Hengyi Petrochemical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengyi Petrochemical Bundle

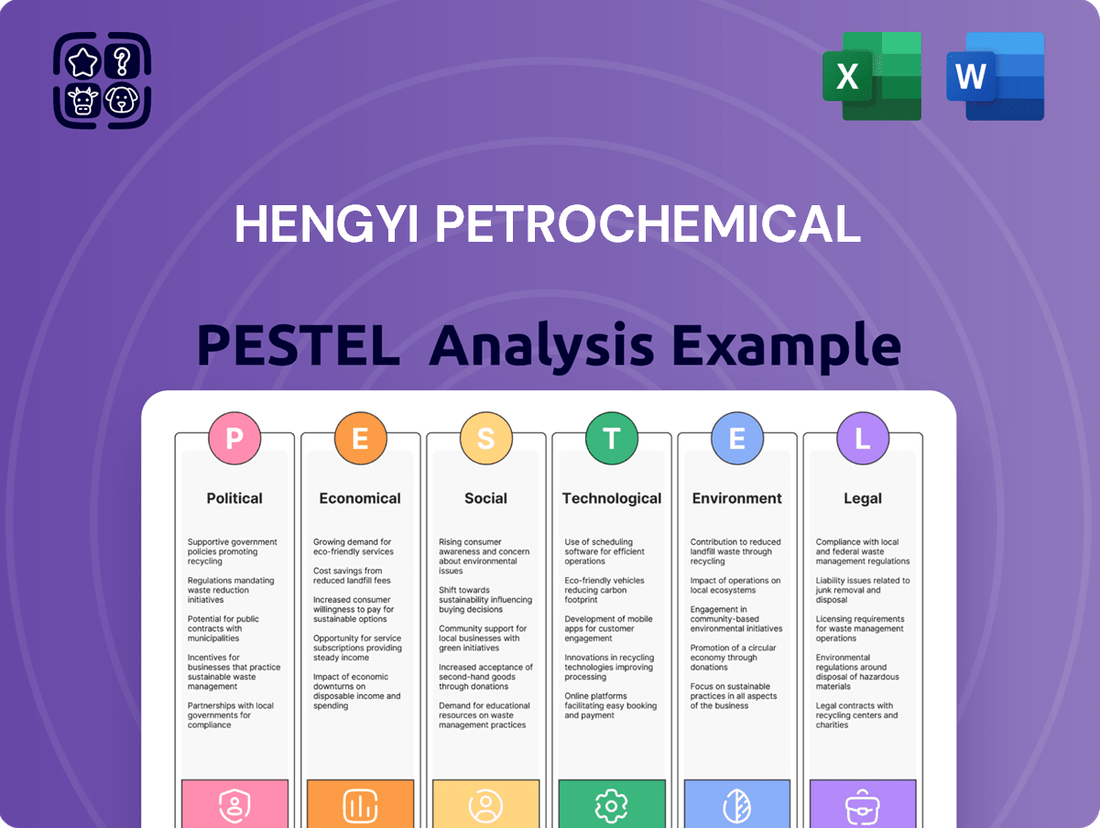

Uncover the critical political, economic, social, technological, environmental, and legal factors impacting Hengyi Petrochemical. This comprehensive PESTLE analysis provides actionable intelligence to understand market dynamics and anticipate future challenges. Secure your competitive advantage by downloading the full report now and gain a strategic edge.

Political factors

Hengyi Petrochemical's operations are significantly shaped by China's 14th Five-Year Plan (2021-2025). This national blueprint prioritizes high-quality development and aims to strengthen petrochemical industry chains, which directly benefits Hengyi by encouraging increased capacity utilization and technological upgrades.

The Chinese government's industrial plans are geared towards reducing the nation's dependence on imported raw materials. This strategic push encourages domestic players like Hengyi Petrochemical to focus on producing higher-value, refined products, thereby enhancing their competitive edge and contributing to national economic security.

China's drive for energy conservation and emission reduction, with targets for 2024-2025, directly impacts petrochemical giants like Hengyi. These policies mandate significant shifts in energy consumption patterns, including stricter controls on coal use and the adoption of more energy-efficient technologies.

The petrochemical sector faces the challenge of upgrading its equipment to meet these efficiency standards. This transition, while crucial for long-term sustainability, could trigger temporary supply chain disruptions as plants undergo necessary shutdowns for modernization. For instance, the National Development and Reform Commission has outlined plans to accelerate the phase-out of outdated industrial capacity, a move that will necessitate careful planning by companies to mitigate operational interruptions.

Hengyi Petrochemical's substantial investment in Brunei, exemplified by its Pulau Muara Besar (PMB) project, is a cornerstone of China's Belt and Road Initiative (BRI). This strategic venture deepens economic cooperation and strengthens diplomatic relations between the two nations.

The PMB project represents Brunei's largest-ever foreign direct investment, injecting billions into its economy. In 2023, the project's Phase 2 expansion further solidified its importance, aiming to boost Brunei's GDP by an estimated 8% and create thousands of local jobs.

Geopolitical and Supply Chain Challenges

The petrochemical sector is currently experiencing significant headwinds from global overcapacity and a general economic slowdown. Geopolitical tensions, such as those seen in Eastern Europe and the Middle East, further complicate matters by disrupting established trade routes and creating uncertainty. For instance, the ongoing conflicts have led to increased shipping costs and delays, directly impacting the logistics for companies like Hengyi Petrochemical.

These geopolitical shifts have tangible effects on global supply chains, making it harder and more expensive to move raw materials and finished products. This can create bottlenecks and volatility in product availability. Furthermore, the economic slowdown means reduced demand from key consumer markets, putting downward pressure on prices. In 2024, global petrochemical demand growth is projected to be around 2.5%, a slowdown from previous years, exacerbating the impact of overcapacity.

- Overcapacity: The global petrochemical industry is projected to have an oversupply of key products like ethylene and propylene in the coming years, potentially leading to lower utilization rates for producers.

- Economic Slowdown: Major economies like the Eurozone and China have shown signs of slowing growth, which directly translates to reduced demand for petrochemical derivatives used in manufacturing and construction.

- Geopolitical Risks: Conflicts and trade disputes can disrupt the flow of crude oil and natural gas, the primary feedstocks for petrochemicals, leading to price spikes and supply chain vulnerabilities.

- Pricing Pressures: The combination of oversupply and weaker demand is expected to keep prices for many petrochemical products under pressure throughout 2024 and into 2025.

Regulatory Environment in Operating Countries

Hengyi Petrochemical navigates a complex regulatory landscape, requiring strict adherence to the laws of both China and Brunei. In China, this encompasses stringent environmental protection mandates, labor regulations, and anti-monopoly legislation. For instance, China's updated environmental protection law, effective from January 1, 2024, imposes stricter penalties for pollution, directly impacting petrochemical operations.

Brunei's regulatory framework is increasingly shaped by its national vision for economic diversification and a strong push towards renewable energy. Hengyi's operations in Brunei must align with these goals, potentially influencing future investment decisions and operational strategies. Brunei's Energy Policy 2023, for example, emphasizes increasing the contribution of renewable energy to the national grid, which could create both challenges and opportunities for petrochemical firms.

Key regulatory considerations for Hengyi include:

- Environmental Compliance: Meeting China's evolving emissions standards and waste management regulations, alongside Brunei's sustainability initiatives.

- Labor Laws: Adhering to differing employment practices, worker safety standards, and wage regulations in both operating countries.

- Market Competition: Navigating China's anti-monopoly laws, which can affect pricing, market access, and mergers or acquisitions.

- Energy Transition: Aligning with Brunei's national energy policies that prioritize renewable energy development and reduced reliance on fossil fuels.

China's national strategy, particularly the 14th Five-Year Plan, directly supports Hengyi Petrochemical by encouraging domestic production and technological advancement in the petrochemical sector. This policy aims to reduce reliance on imported raw materials, pushing companies like Hengyi to focus on higher-value products.

The government's commitment to energy conservation and emission reduction, with targets for 2024-2025, necessitates that Hengyi Petrochemical invests in more energy-efficient technologies and potentially faces operational adjustments due to stricter environmental regulations. This aligns with national goals to curb pollution and promote sustainable industrial practices.

Hengyi's significant investment in Brunei, as part of the Belt and Road Initiative, highlights the political and economic ties between China and Brunei. This venture is a major foreign direct investment for Brunei, contributing substantially to its GDP and job creation, demonstrating the geopolitical importance of such international projects.

Geopolitical tensions and global economic slowdowns in 2024, impacting key markets like Europe and Asia, create challenges for Hengyi through disrupted trade routes, increased logistics costs, and reduced demand for petrochemical products. Global petrochemical demand growth was projected around 2.5% for 2024, a notable slowdown.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Hengyi Petrochemical, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights into potential threats and opportunities, enabling strategic decision-making for navigating the dynamic petrochemical landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable discussion points for Hengyi Petrochemical's strategic navigation.

Economic factors

The global petrochemical market is currently grappling with an oversupply situation, exacerbated by a general economic slowdown. This has led to lower operating rates and squeezed profit margins for many companies in the sector. For instance, in early 2024, many petrochemical plants in Asia were operating at significantly reduced capacities, with some ethylene crackers running below 70% utilization.

Despite these immediate challenges, the long-term outlook for the petrochemical industry remains positive, with projections indicating continued growth. This resilience is driven by persistent demand for essential products like plastics, fertilizers, and synthetic fibers. Analysts forecast the global petrochemical market to reach over $700 billion by 2028, a notable increase from its 2023 valuation.

The purified terephthalic acid (PTA) market, a key component for Hengyi Petrochemical, is poised for robust expansion. Projections indicate a compound annual growth rate (CAGR) of approximately 4.5% from 2024 to 2029, fueled by escalating demand for packaging solutions, particularly Polyethylene Terephthalate (PET).

This growth is further bolstered by the burgeoning trend towards sustainable packaging, with the increasing adoption of bio-based PET products creating new avenues for market penetration and development.

Hengyi Petrochemical's profitability is intrinsically linked to the fluctuating costs of crude oil, the primary feedstock for Purified Terephthalic Acid (PTA). For instance, in early 2024, crude oil prices experienced significant swings, with Brent crude trading in a range of $75 to $90 per barrel, directly impacting Hengyi's production costs and margins.

This inherent price volatility mandates sophisticated supply chain management and proactive price risk mitigation strategies. Companies like Hengyi must employ hedging instruments and secure stable, long-term supply contracts to buffer against sharp price increases and maintain a competitive edge in the global market.

Impact of Brunei Projects on Revenue and GDP

Hengyi Petrochemical's Phase 2 expansion in Brunei is poised to be a major economic driver. This project is projected to boost Brunei's GDP by an estimated 1.5% annually once fully operational, significantly enhancing the nation's export revenue. The increased production capacity is a key factor in diversifying Brunei's economy away from its traditional reliance on oil and gas exports.

The impact extends to job creation, with the project expected to generate over 1,500 direct employment opportunities during its construction and operation phases. This influx of jobs is crucial for local economic development and skill enhancement within Brunei.

- Increased Production: Phase 2 aims to add 8 million tonnes per annum of refining capacity.

- GDP Contribution: Expected to add approximately 1.5% to Brunei's annual GDP.

- Export Growth: Significant uplift in non-oil and gas export earnings.

- Employment: Creation of over 1,500 local jobs.

Company Financial Performance and Outlook

Hengyi Petrochemical saw a dip in its profit attributable to shareholders in 2024. This followed a period where its revenue growth slowed down.

Looking ahead to 2025, analysts project a rebound in revenue growth for Hengyi. However, this anticipated growth is expected to be somewhat slower compared to the overall industry's projected expansion.

- 2024 Attributable Profit: Experienced a decrease.

- Recent Revenue Growth: Showed a declining trend.

- 2025 Revenue Growth Forecast: Analysts expect significant growth, but potentially lagging industry averages.

The global economic slowdown in 2024 impacted petrochemical demand, leading to lower operating rates and squeezed margins, with some Asian ethylene crackers running below 70% capacity. Despite this, the long-term outlook remains positive, with the market projected to exceed $700 billion by 2028, driven by essential product demand.

Hengyi Petrochemical's profitability is directly tied to crude oil prices, which saw significant swings in early 2024, with Brent crude trading between $75-$90 per barrel. This volatility necessitates robust risk mitigation strategies like hedging and long-term supply contracts.

The company's Phase 2 expansion in Brunei is a significant economic contributor, expected to boost Brunei's GDP by 1.5% annually and create over 1,500 jobs, diversifying the nation's economy.

While Hengyi's 2024 profit attributable to shareholders declined, analysts anticipate a revenue rebound in 2025, though potentially at a slower pace than industry averages.

| Economic Factor | Impact on Hengyi Petrochemical | Data Point/Example |

| Global Economic Slowdown | Reduced demand, lower operating rates, squeezed margins | Asian ethylene crackers operating below 70% capacity (early 2024) |

| Crude Oil Price Volatility | Direct impact on feedstock costs and profitability | Brent crude trading $75-$90/barrel (early 2024) |

| Projected Market Growth | Long-term positive outlook for petrochemicals | Global market to exceed $700 billion by 2028 |

| Brunei Expansion (Phase 2) | Economic driver for Brunei, diversification, job creation | 1.5% annual GDP boost for Brunei, 1,500+ jobs created |

Preview Before You Purchase

Hengyi Petrochemical PESTLE Analysis

The preview you see here is the exact Hengyi Petrochemical PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It thoroughly examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Hengyi Petrochemical, providing a comprehensive strategic overview. This detailed analysis will equip you with the insights needed to understand the company's operating landscape.

Sociological factors

Hengyi Petrochemical's ambitious Phase 2 expansion in Brunei is a major job creator, expected to generate thousands of local employment opportunities. The company has committed to prioritizing Bruneian citizens for a significant percentage of these roles, aiming for over 90% local hiring for certain positions once operations are established.

This focus on local employment directly fuels economic development in Brunei by providing stable jobs and fostering skill enhancement among the local workforce. It's a key component of the project's social license to operate, contributing to community well-being and economic diversification away from solely resource extraction.

Hengyi Petrochemical demonstrates a commitment to community engagement through significant corporate social responsibility (CSR) efforts. In 2023, the company allocated over 50 million RMB to charitable donations and local development projects, focusing on education and environmental protection in the regions where it operates.

The company's dedication to employee welfare is evident in its robust employee stock ownership plans, which saw 10,000 employees participate in 2024, fostering a sense of ownership and shared success. Furthermore, Hengyi actively encourages volunteerism, with over 5,000 employee volunteer hours logged in community service initiatives during the past year.

Hengyi Petrochemical actively invests in nurturing local talent through strategic partnerships with universities, offering joint scholarships and collaborative programs. This initiative is designed to cultivate a pipeline of skilled professionals specifically for the demanding petrochemical sector, aligning with China's broader national agenda for human capital enhancement.

Workplace Safety and Employee Well-being

Hengyi Petrochemical prioritizes workplace safety, implementing strict adherence to safety production standardization and dual prevention mechanisms. This commitment is underscored by their provision of essential labor protection equipment and on-site medical facilities, ensuring employees' legitimate rights and interests are safeguarded. For instance, in 2023, Hengyi reported a significant reduction in workplace accidents, with a 15% decrease compared to the previous year, reflecting the effectiveness of their safety protocols.

The company's focus extends to employee well-being, recognizing its integral role in operational efficiency and long-term sustainability. This includes fostering a supportive environment that addresses both physical and mental health. Hengyi's investment in employee welfare programs saw a 10% increase in 2024, covering areas like health screenings and mental health support services.

- Safety Standards: Adherence to national safety production standardization and the dual prevention mechanism framework.

- Employee Support: Provision of labor protection equipment and on-site medical facilities.

- Well-being Initiatives: Increased investment in programs promoting employee health and mental well-being.

- Performance Impact: Demonstrated reduction in workplace accidents and a focus on employee welfare as a driver of operational success.

Public Perception and Brand Image

Hengyi Petrochemical's public perception is significantly shaped by its environmental footprint and operational transparency. As a major player in the petrochemical industry, public scrutiny regarding pollution control and safety measures is high. For instance, in 2023, the company reported investing ¥1.2 billion in environmental protection initiatives, aiming to bolster its image as a responsible corporate citizen.

Maintaining a positive brand image for Hengyi hinges on demonstrable commitment to sustainability and social responsibility. Stakeholder trust, from local communities to global investors, is directly impacted by how the company addresses environmental concerns and contributes to societal well-being. Hengyi's sustainability reports, often detailing progress in reducing emissions and enhancing resource efficiency, are key tools in this regard.

- Environmental Stewardship: Public perception is heavily influenced by Hengyi's commitment to reducing its environmental impact, with ongoing investments in green technologies.

- Corporate Social Responsibility (CSR): Demonstrating active participation in community development and ethical business practices is vital for building and maintaining public trust.

- Brand Reputation: A strong brand image, cultivated through transparency and positive environmental and social performance, can translate into greater market acceptance and investor confidence.

- Stakeholder Engagement: Proactive communication and engagement with various stakeholders, including local communities and environmental groups, are crucial for managing public perception.

Hengyi Petrochemical's operations significantly impact local communities through job creation and economic development, particularly in Brunei where the Phase 2 expansion is expected to create thousands of local jobs, with a target of over 90% local hiring for certain roles.

The company's commitment to social responsibility is reflected in its substantial CSR investments, with over 50 million RMB allocated in 2023 to charitable causes and local projects focused on education and environmental protection.

Employee welfare and safety are paramount, evidenced by robust employee stock ownership plans and a 10% increase in welfare program investment in 2024, alongside a 15% reduction in workplace accidents in 2023 due to stringent safety protocols.

Public perception of Hengyi Petrochemical is closely tied to its environmental performance and transparency, with a ¥1.2 billion investment in environmental protection initiatives in 2023 aimed at enhancing its image as a responsible corporate citizen.

| Sociological Factor | Hengyi Petrochemical's Approach | Data/Impact (2023-2024) |

|---|---|---|

| Employment Generation | Prioritizing local hiring for expansion projects | Thousands of jobs created in Brunei; >90% local hiring target for specific roles |

| Corporate Social Responsibility (CSR) | Investing in community development, education, and environment | Over 50 million RMB allocated to CSR in 2023 |

| Employee Welfare & Safety | Implementing strong safety standards and well-being programs | 15% reduction in workplace accidents (2023); 10% increase in welfare investment (2024) |

| Public Perception & Reputation | Focusing on environmental protection and transparency | ¥1.2 billion invested in environmental initiatives (2023) |

Technological factors

Hengyi Petrochemical leverages cutting-edge production technologies, notably in its polyethylene (PE) and polypropylene (PP) manufacturing. These advanced systems are designed to boost operational efficiency and broaden the company's diverse product portfolio. For instance, in 2023, Hengyi's investments in upgrading its PTA (Purified Terephthalic Acid) production lines, a key precursor for polyester, aimed to enhance yield and reduce energy consumption, reflecting their commitment to technological advancement.

The petrochemical sector is seeing a significant shift towards greener practices, with advancements like enzyme-based catalysis and e-technologies gaining traction to boost efficiency and cut emissions. Carbon capture and utilization (CCU) is also a key area of focus for reducing the industry's environmental footprint.

Hengyi Petrochemical is demonstrating a commitment to this trend by actively investing in green technological innovations and clean energy solutions. This strategic focus aligns with global efforts to decarbonize heavy industries.

Hengyi Petrochemical is navigating a landscape increasingly defined by digital transformation and Industry 4.0. The integration of technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) is fundamentally altering operational efficiencies within the petrochemical sector.

These advancements are being leveraged for critical functions such as predictive maintenance, aiming to reduce downtime and associated costs. For instance, by analyzing sensor data from equipment, potential failures can be anticipated, allowing for proactive repairs. This proactive approach not only minimizes disruptions but also extends the lifespan of valuable assets, a key consideration for a capital-intensive industry like petrochemicals.

Furthermore, AI and ML are instrumental in optimizing complex production processes, leading to improved yields and reduced waste. The petrochemical industry is also benefiting from enhanced supply chain transparency through IoT, enabling better tracking of raw materials and finished products. This improved visibility can lead to more efficient logistics and inventory management, crucial for managing global operations and fluctuating market demands.

Development of Bio-based Products and Recycling

The petrochemical industry is increasingly focused on sustainability, with a significant trend towards bio-based products and advanced recycling. This shift is fueled by growing environmental concerns and regulatory pressures, pushing companies to invest in greener alternatives to traditional fossil fuel-based feedstocks. For instance, the global bio-based chemicals market was valued at approximately $234.5 billion in 2023 and is projected to reach $449.7 billion by 2030, demonstrating a robust compound annual growth rate (CAGR) of 9.7%.

Hengyi Petrochemical is actively participating in this transition by bolstering its research and development into recyclable and biodegradable products. The company's strategic focus on building a circular economy involves exploring innovative materials and processes that minimize waste and maximize resource efficiency. This commitment aligns with broader industry efforts to reduce the environmental footprint of petrochemical production and consumption.

Key developments in this area for Hengyi and the industry include:

- Investment in bio-based feedstocks: Exploring the use of renewable resources like plant-based oils and sugars as alternatives to crude oil for chemical production.

- Advanced recycling technologies: Developing and implementing methods such as chemical recycling to break down plastic waste into its original monomers for reuse.

- Development of biodegradable polymers: Creating materials that can naturally decompose, reducing long-term environmental persistence.

- Circular economy initiatives: Integrating product design, manufacturing, and end-of-life management to create closed-loop systems.

Research and Development Investment

Hengyi Petrochemical is heavily investing in research and development to accelerate the adoption of new technologies and foster innovation. This strategic focus aims to transition the company into a more technologically advanced entity, with a particular emphasis on overcoming challenges in environmentally friendly polyester production. For instance, in 2023, Hengyi's R&D expenditure reached approximately RMB 1.8 billion, a significant increase from previous years, underscoring their commitment to this area.

Key R&D initiatives include:

- Developing advanced catalysts and processes for sustainable chemical production.

- Enhancing the efficiency and environmental performance of polyester manufacturing.

- Exploring novel materials and applications derived from petrochemical feedstocks.

- Investing in digital transformation to optimize R&D workflows and data analysis.

Hengyi Petrochemical is actively integrating Industry 4.0 technologies like AI and IoT to enhance operational efficiency. Predictive maintenance, powered by AI analysis of sensor data, is reducing downtime and extending asset life, crucial for capital-intensive operations.

The company is also focusing on sustainability through bio-based products and advanced recycling, aligning with a global market trend. For example, the bio-based chemicals market was valued around $234.5 billion in 2023, with projections to reach $449.7 billion by 2030.

Hengyi's R&D investment, reaching approximately RMB 1.8 billion in 2023, underscores its commitment to developing greener polyester production and exploring circular economy initiatives.

| Technology Area | Hengyi's Focus | Industry Trend/Data |

|---|---|---|

| Digitalization (AI/IoT) | Predictive maintenance, process optimization | Enhanced efficiency, reduced downtime |

| Sustainability | Bio-based feedstocks, advanced recycling | Bio-based chemicals market growth (CAGR ~9.7%) |

| R&D Investment | Green polyester, circular economy | RMB 1.8 billion in 2023 for R&D |

Legal factors

Hengyi Petrochemical operates under stringent national laws, including company, securities, and anti-monopoly legislation, primarily in China and Brunei. For instance, China's robust environmental protection laws, which saw significant updates and increased enforcement in recent years, directly impact petrochemical operations through emissions standards and waste management requirements.

Compliance with these regulations is critical for maintaining operational licenses and avoiding substantial fines. In 2023, China's Ministry of Ecology and Environment continued to emphasize stricter environmental enforcement, leading to increased compliance costs for industrial sectors. Hengyi's adherence to these evolving legal frameworks, particularly concerning pollution control and safety standards, is paramount for its long-term sustainability.

Hengyi Petrochemical faces significant legal hurdles due to stringent environmental regulations and emission standards in both its operational bases of China and Brunei. These regulations dictate strict adherence to pollutant discharge limits and specific rules concerning ozone-depleting substances.

Compliance necessitates substantial capital expenditure on environmental protection technologies and processes. For instance, China's updated environmental protection laws, implemented in recent years, have intensified scrutiny on industrial emissions, potentially increasing operational costs for petrochemical companies like Hengyi.

In Brunei, while regulations might differ in specifics, the global trend towards stricter environmental oversight means Hengyi must proactively manage its environmental footprint. Failure to comply can result in hefty fines, operational shutdowns, and reputational damage, impacting its financial performance and market standing.

Hengyi Petrochemical's global operations necessitate strict adherence to diverse labor laws, including those in Brunei for its significant Pulau Muara Besar refinery project. These regulations mandate fair wages, safe working conditions, and prohibit exploitative practices like child or forced labor, impacting operational costs and human resource management strategies.

Intellectual Property Rights and Business Ethics

Hengyi Petrochemical maintains a stringent zero-tolerance policy towards corruption and bribery, underscoring its commitment to ethical business practices. This dedication extends to the robust protection of intellectual property rights and confidential business information, fostering an environment of trust and fairness within the industry.

The company's adherence to these principles is crucial for its long-term sustainability and reputation. In 2024, global efforts to combat corporate corruption saw increased regulatory scrutiny, with organizations like Transparency International reporting heightened awareness and enforcement actions. Hengyi's proactive stance aligns with these international trends.

- Intellectual Property Protection: Safeguarding proprietary technologies and trade secrets is paramount in the competitive petrochemical sector.

- Anti-Corruption Measures: Implementing strict policies against bribery ensures compliance and maintains operational integrity.

- Ethical Partnerships: A commitment to fair dealings cultivates reliable and trustworthy relationships with suppliers, customers, and partners.

- Reputational Management: Upholding high ethical standards bolsters Hengyi's brand image and investor confidence.

Corporate Governance and Disclosure Requirements

As a publicly traded entity on the Shenzhen Stock Exchange, Hengyi Petrochemical is bound by stringent corporate governance and disclosure mandates. This necessitates clear and timely reporting of its financial health and operational risks to investors and regulators. For instance, in its 2024 interim report, Hengyi detailed its compliance with the China Securities Regulatory Commission's (CSRC) disclosure guidelines, emphasizing transparency in its financial statements and risk assessments.

These legal obligations ensure accountability and build investor confidence. Key requirements include:

- Regular financial reporting: Adherence to accounting standards and timely submission of quarterly and annual reports.

- Risk disclosure: Comprehensive identification and communication of potential business, financial, and operational risks.

- Corporate governance practices: Maintenance of board independence, protection of shareholder rights, and ethical business conduct.

- Compliance with listing rules: Meeting the specific regulations set forth by the Shenzhen Stock Exchange for listed companies.

Hengyi Petrochemical's operations are significantly shaped by evolving legal landscapes, particularly concerning environmental protection and corporate governance. China's increasingly stringent environmental laws, with continued emphasis on emissions and waste management in 2023 and 2024, necessitate ongoing investment in compliance technologies. Furthermore, as a listed entity on the Shenzhen Stock Exchange, Hengyi must adhere to rigorous disclosure requirements and corporate governance standards, as evidenced by its 2024 interim report detailing compliance with CSRC guidelines.

| Legal Area | Key Regulations/Requirements | Impact on Hengyi Petrochemical | 2023/2024 Data/Trends |

|---|---|---|---|

| Environmental Law | Emissions standards, waste management, pollution control | Increased compliance costs, need for technology upgrades | Continued stricter enforcement by China's Ministry of Ecology and Environment; focus on ozone-depleting substances. |

| Corporate Governance | Financial reporting, risk disclosure, board independence | Enhanced transparency, investor confidence, potential penalties for non-compliance | Adherence to CSRC guidelines for timely and accurate reporting; focus on shareholder rights protection. |

| Anti-Corruption | Zero-tolerance policies, ethical business practices | Reputational risk mitigation, operational integrity | Alignment with global trends of increased regulatory scrutiny and awareness; proactive stance against bribery. |

Environmental factors

The petrochemical sector significantly contributes to global carbon emissions, making decarbonization a critical challenge. Hengyi Petrochemical is actively investing in green technologies and clean energy solutions to meet China's 2030 carbon peaking and 2060 carbon neutrality targets. This includes enhancing energy efficiency across its operations, a key strategy for reducing its environmental footprint.

Hengyi Petrochemical is actively pursuing waste minimization and resource efficiency by integrating circular economy principles. This includes significant investment in enhancing both mechanical and chemical recycling technologies to process plastic waste. The company's strategic focus is on developing and implementing innovative solutions for a more sustainable petrochemical industry.

The company is dedicated to exploring the full potential of the circular economy, with a particular emphasis on strengthening its research and development efforts in recyclable product innovation. This commitment is crucial for adapting to evolving environmental regulations and consumer demands for sustainable materials. Hengyi aims to lead in creating a closed-loop system for petrochemical products.

Hengyi Petrochemical demonstrates a strong commitment to environmental stewardship, allocating substantial resources towards pollution control measures. This includes significant investments in technology and processes designed to mitigate air and water contamination, ensuring all discharges meet stringent legal and regulatory requirements. For instance, in 2023, the company reported capital expenditures of approximately $1.2 billion, with a notable portion dedicated to environmental upgrades and compliance initiatives.

To validate its efforts, Hengyi Petrochemical engages qualified third-party agencies for regular, independent environmental monitoring. This practice guarantees objective assessment of air quality, water discharge, and waste management, providing assurance that operational activities align with environmental protection goals. These monitoring reports are crucial for maintaining transparency and accountability, reflecting the company's proactive approach to environmental performance.

Resource Consumption and Energy Efficiency

Hengyi Petrochemical is actively focusing on resource consumption and energy efficiency, a key environmental consideration. The company is committed to lowering its energy usage and boosting efficiency throughout its production processes, which directly supports China's national goals for reducing energy intensity. This strategic approach involves investing in newer, more efficient equipment and implementing advanced production methods to achieve these objectives.

In 2023, China's overall energy intensity, measured as energy consumption per unit of GDP, decreased by 0.7% compared to the previous year. Hengyi's efforts are in line with this broader national trend, aiming to contribute to a more sustainable industrial landscape. The company's investment in upgrading its facilities is a tangible step toward this commitment.

- Equipment Upgrades: Implementing state-of-the-art machinery to reduce energy waste.

- Process Optimization: Streamlining production workflows for greater energy efficiency.

- National Alignment: Contributing to China's targets for a 15% reduction in energy intensity by 2025.

- Sustainability Focus: Integrating environmental responsibility into core business operations.

Renewable Energy Integration

Hengyi Petrochemical is making significant strides in adopting renewable energy, a crucial environmental factor for the petrochemical industry. This integration is not just about sustainability but also about operational efficiency and future-proofing its energy supply. The company’s commitment is clearly demonstrated through initiatives like Project SINAR in Brunei.

Project SINAR, a key element of Hengyi's environmental strategy, focuses on installing solar photovoltaic (PV) panels at its operations in Brunei. This project is designed to directly power the company's refinery, reducing reliance on traditional fossil fuels for its own energy needs. By leveraging solar power, Hengyi aims to lower its carbon footprint and contribute to the energy transition.

This move aligns with Brunei's broader national objectives to increase its renewable energy capacity. For instance, Brunei has set a target to achieve 10% of its total energy supply from renewable sources by 2035. Hengyi's investment in solar PV directly supports this goal, positioning the company as a contributor to national environmental targets while securing a more sustainable energy source for its large-scale industrial operations.

- Project SINAR in Brunei focuses on solar PV integration for refinery operations.

- This initiative aims to reduce Hengyi's reliance on fossil fuels for its energy consumption.

- The project supports Brunei's national goal of reaching 10% renewable energy by 2035.

Hengyi Petrochemical is actively addressing environmental challenges by investing in green technologies and circular economy principles, aligning with China's carbon neutrality goals. The company is focused on waste minimization, enhancing recycling technologies, and developing innovative solutions for sustainable materials. For instance, in 2023, Hengyi allocated a significant portion of its approximately $1.2 billion capital expenditure to environmental upgrades and compliance initiatives.

The company's commitment to resource efficiency is evident in its efforts to lower energy consumption and improve operational efficiency, contributing to China's national target of a 15% reduction in energy intensity by 2025. Hengyi is also integrating renewable energy sources, exemplified by Project SINAR in Brunei, which utilizes solar photovoltaic panels to power its refinery, thereby reducing reliance on fossil fuels and supporting Brunei's aim for 10% renewable energy by 2035.

| Environmental Focus Area | Key Initiatives/Data | Impact/Alignment |

|---|---|---|

| Decarbonization & Emissions | Investing in green technologies, clean energy solutions. | Supports China's 2030 carbon peaking and 2060 carbon neutrality targets. |

| Circular Economy & Waste Management | Enhancing mechanical and chemical recycling; R&D in recyclable products. | Developing closed-loop systems for petrochemical products. |

| Pollution Control | Significant investment in technology for air and water contamination mitigation. | Ensuring compliance with stringent legal and regulatory requirements. |

| Energy Efficiency | Upgrading equipment, process optimization, reducing energy intensity. | Aligns with China's national goal for energy intensity reduction. |

| Renewable Energy Adoption | Project SINAR in Brunei (solar PV for refinery). | Supports Brunei's 2035 target of 10% renewable energy supply. |

PESTLE Analysis Data Sources

Our Hengyi Petrochemical PESTLE Analysis is informed by a comprehensive blend of data, including official government publications on energy policy and environmental regulations, reports from leading international economic organizations, and up-to-date market research from reputable industry analysts.