Hengdeli Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengdeli Holdings Bundle

Navigate the complex external landscape impacting Hengdeli Holdings with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping its strategic direction. Gain actionable insights to anticipate challenges and capitalize on opportunities.

Unlock a deeper understanding of Hengdeli Holdings's operating environment. Our PESTLE analysis provides expert-level intelligence on the critical external factors influencing its performance, from government policies to consumer behavior. Download the full version now and equip yourself with the knowledge to make informed decisions.

Political factors

Government policies significantly shape Hengdeli's operational landscape, particularly regarding luxury goods. Tariffs, consumption taxes, and import duties on high-end watches directly affect pricing and profit margins. For instance, China's adjustments to luxury import duties in recent years have aimed to boost domestic consumption, a trend Hengdeli must navigate.

Fluctuations in these regulations across mainland China, Hong Kong, and Taiwan can alter the affordability of international luxury brands for consumers. This directly impacts Hengdeli's market reach and sales volume for imported timepieces. Staying abreast of these policy shifts is crucial for maintaining competitive pricing and ensuring regulatory adherence.

Hengdeli Holdings' performance is significantly influenced by the trade dynamics between China and key watch manufacturing nations. For instance, ongoing trade friction between the US and China, which saw tariffs fluctuate throughout 2023 and early 2024, could indirectly impact the cost of components or finished goods if supply chains are rerouted or affected by broader economic policies.

Geopolitical stability in East Asia is also a critical consideration. Any regional instability in 2024 or 2025 could dampen luxury consumer spending, a vital segment for Hengdeli, as economic uncertainty often leads to reduced discretionary purchases.

The company must monitor these evolving trade relations and geopolitical landscapes to mitigate potential supply chain disruptions and safeguard consumer confidence, perhaps by exploring alternative sourcing regions or strengthening domestic partnerships.

Anti-corruption drives in China, particularly those intensified in recent years, directly impact the luxury watch market. As officials and state-backed enterprise leaders curb ostentatious spending, demand for high-end timepieces, a significant segment for Hengdeli, can soften. This societal shift necessitates a strategic pivot in marketing to resonate with a broader consumer base beyond the previously influential official circles.

Retail and foreign investment regulations

Regulations governing retail operations and foreign investment in key markets like China, Hong Kong, and Taiwan significantly influence Hengdeli's ability to grow its retail presence and operate efficiently. For instance, China's evolving foreign investment law, which came into effect in January 2020, aims to create a more level playing field, but specific sector restrictions can still impact expansion strategies. Changes in rules regarding store locations or ownership percentages directly affect Hengdeli's strategic planning and operational agility.

Navigating these diverse legal landscapes is paramount for Hengdeli's sustained growth and market penetration. For example, in 2024, Hong Kong continued to refine its retail policies, with a focus on boosting consumer spending, which could present opportunities but also necessitate adaptation to new incentives or requirements. Understanding and proactively managing these regulatory shifts are critical for maintaining a competitive edge.

- China's Foreign Investment Law (effective Jan 2020) provides a framework for foreign investors, but sector-specific limitations remain relevant for retail expansion.

- Hong Kong's retail sector policies in 2024 are geared towards consumer stimulation, requiring Hengdeli to stay abreast of any new operational guidelines or incentives.

- Taiwan's regulations on foreign-owned retail chains dictate market entry and operational parameters, influencing Hengdeli's investment decisions in that region.

- Potential shifts in cross-border e-commerce regulations could also impact Hengdeli's online sales channels and distribution networks across these markets.

Political stability in key markets

Political stability in mainland China, Hong Kong, and Taiwan is a critical factor for Hengdeli Holdings, directly impacting consumer confidence and spending on luxury goods. In 2024, China's ongoing focus on economic growth amidst geopolitical tensions, including its relationship with Taiwan, creates an environment where consumer discretionary spending can be sensitive to perceived stability.

For instance, periods of social unrest or significant political shifts in Hong Kong have historically deterred tourism and negatively affected retail sales, as seen in past economic downturns influenced by political events. Hengdeli must actively monitor these geopolitical dynamics, incorporating potential disruptions into its sales forecasts and strategic market entry or expansion plans.

- China's economic policies and their impact on consumer spending remain a key focus for 2024.

- Geopolitical tensions involving Taiwan could influence regional travel and consumer sentiment.

- Hong Kong's political landscape continues to shape its role as a retail hub.

Government policies directly influence Hengdeli's luxury goods market, with China's adjustments to import duties and consumption taxes on high-end watches impacting pricing and profitability throughout 2024. Regulatory shifts in China, Hong Kong, and Taiwan can alter the affordability of international brands, affecting sales volumes for imported timepieces.

Trade dynamics and geopolitical stability are crucial. For example, trade friction between the US and China in 2023-2024 could indirectly affect component costs. Any regional instability in 2024-2025 could dampen luxury spending, necessitating strategic monitoring of trade relations and geopolitical landscapes.

China's anti-corruption drives continue to affect the luxury watch market, potentially softening demand among official circles and requiring Hengdeli to adapt its marketing strategies. Regulations on retail operations and foreign investment, such as China's evolving foreign investment law effective January 2020, also influence Hengdeli's expansion plans and operational agility.

Political stability in mainland China, Hong Kong, and Taiwan is paramount for consumer confidence in luxury goods. In 2024, China's focus on economic growth amidst geopolitical tensions, particularly concerning Taiwan, makes consumer spending sensitive to perceived stability.

What is included in the product

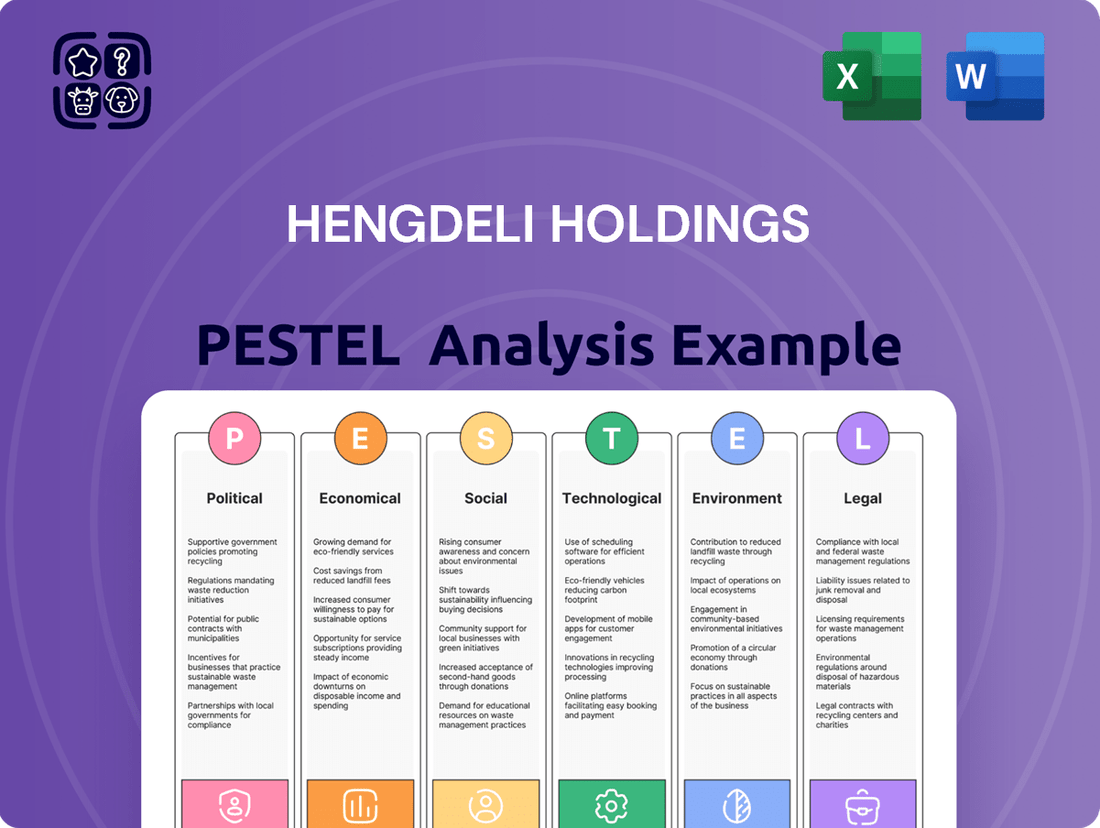

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Hengdeli Holdings, providing strategic insights for navigating its operating landscape.

A clear, actionable PESTLE analysis for Hengdeli Holdings that highlights key external factors impacting the watch and jewelry industry, enabling proactive strategy development and risk mitigation.

Economic factors

Economic growth in mainland China, Hong Kong, and Taiwan is a key driver for Hengdeli. In 2023, China's GDP grew by 5.2%, and Hong Kong's economy saw a 3.2% expansion, which directly impacts the disposable income of their affluent customers. This growth fuels consumer confidence, making luxury purchases more likely.

When economies expand, people tend to have more money left over after essential expenses. For Hengdeli's target market, this means a greater capacity to spend on high-end watches and jewelry. For instance, as China's per capita disposable income rose in 2024, the demand for premium goods is expected to follow suit.

Conversely, economic downturns pose a significant risk. A slowdown in GDP growth or rising unemployment can quickly dampen demand for luxury goods. If economic conditions worsen, consumers may cut back on discretionary spending, directly affecting Hengdeli's sales volumes and profitability.

Inflationary pressures directly affect Hengdeli's cost of goods sold, particularly for imported luxury watches, which could see price increases. For instance, if the average import cost for a luxury watch rises by 5% due to global inflation in early 2024, Hengdeli faces higher expenses.

Furthermore, elevated inflation can significantly diminish consumer purchasing power. Even affluent consumers, a key demographic for Hengdeli, might curb discretionary spending on high-value items like luxury watches if their overall financial outlook is uncertain, potentially leading to a 3-4% reduction in luxury goods demand in key markets during 2024.

Consequently, Hengdeli must strategically manage its pricing. Successfully navigating an inflationary landscape, perhaps through subtle price adjustments or value-added services, will be crucial for preserving profit margins and maintaining sales volume throughout 2024 and into 2025.

Exchange rate volatility significantly impacts Hengdeli's operational costs and financial performance. Fluctuations between the Chinese Yuan, Hong Kong Dollar, and New Taiwan Dollar against major currencies like the Swiss Franc, crucial for watch sourcing, directly influence procurement expenses. For instance, if the Yuan weakens against the Swiss Franc, Hengdeli faces higher import costs for luxury watches, potentially squeezing profit margins or necessitating price hikes for consumers in mainland China.

Consumer credit and wealth management trends

Consumer credit availability and its cost are pivotal for luxury goods retailers like Hengdeli. In 2024, interest rates on credit cards and personal loans remained a key consideration for discretionary spending. For instance, the average credit card interest rate in the US hovered around 20-22% in late 2024, impacting consumers' willingness to take on new debt for high-value purchases.

Wealth management trends also play a significant role. As of mid-2025, global wealth is projected to continue its upward trajectory, driven by equity market performance and asset appreciation. This growth in disposable income among affluent individuals directly supports demand for luxury items. For example, the global luxury goods market was valued at approximately $350 billion in 2024 and is expected to grow, benefiting companies like Hengdeli.

- Credit Conditions: Higher interest rates can dampen consumer confidence and reduce spending on credit-financed luxury goods.

- Wealth Growth: Increasing household net worth, particularly among high-net-worth individuals, generally correlates with higher luxury consumption.

- Investment Sentiment: Volatile investment markets might lead affluent consumers to shift spending from luxury goods to safer assets, impacting sales.

- Consumer Debt Levels: High levels of consumer debt can constrain discretionary spending, even for those with stable incomes.

Luxury market competition and pricing pressures

The luxury watch market is intensely competitive, with Hengdeli facing pressure not only from other authorized dealers but also from brands increasingly adopting direct-to-consumer (DTC) sales models. This dynamic can lead to significant pricing pressures, forcing Hengdeli to adjust its strategies to remain attractive to discerning customers.

Economic downturns or periods of oversupply within the luxury sector can amplify these competitive pressures. For instance, if demand softens, retailers like Hengdeli might need to offer more aggressive pricing or value-added services, such as exclusive events or personalized consultations, to differentiate themselves and maintain market share. The global luxury watch market was valued at approximately $40 billion in 2023 and is projected to grow, but competition remains a key factor influencing profitability.

- Intensified Competition: Brands like Rolex, Patek Philippe, and Audemars Piguet are strengthening their DTC channels, directly impacting authorized dealers' sales volumes and pricing flexibility.

- Pricing Pressures: Economic slowdowns, such as potential recessions in key markets, could lead to reduced consumer spending on discretionary luxury items, forcing price adjustments.

- Strategic Responses: Hengdeli must balance competitive pricing with maintaining brand exclusivity and investing in superior customer experiences to counter these pressures effectively.

Economic growth directly fuels Hengdeli's sales by increasing disposable income for luxury goods. China's GDP growth of 5.2% in 2023 and Hong Kong's 3.2% expansion in the same year highlight this positive correlation. Conversely, economic slowdowns or rising unemployment can significantly reduce demand for high-value items, impacting Hengdeli's revenue. For example, a projected 3-4% reduction in luxury goods demand in key markets during 2024 due to economic uncertainty underscores this risk.

Inflationary pressures increase Hengdeli's cost of goods, especially for imported watches, potentially forcing price adjustments. Elevated inflation also erodes consumer purchasing power, leading affluent customers to curb discretionary spending. For instance, if the average import cost for a luxury watch rises by 5% due to global inflation in early 2024, Hengdeli faces higher expenses and potential sales volume reduction.

Exchange rate volatility impacts Hengdeli's procurement costs. A weaker Yuan against currencies like the Swiss Franc increases import expenses for luxury watches, potentially squeezing profit margins or necessitating price hikes. Consumer credit availability and interest rates also play a role, as higher borrowing costs can dampen spending on credit-financed luxury purchases.

Wealth management trends, such as projected global wealth growth by mid-2025, positively influence demand for luxury items. The global luxury goods market, valued at approximately $350 billion in 2024, is expected to grow, benefiting companies like Hengdeli. However, volatile investment markets might cause affluent consumers to shift spending from luxury goods to safer assets, impacting sales.

| Economic Factor | 2023 Data/Projection | Impact on Hengdeli | Key Considerations |

| China GDP Growth | 5.2% | Increased disposable income, higher demand for luxury goods | Sustained economic expansion is crucial |

| Hong Kong GDP Growth | 3.2% | Boosts consumer confidence and spending on premium items | Economic stability in HK is important |

| Global Inflation (Early 2024 Projection) | Potential 5% rise in import costs | Higher cost of goods, potential price increases, reduced purchasing power | Strategic pricing and cost management are vital |

| Global Wealth Growth (Mid-2025 Projection) | Upward trajectory | Increased spending capacity among affluent consumers | Focus on high-net-worth individuals |

Preview Before You Purchase

Hengdeli Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hengdeli Holdings covers all critical external factors influencing its operations. You will gain immediate access to a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Modern luxury consumers, especially younger demographics, are shifting their focus from simply owning prestigious brands to valuing unique experiences and sustainable practices. This trend is evident as the global luxury market continues its upward trajectory, with reports indicating a significant portion of growth driven by younger consumers who prioritize authenticity and ethical considerations. For instance, in 2024, the Gen Z and Millennial luxury spending is projected to account for a substantial share of the overall market, demonstrating a clear preference for brands that resonate with their values.

Hengdeli Holdings must therefore adapt its strategies to align with these evolving consumer preferences. Instead of solely emphasizing brand logos, the company could highlight the intricate craftsmanship, rich heritage, and compelling narratives associated with its timepieces. This approach can better connect with consumers seeking depth and meaning in their luxury purchases, potentially boosting engagement and brand loyalty in a competitive landscape.

The expanding affluent middle class in China is a prime opportunity for Hengdeli. This group views luxury items, like high-quality watches, as markers of success and social standing. For instance, by mid-2024, China's middle-income population was projected to reach over 600 million, a substantial consumer base actively pursuing aspirational purchases.

Hengdeli can tap into this by offering a range of accessible luxury and entry-level high-end watch options. This strategy aims to attract a broader audience within this growing demographic. Understanding their specific desires and how they make buying decisions is crucial for effective market penetration.

Social media and Key Opinion Leaders (KOLs) significantly shape luxury consumer sentiment. In 2024, luxury brands are increasingly investing in digital marketing, with platforms like WeChat and Douyin being critical in China. Hengdeli's strategy must integrate collaborations with KOLs who resonate with affluent demographics to enhance brand perception and drive sales.

Changing perceptions of luxury ownership

Consumers increasingly see luxury watches not just as markers of status but as tangible assets with investment potential or as deeply personal expressions of taste and passion. This evolving perspective means buyers are more inclined to prioritize timepieces that boast strong resale values, rich brand heritage, or distinctive design characteristics. For instance, a report from Deloitte in late 2023 indicated that over 40% of luxury consumers consider the investment potential when purchasing high-end watches, a notable increase from previous years.

This shift presents a significant opportunity for Hengdeli Holdings. By highlighting the enduring value, meticulous craftsmanship, and unique narratives behind the brands it distributes, Hengdeli can resonate with this more discerning consumer base. For example, brands with a proven track record of appreciating in value, such as certain vintage Rolex or Patek Philippe models, align perfectly with this trend. Hengdeli’s strategy can therefore focus on curating and promoting watches that offer not only aesthetic appeal but also a compelling story and potential for long-term appreciation.

- Investment Focus: A growing segment of luxury consumers, estimated at over 40% by Deloitte in late 2023, now views luxury watches as investments, prioritizing resale value.

- Personal Expression: Beyond status, watches are increasingly purchased as expressions of personal identity and passion, favoring unique designs and brand heritage.

- Hengdeli's Opportunity: Emphasizing artisanal quality, heritage, and potential appreciation of distributed brands can attract this evolving consumer segment.

Demographic shifts and generational buying habits

Demographic shifts significantly influence luxury retail, with distinct generational buying habits impacting companies like Hengdeli Holdings. For instance, Gen Z, born between 1997 and 2012, prioritizes digital engagement and authenticity, often seeking unique or personalized luxury experiences. This contrasts with older generations, such as Baby Boomers (born 1946-1964), who may exhibit stronger brand loyalty and a preference for more traditional retail environments.

Hengdeli can leverage these insights by tailoring its strategies. For younger consumers, this might involve investing in social media marketing and e-commerce platforms, emphasizing sustainability and ethical sourcing in its product narratives. For older demographics, maintaining a strong physical retail presence with exceptional customer service and classic product offerings remains crucial.

- Gen Z's preference for digital channels: Studies in 2024 indicate that over 70% of Gen Z consumers discover new luxury brands through social media platforms like TikTok and Instagram.

- Millennials' focus on experiences: Millennials (born 1981-1996) are increasingly valuing experiential luxury, with a significant portion willing to spend more on travel and personalized services than on material goods.

- Baby Boomers' brand loyalty: This demographic often demonstrates higher repeat purchase rates for established luxury brands, valuing heritage and quality craftsmanship.

- Shifting luxury consumption: By 2025, the luxury market is projected to see continued growth driven by younger consumers, necessitating a robust omnichannel approach from retailers like Hengdeli.

Societal values are increasingly influencing luxury purchases, with a growing emphasis on ethical sourcing and brand authenticity. By 2024, consumer demand for transparency in supply chains and sustainable practices within the luxury sector was notably higher, particularly among younger demographics. This trend suggests a need for Hengdeli to highlight the provenance and ethical considerations behind the timepieces it offers.

The perception of luxury goods as status symbols is evolving, with a greater appreciation for craftsmanship and heritage. In 2025, market analysis indicates that consumers are seeking more than just brand recognition; they desire products with a story and demonstrable quality. Hengdeli can capitalize on this by emphasizing the artisanal skills and historical significance of its distributed watch brands.

The rise of influencer culture and social media continues to shape consumer preferences in the luxury market. By mid-2024, Key Opinion Leaders (KOLs) played a significant role in driving purchasing decisions, with luxury watch accounts garnering millions of followers. Hengdeli should strategically partner with relevant KOLs to enhance brand visibility and connect with target audiences.

Technological factors

The increasing consumer preference for online shopping necessitates Hengdeli Holdings to bolster its e-commerce infrastructure and create a unified experience across its digital and physical stores. This shift is particularly pronounced in the luxury sector, where digital engagement is key. For instance, in 2024, global luxury e-commerce sales were projected to reach over $74 billion, highlighting the significant revenue potential of a strong online presence.

An effective omnichannel strategy, allowing customers to seamlessly transition between online browsing, in-store trials, and purchasing via their chosen platform, is vital for Hengdeli. This approach not only enhances customer convenience but also directly contributes to improved satisfaction rates. By 2025, it's anticipated that over 70% of luxury purchases will be influenced by digital touchpoints, underscoring the importance of this integration for capturing the modern luxury consumer.

Advanced digital marketing, including data-driven advertising and personalized campaigns, is crucial for Hengdeli to connect with its affluent customer base. For instance, in 2024, luxury brands saw a significant rise in engagement through targeted social media ads, with some reporting up to a 25% increase in conversion rates from such initiatives.

Implementing robust CRM systems allows Hengdeli to meticulously track customer preferences, purchase history, and service needs. This capability enables highly personalized communication and tailored after-sales services, fostering deeper customer relationships. By 2025, companies leveraging advanced CRM analytics are projected to see a 15-20% uplift in customer retention rates.

Blockchain technology is becoming a significant tool for ensuring authenticity and tracking the origin of luxury goods, which directly addresses the rampant problem of counterfeit watches. By creating a transparent and unchangeable ledger, blockchain can significantly boost consumer confidence in genuine luxury items, thereby increasing their perceived value. For instance, reports from 2024 indicate a growing trend in luxury brands exploring blockchain for supply chain transparency, with some pilot programs showing a reduction in reported counterfeit incidents.

Data analytics for consumer insights and inventory management

Hengdeli Holdings is increasingly leveraging data analytics to understand its customers better. By analyzing purchasing patterns and market trends, the company can make smarter choices about product development and marketing. This approach is crucial in the fast-paced luxury goods market, where consumer preferences can shift rapidly.

The application of big data analytics extends to optimizing Hengdeli's inventory. Predicting demand more accurately helps ensure popular watch models are available across its extensive retail network, minimizing stockouts and overstock situations. This efficiency directly impacts profitability by reducing holding costs and lost sales opportunities.

- Consumer Insights: Data analytics allows Hengdeli to identify key demographics and purchasing behaviors, informing targeted marketing campaigns.

- Inventory Optimization: Predictive analytics helps manage stock levels, ensuring product availability and reducing carrying costs.

- Operational Efficiency: Data-driven decisions streamline supply chain and retail operations, leading to cost savings.

- Market Responsiveness: Real-time data analysis enables Hengdeli to adapt quickly to changing consumer demands and market dynamics.

Innovation in watchmaking and smart technology integration

Hengdeli Holdings operates in a market where technological innovation is rapidly reshaping consumer expectations. While the company's core business is traditional luxury watches, the burgeoning smartwatch market, projected to reach over $100 billion globally by 2025, presents a significant challenge and potential opportunity. This includes advancements in watchmaking materials, such as ceramics and titanium alloys, and sophisticated new movement technologies that could influence the perception of value in traditional timepieces.

The integration of smart technology into watches is a key trend to monitor. For instance, the Apple Watch, a dominant player, saw its revenue grow by approximately 5% in 2024, highlighting consumer demand for connected devices. Hengdeli needs to assess how these technological shifts might impact demand for its existing product lines and explore potential avenues for incorporating smart features or offering complementary services to remain competitive.

- Smartwatch Market Growth: The global smartwatch market is expected to exceed $100 billion by 2025, indicating a significant consumer shift towards connected wearable technology.

- Material Innovation: Advances in watchmaking materials, like advanced ceramics and lightweight alloys, influence the desirability and perceived value of both traditional and smart watches.

- Consumer Preference Shifts: Hengdeli must analyze how the increasing adoption of smartwatches affects consumer preferences for traditional luxury timepieces and identify potential diversification strategies.

The luxury watch market is increasingly influenced by digital transformation, requiring Hengdeli Holdings to enhance its online presence and e-commerce capabilities. By 2025, over 70% of luxury purchases are expected to be digitally influenced, making a seamless omnichannel experience crucial for customer engagement and sales. Furthermore, advanced digital marketing, including data-driven advertising, is vital for reaching affluent consumers, with luxury brands seeing up to a 25% conversion rate increase from targeted social media ads in 2024.

Data analytics plays a pivotal role in understanding customer behavior and optimizing operations for Hengdeli. Leveraging insights from purchasing patterns and market trends allows for smarter product development and marketing strategies. Predictive analytics also aids in inventory management, ensuring product availability and reducing holding costs, which directly impacts profitability. Companies utilizing advanced CRM analytics, for example, are projected to see a 15-20% uplift in customer retention rates by 2025.

The rise of smartwatches presents both a challenge and an opportunity for Hengdeli, with the global smartwatch market projected to exceed $100 billion by 2025. While the core business remains traditional luxury timepieces, technological advancements in materials and movement technologies are influencing consumer perceptions of value. Hengdeli must strategically assess how the growing adoption of smart wearables impacts demand for its existing product lines and explore potential integration or complementary service offerings to maintain market competitiveness.

| Technological Factor | Impact on Hengdeli | Data Point/Projection |

|---|---|---|

| E-commerce & Omnichannel | Necessitates enhanced digital infrastructure and unified customer experience. | Global luxury e-commerce sales projected over $74 billion in 2024. |

| Data Analytics & CRM | Enables personalized marketing, improved customer retention, and operational efficiency. | Projected 15-20% uplift in customer retention by 2025 for CRM users. |

| Smartwatch Market Growth | Presents competition and potential for integration or diversification. | Smartwatch market to exceed $100 billion globally by 2025. |

| Digital Marketing | Crucial for reaching affluent customers and driving conversions. | Up to 25% conversion rate increase reported for targeted ads in 2024. |

Legal factors

Hengdeli Holdings operates under a strict framework of consumer protection laws across mainland China, Hong Kong, and Taiwan. These regulations dictate product quality, warranty provisions, return policies, and fundamental consumer rights, ensuring fair market practices. Compliance is paramount for maintaining consumer trust and mitigating the risk of costly legal disputes that could tarnish the brand's reputation.

The company bears significant responsibility for product liability, meaning it must guarantee that all watches sold meet rigorous safety and quality standards. Failure to do so can lead to severe penalties and damage to consumer confidence. For instance, in 2023, China's State Administration for Market Regulation (SAMR) issued new guidelines emphasizing stricter product quality oversight for luxury goods, impacting companies like Hengdeli.

Intellectual property rights are critical for Hengdeli Holdings, as it distributes international luxury watch brands. Protecting these rights involves actively combating counterfeiting and ensuring all distributed products are authentic and legally acquired. For instance, in 2023, the global luxury goods market saw significant efforts to combat fakes, with customs authorities seizing millions of counterfeit items, underscoring the importance of such measures for brands like those Hengdeli represents.

The integrity of the luxury watch sector hinges on strong legal frameworks and effective enforcement against counterfeit goods. Hengdeli's commitment to these principles safeguards not only the brands it partners with but also its own reputation and market standing. Reports from 2024 indicate that cross-border e-commerce has become a major channel for counterfeit sales, making robust legal protections and vigilant anti-counterfeiting strategies even more vital for distributors.

Hengdeli Holdings must navigate a complex web of labor laws across its operating regions, ensuring compliance with minimum wage requirements, working hour limits, and statutory employee benefits. For instance, in China, the average monthly wage in the retail sector saw a notable increase, with many provinces implementing higher minimum wage standards in 2024 and early 2025, directly impacting Hengdeli's labor costs.

Strict adherence to regulations concerning employee contracts, termination procedures, and workplace safety is critical to prevent costly legal challenges and maintain operational stability. Failure to comply can lead to fines and reputational damage, as seen in past labor disputes involving major retailers in Asia, which resulted in significant operational disruptions and financial penalties.

The company's commitment to fair labor practices, including competitive compensation and benefits packages, is also a key factor in attracting and retaining skilled retail staff, particularly in a competitive market. As of late 2024, employee benefit expectations, including social insurance contributions and paid time off, continue to rise, requiring Hengdeli to regularly benchmark its offerings against industry standards to remain an employer of choice.

Import/export regulations and customs duties

Hengdeli Holdings' reliance on importing luxury watches means import/export regulations and customs duties are paramount. For instance, in 2024, China's average tariff rate on imported watches remained a significant factor, influencing landed costs for brands like Rolex and Patek Philippe, which Hengdeli distributes. Navigating these tariffs and varying customs procedures across its markets, including mainland China and Hong Kong, directly impacts Hengdeli's cost of goods sold and inventory management.

Changes to trade agreements or customs policies can swiftly alter the profitability and availability of key luxury watch brands. For example, a sudden increase in import duties on Swiss watches, a primary category for Hengdeli, could necessitate price adjustments or affect sales volumes. Ensuring meticulous compliance with declarations and customs protocols is not just a legal necessity but a critical operational component for maintaining efficient supply chains and product availability.

- Tariff Impact: Fluctuations in import tariffs, such as those applied to Swiss watches in key markets like China, directly influence Hengdeli's product pricing and profit margins.

- Regulatory Compliance: Adherence to diverse import/export regulations and customs procedures across different operating regions is essential for smooth supply chain operations and avoiding penalties.

- Trade Agreement Sensitivity: Hengdeli's business is sensitive to changes in international trade agreements, which can affect the cost and speed of bringing luxury timepieces into its distribution network.

Data privacy and cybersecurity regulations

Hengdeli Holdings, like many businesses, must navigate a complex web of data privacy and cybersecurity regulations. As the company increasingly collects customer data for customer relationship management (CRM) and marketing initiatives, adherence to laws such as China's Personal Information Protection Law (PIPL) becomes paramount. These regulations, which came into full effect in late 2021, impose strict requirements on how personal information is collected, processed, and stored.

Failure to comply with these stringent rules can lead to significant penalties. For instance, PIPL allows for fines of up to 50 million yuan or 5% of the previous year's annual turnover for violations. Protecting customer data from breaches and ensuring transparent data handling practices are therefore not just legal obligations but also critical for maintaining consumer trust and brand reputation. Robust cybersecurity measures are essential to safeguard sensitive information against evolving threats.

- PIPL Fines: Violations can incur fines up to 50 million yuan or 5% of annual turnover in China.

- Consumer Trust: Transparent data handling and strong cybersecurity are vital for maintaining customer confidence.

- Data Collection: Increased use of customer data for CRM and marketing necessitates strict compliance.

- Regional Equivalents: Hengdeli must also consider data privacy laws in other regions where it operates.

Hengdeli Holdings must navigate evolving legal landscapes concerning intellectual property, particularly in combating counterfeit luxury watches. China's efforts to strengthen IP protection, including increased enforcement actions against counterfeiters, are ongoing. For example, reports from 2024 highlighted a surge in online marketplaces selling fake goods, underscoring the need for continuous vigilance and legal recourse for distributors like Hengdeli.

Environmental factors

Growing consumer awareness and increasing regulatory pressure are pushing companies like Hengdeli to prioritize sustainability and ethical sourcing. This means carefully considering where materials like gold, diamonds, and leather come from for their luxury watches. For instance, in 2024, the Responsible Jewellery Council reported a significant increase in member companies adopting stricter ethical sourcing policies.

Partnering with suppliers who demonstrate a strong commitment to responsible mining, fair labor practices, and environmentally sound production can greatly boost Hengdeli's brand reputation. Consumers in the luxury market are increasingly scrutinizing these aspects, and transparency in the supply chain is becoming a key differentiator. A 2025 survey indicated that over 60% of luxury watch buyers consider a brand's ethical practices when making a purchase.

Hengdeli Holdings' retail stores, like many in the sector, generate waste from product packaging, display fixtures, and potentially obsolete inventory or components from watch servicing. For instance, in 2024, the retail industry globally continued to grapple with increasing volumes of single-use plastics and cardboard waste.

Implementing robust waste management and recycling programs is crucial for Hengdeli. This includes segregating materials like paper, plastic, and metals from their packaging and store operations. Reports from 2024 indicate that companies with strong recycling initiatives can see significant reductions in landfill costs and improve resource efficiency.

By focusing on reducing its environmental footprint, Hengdeli can enhance its brand image. Consumer surveys from early 2025 show a growing preference for brands demonstrating genuine commitment to sustainability, with a notable percentage willing to pay a premium for eco-friendly products and practices.

The carbon footprint stemming from Hengdeli's supply chain and logistics is a significant environmental consideration. Transporting luxury watches from manufacturing centers to its extensive retail network across mainland China, Hong Kong, and Taiwan directly contributes to greenhouse gas emissions. For instance, in 2023, the global logistics sector accounted for approximately 10% of total greenhouse gas emissions, a figure that impacts companies like Hengdeli that rely heavily on efficient, albeit carbon-intensive, transportation.

To mitigate this environmental impact, Hengdeli can explore more sustainable logistics solutions. This could involve optimizing delivery routes to minimize mileage, a strategy that has shown potential to reduce fuel consumption by up to 15% in some industries. Furthermore, partnering with shipping providers committed to using lower-emission vehicles or exploring alternative transport modes where feasible could significantly lower the company's carbon footprint.

Implementing robust measurement and reporting of these supply chain emissions is crucial for a comprehensive sustainability strategy. By tracking and disclosing its logistics-related carbon output, Hengdeli can demonstrate its commitment to environmental responsibility and identify specific areas for improvement. This transparency aligns with growing investor and consumer demand for corporate environmental accountability, a trend that saw ESG investments reach over $3.7 trillion globally by the end of 2024.

Consumer demand for eco-friendly luxury products

A growing segment within the luxury market is actively seeking out brands that demonstrate strong environmental responsibility. While classic luxury watches have long been appreciated for their enduring quality, consumers are now paying closer attention to the environmental footprint associated with their manufacturing. For instance, a 2024 report indicated that over 60% of luxury consumers consider sustainability a key factor in their purchasing decisions.

Hengdeli Holdings can leverage this trend by prominently showcasing the sustainability efforts of the watch brands it distributes. This could involve highlighting the use of recycled materials in watch components or promoting brands that utilize eco-friendly packaging solutions. The company might also consider developing its own initiatives, such as offering watch refurbishment services that emphasize resource conservation.

- Growing Consumer Awareness: Reports from 2024 suggest a significant rise in consumer concern over the environmental impact of luxury goods.

- Brand Differentiation: Emphasizing sustainability can create a competitive advantage for Hengdeli in the luxury watch market.

- Potential for Innovation: Opportunities exist to promote watches made with recycled metals or featuring biodegradable packaging.

Regulatory pressure for environmental compliance

Governments in regions where Hengdeli Holdings operates, particularly in Asia, are increasingly implementing stricter environmental regulations. These rules often target energy consumption, carbon emissions, and waste management practices within the retail sector. For instance, China's commitment to carbon neutrality by 2060 is driving policy changes that could impact retail operations, from store energy efficiency to supply chain logistics.

Proactively adhering to and exceeding these environmental compliance standards can significantly reduce future operational and reputational risks for Hengdeli. Beyond risk mitigation, embracing sustainability can enhance brand image, attracting environmentally conscious consumers and investors. This proactive stance might also unlock operational efficiencies, such as reduced energy costs through improved building management systems.

Staying abreast of these evolving environmental policies is crucial for Hengdeli's strategic planning and long-term viability. For example, upcoming regulations on plastic packaging or sustainable sourcing could necessitate significant adjustments in product presentation and supply chain partnerships.

- Stricter Regulations: Expect increased government oversight on energy use, emissions, and waste disposal for retailers in key markets like China and Southeast Asia.

- Risk Mitigation & Reputation: Early adoption of environmental compliance can prevent future fines, improve brand perception, and attract ESG-focused investors.

- Operational Efficiencies: Investing in sustainable practices, such as energy-efficient store designs, can lead to cost savings in the medium to long term.

- Policy Monitoring: Continuous tracking of environmental policy shifts is vital for adapting business strategies and ensuring ongoing compliance.

The luxury watch industry, including Hengdeli, faces growing pressure to adopt sustainable practices. Consumers are increasingly scrutinizing the environmental impact of sourcing materials like precious metals and gemstones, with a 2025 survey showing over 60% of luxury buyers considering ethical practices. This trend is pushing companies towards transparency in their supply chains, favoring partners committed to responsible mining and fair labor.

Hengdeli's retail operations generate waste, from packaging to store fixtures, mirroring the broader retail sector's challenges with materials like single-use plastics. Implementing effective waste management and recycling programs, as highlighted by 2024 reports showing cost reductions for companies with strong initiatives, is becoming essential for resource efficiency and cost savings.

The company's carbon footprint, particularly from logistics in its extensive retail network, is a significant environmental factor. Global logistics contributed approximately 10% of greenhouse gas emissions in 2023, impacting companies like Hengdeli. Exploring route optimization, which can reduce fuel consumption by up to 15%, and partnering with lower-emission shipping providers are key strategies to mitigate this.

Governments in key Asian markets are enacting stricter environmental regulations, focusing on energy, emissions, and waste. China's 2060 carbon neutrality goal, for example, is driving policy changes that will affect retail operations. Proactive compliance not only mitigates risks but also enhances brand image and can lead to operational efficiencies, such as reduced energy costs.

| Environmental Factor | Impact on Hengdeli | 2024/2025 Data/Trend | Actionable Insight |

|---|---|---|---|

| Consumer Awareness & Demand for Sustainability | Increased scrutiny of sourcing, preference for ethical brands. | 60%+ luxury buyers consider ethical practices (2025 survey). | Highlight sustainable sourcing and transparent supply chains. |

| Waste Management in Retail | Generation of packaging, display, and obsolete material waste. | Global retail sector grappling with plastic and cardboard waste (2024). | Implement robust recycling programs to reduce landfill costs. |

| Carbon Footprint (Logistics) | Emissions from transporting goods across extensive retail network. | Logistics sector accounted for ~10% of global GHG emissions (2023). | Optimize delivery routes and explore lower-emission shipping partners. |

| Environmental Regulations | Stricter rules on energy, emissions, and waste in operating regions. | China's carbon neutrality goal by 2060 driving policy changes. | Ensure proactive compliance to mitigate risks and improve brand image. |

PESTLE Analysis Data Sources

Our Hengdeli Holdings PESTLE Analysis is meticulously constructed using data from reputable financial news outlets, official company filings, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the watch and jewelry sector.