Hengdeli Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengdeli Holdings Bundle

Hengdeli Holdings faces moderate buyer power as consumers have choices, but brand loyalty can mitigate this. The threat of new entrants is also a consideration, though high capital requirements in watch manufacturing present a barrier. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Hengdeli Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The luxury watch market is dominated by a select group of highly recognizable and aspirational brands, many of which are owned by major luxury groups. This scarcity of premium brands, such as Rolex, Patek Philippe, and Cartier, grants them considerable bargaining power over retailers like Hengdeli Holdings.

Hengdeli's reliance on these exclusive brands to draw in its affluent customer base means it has limited ability to negotiate terms. For instance, in 2023, the global luxury watch market was valued at approximately $50 billion, with these top brands holding a significant share of that value, underscoring their influence.

Brand exclusivity significantly bolsters supplier bargaining power. Luxury watchmakers, for instance, often restrict their distribution networks through selective agreements, ensuring their brands are presented in a controlled environment. This control extends to pricing and marketing, leaving companies like Hengdeli with less leverage in negotiations.

For Hengdeli Holdings, the high switching costs associated with established luxury watch brands significantly bolster supplier bargaining power. Imagine trying to replace a cornerstone brand like Rolex or Patek Philippe; it's not just about finding another watchmaker, but about finding one with comparable prestige and customer appeal. This process is inherently costly and disruptive.

Discontinuing relationships with these key suppliers means Hengdeli faces potential revenue loss from their established customer base who specifically seek these brands. Furthermore, re-establishing credibility with new, potentially less-known luxury brands requires substantial investment in marketing and sales efforts, a challenge given the competitive landscape. In 2023, luxury watch sales in China saw robust growth, with brands like Rolex and Patek Philippe consistently performing well, underscoring their market dominance and the difficulty Hengdeli would face in replacing them.

Brand Equity and Consumer Demand

Hengdeli Holdings' position is significantly influenced by the brand equity and consumer demand for the luxury watches it sells. When consumers have a strong preference for specific high-end brands, their purchasing decisions are less about the retailer and more about the brand itself. This dynamic empowers watch manufacturers, as Hengdeli's sales volume and profitability are directly tied to its ability to stock and promote these desirable timepieces.

The strong pull of certain luxury watch brands means Hengdeli has limited leverage in dictating terms to these suppliers. For instance, in 2024, brands like Rolex and Patek Philippe continued to command premium pricing and controlled distribution channels, often prioritizing authorized dealers with proven sales records and adherence to brand standards. This consumer-driven demand for exclusivity and brand prestige directly translates into higher bargaining power for the watch manufacturers, making it difficult for retailers like Hengdeli to negotiate more favorable wholesale prices or terms.

- Brand Loyalty: Consumers often exhibit intense loyalty to specific luxury watch brands, driving demand independent of the retailer.

- Supplier Dependence: Hengdeli's revenue is heavily reliant on carrying popular luxury watch brands, giving manufacturers significant leverage.

- Pricing Power: High consumer demand allows luxury watch brands to maintain strong pricing power, limiting Hengdeli's ability to negotiate discounts.

Dependency on Key Brands

Hengdeli Holdings' reliance on a select group of prominent luxury watch brands creates a significant dependency. This concentration means that suppliers of these sought-after brands hold considerable sway over Hengdeli's operations and profitability. For instance, if these key brands decide to alter their distribution terms or pursue more direct-to-consumer sales channels, Hengdeli could face substantial disruption. In 2023, luxury watch sales in China saw robust growth, with brands like Rolex and Patek Philippe continuing to command premium pricing and strong demand, highlighting the critical nature of these supplier relationships for retailers like Hengdeli.

- Revenue Concentration: Hengdeli's financial health is closely tied to the performance and terms offered by its top luxury watch brand partners.

- Supplier Leverage: Key suppliers can exert pressure through pricing, allocation, or changes in sales strategies, directly impacting Hengdeli's margins and market access.

- Market Dynamics: The strong demand for luxury watches, as evidenced by continued sales growth in 2023, amplifies the bargaining power of the brands that supply these desirable products.

The bargaining power of suppliers in the luxury watch market, specifically concerning Hengdeli Holdings, is exceptionally high due to brand exclusivity and intense consumer demand. Hengdeli's reliance on a concentrated portfolio of prestigious brands, such as Rolex and Patek Philippe, means these manufacturers dictate terms, limiting Hengdeli's negotiation leverage. This dynamic is reinforced by the significant switching costs and the direct impact on Hengdeli's revenue if these key brands are unavailable.

In 2024, luxury watch sales continued their upward trajectory, with brands like Rolex and Patek Philippe maintaining their premium pricing and strict distribution controls. This sustained consumer pull for exclusivity and brand prestige directly translates to substantial bargaining power for these watch manufacturers, making it challenging for retailers like Hengdeli to secure more favorable wholesale prices or terms.

| Factor | Impact on Hengdeli | Supporting Data (2023/2024) |

|---|---|---|

| Brand Exclusivity | High supplier leverage; limited retailer negotiation | Top brands like Rolex and Patek Philippe control distribution |

| Consumer Demand | Empowers suppliers; reduces retailer price flexibility | Global luxury watch market valued around $50 billion (2023), with strong brand performance |

| Switching Costs | Significant disruption and revenue loss if key brands are dropped | Replacing cornerstone brands requires substantial marketing investment |

What is included in the product

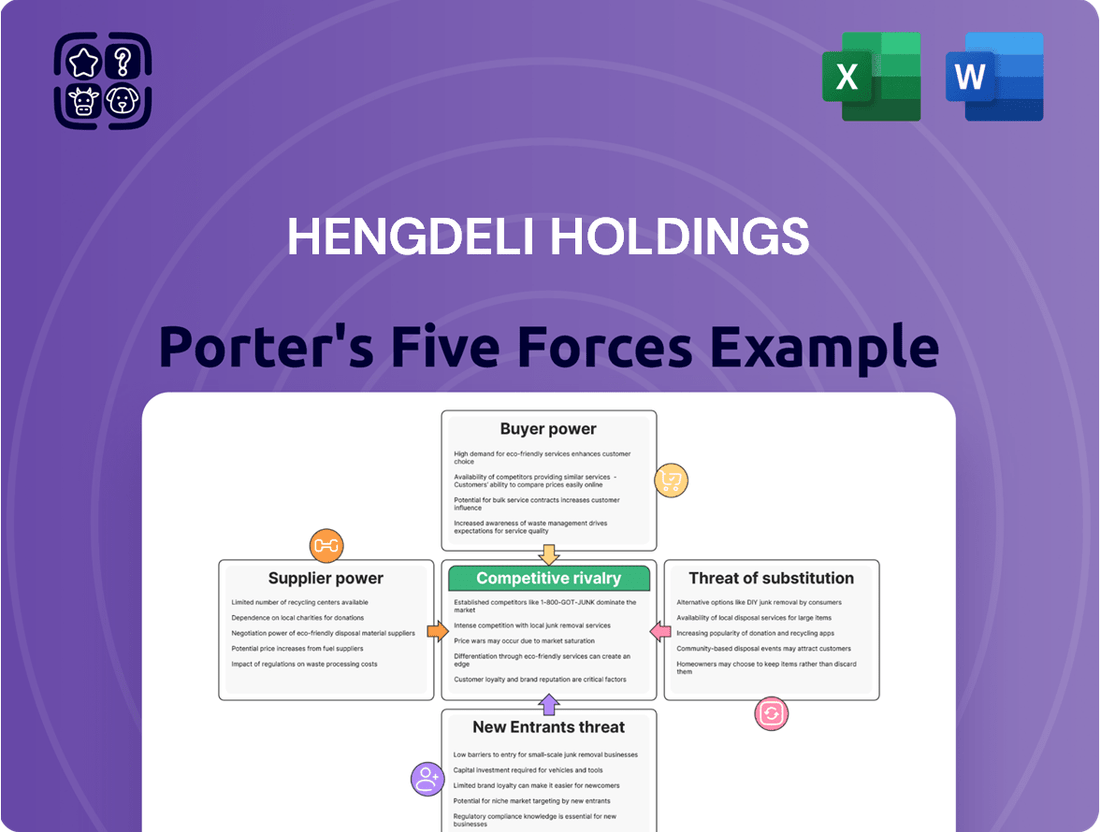

This analysis examines the competitive forces impacting Hengdeli Holdings, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the watch and jewelry market.

A clear, one-sheet summary of Hengdeli's five forces—perfect for quick decision-making on competitive pressures.

Instantly understand strategic pressure points with a powerful spider/radar chart for Hengdeli's market landscape.

Customers Bargaining Power

The bargaining power of customers for luxury watches like those sold by Hengdeli Holdings is influenced by the high price point and the discretionary nature of these purchases. Consumers in this segment are typically affluent and prioritize brand prestige, authenticity, and the overall value proposition over mere cost savings. For instance, in 2024, the global luxury watch market continued to see robust demand, with brands emphasizing craftsmanship and heritage to justify their premium pricing.

Customers today have an incredible amount of information at their fingertips, thanks to the internet. They can easily research different watch models, compare prices from various retailers, and even check customer reviews. For instance, in 2024, a significant portion of consumers actively used online comparison tools before making a purchase in the luxury goods sector, directly impacting pricing strategies.

This easy access to information means customers are more empowered than ever to negotiate. They can quickly identify the best deals and are less likely to accept inflated prices, forcing companies like Hengdeli Holdings to offer more competitive pricing or enhanced value propositions to retain their business.

Customers in the luxury watch market often display significant loyalty to specific brands, sometimes eclipsing their allegiance to the retailer. This means if a sought-after watch brand is accessible through various authorized sellers, Hengdeli's ability to retain customers solely on its retail platform diminishes. For instance, a customer might prioritize acquiring a Patek Philippe from the most convenient authorized dealer, regardless of whether it's a Hengdeli store.

Importance of After-Sales Service

For luxury watch brands like those Hengdeli Holdings distributes, the quality and accessibility of after-sales service significantly influence customer loyalty and perceived value. Customers investing in high-end timepieces expect meticulous maintenance, timely repairs, and readily available spare parts. This expectation gives them considerable bargaining power, as they can choose retailers based on the strength of their service offerings.

Hengdeli's commitment to superior after-sales support directly impacts its ability to retain customers and mitigate the bargaining power of buyers. For instance, in 2024, the luxury goods market continued to see a strong emphasis on customer experience, with after-sales service being a key differentiator.

- Customer Expectation: Luxury watch buyers anticipate comprehensive support, including warranty services, repairs, and polishing, influencing their purchase decisions.

- Service as a Differentiator: Retailers offering exceptional after-sales care can command customer loyalty and potentially higher margins, reducing price sensitivity.

- Brand Reputation: A strong service network enhances brand image and customer satisfaction, directly countering the bargaining power of customers seeking reliable long-term value.

Growth of Online Sales Channels

The burgeoning growth of online sales channels significantly amplifies customer bargaining power. As of 2024, the global luxury e-commerce market continues its upward trajectory, with many brands seeing substantial portions of their revenue generated online. This increased accessibility means customers can easily compare prices and product offerings across numerous platforms, from brand-specific e-boutiques to major multi-brand luxury e-tailers.

This shift empowers consumers by offering convenient alternatives to traditional physical stores. For instance, customers can readily find discounts or exclusive online promotions that may not be available in-store. This wider array of choices directly challenges the pricing power of established brick-and-mortar retailers, as customers are less reliant on a single point of purchase.

- Increased Online Luxury Sales: Global luxury e-commerce sales are projected to reach hundreds of billions of dollars by 2025, indicating a strong customer preference for digital purchasing.

- Price Transparency: Online platforms facilitate easy price comparison, forcing retailers to remain competitive to attract and retain customers.

- Convenience Factor: Customers can shop anytime, anywhere, reducing their dependence on store hours and location, thereby increasing their leverage.

Customers in the luxury watch market, while often brand loyal, are increasingly empowered by information and alternative purchasing channels. This reduces Hengdeli's ability to dictate terms, as consumers can readily compare prices and services online and across different authorized dealers. The emphasis on after-sales service also becomes a key battleground, where superior support can mitigate some of this customer leverage.

| Factor | Impact on Hengdeli | 2024 Data/Trend |

|---|---|---|

| Information Access | High; customers easily compare prices and reviews. | Significant growth in online luxury research tools. |

| Brand Loyalty vs. Retailer Loyalty | Moderate; customers may prioritize brand availability. | Customers often seek specific sought-after models across multiple retailers. |

| After-Sales Service Expectations | High; influences purchasing decisions. | Customer experience, including service, remains a key differentiator in luxury. |

Preview Before You Purchase

Hengdeli Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Hengdeli Holdings, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It meticulously breaks down the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the watch and jewelry retail sector.

Rivalry Among Competitors

Hengdeli Holdings navigates a crowded marketplace, facing off against a multitude of specialized luxury watch retailers, broader luxury goods stores, and high-end department store concessions. This intense competition, fueled by both established domestic brands and aggressive international players, directly impacts Hengdeli's ability to capture and retain market share among discerning, affluent customers.

The emergence of online retail platforms significantly intensifies competitive rivalry for Hengdeli Holdings. Sophisticated e-commerce sites, both from luxury brands themselves and independent luxury online retailers, now offer consumers unparalleled convenience and a wider array of choices, directly challenging the traditional dominance of physical stores.

This digital shift necessitates that retailers like Hengdeli adapt their strategies to compete effectively in this evolving landscape. For instance, in 2024, the global luxury e-commerce market was projected to reach over $75 billion, highlighting the substantial and growing influence of online channels.

Luxury watch brands, including many of Hengdeli's suppliers, are aggressively pursuing direct-to-consumer (DTC) strategies. This involves significant investment in their own standalone boutiques and e-commerce platforms. For instance, Richemont, a major player in the luxury watch sector, reported a 12% increase in its retail network expansion in 2023, with a strong focus on enhancing its online presence.

This shift by brands creates a more intense competitive landscape for Hengdeli. It’s no longer just about competing with other multi-brand retailers; Hengdeli now faces direct competition from the very brands it represents. This dual role as both a partner and a competitor can lead to channel conflict, as brands aim to capture a larger share of the customer relationship and sales margin directly.

The financial implications are substantial. As brands build out their DTC channels, they may prioritize these direct sales, potentially impacting the allocation of limited stock to multi-brand retailers like Hengdeli. This heightened rivalry puts pressure on Hengdeli's sales volumes and margins, forcing a strategic re-evaluation of its value proposition to customers and brand partners.

Service Differentiation as a Key Battleground

Competitive rivalry in the luxury watch sector, including for companies like Hengdeli Holdings, is increasingly defined by service differentiation. It's not just about having the right watches; it's about how customers are treated. Retailers are investing heavily in enhancing the in-store experience, offering personalized consultations, and building loyalty through exclusive clienteling programs.

This focus on service excellence is a direct response to market saturation and the need to stand out. For instance, in 2024, many luxury retailers reported that a significant portion of their customer acquisition and retention efforts were tied to service-related initiatives. This includes specialized after-sales care and bespoke events designed to foster deeper customer relationships.

- Customer Experience as a Differentiator: Beyond product offerings, the quality of customer interaction is paramount in luxury watch retail.

- Personalized Clienteling: Building individual relationships with customers through tailored recommendations and follow-ups is a key strategy.

- Exclusive Events and After-Sales Support: Hosting unique events and providing exceptional after-sales service contribute to brand loyalty and competitive advantage.

Geographic Concentration of Competition

Competitive rivalry is particularly fierce in key luxury consumption centers like mainland China, Hong Kong, and Taiwan. Retailers often cluster in prime locations, creating intense competition for customer flow and visibility.

This geographic concentration means that in major cities, it's common to find several high-end watch boutiques situated very close to each other. For instance, in Shanghai's luxury shopping districts, multiple international luxury watch brands and retailers vie for the same affluent customer base.

- High Density of Competitors: Luxury watch retailers are heavily concentrated in major economic hubs within Greater China.

- Proximity Competition: Prime retail spaces often house numerous competing luxury watch brands side-by-side.

- Intensified Customer Acquisition: Retailers must actively compete for foot traffic and customer loyalty in these concentrated markets.

Hengdeli Holdings faces intense competition from both established luxury watch brands and other multi-brand retailers, exacerbated by the growing influence of online channels. Brands increasingly adopting direct-to-consumer strategies, like Richemont's 12% retail network expansion in 2023, directly challenge Hengdeli's market position and can lead to channel conflict. The global luxury e-commerce market's projected growth to over $75 billion in 2024 underscores the need for Hengdeli to enhance its digital presence and service offerings to remain competitive.

| Competitive Factor | Impact on Hengdeli | Supporting Data (2023-2024) |

| Multi-brand Retailers | Direct competition for market share and customer loyalty. | Numerous specialized luxury watch retailers and department store concessions operate globally. |

| Online Luxury Retail | Increased customer choice and convenience, challenging physical store dominance. | Global luxury e-commerce market projected to exceed $75 billion in 2024. |

| Brand Direct-to-Consumer (DTC) Strategies | Potential channel conflict and reduced stock allocation for multi-brand retailers. | Richemont reported a 12% increase in retail network expansion in 2023, focusing on online. |

| Service Differentiation | Necessity to invest in customer experience to stand out. | Luxury retailers in 2024 tied significant customer acquisition/retention efforts to service initiatives. |

SSubstitutes Threaten

The rise of smartwatches and wearable tech poses a significant threat of substitution for traditional watchmakers like Hengdeli Holdings. These devices, offering functionalities beyond mere timekeeping such as health tracking and connectivity, are increasingly appealing, particularly to younger consumers. For instance, the global smartwatch market size was valued at approximately USD 49.3 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards these alternatives.

Consumers with substantial disposable income have a broad selection of luxury items, such as fine jewelry, designer bags, and premium apparel. These alternatives can fulfill similar desires for status and self-expression, diverting spending from luxury watches. For instance, in 2024, the global luxury goods market was projected to reach over $350 billion, with watches and jewelry representing a significant portion, but other categories like fashion and travel also vie for consumer attention.

Beyond functional substitutes, other high-end fashion accessories and aspirational items can fulfill a similar role as status symbols or personal statements for consumers. While not directly replacing a watch's core function, these alternatives compete for the luxury consumer's budget dedicated to showcasing affluence and personal style. For instance, the global luxury goods market, which includes items like designer handbags and high-end jewelry, saw significant growth, with reports indicating a 9% increase in 2024, reaching an estimated €362 billion.

Second-Hand and Vintage Watch Market

The burgeoning second-hand and vintage watch market presents a significant threat of substitutes for new watch sales. This segment offers consumers access to luxury timepieces at more accessible price points, with the global pre-owned watch market valued at approximately $20 billion in 2023 and projected to grow further.

Consumers are increasingly drawn to the unique appeal and potential investment value of vintage watches, which can bypass the premium associated with new luxury goods. This trend is fueled by online platforms and specialized retailers that cater to this niche, making it easier for buyers to find sought-after or discontinued models.

- Growing Market Value: The pre-owned watch market is a substantial and expanding sector, offering a viable alternative to purchasing new timepieces.

- Price Accessibility: Consumers can acquire desirable luxury watches at lower price points compared to brand-new models.

- Unique Offerings: The vintage market provides access to discontinued or rare models, appealing to collectors and those seeking distinctive pieces.

- Increased Sophistication: The market's growing professionalism and online presence enhance its attractiveness as a substitute.

Lack of Direct Functional Substitutes for Craftsmanship

The threat of substitutes for Hengdeli Holdings, particularly concerning traditional luxury watches, is relatively low due to the unique appeal of mechanical craftsmanship. While smartwatches and other time-telling devices exist, they don't replicate the heritage, artistry, and intricate engineering that define luxury timepieces. For instance, in 2024, the global luxury watch market continued to demonstrate resilience, with brands emphasizing their artisanal production and historical significance as key differentiators.

The core value proposition of a luxury watch often lies beyond mere timekeeping; it encompasses status, investment potential, and a connection to tradition. These intangible aspects are difficult for functional substitutes to replicate.

- Limited functional substitutes: While digital devices tell time, they lack the mechanical complexity and artistic appeal of traditional luxury watches.

- Heritage and craftsmanship: The intricate engineering and historical legacy of brands like those Hengdeli might represent are not easily replicated by mass-produced alternatives.

- Status and investment: Luxury watches are often purchased for their brand prestige and potential as an appreciating asset, a factor less relevant for functional substitutes.

- Market resilience: In 2024, the luxury watch segment showed continued strength, indicating consumer preference for traditional craftsmanship over purely functional alternatives.

The threat of substitutes for Hengdeli Holdings is multifaceted, encompassing both technological advancements and alternative luxury goods. Smartwatches, with their expanding functionalities, present a direct challenge, as evidenced by the global smartwatch market's valuation of approximately USD 49.3 billion in 2023. Beyond technology, other luxury items like designer bags and fine jewelry compete for discretionary spending, with the global luxury goods market projected to exceed $350 billion in 2024. The pre-owned watch market, valued at around $20 billion in 2023, also offers a significant substitute by providing access to luxury timepieces at lower price points.

| Substitute Category | Key Characteristics | Market Data (Approximate) | Impact on Hengdeli |

|---|---|---|---|

| Smartwatches/Wearable Tech | Multi-functional (health tracking, connectivity) | Global market valued at USD 49.3 billion (2023) | Appeals to tech-savvy consumers, potential diversion of traditional watch buyers. |

| Other Luxury Goods (Fashion, Jewelry) | Status symbols, self-expression | Global luxury market projected over $350 billion (2024) | Competes for discretionary spending of affluent consumers. |

| Pre-owned/Vintage Watches | Price accessibility, unique/rare models | Pre-owned watch market valued at $20 billion (2023) | Offers luxury at a lower entry cost, impacts new watch sales. |

Entrants Threaten

Establishing a strong foothold in luxury watch retail demands considerable financial outlay. This includes securing premium real estate in high-traffic areas, creating lavish store environments, and stocking a diverse, high-value inventory, often requiring millions in upfront capital. For instance, a flagship store in a prime global city could easily cost upwards of $5 million to set up and stock.

These substantial initial costs serve as a significant deterrent for aspiring competitors looking to enter the luxury watch market. The sheer volume of investment needed to compete effectively means only well-funded entities can realistically consider entering, thereby limiting the threat of new entrants for established players like Hengdeli Holdings.

New entrants into the luxury watch retail market, like Hengdeli Holdings, face a significant hurdle due to the strong brand relationships already in place. Luxury watch brands are notoriously selective, often favoring retailers with proven track records and established customer bases.

Securing distribution agreements with these coveted brands is incredibly difficult for newcomers. These brands have cultivated deep, long-standing partnerships with existing retailers, making it a challenge for new players to gain access to desirable product portfolios. For example, in 2024, many premium Swiss watch brands reported that over 90% of their sales volume was through established authorized dealers.

Hengdeli Holdings' commitment to exceptional after-sales service acts as a significant barrier to new entrants in the luxury watch market. This includes maintaining a network of certified technicians and specialized repair facilities, which requires substantial upfront investment and ongoing operational costs.

For instance, the luxury watch industry often demands highly skilled labor and precision equipment for maintenance and repair. Developing this level of expertise and the necessary infrastructure can take years, making it difficult for newcomers to match Hengdeli's established service capabilities and customer trust.

Brand Recognition and Trust

Existing players like Hengdeli Holdings have cultivated strong brand recognition and customer trust over many years. New entrants face a significant hurdle in replicating this established credibility, which often translates into a preference for known brands and a reluctance to switch. This loyalty is built on consistent service quality and a reputation for authenticity, making it difficult for newcomers to gain immediate traction.

To counter Hengdeli's brand strength, new entrants would require substantial marketing expenditures and a considerable timeframe to build comparable consumer trust and overcome ingrained preferences. For instance, in 2024, the global luxury goods market, where brand loyalty is paramount, saw continued growth, underscoring the value of established reputations. Newcomers must invest heavily to even begin chipping away at this ingrained consumer behavior.

- Brand Loyalty: Consumers often stick with brands they trust, especially in sectors like watches and jewelry where authenticity and perceived quality are key.

- Marketing Investment: New entrants need to allocate significant capital to advertising and promotional activities to build awareness and credibility.

- Time to Establish Credibility: Building a reputation for quality and trustworthiness takes years of consistent performance and customer engagement.

- Overcoming Consumer Inertia: Shifting consumer habits away from established brands requires compelling reasons and a superior offering.

Regulatory and Import Complexities

The luxury watch market, particularly for a company like Hengdeli Holdings, faces significant hurdles for new entrants due to stringent regulatory and import complexities across key Asian markets. Navigating these intricate frameworks, including varying import duties and specific licensing requirements for high-value goods in mainland China, Hong Kong, and Taiwan, presents a substantial barrier.

New players often find it challenging to overcome these operational hurdles, which established brands have already developed expertise and infrastructure to manage efficiently. For instance, in 2023, China's average import duty on watches remained a significant factor, impacting profitability and requiring sophisticated logistics and compliance strategies that new entrants may not possess. Hengdeli, with its long-standing presence, has built robust relationships and understanding of these regulatory landscapes, giving it a competitive edge.

- Regulatory Hurdles: New entrants must comply with diverse import regulations and licensing in China, Hong Kong, and Taiwan.

- Import Duties: Significant import duties, particularly in mainland China, increase the cost of entry and operational expenses.

- Established Expertise: Hengdeli possesses deep knowledge of these complex systems, a significant advantage over newcomers.

The threat of new entrants for Hengdeli Holdings in the luxury watch market is relatively low due to substantial capital requirements and the need for established brand relationships. Newcomers face significant upfront costs for prime retail locations and inventory, often exceeding millions. Furthermore, securing distribution agreements with prestigious watch brands is a major challenge, as these brands prioritize established retailers with proven track records.

Hengdeli's strong brand loyalty and extensive investment in marketing create a formidable barrier. Consumers in the luxury segment exhibit high brand preference, and building comparable trust and recognition takes years and significant expenditure. For example, in 2024, the global luxury market continued to emphasize brand equity, with established players benefiting from long-standing customer relationships.

The complexity of regulatory environments and import duties in key Asian markets like China also limits new entrants. Navigating these intricate frameworks requires specialized knowledge and infrastructure, which Hengdeli has developed over its operational history. In 2023, China's import duties on watches remained a considerable factor, highlighting the advantage of established players adept at managing compliance and logistics.

| Barrier to Entry | Description | Impact on New Entrants | Hengdeli's Advantage |

|---|---|---|---|

| Capital Requirements | High cost of prime real estate, store fit-outs, and inventory. | Significant financial hurdle. | Established financial resources. |

| Brand Relationships | Difficulty in securing distribution agreements with luxury watch brands. | Limited access to desirable products. | Long-standing partnerships with top brands. |

| Brand Loyalty & Marketing | Need for substantial investment to build brand recognition and trust. | Challenging to overcome consumer inertia. | Strong existing brand equity and customer base. |

| Regulatory & Import Complexities | Navigating diverse import duties and licensing in key markets. | Increased operational costs and compliance challenges. | Expertise and established infrastructure for compliance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hengdeli Holdings leverages data from its annual reports, investor presentations, and industry-specific market research reports to understand competitive intensity and market dynamics.