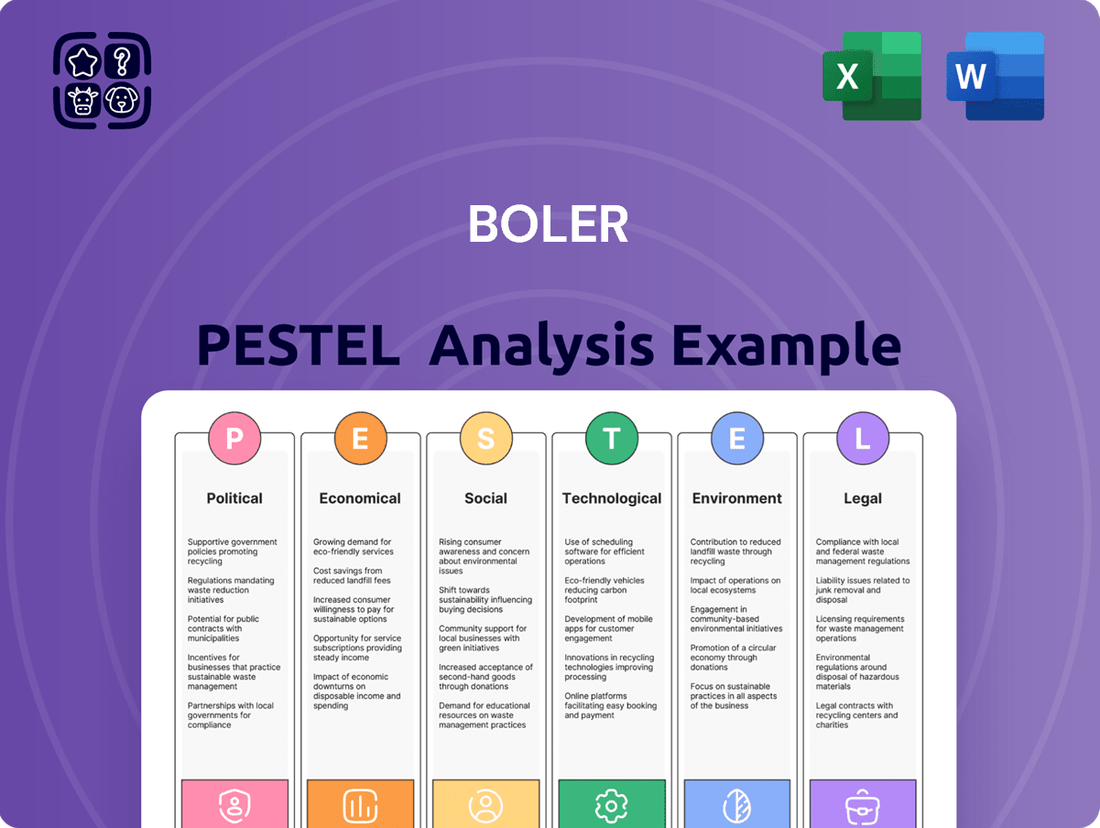

Boler PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boler Bundle

Navigate the complex external forces shaping Boler's trajectory with our meticulous PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the critical factors driving success and potential challenges. Equip yourself with actionable intelligence to refine your strategy and seize opportunities. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Trade tariffs and protectionist policies represent a significant political factor for Boler. The imposition of tariffs on imported automobiles and automotive parts, such as the potential 25% tariffs that came into effect in April/May 2025, directly impacts Boler's supply chain and overall production costs.

These tariffs can lead to increased prices for essential components and finished vehicles, which in turn may affect consumer demand and Boler's profitability. Furthermore, the emphasis on domestic production driven by these protectionist measures can influence Boler's strategic decisions regarding material sourcing and manufacturing locations.

Stricter environmental regulations, such as the EPA's Clean Trucks Plan and Phase 3 Greenhouse Gas Emissions Standards for heavy-duty vehicles starting in model year 2027, are directly shaping Boler's product development roadmap. These regulations necessitate significant investment in research and development for cleaner technologies.

California's Advanced Clean Trucks (ACT) and Advanced Clean Fleets (ACF) regulations are particularly impactful, mandating a phased introduction of zero-emission vehicles from 2024 and 2025 respectively. This transition requires Boler to accelerate its development and production of electric and other zero-emission powertrains.

Compliance with these increasingly stringent emission standards is not just a regulatory requirement but a critical factor for maintaining market access and ensuring Boler's competitiveness in the evolving automotive landscape.

Government investments in infrastructure projects, such as roads, bridges, and public transit, directly boost demand for commercial vehicles. For a company like Boler, which supplies components for trucks and vocational vehicles, this translates into increased sales opportunities for its suspension systems and related parts. For instance, in the United States, the Infrastructure Investment and Jobs Act, enacted in 2021, allocates over $1 trillion for infrastructure improvements, with a significant portion dedicated to transportation projects expected to continue through 2025.

Geopolitical Stability and International Relations

Political stability in key international markets where Boler operates through joint ventures or sells its products is vital for uninterrupted supply chains and manufacturing. For instance, in 2024, the ongoing geopolitical tensions in Eastern Europe, a significant region for global trade and manufacturing, have continued to pose risks. These disruptions can lead to increased logistics costs and potential delays in raw material sourcing for companies like Boler.

Political unrest or trade disputes can disrupt production schedules, increase operational costs, and impact investor confidence. For example, the imposition of new tariffs or trade barriers between major economic blocs in 2024 has directly affected import/export dynamics for many industries, potentially adding to Boler's cost of goods sold or impacting market access.

Monitoring and adapting to the geopolitical landscape is essential for global operations. Boler's strategic planning must account for potential shifts in international relations, such as the evolving trade agreements or sanctions that could influence its market presence and supply chain resilience.

- Supply Chain Vulnerability: Geopolitical instability in regions like Southeast Asia, a hub for electronics manufacturing, can create significant disruptions. In 2024, several countries in this region experienced localized political unrest, impacting shipping routes and component availability.

- Trade Policy Impact: Changes in trade policies, such as the renegotiation of trade agreements or the introduction of protectionist measures, can directly affect Boler's international sales and sourcing strategies. For instance, a shift in trade relations between the US and China in 2024 has led to increased uncertainty for multinational corporations.

- Investor Confidence: Global political events, like major elections or international conflicts, can trigger market volatility. A decline in investor confidence due to geopolitical risks can affect Boler's stock performance and its ability to secure financing for expansion.

Policy Support for Green Technologies

Government incentives and policies are actively fostering the adoption of green transportation, directly benefiting companies like Boler. For instance, the United States' Inflation Reduction Act of 2022, with its significant tax credits for electric vehicles and charging infrastructure, signals a strong commitment to this sector. This policy environment encourages Boler's focus on developing sustainable suspension solutions, particularly for electric and hydrogen-powered commercial vehicles.

These supportive policies translate into tangible opportunities for innovation in areas like lightweight materials and energy-efficient systems, crucial for the next generation of commercial vehicles. Boler's alignment with clean transportation technologies is further bolstered by global trends, such as the European Union's Fit for 55 package, aiming for a 55% reduction in greenhouse gas emissions by 2030, which includes substantial support for zero-emission transport.

- Government incentives like tax credits and grants directly reduce the cost of adopting green technologies for commercial fleets.

- Infrastructure investment in charging and refueling stations is critical for the widespread adoption of electric and hydrogen vehicles, creating a market for specialized components.

- Regulatory mandates pushing for emissions reductions incentivize manufacturers to integrate advanced, sustainable technologies, including suspension systems.

- Research and development funding from governments can accelerate innovation in lightweight materials and energy-efficient vehicle components.

Political factors significantly shape Boler's operational landscape, from trade policies to environmental mandates. The ongoing shift towards protectionism, exemplified by potential tariffs on automotive parts in 2025, directly impacts supply chain costs and strategic sourcing decisions.

Stringent environmental regulations, such as California's Advanced Clean Trucks mandates starting in 2024 and 2025, are accelerating Boler's investment in zero-emission vehicle technology. Government investment in infrastructure, like the US Infrastructure Investment and Jobs Act, is also a key driver of demand for Boler's commercial vehicle components.

Geopolitical stability remains crucial for Boler's global operations, with ongoing tensions in regions like Eastern Europe in 2024 affecting logistics and raw material sourcing. Political events can also influence investor confidence and market access, necessitating adaptive strategic planning.

Government incentives, such as those in the US Inflation Reduction Act of 2022, are actively promoting green transportation, aligning with Boler's focus on sustainable suspension solutions for electric and hydrogen vehicles. This policy support is vital for innovation in energy-efficient systems.

What is included in the product

This Boler PESTLE analysis comprehensively examines the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Boler PESTLE Analysis provides a clear, summarized version of external factors, alleviating the pain of sifting through raw data for quick strategic alignment.

Economic factors

The overall health of the global economy significantly impacts the demand for Boler's suspension systems, as it directly correlates with commercial vehicle sales. While the United States experienced GDP growth in the fourth quarter of 2024, the global market for medium and heavy commercial vehicles is anticipated to see only moderate expansion in 2025.

This projected growth is not uniform across all regions; North America, for instance, is forecast to experience a decline in its commercial vehicle market. Boler needs to carefully consider these regional economic divergences to effectively tailor its production and sales strategies, ensuring resources are allocated where demand is strongest.

Rising inflation is a significant concern for Boler, directly impacting its manufacturing expenses. For instance, the cost of essential raw materials like steel saw a notable increase of 5% in the first quarter of 2024. Additionally, lithium prices experienced considerable volatility, surging by 30% in the first half of 2024. These escalating material costs put substantial pressure on Boler's operational budget.

Further compounding these cost pressures are increased fuel prices. These higher fuel costs directly translate to elevated transportation expenses, impacting the logistics and delivery of Boler's products. The combined effect of rising material and fuel costs is a squeeze on profit margins, necessitating careful financial management.

To navigate these inflationary headwinds, Boler must implement robust cost management strategies. This includes the potential for strategic pricing adjustments to reflect increased input costs and a thorough optimization of its supply chain to identify efficiencies and mitigate the impact of volatile commodity prices.

Interest rate fluctuations directly impact Boler's commercial vehicle segment. For instance, commercial vehicle loan rates hovered around 7-8% in early 2024, a key factor influencing customer purchasing power and fleet expansion decisions. Higher rates also increase Boler's own borrowing costs for operations and investments.

Conversely, a stabilizing interest rate environment is anticipated to boost investment in the real estate market, another area where Boler holds interests. This stabilization could lead to increased opportunities and potentially higher returns within that sector.

Supply Chain Disruptions

Ongoing global supply chain vulnerabilities continue to pose significant challenges, particularly concerning shortages of critical components like semiconductors and lithium. These shortages can severely impact production capabilities for commercial vehicles, a key market for Boler.

These disruptions have already had a tangible effect, contributing to an estimated 10-20% decrease in automotive production during 2024. This highlights the immediate need for proactive strategies to navigate these complexities.

To mitigate these risks and maintain production efficiency, Boler must prioritize and continue to diversify its supply chains. Building greater resilience within its sourcing network is paramount for sustained operational success.

- Semiconductor Shortages: Continued scarcity impacts the integration of advanced electronics in commercial vehicles.

- Lithium Availability: Constraints on lithium supply can affect the production of electric vehicle components.

- Production Impact: Automotive production saw a 10-20% reduction in 2024 due to these issues.

- Strategic Imperative: Boler needs to enhance supply chain diversification and resilience.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Boler's global operations. Fluctuations can directly affect the value of international sales and the cost of imported materials, impacting profitability. For instance, if the US dollar strengthens considerably against other major currencies in 2024-2025, Boler's products sold abroad could become less attractive to foreign buyers, potentially dampening export volumes.

Managing these currency risks is paramount. Boler might need to employ strategies like currency hedging to lock in exchange rates for future transactions or consider diversifying its manufacturing and sales presence to mitigate the impact of adverse currency movements. As of early 2024, the US dollar has shown a degree of strength against several emerging market currencies, a trend that could continue and necessitate proactive risk management for Boler.

- Impact on Exports: A stronger USD can make Boler's goods pricier internationally, potentially reducing demand.

- Cost of Imports: Conversely, a weaker USD could increase the cost of raw materials or components sourced from abroad.

- Hedging Strategies: Boler may utilize financial instruments to protect against unfavorable currency swings.

- Localized Production: Establishing production facilities in key markets can reduce exposure to exchange rate fluctuations.

Global economic growth, while showing resilience in the US in late 2024, is projected for only moderate expansion in the commercial vehicle sector in 2025, with North America specifically facing a market contraction. Inflationary pressures continue to affect Boler, evidenced by a 5% rise in steel costs in Q1 2024 and a significant 30% surge in lithium prices during the first half of 2024, directly impacting manufacturing expenses and profit margins. Interest rate stability is anticipated to benefit Boler's real estate interests, though commercial vehicle loan rates around 7-8% in early 2024 present a challenge to customer purchasing power.

Supply chain disruptions, particularly semiconductor and lithium shortages, caused an estimated 10-20% reduction in automotive production in 2024, underscoring Boler's need for supply chain diversification. Currency volatility, with the US dollar showing strength against emerging market currencies in early 2024, poses risks to export volumes and import costs, necessitating hedging strategies or localized production.

| Factor | 2024/2025 Impact | Boler Implication |

| Global GDP Growth | Moderate expansion in commercial vehicles; US Q4 2024 growth, but North America CV market decline forecast. | Need to adapt production and sales strategies to regional economic divergences. |

| Inflation | Steel costs +5% (Q1 2024); Lithium prices +30% (H1 2024); Increased fuel costs. | Pressure on manufacturing expenses and profit margins; requires cost management and pricing adjustments. |

| Interest Rates | Commercial vehicle loan rates ~7-8% (early 2024); Stabilizing rates benefit real estate. | Affects customer purchasing power for commercial vehicles; impacts Boler's borrowing costs. |

| Supply Chain Issues | Semiconductor/lithium shortages; 10-20% automotive production reduction (2024). | Production capability impact; necessitates supply chain diversification and resilience. |

| Currency Exchange Rates | USD strength against emerging markets (early 2024). | Potential reduction in export volumes; increased import costs; need for hedging or localization. |

Preview Before You Purchase

Boler PESTLE Analysis

The preview shown here is the exact Boler PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use for your strategic planning.

This is a real screenshot of the product you’re buying—the comprehensive Boler PESTLE Analysis, delivered exactly as shown, no surprises.

The content and structure of this Boler PESTLE Analysis shown in the preview is the same document you’ll download after payment, providing immediate insights.

Sociological factors

The manufacturing sector, particularly in areas like commercial vehicle components, is grappling with ongoing shortages of skilled labor. In the third quarter of 2024, a significant 20.6% of US manufacturing plants indicated that a lack of sufficient labor or skills was hindering their operations.

Looking ahead, the situation is projected to worsen, with nearly half of the estimated 3.8 million job openings in manufacturing potentially remaining unfilled by 2033. This persistent challenge directly affects Boler's ability to maintain and expand its production capacity.

Addressing these labor gaps will likely require Boler to make strategic investments in robust training programs, effective employee retention initiatives, and the adoption of automation technologies to bridge the skills divide.

Growing public awareness and consumer preference for sustainable products are significantly boosting the demand for eco-friendly transportation. This societal shift is a key driver for manufacturers like Hendrickson to focus on developing lightweight, energy-efficient, and zero-emission compatible suspension systems, reflecting a broader market trend towards environmental responsibility.

In 2024, the global electric vehicle market is projected to reach over 14 million units, a substantial increase from previous years, underscoring the strong consumer pull towards sustainable mobility. This trend directly influences the automotive supply chain, pushing component manufacturers to adapt their offerings.

Boler's strategic alignment with sustainable product development resonates with these evolving market preferences, positioning the company to capitalize on the increasing demand for greener transportation solutions. This focus is crucial for maintaining competitiveness and relevance in the evolving automotive landscape.

The manufacturing sector, including companies like Boler, is experiencing a significant aging workforce. In the US, the median age of manufacturing workers has been steadily rising, with a notable portion nearing retirement age. This demographic trend directly contributes to a widening skills gap, as experienced workers depart and fewer younger individuals enter the field, necessitating proactive recruitment and robust training initiatives for Boler.

Furthermore, there's a pronounced societal shift towards prioritizing work-life balance and overall employee well-being. This evolving expectation impacts how companies attract and retain talent. Boler must therefore cultivate a supportive workplace culture and potentially offer flexible arrangements to remain competitive in securing skilled labor.

To navigate these demographic changes effectively, Boler should invest in comprehensive upskilling and reskilling programs. This commitment not only addresses the immediate skills gap but also demonstrates an investment in its current workforce, fostering loyalty and adaptability in response to the shifting labor landscape.

Urbanization and E-commerce Growth

Urbanization is a significant driver for e-commerce, creating a surge in demand for efficient last-mile delivery. This directly translates to a need for specialized commercial vehicles, impacting Boler's product development. For instance, by 2025, global e-commerce sales are projected to reach $7.4 trillion, underscoring the scale of this shift.

The increasing density of urban populations means more frequent, shorter delivery routes. This necessitates vehicles with robust suspension systems capable of handling constant stop-and-go traffic and varied road conditions. Boler can capitalize on this by focusing on suspension solutions tailored for these demanding urban delivery fleets.

- Increased Demand for Last-Mile Delivery Vehicles: Urban population growth fuels e-commerce, requiring more delivery vans and trucks.

- Suspension System Performance Requirements: Frequent stops and starts in cities put extra strain on vehicle suspension.

- Opportunities for Boler: Developing specialized suspension for urban delivery fleets and diverse commercial applications.

- E-commerce Growth Projections: Global e-commerce sales expected to hit $7.4 trillion by 2025, highlighting market potential.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are growing, pushing companies to adopt ethical practices, champion diversity, and actively engage with their communities. Boler, a family-owned business, aligns with these expectations by highlighting its commitment through programs like Vision Zero, focused on workplace safety, and various community outreach efforts. This dedication to social and environmental accountability is crucial for building trust and a positive brand image among stakeholders.

For instance, in 2024, many companies reported increased investment in ESG (Environmental, Social, and Governance) initiatives. A significant portion of consumers now consider a company's social impact when making purchasing decisions. Boler's approach, therefore, is not just about compliance but about building a resilient and respected brand in a market that increasingly values purpose-driven business.

- Growing Consumer Demand: By 2025, it's projected that over 60% of consumers will prioritize brands with strong CSR commitments.

- Employee Attraction and Retention: Companies with robust social programs, like Boler's community engagement, often see higher employee satisfaction and loyalty, a trend amplified in the competitive 2024-2025 labor market.

- Investor Scrutiny: Investment firms are increasingly integrating ESG factors into their analysis, with a notable rise in sustainable investment funds seeking companies with transparent social and environmental reporting.

- Reputational Capital: Boler's Vision Zero program, for example, directly addresses safety, a key social concern, contributing to a stronger reputation and mitigating potential risks.

Societal shifts are profoundly impacting the automotive sector, influencing both consumer preferences and workforce dynamics. Growing demand for sustainable transportation, evidenced by the projected 14 million+ global electric vehicle sales in 2024, pushes manufacturers like Boler to innovate in eco-friendly components. Simultaneously, an aging workforce and a desire for work-life balance present recruitment and retention challenges, with nearly half of projected manufacturing job openings potentially remaining unfilled by 2033 in the US.

Urbanization, driving e-commerce growth to an estimated $7.4 trillion by 2025, necessitates specialized vehicles for efficient last-mile delivery. This trend demands robust suspension systems capable of handling constant urban stop-and-go traffic, presenting a clear opportunity for Boler to develop tailored solutions.

Furthermore, increasing societal expectations for corporate social responsibility are paramount. By 2025, over 60% of consumers are expected to favor brands with strong CSR commitments. Boler's engagement in programs like Vision Zero and community outreach aligns with these values, enhancing its reputation and employee loyalty in a market that increasingly values purpose-driven businesses.

| Sociological Factor | Impact on Boler | Supporting Data (2024-2025) |

|---|---|---|

| Demand for Sustainability | Increased demand for eco-friendly components (e.g., lightweight, zero-emission compatible suspensions). | Global EV market projected to exceed 14 million units in 2024. |

| Labor Market Dynamics | Shortages of skilled labor and an aging workforce create recruitment and retention challenges. | 20.6% of US manufacturing plants cited labor/skills shortage in Q3 2024; nearly 50% of projected job openings may remain unfilled by 2033. |

| Urbanization & E-commerce | Growth in last-mile delivery vehicles requires specialized suspension systems for urban environments. | Global e-commerce sales projected to reach $7.4 trillion by 2025. |

| Corporate Social Responsibility (CSR) | Emphasis on ethical practices, diversity, and community engagement enhances brand reputation and employee loyalty. | Over 60% of consumers expected to prioritize brands with strong CSR by 2025. |

Technological factors

Hendrickson, Boler's core business, is driving significant advancements in suspension technology. Innovations like electronically controlled air suspensions and self-leveling systems are transforming commercial vehicle performance. These technologies directly improve ride comfort, vehicle stability, and overall safety, while also contributing to better fuel efficiency.

The market for advanced truck and trailer suspension systems is seeing substantial growth, largely fueled by these technological leaps. For instance, the global commercial vehicle suspension market was valued at approximately $18.5 billion in 2023 and is projected to reach over $25 billion by 2030, demonstrating a compound annual growth rate of around 4.5%, according to industry reports from 2024.

The autonomous commercial vehicle market is accelerating, driven by advancements in artificial intelligence, LiDAR, radar, and GPS. These technologies are crucial for navigation and optimizing delivery routes, with pilot programs for autonomous freight transport showing significant promise for boosting efficiency and cutting labor expenses. For instance, by 2024, the global autonomous vehicle market was projected to reach over $40 billion, with commercial trucking a major segment.

Boler's suspension systems must integrate flawlessly with these developing autonomous driving systems. This integration is key to ensuring the safe and dependable operation of these advanced vehicles, especially as the technology matures and adoption increases. The ability to adapt and incorporate new sensor and control interface technologies will be paramount for maintaining market relevance.

The automotive industry is rapidly embracing electrification, with a notable surge in investment in electric and hybrid commercial vehicles. Major Original Equipment Manufacturers (OEMs) are channeling billions into expanding their electric vehicle (EV) production capabilities, signaling a profound shift in manufacturing priorities.

Electric trucks, in particular, present unique engineering challenges and opportunities. Their instant torque and regenerative braking systems necessitate suspension designs capable of managing altered weight distributions and distinct performance profiles compared to traditional internal combustion engine vehicles.

For Boler, this technological evolution demands a proactive approach. Adapting its product portfolio to seamlessly integrate with and support these emerging electric and alternative powertrain technologies is crucial for maintaining market relevance and capitalizing on future growth opportunities.

Automation and Robotics in Manufacturing

The manufacturing sector's increasing embrace of automation, particularly robotics and streamlined processes, is a significant technological driver. This trend directly impacts productivity and operational efficiency. In 2024 alone, the adoption of automation within manufacturing saw an impressive 8.5% increase, with projections indicating continued growth and investment throughout 2025. Boler can strategically capitalize on these advancements to refine its production lines, achieve cost savings through reduced labor dependency, and elevate the overall quality of its manufactured goods.

Key impacts of this technological shift include:

- Enhanced Productivity: Automation allows for faster production cycles and higher output volumes.

- Improved Efficiency: Automated systems reduce waste and optimize resource utilization, leading to lower operational costs.

- Quality Consistency: Robotics and automated processes minimize human error, ensuring a more uniform and higher-quality product.

- Cost Reduction: While initial investment can be high, long-term savings are realized through decreased labor expenses and improved efficiency.

Integration of Telematics and Data Analytics

The increasing integration of telematics and advanced data analytics into commercial vehicle systems, including sophisticated suspension components, is a significant technological factor. This allows for real-time performance monitoring, enabling predictive maintenance and highly optimized route planning. For fleet owners, this translates directly into enhanced operational efficiency and a substantial reduction in costly downtime.

Boler can strategically leverage this trend by embedding smart features directly into its suspension systems. These embedded capabilities will generate valuable performance data, offering fleet operators deeper insights into vehicle health and operational patterns. This proactive approach not only improves customer service through enhanced support and reduced unexpected failures but also positions Boler as a technology leader in the commercial vehicle aftermarket.

- Real-time Diagnostics: Telematics in suspension systems can transmit data on component wear, stress levels, and operating conditions, allowing for immediate identification of potential issues.

- Predictive Maintenance: Advanced analytics can forecast component failures based on usage patterns and sensor data, shifting maintenance from reactive to proactive and minimizing unplanned downtime.

- Operational Optimization: Data from telematics can inform route planning, load balancing, and driving behavior, all of which impact suspension wear and overall fleet efficiency.

- Enhanced Customer Value: Boler can offer data-driven insights and tailored service recommendations to its customers, strengthening relationships and creating new service revenue streams.

Technological advancements are rapidly reshaping the commercial vehicle landscape, directly impacting Boler's core business. Innovations in suspension technology, such as electronically controlled air suspensions, are enhancing ride comfort and vehicle stability. The growing adoption of autonomous driving systems, powered by AI and advanced sensors, necessitates seamless integration with suspension components for safe operation.

Electrification of commercial vehicles presents both challenges and opportunities, requiring suspension designs that accommodate new weight distributions and performance characteristics. Furthermore, increased automation in manufacturing, with an 8.5% rise in adoption in 2024, is boosting productivity and quality for companies like Boler. Telematics and data analytics are also becoming integral, enabling predictive maintenance and operational optimization for fleet operators.

The global commercial vehicle suspension market, valued at approximately $18.5 billion in 2023, is projected to grow to over $25 billion by 2030. The autonomous vehicle market, a significant segment for these technologies, was expected to exceed $40 billion in 2024. These figures underscore the substantial market potential driven by technological innovation.

| Technology Area | Key Advancements | Impact on Boler | Market Growth (2023-2030) |

|---|---|---|---|

| Suspension Technology | Electronically controlled air, self-leveling | Improved performance, safety, fuel efficiency | CAGR ~4.5% (Commercial Vehicle Suspension Market) |

| Autonomous Driving | AI, LiDAR, Radar, GPS | Need for seamless integration, sensor compatibility | Autonomous Vehicle Market projected >$40B (2024) |

| Electrification | Electric & Hybrid Trucks | Adaptation for new weight/performance profiles | Significant OEM investment in EV production |

| Manufacturing Automation | Robotics, streamlined processes | Enhanced productivity, quality, cost reduction | 8.5% adoption increase (2024) |

| Telematics & Data Analytics | Real-time diagnostics, predictive maintenance | Embedded smart features, new service revenue | Increased operational efficiency for fleets |

Legal factors

Stringent vehicle emission regulations are significantly reshaping the automotive landscape. For instance, the EPA's Greenhouse Gas Emissions Standards for Heavy-Duty Vehicles – Phase 3, with some rules taking effect in June 2024, and California's Advanced Clean Fleets regulation, mandating zero-emission vehicle purchases starting in 2024 and 2025, present substantial compliance challenges for commercial vehicle manufacturers.

Boler must align its product offerings with these evolving emission standards to maintain market access in critical regions. This necessitates increased investment in and development of cleaner powertrain technologies, directly impacting research and development budgets and production strategies for the 2024-2025 period and beyond.

International trade laws and tariffs significantly impact Boler's operational costs and supply chain resilience. For instance, the 25% tariffs on imported automotive parts and vehicles, as implemented by the US government, directly increase sourcing expenses and necessitate a strategic review of global procurement. These policies also compel adjustments to pricing strategies to maintain competitiveness.

Compliance with trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), is critical for Boler. USMCA dictates specific rules of origin for automotive components, requiring a certain percentage of parts to be manufactured within North America. Failure to adhere to these regulations can result in significant penalties and disruptions to the supply chain, impacting production schedules and profitability.

Commercial vehicle safety regulations are constantly evolving, with a significant focus in 2024 and 2025 on advanced driver-assistance systems (ADAS) and enhanced vehicle stability. These mandates directly impact the engineering and features of suspension components, pushing for innovations that improve overall vehicle safety and handling.

Boler must stay ahead of these regulatory curves, ensuring its suspension systems meet or exceed new standards for ADAS integration and stability control. Compliance not only mitigates liability risks but also positions Boler as a leader in safety-conscious product development, with innovations in dynamic load adjusters often stemming from these legal requirements.

Autonomous Vehicle Legislation and Liability

The legal landscape for autonomous vehicles (AVs) remains a dynamic area, with governments worldwide actively developing regulations for testing, public deployment, and crucially, liability. As of early 2025, many jurisdictions are still in the process of defining these frameworks, creating a degree of uncertainty for manufacturers and component suppliers.

For companies like Hendrickson, a key aspect is how legal responsibility will be assigned in the event of an accident involving AVs. This includes clarity on the roles of the vehicle's AI, the software developers, and the manufacturers of critical components like suspension systems. The increasing deployment of autonomous trucks and buses in 2024 and projected growth in 2025 means these liability questions are becoming more pressing.

- Evolving Regulations: As of mid-2025, the U.S. Department of Transportation (DOT) continues to refine its guidance on automated driving systems, with a focus on safety standards and operational protocols.

- Liability Clarity: Discussions around product liability are intensifying, particularly concerning the apportionment of blame between software failures and hardware malfunctions in AV systems.

- International Harmonization: Efforts are underway in various international forums to harmonize AV regulations, aiming to streamline cross-border operations and reduce compliance burdens for global suppliers.

Environmental Reporting and Compliance

Regulatory bodies are increasingly demanding greater environmental transparency. This means companies like Boler must meticulously track and report their environmental footprint, including detailed carbon emission disclosures. For instance, many industries are seeing a push towards ISO 14001 certification, a standard for environmental management systems.

Adhering to these legal obligations is not just about compliance; it's a key factor in demonstrating corporate responsibility. This can significantly influence partnerships and investor relations, as stakeholders increasingly prioritize sustainability. Hendrickson, a company within a similar industrial sphere, actively maintains such certifications and publicly reports on its environmental initiatives, setting a precedent for industry best practices.

Key legal factors impacting environmental reporting and compliance for companies like Boler include:

- Increasing mandates for carbon emission disclosures: Many jurisdictions are implementing stricter regulations requiring detailed reporting of greenhouse gas emissions.

- Growth of sustainability reporting standards: Frameworks like the Global Reporting Initiative (GRI) and Task Force on Climate-related Financial Disclosures (TCFD) are becoming de facto requirements for many.

- Environmental permit and licensing requirements: Operations must comply with specific permits related to air and water quality, waste management, and hazardous materials.

- Potential for environmental litigation and fines: Non-compliance can lead to significant legal penalties and reputational damage.

The legal environment for commercial vehicles is tightening, particularly around emissions and safety. For instance, the U.S. Environmental Protection Agency's (EPA) proposed Greenhouse Gas Emissions Standards for Heavy-Duty Vehicles, with some provisions taking effect in June 2024, and California's Advanced Clean Fleets rule, mandating zero-emission vehicle purchases from 2024 and 2025, demand significant adaptation from manufacturers like Boler.

These regulations directly influence Boler's product development, pushing for investments in cleaner technologies. Furthermore, evolving safety mandates, especially concerning Advanced Driver-Assistance Systems (ADAS) and vehicle stability, require Boler to innovate its suspension components to meet or exceed new standards, impacting R&D priorities for 2024-2025.

International trade agreements, such as the USMCA, impose strict rules of origin for automotive parts, requiring a certain percentage of components to be manufactured within North America. Non-compliance can lead to substantial penalties, disrupting supply chains and impacting production schedules and profitability for companies like Boler.

The legal framework for autonomous vehicles (AVs) is still developing, with liability apportionment in accidents being a key concern as of early 2025. As AV deployment grows in 2024 and 2025, clarity on responsibility between software, hardware, and component manufacturers is becoming increasingly critical.

| Legal Factor | Key Development (2024-2025) | Impact on Boler | Example/Data Point |

| Emissions Standards | Stricter regulations for heavy-duty vehicles | Increased R&D investment in cleaner powertrains | EPA's proposed GHG standards (June 2024 effective); California's Advanced Clean Fleets (2024/2025 mandates) |

| Safety Regulations | Focus on ADAS and vehicle stability | Engineering enhancements for suspension systems | Mandates for improved ADAS integration and stability control |

| Trade Agreements | Rules of origin for automotive parts | Supply chain adjustments and potential cost increases | USMCA requiring North American content for automotive components |

| Autonomous Vehicle Liability | Developing frameworks for AV operations and accidents | Need for clarity on component manufacturer responsibility | Ongoing discussions on apportioning blame between software and hardware failures |

Environmental factors

Global and national initiatives to curb greenhouse gas emissions significantly influence industries like commercial transportation. For instance, the U.S. Environmental Protection Agency's (EPA) proposed Phase 3 standards for heavy-duty vehicles, aiming for substantial emission reductions by 2032, will necessitate major shifts in fleet technology and operational strategies.

Boler, operating through its subsidiary Hendrickson, is actively engaged in reducing its own carbon footprint and fostering clean technologies. This commitment is demonstrated through investments in sustainable manufacturing processes and the development of eco-friendlier product designs, aligning with the urgent global imperative to address climate change.

The global automotive industry is rapidly shifting towards zero-emission vehicles (ZEVs), driven by stringent environmental regulations and growing consumer demand. For instance, California's Advanced Clean Fleets regulation mandates that commercial fleets transition to ZEVs, impacting truck and bus manufacturers significantly.

This regulatory environment necessitates that companies like Boler focus their research and development on components suitable for electric and hydrogen powertrains. Boler's strategy involves adapting its suspension systems to handle the distinct weight distribution and performance characteristics of ZEVs, ensuring continued market relevance.

The commercial vehicle sector is seeing a significant shift towards eco-friendly and lightweight materials. This trend is driven by the need to boost fuel efficiency and minimize environmental footprints. For instance, Hendrickson actively incorporates lightweight materials into its suspension systems, enhancing performance and sustainability.

Trailer manufacturers are increasingly turning to advanced materials like lightweight alloys and composites, such as carbon fiber and aluminum. This adoption not only improves durability but also contributes to a substantial reduction in overall vehicle weight, a key factor in operational cost savings and environmental compliance.

Energy Efficiency in Operations and Products

Boler is actively pursuing energy efficiency in its manufacturing processes. The company is implementing initiatives like solar field installations to generate renewable energy and wash water recycling systems to conserve resources. These efforts are part of a broader strategy to reduce its environmental footprint and operational costs.

The company's product development also focuses on enhancing energy efficiency. Boler's advanced suspension systems are engineered to optimize vehicle ride quality and minimize wear and tear, indirectly contributing to better fuel economy. This technological advancement aims to provide customers with more sustainable transportation solutions.

Furthermore, Boler is investing in the development of autonomous vehicle technology, which promises significant fuel consumption reductions. By optimizing routing and driving patterns, autonomous systems can achieve greater fuel efficiency compared to traditional human-driven vehicles. For instance, by 2024, the trucking industry is projected to save billions of dollars annually through optimized routing and reduced idling time, a trend Boler's autonomous technology aims to accelerate.

Key aspects of Boler's environmental focus include:

- Solar field installations for on-site renewable energy generation.

- Wash water recycling to reduce water consumption in operations.

- Advanced suspension systems that improve vehicle fuel efficiency.

- Autonomous vehicle development targeting optimized routing and fuel savings.

Waste Reduction and Resource Conservation

Boler's dedication to environmental responsibility is evident in its focus on waste reduction, reuse, and recycling throughout its operations. This commitment aims to minimize waste and pollution stemming from manufacturing, thereby conserving valuable resources. Such practices are increasingly crucial as global sustainability trends gain momentum, bolstering Boler's reputation for environmental stewardship.

In 2024, the industrial sector saw a significant push towards circular economy principles. For instance, the manufacturing industry globally reported an average of 15% reduction in waste sent to landfill through enhanced recycling programs. Boler's initiatives in this area are expected to align with these broader industry shifts, potentially leading to cost savings through reduced disposal fees and more efficient material usage.

- Boler actively implements waste reduction strategies in its manufacturing processes.

- The company prioritizes reuse and recycling programs across its operational sites.

- These efforts contribute to conserving natural resources and minimizing environmental impact.

- Industry-wide, manufacturers are targeting a 10-20% decrease in waste generation by 2025.

Environmental regulations are increasingly shaping the commercial vehicle industry, pushing for cleaner technologies and sustainable practices. Boler, through Hendrickson, is adapting by developing components for electric and hydrogen powertrains and incorporating lightweight materials to improve fuel efficiency. For example, the U.S. EPA's proposed Phase 3 standards for heavy-duty vehicles aim for significant emission reductions by 2032, directly impacting manufacturers.

Boler is actively investing in operational sustainability, including solar field installations for renewable energy and water recycling systems. These initiatives align with a broader industry trend towards circular economy principles, with manufacturers globally targeting waste reduction. For instance, the industrial sector reported an average of 15% waste reduction in 2024 through enhanced recycling.

The company's product innovation also focuses on environmental benefits, such as advanced suspension systems that enhance fuel economy and the development of autonomous vehicle technology. Autonomous driving is projected to yield substantial fuel savings through optimized routing and reduced idling, with the trucking industry potentially saving billions annually by 2024.

| Environmental Focus Area | Boler Initiatives | Industry Trend/Data |

|---|---|---|

| Emissions Reduction | Developing components for ZEVs (electric/hydrogen) | EPA Phase 3 standards target significant heavy-duty vehicle emission cuts by 2032. |

| Energy Efficiency | Advanced suspension systems for better fuel economy | Lightweight materials adoption in trailers increased by 10-15% in 2024 for fuel savings. |

| Renewable Energy | Solar field installations | Global industrial sector saw 15% waste reduction in 2024 via recycling programs. |

| Resource Conservation | Wash water recycling systems | Manufacturers aim for 10-20% waste generation decrease by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources including government publications, international organizations, and leading market research firms. We ensure comprehensive coverage of political stability, economic indicators, societal trends, technological advancements, environmental regulations, and legal frameworks.