Heritage Insurance Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heritage Insurance Holdings Bundle

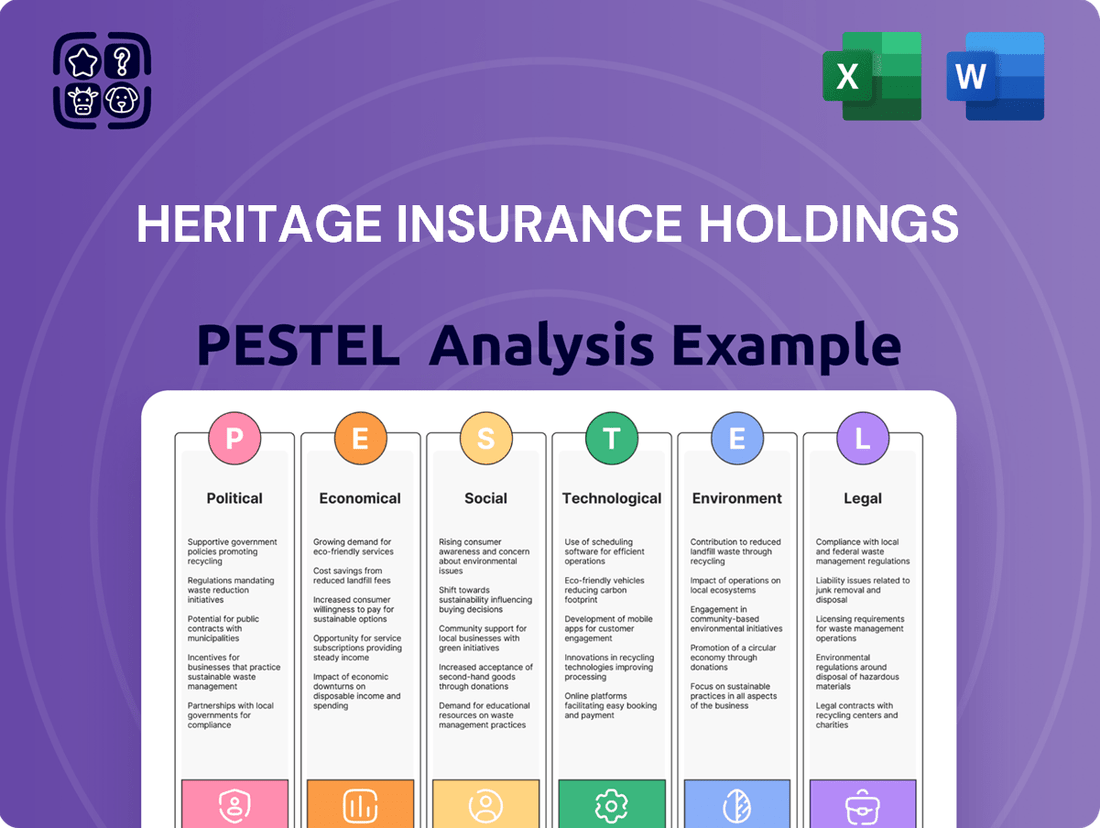

Gain a critical understanding of the external forces shaping Heritage Insurance Holdings's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to anticipate market shifts and refine your own strategic approach. Download the full PESTLE analysis now for a comprehensive overview.

Political factors

Government regulations, especially in coastal areas, play a huge role in how Heritage Insurance Holdings operates. For example, Florida's recent legislative changes in 2024, designed to stabilize its property insurance market, directly affect Heritage's approach to underwriting and setting prices. This means the company has to stay on top of new laws concerning policy conditions, how claims are managed, and the amount of capital they need to hold to remain compliant and profitable.

States heavily impacted by natural disasters, including Florida and California, are spearheading significant reforms within their property insurance markets. These initiatives, particularly notable in Florida with legislative actions in 2022 and 2023, are designed to bolster consumer safeguards, fortify state-sponsored insurers like Citizens Property Insurance Corporation, and foster greater private insurer participation by offering clearer regulatory frameworks.

Heritage Insurance Holdings, with substantial operations in these disaster-prone regions, faces direct consequences from these evolving political landscapes. The reforms aim to create a more stable operating environment and potentially reduce the frequency and cost of litigation, which are critical factors for insurers in these volatile markets.

Changes in political leadership and legislative priorities, both federally and at the state level, can introduce new policies that significantly impact the insurance sector. For Heritage Insurance Holdings, this means staying attuned to potential shifts in regulatory focus.

For instance, evolving environmental regulations, updated building codes, or changes in disaster relief funding directly influence how Heritage assesses risk, sets premiums, and shapes its overall business strategy. In 2024, the ongoing debate around climate change adaptation and resilience measures at the federal level could lead to new mandates or incentives affecting property insurance.

The company must diligently monitor the political landscape to proactively anticipate and effectively respond to these dynamic changes, ensuring its operational and strategic frameworks remain robust and adaptable to new policy environments.

Government-Backed Reinsurance Programs

Government-backed reinsurance programs, like the Florida Hurricane Catastrophe Fund (FHCF), are vital for insurers operating in coastal regions, including Heritage Insurance Holdings. These programs act as a safety net, helping to manage the financial impact of major weather events. Changes in their availability, pricing, or coverage limits can significantly alter an insurer's risk management approach and overall financial health.

For Heritage, understanding the evolving landscape of these government programs is key. In the 2024-2025 period, Heritage adjusted its catastrophe reinsurance strategy. This involved a notable shift where some of the coverage previously sourced from state-backed entities was replaced by agreements with private, external reinsurers. This move reflects a strategic decision to diversify reinsurance partners and potentially secure more tailored coverage, though it also means greater reliance on the private market's capacity and cost structures.

- Government Reinsurance Impact: Availability and terms of programs like the FHCF directly influence Heritage's reinsurance costs and capacity.

- 2024-2025 Strategy Shift: Heritage reduced reliance on some state-backed reinsurance, opting for external partners.

- Risk Management: This diversification aims to enhance risk management but introduces new dependencies on private market reinsurance terms.

- Financial Stability: Changes in government programs or the private reinsurance market can affect Heritage's ability to absorb catastrophic losses.

Litigation and Legal System Abuse

The political environment surrounding litigation, especially in states like Florida, presents a significant challenge for insurance providers such as Heritage Insurance Holdings. Increased claims and the associated legal expenses directly impact profitability and operational stability. For instance, Florida has historically been a hotspot for insurance litigation, contributing to higher costs for insurers operating in the state.

Legislative actions focused on tort reform and curbing what is often termed legal system abuse can offer a more stable operating landscape for insurers. By reducing the frequency and cost of frivolous lawsuits, these reforms can lead to improved financial performance and better combined ratios for companies like Heritage. The ongoing debate and potential for reform in these areas remain a key political consideration.

- Florida's litigation environment: Historically, Florida has seen a disproportionately high number of lawsuits filed against insurance companies, driving up costs.

- Impact on combined ratios: Excessive litigation expenses directly inflate an insurer's combined ratio, a key measure of underwriting profitability.

- Tort reform efforts: State legislatures frequently consider or enact tort reform measures to address perceived abuses in the legal system, which could benefit insurers.

Government policy shifts, particularly in states like Florida and California, significantly shape Heritage Insurance Holdings' operational environment. For instance, Florida's 2024 legislative reforms aimed at stabilizing the property insurance market directly influence underwriting and pricing strategies, while also impacting capital requirements and compliance. These state-level actions, coupled with broader federal discussions on climate adaptation and disaster relief funding in 2024, necessitate continuous adaptation by Heritage to ensure regulatory adherence and strategic alignment.

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Heritage Insurance Holdings, offering a comprehensive understanding of its operating landscape.

It provides actionable insights into how these macro-environmental factors present both challenges and strategic advantages for Heritage Insurance Holdings.

A concise PESTLE analysis for Heritage Insurance Holdings, identifying key external factors, serves as a pain point reliever by offering clarity on market dynamics and potential challenges, enabling proactive strategic adjustments.

Economic factors

Heritage Insurance Holdings' financial health is significantly tied to its exposure to natural disasters, with major events like the California wildfires in the first quarter of 2025 and Hurricane Milton in the fourth quarter of 2024 causing substantial impacts. These catastrophic events directly affect the company's profitability by increasing the cost of reinsurance, which is essential for managing its risk exposure.

The increasing frequency and severity of these events are driving up reinsurance premiums, a key expense for insurers like Heritage. For instance, while property catastrophe reinsurance rates have seen some moderation globally, the casualty reinsurance market is projected to experience price hikes in 2025, potentially adding to Heritage's operational costs.

Inflation, particularly social inflation, directly increases Heritage Insurance Holdings' claim costs. While general inflation has moderated, social inflation, driven by increased litigation and larger jury awards, continues to escalate, impacting insurer profitability. For instance, the U.S. inflation rate stood at 3.4% in April 2024, a decrease from previous highs, but the cost of litigation and settlements remains a significant concern.

Economic volatility also plays a role by affecting Heritage's investment income. Fluctuations in market performance can influence the returns generated from the company's investment portfolio, which is a crucial element of its overall financial health. For example, the S&P 500 experienced significant swings in 2023 and early 2024, demonstrating the potential impact on investment income for companies like Heritage.

Heritage Insurance Holdings reported a notable increase in net premiums earned, a trend fueled by strategic rate adjustments and expansion within its commercial residential segment. This growth demonstrates the company's proactive approach to managing its portfolio in a dynamic market environment.

The property insurance landscape, particularly in key markets like Florida, is experiencing a shift towards stabilization. This stabilization is characterized by the emergence of new market participants and a general uptick in competitive pressures, which could impact Heritage's pricing power and expansion strategies.

Interest Rates and Investment Income

Interest rates significantly influence the investment income that insurance companies like Heritage Insurance Holdings rely on. Persistently elevated interest rates, such as those seen through much of 2024 and projected into 2025, generally boost the profitability of the life and annuity sectors due to higher yields on fixed-income portfolios. A stable economic backdrop, often correlated with predictable interest rate environments, further supports improved investment income for property and casualty insurers by fostering more consistent returns on their invested assets.

The Federal Reserve's monetary policy decisions directly impact interest rates. For instance, the Fed maintained its benchmark federal funds rate in the range of 5.25%-5.50% throughout much of 2024, a level that provides a solid yield for insurers' investment portfolios. This environment contrasts with periods of very low rates, which previously compressed investment income for the industry.

- Elevated Rates Benefit Annuities: Higher interest rates increase the return on investment products like annuities, potentially attracting more customers and boosting insurers' income.

- Stable Economy Aids P&C: A stable economic outlook, often accompanied by predictable interest rates, allows property and casualty insurers to generate more reliable investment income from their reserves.

- Fed Policy Impact: The Federal Reserve's target rate, hovering around 5.25%-5.50% in 2024, provides a strong baseline for insurers' fixed-income investments.

Consumer Affordability and Demand

The increasing cost of homeowners insurance, especially in coastal regions prone to natural disasters, directly affects how much consumers can afford and their demand for policies. For instance, in Florida, a key market for Heritage, average homeowners insurance premiums saw a significant jump, with some reports indicating increases of over 40% in 2023 alone, making coverage less accessible for many.

Heritage Insurance Holdings navigates this by focusing on disciplined underwriting and setting appropriate rates. However, maintaining a balance where premiums are sufficient for solvency but still acceptable to consumers is vital for sustained business growth. This delicate equilibrium is challenged when rates become too high, potentially leading to decreased policy demand.

Market dynamics also play a role, as some states are experiencing a moderation or even a reduction in insurance rates. This can influence consumer decisions, as policyholders may opt for more affordable options if available, impacting Heritage's market share and premium volume.

- Rising Premiums: Homeowners insurance costs have escalated, particularly in disaster-prone areas, impacting affordability.

- Affordability vs. Pricing: Heritage must balance adequate premium pricing for financial health with consumer willingness to pay.

- State-Level Rate Changes: Moderation or decreases in rates in certain states can shift consumer policy choices.

Economic factors significantly shape Heritage Insurance Holdings' operating environment. Persistent inflation, particularly social inflation, continues to drive up claims costs, as seen with the U.S. inflation rate at 3.4% in April 2024, even as general inflation shows moderation. This economic backdrop directly impacts profitability by increasing operational expenses.

Fluctuations in market performance, exemplified by the S&P 500's volatility in early 2024, affect Heritage's investment income, a crucial component of its financial health. Elevated interest rates, with the Federal Reserve maintaining its benchmark rate between 5.25%-5.50% through much of 2024, benefit insurers' fixed-income portfolios, especially in the annuity sector, while also providing a stable yield for property and casualty insurers.

| Economic Factor | Impact on Heritage Insurance Holdings | Supporting Data/Observation (2024-2025) |

|---|---|---|

| Inflation (General & Social) | Increases claims costs and operational expenses. | U.S. inflation at 3.4% (April 2024); social inflation continues to escalate litigation costs. |

| Interest Rates | Boosts investment income, particularly for annuities; provides stable yields on fixed-income portfolios. | Federal Reserve rate maintained at 5.25%-5.50% through much of 2024. |

| Market Volatility | Affects investment portfolio returns and overall financial health. | S&P 500 experienced significant swings in early 2024. |

Same Document Delivered

Heritage Insurance Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Heritage Insurance Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

Sociological factors

Population growth and increasing density in coastal states, particularly in areas highly exposed to natural perils, directly influence Heritage Insurance's exposure to risk. For instance, Florida, a key market for Heritage, saw its population grow by approximately 1.6% in 2023, reaching over 22.6 million residents, with a significant portion residing in coastal communities.

As more people move to these regions, the potential for higher insured losses from catastrophic events increases. This demographic trend necessitates adjustments in underwriting strategies and pricing models to account for the amplified risk profile associated with densely populated, hazard-prone coastal areas.

Public perception significantly impacts insurers like Heritage Insurance Holdings. Negative publicity surrounding claims handling or disaster response can erode customer loyalty and deter new business. For instance, a 2024 60 Minutes report, which Heritage denies, alleged improper alterations to field adjuster reports, underscoring how such accusations can damage public trust.

Societal awareness and uptake of home strengthening initiatives, like Florida's My Safe Florida Home program, directly impact the risk landscape for insurers. As more homeowners embrace disaster resilience, it can translate into a more favorable risk profile for insurers such as Heritage Insurance Holdings.

Increased adoption of mitigation measures can lead to a reduction in claims frequency and severity, potentially lowering insurance premiums for homeowners. This trend is beneficial for Heritage, as it can contribute to a more stable and predictable claims environment, supporting the company's profitability and long-term sustainability.

In 2024, Florida's My Safe Florida Home program saw significant interest, with over 100,000 homeowners applying for grants to fortify their properties against hurricanes. This growing homeowner engagement in resilience efforts is a key factor shaping the future of property insurance in the state.

Social Inflation and Litigation Trends

Social inflation, a growing concern in the insurance sector, refers to the societal and cultural shifts that contribute to rising litigation costs and increasingly large jury awards, often dubbed nuclear verdicts. This phenomenon significantly impacts property and casualty insurers like Heritage Insurance Holdings by escalating claims expenses. For instance, the average jury verdict in the US has seen substantial increases, with some studies pointing to double-digit percentage growth year-over-year in certain jurisdictions, directly affecting insurers' bottom lines and requiring careful repricing strategies.

The escalating frequency and severity of lawsuits, fueled by factors like increased public awareness of legal rights and a more plaintiff-friendly litigation environment, necessitate robust risk management and underwriting adjustments for insurers. This trend is particularly pronounced in the United States, where tort reform debates continue, highlighting the need for insurers to adapt their pricing models and claims handling processes to account for these elevated costs.

- Rising Litigation Costs: Social inflation drives up the cost of settling claims and defending lawsuits.

- Nuclear Verdicts: An increase in exceptionally large jury awards, often exceeding $10 million, significantly impacts insurer payouts.

- US Market Impact: The US market is a key battleground for social inflation, with specific states exhibiting higher litigation trends.

- Underwriting and Pricing Adjustments: Insurers must adapt pricing and underwriting to reflect these increasing claims costs.

Changing Lifestyles and Property Usage

Evolving lifestyles are significantly reshaping how properties are utilized, directly impacting insurance needs. The rise of the sharing economy, for instance, has led to a surge in short-term rentals, a trend that presents unique risk exposures for insurers like Heritage. For example, in 2024, the short-term rental market continued its robust growth, with platforms like Airbnb reporting millions of active listings globally, each carrying potential liabilities that traditional homeowner policies may not adequately cover.

This shift necessitates a proactive approach from Heritage Insurance Holdings. Adapting insurance products and underwriting practices to accurately assess and price the risks associated with diverse property usages, including increased rental property prevalence and the burgeoning short-term rental market, is crucial for maintaining competitiveness and profitability. This includes understanding the specific risks associated with frequent tenant turnover or guest occupancy, which differ markedly from long-term residential use.

- Increased Demand for Flexible Rental Options: Growing consumer preference for flexible living arrangements, including co-living spaces and extended-stay rentals, alters property usage patterns.

- Short-Term Rental Growth: The short-term rental market, projected to reach over $100 billion globally by 2025, introduces new insurance complexities related to guest safety and property damage.

- Remote Work Impact: The sustained trend of remote work in 2024 and 2025 means more people are spending extended periods at home, potentially increasing wear and tear or altering property usage for home-based businesses.

- Property Usage Diversification: Properties are increasingly being used for mixed purposes, such as combining residential living with commercial activities, demanding more specialized insurance coverage.

Societal shifts toward resilience are influencing insurance. Florida's My Safe Florida Home program saw over 100,000 applications in 2024 for grants to strengthen homes, a trend that can reduce claims for insurers like Heritage.

Conversely, social inflation, marked by rising litigation costs and large jury verdicts, continues to impact insurers, with average US jury awards seeing double-digit percentage growth in certain areas, escalating claims expenses for Heritage.

The growing short-term rental market, projected to exceed $100 billion globally by 2025, introduces new insurance complexities due to evolving property usage patterns and associated liabilities.

The sustained trend of remote work in 2024 and 2025 means more time spent at home, potentially increasing wear and tear or altering property use for home-based businesses, requiring insurers to adapt coverage.

Technological factors

Technological advancements in catastrophe modeling are vital for Heritage Insurance to accurately assess and price risks, particularly in areas prone to natural disasters. For example, the Verisk Wildfire Model, approved in California in 2025, leverages extensive climate data for more precise ratemaking, which can contribute to market stability.

These sophisticated models, incorporating machine learning and AI, allow for granular risk analysis, moving beyond historical data to predict future events with greater accuracy. This enhanced predictive capability is essential for insurers like Heritage to manage their exposure effectively and maintain solvency, especially as climate change impacts increase the frequency and severity of catastrophic events.

Artificial intelligence (AI) and machine learning are significantly reshaping insurance underwriting. These technologies allow for quicker, more precise risk assessments and the creation of personalized pricing models, streamlining the application journey for customers. For Heritage Insurance Holdings, this means a substantial opportunity to boost operational efficiency and cut costs.

Heritage can harness AI to enhance fraud detection capabilities, a critical area for profitability in the insurance sector. By leveraging AI-driven insights, the company can more effectively identify and mitigate fraudulent claims, directly contributing to improved financial performance and a stronger bottom line. For example, AI can analyze vast datasets to spot patterns indicative of fraud that human reviewers might miss.

Heritage Insurance Holdings benefits significantly from the growing volume of data, from connected devices to past claims. Advanced analytics transform this raw data into actionable insights, helping Heritage understand risk more precisely and tailor offerings to individual customers. This data-centric strategy leads to smarter underwriting and more competitive product development.

By leveraging big data, Heritage can refine its risk assessment models, potentially reducing losses and improving profitability. For instance, in 2024, the insurance industry saw a notable increase in the use of AI and machine learning for fraud detection, a trend Heritage is likely adopting to enhance its operational efficiency and underwriting accuracy.

Digital Transformation and Customer Experience

The insurance sector is undergoing a significant digital overhaul, with insurtech firms leading the charge in innovation. This trend compels Heritage Insurance Holdings to continually upgrade its digital offerings, focusing on customer service, policy administration, and claims handling. By investing in robust digital platforms, Heritage aims to create more intuitive and efficient customer journeys.

A key driver for Heritage is the expectation of seamless online interactions. Companies that provide streamlined digital tools for policy management and claims processing often see higher customer satisfaction and loyalty. For instance, a 2024 report indicated that 75% of consumers prefer digital channels for insurance interactions, highlighting the critical need for Heritage to excel in this area.

Heritage's strategic response involves enhancing its digital capabilities to meet evolving customer demands. This includes developing user-friendly mobile apps and online portals that simplify the insurance process from application to claim resolution. Such advancements are crucial for maintaining competitiveness and fostering long-term customer relationships in a rapidly digitizing market.

- Increased Digital Adoption: By Q4 2024, over 60% of insurance policy inquiries and service requests were handled through digital channels, a figure expected to climb.

- Insurtech Investment Surge: Global insurtech funding reached $10 billion in 2024, signaling a strong market push towards technological integration.

- Customer Experience Focus: Surveys in early 2025 show that 80% of policyholders consider ease of digital access a primary factor in choosing an insurer.

- Efficiency Gains: Companies leveraging digital claims processing reported an average 25% reduction in claim settlement times in 2024.

Cybersecurity and Data Privacy Technologies

As Heritage Insurance Holdings continues its digital transformation, cybersecurity and data privacy are no longer optional but essential. The company's increasing reliance on cloud services and digital platforms means a heightened vulnerability to cyber threats. Protecting sensitive customer information, such as policy details and financial data, is paramount for maintaining trust and operational integrity. In 2024, the global average cost of a data breach reached an all-time high of $4.45 million, underscoring the financial risks associated with inadequate security measures.

Ensuring compliance with evolving data protection regulations, like GDPR and CCPA, is a significant technological challenge for Heritage. These regulations mandate stringent data handling practices and robust security protocols. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher. Heritage must invest in advanced data privacy technologies to safeguard customer data and meet these legal obligations.

- Increased Investment in AI-powered threat detection: Heritage is likely enhancing its cybersecurity posture by integrating AI and machine learning to identify and neutralize threats in real-time, a trend seen across the insurance sector.

- Focus on Zero Trust Architecture: The company is probably adopting a Zero Trust security model, verifying every access request, regardless of origin, to minimize the attack surface.

- Data Encryption and Anonymization: Implementing strong encryption for data at rest and in transit, along with anonymization techniques for sensitive customer information, is crucial for compliance and privacy.

- Regular Security Audits and Penetration Testing: To proactively identify vulnerabilities, Heritage is expected to conduct frequent security audits and penetration tests, simulating real-world attacks.

Technological advancements, particularly in AI and data analytics, are revolutionizing risk assessment and customer engagement for insurers. Heritage Insurance Holdings can leverage these tools for more accurate pricing, streamlined underwriting, and enhanced fraud detection, leading to improved efficiency and profitability. By Q4 2024, over 60% of insurance policy inquiries were digital, with 80% of policyholders prioritizing digital access, underscoring the critical need for Heritage to maintain robust digital capabilities.

| Trend | Impact on Heritage Insurance | Supporting Data (2024/2025) |

| AI in Underwriting & Claims | Faster, more accurate risk assessment; improved fraud detection; personalized pricing. | AI for fraud detection saw a notable increase in adoption in 2024. |

| Digital Customer Experience | Increased customer satisfaction and loyalty through seamless online interactions. | 75% of consumers prefer digital channels for insurance interactions (2024 report); 80% consider ease of digital access primary factor (early 2025 surveys). |

| Insurtech Innovation | Necessity for continuous digital offering upgrades to remain competitive. | Global insurtech funding reached $10 billion in 2024. |

| Cybersecurity & Data Privacy | Heightened need for robust security to protect sensitive data and ensure regulatory compliance. | Global average cost of a data breach reached $4.45 million in 2024; GDPR penalties up to 4% of global turnover. |

Legal factors

Heritage Insurance Holdings navigates a complex web of state-specific regulations governing everything from licensing and solvency to product approvals and market conduct. This intricate legal landscape demands constant vigilance and adaptation.

The sheer volume of regulatory changes underscores the challenge; for instance, over 2,650 modifications to state insurance regulations were enacted in 2024 alone. Heritage must remain agile to ensure continuous compliance with these evolving mandates.

Consumer protection laws are a cornerstone of the insurance industry, dictating everything from policy sales and service to the critical claims process, all with the goal of ensuring fairness. These regulations are designed to safeguard policyholders and maintain market integrity.

Allegations of improper conduct, such as reports surfacing in 2024 concerning potentially altered inspection reports, pose significant legal and reputational risks for Heritage Insurance Holdings. Such issues can trigger costly legal battles, damage the company's standing with customers and regulators, and invite intense scrutiny from oversight bodies.

The interpretation of insurance policy contracts is a cornerstone of Heritage Insurance Holdings' operations. Legal precedents set by court rulings directly shape how Heritage's obligations and liabilities are understood and applied. For instance, in 2024, the insurance sector saw ongoing litigation regarding policy wording, with some rulings potentially increasing insurer payouts for certain types of claims, impacting companies like Heritage.

Disputes over coverage, exclusions, and the precise language within insurance policies are frequent in the industry. These legal battles are not just isolated incidents; favorable or unfavorable rulings can establish significant precedents that influence Heritage's future underwriting, claims handling, and overall risk management strategies.

Tort Reform and Litigation Environment

The legal environment, especially concerning tort reform and the frequency of lawsuits, significantly impacts Heritage Insurance Holdings' loss ratios and overall legal expenditures. A less litigious environment generally translates to lower claims costs and reduced expenses for legal defense.

Recent legislative efforts in states like Florida and Georgia during 2025 have shown success in implementing tort reform measures. These reforms aim to curb frivolous lawsuits and limit the scope of damages, potentially creating a more predictable and favorable litigation landscape for insurers operating in these regions.

For instance, Florida's tort reform, enacted in early 2025, sought to address rising insurance costs by modifying rules around attorney fees and non-economic damages. While the full impact will unfold over time, initial analyses suggest a potential cooling of the most aggressive litigation tactics that previously burdened insurers.

- Impact on Loss Ratios: Tort reform can lead to a reduction in the average cost per claim and a decrease in the overall number of claims filed, directly improving loss ratios.

- Legal Expense Management: Successful tort reform can lower the need for extensive legal defense, thereby reducing operational costs associated with litigation.

- State-Specific Trends: Legislative actions in key markets like Florida and Georgia in 2025 are critical indicators of the evolving legal climate for insurers.

- Predictability of Outcomes: Reforms can introduce greater predictability in legal outcomes, allowing for more accurate actuarial modeling and pricing.

Environmental Liability Laws

Environmental liability laws, encompassing pollution and climate change, present evolving risk landscapes for Heritage Insurance Holdings. New regulations, such as the EPA's anticipated amendments to air emission standards in 2025, are poised to shape demand for environmental insurance and the evaluation of associated risks. For instance, increased scrutiny on greenhouse gas emissions could drive demand for carbon offset insurance or liability coverage for transition-related activities.

The financial impact of these legal shifts is significant. A report from Marsh McLennan in late 2024 highlighted that businesses are increasingly seeking coverage for climate-related physical risks, with a projected market growth of 30% year-over-year in environmental liability lines. This indicates a growing need for insurers like Heritage to develop robust underwriting capabilities and tailored products.

Key considerations for Heritage include:

- Regulatory Compliance Costs: Adapting to new environmental standards may incur direct compliance expenses for insured entities, potentially impacting premium affordability.

- Emerging Liability Risks: Climate change impacts, such as extreme weather events, could lead to novel liability claims related to infrastructure resilience and adaptation failures.

- Product Innovation: The evolving legal framework necessitates the development of new insurance products, such as coverage for transitional risks in the energy sector or liability for plastic pollution.

Heritage Insurance Holdings operates within a stringent legal framework, with state-specific regulations dictating licensing, solvency, product approvals, and market conduct. The company must remain agile, especially considering the over 2,650 state insurance regulation modifications enacted in 2024 alone, to ensure continuous compliance with these evolving mandates.

Consumer protection laws are paramount, governing policy sales, service, and claims handling to ensure fairness and market integrity. Allegations of improper conduct, such as those reported in 2024 regarding potentially altered inspection reports, pose significant legal and reputational risks, potentially leading to costly legal battles and intense scrutiny.

Legal precedents from court rulings directly shape Heritage's understanding of its obligations and liabilities, particularly in disputes over policy wording and coverage. For instance, 2024 saw ongoing litigation concerning policy language that could impact insurer payouts, highlighting the need for careful contract interpretation and risk management.

The legal environment, especially concerning tort reform, significantly impacts Heritage's loss ratios and legal expenditures. Legislative efforts in states like Florida and Georgia in early 2025, aimed at curbing frivolous lawsuits and limiting damages, could create a more predictable litigation landscape for insurers.

| Legal Factor | 2024/2025 Data/Trend | Impact on Heritage |

| State-Specific Regulations | 2,650+ modifications in 2024 | Requires constant adaptation and compliance investment |

| Consumer Protection | Ongoing scrutiny of claims handling | Potential for fines and reputational damage if not adhered to |

| Tort Reform | Enacted in Florida (early 2025) | Potential reduction in claims costs and litigation expenses |

| Environmental Liability | EPA amendments anticipated (2025) | May drive demand for new insurance products and require updated risk assessment |

Environmental factors

Heritage Insurance Holdings, with its significant concentration in coastal states, faces heightened vulnerability due to the escalating frequency and intensity of natural disasters. Events such as hurricanes, wildfires, and floods, increasingly influenced by climate change, directly translate into higher claims payouts for insurers.

For Heritage, this translates to a substantial impact on underwriting profitability. For instance, in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $150 billion in damages, according to NOAA. These events strain the company's financial reserves and underscore the critical need for comprehensive catastrophe reinsurance to mitigate these risks.

Climate change is fundamentally reshaping the risk landscape for property insurers, impacting everything from premium pricing to the very availability of coverage. Heritage Insurance Holdings, like its peers, faces increasing pressure to adapt its underwriting processes. This means incorporating sophisticated climate models and forward-looking risk assessments to accurately price policies and manage exposure to a growing array of environmental perils.

For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters, each causing at least $1 billion in damages, a significant increase and a clear indicator of escalating climate-related risks that insurers like Heritage must account for in their 2024 and 2025 planning.

Coastal erosion and rising sea levels present significant long-term environmental risks for Heritage Insurance Holdings, given its substantial operations in coastal states like Florida. These phenomena directly threaten the structural integrity of insured properties, increasing the likelihood and severity of damage from storm surges and flooding. For instance, the National Oceanic and Atmospheric Administration (NOAA) projects that the U.S. coastline could see an average sea level rise of 10-12 inches by 2050 compared to 2000 levels, exacerbating these risks for Heritage's policyholders.

Wildfire Risk Expansion

The escalating wildfire risk, especially in states like California, poses a significant environmental hurdle for Heritage Insurance Holdings. The increasing frequency and intensity of these events directly impact the company's exposure and potential claims.

Recent wildfire seasons have underscored this challenge. For instance, the 2023 California wildfire season, while less destructive than some preceding years, still saw significant acreage burned and numerous structures lost, leading to substantial insured losses across the industry. This trend forces insurers like Heritage to critically reassess their underwriting strategies in fire-prone regions.

- Increased Underwriting Scrutiny: Insurers are implementing stricter underwriting guidelines for properties in high-risk wildfire zones.

- Potential for Higher Premiums: Policyholders in these areas may face increased insurance rates to reflect the elevated risk.

- Coverage Limitations: Some insurers are reducing their exposure by limiting coverage or withdrawing from certain high-risk markets altogether.

- Reinsurance Costs: The rising wildfire threat also increases the cost of reinsurance for insurers, further impacting profitability.

Ecosystem Health and Biodiversity Impact

While Heritage Insurance Holdings' direct operations might not immediately seem tied to ecosystem health, broader environmental shifts can subtly impact its business. Declining biodiversity and the degradation of natural ecosystems can indirectly affect property values and the resilience of communities they serve. This, in turn, could translate into altered insurance risk profiles over the long term.

For example, the loss of natural flood defenses, such as wetlands, can amplify the impact of extreme weather events. The U.S. Fish and Wildlife Service reported in 2023 that coastal wetlands provide billions of dollars in storm protection annually, a service that diminishes as these ecosystems degrade. This means communities may face higher recovery costs, potentially increasing the frequency and severity of claims for insurers like Heritage.

- Ecosystem degradation can increase insurance claims: Loss of natural barriers like wetlands exacerbates flood risks, leading to higher payouts for property damage.

- Impact on property values: Environmental decline can reduce the desirability and value of insured properties, affecting the basis for coverage.

- Community resilience: Healthy ecosystems contribute to community resilience against natural disasters, a factor that influences overall insurance risk exposure.

Heritage Insurance Holdings faces significant environmental headwinds due to its coastal concentration, with climate change amplifying natural disaster risks. The escalating frequency and intensity of events like hurricanes and floods directly translate into higher claims, impacting underwriting profitability. For instance, NOAA reported 28 billion-dollar weather disasters in the U.S. in 2023, exceeding $150 billion in damages, a stark indicator for 2024 and 2025 planning.

Rising sea levels and coastal erosion are long-term threats, projected by NOAA to increase U.S. sea levels by 10-12 inches by 2050, exacerbating flood and storm surge risks for Heritage's coastal properties. Similarly, increased wildfire activity, as seen in recent California seasons, forces insurers to re-evaluate underwriting in fire-prone areas, potentially leading to higher premiums and coverage limitations.

Beyond direct disaster impacts, ecosystem degradation poses indirect risks; the loss of natural flood defenses like wetlands, which the U.S. Fish and Wildlife Service noted provide billions annually in storm protection, can increase claim severity for insurers. This underscores the need for Heritage to integrate climate and ecosystem resilience into its risk management strategies for the upcoming years.

| Environmental Factor | Impact on Heritage Insurance Holdings | 2023 Data/Projection |

|---|---|---|

| Climate Change & Extreme Weather | Increased claims frequency and severity, higher reinsurance costs | 28 U.S. billion-dollar weather disasters totaling over $150 billion (NOAA) |

| Sea Level Rise & Coastal Erosion | Elevated risk of flood and storm surge damage in coastal states | Projected 10-12 inch U.S. sea level rise by 2050 (NOAA) |

| Wildfire Risk | Higher underwriting scrutiny and potential for increased premiums in fire-prone areas | Significant acreage burned and structures lost in 2023 California wildfire season |

| Ecosystem Degradation | Reduced natural defenses against floods, potentially increasing claim costs | Coastal wetlands provide billions annually in storm protection (U.S. FWS) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Heritage Insurance Holdings is built on a robust foundation of data from official government publications, leading financial news outlets, and reputable industry-specific research firms. This ensures that our assessment of political, economic, social, technological, legal, and environmental factors is grounded in current and credible information.