Hengyi Petrochemical Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengyi Petrochemical Bundle

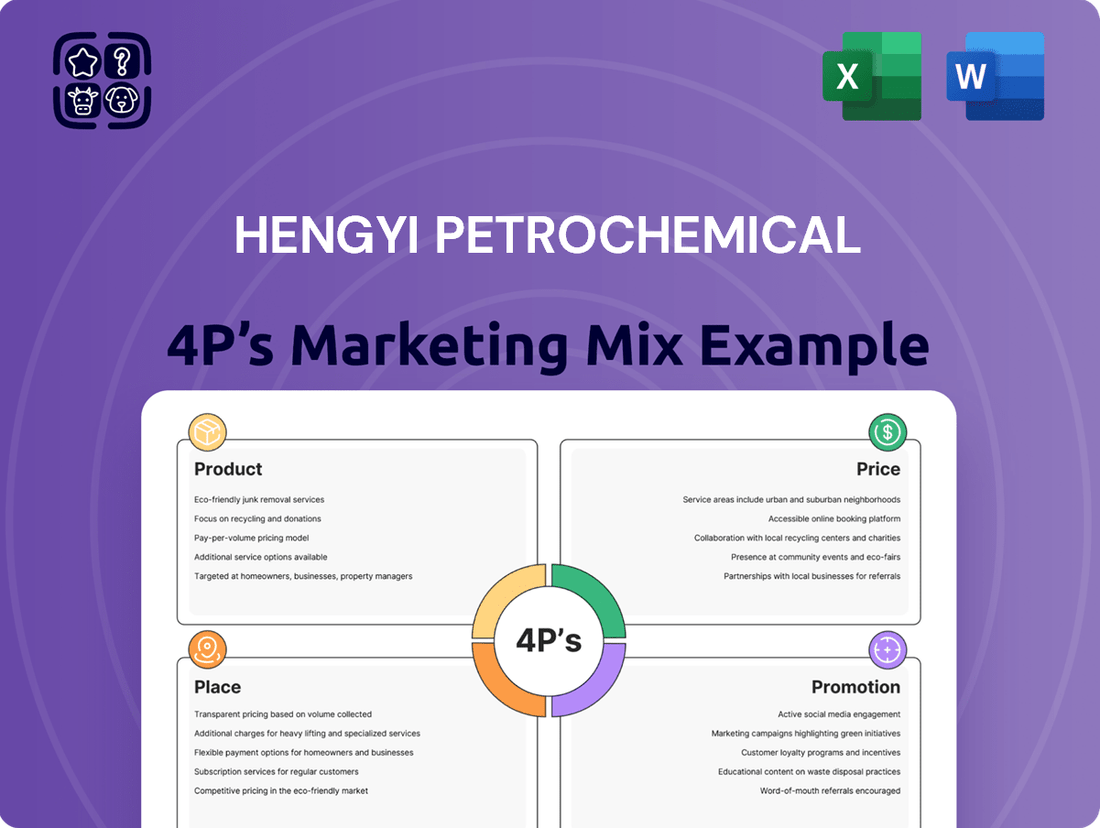

Hengyi Petrochemical's marketing success hinges on a carefully crafted 4Ps strategy, from its diverse product portfolio to its competitive pricing. Understanding their distribution channels and promotional efforts is key to grasping their market dominance.

Dive deeper into the intricacies of Hengyi Petrochemical's marketing mix. Get the full, editable analysis covering product, price, place, and promotion to unlock strategic insights for your own business or academic pursuits.

Product

Hengyi Petrochemical stands as a significant global supplier of Purified Terephthalic Acid (PTA), a fundamental building block for the vast polyester industry. Their commitment to high purity and unwavering quality ensures they meet the demanding specifications of their downstream manufacturing partners, crucial for producing everything from textiles to packaging. In 2023, the global PTA market was valued at approximately $85 billion, with Hengyi Petrochemical holding a substantial share, underscoring the product's critical role in global supply chains.

Hengyi Petrochemical offers a wide array of polyester fibers, encompassing Pre-Oriented Yarn (POY), Fully Drawn Yarn (FDY), Drawn Textured Yarn (DTY), and Polyester Staple Fiber (PSF). This broad product line demonstrates their commitment to serving diverse market demands across textiles, apparel, home decor, and industrial uses.

The company's extensive polyester fiber production directly supports critical global industries. For instance, the global polyester fiber market was valued at approximately $76.3 billion in 2023 and is projected to reach $97.9 billion by 2030, growing at a compound annual growth rate of 3.6% according to some market analyses, underscoring the significant demand for Hengyi's offerings.

Hengyi Petrochemical's Polyethylene Terephthalate (PET) chips and bottle flakes serve as foundational materials for a wide array of applications beyond beverage bottles. These versatile products are essential for manufacturing engineering polyester plastics, vital for automotive and electronics components, and are also key ingredients in plasticizers and dye intermediates. This dual role positions Hengyi Petrochemical as a significant player in both the robust packaging sector and the high-demand fiber industry, showcasing their broad market reach.

Caprolactam (CPL) and Polyamide

Hengyi Petrochemical is significantly boosting its Caprolactam (CPL) and Polyamide production, a key move to fortify its 'Fiber-Centric' industrial strategy. This expansion directly addresses market demand for advanced materials, underpinning their product strategy.

The company's increased output of polyamide, catering to civilian fibers, engineering plastics, and films, diversifies its product portfolio. This strategic product development aims to capture a larger share of the global chemical fiber market, with polyamide 6 (PA6) being a primary focus.

- Capacity Expansion: Hengyi's ongoing projects aim to increase CPL and PA6 production by several hundred thousand tons annually, aligning with projected market growth.

- Market Diversification: The expansion targets high-growth segments such as automotive engineering plastics and high-performance films.

- Competitive Positioning: This move solidifies Hengyi's status as a major integrated producer in the polyamide value chain.

- 2024/2025 Outlook: Analysts anticipate continued strong demand for PA6, driven by the textile and automotive industries, benefiting Hengyi's expanded capacity.

Refined Oil s and Petrochemical Derivatives

Hengyi Petrochemical's Brunei Refinery Project is central to its product strategy, yielding refined oil products like gasoline and diesel, alongside key petrochemical derivatives such as paraxylene (PX). This production is crucial for supplying its own downstream operations.

The company's upstream integration, particularly through the Brunei facility, ensures a stable and cost-effective supply of raw materials for its purified terephthalic acid (PTA) and polyester manufacturing. This vertical integration significantly bolsters Hengyi's efficiency and competitive edge in the market.

- Product Range: Gasoline, diesel, paraxylene (PX), and other refined oil and petrochemical products.

- Strategic Importance: PX is a vital feedstock for PTA, which in turn is used to produce polyester fibers and PET resins.

- Market Position: Hengyi aims to leverage its integrated production to capture value across the petrochemical chain.

- Capacity: The Brunei refinery boasts a refining capacity of 8 million tonnes per annum, with potential for expansion.

Hengyi Petrochemical's product strategy centers on a robust portfolio of essential petrochemicals and their derivatives, primarily PTA and polyester fibers. Their integrated approach ensures high-quality feedstock for diverse downstream applications, from textiles to advanced engineering plastics. This comprehensive offering caters to a wide spectrum of industrial needs.

The company's commitment to expanding its Caprolactam (CPL) and Polyamide (PA6) production is a key element of its product diversification. This strategic move enhances their ability to serve growing markets in automotive, textiles, and films. Hengyi's focus on PA6, a versatile material, positions them for continued growth in specialized applications.

Through its Brunei Refinery Project, Hengyi Petrochemical secures a stable supply of paraxylene (PX), a critical raw material for PTA. This upstream integration not only ensures cost efficiency but also strengthens their control over the value chain, allowing them to produce high-demand polyester products reliably. The refinery's capacity of 8 million tonnes per annum is a significant asset.

| Product Category | Key Products | Primary Applications | 2023 Market Context (USD Billion) | Hengyi's Strategic Focus |

|---|---|---|---|---|

| Feedstock | Paraxylene (PX) | PTA production | PX market valued within broader petrochemicals | Upstream integration via Brunei Refinery |

| Intermediates | Purified Terephthalic Acid (PTA) | Polyester fibers, PET resins | Global PTA market ~ $85 billion | High purity and quality focus |

| Fibers & Polymers | Polyester Fibers (POY, FDY, DTY, PSF) | Textiles, apparel, home decor, industrial | Global polyester fiber market ~ $76.3 billion | Broad product range for diverse market needs |

| Fibers & Polymers | PET Chips & Bottle Flakes | Packaging, engineering plastics, plasticizers | PET market significant within packaging sector | Serving packaging and fiber industries |

| New Growth Areas | Caprolactam (CPL), Polyamide (PA6) | Civilian fibers, engineering plastics, films | Polyamide market growing, driven by automotive and textiles | Capacity expansion and market diversification |

What is included in the product

This analysis provides a comprehensive examination of Hengyi Petrochemical's marketing strategies, detailing its product offerings, pricing structures, distribution channels, and promotional activities.

It offers a strategic overview for understanding Hengyi Petrochemical's market positioning and competitive advantages within the petrochemical industry.

This analysis simplifies Hengyi Petrochemical's marketing strategy, offering a clear roadmap to address market challenges and optimize product placement.

Place

Hengyi Petrochemical's global supply chain integration is a cornerstone of its marketing strategy, creating a seamless flow from raw materials to finished goods. This vertical integration, encompassing refining, processing, and distribution, fortifies its market position. For instance, the Brunei Refinery Project, a significant investment, bolsters its capacity and reach, particularly in key markets like Southeast Asia and Australia.

Hengyi Petrochemical's production footprint is strategically diversified across key locations. The company operates major production bases in Hangzhou, Shanghai, Ningbo, Dalian, and Hainan within China, ensuring robust domestic supply chains.

Furthermore, its significant refinery project in Brunei underscores a strong international presence. This geographical spread allows for optimized logistics and efficient access to both burgeoning Asian markets and global trade routes, a critical component of its market strategy.

Hengyi Petrochemical leverages a robust network of domestic and international sales channels to reach diverse downstream industries. This extensive reach is crucial for its market penetration and continued growth.

The company's strategy is bolstered by a well-established customer base and a competitive cost structure that translates into price advantages. These factors are instrumental in maintaining and expanding its market share.

For instance, Hengyi's commitment to broad distribution was evident in its 2024 performance, where it reported significant sales volume increases across key product lines, driven by strong demand from textile and manufacturing sectors both within China and in export markets like Southeast Asia.

Logistics and Inventory Management

Hengyi Petrochemical's logistics and inventory management are pivotal for ensuring product availability across its extensive network, directly impacting customer satisfaction and sales. The company's significant production capacity, which reached approximately 10.5 million tons of refined oil products in 2023, demands highly efficient systems to handle the immense volume of materials and finished goods. This sophisticated approach minimizes storage costs and ensures timely delivery to diverse markets.

Effective management of its supply chain is crucial for Hengyi to maintain a competitive edge.

- Streamlined Distribution: Hengyi utilizes a robust logistics network, including pipelines, rail, and shipping, to efficiently transport its petrochemical products to domestic and international customers.

- Inventory Optimization: The company employs advanced inventory management software to balance stock levels, reducing holding costs while preventing stockouts and ensuring consistent supply.

- Supply Chain Visibility: Hengyi invests in technology to provide real-time tracking of inventory and shipments, enhancing operational transparency and responsiveness to market demands.

Market Penetration and Accessibility

Hengyi Petrochemical actively pursues enhanced market penetration and accessibility across its broad product range. The company capitalizes on its integrated production facilities and advantageous geographical positioning to serve major industrial customers worldwide, with a notable emphasis on the polyester and textile industries.

This strategic approach is supported by Hengyi's significant production capacity. For instance, as of early 2024, the company operated substantial PTA (Purified Terephthalic Acid) production lines, a key raw material for polyester, with capacities reaching millions of tons annually. This scale allows for competitive pricing and consistent supply, crucial for market penetration.

- Global Reach: Hengyi Petrochemical supplies its products to over 50 countries and regions, demonstrating a commitment to broad market accessibility.

- Integrated Value Chain: The company's control over upstream raw materials through to downstream polyester production enhances its ability to offer competitive and reliable solutions to industrial clients.

- Key Market Focus: Significant efforts are directed towards the polyester and textile sectors, where Hengyi aims to be a primary supplier, leveraging its scale and product quality.

- Logistical Advantages: Strategic port locations and efficient logistics networks facilitate timely delivery to key industrial hubs, further improving market accessibility.

Hengyi Petrochemical's place strategy focuses on leveraging its extensive production bases in China and its significant overseas refinery in Brunei. This geographical diversification ensures efficient access to both domestic and international markets, particularly in Southeast Asia. The company's strategic positioning allows for optimized logistics and a competitive edge in serving key industrial sectors.

The company's commitment to broad distribution was evident in its 2024 performance, where it reported significant sales volume increases across key product lines, driven by strong demand from textile and manufacturing sectors both within China and in export markets like Southeast Asia.

Hengyi Petrochemical's logistics and inventory management are pivotal for ensuring product availability across its extensive network, directly impacting customer satisfaction and sales. The company's significant production capacity, which reached approximately 10.5 million tons of refined oil products in 2023, demands highly efficient systems to handle the immense volume of materials and finished goods.

Hengyi Petrochemical supplies its products to over 50 countries and regions, demonstrating a commitment to broad market accessibility.

| Production Base | Key Markets Served | Strategic Importance |

|---|---|---|

| Hangzhou, Shanghai, Ningbo, Dalian, Hainan (China) | Domestic China, Asia | Robust domestic supply, proximity to major industrial hubs |

| Brunei Refinery | Southeast Asia, Australia, Asia-Pacific | International expansion, access to growing demand centers |

Full Version Awaits

Hengyi Petrochemical 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Hengyi Petrochemical's 4P's Marketing Mix is fully complete and ready for your immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This includes detailed insights into Product, Price, Place, and Promotion strategies employed by Hengyi Petrochemical.

Promotion

Hengyi Petrochemical positions itself as a global leader in the refining-chemicals-chemical fiber industry, emphasizing its multinational conglomerate status. This strategy focuses on showcasing industrial prowess and a dedication to innovation and operational excellence. The company aims to be a benchmark setter, driving advancements across its sectors.

Hengyi Petrochemical champions its 'Tech-Driven Hengyi' strategy, highlighting a robust proprietary intellectual property system and significant R&D investment. This focus aims to develop high-value-added products and refine production processes, underpinning a commitment to innovation and long-term, sustainable growth.

In 2023, Hengyi Petrochemical reported R&D expenditure of approximately RMB 2.3 billion, a notable increase from the previous year, reflecting its dedication to technological advancement. This investment fuels the development of specialized chemicals and advanced materials, positioning the company for future market leadership.

Hengyi Petrochemical champions sustainability through its 'green manufacturing' and 'circular economy' initiatives, demonstrating a proactive approach to low-carbon transformation across its operations. This commitment resonates with growing global environmental consciousness and regulatory demands, bolstering the company's brand image and appeal to stakeholders prioritizing ecological responsibility.

Investor Relations and Public Announcements

Hengyi Petrochemical actively engages its investor base through robust investor relations and public announcements. This strategy aims to clearly communicate financial results, significant strategic shifts, and projections for future growth to a discerning audience of financial professionals and individual investors. The company prioritizes transparency, a key element in building and maintaining trust within the investment community.

Key to this communication are the timely release of comprehensive annual reports and ad-hoc disclosures. These documents provide critical data points for financial analysis and valuation, such as Hengyi Petrochemical's reported revenue of approximately RMB 220.5 billion for the fiscal year 2023. Such disclosures are vital for investors to assess the company's performance and make informed decisions.

The company's approach to investor relations is designed to foster confidence and provide clarity on its operational and financial trajectory. This includes:

- Regular Financial Reporting: Disseminating quarterly and annual financial statements, offering insights into profitability and operational efficiency.

- Strategic Updates: Communicating major project developments, expansions, and strategic partnerships that could impact future earnings.

- Investor Briefings: Hosting calls and meetings to discuss performance and answer investor queries, enhancing accessibility and dialogue.

- Sustainability Disclosures: Increasingly providing information on environmental, social, and governance (ESG) initiatives, reflecting growing investor interest in these areas.

Industry Collaboration and Partnerships

Hengyi Petrochemical actively cultivates cross-border industrial collaborations, aiming to maximize the synergistic advantages derived from its integrated, full-chain operations. This strategic approach reinforces its market position and fosters collective advancement within the petrochemical and chemical fiber industries.

The company's engagement in industry forums and the establishment of strategic partnerships are key drivers for enhancing its market influence. For instance, in 2023, Hengyi Petrochemical announced a significant collaboration with a leading Southeast Asian energy firm to secure long-term feedstock supply, a move expected to bolster its production stability and cost competitiveness through 2025.

- Cross-Border Collaboration: Hengyi Petrochemical's partnerships extend globally, fostering access to diverse markets and resources.

- Synergistic Benefits: By integrating its full-chain operations, the company optimizes efficiency and value creation across its business segments.

- Industry Forums: Active participation in events like the Asia Petrochemical Industry Conference (APIC) allows for knowledge exchange and trend identification.

- Market Influence: Strategic alliances are designed to amplify Hengyi's voice and impact within the broader chemical and petrochemical landscape.

Hengyi Petrochemical's promotion strategy leverages its technological leadership and commitment to sustainability. The company highlights its 'Tech-Driven Hengyi' approach, backed by substantial R&D investments, such as the approximately RMB 2.3 billion spent in 2023, to showcase innovation and high-value product development.

Communication with stakeholders is paramount, with Hengyi Petrochemical emphasizing transparency through regular financial reporting and strategic updates. Its 2023 revenue of approximately RMB 220.5 billion underscores its substantial market presence and operational scale, providing investors with key data for valuation.

Furthermore, Hengyi Petrochemical actively promotes its global collaborations and industry engagement, exemplified by a 2023 agreement with a Southeast Asian energy firm for feedstock security, reinforcing its operational resilience through 2025.

| Promotion Aspect | Key Initiatives | Data/Facts |

|---|---|---|

| Technological Prowess | 'Tech-Driven Hengyi' Strategy | R&D Expenditure: ~RMB 2.3 billion (2023) |

| Sustainability Focus | 'Green Manufacturing' & 'Circular Economy' | Commitment to low-carbon transformation |

| Investor Relations | Financial Reporting & Strategic Updates | 2023 Revenue: ~RMB 220.5 billion |

| Global Engagement | Cross-Border Collaborations | Southeast Asian energy firm partnership (2023) |

Price

Hengyi Petrochemical leverages its integrated upstream-downstream model to implement a cost-driven pricing strategy. This allows them to achieve cost advantages in producing key items like PTA and polyester fibers by effectively managing raw material volatility and production expenses.

For instance, in 2024, Hengyi Petrochemical's robust supply chain management, a direct result of its integrated operations, helped mitigate the impact of fluctuating crude oil prices, a major input cost. This cost control is fundamental to offering competitive pricing in the petrochemical market.

Hengyi Petrochemical's pricing for key products like PTA and polyester is deeply intertwined with the ebb and flow of market demand and supply in the petrochemical and textile sectors. When downstream polyester manufacturers operate at high rates, demand for PTA generally strengthens, supporting higher prices. Conversely, lower operating rates can lead to price softening.

Economic conditions significantly influence these dynamics. For instance, during periods of robust global economic growth in 2024, increased consumer spending on textiles and apparel typically boosts demand for polyester, positively impacting Hengyi's pricing power. Conversely, economic slowdowns can dampen demand and put downward pressure on prices.

Specific data from 2024 illustrates this sensitivity. Reports indicated that PTA prices saw volatility, with surges in early 2024 driven by strong downstream demand, followed by some moderation as inventory levels adjusted. Polyester filament yarn prices also mirrored these trends, reflecting the direct correlation with PTA availability and demand from the weaving and garment industries.

Global crude oil price volatility is a critical factor for Hengyi Petrochemical. As a primary feedstock, fluctuations in crude oil directly impact production costs and, therefore, Hengyi's pricing strategies. For instance, during 2024, Brent crude oil prices have seen significant swings, trading between approximately $75 and $90 per barrel, reflecting ongoing geopolitical uncertainties and shifts in global supply and demand dynamics.

These price movements, influenced by factors like OPEC+ production decisions and geopolitical events in major oil-producing regions, create a challenging environment for petrochemical enterprises. Hengyi must carefully manage its procurement and inventory to mitigate the impact of these external forces on its profitability and market competitiveness.

Competitive Pricing and Market Positioning

Hengyi Petrochemical strategically prices its products to remain competitive and grow its market share, carefully observing rival pricing and its own status as a significant global supplier. This approach requires a delicate balance between ensuring healthy profit margins and making its offerings appealing and accessible to its diverse customer base.

The company's pricing decisions are informed by market dynamics and its cost structure, aiming to offer value without compromising profitability. For instance, in 2024, the global petrochemical market saw fluctuations driven by energy prices and supply chain dynamics, which Hengyi factored into its pricing strategies.

- Competitive Pricing: Hengyi aligns its pricing with major global competitors, ensuring its products are attractively positioned.

- Market Share Focus: Pricing strategies are designed to capture and expand market share in key petrochemical segments.

- Profitability Balance: The company seeks to maintain profitability while offering accessible pricing to a broad customer base.

- 2024 Market Context: Hengyi's pricing operates within a volatile global petrochemical market influenced by energy costs and supply chain stability.

Financing Options and Credit Terms

As a major player in the petrochemical industry, Hengyi Petrochemical likely provides diverse financing options and credit terms tailored for its industrial clientele, especially for substantial orders. These arrangements are crucial for easing the financial burden on buyers and fostering robust, long-term partnerships.

While precise terms are proprietary, typical offerings for large enterprises like Hengyi might include:

- Extended Payment Schedules: Allowing customers more time to pay after receiving goods, potentially 30, 60, or even 90 days.

- Volume Discounts: Offering reduced per-unit pricing for larger purchase quantities, enhancing affordability.

- Credit Lines: Establishing pre-approved credit limits for regular, trusted customers to streamline repeat business.

For instance, in 2023, global petrochemical sales volume reached significant figures, underscoring the importance of flexible payment structures to facilitate such large-scale transactions and maintain market competitiveness.

Hengyi Petrochemical's pricing strategy is a dynamic interplay of cost leadership, market demand, and competitive positioning. Their integrated model allows for cost control, crucial for offering competitive prices in the volatile petrochemical market, as seen with PTA and polyester fibers.

In 2024, the company navigated fluctuating crude oil prices, a key feedstock. For example, Brent crude prices ranged between approximately $75-$90 per barrel, directly impacting production costs and Hengyi’s pricing decisions.

Demand from downstream sectors, like textiles, significantly influences Hengyi's pricing. Robust economic growth in 2024 generally supported higher prices due to increased consumer spending on apparel, while economic slowdowns exerted downward pressure.

Hengyi balances profitability with market share goals, aligning prices with global competitors. This approach ensures their products remain accessible and attractive to a broad customer base, even amidst market volatility.

| Key Pricing Influences (2024) | Impact on Hengyi's Pricing | Example Data/Observation |

| Integrated Cost Structure | Enables cost leadership and competitive pricing. | Mitigation of crude oil price impact through supply chain management. |

| Downstream Demand (Textiles) | Drives price levels for PTA and polyester. | Strong demand in early 2024 supported PTA price surges. |

| Global Economic Conditions | Affects consumer spending and overall demand. | Periods of robust growth boosted textile demand and pricing power. |

| Crude Oil Price Volatility | Directly impacts feedstock costs. | Brent crude prices fluctuated between $75-$90/barrel, influencing production expenses. |

| Competitive Landscape | Informs pricing alignment and market share strategy. | Strategic pricing to remain competitive against major global suppliers. |

4P's Marketing Mix Analysis Data Sources

Our Hengyi Petrochemical 4P's analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market intelligence. We leverage publicly available information on product portfolios, pricing strategies, distribution networks, and marketing communications to provide a thorough overview.