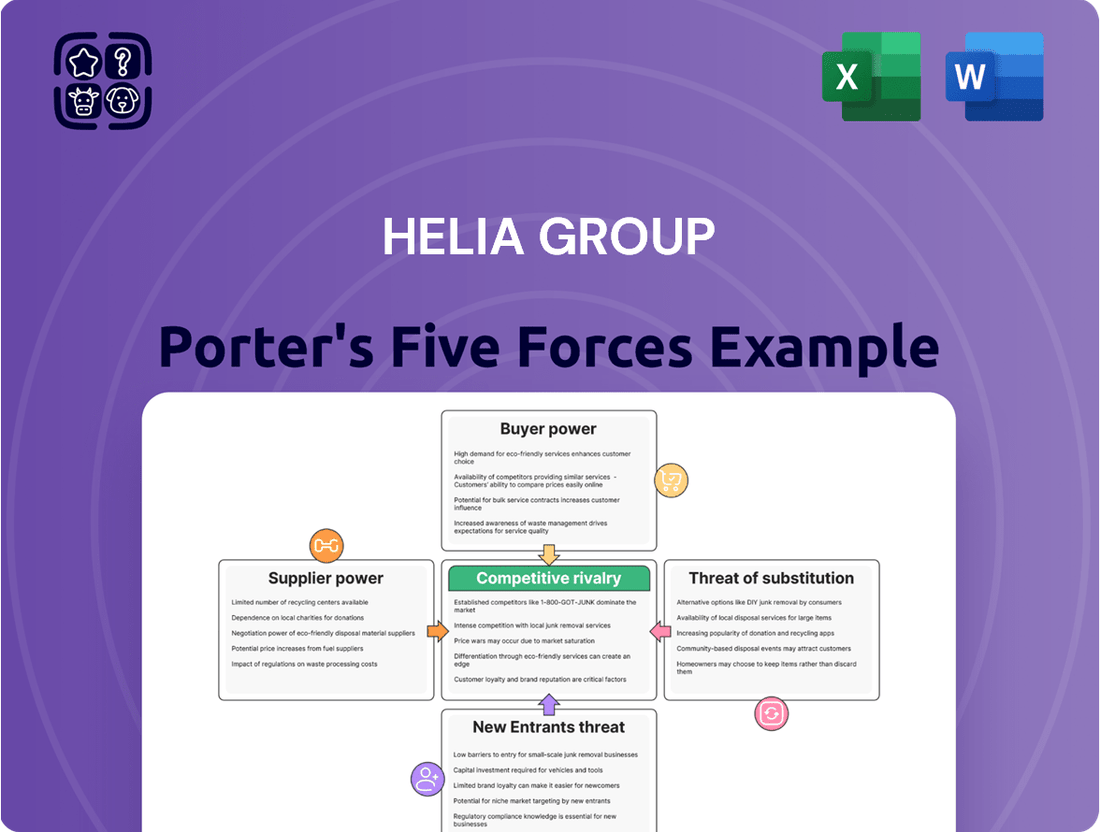

Helia Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helia Group Bundle

Helia Group navigates a landscape shaped by intense competition and evolving market dynamics. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for sustained success. This brief overview highlights key pressures but only scratches the surface of the complex forces at play.

The complete report reveals the real forces shaping Helia Group’s industry—from supplier influence to the threat of new entrants. Gain actionable insights to drive smarter decision-making and uncover strategic advantages.

Suppliers Bargaining Power

Helia Group, as a leading provider of credit insurance and financial solutions, is significantly influenced by the concentration of key data and technology providers. These specialized vendors supply the essential analytics and platforms that underpin Helia's risk assessment capabilities and operational effectiveness. A limited number of such providers means they hold considerable sway, potentially dictating higher prices or less advantageous contract terms for Helia.

For instance, in 2024, the global market for credit risk management software saw continued consolidation, with a few major players dominating the landscape. These dominant firms often possess proprietary algorithms and extensive historical data sets that are difficult for competitors to replicate, thereby strengthening their bargaining position. Helia's reliance on these critical infrastructure components makes it vulnerable to price increases or service disruptions if these suppliers decide to leverage their market power.

Helia Group, like many insurers, relies on reinsurance to manage its exposure to significant losses, particularly those stemming from large-scale credit events. The availability of this reinsurance capacity from global markets is a crucial factor. If the reinsurance market tightens, meaning there's less capacity or it becomes more expensive, reinsurers gain bargaining power. This could lead to higher costs for Helia, directly impacting its profitability and its ability to offer competitive pricing for its own LMI products.

The global reinsurance market experienced significant price increases in 2023 and continuing into early 2024, driven by a series of large natural catastrophe losses and an increase in inflation impacting claims costs. Some reports indicated that property catastrophe reinsurance rates rose by 20-50% at the January 1, 2024 renewal. This trend suggests reinsurers are in a stronger position, potentially increasing Helia’s cost of obtaining coverage and impacting its overall operational expenses.

Helia Group's strong capital position is vital for its operations and meeting regulatory demands. Suppliers of capital, like institutional investors, wield influence based on their other investment choices and Helia's financial health. For instance, if Helia's return on equity (ROE) in 2024 was 12%, a strong performance compared to industry averages, it would attract more capital, thereby reducing supplier bargaining power.

Helia's active capital management, including its dividend payout ratio, which stood at 40% in the first half of 2024, directly impacts how capital providers perceive its value. By consistently returning value to shareholders through dividends and potential share buy-backs, Helia can enhance its appeal to investors, making capital more accessible and less subject to supplier demands.

Talent Pool for Specialized Skills

The LMI (Labor Market Information) industry, crucial for Helia Group's operations, demands highly specialized expertise. Professionals skilled in actuarial science, risk management, and complex financial modeling are in high demand. Furthermore, the increasing reliance on technology and data analytics means experts in these fields also hold significant sway.

A constrained supply of these highly skilled individuals directly translates to increased bargaining power for employees. This can manifest as upward pressure on wages and benefits, making talent acquisition and retention a significant challenge for Helia. For instance, a report by the U.S. Bureau of Labor Statistics in 2024 indicated a projected growth of 14% for actuaries between 2022 and 2032, a rate faster than the average for all occupations, underscoring the competitive landscape for such talent.

- Specialized Skills: Actuarial science, risk management, financial modeling, data analytics, and advanced technology proficiency are essential.

- Talent Scarcity: A limited pool of professionals with these niche skill sets enhances their negotiation leverage.

- Wage Inflation: Increased demand for specialized talent can drive up salary expectations and compensation packages.

- Retention Challenges: Companies like Helia may face difficulties in retaining top performers when competitors offer more attractive terms.

Regulatory and Compliance Software Vendors

The bargaining power of suppliers in regulatory and compliance software for financial services, like those Helia Group interacts with, is significant due to the highly regulated Australian landscape. APRA's prudential standards and reporting mandates mean that specialized software and consulting are not merely helpful, but often critical for Helia to operate legally and efficiently.

Suppliers offering unique, niche solutions that are essential for meeting these complex requirements can exert considerable influence. Their ability to tailor software to specific regulatory frameworks, such as the upcoming Consumer Data Right (CDR) extensions impacting financial services, can make switching providers costly and disruptive for Helia. For instance, in 2024, the push for greater data standardization across financial institutions further amplified the need for specialized compliance tools, solidifying the position of key software vendors.

- Essential Nature of Solutions: Suppliers providing software crucial for meeting APRA regulations hold strong bargaining power.

- High Switching Costs: The complexity and regulatory specificity of compliance software make switching providers expensive and time-consuming for firms like Helia.

- Vendor Specialization: Niche vendors with deep expertise in Australian financial regulations can command higher prices and terms.

- Impact of Data Regulations: Evolving data regulations, like CDR, increase reliance on specialized software, boosting supplier leverage.

Helia Group's bargaining power with its suppliers is notably impacted by the concentration of essential technology and data providers. These firms, often few in number, supply critical analytics and platforms, giving them leverage to dictate terms and pricing. For instance, the credit risk management software market in 2024 showed continued consolidation, with dominant players holding proprietary data, making them difficult to replace and strengthening their negotiating position.

Reinsurers also hold significant bargaining power, particularly when reinsurance capacity tightens. Increased costs for reinsurance directly affect Helia's profitability and pricing ability. This was evident in early 2024, with property catastrophe reinsurance rates seeing substantial hikes, some by 20-50%, due to prior year losses and inflation, placing reinsurers in a stronger stance.

The scarcity of highly skilled professionals in actuarial science, risk management, and data analytics further enhances supplier bargaining power, especially for talent acquisition. The U.S. Bureau of Labor Statistics projected a 14% growth for actuaries between 2022 and 2032, indicating a competitive talent market that can drive up wage expectations for Helia.

Specialized regulatory and compliance software suppliers also possess strong bargaining power due to the critical nature of their solutions for financial institutions. High switching costs associated with these niche, regulatory-specific tools, coupled with evolving data regulations like the Consumer Data Right (CDR) in 2024, solidify the leverage of key software vendors.

What is included in the product

This analysis meticulously examines the competitive forces shaping Helia Group's industry, revealing the intensity of rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Effortlessly visualize competitive intensity across all five forces—ideal for quickly identifying and addressing strategic threats.

Customers Bargaining Power

Helia's primary customer base consists of Australian lenders, with a significant concentration among the major banks. These large financial institutions collectively hold a dominant share of the Australian mortgage market, giving them considerable leverage.

This high concentration of powerful customers, like the major banks, translates directly into substantial bargaining power for them when negotiating with LMI providers such as Helia. Recent contract discussions have highlighted the extent of this influence, as these major lenders can exert pressure on terms and pricing due to their significant market presence and the essential nature of LMI for their business.

Lenders can switch Mortgage Protection Insurance (MPI) providers, meaning switching costs aren't a major barrier. For instance, ING chose not to renew its exclusive deal with Helia, and CBA is exploring other options. This ability to move on from existing contracts highlights that lenders have leverage.

While Helia still earns revenue from existing policies, the loss of new business is a clear signal. This suggests that the costs and effort for lenders to change their MPI provider aren't so high that they are forced to stay. In 2023, Helia reported a 14% decline in new business volumes, underscoring this point.

Some major lenders have the financial muscle and risk management prowess to self-insure a portion of their high loan-to-value ratio (LVR) mortgages. This capability directly diminishes their need for external mortgage insurance providers, such as Helia.

This self-insurance option significantly bolsters the lenders' bargaining power. It allows them to negotiate more favorable terms and exert downward pressure on the premiums charged by LMI companies.

For instance, if a large bank can absorb a certain level of risk internally, it reduces the volume of business it offers to LMI providers, creating a more competitive environment for insurance pricing.

Impact of Government Schemes on Lender Demand

Government schemes like the Home Guarantee Scheme (HGS) significantly influence lender demand by enabling buyers with low deposits to purchase homes without Lender's Mortgage Insurance (LMI). This directly curtails the need for LMI from lenders for these particular buyer groups. The HGS, for instance, aims to assist a substantial number of first-home buyers each year. In 2023-24, the federal government allocated 35,000 guarantees under the HGS.

The impact of these schemes on the LMI sector is substantial, as they effectively transfer a portion of the risk from private insurers to the government. This government backing allows lenders to extend credit more readily to segments previously considered higher risk, thereby empowering them. For example, the Albanese government's expansion of the HGS to include more categories of buyers, such as single parents and regional buyers, broadens the scope of reduced LMI reliance.

- Government initiatives like the Home Guarantee Scheme reduce the need for LMI.

- The federal government allocated 35,000 guarantees under the HGS in 2023-24.

- These schemes shift risk from private insurers to the government.

- Expanded HGS categories empower lenders by reducing perceived risk.

Lenders' Focus on Cost Efficiency and Competitive Pricing

In the intensely competitive mortgage lending landscape, banks are relentlessly pursuing cost efficiencies and aggressively pricing their products. This drive for lower operational expenses and more attractive borrower rates significantly amplifies their bargaining power with mortgage insurers like Helia. Lenders have a strong incentive to negotiate down LMI premiums or switch to providers offering more competitive pricing structures.

- Cost Pressure: Banks face margin compression, pushing them to secure lower LMI costs.

- Competitive Pricing: Offering lower mortgage rates is a key differentiator, making LMI cost a critical factor.

- Provider Options: The availability of multiple LMI providers means lenders can shop around for the best terms.

- Negotiation Leverage: Lenders can credibly threaten to shift business to competitors if premiums are not reduced.

For instance, in 2024, the Australian mortgage market saw continued competition among lenders, with many focusing on retention and new customer acquisition through rate adjustments. This environment inherently strengthens the bargaining position of these lenders when negotiating terms with their insurance partners, including LMI providers.

Helia's major customers, primarily Australia's large banks, possess significant bargaining power. Their dominance in the mortgage market, coupled with low switching costs for services like Mortgage Protection Insurance (MPI), allows them to exert considerable influence on pricing and contract terms. This is further amplified by government initiatives and the lenders' own capacity for self-insurance, all of which reduce their reliance on external LMI providers.

| Customer Type | Market Dominance | Switching Costs | Bargaining Power Drivers |

| Major Australian Banks | High (dominant share of mortgage market) | Low (e.g., ING not renewing, CBA exploring options) | Market concentration, ability to self-insure, government schemes (HGS reducing LMI need), competitive pricing pressures |

| Lenders Pursuing Cost Efficiencies | N/A | Low | Need to reduce operational expenses and offer competitive borrower rates |

Preview Before You Purchase

Helia Group Porter's Five Forces Analysis

This preview showcases the complete Helia Group Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies. It delves into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, providing actionable insights. You are looking at the actual document, ready for download and immediate use the moment you buy.

Rivalry Among Competitors

The Australian Lenders Mortgage Insurance (LMI) landscape is notably concentrated, with Helia Group and QBE LMI holding the dominant market share. This oligopolistic structure means that decisions made by these key players have a substantial ripple effect across the entire market.

Beyond these two giants, the market includes a handful of smaller, often lender-owned, LMI providers. These smaller entities add some diversity but do not significantly alter the overall concentrated nature of the industry.

The recent entry of Arch Capital Group into the Australian LMI market in late 2023, backed by significant capital, is a noteworthy development. This expansion by a global player injects a new dynamic, potentially intensifying competition, although Helia and QBE continue to be the primary forces.

Helia Group, as Australia's largest LMI provider, actively defends and grows its market share through a distinct service offering. However, the competitive environment is heating up, with the potential loss of the Commonwealth Bank of Australia (CBA) contract from January 2026 highlighting the increasing contest for major client relationships.

While LMI, or lender mortgage insurance, is fundamentally a standardized product, companies like Helia Group can carve out a competitive advantage through superior service quality and digital innovation. This differentiation is crucial in a market where the core offering is similar. Helia actively promotes its differentiated service proposition, aiming to stand out from competitors.

Helia's strategic investment in digital solutions and comprehensive broker education programs underscores its commitment to enhancing customer experience and maintaining a competitive edge. These initiatives are designed to foster customer loyalty and satisfaction, which are key drivers in the LMI sector. For instance, Helia reported a strong Net Promoter Score (NPS) in its recent financial disclosures, indicating high levels of customer advocacy.

Pricing Strategies and Profitability

Competitive rivalry within the industry can significantly impact pricing strategies and, consequently, profitability for companies like Helia Group. Intense competition often leads to pricing pressure, which directly affects gross written premiums and the overall bottom line.

Helia's financial performance in FY24 serves as a clear indicator of this. The group experienced a decrease in both statutory net profit after tax and underlying net profit after tax. A contributing factor cited was the lower benefit derived from negative incurred claims, which can signal a more challenging pricing environment or adverse shifts in claims experience that erode profitability margins.

- Pricing Pressure: Direct competition can force companies to lower prices to attract or retain customers, squeezing profit margins.

- Impact on Premiums: Lower prices directly translate to lower gross written premiums, even if customer volume remains stable.

- Claims Experience: A less favorable claims environment, coupled with competitive pricing, further exacerbates profitability challenges.

- FY24 Results: Helia Group's reported decline in net profit after tax highlights the real-world consequences of these competitive pressures.

Impact of Regulatory Changes and Government Initiatives

Government schemes, such as the Home Guarantee Scheme, directly impact the demand for Lender's Mortgage Insurance (LMI). This initiative allows for low-deposit lending without the necessity of LMI, thereby altering the competitive landscape for LMI providers. For instance, in the 2023-24 financial year, the Australian government expanded the Home Guarantee Scheme, increasing the number of places available, which could lead to a reduction in the need for traditional LMI for eligible borrowers.

LMI providers face a dynamic where they must adapt their strategies and value propositions in response to evolving government policies. This can potentially shrink the addressable market for established LMI products as alternative financing solutions become more accessible. The Australian Prudential Regulation Authority (APRA) also plays a role, with its prudential standards influencing how lenders manage risk, which indirectly affects the LMI market.

- Home Guarantee Scheme Impact: Directly reduces LMI demand by enabling low-deposit lending without LMI.

- Market Adaptation: LMI providers must adjust strategies and value propositions due to policy shifts.

- Regulatory Influence: APRA's prudential standards indirectly shape the LMI market by affecting lender risk management.

Competitive rivalry is intense in Australia's LMI market, primarily between Helia Group and QBE LMI, despite the recent entry of Arch Capital Group. This rivalry pressures pricing, impacting premiums and profitability, as evidenced by Helia's FY24 net profit decline. Differentiation through service and digital innovation, like Helia's focus on broker education and digital solutions, is key to maintaining market share amidst this competition. The potential loss of the Commonwealth Bank contract from January 2026 further underscores the high stakes in client acquisition and retention.

| Metric | Helia Group (FY24) | QBE LMI (FY24 Estimate) | Arch Capital Group (Entry) |

|---|---|---|---|

| Market Share | Largest | Significant | Emerging |

| Key Competitive Actions | Service differentiation, digital investment, broker education | Established relationships, product offerings | Capital backing, global expertise |

| Impact on Profitability | FY24 Net Profit Decline due to claims and pricing | Subject to competitive pricing pressures | Potential to disrupt pricing dynamics |

SSubstitutes Threaten

The Australian Government's Home Guarantee Scheme (HGS) presents a significant substitute for Lender's Mortgage Insurance (LMI). This initiative directly enables eligible first home buyers and specific groups to acquire property with a minimal deposit, often as low as 5%, thereby eliminating the requirement for LMI. This bypass mechanism has demonstrably impacted the LMI sector.

The HGS, through its direct reduction of the perceived risk for lenders by circumventing LMI, poses a substantial threat. For instance, by mid-2024, the scheme had supported over 120,000 home purchases, illustrating its growing reach and the direct displacement of LMI demand. This government intervention fundamentally alters the competitive landscape for LMI providers.

Lender self-insurance, or risk retention, presents a significant threat of substitutes for lenders in the credit market. Large financial institutions, especially those with robust capital reserves and advanced risk management systems, can opt to absorb credit risk directly rather than purchasing LMI. This approach bypasses the need for traditional LMI providers, particularly for loans with lower loan-to-value ratios where the inherent risk is perceived as more manageable.

For instance, many major banks in 2024 have the capacity to absorb a certain level of loan defaults without external insurance. This internal capacity to manage risk directly competes with the services offered by LMI companies. As capital adequacy ratios remain a key focus for regulators, banks are incentivized to optimize their capital allocation, and self-insuring against certain risks can sometimes be more cost-effective than paying premiums.

Parental guarantees or family support present a significant threat of substitution for Helia Group. Many first home buyers now lean on the so-called 'bank of mum and dad' to secure larger deposits and avoid the need for lenders mortgage insurance (LMI). This direct financial assistance allows borrowers to achieve higher loan-to-value ratios, effectively bypassing traditional insurance requirements.

In 2024, data indicates a continued surge in parental support for property purchases. For instance, reports from early 2024 highlighted that a substantial percentage of first home buyers received financial assistance from family, often covering a significant portion of their deposit. This trend directly diminishes the demand for LMI products, which Helia Group primarily offers.

Alternative Risk Transfer Mechanisms

Lenders may also consider alternative risk transfer mechanisms that act as substitutes for traditional lender's mortgage insurance (LMI). These can include various forms of securitization, where pools of mortgages are bundled and sold to investors, often with different credit enhancement structures to mitigate risk. For instance, in 2024, the global securitization market continued to be a significant avenue for risk transfer, though specific data on its direct substitution for LMI in retail mortgages is proprietary and varies by lender.

Bespoke financial instruments and structured products could also emerge as substitutes, offering tailored risk mitigation solutions for lenders. While the retail mortgage space has historically relied heavily on LMI, ongoing innovation in financial markets means new, potentially more cost-effective or flexible, substitutes could become available. For example, the development of more sophisticated credit default swaps or collateralized loan obligations could offer alternative pathways for managing mortgage credit risk.

These evolving financial tools present a potential threat by offering alternative ways for lenders to manage credit risk on their loan portfolios without necessarily relying on LMI providers.

- Securitization: Allows lenders to transfer credit risk by selling mortgage-backed securities to investors.

- Structured Products: Bespoke financial instruments designed for specific risk transfer needs.

- Innovation: The financial market's continuous development can introduce new substitute mechanisms.

Changes in Lending Standards and Risk Appetite

If lenders collectively tighten their lending standards or reduce their appetite for high Loan-to-Value Ratio (LVR) loans, the demand for Lenders Mortgage Insurance (LMI) would naturally decrease. This industry-wide shift, perhaps spurred by regulatory mandates or economic contractions, could significantly diminish the perceived value and necessity of LMI for both borrowers and lenders. For instance, in early 2024, major banks saw a slight uptick in stricter lending criteria, particularly for investors, which could indirectly impact LMI demand.

The threat of substitutes for LMI arises when alternative risk mitigation strategies become more attractive or prevalent. This can include lenders holding higher capital reserves against riskier loans, or borrowers opting for larger down payments to avoid LMI altogether. Some innovative fintech solutions are also emerging that aim to provide alternative forms of credit protection, potentially bypassing traditional LMI products.

- Reduced Demand: A tightening of lending standards by major financial institutions, a common occurrence during periods of economic uncertainty, directly curtails the need for LMI.

- Alternative Risk Management: Lenders might increase their own capital buffers or seek other forms of portfolio insurance, reducing reliance on LMI.

- Borrower Behavior: Increased borrower savings leading to larger down payments bypasses the LMI requirement, thereby substituting the need for the insurance product.

- Emerging Technologies: Fintech innovations could offer alternative credit risk mitigation tools, presenting a direct substitute to LMI.

The threat of substitutes for Lender's Mortgage Insurance (LMI) is significant, driven by government initiatives, evolving lender practices, and borrower behavior. The Australian Government's Home Guarantee Scheme, for example, had supported over 120,000 home purchases by mid-2024, directly reducing the need for LMI by allowing lower deposits.

Lenders themselves, particularly large institutions with strong capital reserves, increasingly opt for self-insurance or risk retention. This trend is fueled by a desire to optimize capital allocation, making direct risk absorption potentially more cost-effective than paying LMI premiums. Many major banks in 2024 possess the capacity to absorb a certain level of loan defaults internally, bypassing traditional LMI providers.

Furthermore, parental guarantees, often referred to as the 'bank of mum and dad', continue to be a substantial substitute. Reports from early 2024 indicated a significant percentage of first home buyers receiving family financial assistance, often covering a large portion of their deposit, thereby eliminating the LMI requirement.

Alternative risk transfer mechanisms like securitization and structured financial products also pose a threat. While specific data on their direct substitution for LMI in retail mortgages is proprietary, the ongoing innovation in financial markets means new, potentially more flexible, substitutes are likely to emerge, offering lenders alternative pathways for managing mortgage credit risk.

| Substitute Mechanism | Impact on LMI Demand | Key Drivers | Examples/Data Points (as of mid-2024) |

|---|---|---|---|

| Government Guarantee Schemes (e.g., HGS) | Direct Reduction | Lower deposit requirements, bypass LMI | Supported over 120,000 home purchases by mid-2024 |

| Lender Self-Insurance/Risk Retention | Reduced Reliance | Capital optimization, cost-effectiveness | Major banks have capacity to absorb defaults |

| Parental Guarantees/Family Support | Direct Reduction | Larger down payments, avoid LMI | Substantial percentage of first home buyers receive family assistance |

| Securitization & Structured Products | Potential Reduction | Alternative risk transfer, market innovation | Global securitization market remains significant |

Entrants Threaten

The threat of new entrants in the Australian Lenders Mortgage Insurance (LMI) market is significantly dampened by the substantial capital requirements and complex regulatory landscape. Aspiring insurers must possess considerable financial reserves to navigate potential losses and comply with strict prudential standards mandated by the Australian Prudential Regulation Authority (APRA). For instance, in 2024, APRA's capital adequacy framework requires LMI providers to maintain robust capital buffers, estimated to be in the hundreds of millions of Australian dollars, making it exceptionally difficult for newcomers to establish a foothold without immense financial backing.

Established relationships with lenders represent a significant barrier to entry for new players in the LMI market. Helia Group, for instance, has cultivated deep, often exclusive, partnerships with major Australian banks and a broad spectrum of financial institutions. These long-standing connections are built on trust, proven track records, and mutually beneficial arrangements, making it difficult for newcomers to secure similar access.

Dislodging these entrenched relationships requires new entrants to offer a compelling value proposition that outweighs the inertia and established comfort levels of existing lenders. The concentrated nature of the Australian banking sector, where a few large institutions dominate, further amplifies this challenge. A new entrant would need to demonstrate exceptional reliability, competitive pricing, and innovative solutions to even begin chipping away at these established ties.

Helia Group, formerly Genworth, benefits from significant brand recognition and a long-established reputation for reliability within the Australian mortgage insurance sector. This history allows them to command trust from both lenders and brokers.

For any new competitor seeking to enter this market, a substantial investment in marketing and building brand awareness is essential. This is a considerable hurdle, as it requires time and significant capital to cultivate the same level of trust Helia already possesses.

In 2024, the mortgage insurance market continues to be influenced by regulatory environments and the ongoing need for confidence in financial service providers. New entrants must overcome the established credibility of incumbents like Helia to gain market traction.

Economies of Scale and Experience Curve

The threat of new entrants for Helia Group, particularly in the low-to-moderate income (LMI) housing sector, is significantly mitigated by the substantial advantages established players enjoy through economies of scale and the experience curve. LMI housing is inherently a volume-driven business. Larger organizations like Helia benefit immensely from economies of scale across critical functions such as risk modeling, claims management, and overall operational efficiency. This scale allows for lower per-unit costs and more sophisticated risk assessment capabilities.

Newcomers would face considerable hurdles in matching the accumulated experience and data sets that incumbents possess. Helia, having operated in this space for a considerable time, has built extensive underwriting and claims data. This data is invaluable for refining risk pricing, optimizing claims processing, and developing more accurate predictive models, creating a significant barrier to entry for those without a similar historical footprint.

- Economies of Scale: Larger LMI housing players like Helia leverage scale in risk modeling, claims management, and operations, leading to cost efficiencies.

- Experience Curve: Established firms benefit from accumulated underwriting and claims data, enhancing risk assessment and pricing accuracy.

- Data Advantage: New entrants lack the deep historical data that allows incumbents to refine their strategies and predict outcomes more effectively.

- Operational Sophistication: The scale achieved by players like Helia enables investment in advanced technologies and processes that are difficult for smaller, newer entities to replicate.

Government Policy and Market Saturation

The Australian Lenders Mortgage Insurance (LMI) market exhibits significant concentration, with a handful of dominant players already controlling a substantial share. This existing market structure presents a formidable barrier to entry. For instance, in 2024, the LMI sector continued to be dominated by a few key providers, making it challenging for new companies to gain traction.

Government initiatives, such as the Home Guarantee Scheme, further impact the threat of new entrants. By directly supporting home buyers and reducing the need for LMI in certain scenarios, these policies effectively shrink the addressable market for LMI providers. This reduction in potential customer volume makes the already competitive segment less appealing for new investment and entry.

- Market Concentration: The Australian LMI market is characterized by a high degree of consolidation, with established players holding significant market share, limiting opportunities for newcomers.

- Government Policy Impact: Schemes like the Home Guarantee Scheme reduce the overall demand for LMI, thereby diminishing the attractiveness of the market for new entrants.

- Reduced Addressable Market: Government interventions directly impact the pool of potential customers for LMI, making the segment less viable for new, less established competitors.

- Maturity of the Segment: The LMI market is mature, meaning growth opportunities are limited, further deterring new entrants who seek higher growth potential.

The threat of new entrants to Helia Group's market is considerably low, primarily due to the massive capital requirements and intricate regulatory framework governing Australia's Lenders Mortgage Insurance (LMI) sector. In 2024, APRA's prudential standards necessitate substantial capital reserves, often in the hundreds of millions of dollars, creating a formidable financial barrier for any potential new player seeking to enter the market. This high cost of entry, coupled with the need for established lender relationships, significantly curtails the influx of new competitors.

| Factor | Impact on New Entrants | Helia Group's Advantage |

|---|---|---|

| Capital Requirements | Extremely High (hundreds of millions AUD in 2024) | Established financial strength and access to capital |

| Regulatory Compliance | Complex and costly to navigate | Experienced in meeting APRA standards |

| Lender Relationships | Difficult to establish, often exclusive | Deep, long-standing partnerships with major banks |

| Brand Recognition & Trust | Requires significant investment and time | High, built over years of operation |

| Economies of Scale & Data | Lacking in sophisticated risk modeling and data analytics | Benefits from extensive historical data and operational efficiency |

Porter's Five Forces Analysis Data Sources

Our Helia Group Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and analysis from leading financial institutions.

We leverage data from reputable sources such as company annual reports, trade association publications, and government economic indicators to comprehensively assess competitive dynamics.