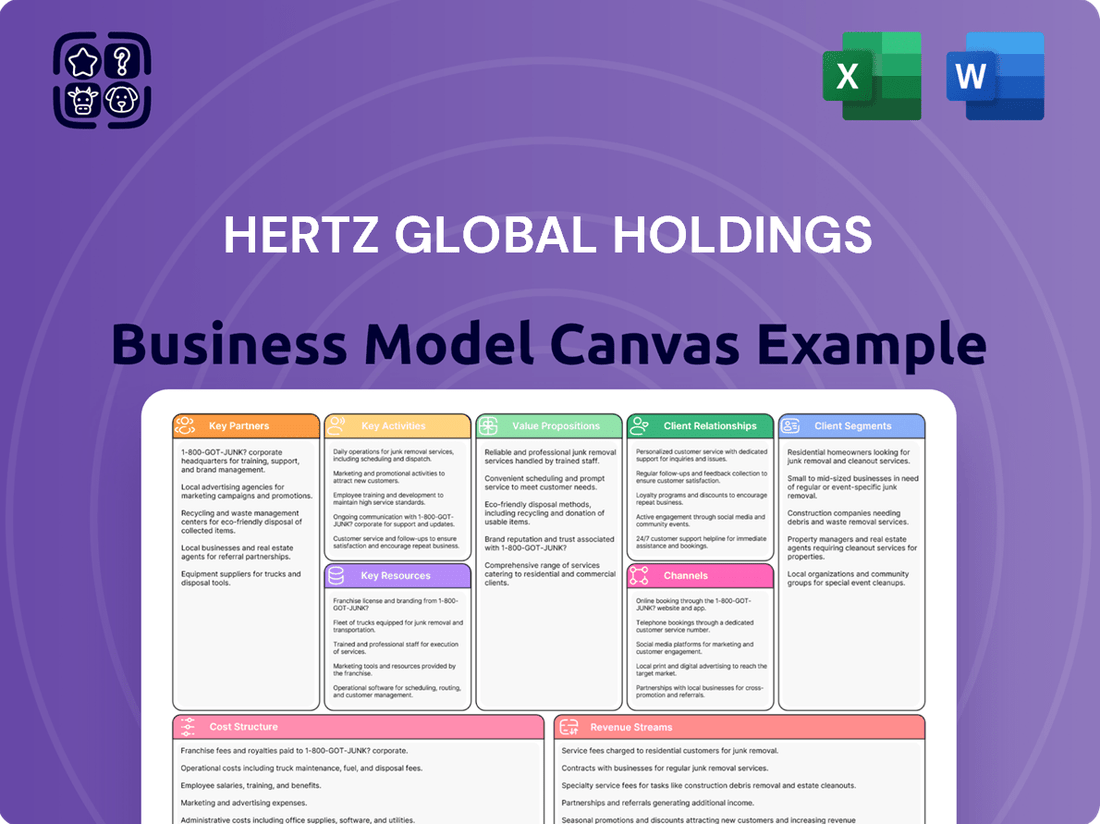

Hertz Global Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hertz Global Holdings Bundle

Unlock the strategic blueprint behind Hertz Global Holdings's success. This comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their operational engine. Ideal for anyone looking to understand the mechanics of a global leader in the car rental industry.

Partnerships

Hertz Global Holdings cultivates key partnerships with major automotive manufacturers such as General Motors, Tesla, and Polestar. These collaborations are vital for sourcing a varied fleet, encompassing both traditional gasoline-powered cars and increasingly popular electric vehicles (EVs).

These strategic alliances are instrumental in securing a consistent influx of new vehicles for Hertz's rental operations. Furthermore, they play a significant role in managing the financial impact of fleet depreciation by negotiating favorable acquisition prices and implementing efficient vehicle rotation strategies.

Franchise owners are crucial partners for Hertz, enabling the company to maintain a vast global presence. These independent operators manage locations under Hertz, Dollar, and Thrifty brands, significantly expanding Hertz's market reach. In 2024, Hertz continued to leverage its franchise network to serve customers across numerous international markets.

Hertz is strategically forming key partnerships with technology and AI providers to significantly boost its operational efficiency and elevate the customer experience. These collaborations are crucial for staying competitive in the evolving mobility landscape.

A prime example is Hertz's collaboration with UVeye, a company specializing in AI-driven vehicle inspection technology. This partnership aims to modernize and streamline vehicle maintenance processes, ensuring vehicles are in optimal condition for renters.

The deployment of UVeye's AI systems is already underway at major U.S. airports, demonstrating Hertz's commitment to integrating cutting-edge technology. This initiative is expected to improve inspection speed and accuracy, directly impacting fleet readiness and customer satisfaction.

Travel and Hospitality Organizations

Hertz Global Holdings deeply relies on strategic alliances within the travel and hospitality sector to fuel customer acquisition and drive demand. These partnerships are not just about visibility; they are critical for embedding Hertz's car rental services directly into the travel planning journey.

Collaborations with major airlines, hotel chains, and online travel agencies (OTAs) are fundamental. By integrating with platforms like Expedia, Booking.com, or directly with airline loyalty programs, Hertz gains access to a vast pool of travelers actively booking their trips. For instance, in 2024, OTAs continued to represent a significant booking channel for car rentals globally, with many travelers preferring to bundle their travel arrangements.

- Airline Partnerships: Hertz often partners with airlines to offer loyalty program members points or discounts, encouraging bookings through these channels.

- Hotel Integrations: Collaborations with hotel groups allow for seamless car rental booking at the time of room reservation, catering to guests needing local transportation.

- OTA Presence: Maintaining strong relationships with OTAs ensures Hertz car rentals are prominently featured and easily accessible to users browsing travel packages.

Financial Institutions and Lenders

Hertz Global Holdings relies on financial institutions and lenders for crucial vehicle financing and corporate liquidity. These partnerships are fundamental to maintaining its extensive fleet and operational needs.

Demonstrating the strength of these relationships, Hertz successfully extended the maturity of significant credit facilities in May 2025. This move highlights strong market acceptance and secured competitive pricing for its vehicle debt facilities, a testament to lender confidence.

- Vehicle Financing: Access to capital for acquiring and maintaining its rental fleet.

- Corporate Liquidity: Securing funds for day-to-day operations, working capital, and strategic initiatives.

- Debt Facility Management: Negotiating favorable terms and maturities on existing and new debt instruments.

Hertz's key partnerships extend to technology providers like UVeye, which enhances fleet maintenance through AI-driven vehicle inspections. In 2024, UVeye's systems were being deployed at major U.S. airports, improving inspection speed and accuracy.

These alliances are crucial for operational efficiency and customer experience, ensuring vehicles are ready and in top condition for renters.

The company also relies on financial institutions for fleet financing and liquidity, evidenced by the successful extension of credit facilities in May 2025, reflecting strong lender confidence and favorable terms.

| Partner Type | Examples | Impact |

|---|---|---|

| Automotive Manufacturers | General Motors, Tesla, Polestar | Fleet diversification (EVs), favorable acquisition prices |

| Technology Providers | UVeye | AI-driven inspections, improved fleet readiness |

| Travel & Hospitality | Airlines, Hotels, OTAs (Expedia, Booking.com) | Customer acquisition, integrated booking channels |

| Financial Institutions | Lenders | Fleet financing, corporate liquidity, debt management |

What is included in the product

Hertz Global Holdings' Business Model Canvas focuses on providing a wide range of mobility solutions, from traditional car rentals to emerging fleet management services, targeting diverse customer segments like leisure travelers and corporate clients through extensive global channels.

This model emphasizes a strong value proposition of convenience, reliability, and accessibility, supported by strategic partnerships and a robust operational infrastructure to ensure efficient vehicle acquisition, maintenance, and customer service.

Hertz's Business Model Canvas effectively relieves the pain point of complex travel planning by providing a clear, one-page snapshot of their rental car services, from customer segments to revenue streams.

It simplifies the often frustrating process of car rental by visually outlining key partnerships and activities, making it easier for customers to understand and engage with their offerings.

Activities

Hertz's key activities center on managing its vast vehicle fleet. This involves a strategic approach to purchasing vehicles at optimal times and prices, ensuring they are well-maintained, and then selling them to maximize resale value.

A crucial element is their 'Buy Right, Hold Right, Sell Right' strategy. This ensures Hertz acquires vehicles cost-effectively, keeps its fleet modern and appealing, and benefits from strong residual values, particularly through their retail sales channels.

As of the first quarter of 2025, over 70% of Hertz's core U.S. rental fleet consists of vehicles that are 12 months old or newer. This commitment to a young fleet directly supports their optimization efforts and customer satisfaction.

Vehicle rental operations form the core of Hertz's business, covering the daily process of providing cars, SUVs, and trucks to customers. This includes managing everything from booking a vehicle to its return, ensuring a smooth customer experience at rental counters, and keeping the fleet ready for use worldwide.

In 2024, Hertz continued to focus on optimizing its fleet and rental processes. The company aimed to enhance digital booking and contactless rental options, streamlining the customer journey. Hertz reported a significant portion of its revenue still comes from traditional rental transactions, highlighting the ongoing importance of efficient on-the-ground operations.

Hertz Car Sales is a crucial component of Hertz Global Holdings' operations, allowing the company to sell vehicles from its rental fleet directly to consumers. This channel is integral to their fleet management, ensuring vehicles are cycled out at optimal times to capture the best residual values.

In 2024, Hertz continued to leverage its used vehicle sales to offset depreciation costs and inject capital back into the business. This strategy is vital for maintaining a healthy fleet and managing the significant expenses associated with vehicle acquisition and maintenance.

Customer Service and Relationship Management

Hertz focuses on delivering exceptional customer service across all touchpoints, from booking to vehicle return. This includes ensuring clean and well-maintained vehicles and providing friendly, efficient assistance at rental counters and through digital channels. For instance, in 2024, Hertz continued to invest in its customer service training programs to enhance the in-person and digital experience.

Managing and enhancing loyalty programs like Hertz Gold Plus Rewards is a core activity. These programs incentivize repeat business by offering benefits such as faster rentals, bonus points, and exclusive offers. In 2023, Hertz reported continued strong engagement with its Gold Plus Rewards program, contributing significantly to customer retention.

Effectively addressing customer inquiries and resolving issues promptly is crucial for maintaining satisfaction and building trust. This involves robust support systems, whether through phone, email, or social media, to handle complaints and provide solutions. Hertz aims to resolve customer concerns efficiently to minimize negative impacts on brand perception.

- Customer Service Excellence: Ensuring a positive rental experience through well-maintained vehicles and helpful staff.

- Loyalty Program Management: Cultivating repeat business via benefits and rewards through programs like Hertz Gold Plus Rewards.

- Issue Resolution: Promptly addressing customer inquiries and complaints to maintain satisfaction and trust.

Technology and Digital Platform Development

Hertz is heavily invested in developing and enhancing its digital platforms, including its mobile app and online reservation capabilities. This focus is essential for providing a seamless customer journey, from booking to vehicle return. In 2024, Hertz continued to refine these digital tools to improve user experience and operational efficiency.

These technological advancements directly support Hertz's ability to manage its fleet and customer interactions more effectively. By streamlining the booking and management processes, Hertz aims to reduce friction for renters and optimize internal workflows. This digital infrastructure is a core component of their strategy to remain competitive in the evolving mobility landscape.

- Digital Platform Investment: Continued investment in enhancing the Hertz mobile app and online reservation systems in 2024.

- Customer Experience: Focus on creating a user-friendly digital interface for easier booking and rental management.

- Operational Efficiency: Leveraging technology to streamline fleet management and customer service operations.

- Competitive Edge: Digital development is key to maintaining a competitive advantage in the car rental market.

Hertz's key activities encompass sophisticated fleet management, including strategic vehicle acquisition, maintenance, and timely disposal to maximize residual values. This is complemented by robust rental operations, ensuring seamless customer experiences from booking to return, and a significant focus on digital platform enhancement for improved user interaction and operational efficiency. The company also leverages its Hertz Car Sales channel to optimize fleet turnover and capital recovery, while actively managing loyalty programs to foster customer retention.

| Key Activity | Description | 2024/2025 Relevance |

|---|---|---|

| Fleet Management | Strategic acquisition, maintenance, and sale of vehicles. | Over 70% of U.S. core fleet is 12 months or newer (Q1 2025). |

| Rental Operations | Core business of providing vehicles to customers. | Continued focus on optimizing processes and digital booking options. |

| Digital Platform Enhancement | Improving mobile app and online reservation systems. | Ongoing investment in 2024 to refine user experience and efficiency. |

| Used Vehicle Sales | Selling vehicles from rental fleet to consumers. | Used in 2024 to offset depreciation and generate capital. |

| Loyalty Program Management | Managing Hertz Gold Plus Rewards for repeat business. | Strong engagement reported, contributing to customer retention (2023 data). |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing for Hertz Global Holdings is the exact document you will receive after purchase. This is not a simplified example or a mockup; it represents the comprehensive analysis that will be delivered directly to you. Upon completing your transaction, you will gain full access to this same, professionally structured Business Model Canvas, ready for your immediate use.

Resources

Hertz's extensive vehicle fleet is its most crucial resource, encompassing a broad range of cars, SUVs, and trucks. This fleet is a mix of traditional internal combustion engine vehicles and an increasing number of electric vehicles, reflecting evolving market demands.

The company prioritizes fleet modernization, with over 70% of its core U.S. rental fleet being 12 months old or newer as of the first quarter of 2025. This focus on newer vehicles enhances customer experience and reduces maintenance costs.

Hertz is strategically managing fleet depreciation, targeting a depreciation per unit (DPU) below $300 by the close of 2025. This financial objective is key to maintaining profitability and optimizing asset utilization.

Hertz boasts an impressive global network of over 11,000 rental locations, a crucial resource that ensures widespread customer accessibility. This extensive physical footprint, operating in approximately 160 countries, includes a strong presence at major airports and in key urban centers, making it convenient for travelers to pick up and drop off vehicles.

Hertz Global Holdings leverages the strong brand recognition and reputation of Hertz, Dollar, and Thrifty. These globally recognized names, cultivated over a century of operation, are foundational to customer trust and preference in the highly competitive car rental market.

Technology Infrastructure and Digital Platforms

Hertz's technology infrastructure is a cornerstone of its operations, encompassing robust IT systems for reservations, fleet management, and customer relationship management. These systems are critical for maintaining efficiency and providing a smooth customer experience.

Digital platforms, including the Hertz mobile app and website, are key resources that facilitate seamless customer interactions and streamline the rental process. In 2024, Hertz continued to invest in enhancing these digital touchpoints to meet evolving customer expectations.

- IT Systems: Core platforms for reservations, fleet tracking, and customer data.

- Digital Platforms: Hertz website and mobile app for booking and managing rentals.

- Operational Efficiency: Technology drives efficiency in fleet utilization and customer service.

Skilled Workforce and Management Team

Hertz Global Holdings relies heavily on the expertise of its entire workforce, from frontline rental agents ensuring customer satisfaction to fleet managers optimizing vehicle utilization and the executive leadership guiding strategic direction. This human capital is fundamental to delivering smooth operations and adapting to market demands.

The company has actively bolstered its management team, appointing new executives to spearhead a critical strategic transformation. This focus is squarely on enhancing fleet management practices, maximizing revenue streams, and driving significant cost efficiencies across the organization. For instance, in 2024, Hertz continued to refine its fleet composition, aiming for greater fuel efficiency and lower maintenance costs, a direct reflection of management's strategic priorities.

- Skilled Rental Agents: Provide direct customer service and manage vehicle check-in/check-out processes.

- Expert Fleet Managers: Oversee vehicle acquisition, maintenance scheduling, and remarketing to optimize fleet health and cost.

- Experienced Executive Leadership: Drive strategic initiatives in areas like fleet modernization, digital transformation, and operational efficiency.

- Focus on Transformation: Recent executive appointments underscore a commitment to improving fleet management, revenue generation, and cost control in 2024.

Hertz's intellectual property, including its brand names and proprietary technology, is a key resource. This encompasses the established Hertz, Dollar, and Thrifty brands, which carry significant customer recognition and trust. Furthermore, the company's investments in digital platforms and operational software represent valuable intellectual capital.

Financial resources are critical, enabling fleet acquisition, technology development, and operational expansion. Hertz's ability to secure financing and manage its capital structure directly impacts its capacity to invest in fleet modernization and customer-facing technologies.

Hertz's strategic partnerships, particularly with airlines and travel agencies, are vital resources that drive customer acquisition and enhance service offerings. These collaborations expand reach and provide integrated travel solutions.

Value Propositions

Hertz provides a vast selection of vehicles, catering to diverse needs, and offers flexible rental periods from short hourly use to extended monthly leases. This adaptability ensures customers can find the right solution for any situation.

With thousands of locations worldwide, including prime spots at major airports, Hertz ensures unparalleled accessibility. This extensive network means convenient pickup and drop-off points are readily available, simplifying travel plans.

In 2024, Hertz continued to emphasize its commitment to customer convenience through its diverse fleet and widespread presence. For instance, their airport locations remain critical hubs, facilitating seamless travel for millions of passengers annually.

Hertz Global Holdings offers customers a vast array of vehicle choices, spanning everything from compact cars to luxury sedans, robust SUVs, and practical trucks. This extensive selection ensures that whether a customer is traveling for business, enjoying a family vacation, or requiring a specific vehicle for a unique task, they can find the perfect fit for their needs.

In 2024, Hertz continued to emphasize this diverse fleet, understanding that customer satisfaction is directly tied to having the right vehicle available. For instance, during peak travel seasons, the demand for larger SUVs and minivans often surges, and Hertz's ability to meet this demand across its network is a key differentiator.

Hertz's commitment to a reliable fleet is central to its value proposition. Through its 'Buy Right, Hold Right, Sell Right' strategy, the company actively manages fleet age and condition, ensuring customers receive newer, well-maintained vehicles. This proactive approach minimizes the chance of unexpected breakdowns, directly improving the customer rental experience.

In 2024, Hertz continued its strategic fleet modernization efforts. By regularly rotating vehicles, the company aims to keep its average fleet age lower than many competitors. This focus on newer vehicles translates to enhanced reliability and a more satisfying rental for customers, a key differentiator in the competitive car rental market.

Global Accessibility and Brand Trust

Hertz's global accessibility is a cornerstone of its value proposition. With operations spanning over 160 countries, the company ensures travelers can access rental services virtually anywhere their journeys take them. This extensive network is crucial for both leisure and business travelers who rely on consistent availability.

The brand trust Hertz has cultivated over its century of operation is invaluable. This long history translates into a perception of reliability and quality service, which is a significant draw for customers seeking a dependable rental experience. This trust is built on consistent performance and customer satisfaction across its vast global footprint.

- Global Reach: Hertz operates in over 160 countries, providing unparalleled accessibility for international travelers.

- Brand Longevity: With a history dating back to 1924, Hertz has established a deep reservoir of brand trust and recognition.

- Service Consistency: Customers expect and generally receive a uniform level of service quality, regardless of their location, reinforcing brand loyalty.

Loyalty Programs and Digital Convenience

Hertz Gold Plus Rewards is a key loyalty program, offering members perks like faster counter service and points accumulation for future rentals. This directly addresses customer retention and encourages repeat business by providing tangible benefits for frequent use.

The company’s digital platforms, including its mobile app, are central to its value proposition, offering unmatched convenience. Users can easily browse vehicles, make reservations, and manage their rentals entirely online, significantly reducing friction in the customer journey. In 2024, Hertz reported a substantial increase in digital bookings, underscoring the importance of this convenience factor.

- Loyalty Program: Hertz Gold Plus Rewards

- Key Benefits: Expedited service, reward points

- Digital Convenience: Mobile app and online booking platforms

- Customer Impact: Streamlined rental management and enhanced user experience

Hertz offers a diverse fleet, from economy cars to larger SUVs, ensuring customers find the right vehicle for any need. This variety, combined with a commitment to newer, well-maintained vehicles through its fleet modernization strategy, enhances customer satisfaction and reliability. In 2024, Hertz continued to prioritize fleet quality, aiming to keep its average fleet age competitive.

The company's extensive global presence, with operations in over 160 countries, provides unparalleled accessibility. This wide network, particularly at major airports, simplifies travel for millions. Furthermore, Hertz leverages its century-long brand heritage, building trust through consistent service and a strong reputation for reliability.

Hertz enhances customer loyalty and convenience through its digital platforms and the Hertz Gold Plus Rewards program. The mobile app streamlines bookings and rental management, while the loyalty program offers benefits like expedited service and reward points, encouraging repeat business. In 2024, digital bookings saw a significant uptick, highlighting the value of these convenient services.

| Value Proposition | Description | Key Features | Customer Benefit | 2024 Data/Focus |

|---|---|---|---|---|

| Diverse & Reliable Fleet | Wide selection of vehicles, maintained for optimal performance. | Economy, SUV, Luxury, Trucks; Fleet modernization strategy. | Right vehicle for any need; Reduced risk of breakdowns. | Continued fleet rotation and quality checks. |

| Global Accessibility & Brand Trust | Presence in over 160 countries, built on a century of service. | Extensive airport locations; Long-standing brand reputation. | Convenient rental worldwide; Confidence in service quality. | Maintaining strong presence in key travel hubs. |

| Digital Convenience & Loyalty | Streamlined booking and rental management via digital tools. | Mobile app, online booking; Hertz Gold Plus Rewards program. | Easy rental process; Rewards for repeat customers. | Increased digital bookings; Enhanced loyalty program engagement. |

Customer Relationships

Hertz empowers customers through self-service via its robust digital platforms, including its website and mobile app. This allows for seamless booking, modification, and management of rentals, aligning with modern traveler demands for convenience and efficiency. In 2023, Hertz reported a significant portion of its bookings occurred through digital channels, reflecting the success of this strategy.

Hertz Gold Plus Rewards is a cornerstone of Hertz's customer relationships, designed to foster loyalty through tangible benefits. Members enjoy expedited service, points accumulation for free rentals, and special discounts, all aimed at making repeat rentals more appealing and valuable.

In 2024, Hertz continued to emphasize its loyalty program as a differentiator. While specific enrollment numbers fluctuate, the program's structure, offering perks like skip-the-counter service and vehicle upgrades, directly incentivizes customers to choose Hertz consistently, thereby strengthening the bond between the company and its frequent renters.

Hertz ensures a human connection through dedicated customer service at its rental counters and via call centers. This is crucial for addressing complex queries, resolving immediate issues, and accommodating unique customer needs, providing a vital layer of support beyond digital channels. For instance, in 2024, Hertz reported a significant volume of customer interactions handled by its service teams, underscoring the continued importance of personal assistance in the rental experience.

Corporate and Business Account Management

Hertz cultivates strong ties with its corporate and business clientele through dedicated account management. This involves building direct relationships to understand and cater to the unique mobility requirements of companies. For instance, in 2024, Hertz continued to focus on strengthening these partnerships, recognizing their significant contribution to overall revenue.

These corporate accounts often come with bespoke service packages, including customized pricing structures and preferential access to vehicles. Dedicated account managers act as primary points of contact, ensuring seamless rental experiences and proactive problem-solving for business travelers. This personalized approach is key to retaining high-value clients.

- Tailored Services: Offering specific vehicle classes, delivery/pickup options, and loyalty program integration for business needs.

- Negotiated Rates: Providing volume-based discounts and fixed pricing agreements for consistent corporate travel budgets.

- Dedicated Account Management: Assigning specific Hertz representatives to manage client relationships, bookings, and issue resolution.

- Reporting and Analytics: Supplying businesses with data on rental patterns, costs, and compliance to optimize travel spend.

Feedback and Resolution Mechanisms

Hertz actively gathers customer insights through multiple avenues, such as post-rental surveys and online review platforms, to gauge satisfaction and identify areas for improvement. For instance, in 2024, Hertz continued to refine its digital feedback tools to capture a broader range of customer sentiment.

Resolving customer issues promptly and effectively is paramount for Hertz to foster loyalty and protect its brand image. By addressing complaints efficiently, Hertz aims to turn potentially negative experiences into opportunities for demonstrating commitment to service excellence.

- Customer Feedback Channels: Hertz utilizes surveys, online reviews, and direct communication to collect customer feedback.

- Complaint Resolution Focus: The company prioritizes efficient and satisfactory resolution of customer complaints to enhance retention.

- Data-Driven Improvements: Feedback data is analyzed to inform operational adjustments and service enhancements.

- Brand Reputation Management: Effective handling of customer issues directly contributes to maintaining and improving Hertz's brand perception.

Hertz cultivates customer relationships through a blend of digital self-service, a robust loyalty program, and personalized human interaction. Its digital platforms, including the Hertz app and website, saw continued growth in bookings throughout 2024, offering convenience and efficiency. The Hertz Gold Plus Rewards program remains a key driver of loyalty, providing benefits like expedited service and points for free rentals, with a focus on enhancing member value in 2024.

Dedicated account management for corporate clients in 2024 further solidified these relationships, offering tailored services and negotiated rates to meet business travel needs. The company actively seeks customer feedback through surveys and online channels to drive service improvements, with a strong emphasis on efficient complaint resolution to maintain brand loyalty and reputation.

Channels

Hertz Global Holdings directly manages a vast network of rental locations, ensuring a strong physical presence at key travel hubs like airports and bustling city centers. This direct ownership model allows for greater control over fleet management, customer experience, and brand consistency across its global operations. As of the first quarter of 2024, Hertz reported approximately 10,000 total global locations, with a significant portion being company-operated.

Franchisee locations are a cornerstone of Hertz's expansive global footprint. These independently owned and operated businesses significantly amplify Hertz's market presence, ensuring accessibility and service in a multitude of diverse geographic areas.

As of the end of 2023, Hertz reported having approximately 1,600 company-owned locations and a substantial network of over 2,000 franchise locations worldwide. This widespread franchisee network is crucial for delivering consistent brand standards and customer experiences across varied international and domestic markets, contributing significantly to Hertz's overall revenue streams and brand recognition.

Hertz's official website and mobile app are crucial digital gateways, allowing customers to easily search for vehicles, make reservations, manage bookings, and complete check-in and check-out procedures. These platforms are designed for the modern, tech-savvy traveler, offering a streamlined experience.

In 2024, Hertz continued to invest in its digital infrastructure, recognizing the growing preference for online transactions. The company reported a significant portion of its reservations are now made through these digital channels, reflecting a strong adoption rate among its customer base.

Online Travel Agencies (OTAs) and Aggregators

Hertz leverages online travel agencies (OTAs) and aggregators to significantly broaden its customer reach. These platforms act as crucial distribution channels, connecting Hertz with travelers who actively compare rental car options alongside flights and accommodations. In 2024, the online travel market continued to be a dominant force in booking decisions, with a substantial percentage of leisure travel bookings originating through these digital intermediaries.

By partnering with major OTAs and aggregators, Hertz gains access to a diverse global customer base that might not directly visit its own website. This strategy is essential for capturing last-minute bookings and catering to travelers who value the convenience of a one-stop-shop for their travel arrangements. The increasing reliance on mobile bookings further amplifies the importance of these online partnerships.

- Expanded Market Access: OTAs and aggregators provide Hertz with visibility to millions of potential customers actively searching for rental vehicles.

- Customer Acquisition: These platforms are key drivers for acquiring new customers who may not be familiar with the Hertz brand.

- Competitive Visibility: Hertz maintains a presence alongside competitors, allowing customers to directly compare offerings.

- Dynamic Pricing Opportunities: Partnerships can facilitate participation in promotional campaigns and dynamic pricing strategies offered by OTAs.

Direct Sales for Used Vehicles

Hertz Car Sales serves as a direct-to-consumer channel for Hertz Global Holdings, offering vehicles from its rental fleet. This approach allows for efficient fleet turnover and provides consumers with a transparent way to purchase pre-owned rental cars. In 2023, Hertz reported selling approximately 200,000 vehicles through its various channels, with Hertz Car Sales being a significant contributor to this disposition.

The strategy involves both online platforms, like HertzCarSales.com, and physical retail locations. These locations offer a no-haggle pricing model and often provide financing options, making the purchasing process more straightforward for buyers. This direct sales model helps Hertz manage its fleet assets effectively and capture additional revenue beyond rental income.

- Direct Sales Channel: Hertz Car Sales directly sells used vehicles from the rental fleet to consumers.

- Online and Physical Presence: Utilizes both digital platforms and brick-and-mortar locations for sales.

- Fleet Disposition: A key strategy for managing and monetizing the rental car fleet.

- Consumer Benefits: Offers transparent pricing and a streamlined purchasing experience.

Hertz utilizes a multi-channel approach to reach customers, combining physical locations with robust digital platforms and strategic partnerships. This diverse channel strategy ensures accessibility and convenience for a wide range of travelers. In 2024, Hertz continued to emphasize digital bookings, with a significant percentage of reservations originating online, reflecting evolving consumer preferences.

The company's owned and franchised locations form the backbone of its physical presence, with approximately 10,000 global locations as of Q1 2024, including over 2,000 franchise sites by year-end 2023. Digital channels like Hertz.com and the mobile app are critical for reservations and customer management, while OTAs and aggregators expand reach to new customer segments. Hertz Car Sales provides a direct-to-consumer outlet for fleet disposition, selling around 200,000 vehicles in 2023.

| Channel | Description | Key Data/Impact |

|---|---|---|

| Company-Operated Locations | Directly managed rental sites | Approx. 10,000 global locations (Q1 2024) |

| Franchise Locations | Independently owned and operated sites | Over 2,000 worldwide (end of 2023) |

| Digital Platforms (Website/App) | Online reservations and booking management | Significant portion of reservations in 2024 |

| Online Travel Agencies (OTAs) & Aggregators | Partnerships for broader customer reach | Key for customer acquisition and visibility |

| Hertz Car Sales | Direct sales of used fleet vehicles | Approx. 200,000 vehicles sold in 2023 |

Customer Segments

Leisure travelers, a core customer base for Hertz, encompass individuals and families planning vacations or short trips. In 2024, Hertz likely saw continued demand from this segment, seeking affordable rental options and a wide selection of vehicles to suit diverse travel needs. Convenience, particularly at airport locations and tourist hotspots, remains a key driver for these renters.

Business travelers, a crucial segment for Hertz, are professionals on the move for meetings, conferences, and project-based work. They prioritize efficiency and reliability in their transportation choices. In 2024, Hertz continued to focus on providing seamless rental experiences for this group, understanding their need for quick pick-ups and drop-offs, especially at major airport hubs.

This segment strongly values corporate agreements and loyalty programs that offer perks like discounted rates and expedited service. Hertz's Gold Plus Rewards program, for instance, aims to cater to these preferences, recognizing the importance of speed and cost-effectiveness for individuals whose travel is dictated by business schedules. The demand for convenient airport locations remains paramount, ensuring minimal disruption to tight itineraries.

This segment comprises individuals requiring vehicles for everyday local needs, such as running errands or commuting, and those whose personal vehicles are undergoing repairs. Hertz prioritizes convenient, neighborhood-based locations for these customers, recognizing their need for immediate and accessible transportation solutions. In 2024, Hertz continued to focus on its neighborhood market presence, a key strategy to capture this demand.

Corporate and Commercial Clients

Hertz Global Holdings serves a broad spectrum of corporate and commercial clients, from small businesses to large enterprises. These clients depend on Hertz for flexible fleet solutions, including long-term rentals and vehicles for their employees. For instance, in 2024, Hertz continued to focus on securing multi-year agreements with major corporations, a strategy that underpins a significant portion of its revenue.

This segment often involves customized offerings and negotiated contracts. Businesses frequently seek volume discounts and specialized vehicle types to meet specific operational needs. Hertz's ability to provide a diverse fleet, from standard sedans to larger vans and trucks, caters to these varied requirements. The company's commercial rental partnerships are crucial for its overall financial performance.

- Fleet Solutions: Businesses of all sizes utilize Hertz for their fleet needs, ranging from short-term project vehicles to extensive employee car programs.

- Long-Term Rentals: Many corporations opt for Hertz's long-term rental agreements, which offer cost predictability and fleet management convenience.

- Negotiated Contracts: Hertz engages in direct negotiations with corporate clients, often providing tailored pricing, service level agreements, and volume discounts.

- Specialized Vehicles: The company accommodates requests for specialized vehicle types, such as cargo vans, luxury vehicles, or specific utility trucks, to support diverse business operations.

Used Car Buyers

Hertz’s used car buyers represent a significant customer segment, primarily composed of individuals and businesses seeking to acquire pre-owned vehicles directly from Hertz’s extensive rental fleet. This group is drawn to Hertz’s offerings due to a combination of transparent, no-haggle pricing structures and the assurance of purchasing well-maintained vehicles that have undergone regular servicing. The appeal is further amplified by Hertz’s specific programs designed to facilitate this transition, such as the ‘Rent2Buy’ initiative, which allows potential buyers to test drive vehicles before committing to a purchase.

In 2024, the used car market continued to be robust, with Hertz actively participating in remarketing its fleet. For instance, Hertz reported selling approximately 1.8 million vehicles in 2023, a substantial portion of which were purchased by individual consumers and smaller businesses. This volume highlights the scale at which Hertz engages this customer segment. The attractiveness of Hertz-certified used cars stems from their perceived reliability and the convenience of the purchasing process, differentiating them from typical dealership transactions.

- Value Proposition: Access to well-maintained, often late-model vehicles at competitive, no-haggle prices.

- Customer Needs: Desire for reliable transportation, transparent pricing, and a straightforward purchase experience.

- Acquisition Channels: Direct sales through Hertz Car Sales locations and online platforms, often supported by the Rent2Buy program.

- Market Trend Impact: Continued demand for affordable used vehicles in 2024, benefiting Hertz’s fleet remarketing strategy.

Hertz's customer segments are diverse, catering to both individual travelers and corporate entities. Leisure and business travelers form a significant portion, valuing convenience and reliability. Corporate clients rely on Hertz for flexible fleet solutions and long-term rentals, often secured through negotiated contracts. Additionally, Hertz actively engages with buyers of its used vehicles, offering well-maintained cars at competitive prices, a strategy that proved successful in 2023 with approximately 1.8 million vehicles sold.

| Customer Segment | Key Characteristics | Value Proposition | 2024 Focus/Activity |

|---|---|---|---|

| Leisure Travelers | Vacationers, families, short trips | Affordable options, wide vehicle selection, convenience | Continued demand, focus on airport and tourist locations |

| Business Travelers | Professionals on business trips | Efficiency, reliability, speed, loyalty programs | Seamless rental experience, airport hub focus |

| Corporate & Commercial Clients | Small to large enterprises | Flexible fleet solutions, long-term rentals, customized offerings | Securing multi-year agreements, volume discounts |

| Used Car Buyers | Individuals and businesses seeking pre-owned vehicles | Transparent pricing, well-maintained vehicles, Rent2Buy program | Active fleet remarketing, leveraging used car market demand |

Cost Structure

The acquisition of its vast vehicle fleet represents Hertz's most significant cost. This initial outlay is then systematically reduced over time through depreciation.

Hertz actively focuses on managing its Depreciation Per Unit (DPU). A key objective is to bring this DPU below $300 by the close of 2025.

Achieving this DPU target involves strategic fleet rotation and careful, cost-effective vehicle purchasing decisions.

Direct operating expenses are the lifeblood of Hertz's rental operations, encompassing everything from routine maintenance and repairs to fuel, cleaning, and insurance for its vast fleet. These are the costs directly tied to getting cars ready and keeping them on the road for customers.

Hertz actively pursues cost control initiatives to boost efficiency in these areas. For instance, in 2023, the company reported significant investments in fleet modernization and maintenance programs, aiming to reduce per-vehicle operating costs and improve vehicle availability.

Selling, General, and Administrative (SG&A) expenses for Hertz Global Holdings are critical to its operations, covering crucial areas like employee salaries and benefits, advertising campaigns, technology upgrades, and general office management. These costs directly impact the company's ability to reach customers and maintain efficient internal processes.

Hertz has been actively managing its SG&A, with a notable reduction observed. For instance, in the first quarter of 2025, the company reported a significant decrease in these expenses, reflecting successful cost-saving initiatives. This focus on efficiency aims to bolster profitability and enhance the company's overall financial health.

Location and Facility Costs

Hertz Global Holdings incurs significant expenses to maintain its extensive network of rental locations. These costs encompass rent for prime airport and city sites, as well as utilities and ongoing maintenance for both corporate-owned and franchised facilities. For example, in 2023, Hertz reported total operating expenses of $9.8 billion, a substantial portion of which is attributable to its physical footprint.

The company's commitment to a widespread presence means substantial investment in real estate and upkeep. This includes costs associated with lease agreements, property taxes, insurance, and general facility upkeep to ensure a positive customer experience. These location and facility costs are fundamental to Hertz's operational model, directly impacting its ability to serve customers effectively across numerous markets.

- Rent: Expenses for leasing airport concessions and other prime rental locations.

- Utilities: Costs for electricity, water, and other services at all operating sites.

- Maintenance: Ongoing expenses for upkeep, repairs, and improvements to facilities.

- Property Taxes & Insurance: Costs associated with owning or leasing property and insuring the facilities.

Technology and IT Infrastructure Costs

Hertz Global Holdings makes substantial investments in its technology and IT infrastructure. This includes the development, ongoing maintenance, and regular upgrades of critical systems like their reservation platforms, advanced fleet management software, and robust cybersecurity measures. These investments are crucial for supporting their digital operations and driving overall efficiency across the business.

In 2024, Hertz continued to focus on enhancing its digital capabilities. For instance, the company has been investing in its mobile app and online booking systems to provide a more seamless customer experience. These technological upgrades are designed to streamline the rental process, from initial booking to vehicle return, thereby improving customer satisfaction and operational effectiveness.

- Reservation Platforms: Ongoing development and maintenance to ensure user-friendly online and mobile booking experiences.

- Fleet Management Software: Investments in systems that track vehicle location, maintenance needs, and utilization for optimal fleet efficiency.

- Cybersecurity: Significant expenditure to protect customer data and company systems from evolving digital threats.

- Digital Transformation Initiatives: Funding for projects aimed at modernizing IT infrastructure and adopting new technologies to improve service delivery and operational insights.

Hertz's cost structure is heavily influenced by its massive vehicle fleet, with depreciation being a primary ongoing expense. The company is actively working to reduce its Depreciation Per Unit (DPU) to below $300 by the end of 2025 through strategic fleet management. Direct operating costs, including maintenance, fuel, and insurance, are also significant, with Hertz investing in modernization to improve efficiency. Selling, General, and Administrative (SG&A) expenses, covering salaries, marketing, and technology, have seen reductions, bolstering profitability.

| Cost Category | Description | 2023 Impact (Illustrative) | 2024 Focus | 2025 Target |

|---|---|---|---|---|

| Fleet Acquisition & Depreciation | Initial purchase and ongoing value reduction of vehicles. | Largest single cost component. | Strategic purchasing, fleet rotation. | DPU below $300. |

| Direct Operating Expenses | Maintenance, fuel, cleaning, insurance. | Significant portion of total operating expenses. | Modernization programs, efficiency drives. | Reduced per-vehicle operating costs. |

| SG&A Expenses | Salaries, marketing, technology, administration. | Managed for efficiency. | Cost-saving initiatives. | Continued reduction. |

| Location & Facility Costs | Rent, utilities, maintenance for rental sites. | Substantial due to extensive network. | Optimizing site management. | Ensure positive customer experience. |

| Technology & IT Infrastructure | Software development, maintenance, cybersecurity. | Crucial for digital operations. | Enhancing digital capabilities, mobile app. | Streamlined rental process. |

Revenue Streams

Hertz Global Holdings generates its main income from charging customers for renting vehicles, whether for a short trip or a longer period. This applies to both individual renters and businesses using Hertz, Dollar, and Thrifty brands, with pricing typically set on a daily, weekly, or monthly basis.

Revenue is generated from selling used vehicles from Hertz's rental fleet directly to the public. This happens mainly through Hertz Car Sales locations.

This revenue stream is becoming more significant for Hertz as they aim to get the most value out of their vehicles. Selling directly to consumers through retail channels helps them achieve higher residual values.

In 2023, Hertz sold approximately 150,000 vehicles through its rental fleet, contributing significantly to its overall financial performance.

Hertz Global Holdings generates significant revenue from ancillary product and service sales, enhancing the customer experience and boosting profitability. These optional add-ons include insurance waivers, which provide peace of mind for renters, and GPS navigation systems like NeverLost, ensuring customers can easily find their way. In 2024, the demand for these convenience services continued to be a strong contributor to overall revenue.

Franchise Fees and Royalties

Hertz Global Holdings taps into its extensive franchise network for significant revenue. This stream primarily consists of initial franchise fees paid by new operators and ongoing royalty payments. These royalties are typically calculated as a percentage of the monthly gross sales generated by each franchisee, creating a direct link between the franchisee's success and Hertz's income.

For example, in 2023, Hertz continued to leverage its franchise model, which is a key component of its revenue generation strategy. While specific figures for franchise fees and royalties are often embedded within broader financial reporting, the company's global presence, with thousands of locations, underscores the substantial contribution of these revenue streams.

The franchise model allows Hertz to expand its market reach with lower capital investment compared to company-owned locations. This strategy is crucial for maintaining brand visibility and accessibility across diverse geographic areas.

- Franchise Fees: Initial lump-sum payments from new franchisees to secure the rights to operate under the Hertz brand.

- Royalty Payments: Recurring revenue derived from a percentage of each franchisee's monthly gross sales.

- Global Network: The franchise model supports Hertz's expansive global footprint, driving brand recognition and customer access.

Fleet Management Services (Potential)

Hertz Global Holdings, while primarily known for its car rental services, possesses significant expertise in fleet management. This core competency could be developed into a distinct revenue stream by offering specialized fleet management services to external businesses. Such a move would align with Hertz's ongoing strategic emphasis on optimizing its own vast fleet operations.

While not a primary revenue driver currently, this potential service offering could tap into a growing market. Businesses increasingly seek external partners to manage their vehicle fleets efficiently, covering aspects like acquisition, maintenance, and disposal. Hertz's established infrastructure and experience in managing tens of thousands of vehicles position it well to capitalize on this demand.

Consider the following potential aspects of fleet management services offered by Hertz:

- Vehicle Acquisition and Disposal: Leveraging Hertz's purchasing power and expertise to procure and sell vehicles for clients.

- Maintenance and Repair Coordination: Managing scheduled maintenance and unexpected repairs through Hertz's network of service providers.

- Telematics and Data Analytics: Providing insights into vehicle usage, driver behavior, and operational efficiency through advanced telematics solutions.

- Fleet Optimization Strategies: Consulting on right-sizing fleets, fuel efficiency, and total cost of ownership for client businesses.

Hertz Global Holdings generates revenue from vehicle rentals across its brands, with pricing structured daily, weekly, or monthly. Additionally, the company profits from selling used vehicles from its rental fleet directly to consumers through Hertz Car Sales locations, a strategy aimed at maximizing residual values.

Ancillary products and services, such as insurance waivers and navigation systems, are also significant revenue contributors. The company's franchise model, involving initial fees and ongoing royalty payments based on franchisee sales, further diversifies its income streams and supports global expansion.

In 2023, Hertz sold approximately 150,000 vehicles, highlighting the importance of fleet sales. The company continues to leverage its franchise network, which is crucial for its broad market presence and brand accessibility.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Vehicle Rentals | Income from renting vehicles to individuals and businesses. | Core revenue source across Hertz, Dollar, Thrifty brands. |

| Used Vehicle Sales | Revenue from selling fleet vehicles directly to the public. | Significant contribution, with ~150,000 vehicles sold in 2023. |

| Ancillary Services | Income from optional add-ons like insurance waivers and GPS. | Continued strong demand in 2024 enhances profitability. |

| Franchise Operations | Fees and royalties from franchisees operating under Hertz brands. | Key to expanding global reach with lower capital investment. |

Business Model Canvas Data Sources

The Hertz Global Holdings Business Model Canvas is informed by a blend of internal financial disclosures, industry-specific market research reports, and operational data. These sources provide a comprehensive view of Hertz's customer segments, value propositions, and revenue streams.