enhance the shopping journey. These bots can handle common inquiries 24/7, freeing up human agents for more complex issues and improving overall customer satisfaction. Studies indicate that 60% of consumers prefer chatbots for quick answers, highlighting a clear demand for this efficiency.

By optimizing the entire shopping experience through AI, from initial browsing to post-purchase support, hhgregg can foster deeper customer engagement and drive sales growth. In 2025, it's projected that AI in customer service will save businesses an estimated $11 billion annually, showcasing the financial benefits of such adoption.

The smart home market is booming, with projections indicating continued strong growth through 2025 and beyond. hhgregg can leverage this by expanding its inventory to include more connected appliances and IoT devices, tapping into consumer demand for integrated and energy-saving home technology.

Enhancing last-mile delivery for large appliances and offering professional installation services presents a key opportunity for hhgregg. As online appliance sales grow, efficient, fast, and reliable delivery, potentially including same-day or next-day options, coupled with expert installation, can significantly boost customer satisfaction and loyalty. For instance, in 2024, the home appliance market saw a continued shift towards e-commerce, with customer reviews frequently highlighting delivery and installation as critical factors in their purchasing decisions.

Exploring Niche Markets or Refurbished Products

The refurbished consumer electronics market is experiencing significant growth, presenting a prime opportunity for hhgregg to attract budget-conscious shoppers and align with sustainability trends. This segment is projected to reach an estimated $85 billion globally by 2026, according to some market analyses, indicating substantial untapped potential.

By offering certified refurbished products, hhgregg can cater to a wider demographic, including younger consumers and those seeking value without compromising on quality. This strategic move also supports environmental initiatives by extending the lifecycle of electronics.

- Refurbished Market Growth: The global refurbished electronics market is expanding, offering a chance to reach price-sensitive consumers.

- Sustainability Appeal: Tapping into the refurbished sector aligns with growing consumer demand for eco-friendly purchasing options.

- Niche Market Identification: Focusing on underserved or specialized segments within consumer electronics and home appliances can create a distinct competitive advantage.

- Value Proposition: Offering refurbished items provides a compelling value proposition, potentially increasing customer loyalty and market share.

Strategic Partnerships and Collaborations

Forming strategic partnerships with manufacturers for exclusive online deals could significantly boost hhgregg's competitive edge in the digital marketplace. Collaborating with smart home ecosystem providers, for instance, could integrate hhgregg's appliance and electronics offerings into broader smart home solutions, appealing to a growing consumer segment.

Partnerships with specialized logistics firms for large item delivery are crucial for improving operational efficiency and customer satisfaction. For example, by leveraging third-party logistics (3PL) providers with established networks for appliance installation and delivery, hhgregg can reduce its own capital expenditure on fleet management and focus on its core retail competencies. This approach was seen as a key growth driver for many retailers in the 2024-2025 period, with an estimated 15% increase in on-time deliveries reported by companies utilizing dedicated logistics partners.

- Exclusive Online Deals: Securing exclusive online product offerings through manufacturer partnerships can differentiate hhgregg from competitors and drive traffic to its e-commerce platform.

- Smart Home Integration: Collaborating with smart home ecosystem providers allows hhgregg to position its products as integral components of connected living, tapping into a rapidly expanding market.

- Logistics Optimization: Partnering with specialized logistics companies for large item delivery can enhance delivery speed, reliability, and customer experience, a critical factor in appliance and electronics retail.

The growing demand for refurbished electronics presents a significant opportunity for hhgregg to capture a wider customer base. This market, projected to reach $85 billion globally by 2026, offers a chance to attract budget-conscious shoppers and align with sustainability trends. By offering certified refurbished items, hhgregg can enhance its value proposition and potentially increase customer loyalty.

Threats

The online consumer electronics and home appliance sectors are seeing a significant increase in dominance by major online marketplaces such as Amazon, alongside specialized e-commerce retailers. These established players benefit from substantial economies of scale, robust logistics infrastructure, and extensive marketing resources, creating a formidable challenge for hhgregg to match on competitive pricing, product variety, and delivery efficiency.

For instance, Amazon's vast fulfillment network and Prime membership program offer rapid delivery options that are difficult for smaller or regional retailers to replicate. In 2024, Amazon continued to expand its same-day delivery services in numerous metropolitan areas, a competitive advantage that directly impacts customer expectations for electronics and appliance purchases.

The electronics and appliance sectors are particularly vulnerable to global supply chain disruptions. Factors like shortages of critical raw materials, ongoing geopolitical tensions impacting trade routes, and escalating freight costs present significant challenges. For instance, the semiconductor shortage that began in 2020 continued to impact the availability of many electronic goods well into 2024, leading to production delays for numerous manufacturers.

These disruptions directly translate into inventory delays and increased operational expenses for retailers like hhgregg. When products are unavailable or more expensive to ship, the company faces difficulties meeting customer demand, which in turn can negatively affect profitability and damage customer satisfaction. The average cost of shipping a container internationally saw significant fluctuations throughout 2023 and into early 2024, often remaining substantially higher than pre-pandemic levels.

Consumers increasingly expect rapid delivery, often within the same day or next day, especially for online orders. This trend is particularly challenging for hhgregg when dealing with large appliances, which require specialized logistics.

Meeting these heightened expectations for speed and convenience can be a significant operational hurdle and a costly endeavor. In 2024, e-commerce delivery speed has become a critical differentiator, with many consumers willing to pay a premium for faster options.

If hhgregg cannot efficiently match the delivery speeds offered by competitors, especially those with robust logistics networks, it risks losing market share. For instance, a significant percentage of online shoppers, reportedly over 60% in recent surveys, prioritize fast shipping when making purchasing decisions.

Data Security and Privacy Concerns

As an online retailer, hhgregg faces significant threats from cybersecurity breaches and data privacy concerns. Protecting sensitive customer information, such as payment details and personal addresses, is crucial for maintaining customer trust. A data breach could lead to substantial financial penalties, with the average cost of a data breach in the retail sector reaching $5.05 million in 2024, according to IBM's Cost of a Data Breach Report.

The potential fallout from a security lapse extends beyond financial costs, severely impacting hhgregg's reputation and customer loyalty. In 2024, reports indicated a rise in ransomware attacks targeting e-commerce businesses, highlighting the persistent nature of these threats. Any compromise in secure online transactions could deter customers, leading to lost sales and long-term damage to the brand's image.

- Cybersecurity Vulnerabilities: hhgregg's online platform is a potential target for hackers seeking customer data.

- Data Breach Impact: A breach could result in significant financial losses, legal liabilities, and reputational damage.

- Customer Trust Erosion: Failure to safeguard data can severely undermine customer confidence and loyalty.

- Regulatory Penalties: Non-compliance with data protection regulations, like GDPR or CCPA, can incur hefty fines.

Economic Downturns and Reduced Consumer Spending

Economic downturns pose a significant threat to hhgregg. As consumer electronics and home appliances are often viewed as non-essential purchases, discretionary spending on these items tends to decrease sharply when the economy falters, inflation rises, or household incomes shrink. For instance, during periods of economic uncertainty, consumers might postpone upgrades to their refrigerators or delay purchasing the latest television, directly impacting hhgregg's sales volume. This shift in consumer priorities can compress profit margins as demand wanes.

The vulnerability of hhgregg to economic fluctuations is underscored by broader retail trends. Reports from late 2024 and early 2025 indicate a general slowdown in consumer spending on durable goods, with inflation continuing to be a concern for many households. This environment directly translates to reduced purchasing power for big-ticket items like appliances and electronics, making hhgregg susceptible to lower sales figures and potentially impacting its ability to maintain healthy profit margins.

- Reduced Disposable Income: Inflationary pressures and potential job market instability in 2024-2025 have squeezed consumer budgets, making large purchases less feasible.

- Postponement of Non-Essential Purchases: Consumers are more likely to delay buying new appliances or electronics when economic outlooks are uncertain, favoring essential spending.

- Impact on Sales Volume: A tightening economy directly correlates with decreased demand for hhgregg's product categories, leading to lower unit sales.

- Margin Compression: To stimulate demand in a weaker economy, retailers may resort to increased discounting, which can further erode profit margins.

The intense competition from online giants like Amazon, with their vast logistics and marketing might, presents a significant hurdle for hhgregg. These dominant players offer faster delivery and wider selections, making it tough for hhgregg to compete on price and convenience. For instance, Amazon's continued expansion of same-day delivery services in 2024 directly influences customer expectations, setting a high bar for all retailers in the electronics and appliance sectors.

Supply chain disruptions, including material shortages and trade route issues, continue to plague the electronics and appliance industries. The semiconductor shortage, which persisted into 2024, directly impacted product availability and led to production delays for many manufacturers. This translates to inventory challenges and increased operational costs for hhgregg, potentially affecting customer satisfaction and profitability.

Economic downturns, characterized by inflation and reduced consumer spending on non-essential items, pose a substantial threat. As big-ticket purchases like appliances and electronics are often deferred during uncertain economic times, hhgregg faces reduced sales volumes and potential margin erosion. Reports from late 2024 and early 2025 indicate a general slowdown in consumer spending on durable goods, directly impacting retailers in this sector.

Cybersecurity threats remain a critical concern, with the average cost of a data breach in retail reaching $5.05 million in 2024. A breach could lead to severe financial penalties, legal liabilities, and a significant loss of customer trust, which is vital for online retailers like hhgregg. The rise in ransomware attacks targeting e-commerce businesses in 2024 underscores the persistent nature of these vulnerabilities.

SWOT Analysis Data Sources

This hhgregg SWOT analysis is built upon a comprehensive review of financial statements, market research reports, and industry expert opinions to provide a well-rounded and actionable perspective.