HF Sinclair Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HF Sinclair Bundle

HF Sinclair's position within the BCG Matrix offers a fascinating glimpse into its product portfolio's health and future potential. Understanding whether its offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed strategic decisions. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

HF Sinclair's renewable diesel production is a standout performer, reflecting a strategic pivot towards a high-growth sector fueled by stringent environmental mandates and a growing preference for sustainable energy solutions. The company's commitment is evident in its substantial investments aimed at converting existing infrastructure and boosting its renewable diesel output capabilities.

This segment is poised for significant expansion, projected to claim an increasing share of the market as the global shift towards cleaner energy intensifies. For instance, in 2024, HF Sinclair announced plans to increase its renewable diesel capacity, targeting an additional 100 million gallons per year, underscoring its aggressive growth strategy in this area.

HF Sinclair's strategic refinery upgrades are a prime example of a Star in the BCG Matrix. Investments in modernizing and optimizing key refinery assets, like the Cheyenne refinery expansion completed in 2024, enhance efficiency and product yield in high-demand areas. These upgrades allow HF Sinclair to process a wider range of crude oils and produce higher-value products, improving their competitive position in profitable refining segments.

High-Growth Specialty Lubricants represent a promising area for HF Sinclair. These lubricants are designed for specific, often demanding applications, such as in electric vehicles or advanced manufacturing processes, which are experiencing significant growth. For example, the global market for specialty lubricants was projected to reach over $20 billion by 2024, with a compound annual growth rate of around 5%.

HF Sinclair's focus on innovation in these niche segments positions these products as potential stars. Their ability to develop and market advanced formulations that meet the evolving needs of high-tech industries, like aerospace or renewable energy, allows them to capture market share in rapidly expanding sectors. This strategic alignment with growth trends is key to their star status.

Sustainable Aviation Fuel (SAF) Development

HF Sinclair's investment in Sustainable Aviation Fuel (SAF) development positions it in a high-growth, high-potential market. With the aviation sector actively pursuing decarbonization, the demand for SAF is expected to climb significantly. This strategic move could see HF Sinclair's SAF segment transform into a market star.

The global SAF market is projected to reach $31.4 billion by 2025, according to some industry forecasts, highlighting the immense growth potential. Companies like HF Sinclair that are investing in this area are tapping into a critical need for lower-emission aviation solutions.

- Market Growth: SAF demand is anticipated to grow at a compound annual growth rate (CAGR) of over 40% in the coming years.

- Industry Mandates: Many countries and airlines are implementing mandates and targets for SAF usage, driving adoption.

- Technological Advancement: Ongoing research and development are improving SAF production efficiency and feedstock availability.

- HF Sinclair's Position: Early-stage development in SAF production could provide HF Sinclair with a competitive advantage in this evolving sector.

Expansion into New, High-Demand Geographic Markets

Expansion into new, high-demand geographic markets can position HF Sinclair as a star within the BCG matrix. This strategy involves aggressively growing refining or marketing operations in regions demonstrating robust economic or industrial expansion. Capturing market share in areas with escalating energy needs or less efficient existing supply chains is key. For instance, if HF Sinclair were to expand into a rapidly developing Southeast Asian market experiencing a surge in manufacturing and transportation, this would represent a potential star. In 2024, many emerging economies, particularly in Asia and Africa, showed significant GDP growth, indicating rising energy consumption. HF Sinclair’s strategic entry into such markets, backed by substantial investment and efficient logistics, could yield high returns and market leadership.

- Aggressive Market Penetration: Targeting regions with demonstrable economic growth and increasing energy demand.

- Strategic Investment: Allocating capital to build or acquire refining and marketing infrastructure in these new territories.

- Competitive Advantage: Leveraging operational efficiencies and supply chain optimization to gain market share.

- Future Growth Potential: Establishing a strong presence in nascent but rapidly expanding markets to secure long-term leadership.

HF Sinclair's renewable diesel and Sustainable Aviation Fuel (SAF) segments are clear Stars in the BCG matrix. These areas benefit from strong market growth driven by environmental regulations and a global push for decarbonization.

The company's strategic investments in expanding renewable diesel capacity, such as the planned 100 million gallons per year increase in 2024, highlight its commitment to these high-growth sectors. Similarly, early development in SAF, a market projected to reach $31.4 billion by 2025, positions HF Sinclair for significant future gains.

These segments represent areas where HF Sinclair has invested heavily to enhance production and capture increasing demand, aligning with favorable market trends and regulatory tailwinds.

HF Sinclair's specialty lubricants for niche, high-tech applications also fall into the Star category. This segment taps into a global market valued at over $20 billion in 2024, with a projected CAGR of around 5%.

| Segment | Market Growth | HF Sinclair's Position | BCG Category |

|---|---|---|---|

| Renewable Diesel | High (Driven by environmental mandates) | Significant investment in capacity expansion (e.g., 100 million gallons/year in 2024) | Star |

| Sustainable Aviation Fuel (SAF) | Very High (CAGR >40%) | Early-stage development, targeting a market projected at $31.4 billion by 2025 | Star |

| Specialty Lubricants | High (Global market >$20 billion in 2024, ~5% CAGR) | Focus on advanced formulations for high-tech industries | Star |

What is included in the product

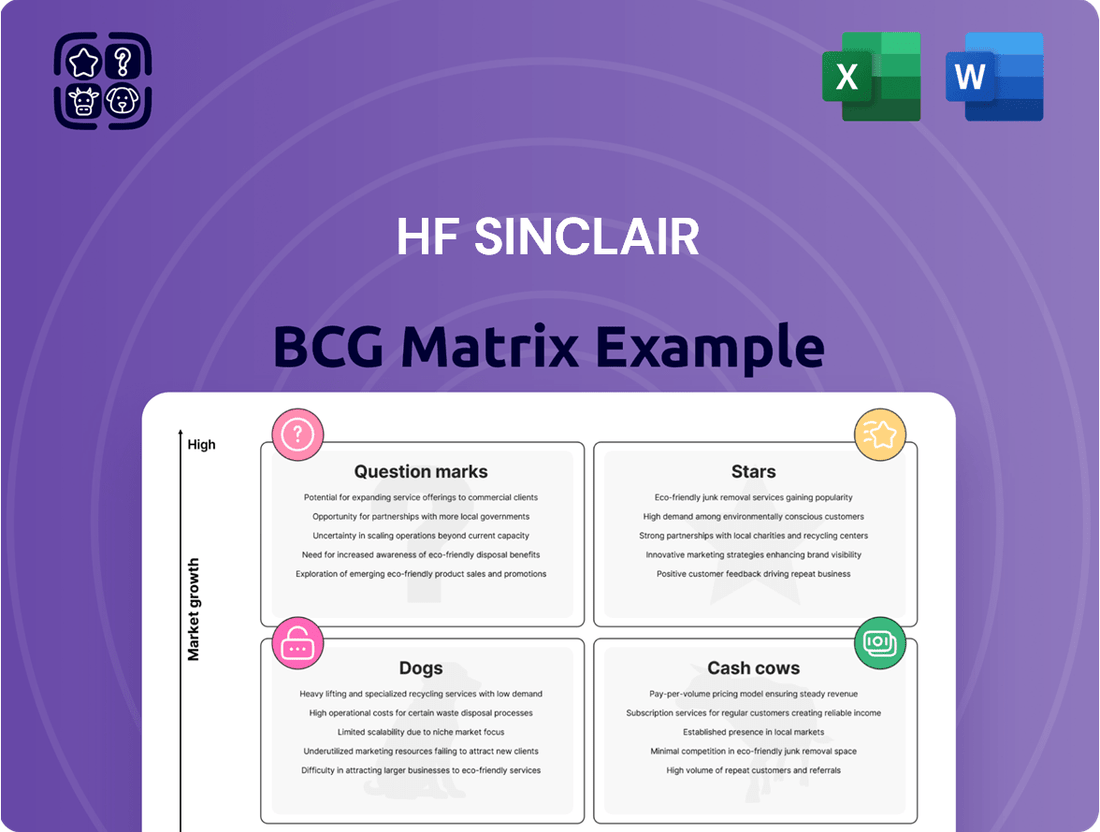

This BCG Matrix overview details HF Sinclair's portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

A clear BCG Matrix visualizes HF Sinclair's portfolio, easing strategic decision-making by highlighting growth and market share.

Cash Cows

HF Sinclair's established petroleum refining operations, focusing on gasoline and diesel, are its primary cash cows. These segments benefit from a solid market presence in regions with consistent demand, ensuring reliable revenue streams.

In 2024, HF Sinclair reported significant contributions from its refining segment. For example, its refining segment generated approximately $1.5 billion in adjusted EBITDA for the first nine months of 2024, showcasing its strong cash-generating capabilities. This segment requires relatively lower capital investment compared to growth-oriented businesses, allowing it to consistently fund other company initiatives.

HF Sinclair's midstream pipelines and terminals are indeed strong cash cows for the company. These assets, which include a significant network of pipelines and marketing terminals, generate consistent revenue. In 2023, HF Sinclair reported that its Midstream segment generated Adjusted EBITDA of $679 million, highlighting the segment's robust performance and its role as a stable income generator.

The stability of these midstream operations stems from their structure. Many of these assets operate under long-term contracts, which provides a predictable and reliable revenue stream. This contractual framework insulates them from the immediate price volatility often seen in the upstream energy sector, ensuring a steady cash flow for HF Sinclair.

Furthermore, the essential nature of these midstream assets within the energy supply chain guarantees consistent utilization. They are critical for transporting and storing refined products, ensuring their availability to consumers. This consistent demand, coupled with the mature infrastructure market, translates into strong and dependable cash generation for HF Sinclair.

HF Sinclair's traditional marketing and distribution networks are a robust cash cow, benefiting from decades of established infrastructure and customer loyalty. This segment consistently delivers steady revenue streams through the wholesale and retail distribution of refined fuels, maintaining a significant market share without the need for heavy capital reinvestment in expansion.

In 2024, HF Sinclair's refined products segment, which encompasses these distribution networks, demonstrated strong performance. For the first quarter of 2024, the company reported a net income of $465 million, with a significant portion attributable to its refining operations and associated distribution channels. This highlights the segment's ability to generate substantial and reliable cash flow.

Conventional Specialty Chemicals

HF Sinclair's conventional specialty chemicals represent established product lines catering to mature industries. These chemicals, like those used in automotive fluids or industrial lubricants, enjoy consistent demand, positioning them as cash cows within the company's portfolio. Their strong market share in stable sectors ensures reliable profit generation and steady cash flow.

These product categories benefit from established brand recognition and predictable consumption trends. While growth might be modest, the high market share in mature segments translates to significant and dependable earnings for HF Sinclair.

- Market Position: High market share in stable, mature industries.

- Demand: Consistent and predictable demand from essential applications.

- Profitability: Generates reliable profits and strong cash flow.

- Growth: Low growth prospects but high market penetration.

Existing Lubricants Portfolio

HF Sinclair's existing lubricants portfolio is a classic cash cow. This established line of conventional lubricant products caters to a wide array of industrial and automotive clients, a segment that's mature with steady, though modest, growth.

The company benefits from significant brand recognition and a well-developed distribution network, which translates into a strong market share and reliable profits. These mature products require minimal new capital for upkeep, allowing HF Sinclair to harvest consistent returns.

- Established Market Position: The conventional lubricants segment is mature, offering predictable demand.

- Strong Brand and Distribution: HF Sinclair's existing infrastructure supports high market share.

- Consistent Profitability: Low investment needs for maintenance ensure steady cash flow.

- Mature Market Dynamics: While growth is low, market share stability is high.

HF Sinclair's refining operations, particularly gasoline and diesel production, are core cash cows. These segments benefit from consistent demand in key regions, generating reliable revenue streams. For instance, HF Sinclair's refining segment generated approximately $1.5 billion in adjusted EBITDA for the first nine months of 2024, highlighting its robust cash-generating capacity with minimal need for significant capital reinvestment.

The company's midstream pipelines and terminals are also strong cash cows, evidenced by the $679 million in Adjusted EBITDA generated by its Midstream segment in 2023. These assets, often secured by long-term contracts, provide predictable income insulated from upstream price volatility, ensuring a steady cash flow.

HF Sinclair's marketing and distribution networks, along with its conventional specialty chemicals and lubricants, further solidify its cash cow status. These mature segments leverage established infrastructure and brand recognition, delivering consistent profits with low capital expenditure requirements. The refined products segment, for example, contributed significantly to the company's $465 million net income in the first quarter of 2024.

| Segment | 2023 Adjusted EBITDA (Millions USD) | 2024 YTD Adjusted EBITDA (Millions USD) | Key Characteristics |

|---|---|---|---|

| Refining | N/A | ~1,500 (First 9 months) | High market share, consistent demand, low reinvestment needs |

| Midstream | 679 | N/A | Long-term contracts, stable revenue, essential infrastructure |

| Marketing & Distribution | N/A | Significant contributor to net income | Established networks, brand loyalty, steady cash flow |

Full Transparency, Always

HF Sinclair BCG Matrix

The HF Sinclair BCG Matrix preview you are viewing is the identical, fully prepared document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally formatted, analysis-ready strategic tool. You can trust that the insights and structure presented here are exactly what you'll gain access to immediately after completing your transaction. This allows for confident decision-making, as the report is ready for immediate integration into your business planning and presentations.

Dogs

Certain older refinery units within HF Sinclair's portfolio might be classified as dogs if they exhibit high operating costs and lower utilization rates. For instance, a unit struggling to achieve above 70% utilization, compared to industry averages that can exceed 90% for efficient facilities, would signal underperformance.

These underperforming assets may also be producing lower-margin products, contributing to a diminished market share in terms of profitability. If a refinery segment consistently generates returns on capital employed below HF Sinclair's overall average, perhaps in the low single digits, it points towards a dog status.

Such units often require significant capital expenditure for maintenance, potentially exceeding 10% of their book value annually, without yielding substantial returns. This scenario makes them prime candidates for strategic review, including potential divestiture or substantial investment in modernization to improve efficiency and product mix.

HF Sinclair's Niche Specialty Chemical Products with Declining Demand would likely be classified as Dogs in the BCG Matrix. Consider legacy plasticizers used in older PVC formulations, where demand has been steadily eroding as newer, more environmentally friendly alternatives gain traction. For instance, the global market for certain phthalate plasticizers, a segment HF Sinclair might have historically served, has seen a compound annual growth rate (CAGR) of approximately -2% between 2020 and 2024, according to industry reports.

These products typically represent a small fraction of HF Sinclair's total revenue, possibly contributing less than 1% in 2024. Their low market share within these shrinking segments means they are not generating significant profits and may even require ongoing investment for maintenance or regulatory compliance, hindering capital allocation to more promising growth areas.

Non-strategic, low-throughput marketing terminals, often characterized by their smaller footprint and minimal operational volume, can be categorized as dogs within the HF Sinclair BCG Matrix. These facilities typically incur higher maintenance expenses relative to their revenue generation, making them less attractive assets.

These types of terminals are frequently situated in markets experiencing stagnant or declining demand, which further limits their potential for growth and profitability. For instance, if a terminal's throughput has consistently fallen below 50,000 barrels per month and its maintenance costs represent over 15% of its gross profit, it might be a candidate for this classification.

Their contribution to HF Sinclair's overall market share and profitability is often negligible. The continued investment in and operation of these low-performing assets can divert valuable resources and capital away from more promising ventures, hindering the company's strategic objectives.

Outdated Lubricant Formulations

Outdated lubricant formulations represent a significant challenge within the BCG matrix, often falling into the 'dog' category. These products, no longer aligned with evolving industry standards or customer demands, experience diminishing sales and shrinking market share. For instance, many legacy engine oil formulations struggle to meet the fuel efficiency and emissions requirements of modern vehicles, impacting their appeal and competitiveness.

These aging products typically operate in mature or declining market segments, finding it difficult to attract new clientele. The cost associated with maintaining such product lines can be substantial, encompassing inventory holding, specialized production runs, and marketing efforts that yield little return. In 2024, the automotive industry's continued push towards advanced synthetic lubricants and electric vehicle fluids exacerbates the decline of older, mineral-based formulations.

HF Sinclair, like other major players, must strategically manage these underperforming assets. The decision to discontinue or divest outdated lubricant formulations is often driven by the need to reallocate resources towards more innovative and profitable product lines. This strategic pruning allows companies to streamline operations and focus on growth areas, thereby improving overall profitability and market position.

- Declining Market Relevance: Lubricants failing to meet new API or ILSAC specifications are prime examples of outdated formulations.

- High Inventory Costs: Maintaining stock of slow-moving, obsolete lubricants ties up capital and incurs storage expenses.

- Lack of Innovation: Products not incorporating advanced additive technologies or environmental considerations are at risk.

- Strategic Divestment: Companies may choose to sell off or phase out these product lines to concentrate on high-performance offerings.

Legacy Assets with High Environmental Liabilities

Legacy assets with high environmental liabilities, such as older refining facilities, often fall into the Dogs category of the BCG Matrix. These sites may require substantial capital for environmental remediation and compliance, potentially exceeding their revenue-generating capacity. For instance, as of late 2024, the cost of environmental compliance for legacy industrial sites can run into millions of dollars, impacting profitability significantly.

- Operational Burden: These assets often have a low effective market share due to the significant operational costs associated with environmental management and upgrades.

- Financial Drain: They can represent a considerable drain on financial resources, diverting capital that could be invested in more promising growth areas.

- Strategic Consideration: Companies typically evaluate these assets for closure or divestment to mitigate ongoing costs and environmental risks.

HF Sinclair's 'dog' assets, such as aging refinery units or niche chemical products, are characterized by low market share and low growth potential. These underperformers often require significant capital for upkeep but yield minimal returns, potentially dragging down overall company performance.

For example, older refinery units with utilization rates below industry benchmarks or specialty chemicals facing declining demand, like certain legacy plasticizers with a projected -2% CAGR for 2020-2024, fit this classification. Such assets may contribute less than 1% of total revenue in 2024, highlighting their limited economic impact.

These dogs necessitate strategic decisions, including divestment or substantial modernization, to free up capital for more profitable ventures and improve HF Sinclair's competitive standing in the evolving energy and chemical markets.

Question Marks

HF Sinclair's exploration into emerging renewable energy technologies like advanced biofuels and hydrogen production positions these as potential question marks within its BCG matrix. While these sectors exhibit strong growth potential, HF Sinclair's current market penetration is minimal, necessitating substantial capital outlay for development and scaling. The returns on these investments are inherently uncertain, but a successful pivot could transform them into future star performers.

HF Sinclair's ventures into new geographic markets for its refined products or specialty chemicals are classic question marks. These are areas where the company is still building its brand and distribution, meaning its market share is currently low, even if the growth potential is high. For example, entering a new international market might require significant upfront investment in logistics and marketing.

To succeed in these emerging territories, HF Sinclair needs to commit substantial resources. This investment is crucial for building brand awareness, establishing robust distribution channels, and understanding local market dynamics. Without this, gaining a foothold and becoming competitive in these potentially lucrative, but undeveloped, markets will be a significant challenge.

HF Sinclair's development of novel specialty chemical applications fits the question mark category. These ventures focus on creating entirely new uses or formulations for chemicals, aiming at emerging sectors or underserved markets. While these products target high-growth areas, their current market penetration is minimal, requiring substantial R&D and market development to succeed.

For instance, the company might be exploring advanced polymers for electric vehicle battery components or specialized coatings for renewable energy infrastructure. These areas represent significant growth potential, with the global specialty chemicals market projected to reach over $900 billion by 2027, according to some industry analyses. However, these nascent applications demand considerable investment and face the challenge of gaining market acceptance.

Pilot Programs for Carbon Capture and Storage (CCS)

HF Sinclair's pilot programs for Carbon Capture and Storage (CCS) would likely fall into the question mark category of the BCG matrix. These are early-stage ventures with uncertain market positions and high investment needs.

While the global carbon capture market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030, HF Sinclair's current market share in this nascent area is probably minimal. These projects demand substantial capital and technological development, holding the promise of future rewards if successful.

- Uncertain Market Position: HF Sinclair's CCS pilot projects are in their infancy, making their future market share and competitive standing unclear.

- High Investment, Uncertain Returns: Significant upfront investment is required for CCS technology, with the potential for high returns if the technology matures and scales effectively.

- Emerging Market Growth: The broader decarbonization solutions market is expanding rapidly, creating potential opportunities for CCS technologies to gain traction.

- Technical and Capital Hurdles: Developing and implementing CCS requires substantial technical expertise and financial resources, typical of question mark ventures.

Acquisitions in Unfamiliar or Emerging Energy Sectors

HF Sinclair's strategic moves into unfamiliar or emerging energy sectors, such as advanced materials or niche renewable energy components, would likely be classified as question marks in a BCG matrix. These acquisitions, while offering significant growth potential, typically involve smaller initial market shares for HF Sinclair within these specific segments. For instance, an acquisition in the battery recycling technology space, a rapidly expanding but complex area, would fit this description.

Such ventures, like potential investments in companies developing novel carbon capture technologies or specialized hydrogen production methods, represent opportunities for substantial future returns. However, they also carry inherent risks due to market uncertainty and the need for significant integration efforts. For example, if HF Sinclair were to acquire a small firm specializing in rare earth element extraction for electric vehicle batteries, its immediate impact on HF Sinclair's overall market position would be minimal, but the long-term growth prospects could be considerable.

The success of these question mark assets hinges on HF Sinclair's ability to effectively integrate the acquired businesses and invest further to scale operations and build market presence. Without dedicated strategic focus and capital allocation, these promising ventures could easily falter and become underperforming assets, or dogs, within the portfolio.

- Emerging Sector Acquisition Example: HF Sinclair acquiring a startup focused on advanced biofuels production.

- Growth Potential: Access to a high-growth market driven by decarbonization efforts.

- Market Share: Initially low combined market share in this specific niche.

- Integration Risk: Need for significant investment and expertise to scale operations and compete effectively.

HF Sinclair's exploration of emerging technologies like advanced biofuels and hydrogen production represents classic question marks. These ventures have high growth potential but currently low market penetration, requiring substantial investment for development and scaling.

New geographic markets for refined products or specialty chemicals are also question marks, demanding significant capital for brand building and distribution to compete.

Pilot programs for Carbon Capture and Storage (CCS) are early-stage question marks, needing considerable capital and technological development despite the expanding decarbonization solutions market.

Acquisitions in niche renewable energy components, such as battery recycling technology, are question marks due to initial low market share within these specific segments, despite significant long-term growth prospects.

| Category | Description | Market Growth | HF Sinclair's Share | Investment Need |

| Emerging Renewables (Biofuels, Hydrogen) | Developing new energy sources | High | Low | High |

| New Geographic Markets | Expanding product reach | Moderate to High | Low | High |

| Carbon Capture & Storage (CCS) | Decarbonization technology | High | Very Low | Very High |

| Niche Energy Components (e.g., Battery Recycling) | Acquiring specialized tech | High | Low (within niche) | High |

BCG Matrix Data Sources

Our HF Sinclair BCG Matrix leverages a blend of financial disclosures, market research, and internal performance data to accurately position business segments. This ensures strategic insights are grounded in robust, verifiable information.