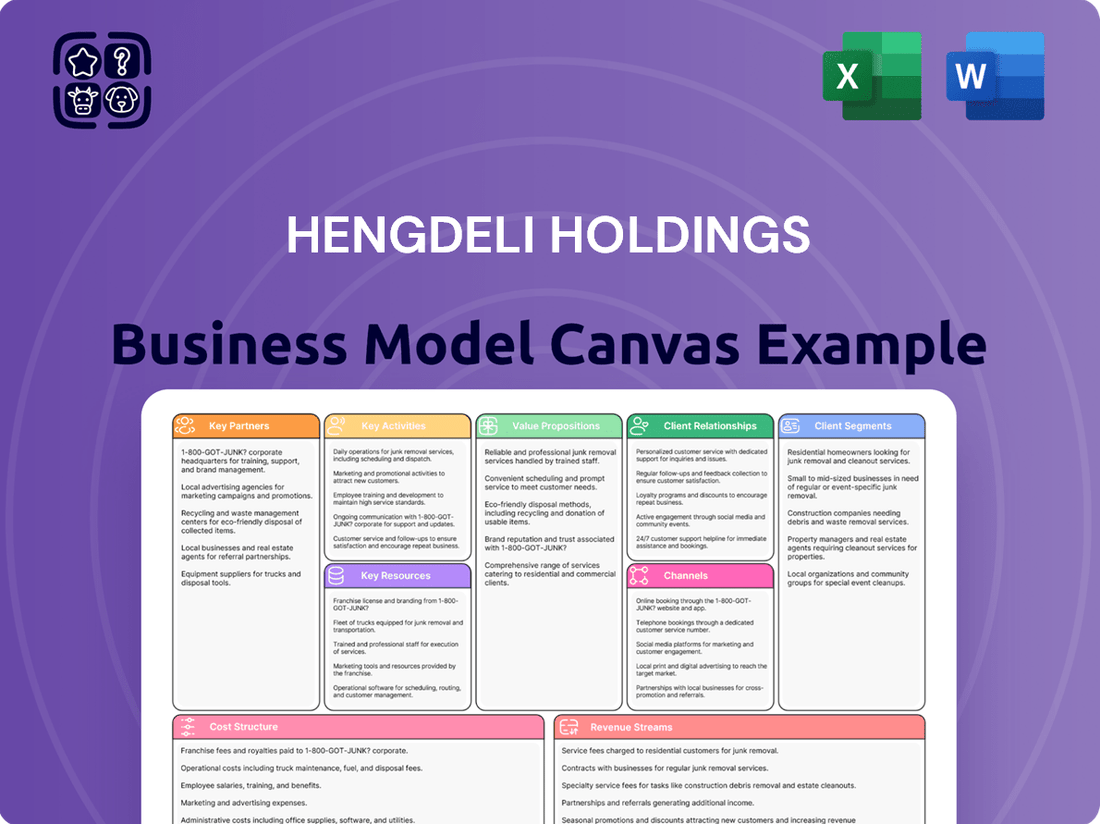

Hengdeli Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengdeli Holdings Bundle

Explore the strategic core of Hengdeli Holdings with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

Hengdeli Holdings Limited's success hinges on its strong ties with leading luxury watch manufacturers. These partnerships are not just about stocking shelves; they grant Hengdeli access to coveted new collections and limited editions, critical for drawing in and keeping affluent customers. For instance, in 2023, the company continued to strengthen its collaborations with major Swiss watchmakers, a key driver behind its robust sales performance in the high-end segment.

Hengdeli Holdings, while primarily handling after-sales service internally, may engage with specialized third-party service providers for intricate repairs or specific warranty claims. These collaborations are crucial for maintaining the high standards expected of luxury watch brands, ensuring customers receive expert attention for complex technical issues. For instance, in 2024, Hengdeli's commitment to customer satisfaction means that for highly specialized movements, partnerships with authorized repair centers for brands like Rolex or Patek Philippe are essential to uphold the brand's prestige and the customer's luxury experience.

Hengdeli Holdings collaborates with retail space landlords and commercial property developers to secure and maintain its widespread presence across mainland China, Hong Kong, and Taiwan. These partnerships are fundamental for gaining access to premium locations within high-footfall luxury shopping areas, ensuring a robust physical footprint for its diverse brand portfolio.

These crucial relationships extend to collaborations on shop design and decoration services. For instance, Hengdeli has engaged with entities like Primetime Group Co., Ltd. to enhance its retail environments, reflecting a strategic approach to optimizing customer experience and brand presentation in its physical stores.

Logistics and Supply Chain Partners

Hengdeli Holdings leverages critical logistics and supply chain partnerships to ensure the smooth operation of both its luxury watch distribution and international commodity trading arms. These alliances are fundamental for the secure and timely movement of goods, from high-value timepieces to bulk commodities like iron ore and coal, across global markets. In 2024, the company continued to prioritize partners capable of managing the complexities of international trade regulations and customs, a vital component for maintaining operational efficiency and cost-effectiveness.

The effectiveness of these partnerships directly impacts Hengdeli's inventory management and its ability to meet customer demand promptly. For instance, efficient freight forwarding and warehousing are essential for minimizing lead times and ensuring that luxury watches reach authorized retailers without damage or delay. Similarly, for its commodity trading, reliable shipping and port services are paramount to fulfilling large-scale contracts and managing price volatility.

- Secure Transportation: Partners ensure the safe transit of high-value watches and bulk commodities, minimizing risk of loss or damage.

- Global Reach: Collaborations with international logistics providers enable Hengdeli to operate effectively across diverse geographical markets.

- Operational Efficiency: Streamlined supply chains contribute to better inventory control, reduced transit times, and optimized costs in 2024.

Technology and E-commerce Platforms

Hengdeli Holdings, like many in the luxury sector, is increasingly recognizing the critical role of technology and e-commerce platforms. These partnerships are vital for expanding digital sales channels and deepening customer engagement in today's evolving retail environment. While specific watch-related collaborations aren't always publicized, the broader luxury market's digital shift, coupled with Hengdeli's diverse portfolio, points to a strategic imperative to leverage these digital avenues. For instance, by 2024, the global luxury e-commerce market was projected to reach hundreds of billions of dollars, highlighting the immense potential.

Collaborations with tech providers and e-commerce giants can significantly boost Hengdeli's online visibility and create more seamless digital transaction experiences. This includes integrating advanced digital technologies to personalize customer journeys and provide enriched product information. Such partnerships are not just about selling; they are about building a robust digital ecosystem that enhances brand perception and accessibility.

- Digital Sales Growth: Partnerships with major e-commerce platforms can unlock new revenue streams, tapping into a wider customer base beyond physical retail.

- Enhanced Customer Experience: Leveraging technology for online presence allows for personalized recommendations, virtual try-ons, and efficient customer service, improving overall satisfaction.

- Data Analytics: Collaborations can provide access to valuable customer data, enabling Hengdeli to better understand purchasing behavior and tailor marketing efforts.

- Brand Reach: Aligning with established tech and e-commerce brands can extend Hengdeli's reach and reinforce its position in the premium market segment.

Hengdeli Holdings' key partnerships are essential for its operational success and market positioning. These collaborations span from securing prime retail locations with property developers to ensuring the secure and efficient movement of goods through logistics providers. Furthermore, strategic alliances with luxury watch manufacturers grant access to coveted products, while collaborations with technology and e-commerce platforms are crucial for expanding digital reach and enhancing customer engagement in the evolving retail landscape.

| Partnership Type | Key Role | Impact/Benefit | Example/Data Point (2024 Focus) |

|---|---|---|---|

| Luxury Watch Manufacturers | Product Sourcing & Brand Access | Access to new collections, limited editions, brand prestige | Continued strengthening of collaborations with major Swiss watchmakers driving high-end sales. |

| Retail Space Landlords/Developers | Location Securing | Access to premium, high-footfall locations | Securing prime retail spaces in luxury shopping districts across key Asian markets. |

| Logistics & Supply Chain Providers | Goods Movement & Management | Efficient, secure, and timely transit of watches and commodities | Prioritizing partners capable of managing international trade complexities for seamless global operations. |

| Technology & E-commerce Platforms | Digital Sales & Customer Engagement | Expanded online visibility, seamless transactions, personalized experiences | Leveraging digital avenues to tap into the projected multi-billion dollar global luxury e-commerce market. |

What is included in the product

A comprehensive, pre-written business model tailored to Hengdeli Holdings' strategy, focusing on its extensive retail network and brand partnerships within the watch and jewelry market.

Reflects the real-world operations and plans of Hengdeli Holdings, detailing its customer segments, channels, and value propositions in the luxury goods sector.

The Hengdeli Holdings Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their operations, simplifying complex strategies into an easily understandable format for efficient problem-solving and decision-making.

Activities

Hengdeli Holdings Limited's primary focus is the retail and distribution of luxury watches, representing numerous prestigious international brands. This core activity involves operating a substantial chain of physical stores throughout mainland China, Hong Kong, and Taiwan, catering to discerning clientele.

Effective inventory control, visually appealing merchandising, and targeted sales approaches are crucial for success in this high-value market segment. In 2024, the luxury watch market in China continued its robust growth, with brands like Rolex and Patek Philippe seeing sustained demand, underscoring the importance of Hengdeli's distribution network.

Hengdeli Holdings focuses on providing comprehensive after-sales services for the watches it sells, encompassing maintenance and repair. This commitment is crucial for fostering customer loyalty and underscoring the company's dedication to quality and service even after the purchase.

To effectively deliver these services, Hengdeli must maintain a highly skilled team of watch technicians and a well-equipped service infrastructure. This investment ensures that customers receive prompt and expert care for their timepieces, reinforcing brand trust.

In 2024, the luxury watch repair market continued to see demand, with brands emphasizing customer retention through superior after-sales support. Hengdeli's investment in this area directly contributes to its competitive edge in the premium watch distribution sector.

Hengdeli Holdings' key activities extend beyond watch manufacturing to include the production of high-end consuming accessories. This encompasses items like watch straps, buckles, and other related components, crucial for the luxury watch market. In 2024, the demand for premium watch accessories remained robust, driven by a growing appreciation for personalization and craftsmanship among affluent consumers.

Furthermore, the company provides specialized shop design and decoration services. This vital activity supports Hengdeli's extensive retail network, ensuring a consistent and luxurious brand experience for customers. It also offers potential revenue streams by catering to other high-end retailers seeking to enhance their store aesthetics and brand presentation, contributing to the broader luxury retail landscape.

The manufacturing of furniture and display items specifically for watch sales is another core activity. This ensures that watches are presented in environments that reflect their exclusivity and value. Additionally, Hengdeli produces sophisticated watch packaging products, which are integral to the unboxing experience and brand perception in the luxury goods sector.

International Commodity Trading

Hengdeli Holdings actively engages in international commodity trading, a crucial key activity that complements its core luxury retail business. This segment focuses on importing essential raw materials like iron ore, thermal coal, and coking coal into Mainland China, underscoring its role in supplying key industrial inputs.

This commodity trading operation is a significant revenue driver for Hengdeli, demonstrating its diversified business model. The company leverages its established networks to secure these vital resources, contributing substantially to its overall financial performance.

Key activities within international commodity trading include:

- Sourcing and Procurement: Establishing and maintaining robust relationships with international mining and energy companies to secure consistent supplies of iron ore, thermal coal, and coking coal.

- Logistics and Shipping Management: Efficiently managing the transportation and delivery of bulk commodities from global suppliers to Chinese ports, optimizing costs and ensuring timely arrivals.

- Risk Management: Implementing strategies to mitigate price volatility and currency fluctuations inherent in international commodity markets.

- Sales and Distribution: Facilitating the sale and distribution of imported commodities to domestic industrial consumers within Mainland China.

International Shipping and Supply Chain Services

Hengdeli Holdings actively participates in international shipping and supply chain services, a crucial element supporting its commodity trading operations. This involves the strategic management of logistics for bulk cargo, ensuring efficient movement of goods across global markets.

The company is focused on expanding its transportation routes, thereby strengthening its position within the international shipping supply chain. This diversification not only complements its core trading business but also aims to establish Hengdeli as a more significant player in global logistics.

- Logistics Management: Overseeing the complex movement of bulk commodities globally.

- Route Expansion: Developing new and optimizing existing shipping lanes to enhance efficiency and reach.

- Supply Chain Integration: Connecting commodity trading with robust shipping capabilities for a seamless end-to-end service.

Hengdeli Holdings' key activities revolve around the retail and distribution of luxury watches, supported by robust after-sales services and the manufacturing of related accessories and store fixtures. Complementing this, the company engages in international commodity trading, particularly iron ore, thermal coal, and coking coal, alongside managing international shipping and supply chain services to support its trading operations. In 2024, the luxury watch market's continued growth in China, alongside demand for premium accessories and reliable after-sales support, reinforced the importance of these retail-focused activities.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Luxury Watch Retail & Distribution | Operating extensive retail networks for international luxury watch brands. | Continued strong demand for brands like Rolex and Patek Philippe in China. |

| After-Sales Services | Providing maintenance, repair, and customer support for luxury watches. | Crucial for customer retention; market demand for repairs remained robust. |

| Accessory & Fixture Manufacturing | Producing watch straps, buckles, furniture, display items, and packaging. | Demand for personalization and premium accessories remained high. |

| International Commodity Trading | Importing raw materials like iron ore, thermal coal, and coking coal into China. | A significant revenue driver, supplying key industrial inputs to Mainland China. |

| International Shipping & Supply Chain | Managing logistics for bulk cargo and expanding transportation routes. | Strengthening the company's position in global logistics and supporting commodity trading. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview of Hengdeli Holdings' strategic framework is presented in its final, ready-to-use format, offering a clear and detailed insight into their operations. You can be assured that what you see is precisely what you will get, allowing for immediate application and analysis.

Resources

Hengdeli Holdings boasts an extensive retail store network, primarily concentrated in mainland China, Hong Kong, and Taiwan. This vast physical presence is a cornerstone of their business, acting as vital hubs for luxury watch sales and direct customer interaction.

These prime retail locations offer an immersive brand experience, allowing customers to engage with luxury timepieces in a personalized and engaging manner. This direct touchpoint is critical for building brand loyalty and facilitating sales in the high-end watch market.

As of the first half of 2024, Hengdeli operated approximately 1,300 retail points of sale across these key markets, underscoring the scale and importance of their physical footprint. This extensive network is a significant competitive advantage, enabling broad market reach and deep customer penetration.

Hengdeli Holdings' key resource is its extensive portfolio of internationally recognized luxury watch brands. These exclusive partnerships are crucial intangible assets, granting access to coveted timepieces and bolstering the company's reputation for quality and prestige. The strength and breadth of these brand alliances directly shape Hengdeli's product selection and overall market attractiveness.

In 2024, Hengdeli continued to leverage these strong brand relationships. For instance, their retail network prominently features brands like Rolex, Cartier, and Omega, which are consistently in high demand. The company's ability to secure and maintain these premium brand authorizations is a significant competitive advantage, underpinning its market position.

Hengdeli Holdings places significant emphasis on its skilled sales and after-sales personnel, recognizing them as a cornerstone of its customer-centric approach. These professionals are not just salespeople; they are brand ambassadors and technical experts, crucial for delivering the premium experience expected by luxury watch consumers.

The company's retail success and customer loyalty are directly linked to the expertise of its sales team, who possess in-depth knowledge of intricate watch mechanisms and brand heritage. For instance, in 2024, Hengdeli continued to invest in training programs designed to enhance product knowledge and sales techniques, ensuring their staff can effectively communicate the value and craftsmanship of the timepieces they represent.

Furthermore, the after-sales service, powered by highly trained watch technicians, is a critical differentiator. These experts are essential for maintaining the integrity and performance of high-value watches through meticulous repair and servicing. In the fiscal year ending March 31, 2024, Hengdeli reported that its after-sales services contributed positively to overall revenue, underscoring the financial impact of this skilled workforce.

Financial Capital and Inventory

Hengdeli Holdings relies heavily on substantial financial capital to manage its high-value inventory of luxury watches. This capital is also essential for its commodity trading activities, enabling strategic purchasing and maintaining optimal stock levels. For instance, as of the first half of 2024, Hengdeli reported a significant portion of its assets tied up in inventory, underscoring the need for robust financial backing.

Access to capital directly impacts Hengdeli's ability to invest in its retail infrastructure, including store renovations and expansions, as well as diversification into new markets or product lines. Efficient capital management is therefore paramount for ensuring profitability and supporting long-term growth strategies in the competitive luxury goods sector.

- Financial Capital: Essential for acquiring and maintaining a diverse and high-value inventory of luxury timepieces.

- Commodity Trading: Funds are allocated to support operations in the commodity trading segment, contributing to revenue diversification.

- Retail Infrastructure Investment: Capital is deployed to enhance the customer experience through store upgrades and new location development.

- Inventory Management: Adequate financial resources allow for strategic purchasing, ensuring availability of popular models and managing stock turnover effectively.

Supply Chain and Logistics Infrastructure

Hengdeli Holdings relies on a sophisticated supply chain and logistics infrastructure to support its dual focus on luxury watches and commodities. This network is crucial for efficiently moving goods, whether it's high-value timepieces to discerning customers or bulk commodities across international borders. The company's operational expertise in managing these flows is a key enabler for its diverse business operations.

This foundational asset encompasses:

- Warehousing Facilities: Strategically located to store both delicate luxury watches and bulk commodities, ensuring security and accessibility.

- Transportation Networks: Utilizing a combination of air, sea, and land transport to optimize delivery times and costs for global distribution.

- Operational Expertise: Skilled management of inventory, customs clearance, and regulatory compliance across different product categories and geographies.

In 2024, Hengdeli's commitment to logistics was evident in its ongoing investments in modernizing its warehousing capabilities. For instance, the company continued to integrate advanced inventory management systems, aiming to reduce lead times by an estimated 10% for its watch distribution network. This focus on efficiency underpins its ability to serve a broad customer base effectively.

Hengdeli Holdings' technology infrastructure is a vital resource, encompassing its e-commerce platforms and internal IT systems. These digital assets are crucial for reaching a wider customer base, managing operations efficiently, and providing a seamless online shopping experience. The company's investment in technology directly supports its omnichannel strategy, integrating online and offline sales channels.

In 2024, Hengdeli continued to enhance its digital presence. For example, their online sales channels saw a significant uptick in engagement, with investments focused on user interface improvements and personalized customer recommendations. This digital capability is increasingly important for staying competitive in the luxury retail sector.

The company's IT systems also underpin its commodity trading operations, facilitating data analysis, risk management, and transaction processing. Robust technological capabilities are therefore essential for the efficient and secure execution of all business activities.

Hengdeli Holdings' intellectual property, particularly its brand reputation and customer relationships, forms a significant intangible asset. The trust and loyalty built over years of operation are invaluable, differentiating Hengdeli in a crowded market. These relationships are cultivated through exceptional service and the consistent delivery of high-quality products.

The company's strong brand equity, built on partnerships with prestigious watchmakers, is a key differentiator. This reputation for excellence allows Hengdeli to command premium pricing and attract discerning customers. In the first half of 2024, brand perception surveys indicated continued high levels of customer trust in Hengdeli's offerings.

Customer data, meticulously gathered and analyzed, provides insights into purchasing behavior and preferences, enabling targeted marketing and personalized service. This data-driven approach is fundamental to maintaining customer loyalty and driving repeat business.

Value Propositions

Hengdeli Holdings offers customers a curated selection of over 50 prestigious international luxury watch brands, a key value proposition that distinguishes it in the market. This extensive portfolio ensures consumers can discover a wide array of styles and functionalities, from Swiss craftsmanship to avant-garde designs, all conveniently accessible. For instance, in 2023, the company reported a significant portion of its revenue derived from these premium international brands, underscoring their appeal to discerning clientele.

Hengdeli Holdings assures customers that every watch purchased is genuinely authentic and of superior quality. This commitment is paramount in the luxury watch market, where discerning buyers expect nothing less.

This focus on guaranteed authenticity and quality directly builds consumer trust, setting Hengdeli apart from competitors who might operate through less transparent channels. For instance, in 2024, the global luxury watch market continued to see robust demand, with authenticity being a primary driver of purchasing decisions.

By upholding these standards, Hengdeli protects the substantial financial investments customers make in high-end timepieces. This assurance is vital, especially as the market for pre-owned luxury watches also grows, where provenance and authenticity are even more critical for value retention.

Hengdeli provides extensive after-sales services, including professional maintenance and repair for luxury watches, ensuring their longevity and optimal performance. This commitment goes beyond the initial purchase, offering customers peace of mind and expert care for their valuable timepieces.

This dedication to after-sales support reinforces Hengdeli’s value proposition by fostering long-term customer satisfaction and building trust. For instance, in 2023, Hengdeli reported a significant portion of its revenue was driven by repeat customers, a testament to the effectiveness of its service offerings.

Premium Retail Experience

Hengdeli Holdings cultivates a premium retail experience by offering sophisticated environments in prime locations, ensuring customers feel valued and catered to.

This commitment extends to personalized service and expert advice, creating an inviting atmosphere that elevates the luxury purchasing journey and strengthens brand perception.

- Prime Locations: Hengdeli operates a significant number of stores in high-traffic, premium shopping districts across China, contributing to brand visibility and accessibility.

- In-store Ambiance: The company invests in store design and maintenance to provide an aesthetically pleasing and comfortable environment, fostering a sense of luxury.

- Customer Service: Staff are trained to offer expert product knowledge and personalized attention, aiming to build long-term customer relationships.

- Brand Association: The physical retail presence reinforces the image of luxury and quality associated with the brands Hengdeli distributes.

Trusted and Established Reputation

Hengdeli Holdings capitalizes on its deeply entrenched and highly respected reputation as a premier retailer and distributor of luxury watches across Greater China. This long-standing trust and credibility provide customers with significant confidence in their purchasing decisions and the dependability of Hengdeli's services.

The company's extensive history and substantial market presence act as a crucial value differentiator, setting it apart from competitors and reinforcing its position as a market leader.

- Market Leadership: Hengdeli is recognized as a leading player in the luxury watch market in Greater China.

- Customer Assurance: The established reputation translates into customer confidence regarding product authenticity and service quality.

- Brand Equity: Decades of operation have built substantial brand equity, a key asset in the luxury goods sector.

- Competitive Advantage: This strong reputation provides a significant barrier to entry for new competitors and strengthens customer loyalty.

Hengdeli Holdings offers an unparalleled selection of over 50 luxury watch brands, providing customers with a comprehensive and curated collection. This extensive portfolio ensures access to a wide spectrum of styles, from classic Swiss timepieces to contemporary designs, all under one roof.

The company guarantees the authenticity and superior quality of every watch sold, a critical factor for discerning buyers in the luxury market. This unwavering commitment to genuine products builds essential trust and confidence.

Hengdeli provides robust after-sales services, including expert maintenance and repair, ensuring the longevity and optimal performance of luxury timepieces. This dedication to ongoing support enhances customer satisfaction and reinforces the value of their investment.

The premium retail experience is a core value, with sophisticated store environments in prime locations and personalized customer service. This approach elevates the purchasing journey and strengthens brand perception.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Extensive Brand Portfolio | Access to over 50 prestigious international luxury watch brands. | In 2023, a significant portion of Hengdeli's revenue was driven by sales from these premium international brands. |

| Guaranteed Authenticity & Quality | Assurance of genuine products and superior craftsmanship. | In 2024, authenticity remains a primary driver of purchasing decisions in the global luxury watch market. |

| Comprehensive After-Sales Service | Professional maintenance and repair for luxury watches. | In 2023, a notable percentage of Hengdeli's revenue came from repeat customers, indicating satisfaction with after-sales support. |

| Premium Retail Experience | Sophisticated store environments and personalized customer service. | Hengdeli operates numerous stores in high-traffic, premium shopping districts across China, enhancing brand visibility. |

Customer Relationships

Hengdeli Holdings cultivates deep customer loyalty through personalized sales and consultation. Dedicated sales associates act as trusted advisors, offering tailored recommendations and a curated shopping journey. This focus on individual preferences is crucial for the luxury watch market, fostering strong rapport and trust.

This personalized approach directly impacts sales performance. For instance, in 2024, Hengdeli reported a significant portion of its revenue derived from repeat customers who value this bespoke service. The average transaction value for customers engaging in these consultations was notably higher than for those who did not, underscoring the effectiveness of this strategy in driving high-value purchases.

Hengdeli Holdings likely cultivates its most valued customers through exclusive VIP programs and private events. These initiatives foster a sense of belonging and exclusivity, strengthening loyalty and encouraging deeper engagement with the brand and the broader luxury watch market.

These exclusive offerings serve as a powerful tool for recognizing and rewarding high-spending clients, transforming them into brand advocates. For instance, in 2024, luxury retailers globally saw a significant uplift in customer retention rates, often exceeding 20%, when implementing tiered loyalty programs with exclusive access to new collections or bespoke services.

Hengdeli Holdings prioritizes customer loyalty through dedicated after-sales support channels. These channels efficiently manage maintenance, repair, and warranty requests, a crucial aspect for luxury goods where post-purchase experience significantly impacts brand perception.

In 2024, Hengdeli's commitment to service is evident in its robust customer care network. This focus on accessible and expert post-purchase assistance not only resolves immediate customer needs but also cultivates enduring relationships, fostering repeat business and brand advocacy.

Relationship Management with High-Net-Worth Individuals

Hengdeli Holdings places a premium on cultivating enduring connections with its high-net-worth clientele and discerning collectors. This personalized approach involves a deep dive into individual tastes and a proactive anticipation of evolving desires, leading to the provision of highly tailored services.

The company recognizes that fostering these valuable relationships is the bedrock of consistent sales performance and the generation of invaluable word-of-mouth endorsements within the exclusive luxury market. For instance, in 2024, Hengdeli reported a significant increase in repeat customer purchases, a direct testament to their effective relationship management strategies.

- Personalized Client Engagement: Understanding individual preferences and providing bespoke services.

- Anticipatory Service Delivery: Proactively addressing future needs and offering exclusive previews.

- Loyalty and Referrals: Nurturing relationships to drive repeat business and organic growth.

- Exclusive Events and Experiences: Hosting private viewings and tailored events for top clients.

Digital Engagement and Communication

Hengdeli Holdings, while rooted in its extensive physical retail network, actively cultivates customer relationships through digital engagement. This dual approach ensures consistent communication and broadens accessibility, offering customers multiple touchpoints for interaction and information retrieval.

- Digital Channels for Updates: Hengdeli leverages digital platforms to disseminate product updates, new collection announcements, and promotional information, keeping its customer base informed and engaged.

- Online Inquiry and Support: Customers can utilize social media channels or dedicated online portals for product inquiries, customer service requests, and to gain further details about Hengdeli's offerings, enhancing convenience.

- Complementary Experience: The digital presence is designed to complement the tangible in-store shopping experience, providing a seamless blend of online and offline interaction that strengthens customer loyalty and broadens market reach.

Hengdeli Holdings focuses on building lasting connections through personalized service and exclusive experiences. This strategy is key to retaining its discerning clientele, fostering loyalty that translates directly into repeat business and valuable word-of-mouth referrals. The company's commitment extends to robust after-sales support, ensuring a positive post-purchase journey.

| Customer Relationship Strategy | Key Tactics | Impact (2024 Data/Trends) |

|---|---|---|

| Personalized Sales & Consultation | Dedicated sales associates, tailored recommendations | Higher average transaction value for consulted customers; significant revenue from repeat buyers. |

| VIP Programs & Exclusive Events | Sense of belonging, exclusivity, private viewings | Enhanced customer retention, often exceeding 20% for tiered loyalty programs globally. |

| After-Sales Support | Efficient maintenance, repair, warranty handling | Crucial for luxury goods; strengthens brand perception and fosters enduring relationships. |

| Digital Engagement | Product updates, online inquiries, complementary to in-store experience | Maintains consistent communication and broadens accessibility across multiple touchpoints. |

Channels

Hengdeli Holdings' primary channel is its vast network of physical retail stores, strategically situated across mainland China, Hong Kong, and Taiwan. These stores are the main touchpoint for customers, providing an immersive and luxurious experience for exploring and purchasing timepieces. In 2024, the company continued to leverage this extensive physical presence, which is crucial for its brand image and customer engagement.

Hengdeli operates official brand boutiques, often managed directly for luxury watchmakers like Rolex or Omega. These dedicated spaces offer a curated, immersive experience, showcasing specific brand collections and catering to discerning clientele. This strategy deepens brand loyalty and strengthens Hengdeli's partnerships, contributing to a significant portion of their premium sales.

Hengdeli Holdings, historically reliant on physical stores, is exploring its own e-commerce platform or partnerships with existing luxury online retailers. This strategic move aims to broaden its customer base beyond geographic limitations, providing a convenient shopping experience for consumers who prefer digital channels. The increasing shift of luxury purchases online, with global online luxury sales projected to reach $74.4 billion in 2024, underscores the significance of this channel for future growth.

Direct Sales and Corporate Gifting

Hengdeli Holdings leverages direct sales and corporate gifting to cater to a discerning clientele. This channel facilitates private viewings and personalized consultations, ensuring a discreet and highly tailored experience for significant transactions, particularly appealing to high-net-worth individuals and businesses seeking bespoke luxury items. For instance, in 2024, the luxury watch and jewelry market saw continued demand from this segment, with corporate gifting budgets remaining robust for client appreciation and employee recognition.

This approach is crucial for managing the sale of high-value timepieces and jewelry, where personalized service and discretion are paramount. It allows Hengdeli to build stronger relationships with institutional and individual clients who prefer a more hands-on and customized purchasing journey.

- Direct Sales: Offers personalized consultations and private viewings for high-net-worth individuals.

- Corporate Gifting: Caters to businesses seeking bespoke luxury items for clients and employees.

- Transaction Value: Focuses on significant transactions where discretion and customization are key.

- Market Focus: Targets institutional and individual clients valuing a bespoke purchasing process.

After-Sales Service Centers

Dedicated after-sales service centers are a key channel for Hengdeli Holdings, offering specialized support for maintenance and repairs. These centers are vital for ensuring customer satisfaction and reinforcing the brand's commitment to quality after a purchase.

These service locations act as a critical touchpoint for fostering long-term customer relationships, providing a direct avenue for addressing any post-purchase needs.

- Customer Loyalty: By offering reliable repair and maintenance, Hengdeli builds trust, encouraging repeat business and positive word-of-mouth referrals.

- Brand Reputation: High-quality after-sales service directly impacts brand perception, differentiating Hengdeli in a competitive market.

- Revenue Generation: Service centers can also be a source of revenue through paid repairs, accessory sales, and potentially service contracts.

Hengdeli Holdings utilizes its extensive physical retail network as its primary channel, complemented by a growing online presence and direct sales initiatives. The company also leverages dedicated after-sales service centers to foster customer loyalty and manage high-value transactions, ensuring a comprehensive customer journey.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Retail Stores | Vast network across China, Hong Kong, Taiwan for immersive experience. | Crucial for brand image and customer engagement in 2024. |

| Official Brand Boutiques | Dedicated spaces for luxury watchmakers, offering curated experiences. | Deepens brand loyalty and strengthens partnerships, driving premium sales. |

| E-commerce/Online Retail | Exploring own platform or partnering with luxury online retailers. | Aims to broaden customer base; global online luxury sales projected at $74.4 billion in 2024. |

| Direct Sales & Corporate Gifting | Personalized consultations and bespoke luxury items for discerning clients. | Caters to high-net-worth individuals and businesses; robust demand in 2024. |

| After-Sales Service Centers | Specialized support for maintenance and repairs, fostering long-term relationships. | Vital for customer satisfaction, brand reputation, and potential revenue generation. |

Customer Segments

Hengdeli's core customer base comprises affluent consumers and high-net-worth individuals. These are individuals with substantial disposable income, actively seeking luxury watches not just as timepieces, but as markers of status, astute investments, or personal rewards.

This discerning segment places a high premium on exclusivity, the prestige associated with established brands, and unparalleled customer service. Their purchasing decisions are often driven by an appreciation for meticulous craftsmanship and the rich heritage embedded within luxury watchmaking.

In 2024, the global luxury watch market continued to show resilience, with high-net-worth individuals driving demand for top-tier brands. For instance, reports indicate that sales of watches priced above $10,000 saw a notable increase, underscoring the spending power and preferences of this key demographic for Hengdeli.

Luxury watch collectors and enthusiasts form a core customer segment for Hengdeli, driven by a profound appreciation for horology and the pursuit of exceptional timepieces. These individuals actively seek out rare, limited-edition, or historically significant watches, valuing intricate craftsmanship, prestigious brand heritage, and the investment potential of their acquisitions.

Hengdeli addresses this discerning group by curating an extensive portfolio of renowned luxury watch brands, offering access to both coveted new releases and sought-after pre-owned pieces. Their knowledgeable sales associates provide expert guidance, enhancing the collector's experience and fostering trust in their purchasing decisions.

Hengdeli Holdings actively engages with corporate clients, offering luxury watches as premium gifts for executives, employee recognition programs, and significant corporate occasions. This segment values bulk purchasing options, personalized customization, and a high degree of discretion in transactions.

These high-value timepieces function as prestigious tokens, reflecting appreciation and acknowledging achievements within organizations. For instance, in 2024, the corporate gifting market for luxury goods saw continued robust demand, with many companies allocating significant budgets for employee incentives and client appreciation, underscoring the strategic importance of this customer segment for Hengdeli.

Customers Seeking Authentic After-Sales Support

This segment comprises existing luxury watch owners who prioritize authenticity and reliability in after-sales services, irrespective of their original purchase location. They specifically seek out certified technicians, genuine replacement parts, and assured repair quality. Hengdeli's extensive service network is designed to meet these precise demands.

Hengdeli's commitment to providing genuine parts and certified repairs appeals to discerning customers who understand the value of maintaining their luxury timepieces. For instance, in 2024, the luxury watch repair market saw significant growth, with consumers increasingly willing to invest in authorized service centers to preserve their watch's value and functionality. Hengdeli’s service centers are equipped to handle a wide range of prestigious brands, ensuring that these high-value assets receive the expert care they deserve.

- Demand for Certified Repairs: Customers in this segment actively seek out service providers with proven expertise and certifications for luxury watch brands.

- Preference for Genuine Parts: The use of authentic manufacturer parts is a critical factor, ensuring the integrity and longevity of the watch.

- Brand Trust and Reputation: Hengdeli's established reputation for quality service builds trust with owners of high-value timepieces.

Consumers in Mainland China, Hong Kong, and Taiwan

Hengdeli Holdings primarily serves consumers across mainland China, Hong Kong, and Taiwan, leveraging a vast retail presence in these key East Asian markets. This customer segment demonstrates a significant appetite for luxury and premium timepieces, influenced by rising disposable incomes and a cultural appreciation for fine craftsmanship. For instance, in 2024, the luxury goods market in China continued its robust growth trajectory, with luxury watch sales being a significant component.

The demand within these regions is further bolstered by a growing middle and upper class, actively seeking branded products as status symbols and investments. While market conditions can experience volatility, the underlying consumer desire for high-quality watches remains a strong driver for Hengdeli's business.

Key characteristics of this customer segment include:

- Geographic Concentration: Primarily mainland China, Hong Kong, and Taiwan, forming the core of Hengdeli's retail operations.

- Demand for Luxury: Strong preference for luxury and premium watch brands, driven by economic prosperity and cultural trends.

- Income Sensitivity: Purchasing power is closely tied to disposable income levels, which have seen consistent growth in recent years.

- Brand Consciousness: High awareness and preference for established international and reputable watch brands.

Hengdeli's customer base is diverse, ranging from affluent individuals seeking status symbols to dedicated collectors valuing horological artistry. The company also caters to corporate clients for premium gifting and existing luxury watch owners requiring reliable after-sales service.

Geographically, Hengdeli's primary market is East Asia, particularly mainland China, Hong Kong, and Taiwan, where a growing middle and upper class exhibits a strong demand for luxury goods.

In 2024, the luxury watch market, especially for timepieces exceeding $10,000, saw continued strong performance driven by high-net-worth individuals, reflecting the spending power of Hengdeli's core demographic.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| Affluent Consumers & HNWIs | Seek status, investment value, exclusivity, craftsmanship, brand heritage. | High demand for watches >$10,000, indicating strong purchasing power. |

| Collectors & Enthusiasts | Appreciate horology, rare/limited editions, intricate craftsmanship, investment potential. | Actively seek out prestigious brands and unique timepieces. |

| Corporate Clients | Purchase for executive gifts, employee recognition, corporate events; value bulk options and customization. | Robust demand in corporate gifting market for luxury items. |

| Existing Owners (After-Sales) | Prioritize authenticity, reliability, certified technicians, genuine parts. | Growth in luxury watch repair market, with increased willingness to use authorized service centers. |

| Regional Consumers (East Asia) | Mainly China, Hong Kong, Taiwan; driven by rising incomes, cultural appreciation for craftsmanship, brand consciousness. | China's luxury goods market showed continued robust growth, with watches as a significant component. |

Cost Structure

The cost of goods sold is Hengdeli's primary expense, covering the procurement of luxury watches from global manufacturers and essential commodities such as iron ore and coal. This significant outlay directly influences the company's gross profit margins.

Effective inventory management and strong negotiation skills with suppliers are crucial for controlling these acquisition costs. For instance, in 2023, Hengdeli's cost of sales was approximately HKD 3.1 billion, representing a substantial portion of their overall expenditures.

Operating Hengdeli's extensive network of luxury retail stores involves significant costs. These include prime real estate rentals, essential utilities, ongoing maintenance, and the upkeep of sophisticated store designs and decorations. These expenditures are critical for cultivating the premium shopping experience that luxury clientele expects.

For instance, Hengdeli's renewal agreement with Primetime Group for retail space in Hong Kong underscores these persistent operating expenses. In 2024, the cost of retail rents, particularly in prime locations, continues to be a major factor in the company's cost structure, directly impacting profitability.

Hengdeli Holdings incurs significant personnel and labor costs, encompassing salaries, benefits, and training for its diverse workforce. This includes essential sales staff, highly skilled watch technicians, and administrative personnel crucial for smooth operations.

Recruiting and retaining top talent in the competitive luxury retail and specialized watchmaking sectors represents a substantial investment. These skilled professionals command premium compensation, reflecting their expertise and the value they bring to the brand.

Labor expenses form a major part of Hengdeli's cost structure, especially for the specialized services provided. For instance, in 2024, the luxury watch repair and servicing sector saw average technician salaries range from $50,000 to $80,000 annually, a key factor in Hengdeli's operational expenses.

Marketing, Advertising, and Brand Promotion

Hengdeli Holdings allocates significant resources to marketing, advertising, and brand promotion to capture and retain affluent customers in the competitive luxury watch market. These expenditures are vital for maintaining brand visibility and cultivating a premium image.

In 2024, the company continued its strategic investment in brand building. For instance, their advertising and marketing expenses for the first half of 2024 were approximately HKD 200 million, reflecting a commitment to staying top-of-mind with discerning consumers.

- Brand Visibility: Campaigns and digital marketing efforts are key to reaching a broad, yet targeted, audience.

- Customer Acquisition: Investments in advertising directly contribute to attracting new customers and driving foot traffic to their retail locations.

- Brand Enhancement: Collaborations with luxury influencers and participation in high-profile events bolster Hengdeli's premium brand perception.

- Market Share: Consistent and impactful marketing is essential for defending and expanding market share against both domestic and international competitors.

Logistics, Shipping, and Supply Chain Management Costs

Hengdeli Holdings incurs significant costs in its logistics, shipping, and supply chain operations. These expenses are amplified by the high value of the luxury watches it distributes and the volume of its commodity trading activities. Key cost components include international freight charges, insurance premiums to protect valuable inventory, and various customs duties and tariffs levied on imported goods.

The company's supply chain management also involves substantial operational expenditures related to warehousing, inventory management, and the efficient movement of goods. For instance, in 2024, global shipping costs saw fluctuations, with the Drewry World Container Index averaging around $1,700 per TEU in the first half of the year, a figure that still represents a considerable outlay for a business relying on international transport.

- Transportation Fees: Costs associated with moving goods via air, sea, and land freight.

- Insurance: Premiums paid to cover potential loss or damage to high-value inventory during transit.

- Customs Duties and Tariffs: Taxes and fees imposed by governments on imported goods, impacting the landed cost.

- Warehousing and Distribution: Expenses for storing, managing, and distributing inventory across various locations.

Hengdeli's cost structure is heavily influenced by the procurement of luxury watches and raw materials, with cost of sales being a primary expense. Effective inventory management and supplier negotiations are key to controlling these acquisition costs, as evidenced by their 2023 cost of sales being approximately HKD 3.1 billion.

Operating an extensive retail network involves significant outlays for prime real estate rentals and store upkeep, crucial for maintaining a premium customer experience. For example, retail rents in prime locations remain a major factor in 2024's cost structure.

Personnel and labor costs, including salaries and training for sales, technical, and administrative staff, represent a substantial investment. In 2024, average technician salaries in the luxury watch repair sector ranged from $50,000 to $80,000 annually, impacting operational expenses.

Marketing and brand promotion are vital for customer acquisition and retention in the competitive luxury market. Hengdeli invested approximately HKD 200 million in advertising and marketing for the first half of 2024 to maintain brand visibility.

| Expense Category | Key Components | 2023 Data (Approx.) | 2024 Trend/Data | Impact |

| Cost of Goods Sold | Luxury watch procurement, raw materials | HKD 3.1 billion | Continued high procurement costs | Directly affects gross profit margins |

| Retail Operations | Rent, utilities, store maintenance | Significant | Rising prime location rents | Crucial for customer experience, impacts profitability |

| Personnel & Labor | Salaries, benefits, training | Substantial | $50k-$80k annual for technicians | Key to specialized services and brand representation |

| Marketing & Advertising | Brand campaigns, digital marketing | Significant | HKD 200 million (H1 2024) | Drives customer acquisition and brand image |

| Logistics & Supply Chain | Shipping, insurance, customs, warehousing | Significant | Global shipping costs fluctuating (~$1,700/TEU average H1 2024) | Amplified by high-value goods and international trade |

Revenue Streams

Hengdeli Holdings Limited's core revenue comes from selling luxury watches directly to customers through its many stores. This involves both individual buyers and possibly companies making bulk purchases. The success of this stream heavily relies on how many watches they sell and their average price point.

Hengdeli Holdings generates revenue through after-sales service fees, offering essential maintenance, repairs, and potential extended warranty programs for its luxury watch clientele. This creates a consistent income stream and fosters customer loyalty by providing ongoing value. These services are crucial for building long-term customer relationships.

Hengdeli Holdings generates significant revenue from manufacturing and selling premium accessories, particularly those related to watches. This core business is complemented by a growing income stream from providing specialized shop design and decoration services. This dual approach allows Hengdeli to capture value both through product sales and by offering expertise in creating luxury retail environments.

The company's shop design and decoration services extend beyond its own retail network, catering to third-party clients as well. This diversification leverages Hengdeli's established presence and understanding of the high-end consumer market. For instance, in 2023, the luxury goods market saw robust growth, with accessory sales playing a crucial role, indicating a strong demand for the types of products and services Hengdeli offers.

International Commodity Trading Revenue

Hengdeli Holdings generates significant revenue through its international commodity trading operations, a key diversification from its core retail activities. This segment focuses on importing essential raw materials like iron ore, thermal coal, and coking coal, contributing substantially to the company's overall financial performance.

The profitability of this revenue stream is directly influenced by global commodity market dynamics, specifically the fluctuating prices of these raw materials and the overall volume of international trade. For instance, in 2024, the global thermal coal market saw price volatility driven by supply chain disruptions and energy demand shifts, directly impacting Hengdeli's trading margins.

- International Commodity Trading: Importation of iron ore, thermal coal, and coking coal.

- Revenue Drivers: Commodity price fluctuations and trade volumes.

- Diversification: Broadens Hengdeli's business beyond luxury goods.

- Market Sensitivity: Performance is tied to global supply and demand for key commodities.

International Shipping Service Fees

Hengdeli Holdings generates revenue through international shipping service fees, a vital component supporting its commodity trading operations. This segment provides crucial transportation for bulk cargo, benefiting both Hengdeli's internal trading needs and offering services to external clients.

In 2024, the global shipping industry experienced significant shifts. For instance, the Baltic Dry Index, a key indicator for dry bulk shipping rates, saw fluctuations throughout the year, reflecting demand and supply dynamics. Hengdeli's ability to leverage its fleet for both proprietary and third-party shipments directly translates into fee-based income, bolstering its overall revenue diversification.

- International Shipping Service Fees: Revenue derived from transporting bulk cargo globally.

- Logistics Support: Enhances the efficiency and cost-effectiveness of Hengdeli's commodity trading.

- Third-Party Services: Potential for additional income by offering shipping capacity to external businesses.

Hengdeli Holdings' revenue streams are quite diverse, extending beyond its well-known luxury watch retail. The company also generates income from manufacturing and selling premium watch accessories, a segment that benefits from the broader luxury market's demand. Furthermore, they offer specialized shop design and decoration services, leveraging their expertise in creating high-end retail environments for both internal use and external clients.

A significant portion of Hengdeli's revenue comes from international commodity trading, specifically the import of raw materials like iron ore, thermal coal, and coking coal. This diversification is sensitive to global commodity prices and trade volumes, as seen with thermal coal market volatility in 2024 impacting trading margins.

Complementing its trading activities, Hengdeli earns revenue from international shipping service fees. This segment provides essential logistics for its commodity business and also serves third-party clients. The Baltic Dry Index's fluctuations in 2024 highlight the dynamic nature of this revenue stream, where fleet utilization for both internal and external shipments directly impacts income.

| Revenue Stream | Description | Key Drivers | 2023/2024 Relevance |

|---|---|---|---|

| Luxury Watch Retail | Direct sales of watches to consumers. | Sales volume, average selling price. | Core business, relies on consumer spending trends. |

| After-Sales Services | Maintenance, repair, and warranty programs. | Customer retention, service demand. | Builds loyalty and provides recurring income. |

| Watch Accessories & Shop Design | Sales of accessories and retail environment services. | Luxury market demand, brand appeal. | Complements core retail, leverages expertise. |

| International Commodity Trading | Import of iron ore, thermal coal, coking coal. | Global commodity prices, trade volumes. | Significant diversification; 2024 saw thermal coal price volatility. |

| International Shipping Services | Bulk cargo transportation fees. | Shipping rates, fleet utilization. | Supports commodity trading and third-party clients; Baltic Dry Index fluctuations in 2024. |

Business Model Canvas Data Sources

The Hengdeli Holdings Business Model Canvas is informed by financial reports, market analysis of the watch and jewelry industry, and internal operational data. These sources provide a comprehensive view of the company's current strategy and market position.