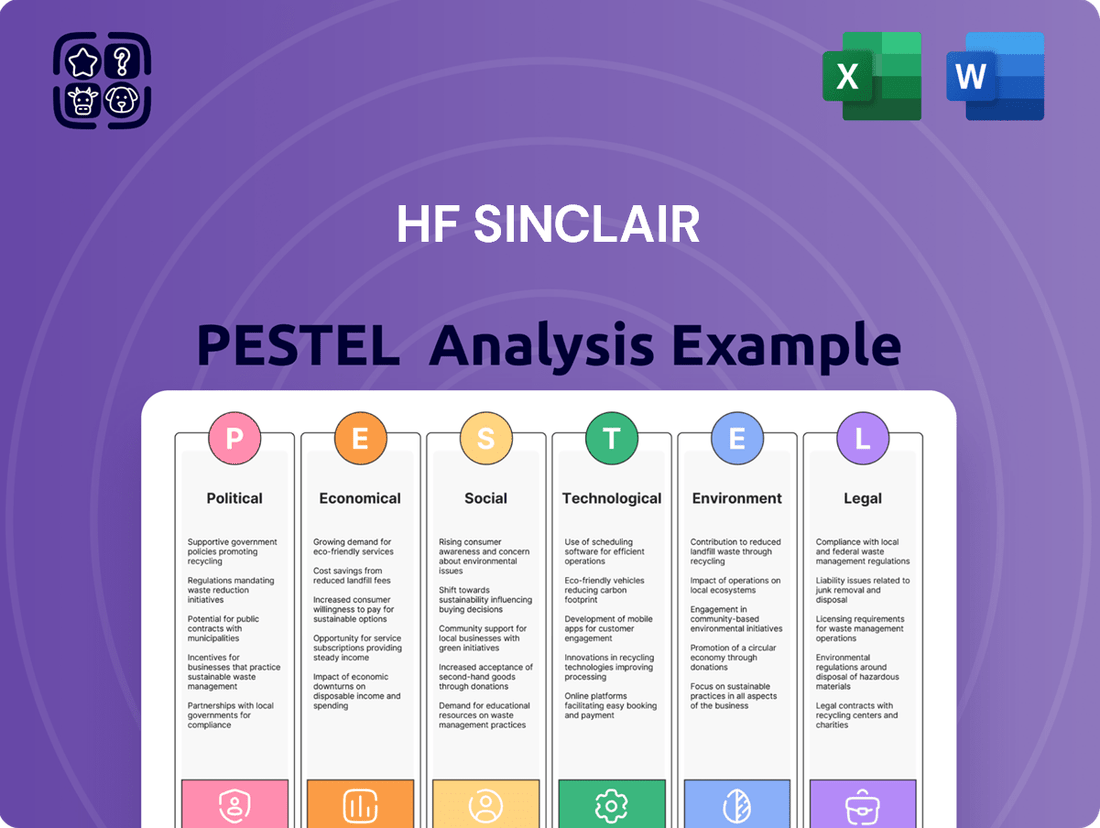

HF Sinclair PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HF Sinclair Bundle

Unlock the critical external factors shaping HF Sinclair's path forward. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the company. Gain a strategic advantage by understanding these dynamics.

Don't get caught off guard by shifts in the market. Our comprehensive PESTLE analysis for HF Sinclair provides actionable intelligence to inform your investment or business strategy. Download the full report now for a complete understanding of the external landscape.

Political factors

Government energy policies, especially those focused on the energy transition and climate change, play a crucial role in shaping HF Sinclair's operational landscape. Federal and state incentives, such as tax credits for renewable fuels like renewable diesel, directly impact the company's ability to capitalize on these markets, presenting both opportunities and potential hurdles.

For instance, the Inflation Reduction Act of 2022 extended and enhanced tax credits for renewable diesel, providing a significant tailwind for producers. Changes in administration priorities, however, can introduce policy uncertainty, potentially altering the investment climate and affecting HF Sinclair's long-term profitability and strategic planning.

Global geopolitical shifts, particularly in regions like the Middle East and Eastern Europe, directly impact crude oil supply. For instance, the ongoing conflict in Ukraine continues to create uncertainty in energy markets, influencing global oil prices and availability. HF Sinclair, heavily reliant on crude oil as its primary feedstock, faces direct consequences from these geopolitical events, which can cause significant price volatility and disrupt its sourcing strategy.

HF Sinclair's operations are significantly influenced by international trade policies. Tariffs and quotas on crude oil, refined fuels, and specialty chemicals directly affect the cost of raw materials and the competitiveness of its finished products in global markets. For instance, in 2024, ongoing geopolitical tensions and evolving trade relationships, particularly between major oil-producing nations and consuming countries, could lead to unpredictable shifts in import/export duties, impacting HF Sinclair's ability to source feedstock and sell its diverse product portfolio.

Regulatory Frameworks for Refinery Operations

The political will driving regulatory enforcement for refineries significantly impacts HF Sinclair. Stricter adherence to environmental and operational standards, such as those concerning emissions and waste management, can compel substantial capital investments for compliance. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations like the National Emission Standards for Hazardous Air Pollutants (NESHAP) for petroleum refineries, potentially requiring upgrades to existing infrastructure.

A less stringent regulatory climate might lower immediate compliance costs for HF Sinclair, but it could also amplify reputational risks and potential future liabilities. The political landscape, including upcoming elections and shifts in environmental policy priorities, will shape the future regulatory environment for the refining sector. For example, discussions around carbon capture technologies and stricter methane emission controls, which gained traction in 2023 and 2024, could lead to new compliance requirements for refineries like those operated by HF Sinclair.

- Environmental Regulations: HF Sinclair must navigate evolving EPA standards for air and water emissions, which can necessitate costly upgrades.

- Safety Standards: Compliance with OSHA and other safety regulations is paramount, with political will influencing enforcement intensity.

- Energy Policy: Government stances on fossil fuels versus renewable energy sources can indirectly affect refinery operations and investment decisions.

- Political Stability: Predictable policy environments reduce uncertainty for long-term capital planning in the refining industry.

Political Support for Infrastructure Projects

Government support for energy infrastructure significantly shapes HF Sinclair's strategic direction. For instance, the Biden administration's focus on clean energy initiatives, including renewable diesel, has been a tailwind for the company's expansion plans in this sector. However, political opposition to traditional fossil fuel infrastructure, such as pipelines, can create hurdles for midstream operations.

Political decisions regarding permitting and environmental reviews are critical. In 2024, the pace of these approvals can greatly influence the timeline for HF Sinclair's new renewable diesel facilities and terminal upgrades. Delays or stringent requirements can impact capital expenditure and project profitability.

The company's long-term growth is directly tied to the political climate surrounding energy policy. Continued government incentives for renewable fuels, like the Blender's Tax Credit, provide a stable foundation for HF Sinclair's renewable diesel business. Conversely, shifts in policy could necessitate strategic adjustments.

- Government Support for Renewables: The Inflation Reduction Act of 2022, for example, provides significant tax credits for renewable diesel production, directly benefiting HF Sinclair's investments in this area.

- Permitting Challenges: Delays in federal permitting for new infrastructure projects, including potential pipeline expansions or modifications, can add months or even years to project timelines and increase costs.

- Land Use Policies: State and local regulations on land use and zoning can impact the siting and development of new terminals and processing facilities.

- Environmental Regulations: Evolving environmental standards and review processes can influence the design and operational costs of all HF Sinclair's assets, from refineries to pipelines.

Government energy policies, particularly those supporting renewable fuels, directly influence HF Sinclair's strategic investments. The extension of tax credits for renewable diesel under legislation like the Inflation Reduction Act of 2022 provides a crucial financial incentive, bolstering the company's commitment to this sector. However, potential shifts in political priorities or the phasing out of such incentives could introduce uncertainty, impacting future capital allocation and profitability for these renewable ventures.

Geopolitical events continue to be a significant factor, with ongoing conflicts and international relations impacting global crude oil supply and price volatility. For instance, the instability in Eastern Europe in 2024 has maintained upward pressure on oil prices, directly affecting HF Sinclair's primary feedstock costs. The company’s reliance on crude oil makes it susceptible to these supply chain disruptions and price fluctuations, necessitating robust risk management strategies.

International trade policies and tariffs can affect the cost of raw materials and the competitiveness of HF Sinclair's refined products. Evolving trade relationships in 2024, particularly concerning energy exports and imports, may lead to changes in duties, influencing the company's ability to source feedstock and market its diverse product portfolio globally.

Regulatory enforcement, especially concerning environmental standards for refineries, significantly impacts HF Sinclair's operational costs and capital expenditures. The U.S. EPA's ongoing refinement of emission standards, such as those for hazardous air pollutants, may require substantial infrastructure upgrades. For example, the push for lower sulfur content in fuels and stricter greenhouse gas emission controls, which gained momentum in 2023 and 2024, could necessitate significant investments in refinery modernization.

What is included in the product

This HF Sinclair PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides a comprehensive overview of the external forces shaping the oil and gas industry, offering actionable insights for strategic decision-making.

HF Sinclair's PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations.

Economic factors

Fluctuations in global crude oil prices present a significant economic variable for HF Sinclair, directly affecting its refining margins. For instance, in the first quarter of 2024, West Texas Intermediate (WTI) crude prices averaged around $78 per barrel, a level that influences the profitability of refining operations.

As a refiner, HF Sinclair's profitability is closely tied to crack spreads, the difference between the cost of crude oil and the selling price of refined products like gasoline and diesel. Wider spreads, such as those seen when crude prices are relatively stable but refined product demand is high, generally boost earnings. Conversely, narrow spreads can significantly compress profitability.

Effective inventory management and robust hedging strategies are therefore paramount for HF Sinclair to navigate this inherent price volatility. These tools help the company lock in margins and mitigate the financial impact of sudden swings in crude oil markets, ensuring greater operational stability.

Global and regional economic health significantly shapes the demand for refined petroleum products like gasoline, diesel, and jet fuel, directly impacting HF Sinclair's sales. A strong economy generally fuels higher industrial activity and robust transportation sector performance, leading to increased consumption of these essential fuels. For instance, in 2024, global oil demand is projected to grow by around 1.1 million barrels per day, according to the International Energy Agency, indicating a positive, albeit moderate, outlook for refined product consumption.

Broader economic growth rates significantly impact HF Sinclair's demand. For instance, the U.S. GDP growth was projected to be around 2.1% in 2024, influencing industrial production and consumer disposable income. Stronger economic performance typically boosts demand for fuels and lubricants, benefiting HF Sinclair's refining and marketing segments.

Consumer spending, a key driver for HF Sinclair, is closely tied to economic health. In 2024, consumer spending was expected to remain robust, supported by a resilient labor market. Increased consumer spending often translates to higher vehicle miles traveled, directly increasing demand for gasoline and diesel fuel.

Conversely, economic slowdowns pose a risk. A projected dip in global economic growth for 2025 could lead to reduced industrial activity and lower consumer confidence, potentially dampening demand for HF Sinclair's products and impacting profitability. For example, a contraction in manufacturing output directly affects demand for specialized industrial lubricants and fuels.

Inflationary Pressures and Operating Costs

Rising inflation directly impacts HF Sinclair's operational expenses. Costs for essential inputs such as labor, crude oil and refined products, chemicals, and equipment maintenance have seen significant increases. For instance, the U.S. Consumer Price Index (CPI) showed a 3.3% annual increase in May 2024, indicating persistent inflationary pressures across various sectors, which likely translates to higher input costs for HF Sinclair.

These escalating operating costs can put pressure on HF Sinclair's profit margins. If the company is unable to fully pass these higher expenses onto consumers through increased prices for gasoline, diesel, and other refined products, its profitability will be negatively affected. The ability to maintain competitive pricing while absorbing cost increases is a key challenge.

In response to these inflationary headwinds, HF Sinclair is focused on enhancing cost efficiencies and strengthening its supply chain resilience. This involves optimizing production processes, managing inventory effectively, and securing reliable sources for raw materials and energy. Proactive measures are crucial to mitigate the impact of volatile input prices on the company's financial performance.

- Increased Input Costs: HF Sinclair faces higher expenses for labor, raw materials (like crude oil), energy, and maintenance due to inflation.

- Margin Erosion Risk: Profitability may decline if the company cannot pass on increased operating costs to customers through higher product prices.

- Focus on Efficiency: Managing cost efficiencies and ensuring supply chain resilience are critical strategies to navigate the inflationary environment.

- Impact on 2024 Performance: Persistent inflation throughout 2024 continues to be a significant factor influencing HF Sinclair's operating cost structure and profitability.

Interest Rate Changes and Capital Expenditures

Changes in interest rates directly impact HF Sinclair's cost of capital for significant investments. For instance, if the Federal Reserve raises its benchmark interest rate, HF Sinclair's borrowing costs for new refinery upgrades or renewable diesel projects will likely increase. This makes capital expenditures more expensive, potentially leading the company to reassess the economic viability of certain expansion plans or delay them until borrowing costs are more favorable.

Higher interest rates can also affect HF Sinclair's overall financial leverage and investment strategy. As borrowing becomes costlier, the company might opt for a more conservative approach to debt financing, potentially relying more on internally generated cash flows for capital projects. This shift can influence the pace of growth and the company's ability to pursue large-scale acquisitions or greenfield developments.

- Increased Borrowing Costs: Higher interest rates translate to more expensive debt for HF Sinclair, impacting the cost of financing capital expenditures.

- Impact on Project Returns: Elevated borrowing costs can reduce the expected returns on capital-intensive projects, potentially slowing down investment decisions.

- Financial Leverage Considerations: The company's financial strategy may shift towards lower leverage or greater reliance on equity financing in a rising rate environment.

- Strategic Investment Decisions: HF Sinclair's decision-making regarding major projects, such as refinery modernization or renewable fuel plant construction, will be heavily influenced by prevailing interest rate levels.

Economic factors significantly influence HF Sinclair's operational landscape, primarily through crude oil price volatility and broader economic health. Fluctuations in crude oil prices directly impact refining margins, as seen with West Texas Intermediate (WTI) averaging around $78 per barrel in Q1 2024. Global economic growth, projected at 1.1 million barrels per day for oil demand in 2024, shapes the consumption of refined products. Inflation, with the US CPI at 3.3% in May 2024, increases operational costs for labor, materials, and energy, potentially squeezing profit margins if not passed on to consumers.

| Economic Factor | Impact on HF Sinclair | 2024 Data/Projection |

|---|---|---|

| Crude Oil Prices | Affects refining margins and profitability | WTI averaged ~$78/barrel (Q1 2024) |

| Global Economic Growth | Drives demand for refined products | Global oil demand projected +1.1 million bpd (2024) |

| Inflation | Increases operational costs (labor, materials, energy) | US CPI +3.3% annually (May 2024) |

| Interest Rates | Impacts cost of capital for investments | Federal Reserve benchmark rates influence borrowing costs |

Same Document Delivered

HF Sinclair PESTLE Analysis

The preview shown here is the exact HF Sinclair PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting HF Sinclair.

The content and structure shown in the preview is the same HF Sinclair PESTLE Analysis document you’ll download after payment, providing a comprehensive overview for strategic planning.

Sociological factors

Societal priorities are increasingly focused on sustainability and mitigating climate change, directly impacting consumer choices regarding energy. This growing awareness is causing a noticeable shift, with more consumers seeking out renewable energy sources and cleaner fuel alternatives.

This evolving consumer demand presents a dual challenge and opportunity for HF Sinclair. While it may temper the demand for traditional petroleum products, it simultaneously bolsters the market for its renewable diesel offerings. For instance, by the end of 2024, the global renewable diesel market was projected to reach over $40 billion, demonstrating significant growth potential.

To remain competitive and aligned with these changing societal values, HF Sinclair needs to proactively adjust its product portfolio. This strategic adaptation will be crucial for capturing market share in the burgeoning renewable energy sector and meeting consumer expectations for environmentally responsible products.

Growing public awareness about climate change and the environmental impact of fossil fuels directly influences HF Sinclair's social license to operate. As of early 2024, surveys indicate a significant majority of consumers in key markets expect companies to demonstrate strong environmental responsibility, with over 60% stating they consider a company's environmental practices when making purchasing decisions.

Negative public perception, fueled by concerns over emissions and spills, can translate into heightened regulatory scrutiny and community opposition to new infrastructure projects. For instance, in 2023, several energy companies faced significant delays and increased costs due to local environmental activism and permitting challenges, underscoring the financial implications of public sentiment.

HF Sinclair's proactive engagement in sustainability initiatives, such as investments in lower-carbon technologies and transparent reporting on its environmental, social, and governance (ESG) performance, is vital. By demonstrating a commitment to reducing its environmental footprint and fostering positive community relations, the company can mitigate reputational risks and maintain stakeholder trust.

The energy sector, including companies like HF Sinclair, faces a significant sociological challenge with an aging workforce. In 2023, the average age of oil and gas extraction workers was reported to be around 45, with many experienced professionals nearing retirement. This demographic trend intensifies competition for skilled talent, especially in critical areas such as advanced refining processes and emerging renewable energy technologies.

HF Sinclair must implement robust strategies to attract, develop, and retain a diverse talent pool. This involves understanding and adapting to evolving generational career aspirations, which increasingly prioritize work-life balance, environmental sustainability, and opportunities for continuous learning. Successfully navigating these workforce dynamics is crucial for maintaining operational efficiency and fostering innovation within the company.

Health and Safety Standards Expectations

Societal expectations for robust health and safety standards in industrial sectors are on an upward trajectory. Companies like HF Sinclair, managing intricate refining and chemical operations, are under increasing public and regulatory observation concerning workplace safety and environmental impact. For instance, the Occupational Safety and Health Administration (OSHA) in the US reported a total of 5,489 worker fatalities in 2022, highlighting the ongoing importance of safety adherence.

HF Sinclair's commitment to rigorous safety protocols and cultivating a strong safety-first culture is paramount. This dedication is not merely about safeguarding its workforce but also about preserving public confidence and mitigating potential reputational harm. In 2023, the energy sector, including refining, saw continued focus on process safety management and emergency preparedness, with industry groups like the American Petroleum Institute (API) promoting best practices.

- Rising Societal Expectations: Public demand for safer industrial operations is a constant driver for improvement.

- Scrutiny of Operations: HF Sinclair's refining and chemical facilities face significant oversight regarding safety and environmental performance.

- Reputational Risk: Failure to meet health and safety standards can lead to severe reputational damage and loss of public trust.

- Regulatory Compliance: Adherence to regulations like OSHA standards is a baseline, with societal expectations often pushing beyond minimum requirements.

Community Engagement and Social Responsibility

HF Sinclair's commitment to community engagement and social responsibility is increasingly vital. Positive contributions to local economies and addressing community concerns directly influence its reputation and operational continuity. For instance, in 2023, HF Sinclair reported $10.7 million in charitable contributions, demonstrating a tangible investment in the communities where it operates.

Strong community relations are built through tangible actions. This includes creating local employment opportunities, which directly benefits the economic well-being of the areas surrounding its facilities. The company's workforce is a significant part of its social license to operate.

Key aspects of HF Sinclair's social responsibility include:

- Philanthropic initiatives: Supporting local causes and non-profits.

- Local employment: Prioritizing hiring from within the communities it serves.

- Stakeholder engagement: Actively listening to and addressing the concerns of local residents and groups.

- Environmental stewardship: Operating in a manner that minimizes environmental impact and supports local ecological health.

Societal priorities are increasingly focused on sustainability and mitigating climate change, directly impacting consumer choices regarding energy. This growing awareness is causing a noticeable shift, with more consumers seeking out renewable energy sources and cleaner fuel alternatives.

This evolving consumer demand presents a dual challenge and opportunity for HF Sinclair. While it may temper the demand for traditional petroleum products, it simultaneously bolsters the market for its renewable diesel offerings. For instance, by the end of 2024, the global renewable diesel market was projected to reach over $40 billion, demonstrating significant growth potential.

Growing public awareness about climate change and the environmental impact of fossil fuels directly influences HF Sinclair's social license to operate. As of early 2024, surveys indicate a significant majority of consumers in key markets expect companies to demonstrate strong environmental responsibility, with over 60% stating they consider a company's environmental practices when making purchasing decisions.

| Sociological Factor | Impact on HF Sinclair | Data/Trend (2023-2025) |

| Sustainability & Climate Change Awareness | Increased demand for renewables, pressure on fossil fuels | Renewable diesel market projected >$40B by end of 2024; 60%+ consumers consider environmental practices |

| Workforce Demographics | Talent acquisition challenges, need for new skillsets | Average age of oil/gas workers ~45 in 2023; competition for skilled talent |

| Health & Safety Expectations | Heightened scrutiny of operations, reputational risk | OSHA reported 5,489 worker fatalities in 2022; API promoting safety best practices |

| Community Engagement & Social Responsibility | Importance for operational continuity and reputation | HF Sinclair reported $10.7M in charitable contributions in 2023 |

Technological factors

Technological advancements are significantly reshaping renewable diesel production. Breakthroughs in feedstock flexibility, like utilizing waste oils and animal fats more effectively, directly benefit HF Sinclair's renewable fuels segment. For instance, the company's renewable diesel production capacity reached approximately 12,500 barrels per day by the end of 2023, showcasing the impact of these innovations.

Improved processing efficiencies and the development of more effective catalysts are also key drivers. These innovations contribute to lower production costs and increased output for renewable diesel. HF Sinclair's investment in research and development, particularly in areas like hydrotreating technologies, is vital for maintaining a competitive edge in this evolving market.

HF Sinclair benefits from ongoing technological advancements in refining. Innovations like advanced process control systems and digitalization are boosting operational efficiency. For instance, in 2024, many refineries are investing in AI-driven predictive maintenance, aiming to reduce unplanned downtime by up to 15%.

New catalyst technologies are also crucial, allowing for better crude oil conversion and higher yields of valuable products. This translates directly to improved profitability for HF Sinclair. The company's commitment to adopting these technologies helps them maximize output while simultaneously lowering energy usage and emissions, aligning with stricter environmental regulations.

The increasing maturity and scalability of Carbon Capture, Utilization, and Storage (CCUS) technologies represent a key technological advancement impacting HF Sinclair. These innovations offer a pathway for refineries to significantly reduce their greenhouse gas emissions, a critical step in meeting evolving climate targets and potentially generating revenue through carbon credits.

For instance, the U.S. Department of Energy has been actively promoting CCUS, with significant investments in pilot projects and research throughout 2024 and into 2025. HF Sinclair's strategic adoption and piloting of these technologies are therefore crucial for ensuring its long-term operational sustainability and competitive positioning in an increasingly carbon-conscious market.

Digitalization and Automation in Operations

The energy sector's embrace of digitalization and automation presents significant opportunities for HF Sinclair. Technologies like artificial intelligence (AI) and machine learning are being deployed to boost operational safety, enable predictive maintenance, and refine supply chain management. These advancements are crucial for cost reduction and enhanced reliability in complex refining and midstream operations.

HF Sinclair can leverage these digital tools to achieve substantial cost savings. For instance, predictive maintenance powered by AI can anticipate equipment failures, reducing downtime and costly emergency repairs. In 2024, the global oil and gas automation market was valued at approximately USD 30 billion, with a projected compound annual growth rate (CAGR) of over 7% through 2030, indicating a strong trend towards digital integration.

- Enhanced Safety: AI-driven analytics can monitor operations in real-time, identifying potential hazards and preventing accidents.

- Predictive Maintenance: Machine learning algorithms analyze equipment data to predict failures, minimizing unscheduled downtime.

- Supply Chain Optimization: Digitalization improves visibility and efficiency across the entire supply chain, from crude oil sourcing to product delivery.

- Cost Efficiencies: Automation of routine tasks and optimized resource allocation contribute to significant operational cost reductions.

New Materials and Chemical Formulations

Technological advancements in material science and chemical engineering are directly influencing HF Sinclair's specialty lubricant and chemical operations. The company's focus on research and development for new formulations and enhanced product performance is key to its competitive edge. For example, in 2024, the specialty chemicals segment saw continued investment in R&D aimed at improving efficiency and environmental profiles of existing product lines.

Innovations in sustainable chemical processes are opening up new market opportunities and bolstering product competitiveness. HF Sinclair's commitment to staying ahead of these technological curves is crucial for maintaining its leadership in niche segments. The company's 2025 strategic outlook emphasizes increased allocation towards developing bio-based and biodegradable chemical solutions, aligning with global sustainability trends and regulatory pressures.

- Material Science Innovation: Development of advanced materials for high-performance lubricants, impacting sectors like aerospace and automotive.

- Chemical Process Efficiency: Implementation of new catalytic processes and reaction chemistries to reduce energy consumption and waste in chemical production.

- Sustainable Formulations: Research into biodegradable and renewable feedstock-based chemical products to meet growing environmental demands.

- Product Performance Enhancement: Continuous improvement of lubricant viscosity, thermal stability, and additive packages for demanding industrial applications.

Technological advancements are crucial for HF Sinclair, particularly in refining and renewable fuels. Innovations in catalysis and processing efficiency are boosting output and lowering costs for renewable diesel, with HF Sinclair's production capacity reaching approximately 12,500 barrels per day by the end of 2023.

Digitalization and automation, including AI-driven predictive maintenance, are enhancing operational efficiency and safety across HF Sinclair's assets. The global oil and gas automation market was valued at around USD 30 billion in 2024, highlighting the sector's digital transformation.

The development and scalability of Carbon Capture, Utilization, and Storage (CCUS) technologies offer HF Sinclair a path to reduce emissions, supported by significant U.S. Department of Energy investments in 2024-2025.

Material science innovations are driving advancements in HF Sinclair's specialty lubricants and chemicals, with a focus on sustainable and high-performance formulations, as seen in their 2025 strategic outlook for bio-based solutions.

| Technological Area | Impact on HF Sinclair | Relevant Data/Trend |

| Renewable Diesel Production | Improved feedstock utilization, increased efficiency, lower costs | Capacity ~12,500 bpd (end of 2023) |

| Refining Operations | Enhanced efficiency, predictive maintenance, cost reduction | AI predictive maintenance can reduce downtime by up to 15% (2024 projection) |

| Emissions Reduction | Pathway for greenhouse gas mitigation | DOE investment in CCUS pilot projects (2024-2025) |

| Specialty Chemicals | New formulations, sustainable products, enhanced performance | Focus on bio-based/biodegradable solutions (2025 outlook) |

Legal factors

HF Sinclair operates under the watchful eye of the Environmental Protection Agency (EPA), facing strict rules on air emissions, water quality, and how it handles hazardous waste. These regulations are constantly being updated, meaning the company must regularly invest in new pollution control equipment and robust monitoring systems to stay compliant. For example, the EPA's focus on reducing greenhouse gas emissions and specific pollutants directly impacts refinery operations.

Failure to meet these EPA standards can lead to substantial financial penalties and serious legal challenges, impacting HF Sinclair's operational costs and reputation. In 2023, the refining industry as a whole faced increased scrutiny and potential liabilities related to environmental compliance, underscoring the importance of proactive environmental management for companies like HF Sinclair.

The Renewable Fuel Standard (RFS) program, overseen by the EPA, mandates the incorporation of renewable fuels into the U.S. transportation fuel supply. For HF Sinclair, this necessitates active participation in the Renewable Identification Number (RIN) markets and strict adherence to compliance regulations, influencing the financial performance and strategic planning of its refining and renewable diesel operations. For instance, in 2023, the EPA set the total renewable volume obligation at 20.5 billion gallons, a figure that directly shapes the market dynamics for companies like HF Sinclair.

HF Sinclair operates in industries with inherent risks, making strict adherence to Occupational Safety and Health Administration (OSHA) regulations paramount for employee protection. This includes maintaining robust safety procedures, providing comprehensive training, and ensuring all equipment is in top working order. Failure to comply can result in significant fines; for instance, OSHA reported over $3.1 billion in penalties collected in fiscal year 2023 for various violations across industries.

Antitrust and Competition Laws

HF Sinclair operates within the energy and chemical sectors, making it subject to stringent antitrust and competition laws. These regulations are in place to prevent monopolistic practices and ensure a level playing field for all market participants. This means HF Sinclair must carefully consider how its actions, from pricing to potential mergers, align with these legal frameworks to avoid scrutiny.

The company's merger and acquisition strategies are particularly impacted, as regulatory bodies scrutinize deals to ensure they do not unduly reduce competition. For instance, the U.S. Department of Justice and the Federal Trade Commission actively review significant mergers. Failure to comply can result in substantial fines and mandated divestitures, as seen in past energy sector consolidations where market share concentration was a key concern.

- Merger Scrutiny: Antitrust laws require regulatory approval for significant acquisitions, assessing potential impacts on market competition.

- Pricing Compliance: HF Sinclair must ensure its pricing strategies do not engage in collusion or predatory practices that harm competitors or consumers.

- Market Conduct: The company's operational behavior is monitored to prevent any actions that could be construed as anti-competitive, such as exclusive dealing arrangements.

- Enforcement Actions: Violations can lead to severe penalties, including hefty fines and court-ordered changes to business operations, impacting profitability and market access.

International and Domestic Trade Laws

HF Sinclair navigates a complex web of international and domestic trade laws, impacting its global operations in petroleum products and chemicals. Compliance with customs regulations, import/export controls, and sanctions is paramount for seamless cross-border transactions. For instance, in 2024, the U.S. Department of Commerce continues to enforce export controls on certain technologies and goods, which could affect the import of specialized equipment or the export of refined products if specific chemical compositions are involved.

Changes in these legal landscapes can significantly disrupt HF Sinclair's supply chains and market access. For example, new tariffs or trade agreements, such as potential adjustments to existing trade pacts in 2025, could alter the cost-effectiveness of importing crude oil or exporting finished goods. The company's ability to adapt to evolving trade policies is therefore crucial for maintaining competitive pricing and securing market share.

Ensuring rigorous legal compliance is not just a regulatory necessity but a strategic imperative for HF Sinclair's global business. Failure to adhere to these laws can result in substantial fines, reputational damage, and operational disruptions. The company's proactive approach to monitoring and implementing changes in trade legislation, including those related to environmental standards for exported products in 2024, directly supports its long-term sustainability and profitability.

- Customs Duties and Tariffs: HF Sinclair must manage varying customs duties on imported crude oil and exported refined products, impacting landed costs and export competitiveness.

- Import/Export Licensing: Obtaining and maintaining necessary licenses for the international movement of petroleum and chemical products is a continuous compliance requirement.

- Sanctions Compliance: Adherence to international sanctions regimes, such as those impacting trade with specific countries or entities, is critical to avoid legal repercussions.

- Trade Agreements: Monitoring and leveraging benefits or mitigating risks from international trade agreements, like the USMCA, influences supply chain efficiency and market access.

HF Sinclair's operations are heavily influenced by environmental regulations, particularly those from the EPA concerning emissions and waste. The Renewable Fuel Standard (RFS) also mandates renewable fuel integration, impacting RIN markets and compliance costs, with 2023 seeing a 20.5 billion gallon obligation. Furthermore, OSHA regulations are critical for worker safety, with the agency collecting over $3.1 billion in penalties in fiscal year 2023 for violations.

Environmental factors

Governments worldwide are intensifying efforts to combat climate change, enacting more stringent policies like carbon pricing and emissions trading schemes. HF Sinclair, as a refiner, directly feels this pressure to curb greenhouse gas emissions from its operations. For instance, the U.S. Environmental Protection Agency's (EPA) proposed standards for vehicle emissions in 2024 aim to significantly reduce greenhouse gas emissions from passenger cars and light-duty trucks, impacting fuel demand and refining processes.

Meeting these evolving net-zero targets necessitates substantial investment in decarbonization technologies. HF Sinclair may need to allocate capital towards cleaner refining processes or explore carbon capture solutions. The company's strategic planning for 2024 and beyond must account for these capital expenditures and the potential need to purchase carbon credits to offset unavoidable emissions, influencing profitability and operational efficiency.

HF Sinclair's refining and chemical facilities are substantial water consumers, placing them under strict regulations for water intake, treatment, and discharge. Growing environmental awareness regarding water scarcity and pollution is driving increasingly rigorous controls on these operations.

To comply with evolving permits and minimize its environmental impact, HF Sinclair needs to adopt highly efficient water management strategies and invest in sophisticated wastewater treatment technologies. For instance, in 2023, the company reported significant water withdrawal volumes across its operations, underscoring the importance of these regulatory and environmental pressures on its operational costs and strategy.

HF Sinclair faces significant environmental scrutiny regarding the handling, storage, and disposal of hazardous waste generated from its refining and chemical operations. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent regulations like the Resource Conservation and Recovery Act (RCRA), which dictates how companies manage hazardous waste from cradle to grave. Failure to comply can result in substantial fines and reputational damage.

The company must invest in advanced waste management infrastructure to ensure compliance and minimize environmental impact. This includes secure storage facilities and approved disposal methods to prevent soil and groundwater contamination. For example, companies in the sector are increasingly adopting technologies for waste-to-energy conversion and exploring circular economy principles to reduce the volume of waste requiring disposal, a trend likely to accelerate through 2025.

Biodiversity Conservation and Land Use

HF Sinclair's operations, including its existing and planned facilities, have the potential to affect local ecosystems and biodiversity. For instance, the company's significant refining and marketing footprint across the United States means that land use decisions for new infrastructure, such as pipelines or renewable fuel facilities, require careful consideration of their environmental impact.

Environmental assessments and strict adherence to land use regulations are paramount, particularly as HF Sinclair expands its renewable energy ventures. This includes understanding the potential disruption to natural habitats and the need for proactive mitigation strategies to ensure responsible environmental stewardship.

- Land Use Impact: HF Sinclair operates numerous facilities that occupy significant land areas, necessitating careful planning to minimize ecological disruption.

- Biodiversity Concerns: New projects, like the proposed renewable diesel facility in Cheyenne, Wyoming, require thorough environmental impact studies to assess effects on local flora and fauna.

- Regulatory Compliance: The company must navigate a complex web of federal, state, and local land use regulations and environmental protection laws to ensure compliance.

- Mitigation Efforts: HF Sinclair is expected to implement measures to offset potential negative impacts on biodiversity, such as habitat restoration or conservation programs.

Renewable Energy Mandates and Energy Transition

The global drive for renewable energy and the ongoing energy transition significantly impact the future demand for HF Sinclair's core petroleum products. While the company is actively expanding its renewable diesel operations, the accelerating global shift away from fossil fuels poses a significant environmental challenge.

HF Sinclair reported that in 2023, its renewable diesel production capacity reached approximately 14,000 barrels per day, with plans to further increase this. This strategic move addresses the environmental pressure to reduce carbon emissions. Navigating this transition requires substantial investment in lower-carbon alternatives to ensure long-term business sustainability.

- Renewable Diesel Growth: HF Sinclair's investment in renewable diesel capacity, aiming for over 20,000 barrels per day by late 2025, directly responds to environmental mandates and market demand for cleaner fuels.

- Fossil Fuel Demand Uncertainty: The accelerating global energy transition creates long-term uncertainty for traditional refined products, necessitating diversification strategies.

- Regulatory Landscape: Evolving environmental regulations and incentives for renewable fuels in key markets like the US (e.g., Renewable Fuel Standard) create both opportunities and challenges for HF Sinclair's product mix.

Governments worldwide are intensifying efforts to combat climate change, enacting more stringent policies like carbon pricing and emissions trading schemes. HF Sinclair, as a refiner, directly feels this pressure to curb greenhouse gas emissions from its operations. For instance, the U.S. Environmental Protection Agency's (EPA) proposed standards for vehicle emissions in 2024 aim to significantly reduce greenhouse gas emissions from passenger cars and light-duty trucks, impacting fuel demand and refining processes.

HF Sinclair faces significant environmental scrutiny regarding the handling, storage, and disposal of hazardous waste generated from its refining and chemical operations. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent regulations like the Resource Conservation and Recovery Act (RCRA), which dictates how companies manage hazardous waste from cradle to grave. Failure to comply can result in substantial fines and reputational damage.

The global drive for renewable energy and the ongoing energy transition significantly impact the future demand for HF Sinclair's core petroleum products. While the company is actively expanding its renewable diesel operations, the accelerating global shift away from fossil fuels poses a significant environmental challenge. HF Sinclair reported that in 2023, its renewable diesel production capacity reached approximately 14,000 barrels per day, with plans to further increase this.

PESTLE Analysis Data Sources

Our HF Sinclair PESTLE analysis is built on a robust foundation of data from government regulatory bodies, industry-specific publications, and reputable financial news outlets. We incorporate economic indicators, environmental reports, and technological advancements to provide a comprehensive view.