Heritage Insurance Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heritage Insurance Holdings Bundle

Unlock the strategic blueprint of Heritage Insurance Holdings with our comprehensive Business Model Canvas. Discover how they connect with key customer segments, deliver unique value propositions, and leverage crucial partnerships to drive revenue and manage costs effectively. This detailed analysis is your gateway to understanding their competitive edge.

Dive deeper into Heritage Insurance Holdings’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Heritage Insurance Holdings relies on reinsurance providers to manage significant risk, particularly from natural disasters in coastal regions. These partnerships are vital for transferring a large portion of potential losses from major events, ensuring financial stability and enabling coverage in high-risk areas.

The company secured its 2024-2025 and 2025-2026 catastrophe excess-of-loss reinsurance programs. This includes multi-year coverage from catastrophe bonds issued by Citrus Re Ltd., demonstrating a strategic approach to long-term risk mitigation.

Heritage Insurance Holdings relies heavily on its extensive network of independent insurance agents and brokers, who serve as crucial sales channels. These partners provide essential localized market access and deliver personalized customer service, which is key to acquiring new policyholders.

Maintaining robust relationships with these agents is paramount for Heritage's expansion and achieving its growth targets. For instance, in 2024, the company continued to emphasize its agent relationships as a core component of its distribution strategy, aiming to leverage their market penetration.

Heritage Insurance Holdings leverages third-party claims adjusters and service providers to supplement its in-house capabilities, particularly for specialized claims or during surges in demand. This strategic outsourcing ensures claims are handled efficiently, even after significant events like hurricanes, which can overwhelm internal resources. For instance, in 2023, the insurance industry saw a substantial increase in catastrophe claims, making such partnerships vital for maintaining service levels and controlling loss expenses.

Catastrophe Modeling and Data Analytics Firms

Heritage Insurance Holdings relies heavily on partnerships with catastrophe modeling and data analytics firms. These collaborations are crucial for understanding and pricing risks associated with properties in peril-prone areas. For instance, in 2024, the increasing frequency and severity of weather events, such as hurricanes and wildfires, underscore the need for sophisticated modeling to accurately assess potential losses. These firms provide Heritage with the granular data and analytical tools necessary to refine underwriting, ensuring policies are priced appropriately to cover expected claims and maintain profitability.

These partnerships enable Heritage to:

- Enhance Risk Assessment: Utilize advanced algorithms to model potential losses from natural disasters, improving the accuracy of underwriting decisions.

- Optimize Pricing Strategies: Develop more precise policy pricing based on detailed risk profiles, ensuring competitiveness and profitability.

- Refine Underwriting: Gain deeper insights into property-specific vulnerabilities, allowing for more disciplined and targeted underwriting.

Financial Institutions and Capital Markets

Heritage Insurance Holdings relies on strong relationships with banks and investment firms to effectively manage its substantial investment portfolio. These partnerships are crucial for securing necessary capital, particularly for underwriting risks and ensuring liquidity. For instance, in 2024, Heritage continued to leverage its financial institution network to optimize its asset allocation strategies, aiming for stable returns while maintaining prudent risk management.

Access to capital markets is another vital component, as demonstrated by Heritage's use of Citrus Re. This subsidiary allows Heritage to access reinsurance capacity through innovative financial instruments like catastrophe bonds. These bonds, a key part of their 2024 strategy, transfer a portion of catastrophe risk to capital market investors, thereby enhancing Heritage's financial flexibility and providing an additional layer of protection against severe weather events. This strategic move in 2024 helped solidify their risk management framework.

- Investment Portfolio Management: Partnerships with financial institutions facilitate expert management of Heritage's investment assets, crucial for generating income and maintaining financial stability.

- Capital Acquisition: Banks and investment firms provide essential access to capital, enabling Heritage to underwrite policies and meet its financial obligations.

- Catastrophe Bonds: The use of Citrus Re and catastrophe bonds, a significant strategy in 2024, allows Heritage to transfer risk and secure vital reinsurance coverage from capital markets.

- Financial Flexibility: These key partnerships enhance Heritage's overall financial resilience, providing the flexibility needed to navigate market volatility and catastrophic events.

Heritage Insurance Holdings collaborates with various third-party service providers to enhance operational efficiency and customer service. This includes partnerships with specialized claims adjusters and technology vendors for claims processing and policy management. For instance, in 2023, the company continued to invest in digital platforms, often through partnerships with tech firms, to streamline customer interactions and claims handling, especially following periods of high claim volume.

These strategic alliances are critical for managing claim volumes, particularly after severe weather events, ensuring timely and accurate settlements for policyholders. The company's reliance on these external experts is a key factor in maintaining service quality and controlling loss adjustment expenses.

Heritage Insurance Holdings also partners with catastrophe modeling firms to refine its risk assessment and pricing strategies. These collaborations are essential for understanding and mitigating the impact of natural disasters, a significant concern for insurers operating in coastal areas. For example, in 2024, the increasing frequency of severe weather events highlights the importance of these data-driven partnerships for accurate underwriting and risk transfer.

The company's relationships with independent agents and brokers are fundamental to its distribution strategy, providing crucial market access and customer acquisition. In 2024, Heritage continued to focus on strengthening these partnerships to drive growth and expand its policyholder base.

| Partner Type | Role/Contribution | Impact on Heritage | Example/Year |

|---|---|---|---|

| Reinsurers | Risk transfer, capacity for catastrophe events | Financial stability, ability to underwrite high-risk areas | Secured 2024-2025 catastrophe excess-of-loss programs |

| Independent Agents & Brokers | Sales channels, market access, customer service | New policyholder acquisition, growth targets | Core component of 2024 distribution strategy |

| Third-Party Claims Adjusters | Claims processing, specialized services | Efficient claims handling, service quality during surges | Vital for managing increased catastrophe claims in 2023 |

| Catastrophe Modeling Firms | Risk assessment, pricing refinement | Accurate underwriting, profitable pricing | Crucial for assessing losses from increasing weather events in 2024 |

| Banks & Investment Firms | Capital acquisition, investment portfolio management | Liquidity, optimized asset allocation | Leveraged network in 2024 for asset strategies |

What is included in the product

Heritage Insurance Holdings' Business Model Canvas focuses on providing property and casualty insurance, leveraging technology and a strong agent network to reach diverse customer segments. Its core strategy revolves around efficient claims processing and risk management to deliver value through reliable insurance products.

Heritage Insurance Holdings' Business Model Canvas acts as a pain point reliever by providing a high-level, one-page snapshot that quickly identifies core components, saving hours of formatting and structuring for efficient internal use and executive summaries.

Activities

Underwriting and policy issuance are the bedrock of Heritage Insurance Holdings. This involves meticulously evaluating the risks associated with insuring residential properties, especially those in areas susceptible to hurricanes and other natural disasters. The company's focus is on ensuring that the premiums charged are adequate to cover potential claims and generate a profit, a crucial element for long-term sustainability.

In 2024, Heritage continued its commitment to disciplined underwriting. This means they are not just selling policies, but carefully selecting which risks to take on and at what price. Their strategy aims for rate adequacy, ensuring that the premiums collected are sufficient to cover claims and expenses, particularly in challenging markets like Florida where catastrophe exposure is high.

Heritage Insurance Holdings' key activity is managing and processing insurance claims, particularly those stemming from natural disasters. In 2024, the company continued to refine its approach to handling these events, aiming for both efficiency and thoroughness.

A significant aspect of their claims management is the vertically integrated model. This includes in-house adjusting, water mitigation, and repair services. This integration is designed to streamline the claims process, reduce costs, and enhance the customer experience following a loss.

Heritage Insurance Holdings actively manages its reinsurance program, a crucial step in protecting against significant losses from events like hurricanes. In 2024, the company continued to refine its approach to catastrophe excess-of-loss reinsurance, aiming for robust coverage.

This management includes negotiating terms with reinsurers and exploring alternative capital solutions. For instance, utilizing instruments such as catastrophe bonds allows Heritage to transfer risk to the capital markets, diversifying its risk mitigation strategies.

Actuarial Analysis and Risk Assessment

Heritage Insurance Holdings continuously engages in rigorous actuarial analysis and risk assessment. This core activity is crucial for setting appropriate premiums and effectively managing potential losses, particularly from catastrophic events. For instance, in 2024, the insurance industry, including companies like Heritage, heavily relied on updated catastrophe models to account for evolving climate patterns and their impact on property damage claims.

This data-driven methodology underpins Heritage's ability to underwrite policies selectively, ensuring profitability and sustainable growth. By refining risk assessment models, the company can identify and price risks more accurately, which is vital for strategic decisions regarding market entry and the development of new insurance products.

- Actuarial Analysis: Ongoing evaluation of mortality, morbidity, and property loss data to inform pricing and reserve calculations.

- Risk Assessment Models: Development and refinement of models to quantify potential losses from various perils, including natural disasters.

- Underwriting Strategy: Using actuarial insights to guide the acceptance or rejection of insurance applications based on risk profiles.

- Product Development: Leveraging risk data to design and price new insurance offerings that meet market demand while managing exposure.

Customer Service and Policyholder Support

Heritage Insurance Holdings prioritizes delivering exceptional customer service, especially during and after significant events like natural disasters. This commitment ensures policyholders receive timely assistance and support when they need it most.

The company focuses on providing a high-quality customer experience throughout the entire policy lifecycle. This includes efficient claims processing, aiming to build trust and encourage long-term policyholder relationships.

- Customer Support: Offering comprehensive assistance to policyholders, particularly during and after catastrophic events.

- Claims Handling: Ensuring an efficient and satisfactory claims resolution process.

- Policyholder Retention: Fostering customer satisfaction to maintain and grow the policyholder base.

Heritage Insurance Holdings' core activities revolve around disciplined underwriting, efficient claims management, and robust risk mitigation. They focus on rate adequacy, particularly in catastrophe-prone areas, and leverage a vertically integrated claims process for better control and customer experience. A key function is managing their reinsurance program to protect against large losses.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Underwriting & Policy Issuance | Evaluating risks and setting premiums for property insurance. | Emphasis on rate adequacy, especially in Florida's high-catastrophe market. |

| Claims Management | Processing and resolving insurance claims efficiently. | Refining in-house adjusting, water mitigation, and repair services for better control and customer satisfaction. |

| Reinsurance Management | Securing protection against significant losses from major events. | Continued refinement of catastrophe excess-of-loss reinsurance and exploration of alternative capital solutions. |

| Actuarial Analysis & Risk Assessment | Using data to inform pricing, reserves, and underwriting decisions. | Heavy reliance on updated catastrophe models to account for evolving climate patterns and their impact on claims. |

Delivered as Displayed

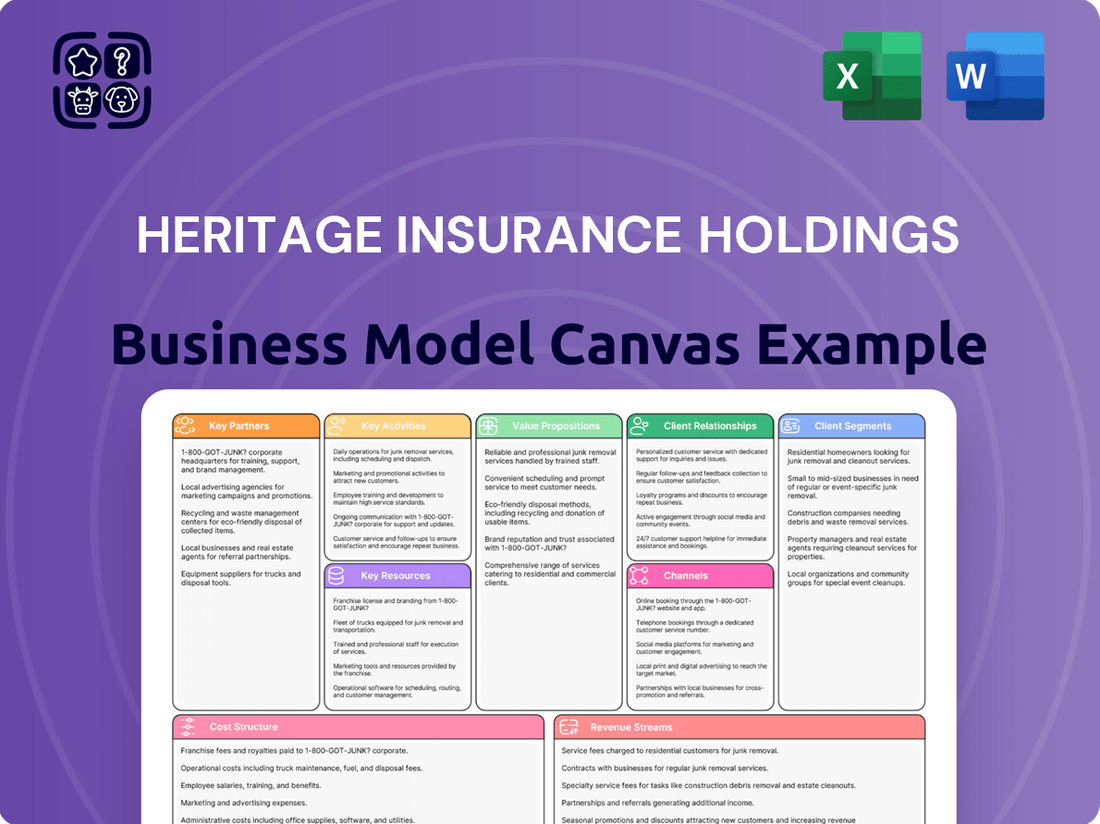

Business Model Canvas

The Business Model Canvas for Heritage Insurance Holdings that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure. You can be assured that what you see is precisely what you will get, ready for your analysis and strategic planning.

Resources

Heritage Insurance Holdings relies on substantial financial capital and reserves to fulfill its obligations, including paying claims and meeting regulatory requirements. As of the first quarter of 2024, the company reported total assets of $3.9 billion, underscoring its capacity to support its insurance operations.

The company's financial strength, demonstrated by its ability to generate positive returns, is a key resource. This financial health instills confidence in policyholders about claim payouts and reassures investors regarding the company's stability and future prospects.

Heritage Insurance Holdings' experienced management team, boasting deep expertise in residential property insurance, is a cornerstone of its operations. This seasoned leadership guides strategic decisions in underwriting, claims handling, and risk management, ensuring the company navigates the complexities of the insurance market effectively.

The company's workforce is equally vital, comprising experienced agents who form a critical distribution network and dedicated employees who drive day-to-day efficiency. In 2024, Heritage Insurance Holdings continued to leverage this human capital to maintain high service standards and operational excellence, a key differentiator in a competitive landscape.

Heritage Insurance Holdings' portfolio of reinsurance contracts and its deep-seated relationships with highly-rated reinsurers are foundational to its business model. These partnerships are critical for effectively managing catastrophic risks, which is paramount in the insurance industry, and for bolstering the company's overall financial resilience. In 2024, securing these cost-effective reinsurance programs remains a top priority.

Proprietary Underwriting Models and Data Analytics Platforms

Heritage Insurance Holdings leverages advanced underwriting models and a robust enterprise analytics platform, enhanced with AI capabilities. These intellectual resources are fundamental to their business, allowing for precise risk selection and accurate rate setting, especially for properties facing natural perils.

The company’s proprietary models and data analytics platforms are key differentiators. They facilitate sophisticated risk assessment, enabling Heritage to manage its exposure effectively and maintain rate adequacy across its portfolio. For instance, in 2024, the company continued to refine its predictive analytics for catastrophe-prone regions, aiming to improve loss ratios.

- Proprietary Underwriting Models: Sophisticated algorithms for granular risk assessment.

- Data Analytics Platforms: A comprehensive system for policy and claims data analysis.

- AI Capabilities: Integration of artificial intelligence for enhanced predictive modeling and automation.

- Risk Selection and Rate Adequacy: Direct impact on profitability and competitive pricing.

Brand Reputation and Agent Network

Heritage Insurance Holdings leverages a strong brand reputation built on reliable coverage and efficient claims processing, particularly in regions susceptible to natural disasters. This intangible asset is crucial for customer acquisition and loyalty. For instance, in 2024, the company continued to focus on strengthening its claims handling efficiency, a key driver of its brand perception.

The company's extensive network of independent agents serves as a vital distribution channel. This network not only facilitates policy sales but also fosters strong relationships with policyholders, contributing to customer retention. In 2024, Heritage continued to invest in agent training and support to enhance this crucial resource.

- Brand Reputation: Heritage is recognized for dependable insurance coverage and streamlined claims, especially in catastrophe-prone areas.

- Agent Network: A large and established network of independent agents is key to attracting and retaining policyholders.

- Customer Acquisition: The combination of a trusted brand and a wide agent reach allows Heritage to effectively reach and secure new customers.

- Policyholder Retention: The company's focus on efficient claims and agent relationships helps maintain strong policyholder loyalty.

Heritage Insurance Holdings' key resources include its substantial financial capital, with total assets reaching $3.9 billion in Q1 2024, ensuring claim fulfillment and regulatory compliance. Its experienced management team, deeply knowledgeable in residential property insurance, guides strategic operations. The company's workforce, including skilled agents and efficient employees, is vital for service delivery and operational excellence.

Furthermore, Heritage Insurance Holdings relies on its reinsurance contracts and strong relationships with reinsurers to manage catastrophic risks and enhance financial resilience. Advanced proprietary underwriting models and AI-enhanced data analytics platforms are critical for precise risk selection and rate adequacy. The company’s brand reputation for reliable coverage and efficient claims, coupled with its extensive independent agent network, drives customer acquisition and retention.

| Key Resource | Description | 2024 Relevance |

| Financial Capital | Total assets of $3.9 billion (Q1 2024) | Supports claim payments and regulatory needs. |

| Management Expertise | Deep experience in residential property insurance | Guides underwriting, claims, and risk management. |

| Agent Network | Extensive independent agent distribution channel | Drives policy sales, customer relationships, and retention. |

| Proprietary Analytics | AI-enhanced underwriting models and data platforms | Enables precise risk assessment and rate setting. |

Value Propositions

Heritage Insurance Holdings excels by offering specialized personal and commercial residential insurance products. These are specifically crafted for properties located in coastal states, areas particularly vulnerable to natural disasters. This focus addresses a significant gap in the market, as many insurers shy away from these high-risk locations.

This specialization allows Heritage to provide tailored protection for properties facing elevated risks. For instance, in 2023, Florida, a key market for Heritage, experienced insured losses from hurricanes and tropical storms that reached billions of dollars, highlighting the critical need for specialized coverage in such environments.

Heritage Insurance Holdings stands out with its vertically integrated claims handling, a key value proposition. This unique model encompasses in-house claims adjusting, water mitigation, and repair services. This integration is designed to ensure claims are processed and resolved quickly and effectively, boosting customer confidence.

Heritage Insurance Holdings offers policyholders a profound sense of security, knowing their claims will be paid even after major disasters, thanks to its strong financial footing and comprehensive reinsurance strategy. This reliability is a cornerstone of their value proposition.

The company's track record of consistent profitability and positive ratings from key agencies like Demotech, which affirmed Heritage's A (Excellent) financial stability rating in early 2024, directly supports this claim of dependability for its customers.

Customized Insurance Solutions

Heritage Insurance Holdings goes beyond the typical insurance policies by offering a broad spectrum of specialized products. This includes tailored coverage for homeowners, condominium owners, and even those with rental properties.

This adaptability is key to their strategy, allowing them to effectively serve a wide range of residential property owners within their carefully chosen operational areas. For example, in 2024, Heritage continued to refine its product suite to address the evolving needs of these distinct customer segments.

- Homeowners Insurance: Comprehensive protection for primary residences.

- Condominium Owners Insurance: Coverage for the interior of units and personal liability.

- Rental Property Insurance: Protection for landlords against property damage and liability.

Experienced and Responsive Support

Heritage Insurance Holdings emphasizes experienced and responsive support as a core value proposition. Policyholders can rely on the expertise of Heritage's management and a dedicated staff ready to address policy inquiries and manage claims, especially following natural disasters. This commitment ensures a focus on policyholder recovery.

In 2024, Heritage Insurance Holdings continued to demonstrate its commitment to policyholder support. For instance, following the significant hurricane activity impacting Florida in late 2023 and early 2024, Heritage’s claims adjusters were rapidly deployed to affected areas. This swift response, a hallmark of their service, aimed to expedite the claims process and provide crucial assistance to policyholders navigating the aftermath.

- Expertise: Heritage's management team brings extensive industry knowledge to guide policyholders.

- Responsiveness: Staff are trained to provide timely assistance with policy questions and claims processing.

- Disaster Preparedness: A key focus is on supporting policyholders effectively in the critical period after natural disasters.

- Recovery Focus: The support structure is designed to facilitate a smoother recovery process for those affected.

Heritage Insurance Holdings offers specialized residential insurance, particularly for coastal properties prone to natural disasters, filling a critical market need. This focus is underscored by the significant insured losses, totaling billions, experienced in key markets like Florida due to hurricane activity in 2023, demonstrating the essential nature of their tailored coverage.

Customer Relationships

Heritage Insurance Holdings cultivates robust connections with its independent agent network, equipping them with essential tools, training, and resources to effectively assist policyholders. This approach ensures policyholders receive personalized, local support and guidance.

In 2024, Heritage continued to invest in its agent portal, enhancing digital tools for quoting and policy management. This focus aims to streamline the customer acquisition process and improve agent efficiency, reflecting a commitment to a strong, supportive partner ecosystem.

Heritage Insurance Holdings prioritizes proactive communication, especially after major events. They actively reach out to policyholders, offering direct support and even setting up 'insurance villages' to connect face-to-face. This commitment aims to streamline the recovery process and show genuine care for their insureds.

Heritage Insurance Holdings prioritizes direct customer engagement through various channels. Policyholders can access online resources for self-service, manage their policies, and report claims efficiently.

The company operates contact centers to provide immediate assistance, aiming for a seamless and supportive policyholder experience. This direct interaction is key to building trust and ensuring customer satisfaction.

In 2024, Heritage Insurance Holdings reported a significant increase in digital self-service adoption, with over 60% of policy inquiries handled through online portals. Their customer satisfaction scores for direct interactions also saw an improvement, reaching 85% in the first half of the year.

Building Trust Through Reliability

Heritage Insurance Holdings builds trust by consistently delivering on its promise of protection, especially in challenging, high-risk markets where reliability is crucial. This commitment fosters deep policyholder loyalty.

The company's financial stability and proven track record in managing catastrophe claims further solidify this trust. For instance, in 2023, Heritage reported strong solvency ratios, demonstrating its capacity to meet obligations even after significant weather events.

- Consistent Claim Payouts: Heritage prioritizes timely and fair claim settlements, a cornerstone of its customer relationship strategy.

- Financial Strength: Maintaining robust capital reserves, evidenced by a strong Risk-Based Capital ratio, ensures Heritage can absorb losses and continue operations.

- Catastrophe Response: Proven expertise in handling large-scale disaster claims reinforces policyholder confidence in the company's ability to protect them when it matters most.

Online Portals and Digital Tools

Heritage Insurance Holdings focuses on enhancing customer experience through the development and maintenance of online portals. These digital platforms are designed for seamless policy management, convenient payment processing, and straightforward claims submission, significantly boosting accessibility for policyholders.

While the company's digital tool development is ongoing, the primary objective remains to streamline all interactions for those insured. This commitment to digital accessibility is crucial in today's market, where customers expect efficient and user-friendly online services.

- Online Portals: Heritage Insurance Holdings actively develops and maintains online portals to provide policyholders with self-service capabilities for managing their accounts.

- Digital Tool Development: The company is investing in and refining its suite of digital tools to simplify customer interactions, from initial policy setup to ongoing claims processing.

- Customer Convenience: The emphasis on these digital channels directly addresses the need for enhanced customer convenience and 24/7 accessibility to insurance services.

- Streamlined Interactions: By focusing on user-friendly design, Heritage Insurance Holdings aims to make policy management, payments, and claims submission as efficient as possible for its customers.

Heritage Insurance Holdings fosters strong relationships through its independent agent network, providing them with tools and training to support policyholders. The company also prioritizes direct customer engagement via online portals and contact centers, aiming for seamless self-service and immediate assistance.

In 2024, Heritage saw over 60% of policy inquiries handled digitally, with customer satisfaction for direct interactions reaching 85% in the first half of the year, underscoring a successful push towards enhanced digital accessibility and support.

Heritage builds trust through consistent claim payouts and financial stability, as demonstrated by strong solvency ratios in 2023, ensuring policyholders feel protected, especially in high-risk markets.

| Customer Relationship Aspect | 2024 Focus/Data | Impact |

|---|---|---|

| Agent Network Support | Enhanced agent portal with improved digital tools | Streamlined acquisition, increased agent efficiency |

| Direct Customer Engagement | Increased digital self-service adoption | 60% of inquiries handled online; improved accessibility |

| Customer Satisfaction (Direct) | Proactive communication, responsive contact centers | 85% satisfaction in H1 2024 |

| Trust & Reliability | Consistent claim payouts, strong financial stability | High policyholder loyalty, especially in catastrophe-prone areas |

Channels

Heritage Insurance Holdings heavily relies on its vast network of independent insurance agents as its primary distribution channel. These agents serve as crucial local touchpoints, offering customers expert guidance, competitive policy quotes, and tailored sales experiences across Heritage's operational states.

In 2024, Heritage continued to leverage this agent network, which is fundamental to its customer acquisition and retention strategy. This model allows for localized market penetration and personalized service, differentiating Heritage in a competitive insurance landscape.

Heritage Insurance Holdings leverages its company website as a central information nexus. This platform provides comprehensive details on their insurance products, investor relations, and company news, acting as a primary touchpoint for prospective and current customers.

While direct online policy purchasing capabilities might be secondary, the website is instrumental in initiating customer engagement and facilitating initial information discovery. In 2024, Heritage reported a significant increase in website traffic, indicating its growing importance as a lead generation and brand awareness tool.

Heritage Insurance Holdings leverages a direct-to-consumer (DTC) strategy for claims management, utilizing its own network of adjusters and claims centers. This approach facilitates direct engagement with policyholders throughout the entire claims journey, often involving in-person assessments and clear lines of communication.

This direct model empowers Heritage to control the customer experience during a critical phase, fostering trust and potentially speeding up resolution times. For instance, in 2024, the company continued to invest in its claims infrastructure, aiming to enhance efficiency and policyholder satisfaction.

Strategic Partnerships with National Insurers/Agencies

Heritage Insurance Holdings cultivates strategic partnerships with national insurers and agencies. These alliances grant Heritage access to extensive agent and production networks, significantly broadening its distribution capabilities. This expansion allows Heritage to reach a wider customer base and tap into new markets, complementing its existing independent agent relationships.

These collaborations are crucial for scaling operations and enhancing market penetration. For instance, in 2024, Heritage reported a substantial increase in its gross written premiums, partly attributed to the expanded reach facilitated by these strategic alliances. The ability to leverage the established infrastructure of national partners provides a cost-effective method for growth compared to building out entirely new distribution channels.

- Expanded Distribution: Access to national insurer and agency agent networks.

- Increased Reach: Penetration into markets beyond the core independent agent base.

- Growth Catalyst: Strategic alliances contributed to a notable rise in gross written premiums in 2024.

- Synergistic Benefits: Leveraging partner networks for efficient market expansion.

Public Relations and Investor Relations

Public Relations and Investor Relations are crucial channels for Heritage Insurance Holdings. They ensure consistent communication about the company's financial standing, strategic initiatives, and operational achievements. This outreach targets a wide array of stakeholders, including current and potential investors, financial analysts, and the general public, fostering transparency and trust.

Heritage Insurance Holdings actively utilizes regular news releases, quarterly earnings calls, and investor presentations. These platforms are designed to disseminate vital information effectively. For instance, in the first quarter of 2024, Heritage reported a net income of $16.6 million, demonstrating solid financial performance that is communicated through these channels.

- News Releases: Disseminate timely updates on company performance, strategic partnerships, and significant operational milestones.

- Earnings Calls: Provide detailed financial results and management commentary, offering investors a direct line to understand the company's trajectory.

- Investor Presentations: Offer in-depth insights into the business model, market position, and future outlook, often presented at industry conferences and dedicated investor events.

Heritage Insurance Holdings utilizes a multi-faceted channel strategy, prioritizing its extensive network of independent agents for localized sales and customer engagement. The company also leverages its corporate website for information dissemination and lead generation, while a direct-to-consumer model governs claims management for enhanced control and customer experience.

Strategic partnerships with national insurers and agencies further expand Heritage's reach, contributing significantly to growth. Public relations and investor relations channels, including news releases and earnings calls, ensure transparent communication with stakeholders, reinforcing trust and financial understanding.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Independent Agents | Primary distribution, local expertise, tailored sales. | Fundamental to customer acquisition and retention; differentiated market penetration. |

| Corporate Website | Information hub, product details, investor relations. | Growing importance for lead generation and brand awareness; significant traffic increase. |

| Direct-to-Consumer (Claims) | In-house claims management, direct policyholder engagement. | Investment in infrastructure to enhance efficiency and satisfaction. |

| Strategic Partnerships | Access to national networks, expanded distribution. | Contributed to a substantial increase in gross written premiums; efficient market expansion. |

| PR & Investor Relations | Stakeholder communication, financial transparency. | Dissemination of performance data, including $16.6 million net income in Q1 2024. |

Customer Segments

Heritage Insurance Holdings identifies homeowners in coastal and catastrophe-prone regions as a primary customer segment. These are individuals who own property in areas frequently impacted by natural disasters like hurricanes, floods, and wildfires.

This segment is crucial because Heritage focuses on providing insurance solutions in markets where other carriers may have withdrawn or significantly increased their pricing due to elevated risk. For instance, in Florida, a state heavily exposed to hurricanes, the homeowners insurance market has seen significant disruption.

In 2023, Florida experienced a notable increase in property insurance claims due to severe weather events, leading many insurers to re-evaluate their exposure and pricing strategies. This environment creates a demand for specialized coverage that Heritage aims to fulfill.

Heritage Insurance Holdings serves condominium owners in specific coastal and catastrophe-prone states, recognizing their unique insurance needs. This segment is crucial as these homeowners often face higher risks from hurricanes, floods, and other natural disasters.

In 2024, the property and casualty insurance market, particularly for coastal regions, continues to see significant pricing adjustments due to increased claims frequency and severity. For instance, states like Florida, where Heritage has a strong presence, have experienced substantial increases in homeowner insurance premiums, reflecting the ongoing challenges in managing catastrophe risk.

Heritage's specialized products for condominium owners are designed to cover not just the individual unit but also the shared structures and liabilities outlined in condominium association master policies. This tailored approach helps ensure comprehensive protection for these property owners in a volatile insurance landscape.

Rental property owners, encompassing landlords of single-family homes and multi-unit apartment buildings, form a crucial commercial residential segment for Heritage Insurance Holdings. These property owners face unique risks that require specialized insurance solutions. For instance, in 2024, the U.S. rental market continued to show robust demand, with vacancy rates for rental units generally remaining low, underscoring the ongoing need for reliable property protection for these investors.

Commercial Residential Property Owners

Commercial Residential Property Owners are a key customer segment for Heritage Insurance Holdings, particularly those with holdings in Florida, New Jersey, and New York. This group includes both individual investors and larger business entities that manage multiple residential units, such as apartment complexes, condominiums, and other multi-family dwellings. Heritage focuses on providing specialized insurance products designed to meet the unique risks associated with these larger-scale commercial ventures.

Heritage Insurance Holdings has been actively expanding its commercial property insurance offerings to cater to this segment. Their strategy involves developing tailored solutions that address the specific needs of commercial residential property owners, recognizing the increased complexity and value of these assets. This focus allows Heritage to build a robust portfolio in key geographic markets.

- Geographic Focus: Primarily targets commercial residential property owners in Florida, New Jersey, and New York.

- Property Types: Covers multi-family dwellings like apartment buildings, co-ops, and condominiums.

- Strategic Growth: Heritage is intentionally increasing its presence and offerings within the commercial property sector.

- Tailored Solutions: Provides insurance products specifically designed for the risks and needs of larger commercial residential properties.

Policyholders Seeking Specialized Risk Management

Heritage Insurance Holdings serves policyholders who demand specialized risk management, particularly those with properties in areas prone to natural disasters. These customers often struggle to find suitable coverage from standard insurers due to the higher risk profile. They value Heritage’s in-depth understanding of these specific perils and its reputation for expert claims handling.

This segment is characterized by a proactive approach to protecting their assets, seeking comprehensive policies that address unique vulnerabilities. For instance, in 2024, Florida, a key market for Heritage, continued to face elevated hurricane risks, driving demand for specialized windstorm coverage. Policyholders in such regions are willing to pay a premium for the assurance of adequate protection and efficient claims resolution.

- Niche Market Focus: Caters to property owners in high-risk natural disaster zones, a segment often underserved by general insurers.

- Expertise in Claims: Policyholders prioritize Heritage's specialized knowledge and experience in handling claims related to specific perils like hurricanes and floods.

- Demand for Comprehensive Coverage: Customers seek robust protection that goes beyond standard offerings, reflecting the heightened exposure of their properties.

- Value Proposition: Heritage offers peace of mind and financial security to those who find it difficult to secure adequate insurance elsewhere.

Heritage Insurance Holdings targets homeowners in catastrophe-prone regions, particularly those in coastal areas. These individuals are seeking specialized coverage that addresses the heightened risks of hurricanes, floods, and other severe weather events. In 2024, states like Florida, a key market for Heritage, continue to experience significant property insurance rate adjustments due to these ongoing risks, making Heritage's niche offerings valuable.

The company also serves condominium owners in these vulnerable locations, acknowledging their distinct insurance requirements. This segment benefits from Heritage's tailored policies that cover individual units as well as shared property structures. The demand for such comprehensive protection remains strong, especially as the property and casualty insurance landscape evolves with increasing claims frequency and severity.

Furthermore, Heritage Insurance Holdings caters to commercial residential property owners, including landlords of apartment buildings and multi-family dwellings, especially in states like Florida, New Jersey, and New York. This segment, which includes both individual investors and larger entities, requires specialized insurance solutions for their substantial assets. The robust demand in the U.S. rental market in 2024 further emphasizes the need for reliable insurance for these property owners.

| Customer Segment | Key Characteristics | Geographic Focus | 2024 Market Context |

|---|---|---|---|

| Homeowners in Catastrophe-Prone Regions | Own property in areas with high risk of hurricanes, floods, wildfires. Seek specialized coverage. | Coastal and disaster-prone states (e.g., Florida) | Continued pricing adjustments in property insurance due to elevated risk and claims. |

| Condominium Owners | Own units in coastal/catastrophe-prone areas. Need coverage for individual units and shared structures. | Coastal and disaster-prone states | Ongoing demand for comprehensive protection against severe weather. |

| Commercial Residential Property Owners | Landlords of single-family homes and multi-unit buildings. Manage larger, more complex assets. | Florida, New Jersey, New York | Robust rental market demand underscores need for reliable property protection. |

Cost Structure

Reinsurance premiums represent a significant cost for Heritage Insurance Holdings, acting as a vital tool to offload catastrophic risk, especially in their core coastal markets. These premiums are crucial for ensuring the company's financial resilience against severe weather events.

For the 2024-2025 policy period, Heritage's reinsurance program incurred substantial costs, reflecting the elevated risk profile of its property insurance operations. This expenditure is a necessary component of their strategy to protect against large-scale losses.

Similarly, the 2025-2026 reinsurance programs continued this trend of significant investment, underscoring the ongoing commitment to risk management. The cost of these programs directly impacts Heritage's profitability, but is essential for maintaining solvency and operational continuity.

Losses and Loss Adjustment Expenses (LAE) represent the core costs of Heritage Insurance Holdings' operations, directly tied to fulfilling policyholder obligations. These encompass the actual payouts for covered events and the intricate process of managing those claims, from initial investigation to final settlement.

For Heritage, particularly with its concentration on catastrophe-exposed properties, these expenses can be substantial. For instance, in the first quarter of 2024, the company reported a net loss of $15.6 million, partly influenced by elevated claims activity. This highlights the direct impact of weather events on their financial performance and cost structure.

Policy acquisition costs are a significant component of Heritage Insurance Holdings' expenses. These include commissions paid to independent agents, as well as other marketing and sales efforts aimed at bringing in new policyholders. For instance, in 2024, the company continued to invest in these areas to drive growth.

These acquisition costs directly impact profitability, as they are incurred upfront to secure future premium revenue. Heritage's strategy in 2024 likely involved balancing the need to expand its customer base with the imperative to manage these expenses effectively.

General and Administrative Expenses

General and administrative (G&A) expenses for Heritage Insurance Holdings encompass the operational overheads essential for running the business. These include salaries for non-claims personnel, such as management, finance, and support staff, alongside costs like office rent, utilities, and the technology infrastructure that underpins their operations. Managing these expenses efficiently is key to maintaining profitability.

For context, in 2024, Heritage Insurance Holdings reported significant G&A expenses as part of their overall cost structure. These costs are carefully monitored to ensure they align with strategic objectives and contribute to overall business efficiency. The company aims to optimize these expenditures without compromising the quality of its administrative functions.

- Salaries for non-claims personnel

- Office rent and utilities

- Technology infrastructure costs

- Other essential administrative expenditures

Technology and Data Investment

Heritage Insurance Holdings makes substantial investments in technology and data. These expenditures are crucial for modernizing core operations and gaining a competitive edge. For example, in 2023, the company continued its strategic investments in upgrading its policy administration, claims, and billing systems, notably including the implementation of Guidewire software. This focus on technological advancement is a significant component of their cost structure.

These technology outlays are not merely expenses but strategic investments designed to yield long-term benefits. By enhancing operational efficiency, improving risk assessment capabilities through advanced data analytics, and elevating the overall customer experience, Heritage aims to drive growth and profitability. The data warehousing and analytics platforms are key to unlocking deeper insights into market trends and customer behavior.

- Technology Modernization: Significant costs are incurred for implementing and maintaining advanced policy administration, claims, and billing systems, such as Guidewire.

- Data Infrastructure: Investments in data warehousing and analytics platforms are essential for data-driven decision-making and risk management.

- Operational Efficiency: These technology investments are directly tied to improving the speed and accuracy of internal processes.

- Customer Experience Enhancement: A portion of the technology budget is allocated to improving customer interactions and service delivery.

Heritage Insurance Holdings' cost structure is heavily influenced by reinsurance premiums, which are essential for managing catastrophic risk, particularly in coastal areas. For the 2024-2025 and 2025-2026 policy periods, these reinsurance costs represented a significant outlay, directly impacting profitability but crucial for financial stability.

Losses and Loss Adjustment Expenses (LAE) are the core operational costs, directly linked to fulfilling policyholder obligations. The company's concentration on catastrophe-exposed properties means these expenses can be substantial, as seen in the first quarter of 2024, where elevated claims activity contributed to a net loss.

Policy acquisition costs, including agent commissions and marketing, are also a key expense, incurred upfront to drive customer growth. Alongside these, general and administrative (G&A) expenses cover essential operational overheads like salaries, rent, and technology infrastructure, all managed to optimize efficiency.

Significant investments in technology, such as the implementation of Guidewire software for modernizing systems, are a major cost component. These expenditures on data infrastructure and operational efficiency are strategic, aiming to enhance risk management and customer experience.

| Cost Category | Description | 2024 Context |

|---|---|---|

| Reinsurance Premiums | Cost to transfer risk to reinsurers. | Substantial costs for 2024-2025 policy period, reflecting elevated risk. |

| Losses & LAE | Payouts for claims and associated expenses. | First quarter 2024 net loss of $15.6M partly due to elevated claims. |

| Policy Acquisition Costs | Commissions, marketing, and sales expenses. | Continued investment in 2024 to drive customer growth. |

| G&A Expenses | Salaries, rent, utilities, technology overhead. | Significant expenses reported in 2024, monitored for efficiency. |

| Technology Investments | System upgrades, data infrastructure, analytics. | Continued strategic investments in 2023 for modernization (e.g., Guidewire). |

Revenue Streams

Heritage Insurance Holdings primarily generates revenue through net premiums earned from its personal residential insurance offerings. This core business encompasses policies for homeowners, condominium owners, and rental properties, distributed across a multi-state operational area. This segment directly reflects the company's fundamental role in providing property and casualty coverage.

In 2023, Heritage reported net earned premiums of $870.6 million, a slight increase from $858.9 million in 2022. This demonstrates a stable, albeit modest, growth in its core insurance premium revenue, underscoring the importance of this stream to its overall financial performance.

Earned premiums from commercial residential insurance represent a key revenue stream for Heritage Insurance Holdings. This segment, which includes coverage for various commercial properties within their target markets, has shown notable growth and contributes substantially to the company's overall premium income.

In 2024, Heritage continued to focus on expanding its commercial residential offerings. The company reported that premiums written in its commercial lines, which encompass these policies, were a significant driver of its financial performance, underscoring the importance of this segment to their business model.

Net investment income is a key revenue source for Heritage Insurance Holdings, stemming from the investment of premiums and reserves before claims are settled. This strategy allows the company to earn returns on its capital.

Heritage Insurance Holdings maintains a conservative investment portfolio, prioritizing stability and steady returns. For instance, in the first quarter of 2024, the company reported net investment income of $24.4 million, demonstrating the consistent contribution of this revenue stream to its overall financial performance.

Fees and Other Revenue

Heritage Insurance Holdings also generates revenue through various fees beyond core premiums. These can include charges for policy administration, making changes or endorsements to existing policies, and other ancillary services provided to policyholders. While these fee-based revenues are generally a smaller component compared to underwriting income or investment returns, they nonetheless contribute to the company's overall financial performance.

For instance, in 2024, Heritage Insurance Holdings reported that its fee and other revenue streams played a role in its diversified income. These smaller, but consistent, revenue sources help to bolster profitability and provide a cushion against fluctuations in the primary insurance markets.

- Policy Administration Fees: Charges related to the ongoing management and servicing of insurance policies.

- Endorsement Fees: Revenue generated from modifications or additions made to existing insurance contracts.

- Ancillary Service Fees: Income derived from other services offered to policyholders, such as claims processing assistance or consulting.

- Contribution to Overall Profitability: While typically a smaller percentage of total revenue, these fees enhance the company's financial stability and profit margins.

Reinstatement Premiums (Post-Catastrophe)

Reinstatement premiums represent a cost incurred by Heritage Insurance Holdings when their reinsurance coverage is triggered by a major catastrophe. These payments are necessary to restore the full coverage limit, essentially replenishing the protection that was used. For instance, in 2023, the insurance industry saw significant payouts due to severe weather events, highlighting the potential for such reinstatement costs.

These reinstatement premiums directly impact Heritage's net income. While they are a necessary expense to maintain adequate protection, they are directly linked to the company's utilization of its reinsurance program. This means that periods of high catastrophe activity, which lead to reinsurance claims, will also likely lead to higher reinstatement premium expenses for Heritage.

- Reinstatement Premiums: Costs to restore reinsurance coverage after a catastrophe event.

- Impact on Net Income: These premiums are an expense that reduces profitability.

- Link to Catastrophe Activity: Higher frequency of major events leads to increased reinstatement premium costs.

Heritage Insurance Holdings' revenue is predominantly built upon net premiums earned from its personal residential insurance policies. This core business, covering homeowners, condominium owners, and rental properties across multiple states, forms the bedrock of its income. In 2023, net earned premiums reached $870.6 million, a slight increase from the previous year, demonstrating the stability of this primary revenue stream.

The company also generates significant income from commercial residential insurance, which has shown robust growth. This segment, offering coverage for various commercial properties, is a key contributor to Heritage's overall premium income. In 2024, premiums written in commercial lines were a notable driver of financial performance.

Net investment income, derived from investing premiums and reserves, is another crucial revenue source. Heritage maintains a conservative investment portfolio, and in the first quarter of 2024, this yielded $24.4 million in net investment income, highlighting its consistent contribution.

Additionally, Heritage earns revenue through policy administration and endorsement fees, as well as other ancillary services. While typically smaller, these fees enhance overall profitability and financial stability, with fee and other revenue streams playing a role in its diversified income in 2024.

| Revenue Stream | 2023 (Millions USD) | Q1 2024 (Millions USD) | Key Focus |

|---|---|---|---|

| Net Premiums Earned (Personal Residential) | 870.6 | N/A | Core business, stable growth |

| Net Premiums Earned (Commercial Residential) | N/A | Significant driver | Expansion and growth |

| Net Investment Income | N/A | 24.4 | Conservative portfolio, steady returns |

| Fees & Other Revenue | N/A | Contributory | Diversification, enhanced profitability |

Business Model Canvas Data Sources

The Heritage Insurance Holdings Business Model Canvas is built upon comprehensive market research, internal financial statements, and competitor analysis. These data sources ensure each canvas element is informed by industry realities and strategic objectives.