Hertz Global Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hertz Global Holdings Bundle

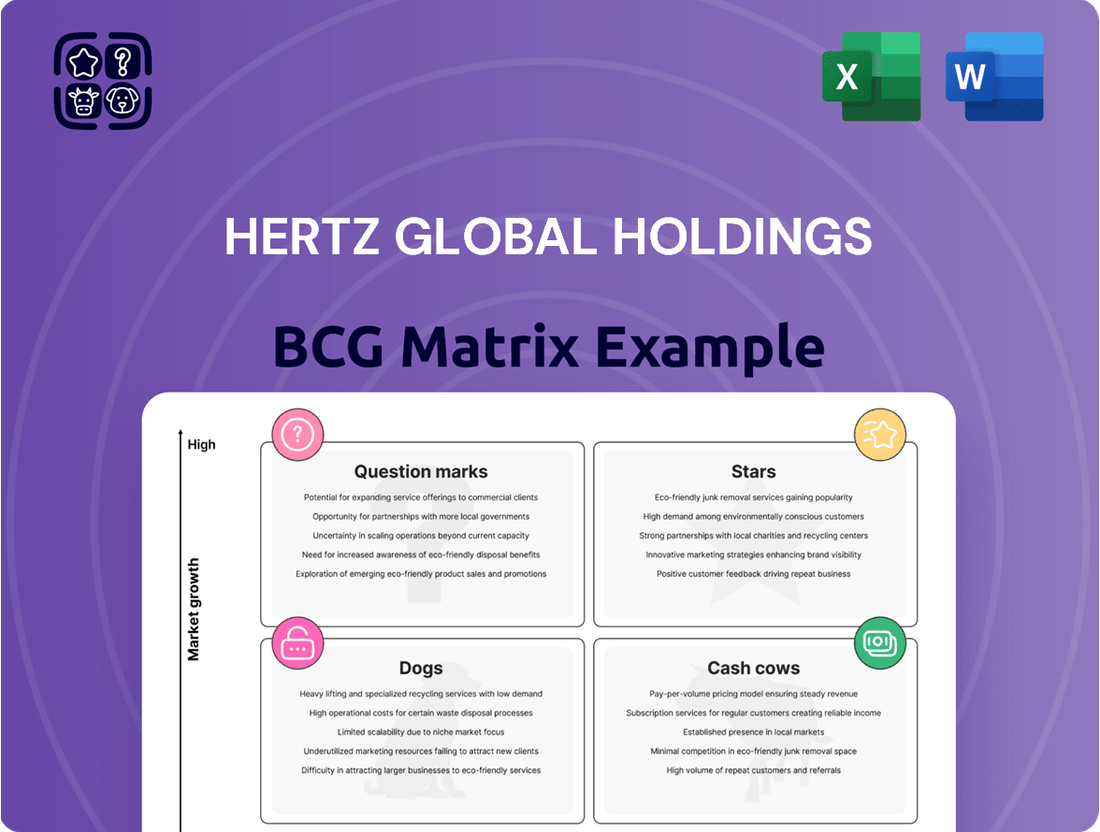

Curious about Hertz Global Holdings' market standing? Our BCG Matrix analysis reveals their fleet's potential as Stars, Cash Cows, Dogs, or Question Marks, offering a strategic overview of their competitive landscape.

Unlock the full potential of this analysis by purchasing the complete Hertz Global Holdings BCG Matrix. Gain detailed quadrant placements and actionable insights to optimize your investment and fleet management strategies.

Don't miss out on the comprehensive breakdown. The full report provides a roadmap for smart capital allocation and product decisions, ensuring Hertz Global Holdings stays ahead in the dynamic rental car market.

Stars

The core Hertz brand is undergoing a significant strategic transformation, guided by a 'Back-to-Basics Roadmap'. This initiative prioritizes robust fleet management, enhanced revenue optimization, and stringent cost efficiency measures. The goal is to reinforce Hertz's standing as a leader in the expanding global car rental sector.

This strategic reset is crucial for boosting operational performance and building a more resilient financial footing, essential for sustained value creation. The car rental market is anticipated to see a compound annual growth rate of 10.5% between 2025 and 2030, highlighting the opportune timing for Hertz's proactive market positioning.

Hertz's commercial strategy centers on enhancing Revenue Per Unit (RPU) by shifting its fleet mix towards higher Revenue Per Day (RPD) segments. This strategic emphasis on premium rental channels, where demand is robust, enables the company to secure more favorable pricing and boost overall profitability.

By maintaining disciplined capacity management and prioritizing premium RPD business, Hertz aims for sustained revenue expansion within this profitable market. For instance, in the first quarter of 2024, Hertz reported a total revenue of $1.8 billion, with a notable increase in average rental rates contributing to improved financial performance.

Hertz has aggressively optimized its fleet composition, with a significant refresh program underway in 2024 and 2025. This involves replacing older vehicles with newer models that boast lower operating costs and better depreciation profiles.

By the first quarter of 2025, an impressive 70% of Hertz's core U.S. rental fleet is 12 months old or newer. This strategic move ensures a modern and appealing fleet for customers.

This modernized fleet is a key differentiator for Hertz, directly contributing to an enhanced customer experience and strengthening its market position against competitors.

Disciplined Fleet Management ('Buy Right, Hold Right, Sell Right')

Hertz Global Holdings' 'Buy Right, Hold Right, Sell Right' strategy is a cornerstone of its fleet management, aiming to transform the fleet into a competitive asset. This disciplined approach focuses on acquiring vehicles at optimal prices, ensuring the fleet composition aligns with evolving customer demand, and strategically selling vehicles to maximize their residual value. The objective is to significantly reduce depreciation per unit (DPU), a key metric in the car rental industry.

This strategy directly impacts Hertz's position within the BCG Matrix by optimizing its Stars. By buying right, Hertz secures vehicles at favorable costs, enhancing the profitability of its most in-demand vehicles (Stars). Holding right ensures these vehicles are maintained and utilized efficiently, maximizing their revenue-generating potential. Selling right at the opportune moment, often through retail channels, helps Hertz recoup a larger portion of the vehicle's initial cost, further boosting the performance of its Star assets.

- Buy Right: Focuses on strategic sourcing and negotiation to acquire vehicles at the lowest possible cost, directly impacting the initial investment for Star assets.

- Hold Right: Emphasizes efficient fleet utilization and maintenance to maximize revenue generation and minimize operational costs for Star vehicles.

- Sell Right: Involves optimizing the timing and channels for vehicle disposal to achieve the highest possible residual value, crucial for the profitability of Star assets.

- DPU Reduction: The combined effect of these practices aims to lower the depreciation per unit, a critical factor in the financial health of Hertz's Star segment.

Strength in Key Geographic Markets

Hertz Global Holdings demonstrates considerable strength in its key geographic markets, particularly North America, which stood as its largest revenue-generating region in 2024. This established presence allows Hertz to capitalize on its existing infrastructure and strong brand recognition to capture growth opportunities within these vital areas.

Despite facing competitive pressures, Hertz's strategic focus and continued investment in these high-growth, high-revenue geographies are crucial for solidifying its market share and enhancing profitability within the dynamic global car rental sector.

- North America Dominance: In 2024, North America represented Hertz's primary revenue driver, underscoring its significant market penetration and operational scale in this region.

- Leveraging Existing Infrastructure: The company's extensive network in key markets enables it to efficiently deploy assets and services, thereby reducing operational costs and improving customer accessibility.

- Brand Recognition Advantage: Hertz's well-established brand in major geographies provides a competitive edge, attracting customers who value familiarity and trust in their rental choices.

- Strategic Investment Focus: Continued capital allocation towards strengthening its position in these core markets is vital for sustained growth and competitive positioning against rivals.

Hertz's Stars in the BCG Matrix represent its high-market-share, high-growth segments, primarily driven by its strong presence in North America. The company's strategic focus on premium rental channels and fleet modernization directly bolsters these Star assets.

By acquiring vehicles at optimal costs and ensuring efficient utilization, Hertz maximizes the profitability of its Star segment. The aggressive fleet refresh, with 70% of the U.S. core fleet being 12 months or newer by Q1 2025, directly supports the appeal and revenue generation of these Star vehicles.

North America, Hertz's largest revenue-generating region in 2024, is a key indicator of its Star performance. The company's ability to leverage existing infrastructure and brand recognition in these high-growth areas solidifies its Star position.

Hertz's 'Buy Right, Hold Right, Sell Right' strategy directly enhances the financial performance of its Stars by reducing depreciation per unit and maximizing residual values.

| BCG Matrix Category | Hertz's Position | Key Drivers | Supporting Data/Facts |

| Stars | Strong Market Share & High Growth | Premium Rental Channels, Fleet Modernization, North American Dominance | North America was largest revenue-generating region in 2024. 70% of U.S. core fleet 12 months or newer by Q1 2025. |

What is included in the product

Hertz Global Holdings' BCG Matrix identifies growth opportunities and cash generators within its diverse rental segments, guiding investment and divestment strategies.

A clear BCG Matrix visualizes Hertz's portfolio, alleviating strategic uncertainty by pinpointing growth opportunities and areas needing divestment.

Cash Cows

Hertz's traditional internal combustion engine (ICE) vehicle rentals are a prime example of a cash cow. Following a strategic pivot away from a large electric vehicle fleet, the company is bolstering its gasoline-powered inventory to cater to enduring customer demand. This segment, which constitutes the bulk of Hertz's fleet, operates within a mature yet stable market where the company holds a substantial market share.

These ICE vehicles are consistent revenue generators, providing significant cash flow with predictable operating expenses. For instance, in the first quarter of 2024, Hertz reported total revenues of $1.8 billion, with a significant portion still attributable to their traditional fleet operations, underscoring the segment's role as a reliable revenue anchor.

Hertz Global Holdings boasts an impressive global rental network, featuring over 11,000 locations spanning 160 countries. This extensive reach, encompassing brands like Hertz, Dollar, and Thrifty, solidifies its position as a cash cow.

The mature markets served by this vast infrastructure generate consistent revenue streams, requiring minimal incremental investment for growth. This established operational scale translates into predictable and stable cash flow for the company.

Dollar and Thrifty, under Hertz Global Holdings, target budget-conscious travelers, offering a cost-effective rental experience. These brands benefit from Hertz's vast network and operational efficiencies, ensuring consistent service delivery to a wide customer base.

In 2024, Hertz reported that its value brands, including Dollar and Thrifty, continued to be significant contributors to overall revenue, demonstrating stable demand even in a competitive market. Their ability to attract a large volume of rental transactions solidifies their role as reliable cash cows.

Corporate and Business Travel Segment

The corporate and business travel segment represents a significant Cash Cow for Hertz Global Holdings. The company benefits from deeply entrenched, long-standing relationships and established contracts within this sector. This translates into consistent, high-volume rentals and predictable demand, forming a stable, recurring revenue stream.

While this segment may not exhibit rapid growth, its mature business relationships are crucial for Hertz's overall cash flow generation. The costs associated with marketing and acquiring customers in this established segment are relatively low, further enhancing its profitability.

- Stable Revenue: Corporate contracts provide predictable rental volumes.

- Low Acquisition Costs: Established relationships minimize marketing spend.

- Significant Cash Flow: This mature segment is a reliable source of funds.

- Market Position: Hertz's strong presence in business travel underpins its Cash Cow status.

Airport Rental Operations

Airport rental operations for Hertz Global Holdings are a classic example of a cash cow within the BCG matrix. These locations are inherently high-demand and high-volume, catering to a steady stream of travelers. This segment represents a mature, often premium, part of the car rental market.

Hertz's strategic positioning at major global airports ensures consistent traveler demand, translating into substantial and predictable revenue. This stability makes airport operations a significant cash generator, leveraging their established customer base and prime locations.

- High Demand & Volume: Airport hubs are consistently busy, driving high rental volumes.

- Mature Market Segment: This is an established, reliable revenue source for Hertz.

- Premium Positioning: Airport locations often command higher rental rates.

- Predictable Revenue: Consistent traveler flow ensures stable income generation.

Hertz's traditional internal combustion engine (ICE) vehicle rentals, along with its value brands Dollar and Thrifty, are key cash cows, generating stable revenue with minimal investment. The company's extensive global network of over 11,000 locations further solidifies these segments' cash cow status by ensuring consistent demand and operational efficiency.

Corporate and business travel rentals also represent a significant cash cow for Hertz, driven by long-standing relationships and contracts that ensure predictable, high-volume rentals. Airport rental operations are another prime example, leveraging high demand and premium positioning for consistent revenue generation.

In the first quarter of 2024, Hertz reported $1.8 billion in total revenues, with these established segments contributing significantly to this figure. The value brands, Dollar and Thrifty, specifically demonstrated stable demand, reinforcing their role as reliable revenue generators.

| Segment | BCG Classification | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| ICE Vehicle Rentals | Cash Cow | Mature market, high market share, predictable expenses | Significant portion of Q1 2024 revenue |

| Value Brands (Dollar, Thrifty) | Cash Cow | Cost-effective offerings, large customer base, operational efficiencies | Continued revenue contributors in 2024 |

| Corporate & Business Travel | Cash Cow | Established relationships, consistent demand, low acquisition costs | Stable, recurring revenue stream |

| Airport Rental Operations | Cash Cow | High demand, premium locations, consistent traveler flow | Substantial and predictable revenue generator |

What You’re Viewing Is Included

Hertz Global Holdings BCG Matrix

The Hertz Global Holdings BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no sample data, and no missing sections – just the complete, analysis-ready strategic report. You can be confident that the insights and visualizations presented here are precisely what you'll gain access to, enabling you to directly apply this valuable market analysis to your business planning. This ensures a seamless transition from preview to actionable strategy, empowering you with the tools needed for informed decision-making.

Dogs

Hertz's ambitious foray into electric vehicles, notably with a large Tesla fleet, became a significant financial drain. Unexpectedly high depreciation, costly repairs, and weaker customer uptake, exacerbated by charging challenges, turned this initiative into a cash trap.

The company recorded a substantial $1 billion impairment charge in the third quarter of 2024 and a staggering $2.9 billion net loss for the full fiscal year 2024. This led to Hertz's decision to divest approximately 30,000 EVs by the end of 2024, highlighting the segment's underperformance.

Before its significant fleet refresh, Hertz operated a substantial number of aging vehicles that were becoming less popular with customers. This aging segment included older models that demanded more frequent and costly maintenance. In 2023, Hertz reported that a portion of its fleet was indeed older, contributing to operational inefficiencies.

These less desirable vehicles generated lower revenue per rental due to reduced customer appeal and were subject to accelerated depreciation. This combination of higher costs and lower income made this part of the fleet a drag on overall profitability. For instance, the cost to maintain older vehicles can be significantly higher than newer models, impacting margins.

Hertz Global Holdings, like many large companies, faces challenges with certain geographic locations or business segments that don't perform as well as others. These can be smaller regional markets where demand for car rentals is consistently low, or perhaps areas with higher operating expenses that eat into any revenue generated. For instance, in 2024, Hertz might have identified specific airport locations or smaller city branches that, despite efforts, consistently showed lower utilization rates and higher staffing or maintenance costs compared to their revenue contribution.

These underperforming areas can become inefficient assets within the company's broader portfolio. They might generate minimal revenue relative to the costs associated with maintaining them, essentially acting as drains on overall profitability. For example, a branch in a less-trafficked tourist destination might struggle to achieve the same revenue per vehicle as a busy city center location, even with similar overheads.

Effectively addressing these underperforming segments is key to boosting the company's overall operational efficiency and financial health. This could involve strategic decisions like optimizing fleet allocation, adjusting pricing models for those specific markets, or even considering divestment or closure if the situation doesn't improve. In 2024, Hertz's focus on streamlining its operations would likely include a close examination of such underperforming units to reallocate resources more effectively.

Inefficient Legacy Operational Processes

Before its current transformation, Hertz likely grappled with legacy operational processes that were inherently inefficient. These outdated methods often led to higher direct operating expenses (DOE), directly impacting profitability and hindering the company's ability to generate optimal returns from its core car rental operations.

These inefficiencies, if left unaddressed, can significantly drag down a company's financial performance. For Hertz, this meant a reduced capacity to capitalize on its market presence. The company is actively working to streamline these processes, aiming for structural operational efficiencies.

- Legacy inefficiencies can increase Direct Operating Expenses (DOE).

- Streamlining operations is key to improving profitability.

- Hertz is implementing structural changes to address these issues.

High Debt Burden and Related Financial Obligations

Hertz Global Holdings carries a considerable debt burden, exceeding $6 billion, a legacy of its past restructuring efforts and persistent financial headwinds. This substantial leverage, coupled with ongoing interest payments and legal entanglements with bondholders, represents a significant and continuous drain on the company's financial resources.

The high level of debt significantly constrains Hertz's profitability and diminishes its financial maneuverability. This makes its debt management a critical factor, positioning it as a 'dog' within a BCG matrix framework concerning efficient capital allocation, as a large portion of available capital is directed towards servicing these obligations rather than growth initiatives.

- Debt Load: Hertz's total debt stood at approximately $6.5 billion as of the first quarter of 2024.

- Interest Expense: Annual interest expenses related to this debt have historically been in the hundreds of millions of dollars, impacting net income.

- Financial Flexibility: High leverage ratios limit Hertz's ability to secure additional favorable financing for strategic investments or acquisitions.

- Capital Allocation: A substantial portion of cash flow is dedicated to debt repayment and interest, reducing funds available for innovation or market expansion.

Hertz's significant investment in electric vehicles, particularly Tesla, turned into a financial burden. High depreciation, repair costs, and lower-than-expected customer demand, compounded by charging infrastructure issues, made this segment a cash drain. The company incurred a $1 billion impairment charge in Q3 2024 and a $2.9 billion net loss for the full year, prompting the sale of about 30,000 EVs by year-end.

The company's substantial debt, exceeding $6 billion as of early 2024, consumes a large portion of its resources for interest payments and principal repayment. This high leverage limits financial flexibility for growth initiatives and positions debt servicing as a major drag on profitability, characteristic of a 'dog' in the BCG matrix.

Older, less desirable vehicles in the fleet also contributed to inefficiencies. These models incurred higher maintenance costs and lower rental revenue due to reduced customer appeal, accelerating depreciation and impacting overall margins. Hertz's efforts to streamline operations in 2024 likely included addressing these underperforming fleet segments.

Certain underperforming geographic locations or smaller business segments within Hertz also act as dogs. These areas may have low demand or high operating expenses, resulting in minimal revenue relative to their costs. Strategic decisions in 2024 would focus on optimizing fleet allocation and potentially divesting or restructuring these inefficient units.

Question Marks

Hertz Car Sales, Hertz's retail channel for used vehicles, is experiencing significant growth, with Q1 2025 marking a record quarter for sales. This strategic expansion taps into the expanding used car market, which is further bolstered by rising prices attributed to tariffs.

While Hertz Car Sales currently holds a smaller market share than Hertz's core rental operations, its rapid expansion and high growth potential position it as a key strategic focus. The company's aggressive prioritization of this channel aims to capitalize on market trends and increase its footprint in used vehicle retail.

Hertz's 24/7 car-sharing initiative in Europe, while a nascent venture, is positioned as a potential 'Question Mark' in the BCG matrix. This segment taps into the burgeoning urban mobility market, a space experiencing significant growth and innovation, particularly in major European cities.

The car-sharing sector in Europe is dynamic, with companies like Share Now and Zipcar already established players. Hertz's entry, though smaller in scale currently, aims to leverage its existing brand recognition and fleet management expertise. For instance, by mid-2024, the demand for flexible mobility solutions continued to rise, with reports indicating a steady increase in car-sharing usage across key European metropolitan areas.

Strategic investment in Hertz 24/7 is crucial. The company needs to aggressively expand its footprint and enhance its technological offering to compete effectively. Failure to do so could see this segment remain a low-market-share entity, while success could transform it into a significant growth driver, potentially shifting its position in the BCG matrix.

Hertz is investing heavily in new digital initiatives, particularly to revamp its revenue management systems. These efforts are designed to improve how they generate demand, especially in off-airport locations and their broader mobility services. This strategic shift aims to fine-tune pricing, elevate the customer journey, and open up new avenues for income.

These digital advancements fall into the question mark category of the BCG matrix. This classification stems from the fact that while they operate in a sector with significant growth potential, the market share is still developing and the ultimate returns are not yet fully predictable. For example, Hertz reported a 10% increase in digital bookings in Q1 2024, highlighting early traction in these areas.

Exploration of Subscription-Based Rental Models

Hertz's exploration of subscription-based rental models positions them within a burgeoning segment of the automotive industry. This approach offers consumers flexible, long-term vehicle access, diverging from traditional ownership or short-term rentals.

These subscription services, while still in their early phases, represent a significant growth opportunity for Hertz. In 2024, the car subscription market, though not yet a dominant force, is projected to experience substantial expansion as consumer preferences shift towards flexibility and reduced commitment.

- Nascent Stage: Subscription models are currently a small but rapidly growing part of Hertz's offerings, indicating low current market share.

- High Growth Potential: This segment is identified as having significant future growth prospects, aligning with evolving consumer demand for flexible mobility solutions.

- Strategic Importance: Successful development and scaling of these subscription services could elevate them to become future Stars within Hertz's portfolio.

- Uncertainty: The ultimate success of these nascent models depends on market adoption, competitive landscape, and Hertz's strategic execution, making their future position uncertain.

Targeted Electric Vehicle (EV) Fleet (Post-Adjustment)

Hertz is recalibrating its electric vehicle (EV) strategy after facing significant financial headwinds from its earlier, aggressive expansion. The company is now focusing on a more targeted approach, prioritizing regions with robust EV adoption and superior charging infrastructure. This strategic pivot aims to mitigate losses while still participating in the growing EV rental market.

This adjusted EV fleet, while smaller in scale than initially planned, could be classified as a Question Mark within the BCG matrix. Its success hinges on Hertz's ability to effectively capture niche market share in specific, high-demand EV rental segments. For instance, in 2024, Hertz reported a substantial reduction in its EV fleet, selling off thousands of vehicles, a move that reflects the challenges in managing these assets profitably. However, they are maintaining a presence in key markets where EV demand is demonstrably higher.

- Strategic Shift: Hertz is moving from a broad EV rollout to a focused strategy, concentrating on areas with strong EV infrastructure and consumer acceptance.

- Market Responsiveness: The adjustment reflects Hertz's response to actual demand and operational costs associated with EVs, aiming for profitability in this segment.

- Potential for Growth: While a smaller part of the fleet, this targeted approach could evolve into a Star if Hertz successfully identifies and serves profitable EV rental niches.

- Financial Realities: The company's 2024 actions, including significant EV sales, underscore the financial complexities and the need for a more measured EV deployment.

Hertz's 24/7 car-sharing initiative in Europe and its subscription-based rental models are currently positioned as Question Marks. These ventures operate in high-growth potential markets but have not yet established a significant market share, making their future success uncertain.

The company's digital revenue management initiatives also fall into this category. While showing early traction, such as a 10% increase in digital bookings in Q1 2024, their ultimate market share and profitability remain to be seen.

Similarly, Hertz's recalibrated electric vehicle (EV) strategy, focusing on specific markets after significant fleet adjustments in 2024, represents a Question Mark. Success depends on Hertz's ability to capture profitable niche demand in the evolving EV rental landscape.

| Initiative | BCG Category | Market Share (Current) | Growth Potential | Key Considerations |

|---|---|---|---|---|

| Hertz 24/7 (Europe) | Question Mark | Low | High | Urban mobility demand, competition, infrastructure needs |

| Subscription Rentals | Question Mark | Low | High | Consumer adoption, competitive offerings, operational scaling |

| Digital Revenue Management | Question Mark | Developing | High | Market acceptance, technological integration, revenue impact |

| Targeted EV Fleet | Question Mark | Niche | Moderate to High | EV adoption rates, charging infrastructure, profitability |

BCG Matrix Data Sources

Our Hertz BCG Matrix is informed by comprehensive data, including financial reports, market share analysis, and industry growth projections to accurately assess business units.