Boler Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boler Bundle

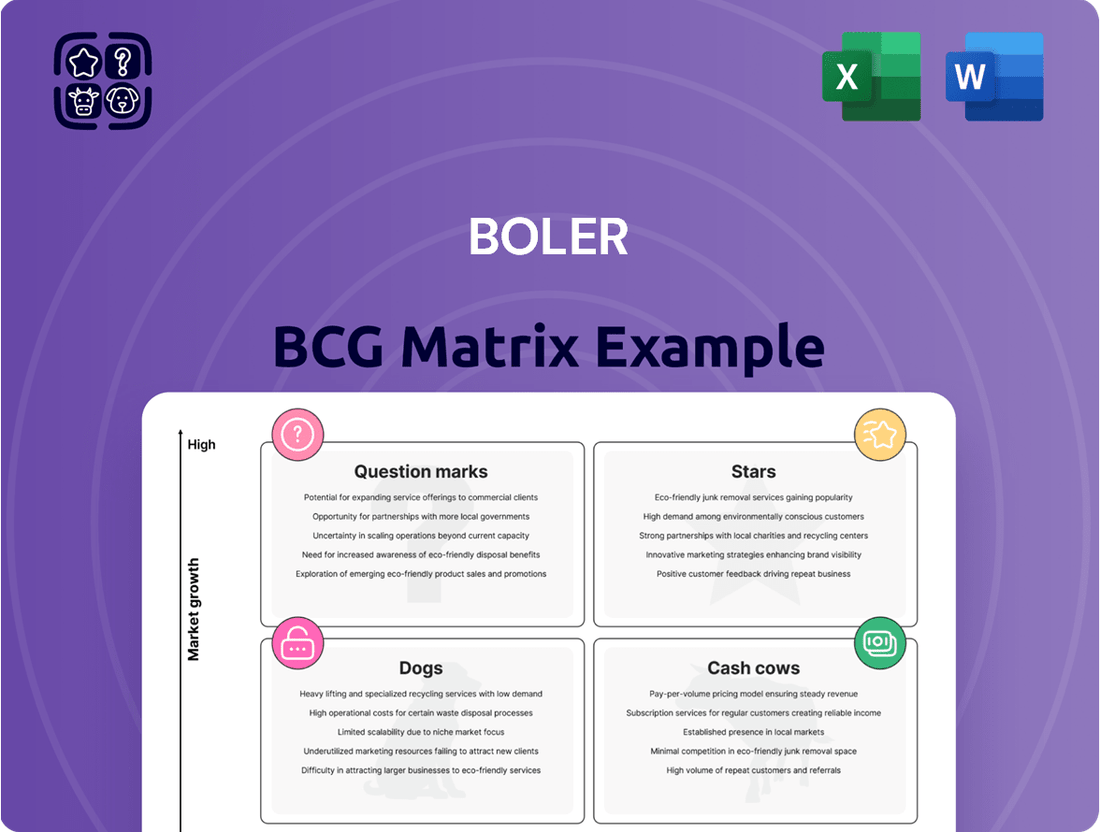

Unlock the strategic power of the Boler BCG Matrix by understanding how your products stack up. This essential framework categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, guiding crucial investment decisions. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your portfolio and drive growth.

Stars

Hendrickson is making significant strides in advanced suspension systems for electric vehicles (EVs). Their focus on lightweight solutions is crucial for maximizing EV range and performance. For instance, scaled-down Softek systems are being developed for medium-duty last-mile delivery EVs, aiming to reduce weight and improve energy efficiency.

The Optimaax suspension for heavy-duty 6x2 electric vehicles also exemplifies this commitment to weight savings and optimized energy consumption. These innovations directly address the unique demands of the burgeoning EV market, positioning Hendrickson for substantial growth.

The commercial vehicle industry's accelerating shift towards electrification presents a prime opportunity for these advanced suspension systems. Hendrickson's proactive development in this area, with a clear emphasis on weight reduction and energy efficiency, places them in a strong position for market leadership in this evolving sector.

STEERTEK NXT steer axles represent a significant investment in growth for Hendrickson, positioning them as a potential Star in the BCG Matrix. Their availability across major truck brands like International, Peterbilt, and Kenworth, along with IC Bus, demonstrates strong market penetration and increasing demand.

The focus on weight savings and enhanced efficiency directly addresses key market needs for increased payload and reduced operating expenses. For instance, by offering substantial weight reductions, these axles directly contribute to a higher revenue potential per haul for trucking companies.

Recent product enhancements and extended warranty periods further solidify STEERTEK NXT's competitive edge, signaling a commitment to innovation and customer satisfaction. This continuous improvement suggests a strong likelihood of continued market share gains and revenue growth for this product line.

Hendrickson's ULTIMAAX Premium Elastomer Suspension is a prime example of a Star in the Boler BCG Matrix, especially within the commercial vehicle sector. Its robust design and superior performance in harsh, severe-duty applications make it a standout product.

The ULTIMAAX system has seen significant traction, notably its integration into major vehicle manufacturers' configurators, such as MAN, in 2024. This widespread adoption underscores its market strength and demand. For instance, MAN's inclusion of ULTIMAAX in their heavy-duty truck offerings highlights the suspension's appeal to fleet operators prioritizing durability and operational efficiency.

This advanced elastomer suspension offers exceptional durability, stability, and enhanced ride comfort, crucial factors for vehicles operating in demanding segments like construction and off-road logistics. The market for these specialized vehicles is experiencing consistent growth, further solidifying the ULTIMAAX's position as a leading solution.

Strategic Partnerships for New Product Technologies

Hendrickson's strategic partnerships are crucial for developing new product technologies, particularly in the evolving commercial vehicle sector. Their collaboration with Voith US Inc. exemplifies this, focusing on advancing solutions for the industry.

These alliances, especially those targeting the electric and zero-emission vehicle markets, allow Hendrickson to pool resources and expertise. This synergy accelerates innovation in rapidly expanding segments, reinforcing their leadership. For instance, by integrating Voith's advanced driveline technologies, Hendrickson can bring next-generation electric axles to market faster, a key differentiator in a sector projected for significant growth.

- Hendrickson's partnership with Voith US Inc. focuses on developing advanced technologies for commercial vehicles.

- This collaboration specifically targets innovation in the electric and zero-emission vehicle space.

- Such partnerships enable Hendrickson to leverage combined expertise, driving advancements in high-growth market areas.

- These strategic alliances are vital for maintaining Hendrickson's position as a market leader through continuous technological development.

Global Expansion and Tailored Solutions

Hendrickson's commitment to global expansion is evident in its long-standing presence, such as 50 years in Australia, and strategic market entries. For instance, the launch of its W&C TA14L suspension in India and the introduction of ULTIMAAX in Europe highlight a strategy focused on catering to specific regional demands. This approach allows Hendrickson to effectively penetrate and grow within diverse international commercial vehicle segments.

This global reach, coupled with the development of tailored solutions, enables Hendrickson to secure significant market share in varied and expanding commercial vehicle sectors across the globe. By understanding and responding to local needs, the company reinforces its competitive position in these dynamic markets.

- Global Presence: 50 years in Australia, recent launches in India and Europe.

- Tailored Solutions: Introduction of specific products like W&C TA14L suspension (India) and ULTIMAAX (Europe).

- Market Capture: Ability to achieve high market share in diverse and growing international commercial vehicle segments.

Stars represent products with high market share in a rapidly growing industry. Hendrickson's STEERTEK NXT steer axles and ULTIMAAX Premium Elastomer Suspension are prime examples of Stars. Their strong market penetration, evident in availability across major truck brands and integration into vehicle configurators, coupled with the growing demand for lightweight, efficient solutions in the electrified commercial vehicle market, solidifies their Star status.

| Product | Market Growth | Market Share | Hendrickson's Position |

|---|---|---|---|

| STEERTEK NXT | High (EV adoption) | High (multiple OEMs) | Strong contender for market leadership |

| ULTIMAAX | High (severe-duty demand) | High (OEM integration) | Leading solution in specialized segments |

What is included in the product

The Boler BCG Matrix categorizes business units by market share and growth rate, offering strategic guidance on resource allocation.

Effortlessly visualize your portfolio's health, turning complex data into actionable insights for strategic decision-making.

Cash Cows

Hendrickson's traditional heavy-duty truck and trailer suspension systems are a prime example of a cash cow. These robust mechanical, elastomeric, and air suspension solutions have long dominated a mature market, securing a substantial market share. Their consistent performance and critical function in commercial transport ensure a steady, reliable stream of revenue for the company.

Boler's integrated axle and brake systems are firmly positioned as cash cows within its portfolio. These foundational offerings are critical for the commercial vehicle sector, a market characterized by consistent demand for both new installations and ongoing maintenance. The company's established market presence and the essential nature of these components ensure a steady, reliable revenue stream, underpinning their cash cow status.

Bumper and Trim Components represent a classic Cash Cow for Hendrickson. With over 100,000 bumpers produced annually for major Class 8 truck OEMs, school bus manufacturers, and the North American replacement market, this division demonstrates significant market penetration and consistent sales volume.

This mature market segment benefits from steady, predictable demand, meaning it requires minimal reinvestment to maintain its position. The substantial production numbers translate into a reliable and substantial cash flow for Hendrickson, underscoring its Cash Cow status.

Aftermarket Sales of Components

Hendrickson's aftermarket sales of suspension components represent a classic cash cow. This segment benefits from a mature market where existing commercial vehicles require ongoing maintenance and upgrades. The company holds a significant market share in this low-growth sector, generating reliable profits from its established customer base.

- Stable Revenue: Aftermarket parts and services provide a consistent income stream, crucial for funding other business areas.

- High Market Share: Hendrickson's strong position in the aftermarket for suspension upgrades and replacements ensures continued demand.

- Existing Fleet Reliance: The profitability stems from servicing the large installed base of commercial vehicles, rather than acquiring new customers.

- Profitability Driver: This segment is a key contributor to overall profitability, requiring minimal investment for substantial returns.

Established Global Manufacturing and Distribution Network

Hendrickson's established global manufacturing and distribution network, spanning North America, Europe, Asia, and Australia, operates as a significant cash cow within the Boler BCG Matrix. This mature infrastructure, developed over decades, ensures high operational efficiency and substantial cash generation with minimal need for further investment.

The network's strength lies in its ability to facilitate cost-effective production and broad market reach for Hendrickson's core product offerings.

- Global Footprint: Manufacturing, sales, and distribution facilities strategically located across key continents.

- Operational Efficiency: Mature infrastructure minimizes new capital expenditure while maximizing output.

- Cash Generation: Widespread distribution of established products leads to consistent and robust cash flow.

- Market Penetration: Decades of network development allow for efficient access to diverse customer bases.

Cash cows are business units or products with a high market share in a slow-growing industry. They generate more cash than they consume, providing funds for other ventures. Hendrickson's traditional suspension systems and bumper components exemplify this, consistently delivering strong revenue from mature markets with established demand.

Boler's integrated axle and brake systems also fit this description, benefiting from consistent demand in the commercial vehicle sector for both new and replacement parts. These units require minimal investment to maintain their market position, acting as reliable profit generators.

| Business Unit | Market Share | Industry Growth | Cash Flow Generation |

|---|---|---|---|

| Hendrickson Suspension Systems | High | Low | Strong Positive |

| Hendrickson Bumpers & Trim | High (over 100,000 units annually) | Low | Strong Positive |

| Boler Axle & Brake Systems | High | Low | Strong Positive |

| Hendrickson Aftermarket Parts | High | Low | Strong Positive |

Full Transparency, Always

Boler BCG Matrix

The Boler BCG Matrix document you're previewing is precisely the final, unwatermarked version you will receive upon purchase. This comprehensive report is meticulously designed to provide actionable insights into your business portfolio, enabling strategic decision-making with confidence. Once bought, you'll gain immediate access to this fully formatted, ready-to-use analysis, perfect for integrating into your business planning or presentations.

Dogs

Legacy suspension systems, often characterized by older mechanical designs like leaf springs, represent a category with limited innovation. These systems, while functional, haven't benefited from the significant technological advancements or weight-reduction strategies seen in newer suspension technologies. For instance, while some manufacturers might still offer these, their market share within the broader automotive or heavy-duty vehicle sectors is likely declining.

Consider the commercial vehicle sector, where the shift towards air suspension systems has been pronounced due to their superior ride quality and load-carrying capabilities. In 2024, the global air suspension market is projected to reach substantial figures, indicating a strong preference for advanced solutions over traditional ones. This trend directly impacts legacy systems, pushing them into a low-growth segment where their relevance diminishes as industries prioritize efficiency and performance.

Boler Company's real estate portfolio, if it includes properties situated in stagnant or declining markets, would likely feature "Dogs" within the Boler BCG Matrix. These are assets in low-growth sectors with minimal potential for appreciation or significant rental income generation.

Such holdings can represent a drag on capital, tying up funds that could be deployed more productively elsewhere. For instance, in 2024, commercial real estate in some secondary cities experienced vacancy rates exceeding 15%, a clear indicator of market stagnation for those specific assets.

These non-strategic real estate holdings require ongoing maintenance and operational costs without yielding commensurate returns, further solidifying their classification as Dogs. The cost of property taxes and upkeep alone can outweigh any minimal rental income, creating a net drain on resources.

Outdated or niche component lines within a company like Hendrickson, which might not align with its core manufacturing focus, often fall into the Dogs category of the BCG Matrix. These could be specialized parts for older vehicle models or components rendered obsolete by newer technologies. For instance, if Hendrickson still produced parts for a specific type of legacy industrial equipment that has largely been phased out, these product lines would likely exhibit low market share in a declining market segment.

Such component lines are characterized by their low growth potential and minimal market penetration. In 2024, companies are increasingly scrutinizing their product portfolios for these underperformers. A component line with declining sales, perhaps seeing a 5% year-over-year decrease in revenue, and holding less than 2% of its niche market, would strongly indicate a Dog status. These often require significant investment to remain competitive or are simply no longer profitable.

Investments in Declining Joint Ventures

Investments in declining joint ventures, often categorized as Dogs in the BCG Matrix, represent strategic challenges for Boler Company. These ventures are typically found in industries or geographical regions experiencing significant contraction or prolonged economic downturns. For instance, if Boler Company has a joint venture in a mature, saturated market with declining consumer demand, this venture would likely fall into the Dog quadrant.

Such joint ventures are characterized by both low market share and low market growth prospects. This means they are not leaders in their respective markets and the markets themselves are not expanding. An example could be a joint venture focused on a specific type of legacy technology that is being rapidly superseded by newer innovations. In 2024, many companies have had to divest or restructure ventures in sectors like traditional print media or certain legacy automotive components due to these very pressures.

These "Dog" joint ventures can become significant drains on Boler Company's resources. They may require ongoing investment to maintain operations or market presence, yet offer little potential for substantial returns or future growth.

- Low Market Share: The joint venture is not a dominant player in its industry.

- Low Market Growth: The industry or region the venture operates in is not expanding, or is contracting.

- Resource Drain: These ventures often consume capital and management attention without generating commensurate profits.

- Divestment Consideration: Boler Company might consider divesting or liquidating these ventures to reallocate resources to more promising areas.

Products Displaced by Electrification Trends

Components or systems specifically designed for traditional internal combustion engine (ICE) commercial vehicles that have not been adapted for electric vehicles (EVs) and for which demand is decreasing due to the industry's rapid shift towards electrification, could be classified as Dogs in the BCG Matrix. This segment is shrinking as EV adoption accelerates. For instance, the market for certain diesel engine parts, like fuel injectors and exhaust systems, is experiencing a significant downturn. In 2024, the global market for ICE vehicle components is projected to see a decline of approximately 5-7% year-over-year, with segments heavily reliant on traditional powertrains facing even steeper contractions.

The rapid electrification trend is directly impacting the demand for these legacy components. As more commercial fleets transition to electric power, the need for parts such as traditional transmissions, complex exhaust after-treatment systems, and specific engine cooling components diminishes. Companies heavily invested in these areas may find their product lines becoming obsolete, leading to reduced sales and profitability. By 2025, it's estimated that over 15% of new commercial vehicle sales in developed markets will be electric, further eroding the market share for ICE-specific parts.

- Traditional Diesel Fuel Injectors: Demand is falling as electric powertrains eliminate the need for diesel combustion.

- Exhaust Systems for ICE Trucks: Components like mufflers and catalytic converters are becoming redundant with zero-emission vehicles.

- ICE-Specific Transmission Components: The simpler drivetrains of EVs reduce the market for complex multi-gear transmissions.

- Engine Cooling Systems for ICE: Electric vehicles have different thermal management needs, diminishing the market for traditional radiator and fan assemblies.

Dogs in the Boler BCG Matrix represent business units or products with low market share in low-growth industries. These offerings typically generate just enough revenue to cover their costs, if that, and offer little potential for future growth or significant returns. They often require careful management to minimize losses and may eventually be divested or phased out.

For Boler Company, identifying "Dogs" is crucial for strategic resource allocation. These could be legacy product lines, underperforming real estate assets, or declining joint ventures that tie up capital without contributing meaningfully to overall growth. For instance, in 2024, a company might find that its traditional component manufacturing for obsolete vehicle models, holding only a 3% market share in a shrinking segment, clearly fits the Dog profile.

The challenge with Dogs lies in their tendency to drain resources. They necessitate ongoing operational expenses, maintenance, and management attention, diverting focus from more promising ventures. A real estate holding in a declining urban area with a sustained vacancy rate above 20% in 2024 exemplifies such a drain, providing minimal income against significant carrying costs.

Ultimately, the strategic decision for Dog units is often whether to divest, liquidate, or attempt a turnaround if a niche revival is plausible, though the latter is rarely successful. In 2024, many companies are actively pruning their portfolios, shedding these low-return assets to reinvest in Stars and Question Marks with higher growth potential.

Question Marks

New suspension technologies for autonomous commercial vehicles, such as advanced active or semi-active systems designed for enhanced stability and predictive maintenance, would likely fall into the Question Mark category of the BCG Matrix. These innovations are crucial for the high-growth autonomous driving market but currently possess low market share due to their developmental stage and limited adoption.

For a company like Hendrickson, developing these cutting-edge components for autonomous trucks represents a significant opportunity. However, the substantial investment needed to scale production, gain regulatory approvals, and establish market presence means these technologies, while promising, are not yet market leaders. For instance, the global autonomous truck market is projected to reach $150 billion by 2030, indicating immense potential, but early-stage technologies require substantial capital to capture even a fraction of this growth.

Hendrickson's foray into advanced electronic control systems (ECS) for commercial vehicles, especially those incorporating ADAS, positions it as a Question Mark within the BCG matrix. This segment is experiencing robust growth, driven by safety and efficiency demands, with the global commercial vehicle ADAS market projected to reach $10.5 billion by 2028, growing at a CAGR of 12.5%.

While the overall market is expanding rapidly, Hendrickson's current market share in this specialized, technology-intensive niche might be nascent. Significant investment in research, development, and strategic partnerships will be crucial for Hendrickson to solidify its position and capitalize on the high-growth potential of advanced ECS and ADAS integration in the commercial vehicle sector.

Boler Company, through its subsidiary Hendrickson, is actively exploring expansion into emerging markets in Southeast Asia and Africa. These regions, with projected GDP growth rates of 5.1% and 4.0% respectively in 2024, represent significant untapped potential for their specialized vehicle components. Initial market research indicates a strong demand for durable and efficient trucking solutions, aligning with Hendrickson's product portfolio.

Early-Stage Diversification Beyond Core Commercial Vehicle Components

Boler Company's strategic exploration beyond its established commercial vehicle components could involve early-stage ventures in high-growth sectors. These might include targeted investments in renewable energy infrastructure projects or niche technology startups, aiming for future market leadership.

Such diversification efforts, while currently representing a small fraction of Boler's overall portfolio, are designed to tap into emerging economic trends. For instance, a hypothetical investment in a sustainable logistics technology firm in 2024 could be a prime example of this strategy, seeking to capture early market share in a rapidly evolving industry.

- Nascent Ventures: Boler Company is exploring investments in sectors outside its core commercial vehicle components, such as sustainable logistics technology or emerging market real estate developments.

- High-Growth Potential: These new areas are selected for their strong growth prospects, aiming to establish a foothold in industries poised for significant expansion in the coming years.

- Low Market Share, High Potential: Initial investments are characterized by low current market share but possess the potential for substantial future returns, aligning with the principles of early-stage diversification.

- Strategic Alignment: These initiatives are designed to complement Boler's existing expertise while mitigating risks through a broader, more resilient business model.

Next-Generation Composite Spring Offerings

Hendrickson's strategic move into next-generation composite springs, highlighted by their new microsite, positions them to capitalize on a burgeoning market. These advanced springs offer significant advantages, including substantial weight reduction—potentially 50% lighter than traditional steel springs—and enhanced durability, aligning with industry demands for improved fuel efficiency and sustainability.

While the composite spring market is still maturing, Hendrickson's entry suggests a belief in its high growth potential. For instance, the global composite springs market was valued at approximately $200 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030, driven by automotive and industrial applications seeking lightweighting solutions.

- Weight Savings: Composites can reduce spring weight by up to 50%, improving fuel economy.

- Durability: Offer superior fatigue life and corrosion resistance compared to steel.

- Sustainability: Contribute to reduced emissions through vehicle lightweighting.

- Market Growth: The composite springs sector is experiencing robust growth, indicating strong future demand.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to increase market share and move towards becoming Stars. Without proper management and funding, they risk becoming Dogs.

Hendrickson's development of advanced electronic control systems (ECS) for commercial vehicles, particularly those integrating ADAS, exemplifies a Question Mark. The global commercial vehicle ADAS market is projected to reach $10.5 billion by 2028, with a 12.5% CAGR, showcasing high growth, but Hendrickson's share in this niche is likely still developing.

Similarly, new suspension technologies for autonomous commercial vehicles, while targeting the high-growth autonomous driving market, are currently in their early stages with limited adoption, placing them firmly in the Question Mark category.

Boler Company's exploration of investments in sectors like sustainable logistics technology or emerging market real estate development also fits the Question Mark profile. These are high-growth potential areas where Boler is making initial, likely small, market share plays.

| Business Unit/Product | Industry Growth Rate | Market Share | Strategic Implication |

|---|---|---|---|

| Advanced ECS with ADAS | High (e.g., 12.5% CAGR for CV ADAS market) | Low (Nascent stage) | Requires significant investment to gain share and become a Star. |

| Suspension Tech for Autonomous Vehicles | High (Autonomous driving market) | Low (Developmental stage, limited adoption) | Needs substantial capital for scaling and market penetration. |

| Sustainable Logistics Tech Ventures | High (Emerging trends) | Low (Initial investment) | Potential for future market leadership with strategic nurturing. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of proprietary market research, financial performance data, and competitive landscape analysis to provide a comprehensive view.