hhgregg Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

hhgregg Bundle

hhgregg's competitive landscape is shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for any business operating in the electronics retail space.

The complete report reveals the real forces shaping hhgregg’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The consumer electronics and home appliance sector is characterized by a limited number of dominant manufacturers. Companies like Samsung, LG, and Whirlpool are key players, meaning they hold considerable sway in the market.

This concentration of suppliers directly impacts the bargaining power they wield over retailers such as hhgregg. When a few major manufacturers control the supply of popular or in-demand products, they can dictate terms, potentially squeezing retailer margins.

For instance, in 2024, Samsung's global revenue reached approximately $200 billion, highlighting its significant market presence. Similarly, LG reported substantial revenues, underscoring their influence as suppliers to electronics retailers.

For hhgregg, the bargaining power of suppliers is significantly influenced by the switching costs associated with changing vendors. If hhgregg were to transition to new suppliers, it would likely face substantial expenses. These could include the costs of renegotiating existing agreements, the effort involved in integrating new product lines and inventory systems, and the potential need to reconfigure its entire logistics and distribution network. These financial and operational hurdles make it more difficult for hhgregg to switch, thereby strengthening the hand of its current suppliers.

The uniqueness of products and components significantly influences supplier bargaining power. While many electronics offer similar core functions, brands like Samsung with its QLED technology or LG with its advanced OLED displays possess unique selling propositions. If hhgregg's product assortment heavily featured such differentiated items, the suppliers of these unique components or finished goods would command greater leverage, potentially increasing costs for hhgregg.

Threat of Forward Integration by Suppliers

Major manufacturers are increasingly establishing their own direct-to-consumer (D2C) online sales channels and robust brand websites. This shift allows suppliers to bypass traditional retailers like hhgregg, directly reaching end customers.

This capability significantly enhances supplier bargaining power, as they can control pricing, customer relationships, and product availability without relying on intermediaries. For instance, in 2024, many electronics manufacturers reported substantial growth in their D2C sales, often exceeding 20% of their total revenue, putting pressure on brick-and-mortar retailers.

- Increased D2C Sales: Manufacturers are leveraging online platforms to sell directly, capturing a larger share of the retail margin.

- Brand Control: Suppliers gain more control over their brand image and customer experience through their own sales channels.

- Reduced Retailer Dependence: Retailers like hhgregg face weakened negotiation positions as suppliers have alternative sales avenues.

Importance of hhgregg to Suppliers

The bargaining power of suppliers to hhgregg is influenced by how crucial hhgregg is to their business. If hhgregg accounts for only a small fraction of a supplier's total revenue, that supplier holds more leverage. For instance, if a component manufacturer sells to hundreds of retailers, hhgregg's business is less critical, allowing the supplier to dictate terms more easily.

Conversely, if hhgregg represents a substantial portion of a supplier's sales volume, the supplier's power is diminished. In such a scenario, the supplier would be more inclined to offer favorable pricing or terms to maintain the relationship with hhgregg. This dynamic is particularly relevant in the electronics retail sector where economies of scale are important for suppliers.

Consider the case of a major appliance manufacturer. If hhgregg were one of their largest or only significant retail partners in certain regions, the manufacturer would have less power to impose unfavorable conditions. The volume of hhgregg's purchases directly correlates with the supplier's dependence, thereby shaping the bargaining power.

- Suppliers who sell a small percentage of their output to hhgregg have greater bargaining power.

- Suppliers who rely heavily on hhgregg for a large portion of their sales have less bargaining power.

- The volume of hhgregg's purchases relative to a supplier's total sales is a key determinant of supplier power.

- In 2024, the consolidation within the consumer electronics supply chain means some suppliers might have fewer alternative distribution channels, potentially increasing their reliance on major retailers like hhgregg, thus reducing their individual bargaining power.

The bargaining power of suppliers for hhgregg is substantial due to the concentrated nature of the consumer electronics market, with a few dominant manufacturers like Samsung and LG holding significant sway. These suppliers can dictate terms, impacting retailer margins, especially when their products are unique or in high demand. For instance, Samsung's 2024 revenue of around $200 billion exemplifies its market dominance.

Switching costs for hhgregg are also high, involving renegotiating contracts and integrating new systems, which further strengthens supplier leverage. Moreover, suppliers increasingly bypass retailers through direct-to-consumer (D2C) channels, which grew significantly in 2024, often representing over 20% of manufacturers' revenue, thus diminishing hhgregg's negotiation position.

The degree to which hhgregg contributes to a supplier's overall sales is a critical factor; if hhgregg represents a small portion of a supplier's revenue, the supplier has more power. Conversely, if hhgregg is a major client, the supplier's power is reduced, making them more amenable to favorable terms.

| Supplier Factor | Impact on hhgregg | 2024 Data/Trend |

|---|---|---|

| Market Concentration | High supplier power | Dominant players like Samsung and LG |

| Switching Costs | High supplier power | Significant expenses for hhgregg to change vendors |

| D2C Sales Growth | High supplier power | D2C channels grew over 20% of revenue for many manufacturers |

| hhgregg's Sales Contribution | Varies (Low contribution = High supplier power) | Depends on specific supplier relationships |

What is included in the product

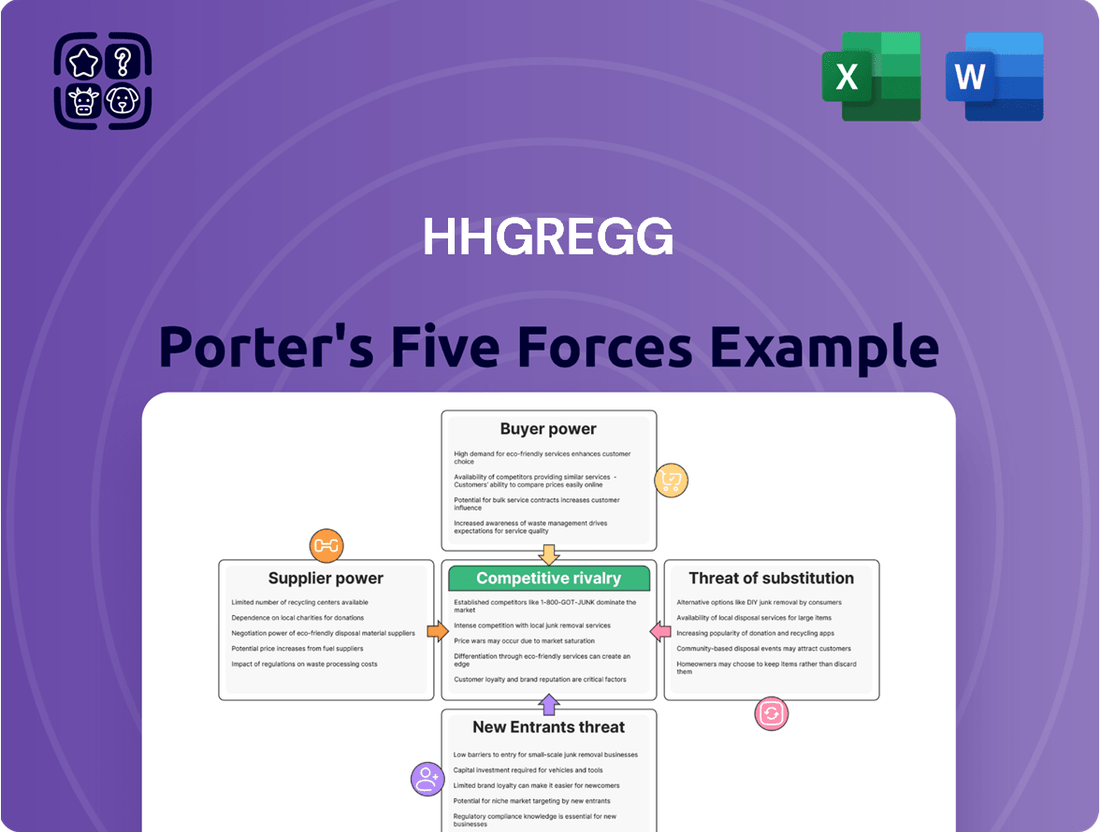

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for hhgregg, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, simplifying complex competitive dynamics for hhgregg.

Customers Bargaining Power

Customers in the online consumer electronics and home appliance market exhibit significant price sensitivity. In 2024, the prevalence of comparison shopping engines and readily accessible online reviews empowers consumers to pinpoint the most competitive pricing. This transparency directly amplifies their bargaining influence.

For customers, switching between online retailers like hhgregg and its competitors is remarkably simple, often involving just a few clicks. This ease of transition significantly enhances customer bargaining power, as they can readily explore alternative platforms for better pricing or service. In 2024, the average online shopper in the electronics sector demonstrated this by comparing prices across an average of 3.5 different retailers before making a purchase.

When many retailers sell identical consumer electronics and home appliances, customers have a significant advantage. This product homogeneity means brands like Samsung or LG are available everywhere, making it hard for one store to stand out based on the product itself. For instance, a specific 65-inch LG OLED TV model will likely be priced similarly across major electronics retailers, giving customers the power to easily switch based on minor price differences or store location.

Customer Knowledge and Education

The internet has dramatically increased customer knowledge, giving them access to detailed product specifications, user reviews, and expert comparisons. This readily available information empowers consumers to make highly informed purchasing decisions.

With such a wealth of data at their fingertips, customers are better equipped to negotiate prices and demand superior service. For instance, in 2024, online price comparison tools are ubiquitous, allowing shoppers to instantly see the best deals available, thereby increasing their bargaining power against retailers like hhgregg.

- Informed Decisions: Customers can research product features, durability, and pricing across multiple brands and retailers.

- Price Sensitivity: Access to competitor pricing information makes customers more sensitive to price differences.

- Demand for Value: Educated customers expect better service, warranties, and post-purchase support to justify their spending.

- Online Reviews Influence: Customer reviews significantly impact purchasing decisions, pushing companies to improve product quality and customer experience.

Rise of Marketplaces

The rise of large online marketplaces significantly amplifies customer bargaining power. These platforms, like Amazon and Walmart.com, consolidate a vast array of sellers and brands, making it effortless for consumers to compare prices, features, and reviews. This aggregation creates a highly competitive environment where customers can easily switch between providers, forcing sellers to offer more attractive terms. For hhgregg, this means facing intense price pressure and the need to differentiate beyond just product offering.

In 2024, online marketplaces continued their strong trajectory, with global e-commerce sales projected to reach trillions of dollars. This dominance means customers have readily available alternatives for almost any product hhgregg sells. For instance, a customer looking for a new television can easily compare dozens of models from various brands and retailers on a single marketplace page, often with transparent pricing and delivery options. This accessibility directly challenges hhgregg's ability to command premium pricing or retain customer loyalty solely through product availability.

- Marketplace Dominance: Online marketplaces offer unparalleled price and product comparison, increasing customer leverage.

- Increased Competition: Aggregating numerous sellers forces businesses like hhgregg to compete on price and value.

- Customer Choice: Customers can easily switch to alternatives found on these platforms, reducing switching costs.

- Price Sensitivity: The ease of comparison fosters greater price sensitivity among consumers.

Customers in the consumer electronics and home appliance market possess substantial bargaining power, largely due to readily available information and the ease of switching between retailers. In 2024, the proliferation of online comparison tools means consumers can effortlessly identify the lowest prices and best deals across numerous vendors. This transparency, coupled with the low cost of switching, significantly tips the scales in favor of the buyer.

| Factor | Impact on hhgregg | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High | Consumers compare prices across an average of 3.5 retailers online. |

| Switching Costs | Low | Few clicks to switch between online stores. |

| Product Homogeneity | High | Identical models from brands like LG and Samsung are widely available. |

| Information Availability | High | Ubiquitous online reviews and comparison tools empower informed choices. |

What You See Is What You Get

hhgregg Porter's Five Forces Analysis

This preview showcases the comprehensive hhgregg Porter's Five Forces Analysis, detailing competitive rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, providing a complete and ready-to-use strategic overview.

Rivalry Among Competitors

The online consumer electronics and home appliance market is incredibly crowded. Think of giants like Amazon and Walmart, alongside many specialized online shops and even brands selling directly to you. This sheer volume of competitors means hhgregg faces constant pressure to stand out and attract customers.

While the broader consumer electronics and home appliance e-commerce sector continues to expand, specific niches within this market may exhibit subdued growth or even contraction. This dynamic intensifies competition among established retailers as they vie for a larger slice of a more limited market pie.

This intensified competition often translates into aggressive pricing tactics and heightened marketing expenditures. For instance, in 2024, the U.S. consumer electronics retail market saw a notable increase in promotional activities, with average discounts on major appliances reaching 15-20% during peak holiday seasons, according to industry reports.

Operating an online retail platform for large consumer goods, like those hhgregg dealt with, necessitates substantial fixed costs. These include investments in robust IT infrastructure, expansive warehousing facilities, and complex logistics networks. For instance, in 2024, the average cost for a large e-commerce fulfillment center can range from $50 million to over $100 million, a significant barrier to entry.

High fixed costs create pressure to maintain sales volume, intensifying competition. When retailers carry large inventories of big-ticket items, they face the risk of obsolescence or the need to liquidate stock quickly. This often results in aggressive price cutting to move inventory, as seen when retailers like Best Buy offered significant discounts on appliances and electronics throughout 2024 to manage stock levels.

Product Differentiation Challenges

For retailers like hhgregg, differentiating products beyond price and service is a significant hurdle. Many electronics and appliance stores offer identical items from the same major manufacturers, making it tough to stand out. This often forces competition to focus on other areas like promotional pricing, rapid delivery, and the overall customer experience to capture market share.

The difficulty in product differentiation directly fuels intense rivalry. Retailers must constantly innovate in their service offerings or pricing strategies to attract and retain customers. For instance, in 2024, the consumer electronics market saw aggressive price matching and extended warranty offers as key competitive tactics, with many retailers investing heavily in same-day delivery options to gain an edge.

- Product Similarity: Most retailers stock the same popular brands and models, limiting unique product offerings.

- Price as a Differentiator: Competition frequently devolves into price wars, impacting profit margins.

- Service & Experience Focus: Differentiation efforts often shift to delivery speed, installation services, and in-store customer support.

- Promotional Reliance: Sales events and discounts become critical tools for attracting shoppers in a crowded market.

Exit Barriers

High fixed costs, such as those associated with maintaining large appliance warehouses and specialized retail footprints, can significantly trap capital within the hhgregg business. These costs don't disappear easily, making it difficult for a company to simply shut down operations without incurring substantial losses.

Furthermore, established supply chain relationships, often built over years with manufacturers and logistics providers, represent another significant exit barrier. Untangling these complex networks can be costly and time-consuming, further incentivizing continued operation even in challenging market conditions.

The presence of these substantial exit barriers means that even financially distressed retailers like hhgregg might continue to operate, albeit at a loss. This prolonged presence intensifies competitive rivalry for healthier players in the market, as these struggling entities can still exert pricing pressure and vie for market share.

- High Fixed Costs: Retailers in this sector often invest heavily in physical stores and inventory, creating significant sunk costs that are difficult to recoup upon exit.

- Specialized Assets: Assets like large appliance warehouses are not easily repurposed, increasing the financial penalty for ceasing operations.

- Supply Chain Entanglement: Long-standing relationships with suppliers and distributors can involve contractual obligations and economies of scale that are costly to break.

- Continued Competitive Pressure: The inability to easily exit means underperforming firms may remain in the market, prolonging competitive intensity and potentially leading to price wars.

Competitive rivalry within the consumer electronics and home appliance sector is fierce, driven by product similarity and aggressive pricing. In 2024, retailers frequently engaged in price matching and offered substantial discounts, with major appliance sales seeing average reductions of 15-20% during peak periods. This intense competition forces companies to differentiate through service, such as faster delivery or enhanced customer support, rather than solely on product uniqueness.

| Competitive Factor | Impact on Rivalry | 2024 Data/Example |

|---|---|---|

| Product Similarity | Increases direct competition as offerings are often identical. | Most major brands and models are available across multiple retailers. |

| Price Competition | Leads to price wars and reduced profit margins. | Average discounts on major appliances reached 15-20% during holiday seasons. |

| Service Differentiation | Focus shifts to delivery speed, installation, and customer experience. | Many retailers invested in same-day delivery options. |

| Promotional Reliance | Sales events and discounts are critical for customer acquisition. | Extended warranty offers became a common competitive tactic. |

SSubstitutes Threaten

The burgeoning market for refurbished and used electronics presents a significant threat of substitutes for new products. Consumers are increasingly drawn to these cost-effective alternatives, driven by both financial prudence and a growing awareness of environmental sustainability. This trend directly impacts the demand for new electronics, as a substantial segment of the market finds these pre-owned options to be a perfectly viable, and often preferable, choice.

In 2023, the global refurbished electronics market was valued at approximately $82.4 billion, with projections indicating continued robust growth. This expanding availability of quality pre-owned devices, from smartphones to laptops, offers a compelling value proposition that directly competes with the higher price points of new merchandise. As more consumers embrace this circular economy model, the pressure on manufacturers and retailers of new electronics intensifies.

Emerging rental and subscription services for home appliances present a significant threat of substitution for traditional appliance retailers like hhgregg. These models offer consumers an alternative to outright ownership, particularly for high-value items, by providing access rather than possession. This shift in consumption patterns directly challenges the core business of selling appliances.

For instance, companies offering appliance subscription boxes or rental plans allow consumers to use products for a monthly fee, often including maintenance and upgrades. This flexibility can be particularly appealing to younger demographics or those who prefer not to commit to a large upfront purchase. The growing popularity of the "as-a-service" economy across various sectors indicates a broader consumer acceptance of these alternative consumption models.

The rise of DIY repairs and upgrades presents a significant threat of substitutes for appliance retailers like hhgregg. Consumers can increasingly access detailed online repair guides and readily available spare parts, making it feasible for them to fix their own appliances instead of buying new ones.

This trend is further bolstered by the growing 'right-to-repair' movement, which advocates for easier access to repair information and parts. For instance, in 2024, consumer electronics repair rates saw a notable increase, with many individuals opting for self-repair to save money and reduce electronic waste, directly impacting the demand for new appliance sales.

Multi-functional Devices

The rise of multi-functional devices poses a significant threat of substitution for specialized electronics. For instance, the convergence of computing, communication, and entertainment into smartphones means consumers may forgo purchasing separate devices like digital cameras or portable music players. This trend is evident as smartphone shipments continue to grow, with global shipments reaching over 1.2 billion units in 2024, according to industry estimates.

Smart TVs, now equipped with built-in streaming apps and web browsing, can also substitute for dedicated media players or even gaming consoles for casual users. This integration reduces the perceived need for multiple electronic gadgets, impacting sales of single-purpose devices. In 2024, the smart TV market is projected to exceed 250 million units sold globally.

- Smartphones consolidate multiple functionalities, reducing demand for single-purpose gadgets like digital cameras.

- Smart TVs integrate streaming and web browsing, substituting for separate media players.

- This convergence limits the market for specialized electronics, increasing the threat of substitutes.

Offline Retail Experiences

Even though hhgregg has an online presence, traditional brick-and-mortar stores remain a significant substitute. These physical locations offer tangible product interaction, immediate availability, and personalized customer service, which are highly valued by consumers, especially when purchasing large, expensive items like appliances.

In 2024, the retail landscape continued to show the resilience of physical stores. Reports indicate that while e-commerce growth persists, a substantial portion of consumer spending, particularly for big-ticket items, still occurs in physical retail environments where customers can see, touch, and test products before buying. This hands-on experience is a key differentiator that online-only retailers struggle to replicate.

The threat of substitutes from offline retail experiences for hhgregg is amplified by the convenience and trust associated with established physical stores. Consumers often prefer the assurance of seeing a large appliance in person and receiving immediate assistance from sales associates, which can influence their purchasing decisions away from online channels.

Key factors contributing to the threat of offline retail substitutes include:

- Immediate Gratification: Customers can take home purchases immediately from physical stores.

- Tangible Product Experience: The ability to see, touch, and test products before buying is crucial for high-value items.

- Personalized Sales Assistance: Expert advice and tailored recommendations from in-store staff can sway purchasing decisions.

- Reduced Perceived Risk: Many consumers feel more secure buying expensive items from a physical store with a clear return policy and local support.

The increasing availability of refurbished and used electronics directly challenges new product sales. Consumers are increasingly opting for these more affordable options, driven by both cost savings and a desire for sustainability, making pre-owned devices a viable alternative for a significant market segment.

Rental and subscription services for appliances offer a compelling substitute for outright ownership, appealing to consumers who prefer flexibility and access over possession. This shift in consumer behavior, exemplified by the growing 'as-a-service' model, directly impacts traditional appliance sales models.

DIY repairs and the 'right-to-repair' movement empower consumers to fix their own appliances, reducing the need for new purchases. With repair rates rising in 2024, this trend directly eats into the market for new appliance sales.

The convergence of functionalities into devices like smartphones and smart TVs substitutes for single-purpose electronics. In 2024, over 1.2 billion smartphones were shipped globally, demonstrating this trend and its impact on sales of devices like digital cameras.

| Substitute Type | Impact on hhgregg | 2024 Data/Trend |

|---|---|---|

| Refurbished/Used Electronics | Reduces demand for new products | Global refurbished electronics market projected for continued strong growth. |

| Appliance Rentals/Subscriptions | Challenges ownership model | Growing consumer acceptance of 'as-a-service' models. |

| DIY Repairs / Right-to-Repair | Decreases new appliance purchases | Increased consumer electronics repair rates observed in 2024. |

| Multi-functional Devices (Smartphones, Smart TVs) | Limits sales of specialized electronics | Over 1.2 billion smartphones shipped globally in 2024; smart TV market exceeding 250 million units. |

Entrants Threaten

Establishing a robust online retail presence in the consumer electronics and home appliance sector demands significant upfront capital. This includes substantial investments in sophisticated e-commerce platforms, secure data centers, and scalable cloud infrastructure, often running into millions of dollars for a comprehensive setup.

Beyond technology, acquiring and maintaining a diverse inventory of high-value goods like televisions, refrigerators, and washing machines necessitates considerable working capital. For instance, a new entrant might need to secure tens of millions in inventory financing to compete effectively with established players who benefit from economies of scale and existing supplier relationships.

The logistical backbone, including warehousing, shipping, and returns management, also presents a high capital hurdle. Building or leasing strategically located distribution centers and investing in efficient delivery fleets can easily add tens of millions more to the initial investment, making it a formidable barrier for aspiring competitors.

Established retailers like Best Buy and Amazon have cultivated significant brand loyalty, making it difficult for newcomers to gain traction. For instance, in 2023, Amazon's brand value was estimated at over $500 billion, reflecting deep consumer trust and purchasing habits.

New entrants in the electronics retail space face substantial customer acquisition costs. Attracting consumers requires extensive marketing and competitive pricing to overcome the inertia of loyalty to existing, well-recognized brands and established online marketplaces.

Establishing a sophisticated supply chain and distribution network for bulky items like electronics and appliances is a significant hurdle for potential new competitors. This includes managing inventory, transportation, and crucial last-mile delivery, often with installation services. For instance, in 2024, the average cost of last-mile delivery for large items can range from $50 to $150 per delivery, a substantial investment for any newcomer.

Replicating the established infrastructure and operational efficiencies of existing players, like hhgregg, would require immense capital and time. The complexity of warehousing, fleet management, and skilled labor for installation presents a formidable barrier. Companies that have perfected these logistics can offer faster, more reliable service, which is a key differentiator in the appliance and electronics market.

Economies of Scale

Existing large online retailers, like Amazon and Walmart, leverage significant economies of scale. This allows them to negotiate lower prices from suppliers, spread marketing costs over a vast customer base, and optimize logistics for greater efficiency. For instance, Amazon's immense purchasing power in 2024 likely translates to substantial cost advantages over smaller competitors.

New entrants face a considerable hurdle as they would initially operate at a cost disadvantage. Without the same volume, their per-unit costs for inventory, shipping, and advertising would be higher, making it difficult to match the pricing of established players. This cost gap can deter new businesses from entering the market.

- Economies of Scale: Large online retailers benefit from lower per-unit costs due to high sales volumes.

- Purchasing Power: Established players secure better deals with suppliers, reducing their cost of goods sold.

- Marketing Efficiency: Brand recognition and existing customer bases allow for more cost-effective marketing campaigns.

- Operational Leverage: High operational volumes lead to lower overhead per transaction for incumbents.

Regulatory Hurdles and Product Safety Standards

The consumer electronics and home appliance sector faces significant regulatory scrutiny. New companies entering this market must contend with a complex web of safety standards, such as those set by the Consumer Product Safety Commission (CPSC) in the US, and environmental regulations like the Restriction of Hazardous Substances (RoHS) directive in Europe. These compliance requirements can substantially increase the initial investment and time-to-market for new entrants.

For example, in 2024, the average time for a new electronic product to gain necessary safety certifications could range from several months to over a year, depending on the product's complexity and the markets targeted. This lengthy process, coupled with the associated testing and documentation costs, acts as a substantial barrier.

- Regulatory Compliance Costs: New entrants must budget for extensive testing, certification, and legal consultation to meet varying national and international standards.

- Product Safety and Environmental Standards: Adherence to standards like UL certification for electrical safety and energy efficiency ratings (e.g., Energy Star) is mandatory and costly.

- Time-to-Market Delays: Navigating regulatory approvals can significantly extend the period before a new product can be launched, impacting competitive timing.

- Increased Capital Expenditure: Meeting these standards often requires investment in specialized manufacturing processes and quality control systems.

The threat of new entrants for hhgregg is moderate, primarily due to the substantial capital requirements for establishing a physical retail presence and a robust online platform. Significant investments are needed for inventory, logistics, and marketing to compete with established players.

High customer acquisition costs and the need to build brand loyalty present further challenges. Newcomers must overcome the established trust and purchasing habits of consumers who favor brands like Amazon and Best Buy, which have demonstrated significant brand value, estimated in the hundreds of billions of dollars.

The complexity of supply chains and distribution networks for bulky electronics and appliances also acts as a barrier. For instance, last-mile delivery costs for large items in 2024 can range from $50 to $150 per delivery, a substantial investment for any newcomer aiming to match the service levels of incumbents.

Additionally, stringent regulatory compliance for product safety and environmental standards, which can take months to over a year and incur significant costs for certifications, further deters new entrants. This multifaceted barrier landscape makes the threat of new entrants a manageable concern for established retailers.

Porter's Five Forces Analysis Data Sources

Our hhgregg Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, company financial statements, and publicly available consumer behavior data. We also incorporate insights from trade publications and economic indicators to provide a comprehensive view of the competitive landscape.