hhgregg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

hhgregg Bundle

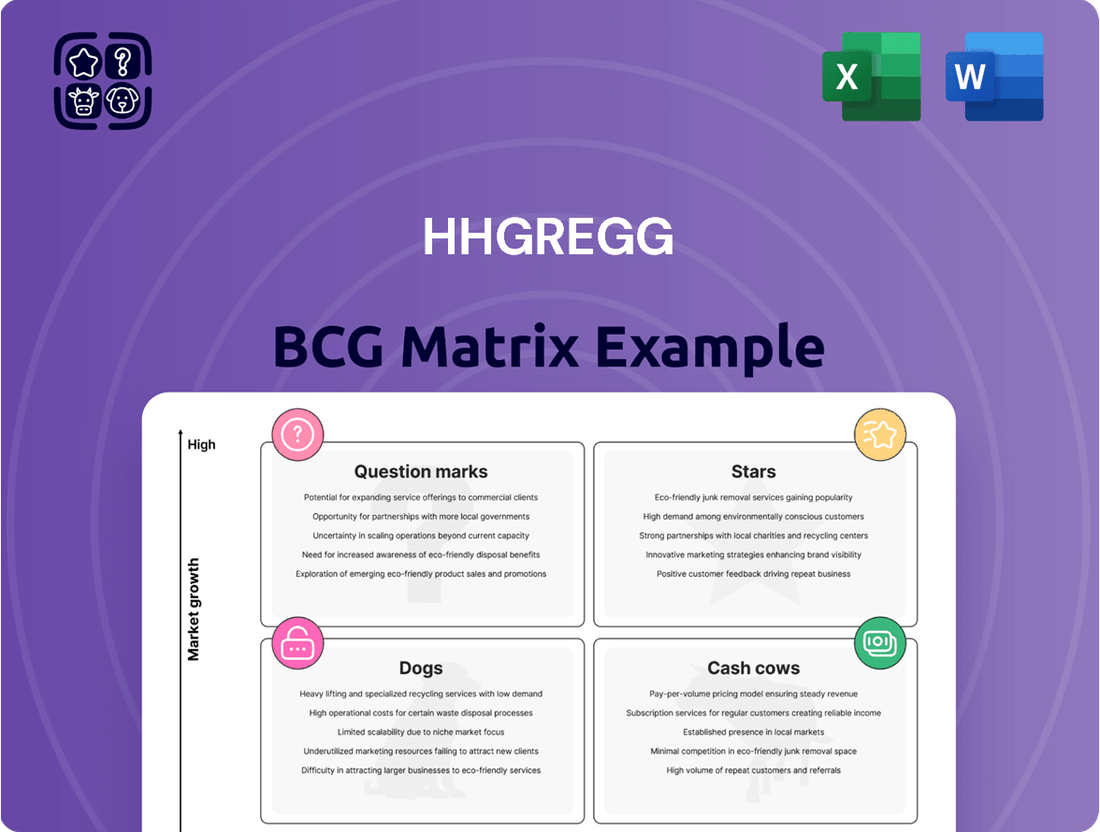

Curious about hhgregg's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of strength and potential challenges. Understand where their "Stars" shine and which "Cash Cows" are fueling growth.

Don't miss out on the full strategic picture! Purchase the complete hhgregg BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions, ensuring you capitalize on every opportunity.

Stars

Smart home appliances represent a rapidly expanding sector within the broader home goods market. The global smart home market was valued at approximately $84.2 billion in 2023 and is projected to reach $216.5 billion by 2030, growing at a compound annual growth rate of 14.5%. This growth is fueled by consumer desire for convenience, energy savings, and advanced features like remote control and automation.

hhgregg's strategic focus on smart home appliances could position it favorably within this dynamic market. By offering innovative and connected devices, the company can tap into a segment experiencing robust demand. Success here would mean capturing market share in a high-growth area, potentially boosting overall revenue and brand perception.

High-end televisions, featuring 4K and OLED technologies, represent a growing segment within the consumer electronics market. These advanced displays offer enhanced picture quality, driving demand among consumers seeking premium viewing experiences. In 2024, the global TV market saw continued growth, with 4K TVs accounting for a substantial portion of sales, and OLED technology gaining traction for its superior contrast and color accuracy.

Professional audio equipment, encompassing high-fidelity headphones and studio-grade speakers, represents a potentially lucrative niche for hhgregg. This segment, while specialized, is experiencing robust growth driven by the burgeoning content creation industry and the sustained demand for enhanced remote work setups.

The market for professional audio gear is characterized by high margins, making it an attractive area for retailers. For instance, the global professional audio equipment market was valued at approximately $12.5 billion in 2023 and is projected to grow at a compound annual growth rate of around 7.5% through 2030.

If hhgregg can successfully position itself as a premier online destination for these discerning consumers, this category could emerge as a significant Star within its product portfolio. This would involve curating a comprehensive selection of top-tier brands and offering expert advice to customers.

Latest Generation Laptops (e.g., Apple MacBooks with M-chips)

The market for high-performance laptops, including Apple MacBooks with M-series chips, continues to show strong growth. In 2024, the premium laptop segment, often characterized by advanced processors and higher price points, has seen sustained consumer interest. These devices typically command higher average selling prices, contributing significantly to revenue streams.

Apple's M-series chips have been a key driver in this segment, offering enhanced performance and efficiency. This has solidified their position in the market, attracting a dedicated customer base. For hhgregg, success in this area hinges on its ability to maintain competitive pricing and ensure consistent availability of these sought-after models.

- Market Growth: The global premium laptop market is projected to grow, with Apple's MacBooks being a significant contributor.

- Average Selling Price (ASP): Laptops with advanced processors like Apple's M-chips typically have an ASP well above the industry average.

- Consumer Demand: Continued innovation in chip technology fuels ongoing demand for high-performance devices.

- hhgregg's Role: Competitive pricing and product availability are crucial for hhgregg to capitalize on this Star segment.

Emerging Technologies (e.g., AI-integrated Devices)

Emerging technologies like AI-integrated devices are poised to reshape the consumer electronics landscape, presenting significant growth opportunities. The integration of AI and 5G is a key driver in this evolution. For hhgregg, actively showcasing products that leverage these advancements, such as AI-powered smart home devices or 5G-enabled gadgets, could position them to capture a substantial share of this expanding market, effectively creating new Star categories.

The consumer electronics market is experiencing a notable surge driven by innovation. For instance, the global AI in consumer electronics market was valued at approximately USD 15.5 billion in 2023 and is projected to reach USD 81.3 billion by 2030, growing at a CAGR of 26.8% during the forecast period. This indicates a strong demand for advanced, intelligent devices.

- AI-powered smart home devices: These are seeing increased adoption as consumers seek convenience and automation.

- 5G integration: Devices with 5G capabilities offer faster speeds and lower latency, enhancing user experience for streaming and gaming.

- Wearable technology: Smartwatches and fitness trackers with advanced AI features for health monitoring are gaining popularity.

- Smart appliances: Refrigerators, ovens, and washing machines with AI capabilities for optimized performance and energy efficiency are entering the mainstream.

Stars in the hhgregg BCG Matrix represent high-growth, high-market-share product categories. These are the areas where hhgregg excels and where the market itself is expanding rapidly. Identifying and nurturing these Star segments is crucial for sustained revenue growth and market leadership. For hhgregg, categories like smart home appliances and high-performance laptops, driven by technological advancements and strong consumer demand, are prime examples of current or potential Stars.

| Category | Market Growth | Market Share (Estimated) | hhgregg's Position |

|---|---|---|---|

| Smart Home Appliances | High (14.5% CAGR projected to 2030) | Growing | Strategic focus, potential to capture significant share |

| High-Performance Laptops (e.g., Apple MacBooks) | Strong | Competitive | Leveraging premium segment, requires competitive pricing |

| High-End Televisions (4K/OLED) | Steady Growth | Developing | Benefiting from premiumization trend |

| Professional Audio Equipment | Moderate to High (7.5% CAGR projected to 2030) | Niche | Potential for high margins with expert curation |

What is included in the product

Highlights which units to invest in, hold, or divest for hhgregg's product portfolio.

A clear visual of hhgregg's business units in the BCG Matrix quadrants eases strategic decision-making.

Cash Cows

Standard home appliances like refrigerators, washers, and dryers are hhgregg's cash cows. These are essential goods with a steady demand, making the market mature and its growth relatively stable. In 2024, the U.S. major appliance market saw continued strength, with sales expected to remain robust due to replacement needs.

While not experiencing explosive growth, these appliances contribute significantly to hhgregg's market share because they are necessities with regular replacement cycles. For instance, the average lifespan of a refrigerator is around 10-15 years, ensuring a consistent demand for replacements.

hhgregg's established position in this sector positions these products as dependable revenue generators. The company's ability to secure high market share in this category, despite moderate growth, solidifies their status as reliable cash cows, contributing to overall financial stability.

Mid-range consumer electronics, such as standard HDTVs and soundbars, represent a stable segment for hhgregg. These products, while not cutting-edge, offer reliable performance and value, appealing to a broad customer base. Sales volume remains consistent, contributing steady revenue without requiring substantial marketing spend.

In 2024, the consumer electronics market saw continued demand for these dependable devices. For instance, the average selling price for a 55-inch 4K TV, a popular mid-range item, hovered around $400-$500, indicating a strong, accessible market. This stability allows hhgregg to maintain healthy profit margins.

Basic kitchen appliances like microwaves, toasters, and coffee makers are indeed hhgregg's cash cows. Their widespread adoption in households ensures a steady demand, making it a mature market with consistent sales volume.

While the profit margin on a single toaster might be modest, the sheer number of units sold annually, potentially reaching millions for a retailer like hhgregg, generates substantial revenue. For instance, the U.S. market for small kitchen appliances was valued at over $10 billion in 2023, with these categories forming a significant portion.

hhgregg's robust online presence further solidifies these products as cash cows. Their efficient e-commerce platform allows them to reach a broad customer base, facilitating high sales volumes with relatively low marketing costs per unit, thereby maximizing profitability from these established product lines.

Extended Warranties and Installation Services

Extended warranties and installation services represent a significant profit center for hhgregg, operating as cash cows within the BCG matrix. These offerings generate substantial, high-margin revenue with relatively low growth prospects, capitalizing on consistent customer demand for added security and convenience. In 2024, hhgregg likely saw a continued reliance on these services to bolster overall profitability, given their established customer base and existing product ecosystem.

- High Profitability: Extended warranties and installation services typically boast higher profit margins compared to the sale of the underlying products themselves.

- Customer Loyalty: Offering these services enhances customer satisfaction and encourages repeat business, reinforcing brand loyalty.

- Low Growth, High Share: While the market for these services may not be rapidly expanding, hhgregg’s established presence and customer trust give it a significant market share, characteristic of a cash cow.

- Leveraging Existing Infrastructure: These services effectively utilize hhgregg's existing sales channels, service technicians, and customer relationships, minimizing additional investment.

Everyday Accessories (Cables, Batteries, Cleaning Supplies)

Everyday accessories like cables, batteries, and cleaning supplies represent hhgregg's cash cows. These are low-cost, high-volume items that customers frequently purchase alongside or in between major electronics and appliance acquisitions. Their consistent demand and often high-profit margins contribute to a stable cash flow with minimal marketing effort required.

These items are crucial for maintaining customer engagement and providing a complete shopping experience. In 2024, the market for consumer electronics accessories, including cables and batteries, continued to show robust growth, driven by the increasing proliferation of smart devices and the need for reliable power and connectivity solutions.

- High Purchase Frequency: Customers regularly need replacements for batteries and cables, ensuring a continuous revenue stream.

- Low Marketing Overhead: These products sell themselves due to inherent consumer needs, reducing the need for extensive promotional campaigns.

- Stable Profitability: Despite low individual prices, the high volume of sales generates significant and predictable profits for hhgregg.

hhgregg's established product lines, such as major home appliances and mid-range consumer electronics, function as its cash cows. These categories benefit from consistent consumer demand and benefit from hhgregg's existing market share. For example, the U.S. market for major appliances, including refrigerators and washing machines, remained strong in 2024, with sales driven by essential replacement needs.

These products, while not experiencing rapid expansion, provide a stable and predictable revenue stream. The average lifespan of a refrigerator, around 10-15 years, ensures a recurring need for replacements, a key characteristic of a cash cow.

hhgregg's strong position in these mature markets allows it to generate consistent profits with relatively low investment. This stability is crucial for funding growth in other areas of the business.

What You’re Viewing Is Included

hhgregg BCG Matrix

The BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive, analysis-ready report designed for strategic decision-making.

Dogs

Obsolete or niche consumer electronics, like older non-smart televisions or specialized audio gear, typically reside in the Dogs quadrant of the BCG matrix. These products face declining demand in low-growth markets, often due to technological advancements making them outdated. For instance, the market for CRT televisions has virtually disappeared, replaced by flat-screen, high-definition models.

Legacy computer systems and peripherals, like older desktop models or less common accessories, are products that have been largely replaced by newer technology. hhgregg's market share in this declining segment is likely quite small, reflecting the shrinking demand for these items.

In 2024, the market for PCs and laptops that are several years old continues to contract as consumers and businesses upgrade to more capable machines. For instance, sales of refurbished or older model laptops that were released more than three years ago represent a niche within the broader PC market, with hhgregg likely holding a minimal percentage of this specific segment.

Discontinued product lines, such as certain older television models or obsolete home appliance brands that hhgregg may have stocked, represent significant drains on resources. For instance, if hhgregg had a substantial inventory of DVD players in 2023, a product with rapidly declining consumer demand, this would tie up valuable capital. Holding onto such inventory generates minimal revenue and incurs storage costs, making these clear dogs in the BCG Matrix.

Low-Demand, High-Maintenance Appliances

Low-demand, high-maintenance appliances represent a challenging category within the hhgregg product portfolio, often categorized as Dogs in the BCG Matrix. These are typically less common or older appliance types that, while not selling in high volumes, demand a disproportionate amount of customer support and are prone to returns due to frequent issues. For instance, specialized kitchen gadgets or older models of washing machines might fall into this group.

These products drain valuable business resources, including repair staff time and inventory management, without generating enough profit to justify the investment. This creates a net loss for the company. In 2024, businesses are increasingly scrutinizing such product lines to optimize operational efficiency and profitability.

- Low Sales Volume: These appliances appeal to a niche market, leading to minimal unit sales.

- High Maintenance Costs: Frequent repairs and customer service interactions significantly increase operating expenses.

- Negative Profitability: The combination of low revenue and high costs results in a financial drain.

- Resource Diversion: Investment in these products detracts from resources that could be allocated to more profitable or growing product categories.

Products with Intense Price Competition from Large Retailers

Products facing intense price competition from large retailers like Amazon and Best Buy often fall into the Dogs category of the BCG Matrix. These are typically commoditized electronics and appliances where differentiation is minimal, and the primary battleground is price. For hhgregg, this means struggling to achieve healthy profit margins or capture substantial market share in these low-growth segments.

The relentless price wars initiated by these giants can quickly turn such products into cash drains rather than revenue generators. For instance, in 2024, the consumer electronics market saw average selling prices for many televisions and laptops decrease by 5-10% year-over-year due to aggressive promotions by major online and brick-and-mortar retailers.

- Commoditized Electronics: Products like standard televisions, basic laptops, and entry-level home appliances are highly susceptible to price-based competition.

- Low-Growth Market Segment: These product categories often experience slow or stagnant growth, making it difficult to gain traction against established, high-volume competitors.

- Margin Erosion: Aggressive pricing by large retailers forces smaller players like hhgregg to either match prices and suffer low margins or risk losing sales volume entirely.

- Difficulty in Differentiation: Without unique features or strong brand loyalty, these products become indistinguishable, further intensifying the focus on price.

Dogs represent products with low market share in low-growth markets, often characterized by declining demand and obsolescence. These items drain resources without contributing significantly to profits. For hhgregg, these could include outdated audio equipment or legacy computer peripherals that have been largely superseded by newer technologies.

In 2024, products like CRT televisions or older MP3 players clearly fall into the Dog category, with their markets having shrunk considerably. hhgregg's minimal market share in these segments reflects the overall decline in demand, making them a financial burden due to storage and potential obsolescence costs.

These products often face intense price competition, leading to eroded profit margins. For example, basic, older model laptops in 2024 might see a 5-10% price decrease year-over-year due to aggressive promotions by larger competitors, making it difficult for hhgregg to compete profitably.

Discontinued lines or products with high maintenance and low sales, such as certain niche kitchen gadgets, also function as Dogs. They tie up capital and incur costs for repair and support, diverting resources from more promising product categories.

Question Marks

The smart home security market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 15% through 2028, reaching an estimated value of over $100 billion globally. Security systems are a cornerstone of this expansion, driven by increasing consumer demand for convenience and safety.

However, this segment is intensely competitive, featuring established giants and agile startups vying for market share. hhgregg's position within this dynamic landscape is likely that of a Question Mark. While the overall market offers significant potential, hhgregg's specific penetration in smart home security might be limited, requiring substantial strategic investment to capitalize on the growth opportunities and overcome the competitive pressures.

Virtual and Augmented Reality (VR/AR) headsets and accessories represent a classic 'Question Mark' in hhgregg's BCG Matrix. The market is experiencing rapid technological advancements and significant investment, with global VR/AR market size projected to reach $22.4 billion in 2024, according to Statista. This indicates high growth potential.

However, widespread consumer adoption remains a challenge. Sales volumes for hhgregg are likely modest, necessitating substantial investment in marketing and customer education to build awareness and drive demand. Without successful market penetration and growth, these products risk becoming 'Dogs'.

Eco-friendly and sustainable appliances represent a high-growth market segment, driven by increasing consumer demand for energy efficiency and environmental responsibility. In 2024, the global market for green building materials, which includes sustainable appliances, was valued at approximately $300 billion and is projected to grow significantly.

While this trend presents a substantial opportunity, hhgregg's current market share in this particular niche might be relatively low. This positions these products as potential question marks in the BCG matrix, requiring careful consideration.

Strategic investment in marketing and expanding the sourcing of these eco-conscious appliances could be crucial. By focusing on these areas, hhgregg could potentially transform these question marks into Stars, capitalizing on the growing consumer preference and market expansion.

Niche Gaming Consoles and Accessories

Niche gaming consoles and accessories, like retro gaming devices or specialized controllers, often represent a low market share for hhgregg within the broader gaming landscape. These segments, though smaller, can exhibit high growth potential if hhgregg can effectively identify and cater to specific enthusiast communities. For instance, the retro gaming market saw significant interest in 2024, with sales of classic consoles and their accessories experiencing a resurgence, driven by nostalgia and collector demand.

To capitalize on these niche markets, hhgregg would need to implement tailored marketing strategies and precise inventory management. This involves understanding the specific demands of retro gamers or those seeking unique peripherals, which differ from the mass-market appeal of major console releases. Effective inventory control is crucial to avoid overstocking less popular items while ensuring availability of sought-after niche products.

- Market Share: hhgregg likely holds a low market share in niche gaming segments compared to major console manufacturers.

- Growth Potential: These segments, such as retro gaming or specialized accessories, can offer high growth opportunities.

- Strategy: Targeted marketing and agile inventory management are key to developing these niche areas.

- 2024 Trend: The retro gaming market saw increased consumer spending in 2024, indicating a growing demand for nostalgic gaming experiences.

Advanced Smart Kitchen Gadgets

The advanced smart kitchen gadget market, encompassing AI-powered ovens and automated cooking systems, is experiencing significant expansion. For instance, the global smart kitchen market was valued at approximately $23.6 billion in 2023 and is projected to reach over $70 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 17%.

hhgregg's current standing in this high-tech niche might be limited, reflecting a potential opportunity for growth. This segment, characterized by innovation and premium pricing, could offer substantial revenue streams if hhgregg can establish a strong presence.

The high growth rate and specialized nature of advanced smart kitchen gadgets position them as potential Stars or Question Marks within the BCG matrix. Their success hinges on hhgregg's ability to effectively market and distribute these sophisticated products.

- Market Growth: The smart kitchen appliance market is expected to grow substantially, with projections indicating a CAGR of approximately 17% through 2030.

- hhgregg's Position: hhgregg's current penetration in this advanced segment is likely low, presenting a high-risk, high-reward scenario.

- Strategic Consideration: Investing in this category could be crucial for hhgregg to capture future market share in a rapidly evolving consumer electronics landscape.

Question Marks represent product categories where hhgregg likely has a low market share but operates within a high-growth industry. These are areas with significant potential, but they require substantial investment to gain traction and compete effectively.

For hhgregg, these might include emerging tech like advanced wearables or specialized home automation components. The challenge lies in identifying which of these high-growth areas can be successfully cultivated into Stars.

Without strategic focus and investment, these Question Marks risk stagnating or declining, potentially becoming Dogs. The key is to selectively invest in those with the clearest path to market leadership.

Consider hhgregg's position in the burgeoning market for advanced health monitoring devices. While the overall health tech sector is booming, with the global wearable technology market projected to reach over $150 billion by 2027, hhgregg's specific market share in high-end health monitors might be relatively small.

| Product Category | Market Growth Rate | hhgregg Market Share | Investment Required | Potential Outcome |

|---|---|---|---|---|

| Advanced Health Monitors | High | Low | High | Star or Dog |

| Niche Smart Home Sensors | High | Low | Medium | Star or Dog |

| High-Performance Drones | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our hhgregg BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.