Heritage Insurance Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heritage Insurance Holdings Bundle

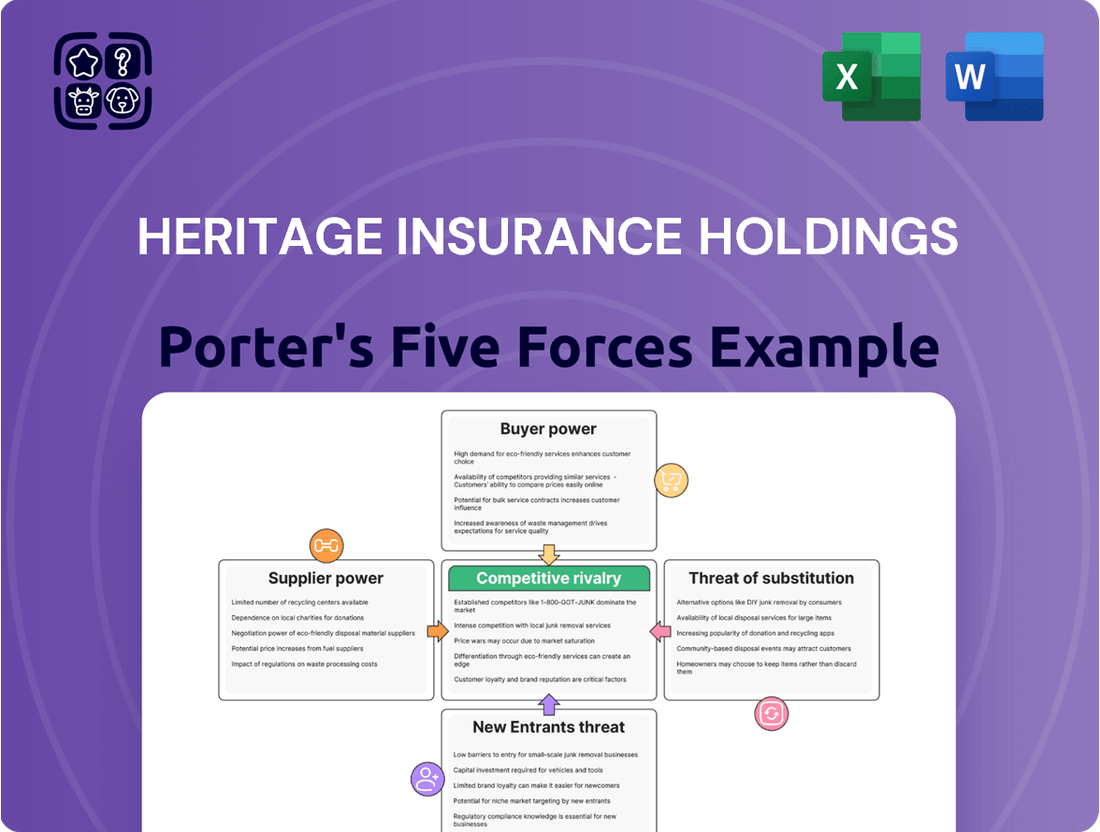

Heritage Insurance Holdings faces a dynamic competitive landscape, with moderate threats from new entrants and substitutes in the insurance sector. Buyer power is significant, as customers can readily switch providers. The full Porter's Five Forces Analysis reveals the real forces shaping Heritage Insurance Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Heritage Insurance Holdings, like many property and casualty insurers, depends significantly on reinsurance to mitigate risks from major events, particularly in vulnerable coastal regions. The financial health and accessibility of reinsurance directly impact Heritage's operational stability and pricing strategies.

Heritage secured its 2024-2025 catastrophe excess-of-loss reinsurance program for roughly $422.3 million, highlighting the substantial cost associated with this risk management tool. This figure underscores the importance of reinsurance availability and its pricing in Heritage's overall financial planning.

The global reinsurance market in 2024 and 2025 shows resilience with robust profits and strong capital reserves. However, the sector is navigating increased losses from natural catastrophes and persistent economic inflation, which could potentially influence reinsurance costs for insurers like Heritage.

The bargaining power of catastrophe modeling and data analytics firms is substantial for Heritage Insurance Holdings. These specialized providers offer critical tools for risk assessment and pricing, especially in the face of escalating climate-related events. For instance, the increasing frequency and severity of natural disasters, such as hurricanes and wildfires, directly impact the demand for sophisticated modeling that can accurately predict losses. In 2023, insured losses from natural catastrophes globally reached an estimated $110 billion, underscoring the vital need for these analytical services to manage exposure effectively.

The bargaining power of suppliers, particularly claims adjusters and restoration services, significantly influences Heritage Insurance Holdings. The availability and cost of these skilled professionals directly impact Heritage's claims handling efficiency and, consequently, its overall loss ratios. For instance, in 2023, the insurance industry experienced a notable increase in claims volume following severe weather events, which can empower these service providers by increasing demand for their specialized skills.

When demand for restoration services spikes, as it often does after widespread catastrophes, these suppliers can command higher prices and more favorable terms. This surge in demand can strain Heritage's ability to secure these services promptly and at a cost that aligns with its underwriting assumptions. The industry's reliance on a finite pool of qualified adjusters and restoration experts means that during peak times, their leverage grows, potentially leading to increased operational costs for insurers like Heritage.

Technology and Software Providers

The bargaining power of technology and software providers for Heritage Insurance Holdings is growing as the insurance sector embraces digital transformation. Companies offering core insurance software, advanced AI solutions, and robust cybersecurity platforms are becoming increasingly vital. These suppliers are critical for Heritage's operations, impacting everything from underwriting and policy management to claims processing and data protection.

Heritage's reliance on these technological partners means that disruptions or price increases from these suppliers could significantly affect its efficiency and competitive edge. For instance, the global InsurTech market was projected to reach $100 billion by 2025, highlighting the increasing dependence and value placed on these digital solutions. In 2024, the demand for specialized AI in claims automation and fraud detection is particularly high, giving these niche providers considerable leverage.

- Increased reliance on specialized software: Heritage depends on providers for core systems, AI, and cybersecurity.

- Impact on operational efficiency: These suppliers are key to underwriting, claims, and data security.

- Growing InsurTech market: The sector's expansion, projected to hit $100 billion by 2025, underscores supplier influence.

- Demand for AI in claims: High demand for AI in fraud detection and automation in 2024 bolsters supplier power.

Investment Management Services

Suppliers of investment management services hold considerable power over Heritage Insurance Holdings because investment income is a crucial revenue stream for insurers. The expertise of these managers in navigating market fluctuations, particularly in the current economic environment, directly influences Heritage's profitability and overall financial health. For instance, as of the first quarter of 2024, the average yield on the U.S. 10-year Treasury note hovered around 4.3%, a key benchmark for investment returns that asset managers aim to outperform.

The ability of these suppliers to generate superior returns on Heritage's substantial investment portfolio is paramount. Their strategic allocation of assets and risk management directly impacts the company's ability to meet its long-term obligations and maintain financial stability. In 2023, the total investment income for the U.S. property and casualty insurance industry reached over $100 billion, highlighting the significance of effective investment management.

- High Switching Costs: Insurance companies often have long-term contracts with investment managers, making it costly and time-consuming to switch providers.

- Specialized Expertise: Investment management requires highly specialized skills and knowledge that are not readily available internally for many insurance firms.

- Concentration of Suppliers: A few large, reputable investment management firms may dominate the market, giving them leverage in negotiations.

- Impact on Profitability: The performance of the investment portfolio directly affects an insurer's bottom line, giving successful managers significant influence.

The bargaining power of suppliers for Heritage Insurance Holdings is notably influenced by the reinsurance market, where providers of catastrophe coverage hold significant sway. Heritage's reliance on these reinsurers to manage large-scale risks, especially from natural disasters, means that pricing and availability of reinsurance directly impact its operational capacity and profitability. In 2024, the reinsurance sector, while robust, faces pressures from increased catastrophe losses and inflation, potentially leading to higher costs for insurers like Heritage.

The bargaining power of suppliers, particularly those providing specialized services like claims adjustment and restoration, is considerable for Heritage Insurance Holdings. The increasing frequency of severe weather events in 2023 and 2024 has heightened demand for these skilled professionals, granting them greater leverage in pricing and terms. This surge can strain Heritage's ability to manage claims efficiently and control costs, impacting overall loss ratios.

Technology and software providers also exert considerable bargaining power over Heritage Insurance Holdings, driven by the sector's digital transformation and the growing InsurTech market, projected to reach $100 billion by 2025. Heritage's dependence on these suppliers for core systems, AI solutions, and cybersecurity makes them critical for operational efficiency and competitive positioning. The high demand for AI in claims automation in 2024 further amplifies the influence of these technology vendors.

| Supplier Type | Influence on Heritage | Key Factors | 2024/2025 Data Points |

|---|---|---|---|

| Reinsurers | High | Risk mitigation, pricing of catastrophe coverage | Reinsurance programs secured for ~ $422.3 million (2024-2025); market resilience amidst rising catastrophe losses and inflation. |

| Claims Adjusters & Restoration Services | Significant | Availability, cost, claims handling efficiency | Increased claims volume post-severe weather events in 2023; demand for specialized skills during peak periods. |

| Technology & Software Providers | Growing | Operational efficiency, data security, digital transformation | InsurTech market projected to reach $100 billion by 2025; high demand for AI in claims automation in 2024. |

What is included in the product

This analysis of Heritage Insurance Holdings reveals how bargaining power of buyers and suppliers, threat of new entrants and substitutes, and the intensity of rivalry shape its competitive environment.

Effortlessly visualize the competitive landscape of Heritage Insurance Holdings with a dynamic spider chart, instantly highlighting areas of intense pressure from rivals, suppliers, and new entrants.

Customers Bargaining Power

Customers, especially in a competitive landscape like Florida's insurance market, are keenly focused on price. They can readily shop around and compare quotes from different companies, which naturally puts pressure on insurers to offer competitive rates.

Recent legislative changes in Florida have contributed to a more competitive environment, with some indications of a slight decrease in insurance premiums. This shift empowers consumers further, as they have more choices and can leverage these options to negotiate better terms or switch to more affordable providers.

The sheer number of property and casualty insurers actively operating, coupled with the re-entry of companies into markets like Florida, significantly broadens customer options. This increased availability of coverage, including specialized excess and surplus lines, directly amplifies customer bargaining power.

Customers can readily compare offerings and switch to providers presenting more attractive terms or pricing. For instance, in 2024, Florida's insurance market saw a notable influx of new carriers and the return of established ones, providing policyholders with a wider array of choices than in previous years.

Customers today wield significant bargaining power due to unprecedented access to information. Online platforms, comparison websites, and consumer advocacy groups empower individuals with detailed knowledge of policy terms, coverage options, and insurer performance. This transparency allows them to readily compare offerings and identify the best value, directly influencing their choices and pushing insurers to be more competitive.

Impact of Legislative Reforms

Recent legislative reforms in Florida, a key market for Heritage Insurance Holdings, have significantly impacted the bargaining power of customers. These changes, enacted to stabilize the property insurance sector, have introduced measures to curb litigation and attract more insurers. For instance, legislative efforts in 2023 aimed to reduce fraudulent claims and frivolous lawsuits, which historically drove up costs and limited consumer choice.

The intended outcome of these reforms is a more competitive insurance landscape. By reducing the prevalence of costly litigation, insurers are better positioned to offer more stable and potentially lower premiums. This increased competition and improved market stability directly empower policyholders, giving them more options and leverage when selecting insurance coverage.

The impact on customer bargaining power can be seen in several ways:

- Increased Policy Options: Reforms encouraging new insurer entry can lead to a wider array of policy choices for consumers.

- Potential for Lower Premiums: Reduced litigation costs and a more stable market can translate into more competitive pricing.

- Enhanced Consumer Protections: Legislative measures often include provisions that strengthen consumer rights and dispute resolution processes.

- Greater Negotiation Leverage: With more insurers competing for business, customers may find they have more room to negotiate terms and pricing.

Demand for Tailored Products and Services

Customers can significantly influence Heritage Insurance Holdings by demanding highly personalized insurance products. This includes options like usage-based auto insurance, where premiums are tied to driving habits, or specialized coverage for unique risks, such as specific flood zones or earthquake-prone areas. This trend forces insurers to continuously develop more adaptable and customer-centric offerings.

The drive for customization means Heritage must be agile in its product development. For instance, in 2024, the demand for parametric insurance, which pays out based on predefined triggers like wind speed or rainfall, continued to grow. This type of product offers a more direct and often faster payout than traditional indemnity-based policies, directly addressing customer needs for speed and certainty in claims processing.

- Increased demand for usage-based insurance (UBI) in auto policies.

- Growing interest in tailored coverage for specific natural disaster risks.

- Insurers are investing in data analytics to better understand and meet individual customer needs.

- The need for flexible policy structures to accommodate diverse customer requirements.

Customers in Florida's insurance market, a key area for Heritage Insurance Holdings, possess substantial bargaining power. This is driven by the availability of numerous insurers and the ease with which policyholders can compare quotes and switch providers, especially in 2024 with new entrants and returning companies. The focus on competitive pricing is paramount, as consumers actively seek the best value.

Legislative reforms enacted in Florida, including those in 2023 aimed at curbing litigation, have fostered a more competitive environment. This shift empowers customers by potentially leading to more stable premiums and a wider selection of policies. The increased transparency through online platforms further bolsters their ability to negotiate favorable terms.

The demand for personalized insurance, such as usage-based auto policies or coverage tailored to specific risks, also amplifies customer bargaining power. For instance, the growing interest in parametric insurance in 2024 highlights a customer desire for faster, trigger-based payouts, pushing insurers like Heritage to innovate their product offerings.

| Factor | Impact on Customer Bargaining Power | 2024 Market Trend Example |

|---|---|---|

| Number of Insurers | High (More choices) | Increased insurer entry/re-entry in Florida |

| Information Availability | High (Easy comparison) | Growth of insurance comparison websites |

| Switching Costs | Low (Easy to change) | Minimal penalties for early termination in many policies |

| Price Sensitivity | High (Focus on cost) | Consumers actively seeking premium reductions |

Full Version Awaits

Heritage Insurance Holdings Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Heritage Insurance Holdings, detailing the competitive landscape and strategic implications for the company. You're looking at the actual document, which meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the insurance sector. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your immediate use.

Rivalry Among Competitors

The property and casualty insurance market, particularly in coastal regions where Heritage Insurance Holdings primarily operates, is a crowded space. This means there are many companies trying to attract the same customers. For instance, in 2024, the U.S. property and casualty insurance industry is projected to see continued competition, with insurers actively seeking growth opportunities in areas like homeowners insurance, which is critical for Heritage.

This vast array of competitors isn't just about quantity; it's also about diversity. You have major national insurance giants with broad reach and deep pockets, alongside smaller, specialized regional insurers who might have a more focused approach. This mix means Heritage faces rivalry not only from large, established players but also from nimble, niche competitors who can adapt quickly to market changes and customer needs.

The U.S. property and casualty (P&C) insurance sector experienced robust underwriting results and improving investment income in 2024. However, projections indicate a deceleration in premium growth for 2025.

This anticipated slowdown in market expansion, combined with persistent challenges from severe weather events, is likely to intensify competition among insurers. As opportunities for organic growth diminish, companies may engage in more aggressive pricing and product differentiation to capture a larger share of the remaining profitable market segments.

Heritage Insurance Holdings operates in an industry characterized by substantial fixed costs. These include significant investments in IT infrastructure, extensive regulatory compliance measures, and ongoing technology upgrades necessary to remain competitive. For instance, in 2024, the property and casualty insurance sector saw continued investment in digital transformation, with many firms allocating substantial portions of their budgets to enhance customer experience and operational efficiency through technology.

These high fixed costs act as considerable barriers to exiting the market. Companies may find it difficult to divest or shut down operations without incurring substantial losses, leading them to persist in the market even when profitability is challenged. This dynamic can sustain a high level of competitive rivalry as firms are incentivized to maintain market share and operational capacity rather than withdraw.

Product Differentiation and Innovation

While insurance products can seem very similar, companies try to stand out by offering better customer service, faster claims processing, unique pricing, and coverage for specific, unusual risks. Heritage Insurance Holdings, for example, focuses on coastal regions and natural disasters, which is a way to differentiate itself. However, other insurance providers are also working to innovate and offer similar specialized coverage, intensifying the rivalry.

In 2024, the insurance industry continues to see a push for differentiation. For instance, companies are investing in digital platforms to streamline the customer experience and claims management. Heritage's strategy in coastal markets, while specific, means it competes directly with other insurers who are also developing expertise and offerings for these high-risk areas. This creates a dynamic environment where innovation in product design and service delivery is crucial for maintaining market share.

- Service Quality: Differentiating through superior customer service and efficient claims handling remains a key strategy for insurers.

- Pricing Models: Innovative pricing structures, including usage-based insurance, are emerging to attract and retain customers.

- Specialized Coverage: Heritage's focus on coastal states and natural perils is a form of product differentiation, but competitors are also innovating in these niches.

- Technological Advancement: Insurers are leveraging technology to improve operational efficiency and customer engagement, further blurring product lines.

Impact of Catastrophic Events

The insurance industry, including Heritage Insurance Holdings, faces intense rivalry, particularly when catastrophic events strike. The increasing frequency and severity of natural disasters like hurricanes and wildfires directly influence how insurers compete. For instance, the 2023 hurricane season, while not as devastating as some prior years, still presented significant challenges, with insured losses estimated to be in the tens of billions of dollars globally.

These events, while boosting demand for insurance coverage, also inflict substantial financial strain on insurers. This can lead to a temporary decrease in competition as some companies scale back their operations or withdraw from markets deemed too high-risk. For example, following major catastrophe events, it's not uncommon for insurers to non-renew policies in certain coastal or wildfire-prone areas, effectively reducing the competitive landscape for policyholders in those regions.

- Increased Catastrophe Losses: In 2023, global insured losses from natural catastrophes were estimated to be around $110 billion, according to Swiss Re, highlighting the significant financial impact on the industry.

- Market Exits and Reduced Exposure: Following substantial losses, some insurers may reduce their footprint in vulnerable areas, leading to fewer choices for consumers in those specific markets.

- Shift in Market Share: When insurers exit or reduce exposure, remaining competitors can see a temporary gain in market share, altering the competitive dynamics.

- Pricing Adjustments: The heightened risk associated with catastrophes often leads to increased premiums, a competitive factor that influences customer choice and insurer profitability.

Competitive rivalry within the property and casualty insurance sector, where Heritage Insurance Holdings operates, is notably intense. This is driven by a fragmented market with numerous players, including large national carriers and specialized regional insurers, all vying for customer acquisition. For instance, in 2024, the U.S. property and casualty insurance market continues to experience robust competition, especially in homeowners insurance, a key area for Heritage.

The industry's high fixed costs associated with technology and regulatory compliance also contribute to sustained rivalry, as firms are incentivized to maintain market share rather than withdraw. Furthermore, insurers differentiate themselves through service quality, innovative pricing, and specialized coverage, particularly in high-risk areas like coastal regions where Heritage focuses. This constant drive for differentiation intensifies the competitive landscape.

The impact of natural catastrophes further shapes competition. While severe weather events can lead to temporary market exits by some insurers, increasing competition among remaining players for market share. For example, global insured losses from natural catastrophes in 2023 were estimated at approximately $110 billion, underscoring the financial pressures that can influence competitive dynamics and pricing strategies.

SSubstitutes Threaten

Larger commercial property owners and groups of homeowners are increasingly exploring self-insurance or forming captive insurance companies to manage their risks, especially when traditional insurance premiums rise significantly or coverage terms become unfavorable. This trend is amplified by the growing demand for alternative risk transfer (ART) solutions, particularly for clients facing complex or challenging risk profiles.

Government-backed insurance programs present a significant threat of substitution for private insurers like Heritage Insurance Holdings, especially in high-risk regions. In coastal areas, entities such as the Florida Hurricane Catastrophe Fund and Citizens Property Insurance Corporation offer coverage when private options become unavailable or excessively costly. This can directly siphon customers away from private insurers if their pricing or availability becomes less competitive.

While Citizens Property Insurance Corporation saw a reduction in its policy count during 2024, suggesting some strengthening in the private insurance market, it still represents a substantial alternative. This continued presence underscores the ongoing competitive pressure from government-sponsored entities that can offer a safety net, influencing pricing strategies and market share for private insurers operating in similar territories.

Catastrophe bonds and parametric insurance present a growing threat of substitution for traditional reinsurance, particularly for large-scale risks like natural disasters. These alternative risk transfer mechanisms directly tap into capital markets, offering a distinct avenue for risk management.

In 2023, the catastrophe bond market saw significant activity, with issuance reaching approximately $15 billion, demonstrating a strong appetite from investors seeking yield and diversification. This trend is expected to continue into 2024, as insurers increasingly explore these options to supplement or replace traditional reinsurance capacity.

Risk Mitigation and Prevention Measures

Investments in robust risk mitigation and prevention measures can significantly impact the threat of substitutes for insurers like Heritage Insurance Holdings. For instance, widespread adoption of hurricane-resistant building codes, as seen in Florida's updated regulations, directly lowers the potential for windstorm damage, thus reducing the perceived need for comprehensive wind insurance coverage.

Wildfire-resistant landscaping and smart home technology that detects and mitigates water damage are other examples. These innovations empower homeowners to actively reduce their risk exposure. This proactive approach can lead to a shift where individuals feel less dependent on traditional insurance policies to cover preventable losses.

The effectiveness of these measures can be seen in evolving consumer behavior and product demand.

- Reduced Claims Frequency: Proactive risk reduction leads to fewer insurance claims, impacting insurer profitability.

- Shift in Coverage Demand: Consumers may opt for lower coverage limits or specialized policies as their perceived risk decreases.

- Technological Integration: Smart home devices, like leak detectors, offer an alternative to water damage insurance.

- Regulatory Impact: Stricter building codes, such as those implemented in disaster-prone areas, are a direct response to mitigating losses and can influence insurance product design.

Non-Insurance Risk Management Strategies

Businesses and individuals are increasingly exploring non-insurance risk management strategies to bolster their financial resilience. Diversifying assets geographically, for instance, can mitigate exposure to localized disasters. In 2023, for example, companies with significant international operations often saw better performance during regional economic downturns compared to those heavily concentrated in a single market.

Robust emergency preparedness plans also serve as a crucial layer of protection. A 2024 survey indicated that 65% of small businesses with comprehensive business continuity plans were able to resume operations within 48 hours following a disruptive event, compared to only 30% of those without such plans.

These proactive measures, while not direct replacements for insurance, can diminish the perceived necessity of extensive traditional policies. This trend could impact insurers by reducing demand for certain coverage types, particularly for those risks that can be effectively managed through internal controls and diversification.

- Geographic Asset Diversification: Reduces vulnerability to localized economic or environmental shocks.

- Emergency Preparedness: Enhances operational continuity and minimizes downtime after disruptions.

- Reduced Perceived Value of Insurance: Non-insurance strategies can lessen the reliance on and demand for traditional insurance products.

The threat of substitutes for Heritage Insurance Holdings is significant, driven by alternative risk management strategies and government programs. Self-insurance and captive insurance are growing, particularly for larger entities seeking to control costs when traditional premiums rise. Government-backed programs, like Citizens Property Insurance Corporation in Florida, continue to offer a safety net, influencing private market pricing even as their policy counts fluctuate. The increasing sophistication of alternative risk transfer, such as catastrophe bonds, also provides direct competition for reinsurance needs.

Innovations in risk mitigation, like advanced building codes and smart home technology, are reducing the perceived need for certain types of insurance coverage. Similarly, proactive business strategies such as geographic asset diversification and robust emergency preparedness plans can diminish reliance on traditional insurance policies. For example, a 2024 survey showed 65% of small businesses with continuity plans resumed operations within 48 hours of a disruption, compared to only 30% without them.

| Substitute Strategy | Impact on Traditional Insurance | Example/Data Point |

|---|---|---|

| Self-Insurance/Captives | Reduces demand for commercial property insurance | Growing trend among large commercial property owners |

| Government Programs | Offers alternative coverage, especially in high-risk areas | Citizens Property Insurance Corporation remains a significant competitor in Florida |

| Catastrophe Bonds | Competes with traditional reinsurance markets | Market issuance reached ~$15 billion in 2023 |

| Risk Mitigation Tech | Decreases demand for specific coverages (e.g., water damage) | Smart home leak detectors offer proactive protection |

| Business Continuity Plans | Lessens reliance on business interruption insurance | 65% of businesses with plans resumed operations within 48 hours (2024 survey) |

Entrants Threaten

The insurance sector, including companies like Heritage Insurance Holdings, faces substantial hurdles for new players due to stringent regulatory frameworks. These regulations often mandate significant capital reserves, with states requiring insurers to maintain solvency margins, for instance, a minimum surplus of $1 million or 10% of liabilities, whichever is greater, as a baseline. Navigating complex licensing procedures across various jurisdictions further complicates market entry, effectively deterring many potential competitors.

Established insurers like Heritage Insurance Holdings benefit from significant brand recognition and deep-rooted customer loyalty, making it difficult for new entrants to gain traction. Building trust in the financial protection sector, especially concerning catastrophic events, requires substantial time and considerable marketing expenditure. For instance, in 2024, the insurance industry continued to see high customer retention rates for well-known brands, with many consumers prioritizing reliability and established reputations over potentially lower initial costs offered by newcomers.

New entrants to the insurance market, like Heritage Insurance Holdings, often struggle to gain access to established distribution channels. Building a robust network of independent agents, brokers, or even a cost-effective direct-to-consumer platform requires significant investment and time, acting as a considerable barrier.

For instance, in 2024, the cost of acquiring a new customer through traditional agent channels can range from hundreds to thousands of dollars, making it difficult for new players to compete with incumbents who have amortized these costs over years. This reliance on established networks means new entrants must either partner with existing distributors, which can be costly, or invest heavily in building their own, a process that can take years to yield comparable reach.

Data and Technology Investment

The significant investment required in advanced data analytics, artificial intelligence, and robust IT infrastructure creates a substantial barrier for new companies looking to enter the insurance market. Established players like Heritage Insurance Holdings have already made these foundational investments, giving them a competitive edge.

While insurtechs are emerging, the landscape for new entrants is becoming more challenging. Investor confidence in insurtech disruptors has seen an increase, but overall funding has slowed down, suggesting a more cautious investment climate. For example, while insurtech funding reached billions in previous years, 2023 saw a more tempered approach, with many startups focusing on sustainable growth rather than rapid expansion.

- High upfront costs for technology: New entrants need to invest heavily in data processing, AI capabilities, and cybersecurity.

- Talent acquisition challenges: Securing skilled data scientists and IT professionals is competitive and costly.

- Evolving regulatory landscape: Compliance with data privacy and security regulations adds to the complexity and cost of entry.

Reinsurance Market Access and Cost

Securing sufficient and cost-effective reinsurance is a critical hurdle for property and casualty insurers, especially those exposed to high-risk coastal or catastrophe-prone regions. New companies entering the market may struggle to secure the same favorable reinsurance terms as established insurers who have built long-term relationships and demonstrated a reliable claims history.

For instance, in 2023, the global reinsurance market saw significant rate increases, particularly for property catastrophe coverage, as insurers grappled with the aftermath of numerous natural disasters. This environment makes it more difficult and expensive for new entrants to obtain the necessary reinsurance capacity to underwrite policies effectively.

- Reinsurance Costs: New entrants face higher reinsurance premiums due to a lack of established track record and bargaining power.

- Capacity Constraints: Reinsurers may be more hesitant to offer substantial capacity to unproven market participants.

- Relationship Advantage: Established insurers benefit from existing, often preferential, relationships with reinsurers.

- Market Volatility: The current reinsurance market, characterized by hardening rates and increased scrutiny, presents a significant barrier to entry for new P&C insurers.

The threat of new entrants for Heritage Insurance Holdings remains moderate. Significant capital requirements, complex licensing, and the need for substantial technology investments create high barriers. Furthermore, established brand loyalty and distribution networks are difficult for newcomers to replicate, demanding considerable time and resources to overcome.

In 2024, the insurance industry continued to emphasize digital transformation, requiring new entrants to invest heavily in advanced analytics and AI. This technological imperative, coupled with the ongoing need for robust cybersecurity, adds to the already considerable cost of market entry, making it challenging for startups to compete effectively with incumbents like Heritage Insurance Holdings.

The reinsurance market in 2023 and early 2024 presented a tougher environment for new property and casualty insurers. Increased premiums and capacity constraints for catastrophe coverage mean that new players struggle to secure the same favorable terms as established companies with proven track records and strong reinsurer relationships.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Mandatory solvency margins and reserves | High barrier; requires significant initial funding | Minimum surplus often exceeding $1 million |

| Distribution Channels | Access to agents and brokers | Difficult to establish; costly to build direct channels | Customer acquisition costs can range from hundreds to thousands of dollars per customer |

| Technology Investment | Data analytics, AI, IT infrastructure | Substantial upfront cost; essential for competitiveness | Ongoing investment in AI and data capabilities is a key differentiator |

| Reinsurance Access | Securing cost-effective reinsurance | Challenging, especially for catastrophe-exposed risks | Reinsurance rates for property catastrophe coverage saw increases in 2023 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Heritage Insurance Holdings is built upon data from their annual reports, SEC filings, and investor relations materials. We also incorporate insights from industry publications and market research reports to understand the broader competitive landscape.