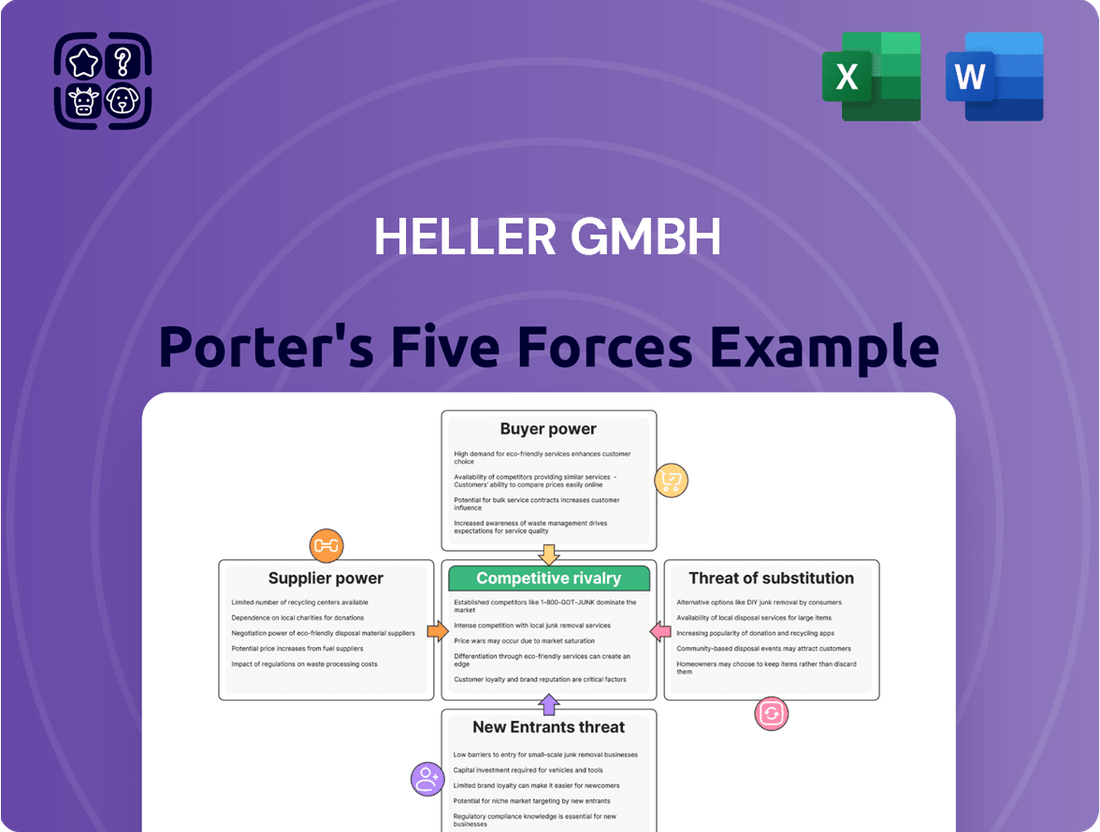

Heller GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heller GmbH Bundle

Heller GmbH operates in a landscape where buyer bargaining power is a significant factor, potentially squeezing profit margins. Understanding the intensity of this force, alongside the threat of substitutes and new entrants, is crucial for strategic planning.

The complete report reveals the real forces shaping Heller GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Heller GmbH's reliance on specialized components for its advanced CNC machine tools, including intricate control systems and precision bearings, significantly shapes supplier power. The limited pool of high-technology suppliers for these critical parts grants them considerable leverage. For instance, in 2024, the global market for advanced industrial automation components saw price increases averaging 5-8% due to supply chain constraints and high demand, directly impacting manufacturers like Heller.

Suppliers providing advanced software for AI, automation, and digital twins, vital for Heller GmbH's integrated offerings, often possess proprietary technology and intellectual property. This exclusivity grants them substantial bargaining power, as switching these core technology providers would involve significant costs and potential disruptions for Heller. For instance, in 2024, the global market for industrial AI software was projected to reach over $15 billion, highlighting the value and scarcity of such specialized solutions.

The availability of highly skilled labor is a significant factor influencing supplier power in the labor market for companies like Heller GmbH. A scarcity of qualified engineers, technicians, and software developers, especially those with expertise in advanced manufacturing and complex machine tool development, can directly increase labor costs. This talent shortage can hinder Heller's capacity for innovation and efficient production, effectively giving skilled labor strong bargaining power as a critical input.

Raw Material Price Volatility

Fluctuations in the prices of specialized raw materials, like high-grade metals and rare earth elements, significantly bolster the bargaining power of material suppliers. These unpredictable price swings directly affect Heller GmbH's production costs and overall profitability, even though Heller produces finished machines.

Market volatility for these critical inputs translates into uncertain supply chain expenses for Heller. For instance, the price of lithium, a key component in electric vehicle batteries, saw significant increases throughout 2023 and early 2024, impacting industries reliant on these materials.

- Increased Input Costs: Volatile raw material prices can lead to higher manufacturing expenses for Heller.

- Supplier Leverage: Suppliers can leverage periods of scarcity or high demand to dictate terms and prices.

- Profit Margin Squeeze: Unforeseen cost increases can compress Heller's profit margins if not passed on to customers.

Supplier's Forward Integration Threat

The threat of suppliers engaging in forward integration, where they move into the customer's business, can significantly impact Heller GmbH. Highly specialized component suppliers, particularly those with unique technological expertise in machine tool systems or advanced manufacturing solutions, could potentially develop their own integrated offerings. This would allow them to bypass Heller and directly serve end-users, thereby increasing their bargaining power.

While the capital-intensive nature of the machine tool industry generally makes widespread supplier forward integration less common, the possibility remains a strategic consideration for Heller. For instance, a supplier of critical, proprietary control software for CNC machines might consider developing its own integrated machining centers. This scenario could force Heller to maintain exceptionally strong relationships and consistently offer competitive pricing and innovation to retain these key suppliers.

In 2024, the global machine tool market saw significant investment in automation and digital solutions. Suppliers specializing in these areas, such as advanced robotics or AI-driven manufacturing software, are well-positioned to consider such integration strategies. For example, a company providing advanced robotic arms for automated loading and unloading of machine tools could potentially expand into offering complete automated work cells, directly competing with machine tool builders like Heller.

- Supplier Specialization: Suppliers with unique, hard-to-replicate technologies in areas like advanced control systems or specialized tooling pose the greatest risk of forward integration.

- Industry Capital Intensity: The high cost of entry for manufacturing complex machine tools generally acts as a deterrent to broad supplier integration, but niche players may still pose a threat.

- Strategic Importance of Suppliers: Heller GmbH must identify critical suppliers whose capabilities, if integrated forward, would most disrupt its business model and proactively manage these relationships.

The bargaining power of suppliers for Heller GmbH is amplified by the specialized nature of components and the limited availability of high-technology providers. For instance, in 2024, the industrial automation component market experienced price hikes of 5-8% due to supply chain pressures, directly impacting Heller's input costs.

Suppliers of proprietary AI and digital twin software also wield significant power due to the exclusivity of their technology, making switching costly and disruptive for Heller. The industrial AI software market's projected growth to over $15 billion in 2024 underscores the value and scarcity of these critical solutions.

Furthermore, a scarcity of highly skilled labor, particularly in advanced manufacturing, grants significant leverage to specialized workers, potentially increasing labor costs for Heller and impacting innovation timelines.

| Supplier Characteristic | Impact on Heller GmbH | 2024 Market Context |

|---|---|---|

| Specialized Components (e.g., control systems, precision bearings) | High supplier leverage, potential for price increases | 5-8% average price increases in industrial automation components |

| Proprietary Software (AI, Digital Twins) | Significant bargaining power due to exclusivity and switching costs | Industrial AI software market projected over $15 billion |

| Skilled Labor (engineers, technicians) | Increased labor costs due to talent shortages | Ongoing talent shortages in advanced manufacturing sectors |

What is included in the product

This analysis provides a strategic overview of Heller GmbH's competitive environment, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly identify and mitigate competitive threats with a visual breakdown of all five forces.

Effortlessly adapt your strategy by clearly seeing how each force impacts profitability.

Customers Bargaining Power

Heller GmbH's primary customers are large, sophisticated companies within the automotive, aerospace, and general mechanical engineering industries. These buyers possess substantial purchasing power and a keen understanding of their technical requirements, allowing them to negotiate effectively for specific features, top-tier performance, and aggressive pricing.

The global machine tool market, a sector Heller operates in, is substantial, exceeding USD 100 billion. This vast market size reinforces the bargaining power of Heller's major clients, as they represent significant volume and are well-versed in the competitive landscape of machine tool suppliers.

While customers possess inherent bargaining power, Heller GmbH benefits from substantial switching costs for its advanced machine tools. The significant capital outlay and extended integration periods for Heller's specialized CNC machinery mean that once a client adopts their systems, transitioning to a competitor incurs considerable expenses. These costs encompass retooling, employee retraining, and the potential disruption of production lines, effectively anchoring customers to Heller's offerings and mitigating the immediate risk of customer defection.

Customers in demanding sectors like automotive and aerospace are actively seeking integrated and highly customized machine tools. This trend empowers them to negotiate for tailored solutions that optimize their specific manufacturing workflows, pushing Heller to deliver comprehensive ecosystems rather than just individual machines.

Customer Price Sensitivity and Performance Demands

Even with significant investment in Heller's machine tools, customers remain keenly aware of the total cost of ownership. This includes not just the upfront price but also the ongoing expenses related to operation and upkeep. For example, in 2024, the average industrial machinery operating cost can represent a substantial portion of a company's budget, making price sensitivity a persistent factor.

Customers also place a premium on performance, expecting high levels of precision, accuracy, and productivity. These demands are critical for them to optimize their own manufacturing processes, reduce material waste, and ultimately enhance their profitability. In the competitive landscape of 2024, machine tool manufacturers like Heller must demonstrate clear value in these performance metrics.

- Customer Price Sensitivity: Despite high switching costs, customers prioritize the total cost of ownership, encompassing purchase price, operational efficiency, and maintenance.

- Performance Demands: Customers require high precision, accuracy, and productivity from machine tools to maximize their own output and minimize waste.

- Negotiation Leverage: This dual focus on cost and performance grants customers significant bargaining power, compelling Heller to deliver exceptional value.

- Market Context (2024): The industrial sector in 2024 continues to see intense competition, amplifying the importance of both competitive pricing and superior machine tool performance for customer acquisition and retention.

Global Competition Among Machine Tool Manufacturers

The global machine tool market is characterized by fierce competition, with a multitude of established manufacturers vying for market share. This abundance of choice empowers customers, allowing them to easily switch between suppliers or negotiate more favorable terms. For instance, in 2024, the global machine tool market was valued at approximately $100 billion, with significant contributions from various international players, underscoring the intense competitive landscape.

This intense rivalry among machine tool producers compels customers to actively compare offerings, seeking the best combination of price, technology, and service. They can leverage competing bids and the availability of advanced features from different manufacturers to secure advantageous deals. This dynamic directly impacts Heller GmbH, forcing it to remain highly competitive to retain its customer base.

To counteract this strong bargaining power, Heller GmbH must focus on continuous innovation and product differentiation. By offering unique technological advantages, superior quality, or specialized solutions, Heller can create a stronger value proposition that reduces customer price sensitivity. The ability to offer integrated solutions, such as smart manufacturing capabilities, can further enhance customer loyalty and mitigate the impact of price-based competition.

- High Market Saturation: The machine tool industry features numerous global and regional players, providing customers with a wide array of alternatives.

- Price Sensitivity: Intense competition often leads to price wars, enabling customers to negotiate lower prices by playing manufacturers against each other.

- Information Availability: Customers have access to extensive product information and reviews, facilitating informed comparisons and purchasing decisions.

- Switching Costs: While switching can involve costs, the availability of standardized interfaces and the competitive pricing often make it feasible for customers to change suppliers.

Heller GmbH's customers, primarily large industrial firms, wield significant bargaining power due to their substantial order volumes and deep understanding of the machine tool market. This power is amplified by the competitive nature of the industry, where multiple suppliers vie for business, allowing customers to leverage offers and demand favorable pricing and specifications. For instance, in 2024, customers in the automotive sector, a key market for Heller, often procure entire production lines, giving them considerable leverage in negotiations.

| Factor | Description | Impact on Heller GmbH |

| Buyer Volume | Customers represent large portions of Heller's sales, making them crucial. | Increases customer negotiation leverage. |

| Information Availability | Buyers are well-informed about market prices and technologies. | Enables effective price comparison and demand for best value. |

| Price Sensitivity | Customers focus on total cost of ownership, including operational expenses. | Pressures Heller to offer competitive pricing and efficient machines. |

| Product Differentiation | Customers seek tailored solutions for specific manufacturing needs. | Requires Heller to innovate and customize, potentially increasing costs but also loyalty. |

What You See Is What You Get

Heller GmbH Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Heller GmbH, providing a thorough examination of competitive forces within their industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights without any placeholders or surprises.

Rivalry Among Competitors

The machine tool industry, especially for advanced CNC machines, is a mature landscape dominated by numerous large, established global competitors. Heller GmbH operates within this environment, facing off against a formidable group of well-recognized manufacturers, all fiercely competing for market share.

This intense rivalry, fueled by the high concentration of powerful players, makes it a significant challenge for any single company to achieve substantial market gains. For instance, in 2024, the global machine tool market was valued at approximately $87.5 billion, with key players like DMG Mori, Mazak, and Haas Automation holding significant portions of this market, alongside Heller GmbH.

Manufacturing advanced machine tools, like those produced by Heller GmbH, demands significant upfront investment. These costs cover everything from cutting-edge research and development to maintaining highly specialized production facilities and employing a skilled engineering team. For instance, a single advanced CNC machining center can cost hundreds of thousands of dollars, and the infrastructure to support them adds considerably more.

These substantial fixed costs, coupled with the highly specialized nature of the machinery and intellectual property involved, erect considerable exit barriers. Companies find it difficult and financially crippling to simply shut down operations or divest assets, as they are not easily transferable or convertible to cash. This often forces competitors to stay in the market, even when facing challenging economic conditions, thereby intensifying ongoing competitive rivalry.

Competitive rivalry in the machine tool industry is intense, fueled by relentless technological progress. Companies vie for market share by offering products with enhanced precision, advanced automation, artificial intelligence integration, and sophisticated multi-axis capabilities. For instance, Heller GmbH is actively differentiating itself through its emphasis on integrated solutions, the application of AI in mechanical engineering, and the introduction of new technologies like its 5-axis machining centers, exemplified by the F 8000 model.

Global Market Dynamics and Regional Shifts

The global machine tool market saw a dip in 2024, but forecasts indicate a strong rebound and sustained growth moving forward. Asia Pacific is currently the leading region, significantly shaping the competitive environment worldwide. Heller GmbH, being a global player, navigates these varied regional competitive pressures and distinct customer preferences for different machine tool technologies.

Key aspects influencing competitive rivalry include:

- Market Size and Growth: The global machine tool market, valued at approximately USD 100 billion in 2023, is expected to experience fluctuations in 2024 before resuming a compound annual growth rate (CAGR) of around 4-5% through 2030.

- Regional Dominance: Asia Pacific, particularly China, accounted for over 40% of the global machine tool market share in 2023, driving innovation and setting pricing benchmarks.

- Heller's Global Footprint: Heller's operations span key markets like Europe, North America, and Asia, each presenting unique competitive intensities and customer demands for precision engineering and automation solutions.

Strategic Partnerships and Integrated Solutions Focus

Heller GmbH is navigating a competitive landscape where strategic partnerships are becoming crucial for enhancing competitiveness. Companies are shifting from offering individual machines to providing integrated solutions that encompass a broader range of services and technologies. This evolution means that competition is no longer just between individual firms, but between entire ecosystems and value chains.

A prime example of this trend is Heller's recent collaboration with Seco. This partnership aims to transform machining technology by combining their respective strengths. Such alliances create a more intricate competitive environment, as the combined capabilities of partners can offer a more compelling value proposition to customers than standalone offerings.

The focus on integrated solutions and strategic alliances means that Heller must consider not only direct machine tool competitors but also the broader network of partners and technology providers that can assemble comprehensive offerings. This strategic shift, observed across the industry, highlights the growing importance of ecosystem play in the machine tool sector.

- Strategic Alliances: Heller's partnership with Seco underscores the industry's move towards collaborative innovation in machining technology.

- Integrated Solutions: The competitive advantage increasingly lies in offering complete solutions rather than isolated products.

- Ecosystem Competition: The market is evolving into a battle between interconnected value chains and technological ecosystems.

- Enhanced Value Proposition: Partnerships allow companies to deliver more comprehensive and sophisticated offerings to customers.

Competitive rivalry within the machine tool sector is fierce, driven by a high number of established global players and continuous technological advancements. Heller GmbH faces intense competition from manufacturers like DMG Mori, Mazak, and Haas Automation, all vying for market share in a market valued at approximately $87.5 billion in 2024. This intense competition is further amplified by significant exit barriers, such as high capital investments in specialized facilities and skilled labor, which keep even struggling competitors engaged.

Companies are differentiating themselves by offering advanced features like AI integration and multi-axis capabilities; Heller's F 8000 model exemplifies this. The industry is also seeing a trend towards strategic partnerships and integrated solutions, as seen in Heller's collaboration with Seco, to create a more compelling value proposition and navigate an increasingly complex competitive landscape.

| Competitor | Approximate 2024 Market Share (Global Machine Tool Market) | Key Product Focus |

|---|---|---|

| DMG Mori | Significant | High-precision CNC machines, automation |

| Mazak | Significant | Multi-tasking machines, advanced manufacturing solutions |

| Haas Automation | Significant | Affordable, user-friendly CNC machinery |

| Heller GmbH | Notable | High-performance machining centers, integrated systems |

SSubstitutes Threaten

While Heller GmbH focuses on sophisticated CNC machine tools, traditional machining methods like manual milling and turning persist as substitutes. These older techniques, though less precise and slower, can be more economical for simpler tasks or for smaller enterprises with tighter budgets, offering a lower barrier to entry.

For instance, in 2024, the global market for manual machine tools, while shrinking, still represented a segment where cost sensitivity can favor these less advanced options. However, the overwhelming trend in manufacturing, driven by demands for efficiency and quality, is a clear migration towards advanced CNC solutions, making the threat from traditional methods less significant for high-value production.

Additive manufacturing, or 3D printing, presents a growing threat of substitution for traditional metal cutting, especially for intricate designs, quick prototypes, and lightweight parts, particularly within the aerospace sector. While not a complete replacement for all machining needs, its ongoing improvements in materials and production scale offer a developing challenge to certain manufacturing processes.

Emerging metal cutting technologies like advanced fiber laser and waterjet cutting present a growing threat of substitution for traditional methods used in metal fabrication. These advanced techniques offer high precision and efficiency, capable of performing tasks previously requiring milling or grinding. For instance, the global laser cutting machine market was valued at approximately USD 7.5 billion in 2023 and is projected to grow significantly, indicating increasing adoption.

These substitutes are becoming more competitive as their speed, quality, and material handling capabilities continuously improve. In specific applications, such as intricate designs or heat-sensitive materials, laser and waterjet cutting can offer superior results or cost-effectiveness compared to conventional machining. This technological advancement means that companies like Heller GmbH must continually assess if these alternative cutting methods can fulfill customer needs more effectively, potentially impacting demand for their traditional machining solutions.

Outsourcing to Specialized Job Shops

Customers may choose to outsource their precision machining requirements to specialized job shops instead of purchasing Heller's equipment. This offers a viable substitute, as these shops provide access to advanced machinery and skilled labor without the significant upfront investment for the customer. For example, the global contract manufacturing market was valued at approximately $534.4 billion in 2023 and is projected to grow, indicating a strong alternative for many businesses.

- Outsourcing Advantage: Access to cutting-edge technology and expertise without capital expenditure.

- Market Trend: The contract manufacturing sector continues to expand, presenting a growing substitute option.

- Cost-Benefit: Businesses can achieve cost savings by outsourcing rather than investing in their own manufacturing capabilities.

Evolution of Manufacturing Processes

The threat of substitutes for Heller GmbH is heightened by the rapid evolution of manufacturing processes. As customer industries adopt new materials and product designs, alternative production methods emerge that can bypass the need for traditional metal cutting. For example, advancements in additive manufacturing, or 3D printing, are increasingly capable of producing complex metal parts with less machining, potentially reducing demand for Heller's core competencies. In 2023, the global 3D printing market reached an estimated $20.7 billion, demonstrating significant growth and adoption across various sectors.

New joining techniques and advanced material forming processes also present substitutes. Instead of machining to achieve specific shapes or tolerances, methods like friction stir welding or advanced stamping could offer more efficient ways to create components, thus diminishing the reliance on Heller's machining solutions. This dynamic necessitates continuous adaptation of Heller's product portfolio to align with future manufacturing paradigms.

- Advancements in Additive Manufacturing: 3D printing technologies are increasingly substituting traditional subtractive manufacturing methods in producing complex metal components.

- Emergence of New Joining Techniques: Innovations like friction stir welding offer alternatives to machining for creating strong, integrated metal structures.

- Material Forming Innovations: Advanced stamping and forging processes can achieve tighter tolerances and complex geometries with less material removal.

- Market Impact: The global 3D printing market's growth to an estimated $20.7 billion in 2023 underscores the increasing viability of substitute technologies.

The threat of substitutes for Heller GmbH is multifaceted, encompassing both traditional and emerging manufacturing technologies. While Heller specializes in advanced CNC machine tools, simpler manual machining methods remain a cost-effective substitute for less demanding applications, especially for smaller businesses. Furthermore, additive manufacturing, or 3D printing, is increasingly viable for complex parts, with the global 3D printing market reaching an estimated $20.7 billion in 2023. Advanced cutting technologies like laser and waterjet cutting, valued at approximately USD 7.5 billion in 2023 for the laser cutting segment alone, also offer alternatives by providing high precision and efficiency for specific fabrication tasks, potentially reducing the need for traditional milling or grinding.

| Substitute Technology | Key Advantage | Market Data/Relevance |

|---|---|---|

| Manual Machining | Lower cost for simple tasks, lower barrier to entry | Still a segment in the global manual machine tool market (2024) |

| Additive Manufacturing (3D Printing) | Intricate designs, rapid prototyping, lightweight parts | Global market estimated at $20.7 billion (2023) |

| Laser Cutting | High precision, efficiency, complex shapes | Laser cutting machine market valued at approx. USD 7.5 billion (2023) |

| Waterjet Cutting | Precision, efficiency, no heat-affected zone | Complementary to laser cutting in advanced fabrication |

| Contract Manufacturing/Outsourcing | Access to advanced tech without capital expenditure | Global contract manufacturing market valued at approx. $534.4 billion (2023) |

Entrants Threaten

The machine tool manufacturing sector demands significant upfront capital for cutting-edge research and development, sophisticated production plants, and specialized equipment. For instance, establishing a new, competitive facility in this industry could easily run into tens or even hundreds of millions of Euros, creating a formidable financial hurdle.

This substantial financial barrier effectively deters many aspiring companies from entering the market and challenging established leaders like Heller GmbH. The sheer scale of investment required acts as a powerful deterrent, limiting the number of new players who can realistically contend.

The threat of new entrants for Heller GmbH is significantly shaped by the immense need for deep technical expertise and substantial research and development investment. Developing and manufacturing cutting-edge CNC machine tools requires a profound understanding of mechanical, electrical, software, and automation engineering.

Aspiring competitors must establish or procure advanced R&D capabilities to foster innovation and maintain relevance amidst swift technological evolution in this sector. Heller's commitment to investing in AI and sophisticated solutions underscores this barrier to entry.

For instance, in 2023, the global CNC machine market was valued at approximately $140 billion, with significant portions dedicated to R&D by established players like Heller, making it difficult for newcomers to compete without similar resource allocation.

Heller GmbH benefits from decades of cultivating a robust brand reputation and deep-rooted customer relationships, particularly within demanding sectors like automotive and aerospace. This established trust is a significant barrier for newcomers.

New entrants struggle to replicate Heller's credibility and extensive network, making it difficult to gain initial traction and establish a loyal following in a market where reliability and proven performance are paramount. For instance, in 2024, the automotive industry continued to prioritize established suppliers with proven track records for critical components, with over 80% of new vehicle contracts awarded to companies with more than a decade of experience in the sector.

Intellectual Property and Proprietary Technology

The machine tool sector, especially for companies like Heller GmbH, is heavily reliant on intellectual property. This includes patents covering everything from sophisticated CNC control systems to the very designs of their advanced machinery and integrated manufacturing solutions. For instance, in 2023, companies in the advanced manufacturing equipment sector invested an average of 5.8% of their revenue into research and development, highlighting the importance of innovation.

Heller, being a leader in advanced systems, undoubtedly possesses substantial proprietary technology. This creates a significant barrier for potential new entrants. They would either need to invest heavily in developing their own unique technologies from scratch or face the considerable costs and time associated with licensing existing intellectual property.

- Patented CNC Controls: Protects core operational software and hardware.

- Proprietary Machine Designs: Safeguards unique engineering and performance advantages.

- Integrated Manufacturing Solutions: Covers complex, system-level innovations.

- R&D Investment: Companies in this space often allocate significant portions of revenue to protect and advance their IP.

Regulatory Hurdles and Compliance Standards

The manufacturing of precision machine tools, especially for sectors like aerospace, demands strict adherence to industry standards, safety regulations, and quality certifications. New companies entering this market must navigate these complex regulatory environments, a process that significantly increases both the cost and the time required for market entry.

For instance, achieving certifications like ISO 9001 or specific aerospace standards can take months, if not years, and involve substantial investment in quality control systems and documentation. This barrier is particularly high for international entrants needing to comply with multiple national regulatory frameworks.

- Stringent Industry Standards: Compliance with standards like ISO 9001 is often a prerequisite for supplying to major industries.

- Safety Regulations: Machine tool safety directives, such as those from the European Machinery Directive, require rigorous design and testing.

- Quality Certifications: Sector-specific certifications, like AS9100 for aerospace, are critical and demand robust quality management systems.

- Navigating Complex Landscapes: The sheer volume and specificity of regulations create a significant hurdle for new players.

The threat of new entrants for Heller GmbH is considerably low due to the immense capital required for advanced R&D and sophisticated manufacturing facilities, with new plant setups easily costing tens of millions of Euros.

Furthermore, deep technical expertise across multiple engineering disciplines is essential, making it difficult for newcomers to match Heller's established capabilities and innovation pace, as evidenced by the global CNC machine market's substantial R&D investments.

Heller's strong brand reputation and long-standing customer relationships, particularly in demanding sectors like automotive where over 80% of new contracts in 2024 went to experienced suppliers, create a significant barrier to entry.

The extensive intellectual property portfolio, including patented CNC controls and proprietary machine designs, alongside the need to navigate complex industry standards and safety regulations, further solidifies Heller's competitive advantage against potential new market participants.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of R&D, plants, and equipment (millions of Euros). | Significant financial hurdle, limiting market entry. |

| Technical Expertise & R&D | Need for deep engineering knowledge and continuous innovation. | Difficult to replicate Heller's advanced capabilities. |

| Brand Reputation & Relationships | Established trust and loyalty from key industries. | Challenging for newcomers to gain initial traction and credibility. |

| Intellectual Property | Patented technologies and proprietary designs. | Requires substantial investment in IP development or licensing. |

| Regulatory Compliance | Adherence to strict industry standards and certifications. | Increases cost and time-to-market for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Heller GmbH is built upon a foundation of robust data, incorporating financial reports, industry-specific market research, and competitor disclosures. We also leverage economic indicators and regulatory filings to provide a comprehensive view of the competitive landscape.