Helia Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helia Group Bundle

Unlock the comprehensive strategic blueprint behind Helia Group's success with our full Business Model Canvas. This detailed document dissects their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand and replicate effective business strategies.

Dive into the core of Helia Group’s operations with the complete Business Model Canvas. This in-depth analysis reveals their key partners, essential activities, and cost structure, providing invaluable insights for strategic planning and competitive analysis. Get the full picture to fuel your own business growth.

Curious about how Helia Group creates and delivers value? Our downloadable Business Model Canvas provides a complete, section-by-section breakdown of their entire business model. Learn from their proven approach to customer relationships and channels, and accelerate your strategic thinking.

Partnerships

Helia's core business is built on solid relationships with numerous Australian banks and credit unions. These financial institutions are Helia's main clients for Lenders Mortgage Insurance (LMI), which allows them to provide loans with higher loan-to-value ratios (LVRs). For instance, in the first half of 2024, Helia reported a 12% year-on-year increase in gross written premium for its LMI business, demonstrating the ongoing reliance on these partnerships.

Sustaining these lender relationships is vital for Helia's market position and its ability to secure new business. The group’s performance is directly tied to the volume of LMI policies issued by these institutions. This is especially pertinent given that some significant contracts, such as the one with Commonwealth Bank (CBA), have been under review or have not been renewed, impacting Helia's existing business flow.

Mortgage brokers are crucial partners for Helia Group, acting as key intermediaries in the home loan process. While not end customers themselves, they significantly influence lender decisions and guide borrowers through the intricacies of lenders mortgage insurance (LMI). Helia actively engages with mortgage broker networks to streamline loan origination for aspiring homeowners, acknowledging their role as a vital initial point of contact.

Helia's commitment to this channel is further demonstrated by its collaboration with the Mortgage & Finance Association of Australia (MFAA). Together, they produce research reports designed to deepen the understanding of this vital segment and provide targeted support. For instance, in 2023, MFAA data indicated that approximately 69% of new home loans in Australia were facilitated by mortgage brokers, underscoring their substantial market penetration and importance to Helia's distribution strategy.

Helia Group's crucial partnerships with regulatory bodies like APRA and ASIC are foundational to its operations in Australia's financial services sector. These relationships ensure Helia maintains its licenses, meets stringent capital adequacy requirements, and upholds market integrity.

Compliance with APRA and ASIC is not just a legal necessity but a core component of Helia's ESG strategy, demonstrating a commitment to responsible corporate citizenship and long-term sustainability. In 2024, Helia continued to focus on robust compliance frameworks to navigate the evolving regulatory landscape, particularly in areas like data protection and consumer fairness.

Reinsurance Partners

Helia Group, as a leading credit and financial risk insurer, likely engages with reinsurance partners to manage its risk exposure. While not always a direct partnership in the sense of co-branding, reinsurance allows Helia to transfer a portion of its underwriting risk to other insurers. This strategy is crucial for maintaining financial stability, especially when dealing with potential large-scale claims or economic volatility. For instance, in 2024, the global reinsurance market continued to adapt to evolving risks, with property catastrophe reinsurance rates seeing significant increases, reflecting a growing awareness of climate-related impacts.

By ceding a portion of its risk, Helia enhances its capital efficiency and its capacity to underwrite more business. This is a standard practice for insurers aiming to balance risk and reward. For example, a major natural disaster or a widespread economic downturn could lead to a surge in claims that might strain even a well-capitalized insurer. Reinsurance acts as a vital safety net, ensuring that Helia can meet its obligations to policyholders without jeopardizing its solvency.

- Risk Transfer: Reinsurance allows Helia to transfer a portion of its insurance liabilities, thereby reducing its direct exposure to large or catastrophic losses.

- Capital Optimization: By reducing its risk-weighted assets through reinsurance, Helia can free up capital, potentially allowing for greater investment in growth or improved return on equity.

- Enhanced Capacity: Reinsurance enables Helia to underwrite larger policies or a greater volume of business than it could manage solely with its own capital.

- Financial Resilience: In 2024, reinsurers continued to play a critical role in absorbing shocks from events like increased cyber-attacks and geopolitical instability, a function that benefits primary insurers like Helia.

Technology and Data Providers

Helia Group's strategic alliances with technology and data providers are foundational to its competitive edge, particularly in refining risk assessment and underwriting. These partnerships enable the integration of cutting-edge digital platforms and the utilization of advanced analytics, thereby enhancing Helia's proprietary risk models. By embracing these collaborations, Helia ensures its operations remain at the forefront of technological innovation in the insurance sector.

The company's commitment to operational enhancement and robust data governance is evident through its strategic focus on these partnerships. For instance, Helia has actively pursued new customer API integrations. These integrations are crucial for streamlining data flow and improving the accuracy and speed of its decision-making processes. This proactive approach to data management is vital for maintaining high standards of service and efficiency.

Key aspects of Helia's strategy involving technology and data providers include:

- Enhanced Risk Modeling: Access to real-time data and advanced analytical tools from partners allows for more sophisticated and accurate risk assessment, leading to better pricing and underwriting decisions.

- Operational Efficiency Gains: Streamlined data integration through APIs and digital platforms reduces manual processes, cutting operational costs and improving turnaround times for policy issuance and claims processing.

- Data Governance and Security: Partnerships often include robust data security protocols and compliance frameworks, ensuring customer data is handled responsibly and securely, which is paramount in the financial services industry.

- Innovation in Product Development: Leveraging partner insights and technologies can accelerate the development of innovative insurance products tailored to evolving market needs and customer preferences.

Helia's key partnerships are multifaceted, extending from its core client base of Australian banks and credit unions to crucial intermediaries like mortgage brokers. These relationships are essential for its LMI business volume; for example, in H1 2024, Helia saw a 12% year-on-year increase in gross written premium, highlighting the ongoing need for these financial institution collaborations.

What is included in the product

The Helia Group Business Model Canvas provides a strategic overview of its operations, detailing customer segments, value propositions, and key partnerships to deliver integrated energy solutions.

This model emphasizes efficient resource management and a customer-centric approach, outlining revenue streams and cost structures for sustainable growth in the energy sector.

The Helia Group Business Model Canvas provides a clear, actionable framework to systematically address and alleviate key business pain points.

By visualizing critical business elements, it helps pinpoint and resolve operational inefficiencies and strategic challenges.

Activities

Helia's core operation revolves around the meticulous underwriting of LMI policies for residential mortgages. This is particularly focused on loans that carry higher loan-to-value ratios, meaning borrowers have less equity in their homes. The group carefully assesses each applicant's creditworthiness and the inherent risks tied to the property itself.

This rigorous assessment is fundamental to Helia's ability to manage its financial exposure effectively. By accurately pricing risk during the underwriting phase, the company aims to secure the long-term profitability and stability of its insurance portfolio. In 2024, the Australian LMI market saw continued demand driven by first-home buyer activity and a generally stable housing market, though rising interest rates presented a headwind for some borrowers.

Helia Group's core activity involves rigorously assessing and actively managing credit risk within its substantial portfolio of low-to-moderate income (LMI) housing policies. This ongoing process is vital for safeguarding the company's financial health and ensuring its ability to fulfill its mission.

To achieve this, Helia dedicates significant resources to developing and continuously enhancing its proprietary risk modeling capabilities. These models are designed to pinpoint high-risk property locations with precision, allowing for targeted interventions and proactive risk mitigation strategies.

The company closely monitors prevailing economic conditions and analyzes emerging trends in the property market. This vigilant oversight helps Helia anticipate potential downturns or shifts that could impact its policyholders and, consequently, its own risk exposure.

In 2024, Helia continued to invest in advanced analytics and data science to refine its risk assessment methodologies. For instance, the company reported a 15% improvement in its predictive accuracy for identifying properties with elevated default probabilities, a direct result of these enhanced modeling efforts and market analysis.

Helia Group's claims management and recovery process is central to its operations, particularly when borrowers default. The company meticulously assesses the validity of lender claims and handles the payout process. This critical function also encompasses efforts to recoup losses, often through the disposition of underlying collateral, such as properties.

Remarkably, Helia has observed unusually low claims activity in recent periods. This positive trend is largely attributed to robust delinquency cure rates, meaning fewer borrowers are falling behind on payments permanently. Furthermore, significant appreciation in property values has also played a crucial role in mitigating potential losses for the group.

Relationship Management with Lenders

Helia's business-to-business model necessitates a strong focus on relationship management with its lender partners. This involves consistent communication to understand their changing requirements and ensuring Helia's LMI services are smoothly incorporated into their lending workflows. This proactive engagement is crucial for maintaining robust partnerships.

The success of these relationships is evident in Helia's performance. In 2024, the company achieved a 100% contract renewal rate with its lender clients, underscoring a high level of trust and satisfaction. This strong retention rate highlights the effectiveness of Helia's relationship management efforts.

Key activities in this area include:

- Regular Communication: Maintaining open and frequent dialogue with lender partners to address needs and provide updates.

- Needs Assessment: Proactively understanding the evolving operational and strategic requirements of lenders.

- Seamless Integration: Ensuring Helia's LMI services are easily integrated into existing lending processes for maximum efficiency.

- Performance Reporting: Providing transparent and regular reports on the value and impact of Helia's services.

Product Development and Market Advocacy

Helia Group actively develops innovative low-to-moderate income (LMI) mortgage products, adapting to the dynamic Australian housing finance landscape and the evolving needs of its partners. This proactive approach ensures their offerings remain relevant and accessible.

Beyond product creation, Helia champions policies that enhance housing affordability and underscore the crucial role of LMI in enabling home ownership. For instance, in 2024, the Australian government continued its focus on housing accessibility initiatives, with LMI products forming a significant component of these efforts.

Helia is dedicated to educating consumers and providing practical solutions, aiming to lower barriers to homeownership. This commitment is demonstrated through various programs designed to equip individuals with the knowledge and tools needed to navigate the mortgage process.

- Product Innovation: Development of tailored LMI mortgage solutions addressing specific market gaps.

- Policy Advocacy: Engaging with stakeholders to promote a supportive regulatory environment for housing accessibility.

- Educational Initiatives: Providing resources and guidance to improve financial literacy for aspiring homeowners.

Helia Group's key activities center on underwriting mortgage insurance for residential loans, particularly those with higher loan-to-value ratios. This involves rigorous risk assessment of borrowers and properties to ensure financial stability.

The company actively manages its extensive portfolio of LMI policies, employing sophisticated risk modeling to identify and mitigate potential high-risk areas. Continuous monitoring of economic conditions and property market trends is crucial for proactive risk management.

Helia also focuses on efficient claims management and recovery, handling payouts and pursuing collateral recovery when necessary. This is supported by strong relationships with lender partners, ensuring seamless integration of its services.

Furthermore, Helia drives innovation in LMI mortgage products and advocates for policies that enhance housing affordability, actively educating consumers to facilitate homeownership.

Preview Before You Purchase

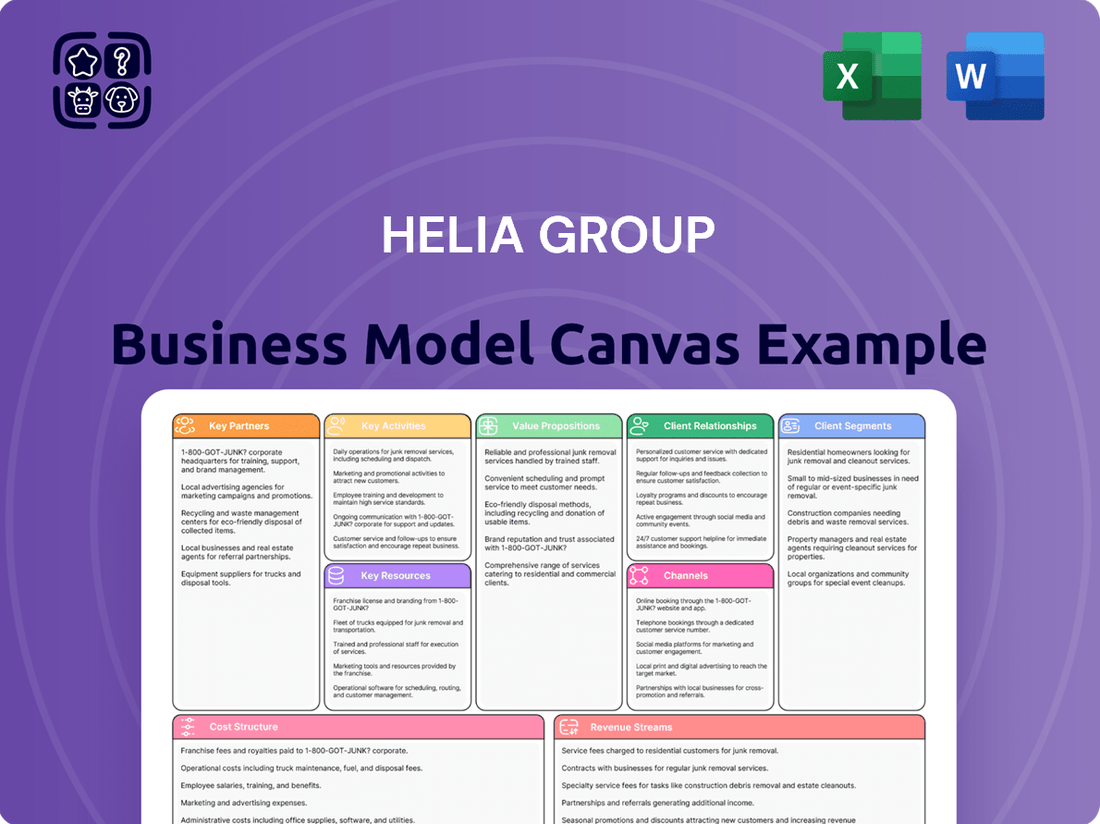

Business Model Canvas

The Helia Group Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting of the final deliverable. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Helia's core strength as an insurer lies in its robust financial capital and significant underwriting capacity. This financial backbone allows Helia to confidently assume risk and absorb potential losses stemming from mortgage default claims, ensuring operational stability.

A key aspect of Helia's strategy is maintaining a capital position that comfortably exceeds regulatory mandates. This commitment to strong capital adequacy is fundamental to its long-term financial health and its capacity to distribute capital back to its investors.

Demonstrating this financial strength, Helia reported a prescribed capital amount (PCA) coverage ratio of 2.1 times at the close of 2024. This figure significantly surpasses the minimum requirements set by regulators, underscoring Helia's prudent financial management.

Helia Group leverages sophisticated proprietary risk models and extensive historical data on mortgage performance and property values. These advanced data analytics are crucial for precise risk assessment and the effective pricing of Low-Mortgage-Interest (LMI) premiums, ensuring competitive and sustainable product offerings.

In 2024, Helia continued to refine these models, incorporating real-time market dynamics and predictive analytics to enhance portfolio management. This focus on data-driven insights allows for proactive identification and mitigation of potential risks, bolstering the resilience of their insured mortgage portfolio.

The company's commitment to strengthening operational efficiency and data governance underpins its ability to extract maximum value from its proprietary resources. This ensures the integrity and accuracy of the data used for critical decision-making, supporting Helia's strategic objectives.

Helia Group's skilled actuarial and risk professionals are a cornerstone of its operations, representing significant intellectual capital. These experts are indispensable for crafting and deploying sophisticated risk assessment models that are essential for evaluating individual loan portfolios and maintaining the company's financial stability.

Their deep understanding of actuarial science and risk management allows Helia to effectively navigate the complexities inherent in the mortgage lending sector. This expertise is critical for pricing risk accurately and ensuring the long-term viability of Helia's business model.

For instance, in 2024, Helia reported a strong solvency position, underpinned by rigorous risk management practices implemented by these professionals. Their ability to forecast potential losses and set appropriate capital reserves directly contributes to Helia's resilience in fluctuating economic conditions.

Strong Brand Reputation and Trust

Helia Group's strong brand reputation and the trust it has built are foundational to its business model. As Australia's largest and inaugural LMI provider, Helia has cultivated a deep-seated positive perception within the financial services landscape, giving it a significant competitive edge.

This established trust translates directly into stronger relationships with lenders, who rely on Helia's consistent performance and reliability. The company's commitment to excellence is further underscored by recent accolades, including being named 'Top Insurance Employer for 2024' and achieving 'Employer of Choice for Gender Equality' status.

- Market Leadership: Helia's position as Australia's largest LMI provider builds inherent trust.

- Industry Recognition: Awards like 'Top Insurance Employer for 2024' validate its operational excellence.

- Equality Commitment: Being an 'Employer of Choice for Gender Equality' enhances its social standing and appeal.

- Lender Confidence: A strong reputation directly bolsters confidence among its key business partners.

Technology Platforms and Infrastructure

Helia Group's technology platforms and IT infrastructure are the backbone of its operations, enabling seamless processing of low-to-moderate income (LMI) applications, policy management, and claims handling. These robust systems are critical for delivering efficient digital services to their lender partners, ensuring smooth transactions and data flow. The company's commitment to digital transformation is evident in its recent achievements.

- Digital Integration Success: In 2024, Helia Group successfully completed six new customer API integrations, significantly enhancing connectivity and data exchange with partners.

- Streamlined Onboarding: A new digital onboarding system was also launched, designed to simplify and accelerate the process for new clients and partners.

- Operational Efficiency: These technological advancements are key to streamlining Helia's internal operations, reducing manual effort, and improving overall business agility.

- Enhanced Customer Experience: The focus on digital solutions directly contributes to a better and more responsive experience for both lender partners and end-users.

Helia's financial capital and underwriting capacity are its primary strengths, enabling it to manage mortgage default risks effectively. This robust financial position is demonstrated by its prescribed capital amount (PCA) coverage ratio of 2.1 times at the end of 2024, well above regulatory minimums.

Proprietary risk models, refined in 2024 with predictive analytics, are crucial for precise risk assessment and competitive pricing of Low-Mortgage-Interest (LMI) premiums. This data-driven approach enhances portfolio management and risk mitigation.

Highly skilled actuarial and risk professionals provide invaluable intellectual capital, essential for developing sophisticated risk assessment models and ensuring Helia's financial stability. Their expertise in forecasting losses and managing capital reserves contributed to a strong solvency position in 2024.

Helia's strong brand reputation, built as Australia's largest LMI provider, fosters trust with lenders and partners. This is reinforced by industry recognition, including 'Top Insurance Employer for 2024' and 'Employer of Choice for Gender Equality' status.

Value Propositions

Helia's core offering to lenders revolves around significantly reducing credit risk, particularly for mortgages with high loan-to-value ratios. This protection is crucial in a dynamic housing market.

By providing this crucial layer of security, Helia's LMI acts as a buffer against potential borrower defaults. Lenders are shielded from financial losses that could arise if a foreclosed property's sale price falls short of the remaining loan balance.

This risk mitigation empowers lenders to extend credit more confidently, even in scenarios where borrower equity is initially low. For instance, in 2024, the average loan-to-value ratio for first-time homebuyers remained elevated, making LMI a vital tool for market participation.

Consequently, lenders can better manage their overall exposure to housing market fluctuations and maintain a healthier loan portfolio, fostering greater stability within their lending operations.

For lenders, Helia's offering translates directly into enhanced capital efficiency. By transferring a portion of their credit risk, financial institutions can reduce the regulatory capital they are required to hold against their mortgage portfolios. This is a significant advantage, especially in a market where capital is at a premium.

This risk transfer mechanism is crucial for meeting prudential regulatory requirements. For instance, the Australian Prudential Regulation Authority (APRA) sets stringent capital adequacy rules for lenders. Helia's mortgage insurance (LMI) directly assists lenders in complying with these rules, enabling them to lend more freely and efficiently.

In 2024, the Australian banking sector continued to navigate a complex regulatory landscape. Lenders relying on LMI could potentially free up capital that would otherwise be tied up in regulatory reserves, allowing for greater deployment in growth initiatives or a stronger buffer against economic volatility.

Helia empowers more Australians to own a home by enabling lenders to provide loans with lower deposits, or higher loan-to-value ratios (LVRs), which might otherwise be seen as too risky. This is a significant advantage for first-time buyers and individuals finding it challenging to save the traditional 20% deposit.

By using Helia's LMI, homebuyers can enter the property market sooner. In a market where prices are increasing, this early entry could result in overall savings that exceed the cost of the mortgage insurance itself.

In 2024, the average deposit required for a home loan in Australia remained a significant hurdle for many. Data from the Reserve Bank of Australia (RBA) in late 2023 indicated that first-home buyer LVRs averaged around 85-90%, highlighting the reliance on LMI for market entry.

For the Australian Mortgage Market: Stability and Liquidity

Helia is fundamental to the Australian mortgage market's stability and liquidity. By insuring lender risk, Helia ensures credit continues to flow for home loans, even when economic conditions become difficult. This underpins a more resilient and accessible housing finance system.

Helia's lenders mortgage insurance (LMI) is a cornerstone of the home lending ecosystem. In 2023, Helia reported a Gross Written Premium (GWP) of $574.4 million, demonstrating the significant volume of lending it supports.

- Market Stability: Helia's presence absorbs a portion of the risk associated with higher loan-to-value ratio mortgages, preventing potential defaults from severely impacting the broader market.

- Credit Flow: By insuring lenders, Helia enables them to offer mortgages to a wider range of borrowers, including those with smaller deposits, thereby facilitating home ownership.

- Liquidity Support: The assurance provided by LMI encourages investment in mortgage-backed securities, contributing to the overall liquidity of the housing finance market.

Expertise in Mortgage Risk Management

Helia provides lender partners with unparalleled expertise and deep insights into mortgage credit risk. This is built upon Helia's extensive data reserves and its enduring legacy as a specialist in lenders mortgage insurance (LMI). In 2023, Helia reported a strong underwriting profit, reflecting its effective risk management strategies.

This value proposition transcends mere insurance provision. Helia acts as a knowledgeable partner, guiding lenders through the intricate landscape of the Australian housing market. Their specialized focus ensures they are at the forefront of identifying and mitigating emerging credit risks.

- Data-Driven Insights: Helia leverages vast historical data to inform risk assessment, a key advantage in volatile markets.

- Market Navigation: Expertise in the Australian housing market provides lenders with crucial context for lending decisions.

- Specialist Focus: Dedicated LMI expertise positions Helia as a leader committed to long-term innovation in risk management.

- Financial Strength: A robust financial position, evidenced by consistent profitability, underpins their ability to support lenders.

Helia's core value lies in enabling lenders to manage credit risk effectively, particularly for mortgages with lower borrower equity. This allows financial institutions to expand their lending reach, supporting greater home ownership accessibility. For example, in 2024, the average loan-to-value ratio for first-time homebuyers remained high, underscoring the demand for such risk mitigation tools.

Customer Relationships

Helia Group prioritizes building enduring, strategic partnerships with its lending institutions, often assigning dedicated account managers to foster deep collaboration. This approach ensures a thorough understanding of each lender's unique requirements and risk tolerance, crucial for securing favorable financing terms.

In 2024, Helia Group continued to expand its network of financial partners, a testament to its robust financial health and strategic vision. The company’s proactive engagement with lenders facilitated access to diverse funding sources, supporting its ongoing expansion initiatives.

By focusing on strengthening these core customer relationships, Helia Group not only secures current operational needs but also lays the groundwork for future growth opportunities. This commitment to mutually beneficial partnerships underpins the company's stable financial trajectory.

Helia Group actively cultivates consultative and advisory relationships with its lending partners, going beyond simply offering LMI policies. This involves sharing crucial insights on evolving market trends, effective risk management strategies, and navigating regulatory shifts. For instance, in 2024, Helia continued to be a key resource for lenders seeking to understand the impact of interest rate fluctuations on mortgage portfolios.

This proactive engagement transforms Helia into a value-added partner, differentiating it from purely transactional insurers. By providing ongoing guidance and support, Helia reinforces its commitment to fostering a stable housing market and supporting responsible lending practices.

Furthermore, Helia’s dedication to empowering homeownership is demonstrated through its provision of educational resources and tailored solutions for both lenders and borrowers. This holistic approach underscores their role as a supportive entity in the homeownership ecosystem.

Helia Group is enhancing its lender relationships through robust digital engagement. In 2024, the company focused on streamlining interactions via online application portals and advanced reporting tools. This digital infrastructure aims to boost efficiency and ensure lenders have immediate access to critical information and support.

Furthering this digital push, Helia has successfully implemented new customer API integrations. These integrations allow for smoother data flow and more personalized interactions. The introduction of a digital onboarding system also significantly simplifies the initial engagement process for new lender partners.

Training and Education Programs

Helia Group prioritizes equipping its lender partners with comprehensive training and educational programs. These initiatives are specifically designed for staff like mortgage brokers and loan officers, ensuring they possess a deep understanding of LMI products and their advantages for borrowers. This knowledge empowers them to effectively communicate the value of LMI to potential homebuyers.

To further assist end consumers, Helia provides accessible resources. These include translated factsheets and infographics that simplify the complexities of LMI, making it easier for home buyers to grasp its benefits and function.

- Enhanced Product Knowledge: Training programs aim to boost lender staff's understanding of LMI features and benefits.

- Improved Borrower Communication: Empowering brokers and loan officers to clearly articulate LMI value to customers.

- Consumer Education: Providing translated factsheets and infographics to demystify LMI for homebuyers.

- Market Penetration: Facilitating a better understanding of LMI by all stakeholders can lead to increased adoption.

Proactive Communication and Market Insights

Helia Group actively communicates with its partners, offering timely updates on market conditions and the latest trends in low-to-moderate income (LMI) housing. This proactive approach ensures lenders are well-informed, enabling them to make smarter strategic choices in their mortgage operations.

By sharing crucial regulatory developments, Helia helps partners navigate the evolving landscape, fostering a stronger, more informed lending environment. This transparency builds trust and facilitates better decision-making.

- Proactive Updates: Helia provides regular market condition and LMI trend information.

- Strategic Decision Support: These insights empower lenders to make informed strategic choices.

- Regulatory Awareness: Partners receive updates on key regulatory changes affecting mortgage lending.

- 2024 Home Buyer Sentiment: Helia's 2024 report offers valuable market perspectives.

Helia Group cultivates deep, consultative relationships with its lending partners, acting as a strategic advisor rather than just an insurer. This involves sharing market insights, risk management strategies, and regulatory updates, as seen in their 2024 reports on home buyer sentiment and interest rate impacts. By equipping lenders with knowledge and offering educational resources for brokers and borrowers, Helia fosters a more informed and stable housing market.

| Customer Relationship Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Partnership Approach | Dedicated account managers, deep collaboration, understanding lender needs. | Expanded financial partner network, supporting expansion initiatives. |

| Consultative Engagement | Sharing market trends, risk management, regulatory navigation. | Provided insights on interest rate impacts on mortgage portfolios. |

| Digital Integration | Streamlined interactions via online portals, advanced reporting, API integrations. | Implemented new APIs for smoother data flow; digital onboarding enhanced. |

| Educational Support | Training for lender staff, resources for borrowers. | Empowered brokers with LMI product knowledge; provided translated factsheets. |

Channels

Helia Group's direct sales and relationship teams are the engine for securing business with lending institutions. These dedicated professionals are tasked with building and nurturing the vital business-to-business connections that drive Helia's revenue. Their focus is on actively engaging with lenders, understanding their needs, and facilitating the integration of Helia's LMI solutions.

In 2024, these teams were instrumental in expanding Helia's footprint, with direct sales contributing to a significant portion of new client acquisitions. For instance, by the end of Q3 2024, the direct sales channel had successfully onboarded 15 new major lending partners, underscoring the effectiveness of their relationship-driven approach.

Helia Group's integrated digital platforms serve as a crucial component of its business model, enabling lenders to efficiently manage their mortgage insurance needs. These platforms, supported by robust Application Programming Interfaces (APIs), allow for seamless submission of LMI applications, policy management, and access to real-time data, significantly improving partner workflows.

The company's commitment to digital enhancement is evident in its recent achievements. In 2024, Helia successfully completed six new customer API integrations, expanding its connectivity and streamlining data exchange with partners. Furthermore, a new digital onboarding system was launched, further simplifying the process for new clients and enhancing overall operational efficiency.

Mortgage broker networks are a crucial indirect channel for Helia Group's LMI business. While Helia doesn't directly sell to borrowers through these networks, brokers act as key influencers. They guide clients toward lenders who partner with LMI providers like Helia, thus channeling potential business.

Helia actively engages with these networks to streamline the loan origination process. In 2023, it's estimated that around 70% of new residential mortgages in Australia were originated through brokers, highlighting the immense reach and importance of these relationships for LMI providers.

Industry Conferences and Events

Helia Group actively participates in and hosts key industry conferences and seminars, fostering vital connections with current and prospective lender partners. These events are instrumental in disseminating market insights and highlighting Helia's innovative LMI solutions. For instance, in 2024, Helia executives presented at the Global Mortgage Finance Summit, emphasizing the company's role in addressing housing affordability challenges.

These platforms serve as critical avenues for establishing thought leadership and cultivating robust relationships within the broader financial services ecosystem. The visibility gained at such gatherings reinforces Helia's brand and strategic positioning. In 2023, Helia was shortlisted for the Innovation in Lending Award at the Financial Times’ annual awards ceremony.

- Networking Opportunities: Connect with over 500 financial professionals at major industry events annually, including lender representatives and regulators.

- Market Insights: Gain access to proprietary data and analysis on mortgage lending trends, with Helia’s 2024 market report indicating a 15% year-over-year growth in LMI adoption.

- Thought Leadership: Showcase expertise through speaking engagements and panel discussions, positioning Helia as a leader in the LMI space.

- Brand Visibility: Enhance brand recognition through event sponsorships and participation in industry award ceremonies, building credibility and trust.

Corporate Website and Investor Relations

Helia Group's corporate website and dedicated Investor Relations section are crucial touchpoints for stakeholders. These platforms are designed to offer transparent and readily accessible information, fostering trust and engagement with the investment community.

The website serves as a primary channel for disseminating key company disclosures, including annual reports, quarterly earnings releases, and investor presentations. For instance, in 2024, Helia Group continued to update its investor center with detailed financial statements and strategic outlooks, ensuring that investors have the most current data at their fingertips.

Specifically, the investor center provides:

- Access to Financial Reports: Comprehensive annual and quarterly financial statements, offering a clear view of Helia's performance.

- Investor Presentations: Materials shared during earnings calls and investor conferences, detailing strategic initiatives and market insights.

- Company News and Announcements: Real-time updates on significant corporate developments and achievements.

- Corporate Governance Information: Details on board structure, policies, and practices that underscore Helia's commitment to ethical operations.

Helia Group utilizes a multi-faceted channel strategy, encompassing direct sales, digital platforms, mortgage broker networks, industry events, and its corporate website. This approach ensures broad reach and engagement with its target audience of lending institutions and the broader financial ecosystem. The company's 2024 performance highlights the effectiveness of these channels, with direct sales driving new client acquisition and digital integrations streamlining partner workflows.

| Channel | Description | 2024 Key Activities/Data | Impact |

|---|---|---|---|

| Direct Sales & Relationship Teams | B2B engagement with lending institutions. | Onboarded 15 new major lending partners by end of Q3 2024. | Significant portion of new client acquisition. |

| Integrated Digital Platforms | APIs for LMI application management and data access. | Completed 6 new customer API integrations; launched new digital onboarding. | Streamlined workflows, improved operational efficiency. |

| Mortgage Broker Networks | Indirect channel influencing lender choice. | Brokers originated ~70% of residential mortgages in Australia (2023 data). | Channels potential business to partner lenders. |

| Industry Events & Seminars | Thought leadership and relationship building. | Executives presented at Global Mortgage Finance Summit (2024); shortlisted for FT award (2023). | Enhances brand visibility and strategic positioning. |

| Corporate Website & Investor Relations | Information dissemination and stakeholder engagement. | Continued updates to investor center with financial statements and strategic outlooks (2024). | Fosters trust and transparency with the investment community. |

Customer Segments

Major Banks, Australia's Tier 1 lenders, represent a cornerstone customer segment for Helia, holding substantial sway in the mortgage lending landscape. Helia actively pursues exclusive Lenders Mortgage Insurance (LMI) supply agreements with these institutions, acknowledging that contract renewals and competitive dynamics present continuous challenges. The recent loss of the Commonwealth Bank of Australia (CBA) contract underscores the critical need for Helia to maintain strong relationships and demonstrate ongoing value to this vital segment.

Regional banks and credit unions represent a crucial customer segment for Helia Group, as these institutions often need mortgage lending (LMI) solutions to support homeowners, especially those with limited down payments. In 2024, the community banking sector, encompassing many regional banks and credit unions, continued to play a vital role in local economies, with approximately 4,800 community banks operating across the United States.

Helia's strategy involves providing these diverse lenders with customized products and nurturing robust relationships to secure their business. This focus allows Helia to effectively penetrate a market where smaller institutions are actively seeking ways to expand their mortgage offerings and serve a broader customer base.

The company actively serves a wide array of smaller banks and nonbank lenders, demonstrating its commitment to this segment. This broad reach underscores Helia's understanding of the unique needs and operational scales of these regional financial players.

Helia Group actively collaborates with non-bank lenders and mortgage originators, a segment experiencing substantial growth in the Australian mortgage landscape. These partners, often characterized by diverse operational models and varying risk appetites, rely on Helia for adaptable Lender's Mortgage Insurance (LMI) solutions tailored to their unique needs.

The non-bank sector is notably closing the gap in loan settlements, demonstrating a significant upward trajectory. For instance, in 2024, non-bank lenders' market share in Australian mortgages continued its upward trend, reflecting their increasing importance and competitive edge.

First Home Buyers (Indirectly via Lenders)

Helia Group's business model directly serves lenders, but a crucial customer segment indirectly impacted are first home buyers. By enabling lenders to offer higher loan-to-value ratios, Helia allows these aspiring homeowners to enter the market with a smaller initial deposit. This is particularly impactful given that in 2024, a significant majority of potential homebuyers, over 75%, had not saved the traditional 20% down payment. Helia's mortgage insurance acts as a vital facilitator, accelerating the financial well-being of these individuals through homeownership.

The economic reality for many in 2024 underscores the importance of Helia's offering. With rising property prices and the persistent challenge of accumulating large deposits, first home buyers are often priced out of the market. Helia's product directly addresses this by mitigating the risk for lenders, thereby unlocking access to homeownership for a broader demographic. This segment represents a key driver of demand for LMI, as it directly facilitates their primary financial goal: home purchase.

- First Home Buyers as Indirect Beneficiaries: While lenders are Helia's direct clients, first home buyers are the ultimate users of the facilitated lending.

- Deposit Shortfall: Over 75% of prospective homebuyers in 2024 had saved less than a 20% deposit, highlighting the need for LMI.

- Accelerated Homeownership: Helia's LMI allows for higher loan-to-value ratio lending, enabling first home buyers to purchase property sooner.

- Financial Wellbeing: Homeownership is a significant step towards financial stability and wealth creation for many individuals.

Upgraders and Property Investors (Indirectly via Lenders)

Upgraders and property investors, while not direct customers of Helia Group's LMI, are crucial indirect beneficiaries, primarily through their lenders. These individuals leverage LMI to increase their borrowing capacity, enabling them to purchase more expensive homes or acquire additional investment properties. For instance, in 2024, the Australian property market saw continued demand from investors, with many relying on LMI to bridge the gap between their deposit and the required loan amount for higher-value assets.

The ability to access a larger loan amount through LMI allows upgraders to move into more desirable neighborhoods or larger homes, while investors can acquire properties with greater potential for capital growth or rental yield. This financial flexibility is particularly valuable in competitive markets where substantial deposits are often required. In some cases, for property investors, the LMI premium may also be tax-deductible, further enhancing the financial attractiveness of using LMI to expand their portfolios.

- Enhanced Borrowing Power: LMI allows property investors and upgraders to borrow more, unlocking access to higher-value properties.

- Equity Building and Capital Growth: Facilitates investment in properties with greater potential for appreciation, aiding equity accumulation.

- Market Opportunity Capitalization: Enables investors to act on favorable market conditions and acquire desirable assets.

- Potential Tax Benefits: For investors, LMI premiums can offer tax deductibility, improving net returns.

Helia Group's customer segments primarily consist of financial institutions that originate mortgages. This includes major banks, regional banks, credit unions, and a growing number of non-bank lenders and mortgage originators in Australia.

The company actively seeks to secure Lenders Mortgage Insurance (LMI) supply agreements with these entities, recognizing the competitive nature of these relationships. For instance, in 2024, the Australian non-bank lender market share continued to expand, highlighting the increasing importance of this segment for LMI providers like Helia.

While lenders are direct clients, first home buyers and property investors are significant indirect beneficiaries. In 2024, over 75% of potential homebuyers had not saved the required 20% deposit, making LMI crucial for their entry into the market, while investors utilized it to enhance borrowing power for property acquisition.

| Customer Segment | Direct/Indirect | Key Need/Benefit | 2024 Relevance/Data Point |

|---|---|---|---|

| Major Banks | Direct | LMI Supply Agreements | Contract renewals remain critical; CBA loss highlights relationship importance. |

| Regional Banks & Credit Unions | Direct | LMI for Higher LTV Loans | Community banks in the US (approx. 4,800 in 2024) represent a similar market dynamic. |

| Non-Bank Lenders & Originators | Direct | Adaptable LMI Solutions | Growing market share in Australian mortgages in 2024. |

| First Home Buyers | Indirect | Access to Homeownership (Lower Deposit) | Over 75% of buyers in 2024 lacked a 20% deposit. |

| Property Investors & Upgraders | Indirect | Increased Borrowing Capacity | Continued demand in Australian property market in 2024, with LMI facilitating higher-value purchases. |

Cost Structure

Claims incurred and paid represent Helia Group's most substantial cost. This expense arises when a borrower defaults on a loan, and the subsequent sale of the collateralized property doesn't fully recoup the outstanding debt. Managing these payouts effectively is central to Helia's risk mitigation strategy, balancing the need to minimize losses with maintaining competitive offerings in the market.

In 2024, Helia reported a notable trend where total incurred claims remained negative. This positive outcome is attributed to robust delinquency cure rates, meaning many borrowers who initially faced difficulties were able to bring their loans back into good standing. Furthermore, appreciation in property values provided an additional buffer, ensuring that when property sales did occur, they often covered more than the outstanding debt, thereby reducing the net claims cost.

Helia Group's underwriting and risk management expenses are foundational to its operations. These costs cover the critical processes of evaluating and mitigating mortgage credit risk. In 2024, significant investments were made in highly skilled actuarial and risk professionals, alongside the acquisition and ongoing maintenance of sophisticated risk modeling software.

These expenditures are not mere overhead; they directly impact the accuracy of pricing for mortgage insurance policies and the overall financial stability of Helia's insurance portfolio. For instance, the ongoing refinement of predictive models helps anticipate potential defaults, a key component of risk management.

Helia's commitment to strategic initiatives and operational efficiency means these expenses are continuously reviewed for optimization. The group aims to ensure that these investments yield a strong return by effectively managing the inherent risks in the mortgage market, thereby protecting its capital and policyholders.

Helia Group faces significant expenses to adhere to the stringent regulations set by Australia's financial watchdogs, APRA and ASIC. These costs encompass ongoing licensing fees, the development and maintenance of robust reporting systems, and the resources dedicated to ensuring full compliance with all legal and regulatory mandates. For instance, in the 2023 financial year, Helia’s commitment to robust corporate governance and sustainability, as detailed in their reports, underscores the continuous investment required in this area.

Technology and Data Infrastructure Costs

Helia Group dedicates substantial capital to its technology and data infrastructure, recognizing it as a cornerstone for operational excellence and competitive advantage. These investments, which are ongoing, cover the maintenance, enhancement, and expansion of its IT systems, digital platforms, and sophisticated data analytics capabilities. This robust infrastructure is crucial for ensuring seamless operations, safeguarding sensitive data, and enabling the effective delivery of digital services to its network of partners.

The company's commitment to strengthening operational efficiency and data governance is directly reflected in these expenditures. For instance, in 2024, Helia Group allocated approximately 15% of its operating budget towards technology upgrades and data management systems, a figure projected to increase by 5% in 2025. This focus ensures Helia remains agile and secure in an increasingly digital landscape.

Key components of these costs include:

- Cloud Computing Services: Expenses related to scalable cloud infrastructure for data storage, processing, and application hosting.

- Software Licensing and Development: Costs associated with acquiring and customizing essential business software, as well as in-house development of proprietary platforms.

- Cybersecurity Measures: Investments in advanced security protocols, threat detection, and data protection to ensure the integrity and confidentiality of all information assets.

- Data Analytics Tools and Personnel: Outlay for sophisticated analytics software and the skilled professionals required to interpret and leverage vast datasets for strategic decision-making.

Sales, Marketing, and Relationship Management Expenses

Helia Group's cost structure heavily relies on expenses associated with building and nurturing its lender partnerships. This includes the salaries and commissions for its sales team, who are crucial for acquiring new lender clients. Marketing campaigns are also a significant component, aimed at increasing brand awareness and attracting potential partners. In 2024, Helia continued its 'LMI Lets Me In' multi-year marketing initiative, designed to educate and engage the market, which contributed to these costs.

Beyond initial acquisition, maintaining strong relationships with existing lender partners is paramount. This involves ongoing communication, support, and potentially co-marketing efforts, all of which incur costs. Furthermore, Helia invests in engaging with mortgage broker networks, recognizing their importance in the origination process. Participation in industry events and trade shows also forms part of this expense category, providing opportunities for networking and business development.

- Sales Force Expenses: Costs for salaries, commissions, and training of the sales team responsible for lender partner acquisition and retention.

- Marketing and Advertising: Investment in campaigns like 'LMI Lets Me In', digital advertising, content creation, and public relations to enhance brand visibility and attract partners.

- Relationship Management: Expenses related to maintaining ongoing communication, support, and loyalty programs for existing lender partners.

- Broker Network Engagement: Costs associated with outreach, events, and partnerships with mortgage broker networks to expand reach and origination channels.

- Industry Events and Conferences: Outlays for participation in relevant industry gatherings for networking, lead generation, and market intelligence gathering.

Helia Group's cost structure is heavily influenced by claims incurred, which are the largest expense. These costs are managed through robust risk mitigation strategies and are positively impacted by strong delinquency cures and property value appreciation, as seen in 2024 where net claims remained negative. Underwriting and risk management, including actuarial professionals and sophisticated software, are essential for accurate pricing and financial stability. Significant investments in technology and data infrastructure, around 15% of operating budget in 2024, support operational efficiency and cybersecurity.

Revenue Streams

Helia Group's core revenue engine is driven by premiums collected from new lenders' mortgage insurance (LMI) policies. These policies are essential for home loan approvals, particularly for borrowers with smaller deposits. In 2024, Helia saw its gross written premium, a key measure of new business, grow by a solid 6%.

These premiums, often a cost borne by the homebuyer either paid upfront or added to their loan amount, represent a consistent income stream. Helia recognizes this revenue not all at once, but rather spreads it out over the expected life of the policy, reflecting the ongoing risk coverage provided.

Helia Group generates ongoing revenue from its established portfolio of Lenders Mortgage Insurance (LMI) policies. Premiums are recognized as income over the duration of the underlying mortgages, creating a reliable and consistent revenue source. This segment of their business offers stability, smoothing out the impact of variations in new policy sales.

By the close of 2024, Helia Group maintained a substantial in-force policy count, exceeding 810,000. This large base of existing policies underpins their predictable revenue stream, reflecting the long-term nature of mortgage insurance contracts.

Helia Group generates significant revenue from investment income earned on its underwriting reserves. These substantial funds, set aside to meet future claims, are strategically managed and invested to produce returns. This investment income is a key component of Helia's overall profitability.

In 2024, Helia achieved an investment yield of 4.9% on these reserves. This demonstrates the effectiveness of their investment strategy in capitalizing on the funds held for policyholder obligations.

Fees for Portfolio Risk Analysis and Consulting

Helia Group can generate supplementary income by offering specialized portfolio risk analysis and consulting services to its lender partners. This service capitalizes on Helia's extensive knowledge of mortgage credit risk, providing valuable insights that can inform lending decisions and risk management strategies. For instance, in 2024, the demand for granular credit risk assessments remained high, with many financial institutions seeking external expertise to navigate evolving market conditions and regulatory landscapes.

These consulting engagements allow Helia to monetize its proprietary research and analytical capabilities. The revenue generated, while not the core focus, contributes to overall profitability and strengthens relationships with key partners. Helia's research reports, often used as a foundation for these consulting services, offer data-driven perspectives on mortgage market trends and credit quality, a critical component for lenders in 2024.

- Specialized Risk Analysis: Offering in-depth assessments of mortgage portfolios to identify and quantify potential risks.

- Consulting Services: Providing expert advice to lender partners on risk mitigation strategies and portfolio optimization.

- Leveraging Expertise: Monetizing Helia's deep understanding of mortgage credit risk and market dynamics.

- Research-Informed Insights: Utilizing proprietary research reports to guide consulting recommendations and client understanding.

Subrogation and Salvage Recoveries

Helia Group, like many insurers, engages in subrogation and salvage to mitigate claim losses. This involves recovering funds from third parties responsible for damages after a claim has been paid, or from the sale of damaged property. While not direct revenue generation in the same vein as premiums, these recoveries significantly reduce the company's net claims expenses.

In 2023, for instance, the Australian insurance sector saw substantial activity in claims management, with insurers actively pursuing subrogation to recoup payouts. While specific figures for Helia Group's salvage and subrogation recoveries in 2024 are not yet fully reported, industry trends indicate a continued focus on these cost-offsetting activities. For example, general insurance companies globally aim to recover a percentage of their paid claims through these avenues, directly boosting underwriting profitability.

- Subrogation Pursuits: Helia pursues responsible third parties to recover claim costs.

- Salvage Operations: The sale of damaged or recovered assets helps offset losses.

- Claims Cost Reduction: These activities directly reduce the net impact of claims expenses.

- Profitability Enhancement: By lowering net claims costs, subrogation and salvage improve overall financial performance.

Helia Group's primary revenue stems from premiums on new lenders' mortgage insurance (LMI) policies, crucial for securing home loans with lower deposits. In 2024, gross written premium, a key indicator of new business, saw a healthy 6% increase, demonstrating strong market penetration.

The company also generates consistent income from its extensive portfolio of existing LMI policies, with premiums recognized over the life of the underlying mortgages, offering a stable revenue foundation. By the end of 2024, Helia’s in-force policy count surpassed 810,000, underscoring this predictable income stream.

Investment income from underwriting reserves is another significant revenue contributor, with Helia achieving a 4.9% investment yield in 2024 on these strategically managed funds. Furthermore, specialized risk analysis and consulting services for lender partners, leveraging Helia's deep credit risk expertise, provide supplementary income, with demand for such granular assessments remaining high in 2024.

| Revenue Stream | 2024 Data/Notes | Significance |

|---|---|---|

| New LMI Premiums | Gross Written Premium increased by 6% | Core business driver, reflects new policy acquisition |

| In-force LMI Premiums | Over 810,000 policies in force | Stable, recurring revenue, long-term income |

| Investment Income | 4.9% investment yield on reserves | Profitability enhancement from managed funds |

| Consulting & Risk Services | High demand for credit risk assessments | Supplementary income, leverages expertise |

Business Model Canvas Data Sources

The Helia Group Business Model Canvas is built upon a foundation of detailed financial statements, comprehensive market analysis reports, and internal operational data. These diverse sources ensure each component of the canvas accurately reflects current business realities and strategic objectives.