HF Sinclair Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HF Sinclair Bundle

HF Sinclair operates within a dynamic energy sector where the bargaining power of buyers, particularly large industrial consumers, can significantly impact pricing and profitability. Understanding the intensity of this force is crucial for strategic planning.

The threat of new entrants in the refining and marketing space, while potentially moderated by substantial capital requirements, remains a key consideration for HF Sinclair's long-term competitive landscape. This analysis delves into the barriers that protect incumbents.

The competitive rivalry among existing players, including major integrated oil companies and independent refiners, dictates market share and pricing strategies for HF Sinclair. Our full report quantifies this intensity.

Ready to move beyond the basics? Get a full strategic breakdown of HF Sinclair’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The global crude oil market, a critical input for HF Sinclair's refining business, is notably concentrated. A handful of major oil-producing countries and large, integrated oil corporations wield significant influence. This concentration means these suppliers can exert considerable bargaining power, particularly when demand is strong or geopolitical events disrupt supply chains. For instance, in early 2024, the average price of West Texas Intermediate (WTI) crude oil fluctuated around $75-$80 per barrel, demonstrating the market's sensitivity to supply-side factors controlled by these key players.

HF Sinclair's renewable diesel production hinges on feedstocks like used cooking oil, animal fats, and agricultural byproducts. The availability of these materials is subject to agricultural cycles, competition from other sectors, and government incentives. For instance, in 2024, the demand for these renewable feedstocks continued to rise, driven by mandates and consumer preference for cleaner fuels, which can strengthen the negotiating position of suppliers.

While crude oil itself might seem like a commodity, HF Sinclair faces switching costs when dealing with different crude grades. Adjusting refinery configurations and logistics to handle a new type of crude can be expensive, giving current suppliers of specific grades more leverage. For instance, in 2024, the average cost for a refinery to reconfigure for a different crude blend can range from hundreds of thousands to millions of dollars, depending on the complexity.

Securing specialized equipment, chemicals, or midstream services also presents switching costs. HF Sinclair might be bound by significant contractual obligations or face substantial operational adjustments if they decide to change suppliers for these critical inputs. This can empower existing suppliers, particularly those providing unique or highly specialized components, by making it costly for HF Sinclair to find and integrate alternatives.

Importance of Supplier's Input to Product Quality

The quality of HF Sinclair's refined products, from gasoline to lubricants, is directly tied to the inputs it sources. Crude oil, the primary raw material, and specialty chemicals are crucial. If a supplier offers a unique or superior grade of crude oil or a specialized chemical that is difficult to substitute, their ability to influence pricing and terms for HF Sinclair becomes more pronounced. This is particularly true if these inputs are essential for meeting specific product quality standards or achieving desired yields in the refining process.

For instance, in 2024, the global supply of certain high-quality crude grades experienced volatility due to geopolitical factors and production adjustments. Companies like HF Sinclair that rely on these specific grades found their suppliers holding greater leverage. Similarly, the availability and cost of specialized additives used in lubricant formulations can significantly impact production efficiency and final product performance, giving those specialized chemical suppliers increased bargaining power.

- Input Dependency: HF Sinclair's reliance on specific crude oil grades and specialty chemicals for product quality and yield dictates supplier leverage.

- Quality Impact: Variations in crude oil quality directly affect the output of refined products, enhancing the bargaining power of suppliers of premium grades.

- Specialty Chemicals: The purity and consistent availability of specialty chemicals used in refining and lubricant production are critical, granting suppliers of these niche inputs greater influence.

- Market Dynamics: In 2024, factors like geopolitical events and production adjustments influenced the supply of key inputs, strengthening the bargaining position of certain suppliers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, particularly large integrated oil companies that also supply crude oil, presents a nuanced challenge. These entities already possess refining and distribution capabilities, meaning they could theoretically expand further downstream. While this is less common for independent refiners, the potential for a major crude supplier to move into their operational space could indirectly impact pricing negotiations and terms with HF Sinclair.

For instance, in 2024, major integrated oil companies continued to invest in downstream assets, seeking to capture more value across the energy chain. This strategic focus on vertical integration, even if not directly targeting HF Sinclair's specific refining segment, can shift the power dynamic. Suppliers with enhanced downstream reach might have more leverage in dictating crude supply contracts or influencing market conditions that affect HF Sinclair's profitability.

- Integrated oil majors possess both upstream crude supply and downstream refining/distribution assets.

- The theoretical risk of suppliers expanding further downstream can influence pricing and contract terms for refiners like HF Sinclair.

- In 2024, continued investment in downstream operations by integrated players signals a potential shift in supplier leverage.

HF Sinclair's bargaining power with suppliers is moderate, influenced by the concentrated nature of crude oil markets and the specialized requirements for renewable feedstocks. While switching costs for crude grades and specialty chemicals can be significant, the company's scale and the availability of alternative suppliers mitigate some supplier leverage. However, in 2024, disruptions in crude supply and increased demand for renewable inputs did empower certain suppliers.

| Input Type | Supplier Concentration | Switching Costs | 2024 Market Factor | Impact on Bargaining Power |

|---|---|---|---|---|

| Crude Oil | High (Major Oil Producing Countries/Corporations) | Moderate to High (Refinery Adjustments) | Supply Volatility, Geopolitical Events | Moderate to High for Suppliers |

| Renewable Feedstocks (e.g., Used Cooking Oil) | Moderate (Agricultural Cycles, Multiple Producers) | Moderate (Logistics, Contracts) | Increased Demand, Mandates | Moderate to High for Suppliers |

| Specialty Chemicals/Equipment | Varies (Can be High for Niche Products) | High (Contractual Obligations, Operational Adjustments) | Critical for Product Quality/Yield | High for Specialized Suppliers |

What is included in the product

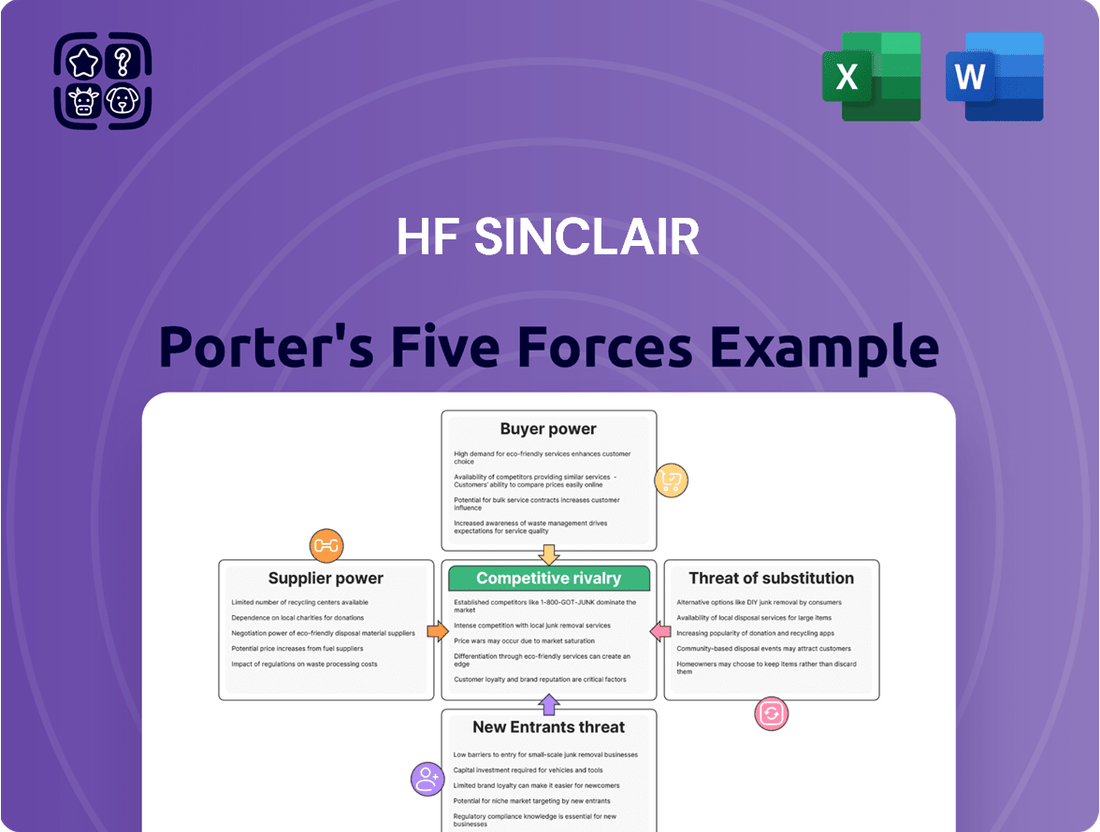

Analyzes the competitive intensity within the refining and marketing industry, focusing on HF Sinclair's strategic positioning against rivals, buyer/supplier power, and potential new entrants.

Instantly understand strategic pressure with a powerful spider/radar chart for HF Sinclair's competitive landscape.

Swap in your own data, labels, and notes to reflect current business conditions and pain points for HF Sinclair.

Customers Bargaining Power

The market for refined petroleum products like gasoline and diesel is highly price-sensitive for both individual consumers and large commercial fleets. This sensitivity means customers, including wholesale distributors and retailers, tend to focus on the lowest available price, which can constrain HF Sinclair's ability to pass on rising costs and ultimately squeeze profit margins.

HF Sinclair's sales volume to its major customers, including wholesale distributors, transportation firms, and airlines, is substantial. These large-scale purchasers represent a concentrated customer base, giving them considerable leverage.

The significant volume of purchases made by these key buyers allows them to negotiate favorable terms. This can include price discounts, customized delivery schedules, and other concessions, particularly if alternative fuel suppliers are readily available to them.

For instance, in the first quarter of 2024, HF Sinclair reported total refined product sales volumes of 369,000 barrels per day, with a significant portion attributable to these larger wholesale and commercial accounts, underscoring their importance in the company's revenue stream.

Customers for gasoline, diesel, and jet fuel often have a variety of suppliers to choose from within a specific region. This abundance of alternatives directly impacts HF Sinclair's ability to dictate terms, as consumers can readily compare prices and service. For instance, in 2024, the U.S. gasoline market features numerous independent refiners and major integrated oil companies, providing ample choice for consumers at the pump.

The ability for customers to easily switch between fuel suppliers, driven by factors like price differentials or logistical convenience, significantly amplifies their bargaining power. This is particularly evident in the transportation sector, where fleet operators can leverage competitive bids from multiple distributors. In 2023, the average retail price for regular gasoline in the U.S. fluctuated, creating opportunities for consumers to seek out the best available rates.

Low Switching Costs for Customers

For standard petroleum products, the cost for customers to switch from one supplier to another is generally low. This low switching cost significantly enhances customer bargaining power, as they can easily move to a competitor if they find better pricing or terms. For instance, in 2024, the retail gasoline market in the US, a key segment for HF Sinclair, is characterized by numerous brands and readily available alternatives, making it simple for consumers to choose based on price at the pump.

Unless there are specific contractual agreements or unique logistic advantages, customers can easily procure similar products from competitors, increasing their leverage. This ease of substitution means that buyers are not locked into any particular supplier, forcing companies like HF Sinclair to remain competitive on price and service to retain their customer base. The ability to source identical or very similar products from multiple providers means that a customer demanding bulk fuel for their fleet, for example, can readily compare offers across the market.

- Low Switching Costs: Customers face minimal financial or operational hurdles when changing petroleum suppliers.

- Price Sensitivity: The ease of switching makes customers highly sensitive to price differences between suppliers.

- Competitive Landscape: HF Sinclair operates in a market with many suppliers offering comparable standard petroleum products.

- Customer Leverage: This situation grants customers significant power to negotiate better terms and pricing.

Customer Knowledge and Market Transparency

Customer knowledge and market transparency significantly impact the bargaining power of customers in the refining and marketing industry, including for a company like HF Sinclair. Information regarding fuel prices, product quality, and availability is readily accessible to consumers and commercial entities alike. This widespread availability of data means customers are generally well-informed about market conditions.

Well-informed customers, especially large commercial buyers such as trucking fleets or industrial users, can leverage this transparency to their advantage. They can compare offerings from various suppliers and use this knowledge to negotiate for more competitive pricing, favorable payment terms, and specific product specifications. This ability to easily switch suppliers based on price or terms directly enhances their bargaining power.

- Information Accessibility: Fuel prices and availability are transparent across numerous retail outlets and wholesale markets.

- Commercial Buyer Influence: Large-volume customers can exert significant pressure on suppliers for better deals due to their purchasing power.

- Price Sensitivity: In 2024, gasoline prices have shown volatility, making customers more attuned to price differences between brands and locations.

- Brand Loyalty vs. Price: While some brand loyalty exists, price often becomes a deciding factor for many consumers, especially during periods of high fuel costs.

The bargaining power of customers for HF Sinclair is considerable due to the commoditized nature of refined petroleum products and the ease with which buyers can switch suppliers. This means customers, from individual drivers to large commercial fleets, can readily compare prices and choose the most cost-effective option, limiting HF Sinclair's pricing flexibility and potentially impacting profit margins.

For instance, in the first quarter of 2024, HF Sinclair reported total refined product sales volumes of 369,000 barrels per day, with a significant portion coming from wholesale and commercial accounts. These large buyers, often with access to multiple suppliers, leverage their volume to negotiate favorable terms, as seen in the competitive U.S. gasoline market in 2024 where numerous refiners and integrated companies offer comparable products.

The low switching costs for customers, combined with readily available market information on prices and product availability, further amplify their leverage. This transparency and ease of transition mean that customers can easily shift their business to competitors offering better deals, forcing HF Sinclair to remain highly competitive on price and service to retain its customer base.

HF Sinclair's customers, particularly large-volume buyers like trucking companies or airlines, possess significant bargaining power. This is driven by the availability of numerous alternative suppliers for standard fuels and the low costs associated with switching. For example, in 2024, the retail gasoline market in the U.S. offers consumers abundant choices, making price a primary determinant in purchasing decisions, which directly influences HF Sinclair's ability to command premium pricing.

Preview Before You Purchase

HF Sinclair Porter's Five Forces Analysis

This preview showcases the complete HF Sinclair Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You are looking at the actual deliverable, ready for your immediate use and strategic planning.

Rivalry Among Competitors

HF Sinclair operates in a North American refining and marketing sector populated by a blend of major integrated oil giants and numerous independent refiners. This creates a highly diverse competitive environment where market share is fiercely contested.

The sheer number of these players, each possessing distinct refining capacities and strategic market focuses, significantly amplifies the rivalry. For instance, as of early 2024, the U.S. refining industry comprises over 130 refineries, with a total capacity exceeding 18 million barrels per day, showcasing the breadth of competition HF Sinclair faces.

The refining industry is mature, with demand for traditional petroleum products growing slowly. However, renewable diesel presents a notable growth opportunity. In 2024, capacity utilization rates across the U.S. refining sector hovered around 85-90%, with some regions experiencing higher rates due to strong demand for gasoline and diesel, while others saw lower utilization due to maintenance or localized demand weakness.

When overcapacity arises, refiners tend to compete aggressively on price to keep their facilities running efficiently. This often results in intense competition and squeezed profit margins. For instance, during periods of low crude oil prices and ample refining capacity in early 2024, spot refining margins for gasoline in the U.S. Gulf Coast dipped below $15 per barrel, a significant decrease from peaks seen in prior years.

HF Sinclair operates in a market where its core products like gasoline, diesel, and jet fuel are largely seen as the same by consumers. This product homogeneity means differentiation is tough, pushing competition towards factors like price, efficient delivery, and consistent availability. For instance, in 2024, the average retail gasoline price in the US fluctuated significantly, underscoring the sensitivity to even small price variations.

High Fixed Costs and Exit Barriers

HF Sinclair, like many in the refining sector, faces intense competitive rivalry driven by high fixed costs. Building and maintaining refineries, pipelines, and terminals requires massive capital investment, creating a significant barrier to entry and a constant pressure to utilize these assets efficiently.

These substantial fixed costs, combined with high exit barriers such as the complex and costly process of decommissioning facilities and addressing environmental liabilities, force companies to maintain high operational capacities. This often means continuing to run refineries even when market demand is low, intensifying competition as companies vie for market share and attempt to cover their fixed expenses.

For example, in 2024, the integrated refining and marketing segment of the energy industry continues to be characterized by these dynamics. Companies must operate at high utilization rates to spread their fixed costs.

- High Capital Intensity: Refining assets are inherently capital-intensive, with significant upfront investments required for infrastructure.

- Operational Pressure: High fixed costs necessitate high operating capacities to achieve economies of scale and cover expenses.

- Exit Challenges: Substantial costs and regulatory hurdles associated with shutting down or selling refineries limit strategic flexibility.

- Competitive Intensity: The need to operate at capacity during various market conditions fuels aggressive competition among refiners.

Strategic Moves of Competitors in Renewable Fuels

Competition in the renewable fuels market is intensifying beyond traditional refining. Many established companies and new entrants are pouring capital into expanding their renewable diesel production capabilities, directly challenging HF Sinclair's ambitions in this burgeoning sector.

This heightened rivalry means companies are vying for market share and critical feedstock supplies, which can influence pricing power and profitability. For instance, in 2024, several major oil companies announced significant investments in renewable diesel projects, signaling a robust competitive landscape.

- Intensifying Competition: The renewable diesel market is seeing a surge of both existing refiners and new players investing heavily in production capacity.

- Market Share and Feedstock Access: HF Sinclair's strategic moves in renewable diesel are met with competition from rivals also seeking to capture market share and secure vital feedstock.

- Impact on Pricing: Increased competition directly affects pricing dynamics and the availability of essential feedstocks, influencing overall profitability in the sector.

- Industry Investments (2024 Example): Major energy firms announced substantial investments in renewable diesel projects throughout 2024, underscoring the competitive pressure.

HF Sinclair operates in a highly competitive North American refining and marketing sector, facing a diverse array of major integrated oil companies and numerous independent refiners. This intense rivalry is fueled by high fixed costs and exit barriers, forcing companies to maintain high operating capacities to cover expenses, even during periods of low demand.

The market for traditional products like gasoline and diesel is mature, with slow growth and homogeneous offerings that push competition towards price and efficiency. For example, in early 2024, U.S. refining capacity utilization rates hovered around 85-90%, with spot refining margins for gasoline in the U.S. Gulf Coast dipping below $15 per barrel at times, illustrating the pressure on profitability.

Furthermore, the burgeoning renewable diesel market is experiencing escalating competition. Many established players and new entrants are investing heavily in production, creating a dynamic landscape where companies vie for market share and crucial feedstock supplies, impacting pricing and profitability.

| Key Competitive Factors | Description | 2024 Data/Context |

| Number of Competitors | Large number of integrated oil giants and independent refiners. | Over 130 refineries in the U.S. (early 2024). |

| Product Homogeneity | Core products like gasoline and diesel are largely undifferentiated. | Competition centers on price, delivery, and availability. |

| Fixed Costs & Utilization | High capital investment in infrastructure necessitates high operating capacities. | Capacity utilization rates around 85-90% (U.S., 2024). |

| Renewable Diesel Competition | Increasing investment from existing and new players in renewable fuels. | Major energy firms announced significant renewable diesel projects in 2024. |

SSubstitutes Threaten

The increasing adoption of electric vehicles (EVs) presents a significant long-term threat to HF Sinclair's primary fuel market. By the end of 2023, global EV sales surpassed 13.6 million units, a notable increase from previous years. This trend directly impacts demand for gasoline and diesel, HF Sinclair's core products.

As EV technology continues to advance and charging infrastructure expands, a substantial portion of the transportation sector is expected to transition away from traditional internal combustion engines. This shift could fundamentally alter the demand landscape for refined petroleum products, posing a direct challenge to HF Sinclair's business model.

Beyond renewable diesel, other biofuels like ethanol and advanced biofuels, alongside hydrogen and natural gas, offer compelling alternatives to traditional petroleum products across numerous sectors. For instance, in 2023, global ethanol production reached approximately 110 billion liters, while renewable diesel capacity continued its upward trajectory, signaling a growing market share for these substitutes.

These advancements, often bolstered by government incentives and evolving consumer preferences, directly challenge the demand for HF Sinclair's refined gasoline and diesel. If these alternative fuels achieve greater cost-competitiveness or wider infrastructure availability, they could significantly diminish the market for HF Sinclair's core offerings.

Increased investment in public transportation, ride-sharing services, and urban planning aimed at reducing individual car dependence directly impacts fuel demand. For instance, cities like New York saw a significant increase in public transit ridership, with the Metropolitan Transportation Authority (MTA) reporting over 1.7 billion passenger trips in 2023, a substantial rise from previous years. This shift away from personal vehicles means less gasoline and diesel consumption, posing a threat to fuel providers like HF Sinclair.

Societal trends driven by environmental consciousness and urban congestion are further bolstering these substitute options. As more individuals opt for public transit or carpooling, the overall need for personal vehicle fuel diminishes. This can lead to reduced demand for refined products, impacting sales volumes and potentially pressuring profit margins for companies heavily reliant on fuel sales.

Energy Efficiency Improvements in End-Use Sectors

Ongoing advancements in energy efficiency across various sectors pose a significant threat of substitutes for HF Sinclair. For instance, improvements in vehicle fuel economy directly reduce the demand for gasoline and diesel fuel per mile traveled. In 2024, the average fuel economy for new passenger vehicles sold in the U.S. reached approximately 28.5 miles per gallon, an increase that diminishes overall fuel consumption.

Similarly, the aviation industry is seeing greater fuel efficiency through new aircraft designs and operational improvements, impacting the demand for jet fuel. Industrial machinery is also becoming more energy-efficient, requiring less petroleum-based lubricants and fuels to operate. These cumulative efficiency gains effectively lower the amount of petroleum product needed for a given level of economic output.

- Vehicle Fuel Efficiency: New passenger vehicles in the U.S. averaged around 28.5 mpg in 2024, up from previous years.

- Aircraft Efficiency: Modern aircraft can be 20-25% more fuel-efficient than models from two decades ago.

- Industrial Machinery: Energy efficiency standards for industrial equipment continue to tighten, reducing energy input requirements.

Substitution in Specialty Chemicals and Lubricants

While HF Sinclair's core refined products like gasoline and diesel face established substitutes such as electric vehicles and alternative fuels, its specialty lubricants and chemicals also confront potential substitution. These could come from bio-based alternatives, advanced synthetic materials, or novel chemical processes that deliver comparable performance using different feedstocks. For instance, the growing demand for sustainable lubricants might see bio-lubricants gain traction, potentially impacting traditional mineral oil-based products. In 2023, the global bio-lubricants market was valued at approximately $8.4 billion and is projected to grow, indicating a tangible, albeit developing, substitute threat.

The threat of substitution for HF Sinclair's specialty chemicals and lubricants is present, though the immediate impact may be less widespread than for its fuels. New chemical formulations or materials that offer superior performance, cost-effectiveness, or environmental benefits can displace existing products. For example, advancements in polymer science could lead to new materials that replace certain industrial lubricants or chemical additives. While specific market share shifts due to these substitutes are difficult to quantify precisely for HF Sinclair's niche segments, the broader trend towards performance enhancement and sustainability in chemical applications suggests a continuous need for innovation to counter these evolving threats.

- Bio-based lubricants represent a growing substitute category, with the global market valued around $8.4 billion in 2023.

- Advanced synthetic materials can offer enhanced performance, potentially displacing traditional specialty chemicals and lubricants.

- Novel chemical processes may create alternatives using different raw materials, impacting existing product lines.

- The threat is less pervasive than for core fuels but requires ongoing R&D to maintain competitive advantage.

The shift towards electric vehicles (EVs) represents a significant substitute threat for HF Sinclair's gasoline and diesel sales. Global EV sales exceeded 13.6 million units by the end of 2023, indicating a growing market share. This trend directly impacts the demand for traditional fuels, as more consumers opt for electric alternatives.

Beyond EVs, alternative fuels like renewable diesel, ethanol, and potentially hydrogen are gaining traction. In 2023, global ethanol production neared 110 billion liters, showcasing the scale of these substitutes. As these options become more cost-competitive and infrastructure expands, they directly challenge HF Sinclair's core products.

Furthermore, increased investment in public transportation and ride-sharing services reduces reliance on personal vehicles, thereby lowering fuel consumption. For example, the MTA in New York reported over 1.7 billion passenger trips in 2023, highlighting a substantial shift in mobility patterns that impacts fuel demand.

Advancements in energy efficiency also act as a substitute. In 2024, new passenger vehicles in the U.S. achieved an average of 28.5 mpg, meaning less fuel is consumed per mile. Similarly, more fuel-efficient aircraft and industrial machinery reduce the overall need for petroleum-based products, posing a continuous challenge to demand.

| Substitute Category | 2023/2024 Data Point | Impact on HF Sinclair |

|---|---|---|

| Electric Vehicles (Global Sales) | 13.6 million units (end of 2023) | Directly reduces gasoline/diesel demand |

| Ethanol Production (Global) | ~110 billion liters (2023) | Offers an alternative fuel blend |

| U.S. New Passenger Vehicle Fuel Economy | ~28.5 mpg (2024) | Decreases fuel consumption per mile |

| NYC Public Transit Ridership | >1.7 billion trips (2023) | Reduces personal vehicle fuel demand |

Entrants Threaten

The refining industry is extraordinarily capital-intensive, requiring billions of dollars to construct and operate a modern refinery, distribution network, and midstream assets. For instance, building a new, large-scale refinery in 2024 could easily cost upwards of $10 billion. This immense financial barrier significantly deters potential new entrants from establishing a competitive presence against established players like HF Sinclair.

New entrants in the energy sector, including those looking to compete with HF Sinclair, face significant challenges due to extensive regulatory hurdles and rigorous environmental compliance requirements. Navigating the complex web of federal, state, and local regulations, which encompass permitting processes, safety standards, and emissions controls, demands substantial investment and expertise.

The cost of ensuring compliance with these regulations, coupled with potential liabilities for non-adherence, creates a formidable barrier. For instance, in 2024, the average cost for environmental permits for new energy projects can range from tens of thousands to millions of dollars, depending on the project's scale and location, directly impacting the financial feasibility for newcomers.

HF Sinclair benefits from deeply entrenched relationships with crude oil producers, ensuring consistent and often preferential access to raw materials. For instance, as of late 2023, major integrated oil companies, who are direct competitors and potential benchmarks for new entrants, maintained significant long-term supply contracts that new players would find difficult to replicate.

New entrants face substantial hurdles in establishing comparable supply chains. The capital investment required to build or acquire similar infrastructure, including pipelines and terminals, is immense, often running into billions of dollars. This capital intensity acts as a significant barrier, making it challenging for newcomers to achieve economies of scale and cost competitiveness against established entities.

Furthermore, HF Sinclair's existing distribution network, encompassing refineries, storage facilities, and retail outlets, provides a significant advantage. This integrated system allows for efficient product movement and market penetration. A new entrant would need to invest heavily to replicate this comprehensive network, a daunting task given the current market saturation and the established logistical advantages of incumbents.

Economies of Scale and Experience Curve Effects

Existing refiners like HF Sinclair possess substantial economies of scale, particularly in raw material procurement and distribution networks. For instance, in 2024, major integrated oil companies often operate refineries with capacities exceeding 100,000 barrels per day, enabling them to negotiate better prices for crude oil and achieve lower per-unit production costs. This scale advantage translates directly into a cost barrier for potential new entrants.

Newcomers would struggle to match these established cost efficiencies from the outset. They would likely face higher initial capital expenditures and less favorable terms for feedstock and logistics until they achieve a similar operational scale. This experience curve effect, where costs decrease with accumulated production volume, further solidifies the position of incumbents.

- Economies of Scale: Large existing refineries benefit from lower per-unit costs in purchasing, production, and logistics.

- Experience Curve: Incumbents have accumulated operational experience, leading to greater efficiency and lower costs over time.

- Cost Disadvantage for New Entrants: Newcomers would face higher initial operating costs and lack the bargaining power of established players.

- Barriers to Entry: These scale and experience advantages create a significant cost barrier, deterring new companies from entering the refining market.

Brand Recognition and Customer Loyalty in Specialty Markets

While the market for commodity fuels like gasoline often sees customers choosing based on price and convenience, leading to lower brand loyalty, HF Sinclair also has a significant presence in specialty lubricants and chemicals.

In these niche segments, the threat of new entrants is somewhat mitigated by the strong brand recognition and deep customer loyalty that established players like HF Sinclair have cultivated. This loyalty is typically built on a track record of superior product performance, consistent reliability, and tailored solutions that meet specific industrial needs.

For instance, in the industrial lubricants sector, switching costs can be high for customers who have integrated specific formulations into their machinery and maintenance programs. New entrants would need substantial investment in research and development, marketing, and establishing a distribution network to effectively challenge these entrenched relationships and brand perceptions.

HF Sinclair's commitment to quality in these specialty areas is a key factor. For example, in 2024, the company continued to focus on innovation in its lubricant offerings, aiming to provide enhanced efficiency and longevity for industrial equipment, further solidifying its market position against potential new competitors.

The threat of new entrants for HF Sinclair is significantly low due to the immense capital required to establish a modern refinery, with new large-scale facilities costing upwards of $10 billion in 2024. Additionally, stringent regulatory requirements and environmental compliance demand substantial investment and expertise, creating formidable financial and operational barriers for newcomers. Established players like HF Sinclair also benefit from deeply entrenched supply chain relationships and extensive distribution networks that are prohibitively expensive for new entrants to replicate.

| Barrier Type | Description | Estimated Cost/Impact (2024) | Impact on New Entrants |

|---|---|---|---|

| Capital Intensity | Building a new refinery | $10 billion+ | Extremely High |

| Regulatory Compliance | Permitting, safety, emissions | Millions of dollars | Very High |

| Supply Chain Access | Securing crude oil contracts | Difficult to replicate | Very High |

| Distribution Network | Pipelines, storage, retail | Billions of dollars | Extremely High |

| Economies of Scale | Lower per-unit production costs | Refineries >100,000 bpd | Very High |

Porter's Five Forces Analysis Data Sources

Our HF Sinclair Porter's Five Forces analysis is built upon a foundation of comprehensive data, including HF Sinclair's annual reports and SEC filings, alongside industry-specific market research from firms like IHS Markit and Wood Mackenzie. This blend ensures a robust understanding of competitive dynamics.