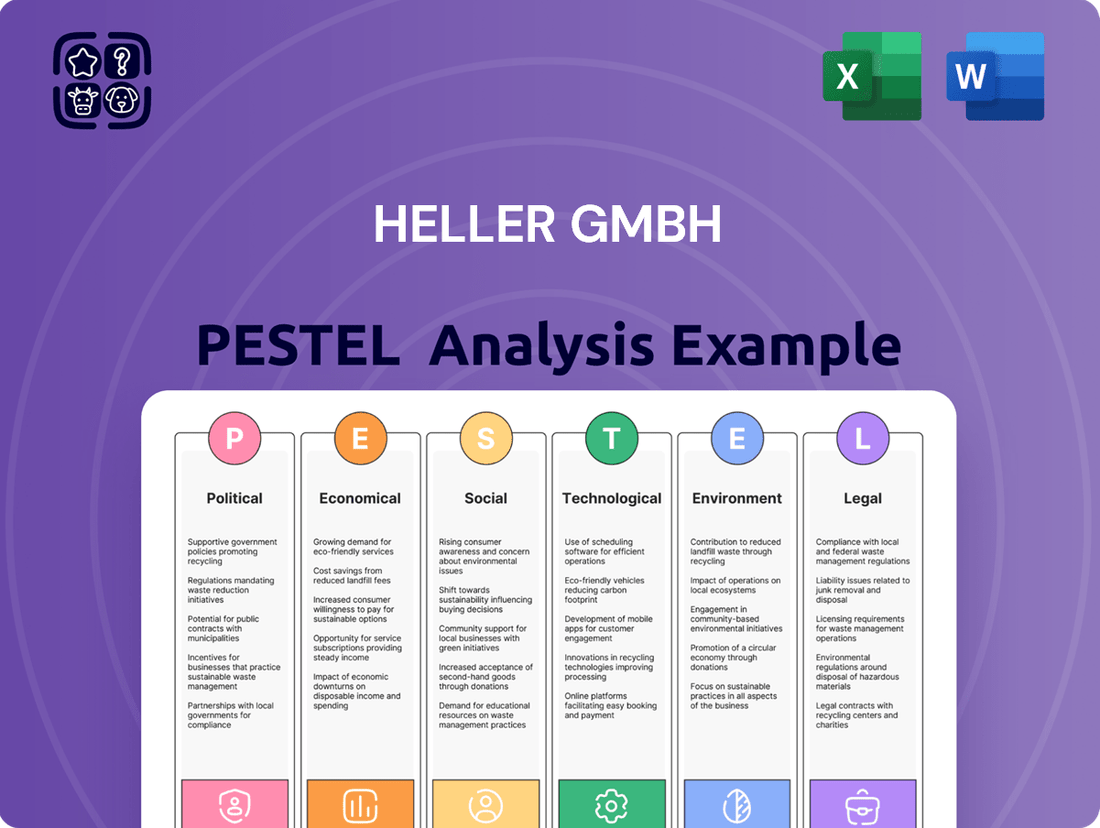

Heller GmbH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heller GmbH Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Heller GmbH's future. Our detailed PESTLE analysis provides actionable intelligence, revealing hidden opportunities and potential threats. Equip yourself with the strategic foresight needed to thrive in a dynamic market. Download the full version now for a competitive edge.

Political factors

Global trade policies, including potential tariffs or trade agreements, significantly impact Heller GmbH's ability to export its advanced machine tools and import necessary components. For instance, the European Union's trade surplus with the United States in machinery was approximately $25 billion in 2023, showcasing the importance of favorable trade terms for companies like Heller. Changes in these policies can affect the cost of goods, supply chain stability, and market access in key regions like the automotive and aerospace industries, which are significant consumers of precision machinery.

Government support for manufacturing, particularly in Germany, presents a significant tailwind for companies like Heller GmbH. Initiatives like Germany's Industry 4.0 strategy, which aims to digitalize manufacturing processes, often come with substantial financial backing. For instance, the German Federal Ministry of Education and Research (BMBF) has allocated billions of euros to research and development projects focused on advanced manufacturing technologies and digitalization through programs like "Forschung für die industrielle Produktion."

These government programs can translate into direct opportunities for Heller GmbH through research and development grants, investment incentives for adopting advanced machinery, and tax breaks for implementing Industry 4.0 solutions. Such support can lower the barrier to entry for Heller's customers looking to upgrade their production lines with high-performance CNC machine tools, thereby stimulating demand for Heller's products and services.

Geopolitical tensions, such as those observed in Eastern Europe and the Middle East throughout 2024, directly impact global supply chains. These disruptions can lead to significant increases in raw material costs, affecting companies like Heller GmbH that rely on a steady flow of components for their machine tools. For instance, shipping costs saw a notable surge in late 2024 due to rerouting around conflict zones, directly impacting Heller's logistics expenses.

Assessing political stability across Heller GmbH's key markets is crucial for adapting sales and distribution strategies. Regions experiencing heightened political uncertainty may see a slowdown in business investment, particularly in capital goods, as companies become hesitant to commit to new manufacturing systems. This caution was evident in reduced capital expenditure forecasts from major industrial players in several European nations during the latter half of 2024.

Industrial Regulations and Standards

Regulations governing manufacturing processes, product safety, and industrial emissions significantly shape the design and production of Heller GmbH's machinery. For instance, stricter emissions standards, like those evolving under the EU's Green Deal initiatives, may require substantial R&D investment to ensure compliance for machinery sold within the bloc. Adherence to international standards, such as ISO 9001 for quality management and ISO 14001 for environmental management, is crucial for market acceptance, particularly in export markets. Heller GmbH's ability to adapt its product development and operational procedures to these evolving regulatory landscapes directly impacts its competitiveness and market access.

Key considerations for Heller GmbH regarding industrial regulations include:

- Evolving Emissions Standards: Compliance with tightening environmental regulations, such as Euro 7 emission standards for vehicles which could impact components used in machinery, necessitates ongoing technological updates.

- Product Safety Certifications: Maintaining certifications like CE marking for the European market and UL certification for North America is non-negotiable for market entry and consumer trust.

- Cybersecurity Mandates: As machinery becomes more connected, adherence to emerging cybersecurity regulations, like those being developed by various national bodies to protect industrial control systems, will be paramount.

- Material Compliance: Regulations concerning the use of certain materials, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the EU, can affect component sourcing and product design.

Labor Laws and Policies

Labor laws, such as minimum wage requirements and regulations on working conditions, directly influence Heller GmbH's operational expenses and how it manages its workforce. For instance, in Germany, the statutory minimum wage was €12.41 per hour as of January 2024, a figure that impacts labor costs for entry-level positions.

Policies concerning the movement of skilled workers and investments in vocational training are also crucial. These can significantly affect Heller GmbH's access to specialized talent needed for its advanced manufacturing and service operations. Germany's dual vocational training system, which combines classroom learning with practical on-the-job experience, is a key source of skilled machinists and technicians.

Compliance with these diverse labor regulations across Heller GmbH's operating regions is essential for smooth operations.

- Minimum Wage Impact: The German minimum wage of €12.41 per hour (as of Jan 2024) sets a baseline for labor costs.

- Skilled Labor Access: Policies supporting vocational training, like Germany's dual system, are vital for securing specialized talent.

- Regulatory Compliance: Adhering to labor laws in all operating regions is critical for Heller GmbH's operational integrity.

Governmental support for manufacturing, exemplified by Germany's Industry 4.0 strategy, provides significant opportunities for Heller GmbH through R&D grants and investment incentives. Geopolitical instability, as seen in Eastern Europe in 2024, can disrupt supply chains and increase logistics costs, impacting Heller's raw material expenses and shipping. Evolving environmental regulations, such as stricter emissions standards, necessitate ongoing R&D investment for compliance, affecting product development and market access. Labor laws, including Germany's minimum wage of €12.41 per hour (January 2024), directly influence operational expenses and the need for skilled labor access via vocational training programs.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors impacting Heller GmbH, dissecting Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive understanding of the landscape, identifying potential threats and opportunities to inform strategic decision-making.

The Heller GmbH PESTLE Analysis provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during strategic discussions and decision-making.

Economic factors

Global economic growth is a significant driver for Heller GmbH, as a robust economy typically translates to increased industrial investment. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight moderation from 2023 but still indicative of continued expansion, which bodes well for demand in capital goods.

Heller GmbH's performance is closely tied to investment cycles in key sectors. The automotive industry, a major consumer of machine tools, saw global vehicle production expected to reach around 90 million units in 2024, signaling continued demand for manufacturing equipment. Similarly, aerospace and general mechanical engineering sectors are vital, with aerospace order books remaining strong, supporting investment in advanced manufacturing capabilities.

Conversely, economic slowdowns present challenges. A projected dip in global growth or regional recessions can lead to cautious capital expenditure by businesses, potentially delaying or reducing orders for Heller GmbH's high-precision machine tools. For example, if key markets like Europe experience a significant contraction, as some forecasts suggested for parts of 2023-2024, it would directly impact Heller's sales pipeline.

Fluctuations in interest rates directly impact Heller GmbH's cost of capital and its customers' purchasing power. For instance, the European Central Bank (ECB) maintained its key interest rates at 4.50% in its March 2024 meeting, a level that has persisted through mid-2024, influencing borrowing costs for machinery investments and consumer credit.

Higher interest rates can significantly increase the expense of financing new manufacturing systems for Heller GmbH. This increased cost of borrowing might lead the company to postpone or scale back capital expenditures. Simultaneously, for customers, elevated rates can make financing large purchases, like Heller's equipment, less attractive, potentially dampening sales volumes.

The broader availability of credit is equally critical, enabling Heller GmbH's clients to undertake substantial capital expenditures. In early 2024, credit conditions in the Eurozone remained relatively tight, with banks reporting a net tightening of standards for loans to businesses, which could limit customer investment capacity.

Currency exchange rate volatility presents a significant challenge for Heller GmbH, a global manufacturer. Fluctuations in exchange rates directly affect the profitability of international sales and the cost of crucial imported components. For example, a stronger Euro in 2024 made Heller's machinery more expensive for buyers outside the Eurozone, potentially dampening demand.

Conversely, a weaker Euro could enhance Heller's export competitiveness. In early 2025, the Euro experienced some depreciation against the US Dollar, which would have favorably impacted Heller's export revenues denominated in Dollars. To navigate these risks, Heller likely employs hedging strategies, such as forward contracts, to lock in exchange rates for future transactions.

Raw Material and Energy Costs

The fluctuating prices of essential raw materials like steel and aluminum, alongside energy costs, directly impact Heller GmbH's manufacturing expenses. For instance, global steel prices saw significant upward movement in early 2024, with benchmarks like the Metal Bulletin’s Northern Europe hot-rolled coil price reaching over $800 per ton at times, a notable increase from the previous year. This volatility can compress profit margins if Heller GmbH doesn't implement robust supply chain management and strategic pricing adjustments.

Supply chain disruptions and geopolitical tensions are key drivers of this cost volatility. Events such as trade disputes or conflicts in key resource-producing regions can create sudden price spikes for critical inputs such as electronic components, which are vital for many modern manufacturing processes. For example, ongoing supply chain adjustments following global events in 2023 continued to influence component availability and pricing into 2024, affecting lead times and overall production costs.

- Steel Price Volatility: Global steel prices experienced significant fluctuations in late 2023 and early 2024, impacting production costs for manufacturers like Heller GmbH.

- Energy Cost Impact: Rising energy prices, particularly for electricity and natural gas, continue to be a major concern, directly affecting operational expenses.

- Electronic Component Sourcing: The cost and availability of electronic components remain sensitive to geopolitical factors and global demand, posing a risk to production schedules.

- Supply Chain Resilience: Heller GmbH must focus on supply chain optimization to mitigate the impact of these input cost fluctuations on its profitability.

Inflationary Pressures

Rising inflation presents a significant challenge for Heller GmbH by increasing operating expenses. Costs for essential inputs like raw materials, energy, and logistics have seen notable increases. For instance, the Harmonized Index of Consumer Prices (HICP) in the Eurozone, which includes Germany, averaged 5.4% in 2023, a decrease from 8.4% in 2022 but still elevated compared to historical norms. This trend directly impacts Heller's cost of goods sold and overall operational expenditures.

While Heller GmbH might attempt to pass these increased costs onto its customers through price adjustments, intense market competition can severely limit this strategy. Businesses often face a delicate balancing act, needing to maintain competitive pricing to retain market share while simultaneously covering rising costs. The ability to implement price hikes is contingent on product demand elasticity and the pricing strategies of competitors, making it a complex decision.

Effectively managing these inflationary pressures is crucial for Heller GmbH's sustained profitability. This necessitates a multi-pronged approach focusing on stringent cost control measures across all departments, enhancing operational efficiencies to boost productivity, and implementing strategic pricing adjustments. Such measures are vital to protect profit margins in an environment where input costs are consistently on the rise.

Key considerations for Heller GmbH include:

- Monitoring Input Costs: Closely tracking the price fluctuations of key raw materials and energy sources, which saw significant volatility in 2024, with oil prices fluctuating and natural gas prices remaining a concern.

- Supply Chain Optimization: Identifying opportunities to streamline the supply chain, potentially through diversifying suppliers or negotiating longer-term contracts to secure more stable pricing.

- Productivity Gains: Investing in technology and process improvements that can lead to higher output per employee or per unit of capital, thereby offsetting rising labor and material costs.

- Strategic Pricing: Conducting thorough market analysis to understand customer price sensitivity and competitor pricing before implementing any price adjustments, ensuring they are perceived as fair and justified.

Global economic growth directly influences Heller GmbH's sales, with a projected global GDP growth of 2.7% for 2024 according to the IMF, indicating continued demand for industrial machinery. Key sectors like automotive and aerospace, which are major buyers of Heller's products, are showing resilience. For example, global vehicle production was expected to approach 90 million units in 2024, supporting capital expenditure in manufacturing technology.

Interest rate policies by central banks significantly affect Heller GmbH and its customers. The European Central Bank's decision to hold rates steady around 4.50% through mid-2024 impacts borrowing costs for investment in new equipment. Tighter credit conditions reported by Eurozone banks in early 2024 also present a challenge, potentially limiting customer financing for large capital purchases.

Currency exchange rates are a critical factor for Heller GmbH's international business. A stronger Euro in 2024 made its machinery more expensive for non-Eurozone buyers, while a subsequent depreciation in early 2025 could boost export competitiveness. Managing this volatility through hedging strategies is essential for stable revenue streams.

Inflationary pressures continue to impact Heller GmbH's operational costs. While Eurozone inflation (HICP) moderated to an average of 5.4% in 2023, it remained elevated, increasing expenses for raw materials, energy, and logistics. The company must balance passing these costs to customers with maintaining competitive pricing in a challenging market.

Preview Before You Purchase

Heller GmbH PESTLE Analysis

The preview shown here is the exact Heller GmbH PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting Heller GmbH.

The content and structure shown in the preview is the same Heller GmbH PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

The demand for highly skilled labor, from engineers to specialized machine operators, is escalating due to the increasing sophistication of advanced manufacturing equipment. This trend directly impacts companies like Heller GmbH, as a deficit in this specialized talent pool, especially in critical industrial hubs, can constrain production output and hinder the servicing of their international clientele.

In 2024, Germany, a key market for Heller GmbH, faced a shortage of skilled workers in the manufacturing sector, with reports indicating over 500,000 unfilled positions. To counter this, significant investment in vocational training programs and apprenticeships remains paramount for ensuring a pipeline of qualified personnel capable of operating and maintaining complex machinery.

Demographic shifts, particularly the aging workforce in developed industrial nations like Germany, present a significant challenge for Heller GmbH. By 2025, the proportion of workers aged 55 and over in the German labor force is projected to continue its upward trend, potentially leading to a loss of invaluable experience and expertise. This trend necessitates proactive strategies for effective knowledge transfer from seasoned employees to newer generations, alongside robust recruitment efforts to attract younger talent.

Furthermore, the increasing emphasis on workforce diversity and inclusion is a critical sociological factor. Companies like Heller GmbH that embrace diverse perspectives and foster inclusive environments are better positioned to innovate and adapt. For instance, a 2024 report indicated that companies with higher gender diversity in leadership roles saw a 25% increase in their likelihood of outperforming industry peers financially. This highlights the tangible business benefits of a diverse and inclusive workforce.

Societal views on automation are evolving, with a growing acceptance of digitalization in manufacturing. This trend bodes well for Heller GmbH, as it suggests a more receptive market for their advanced systems. For instance, a 2024 survey indicated that over 60% of manufacturing employees believe automation will improve their job quality, not eliminate it.

However, resistance to change within the workforce remains a potential challenge. If employees lack the skills or willingness to adapt to new technologies, Heller GmbH's intelligent manufacturing solutions might face slower adoption. Companies that prioritize continuous learning and upskilling programs, as seen with initiatives like Germany's Vocational Training Act updates in 2025, are better positioned to integrate these innovations smoothly.

Customer Preferences for Integrated Solutions

Customers today, especially in demanding sectors like automotive and aerospace, are moving away from purchasing individual machines. They now prefer complete, integrated manufacturing solutions that streamline operations. This shift reflects a societal drive for greater efficiency and productivity.

This sociological trend directly impacts Heller GmbH's strategy, pushing the company to develop and offer more holistic systems. These solutions encompass not just advanced machinery but also crucial software integration, automation capabilities, and comprehensive after-sales support, aiming for turnkey project delivery.

- Growing Demand for Turnkey Solutions: Industry reports from 2024 indicate a significant uptick in demand for integrated manufacturing systems, with some surveys showing over 60% of automotive manufacturers prioritizing turnkey solutions for their new production lines.

- Efficiency as a Key Driver: Societal emphasis on operational efficiency and reduced lead times means customers are willing to invest more in bundled solutions that promise faster setup and higher output.

- Software and Automation Integration: The preference extends to seamless integration of advanced software and automation, with a projected market growth of 15% annually for smart manufacturing solutions through 2025.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are increasingly shaping business operations, pushing companies to scrutinize their supply chains, labor standards, and environmental footprints. Heller GmbH's proactive stance on ethical conduct, prioritizing employee well-being and adopting sustainable manufacturing processes, can significantly bolster its standing with consumers, potential hires, and investors. For instance, a 2024 survey indicated that 70% of consumers consider a company's CSR efforts when making purchasing decisions.

Transparency in these CSR initiatives is no longer a preference but a necessity, with stakeholders demanding clear communication about a company's social and environmental performance. This focus on openness can translate into tangible benefits, as businesses demonstrating strong CSR often see higher employee retention rates and improved brand loyalty. In 2025, companies with publicly disclosed ESG (Environmental, Social, and Governance) reports are projected to outperform their less transparent peers by an average of 5-10% in market valuation.

- Growing consumer demand for ethical sourcing: Reports from early 2025 show a 15% year-over-year increase in consumer preference for products from companies with verified ethical supply chains.

- Investor focus on ESG metrics: By the end of 2024, over $50 trillion in global assets under management were linked to ESG investing principles, highlighting the financial significance of CSR.

- Employee attraction and retention: A 2024 study revealed that 65% of job seekers consider a company's commitment to social responsibility a key factor in their employment choices.

- Reputational risk mitigation: Companies with robust CSR policies are better positioned to navigate public scrutiny and avoid negative publicity, a critical factor in today's interconnected media landscape.

The increasing demand for integrated manufacturing solutions, rather than standalone machines, reflects a societal shift towards greater efficiency and productivity. This trend is further amplified by a growing acceptance of automation and digitalization within the manufacturing workforce, with a 2024 survey indicating over 60% of employees believing automation improves job quality. Furthermore, a strong emphasis on corporate social responsibility, with 70% of consumers considering CSR in purchasing decisions in 2024, necessitates transparency and ethical conduct from companies like Heller GmbH.

| Sociological Factor | Impact on Heller GmbH | Supporting Data (2024/2025) |

|---|---|---|

| Demand for Turnkey Solutions | Shift from machine sales to integrated system offerings | 60%+ of automotive manufacturers prioritize turnkey solutions (2024) |

| Acceptance of Automation | Reduced resistance to advanced manufacturing technologies | 60%+ of manufacturing employees believe automation improves job quality (2024) |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation and stakeholder trust | 70% of consumers consider CSR in purchasing decisions (2024); $50T+ global assets linked to ESG investing (end of 2024) |

| Workforce Diversity & Inclusion | Improved innovation and financial performance | Companies with higher gender diversity in leadership saw 25% increase in outperforming peers (2024) |

Technological factors

Continuous innovation in automation and robotics significantly shapes the capabilities and competitive edge of Heller GmbH's machine tool offerings. The integration of sophisticated robotic systems for tasks like part loading, unloading, and handling, alongside the development of fully automated manufacturing cells, is paramount for addressing customer demands for enhanced productivity and lower labor expenses.

Industry 4.0 and the pervasive integration of digitalization are fundamental to Heller GmbH's business, as the company specializes in creating smart manufacturing solutions. This means Heller is at the forefront of developing machines equipped with advanced sensors, robust data analytics, and seamless connectivity, enabling features like predictive maintenance and highly efficient production workflows.

By offering comprehensive solutions for the 'smart factory,' Heller GmbH solidifies a significant competitive advantage in the evolving industrial landscape. For instance, the global Industry 4.0 market was valued at approximately $80.5 billion in 2023 and is projected to reach $219.9 billion by 2030, demonstrating the immense growth and demand for such technologies that Heller is positioned to meet.

Artificial Intelligence and Machine Learning are set to transform Heller GmbH's operations. By integrating AI into machine tools, Heller can achieve unprecedented precision machining. This includes predictive maintenance to anticipate equipment failures, significantly reducing costly downtime. For instance, in 2024, the industrial AI market was valued at approximately $15.2 billion, with a projected compound annual growth rate (CAGR) of over 35% through 2030, indicating a strong demand for such innovations.

Furthermore, AI and ML enable advanced process optimization and real-time quality control, ensuring consistent product excellence. Heller can also develop adaptive manufacturing capabilities, allowing machines to adjust parameters on the fly for maximum efficiency and material utilization. This strategic adoption of AI will not only boost Heller's internal performance but also provide valuable intelligent manufacturing insights to its clientele, strengthening customer relationships.

To stay competitive, Heller GmbH must prioritize significant investment in AI and ML research and development. This commitment will ensure the company remains at the forefront of technological advancements in the machine tool industry, driving innovation and securing a competitive edge in the evolving global market.

Additive Manufacturing (3D Printing) Convergence

While Heller GmbH is a leader in subtractive manufacturing, the growing use of additive manufacturing (3D printing) in sectors like aerospace, which saw a market value of approximately USD 10.7 billion in 2023 and is projected to reach USD 38.9 billion by 2030, presents a dynamic landscape. This shift creates both competitive pressure and potential avenues for growth for Heller.

The emergence of hybrid machines that blend additive and subtractive processes, or systems that seamlessly integrate with additive post-processing steps, offers Heller an opportunity to broaden its market appeal. These advancements could allow Heller to provide enhanced solutions and capture new market segments by catering to evolving customer needs.

Considerations for Heller include:

- Market Integration: Exploring partnerships or internal development of solutions that complement additive manufacturing workflows, such as specialized finishing or inspection tools for 3D printed parts.

- Technological Adaptation: Investing in research and development to understand and potentially integrate hybrid manufacturing capabilities into their product portfolio, aligning with industry trends.

- Customer Value Proposition: Developing strategies to showcase how Heller's core subtractive expertise can enhance the quality and efficiency of additive manufacturing processes, creating a unique value proposition.

Cybersecurity in Connected Manufacturing

As Heller GmbH increasingly integrates its machinery into sophisticated digital manufacturing environments, cybersecurity emerges as a paramount technological challenge. The interconnected nature of modern production lines necessitates stringent protection of sensitive information.

Safeguarding proprietary design data, crucial customer production metrics, and preventing unauthorized access or manipulation of connected machine tools are vital for preserving Heller's reputation and ensuring uninterrupted operations. The financial implications of a breach can be substantial, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, according to Cybersecurity Ventures.

- Data Protection: Securing intellectual property and customer production data against theft or espionage is a primary concern.

- Operational Integrity: Preventing cyberattacks that could disrupt manufacturing processes or damage sensitive equipment is essential.

- Trust and Reputation: Maintaining customer confidence hinges on demonstrating a robust commitment to cybersecurity.

- Regulatory Compliance: Adhering to evolving data privacy and security regulations, such as GDPR, is a non-negotiable technological requirement.

Technological advancements, particularly in automation and AI, are central to Heller GmbH's strategy, enhancing machine tool capabilities and driving smart factory solutions. The global Industry 4.0 market, valued at approximately $80.5 billion in 2023, highlights the significant demand for these integrated technologies that Heller is well-positioned to meet.

The increasing adoption of AI in industrial settings, with the market valued at around $15.2 billion in 2024 and expected to grow substantially, offers Heller opportunities for predictive maintenance and advanced process optimization, ensuring operational efficiency and product quality for its clients.

Emerging additive manufacturing technologies, projected to reach $38.9 billion by 2030, present both competitive challenges and opportunities for Heller to integrate hybrid solutions or complementary services, thereby expanding its market reach and value proposition.

Cybersecurity remains a critical technological factor, with global cybercrime costs anticipated to reach $10.5 trillion annually by 2025, necessitating robust data protection and operational integrity measures for Heller to maintain trust and compliance.

Legal factors

Heller GmbH navigates a complex international trade landscape, particularly concerning export controls on sophisticated technologies and dual-use items. Failure to comply can result in severe penalties, market access limitations, and significant reputational harm. For instance, in 2024, the United States expanded its export control measures impacting certain semiconductor manufacturing equipment, a sector relevant to advanced technology exports.

Protecting Heller GmbH's proprietary technologies, designs, and innovations through patents, trademarks, and trade secrets is vital for maintaining its competitive edge. For instance, the global patent landscape saw over 3.4 million patent applications filed in 2023, highlighting the importance of robust IP protection strategies. Heller GmbH's ability to secure and defend its intellectual property directly impacts its market position and future revenue streams.

Simultaneously, the company must ensure its products and processes do not infringe upon the intellectual property rights of competitors. In 2024, intellectual property litigation remains a significant concern for businesses, with infringement cases often resulting in substantial financial penalties and reputational damage. Legal vigilance in this area is paramount for sustained innovation and avoiding costly legal battles.

Strict product liability laws and safety regulations are paramount for industrial machinery manufacturers like Heller GmbH. These regulations dictate everything from initial design to final sale, ensuring operational safety for users. Failure to comply can lead to significant financial penalties and reputational damage.

Meeting rigorous safety standards and obtaining certifications such as CE marking in Europe is essential for Heller GmbH to operate legally and maintain customer trust. The European Machinery Directive 2006/42/EC, for instance, sets comprehensive safety requirements for machinery placed on the EU market, with non-compliance potentially resulting in fines that can reach millions of Euros, as observed in past cases involving safety breaches in the manufacturing sector.

Data Protection and Privacy Laws (e.g., GDPR)

Data protection and privacy laws, like the General Data Protection Regulation (GDPR), significantly impact Heller GmbH. As manufacturing becomes more digital, with connected machines generating vast amounts of operational data, ensuring compliance with these regulations is paramount. This includes the secure collection, storage, processing, and transfer of both customer and operational data, directly affecting Heller's data analytics and cloud-based service offerings.

Heller GmbH must navigate a complex web of data privacy regulations to maintain trust and avoid penalties. For instance, GDPR, which came into full effect in 2018, imposes strict rules on how personal data is handled, with fines for non-compliance reaching up to 4% of global annual turnover or €20 million, whichever is higher. This necessitates robust data governance frameworks and transparent data handling practices for Heller's operations and customer interactions.

- GDPR Fines: Non-compliance can lead to penalties of up to 4% of global annual turnover or €20 million.

- Data Analytics Impact: Stringent rules on data usage affect the development and deployment of data analytics services.

- Cloud Solutions: Secure data storage and processing in cloud environments must adhere to privacy mandates.

- Customer Trust: Demonstrating commitment to data protection is crucial for maintaining customer confidence in Heller's digital offerings.

Environmental Protection Laws and Compliance

Heller GmbH operates within a stringent environmental regulatory landscape. Compliance with laws governing manufacturing processes, waste management, emissions, and chemical handling is paramount. For instance, in 2024, Germany's Federal Immission Control Act (Bundes-Immissionsschutzgesetz) continues to set rigorous standards for industrial emissions, impacting operational permits and technology investments.

These environmental regulations directly shape Heller GmbH's strategic decisions, influencing everything from the energy efficiency requirements for new machinery to the operational protocols for factory waste disposal. The European Union's Green Deal initiatives, with targets for carbon neutrality by 2050, are increasingly translating into national legislation that mandates cleaner production methods and circular economy principles, affecting supply chains and product lifecycle management.

Failure to adhere to these environmental mandates carries significant financial and reputational risks. In 2023, penalties for environmental violations in the EU saw a notable increase, with some member states reporting fines in the millions of euros for non-compliant industrial facilities. Such penalties, alongside potential damage to brand image, underscore the critical importance of robust environmental compliance strategies for Heller GmbH.

- Regulatory Frameworks: Adherence to German and EU environmental laws, including the Federal Immission Control Act and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals).

- Operational Impact: Requirements for energy-efficient machinery and sustainable waste management practices, influencing capital expenditure and operational costs.

- Risk Mitigation: Avoiding substantial fines, which in 2023 saw significant increases across the EU for environmental breaches, and protecting brand reputation.

- Strategic Alignment: Integrating environmental sustainability into business strategy to meet evolving market expectations and comply with targets like those set by the EU's Green Deal.

Heller GmbH's operations are significantly shaped by intellectual property (IP) laws, necessitating robust protection for its innovations. The company must also ensure it does not infringe on competitors' IP rights, a growing area of litigation. In 2024, the global landscape of IP protection and enforcement remains critical for maintaining competitive advantage and avoiding costly disputes.

Compliance with product liability and safety regulations is paramount for industrial machinery manufacturers. These laws dictate design and sale protocols to ensure user safety, with non-compliance leading to severe financial and reputational consequences. For example, the European Machinery Directive 2006/42/EC mandates comprehensive safety standards for machinery in the EU market.

Data privacy laws, such as GDPR, are increasingly influential as manufacturing embraces digitalization. Heller GmbH must manage vast operational data securely and ethically, adhering to strict collection, storage, and processing rules. Failure to comply, as highlighted by GDPR's potential fines of up to 4% of global annual turnover, directly impacts data analytics and cloud service offerings.

| Legal Factor | Relevance to Heller GmbH | 2024/2025 Data/Trend |

| Intellectual Property (IP) | Protecting patents, trademarks, and trade secrets; avoiding infringement. | Increased IP litigation globally; emphasis on digital IP protection strategies. |

| Product Liability & Safety | Ensuring machinery safety and compliance with directives like EU Machinery Directive. | Continued focus on product safety recalls and stringent enforcement of standards. |

| Data Privacy (e.g., GDPR) | Secure handling of customer and operational data; impact on data analytics. | Heightened regulatory scrutiny on data processing and cross-border data transfers. |

Environmental factors

Increasing environmental awareness is fueling a demand for machine tools that are not only efficient in their use of energy and raw materials during operation but also in their manufacturing process. This trend directly impacts manufacturers like Heller GmbH, pushing them towards more sustainable designs.

Heller GmbH can solidify its market position by prioritizing the design of machine tools with extended operational lifespans and incorporating modular components that facilitate straightforward repairs and upgrades. Embracing circular economy principles, such as designing for disassembly and material recovery, can significantly reduce waste generation and lower overall operational expenditures for their customers.

For instance, the European Union's Green Deal aims to make the EU climate-neutral by 2050, which will likely translate into stricter regulations and incentives for resource-efficient manufacturing equipment. Companies that proactively integrate these principles, like Heller GmbH, are better positioned to meet future compliance demands and capture market share in an increasingly eco-conscious global economy.

Global efforts to curb carbon emissions are intensifying, directly affecting manufacturing sectors like machine tool production. Heller GmbH must assess its operational carbon footprint and the emissions associated with its machines in customer operations, especially as regulations tighten. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM) is set to expand its scope, impacting imported goods based on their embedded carbon, which could influence Heller's supply chain and export markets.

Developing energy-efficient machinery and championing sustainable manufacturing processes are crucial for Heller GmbH. This strategy not only aids customers in meeting their own emissions targets but also aligns with broader corporate sustainability objectives and evolving climate change regulations. By focusing on reduced energy consumption and longer product lifecycles, Heller can enhance its competitive edge in a market increasingly prioritizing environmental performance.

Environmental regulations concerning industrial waste and recycling are tightening globally. For instance, the European Union's Circular Economy Action Plan, updated in 2023, emphasizes waste reduction and increased recycling rates for manufactured goods, impacting companies like Heller GmbH. This means Heller must actively manage its manufacturing waste and investigate recycling options for components and retired machinery.

Societal expectations also push for greater environmental responsibility. Consumers and business partners increasingly favor companies with robust sustainability practices. Heller GmbH can gain a competitive edge by implementing efficient waste disposal methods and actively seeking opportunities to recycle materials, potentially reducing raw material costs and enhancing its brand image. By 2025, many industries are expected to see a 10% increase in demand for products with demonstrable circular economy principles.

Designing machines for easier disassembly and material recovery presents a significant strategic advantage. This approach not only aids in complying with evolving environmental directives but also opens avenues for resource efficiency. Heller GmbH could explore partnerships with specialized recycling firms to manage end-of-life products, ensuring materials are properly processed and reintegrated into the supply chain.

Supply Chain Environmental Footprint

The environmental footprint of Heller GmbH's supply chain, encompassing everything from raw material sourcing to the manufacturing of its components, is facing heightened examination. This scrutiny stems from growing expectations from both consumers and regulatory bodies regarding environmental responsibility throughout the value chain.

Customers and regulators are increasingly demanding that companies verify their suppliers' adherence to environmental regulations. This requires robust due diligence in selecting suppliers and active collaboration to minimize the environmental impact across the entire product lifecycle.

For instance, by 2024, the European Union's Corporate Sustainability Reporting Directive (CSRD) mandates extensive environmental disclosures, impacting companies like Heller GmbH and their supply chain partners. Failing to meet these standards can lead to significant penalties and reputational damage. In 2023, a significant portion of global consumers indicated a willingness to pay more for sustainably sourced products, underscoring the market demand for environmental accountability.

- Supplier Audits: Implementing rigorous environmental audits for all key suppliers to ensure compliance with sustainability standards.

- Material Sourcing: Prioritizing suppliers who utilize recycled materials or engage in environmentally sound extraction practices.

- Logistics Optimization: Collaborating with logistics partners to reduce carbon emissions through efficient routing and alternative fuel adoption.

- Waste Reduction Programs: Working with suppliers to implement waste reduction and circular economy principles within their manufacturing processes.

Customer Demand for Sustainable Solutions

Customer demand for sustainable solutions is a significant environmental factor influencing Heller GmbH. Industries like automotive and aerospace, which have robust sustainability targets, are increasingly seeking machine tools that minimize environmental footprints. This trend means Heller must focus on innovations such as energy-efficient drives, reduced lubricant usage, and quieter machine operations, as these features are becoming critical purchasing criteria.

The growing emphasis on eco-friendly products is evident across many sectors. For instance, a 2024 report indicated that over 60% of consumers are willing to pay a premium for products from sustainable brands. This consumer shift directly impacts B2B purchasing decisions, pushing manufacturers like Heller to integrate sustainability into their core product development.

Key areas of focus for Heller GmbH in response to this demand include:

- Energy Efficiency: Developing machine tools that consume less electricity during operation and standby modes.

- Resource Optimization: Innovations aimed at reducing the consumption of lubricants, coolants, and other operational fluids.

- Noise Reduction: Engineering quieter machines to meet stricter environmental regulations and improve workplace conditions.

- Certifications: Pursuing and highlighting green certifications for their products, which can serve as a competitive advantage and a verifiable mark of environmental responsibility.

Environmental factors are increasingly shaping the machine tool industry, pushing companies like Heller GmbH towards greater sustainability. Stricter regulations, such as the EU's Green Deal and Carbon Border Adjustment Mechanism, necessitate a focus on energy efficiency and reduced carbon footprints throughout the product lifecycle. By 2025, many industries anticipate a 10% rise in demand for products demonstrating circular economy principles, making proactive environmental strategies crucial for market competitiveness.

Heller GmbH must prioritize the development of energy-efficient machinery and embrace circular economy principles to meet evolving customer demands and regulatory requirements. This includes designing for disassembly, material recovery, and reducing waste in both manufacturing and product operation. For instance, the EU's Circular Economy Action Plan, updated in 2023, emphasizes waste reduction and recycling, directly impacting how companies manage end-of-life products.

The supply chain's environmental performance is also under scrutiny, with directives like the EU's Corporate Sustainability Reporting Directive (CSRD) mandating extensive environmental disclosures by 2024. This requires robust supplier due diligence and collaboration on sustainability initiatives. In 2023, over 60% of consumers expressed willingness to pay more for products from sustainable brands, highlighting the market's drive for environmental accountability.

| Environmental Factor | Impact on Heller GmbH | Key Actions/Considerations |

|---|---|---|

| Climate Change & Emissions | Increased regulatory pressure (e.g., CBAM), customer demand for low-carbon solutions. | Reduce operational carbon footprint, develop energy-efficient machines, optimize logistics. |

| Resource Scarcity & Circular Economy | Growing emphasis on waste reduction, recycling, and product longevity. | Design for disassembly, explore material recovery, implement waste reduction programs. |

| Environmental Regulations | Stricter compliance requirements (e.g., EU Green Deal, CSRD), potential penalties for non-compliance. | Proactive integration of sustainable practices, rigorous supplier audits, green certifications. |

| Consumer & Societal Expectations | Preference for sustainable brands and products. | Enhance brand image through robust sustainability practices, focus on efficient waste disposal and recycling. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Heller GmbH is built on a comprehensive review of government publications, economic indicators from reputable financial institutions, and industry-specific market research. We ensure all data is current and relevant to the political, economic, social, technological, legal, and environmental landscape.