Heijmans PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heijmans Bundle

Heijmans operates within a dynamic landscape, significantly influenced by political stability, economic fluctuations, and evolving social attitudes. Our comprehensive PESTLE analysis delves into these critical external factors, revealing how they shape Heijmans's strategic decisions and market position. Understanding these forces is paramount for any stakeholder seeking to navigate the construction and property development sector. Don't get left behind; gain a strategic advantage by purchasing the full, detailed analysis today.

Political factors

The Dutch government actively shapes the housing sector through various policies, notably focusing on boosting the supply of affordable housing and implementing rent regulations. These initiatives directly influence companies like Heijmans, which are deeply involved in property development and construction.

The Affordable Rent Act, for instance, is a key policy impacting Heijmans. This legislation introduces rent controls for mid-range housing, which can alter investor strategies and the overall financial viability of development projects, potentially affecting Heijmans' profitability and project pipelines.

In 2024, the Dutch government continued its commitment to addressing housing shortages, with ongoing discussions and potential implementations of further measures. For Heijmans, this means a dynamic regulatory environment where policy shifts can significantly alter market conditions and development opportunities.

Government spending on infrastructure projects significantly influences Heijmans' infrastructure division. The Dutch government has outlined substantial investments aimed at maintaining and upgrading existing infrastructure, along with developing new projects to enhance economic competitiveness.

These initiatives, such as the Zuidasdok project in Amsterdam, which involves extensive road and rail network upgrades, and the Hollandse Kust Noord Wind Farm, a major offshore wind energy project, directly translate into opportunities for Heijmans. The projected total investment for the Zuidasdok is around €1.1 billion, with significant portions allocated to construction and engineering services.

Heijmans is well-positioned to benefit from this increased government expenditure. The company's expertise in civil engineering and construction aligns perfectly with the types of projects being prioritized. For instance, the Netherlands has committed to significant investments in renewable energy infrastructure, with the offshore wind sector alone seeing substantial planned development through 2030.

Heijmans' operations are significantly shaped by the evolving regulatory landscape, particularly the implementation of the Environment and Planning Act (Omgevingswet) and the Quality Assurance Act (Wkb). These legislative changes are designed to streamline building regulations and permit procedures, potentially accelerating project delivery. However, the practical application of the Omgevingswet varies considerably among different municipalities, introducing a layer of complexity that Heijmans must navigate to manage project timelines and associated costs effectively.

Sustainability Targets and Legislation

The Dutch government's commitment to a circular economy by 2050 and significant greenhouse gas emission reduction targets directly shape the construction industry. Heijmans' strategic focus on aligning with these mandates, which includes ambitious CO2 reduction goals, is paramount for its future success. For instance, by 2030, the Netherlands aims to cut emissions by 55% compared to 1990 levels, a target that heavily influences material sourcing and energy efficiency in construction projects. Heijmans' proactive investments in circular construction methods are not just about compliance; they are essential for winning public tenders and maintaining a competitive advantage in a market increasingly driven by sustainability. This includes adopting practices that minimize waste and maximize material reuse, directly responding to legislative pressures and evolving client expectations.

Heijmans' dedication to sustainability aligns with key governmental directives:

- Circular Economy: The Netherlands aims for a fully circular economy by 2050, impacting material sourcing and waste management in construction.

- CO2 Reduction: National targets, such as the 2030 goal of a 55% emission reduction from 1990 levels, necessitate energy-efficient building practices and lower-carbon materials.

- Public Tenders: Demonstrating adherence to these sustainability targets is increasingly a prerequisite for securing lucrative public construction contracts.

- Competitive Edge: Investments in circular construction methods and CO2 reduction strategies position Heijmans favorably against competitors.

Political Stability and Economic Stimulus

Political stability significantly influences Heijmans' operational landscape. An unstable coalition government in the Netherlands, for instance, can create policy gridlock, delaying crucial infrastructure and housing projects. This uncertainty can directly impact Heijmans' ability to secure large-scale contracts and plan long-term investments, as seen in periods of government formation delays that stall public tenders.

Conversely, proactive government intervention can foster a more conducive environment. Initiatives aimed at boosting new construction, such as the Dutch government's commitment to building 900,000 homes by 2030, directly benefit construction firms like Heijmans. Addressing structural issues, like the ongoing efforts to streamline permitting processes and expand grid capacity, are vital for project execution.

Specific government policies can provide tangible support. For example, the Dutch Ministry of Infrastructure and Water Management's investments in sustainable transport and renovation projects, often detailed in their multi-year programs, create opportunities. In 2024, the government allocated billions towards infrastructure upgrades, a portion of which flows into the construction sector.

- Policy Uncertainty: Recent Dutch elections in November 2023 led to a period of government formation uncertainty, potentially delaying key policy decisions impacting the construction sector.

- Stimulus Measures: The Dutch government’s housing agenda, aiming for 900,000 new homes by 2030, provides a significant demand driver for construction companies like Heijmans.

- Infrastructure Investment: Continued government spending on infrastructure, such as road and rail upgrades, creates a stable pipeline of work for companies involved in large civil engineering projects.

- Regulatory Environment: Evolving environmental regulations and building standards, influenced by political decisions, require Heijmans to adapt its practices and invest in sustainable solutions.

Political factors significantly shape Heijmans' operating environment through government policies and stability. The Dutch government's focus on housing supply and rent regulations, such as the Affordable Rent Act, directly impacts project viability and investor strategies. Ongoing government investment in infrastructure, exemplified by projects like Zuidasdok (estimated €1.1 billion), creates substantial opportunities for Heijmans' civil engineering division.

The nation's commitment to sustainability, including circular economy goals and emission reduction targets (55% by 2030), necessitates Heijmans' adaptation to greener construction practices and influences its competitiveness in public tenders. Political stability is crucial, as government formation uncertainty, like that following the November 2023 elections, can lead to policy delays and affect project pipelines.

| Policy Area | Government Target/Initiative | Impact on Heijmans |

|---|---|---|

| Housing | 900,000 new homes by 2030 | Increased demand for construction services |

| Infrastructure | Multi-year investment programs | Stable pipeline for civil engineering projects |

| Sustainability | Circular economy by 2050, 55% CO2 reduction by 2030 | Requirement for sustainable practices, competitive advantage |

| Regulation | Environment and Planning Act (Omgevingswet) | Potential for streamlined procedures but also municipal variations |

What is included in the product

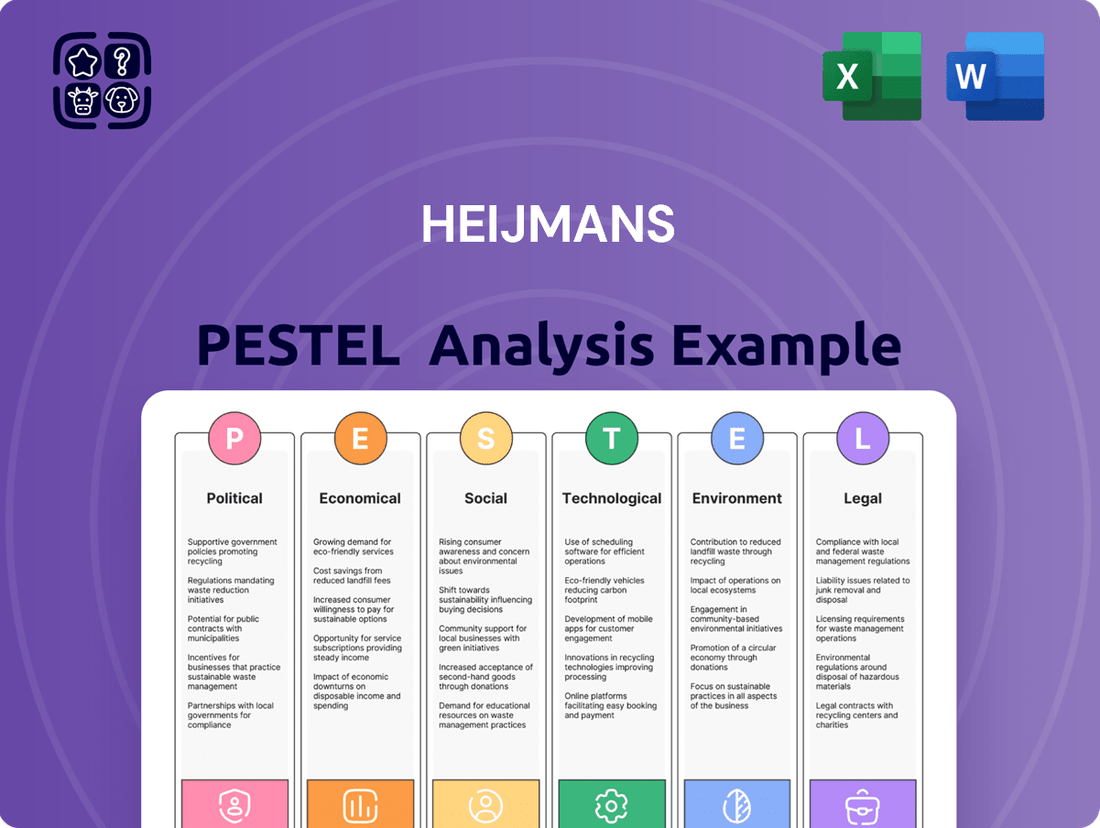

This Heijmans PESTLE analysis provides a comprehensive overview of how external macro-environmental factors, categorized as Political, Economic, Social, Technological, Environmental, and Legal, influence the company's operations and strategic positioning.

The Heijmans PESTLE Analysis acts as a pain point reliever by offering a structured framework to proactively identify and mitigate external threats and opportunities, ensuring strategic decisions are informed and adaptable to the ever-changing market landscape.

Economic factors

Interest rate movements are a major driver for Heijmans' housing business. When rates rise, mortgages become more expensive, which dampens demand for new homes. Conversely, lower interest rates make buying more attractive.

In 2024, we observed a slowdown in new housing construction. However, projections for 2025 suggest a potential uptick. This is supported by an anticipated increase in building permits and a modest easing of interest rates, which should translate into better sales for Heijmans.

Rising inflation continues to put pressure on Heijmans, directly impacting project profitability through increased construction material costs. For instance, the price of cement, a key component in many projects, saw significant increases throughout 2023 and early 2024. This trend necessitates robust supply chain management to secure materials at more stable prices and may require Heijmans to implement strategic pricing adjustments to offset these escalating expenses and wage pressures.

The Dutch labor market, particularly within the construction and engineering sectors, faces significant shortages of skilled professionals. This scarcity directly translates into upward pressure on wages, increasing operational costs for companies like Heijmans. For instance, in early 2024, the Dutch construction sector reported a persistent deficit of skilled workers, with some estimates suggesting a need for tens of thousands of new employees to meet project demands.

Heijmans must proactively address these labor market dynamics to maintain project execution and competitiveness. Strategic responses could include substantial investments in internal training and development programs to upskill existing staff and attract new talent. Furthermore, adjusting wage structures to remain competitive is crucial, alongside exploring the viability of international recruitment to broaden the talent pool and secure necessary expertise for ongoing and future projects.

GDP Growth and Construction Output

The economic health of the Netherlands, particularly its GDP growth, is a significant driver for Heijmans. A strong economy generally translates to more demand for construction services, impacting both revenue and the availability of new projects. The construction sector’s performance is intrinsically linked to Heijmans' operational success.

While the Dutch construction sector experienced a slight downturn, with output decreasing in 2024, there are positive signs for the near future. Projections indicate a modest recovery in 2025, largely fueled by anticipated investments in new housing developments and essential infrastructure projects. This anticipated rebound is crucial for Heijmans' project pipeline and overall financial performance.

- Dutch GDP Growth: Forecasted to be around 1.5% for 2024 and projected to strengthen slightly to 1.7% in 2025, according to recent economic outlooks.

- Construction Output: Experienced a contraction of approximately 2% in 2024.

- 2025 Outlook: Expected to see a positive growth of around 1.0% to 1.5% in construction output.

- Key Drivers: Government initiatives for housing construction and infrastructure upgrades are anticipated to boost the sector.

Investment Climate and Foreign Capital

Changes in the investment climate, especially concerning housing projects, can significantly impact Heijmans. Government policies, such as altered tax incentives or stricter lending regulations introduced in late 2024 or early 2025, could dampen international investor interest in the Dutch real estate market. For instance, if the Dutch government were to adjust corporate tax rates or introduce new property levies, this could directly affect the expected returns for foreign capital.

Heijmans' success hinges on its capacity to draw in investment for its diverse projects and uphold rigorous financial management. In 2024, Heijmans reported total revenue of €1.7 billion, demonstrating its operational scale. Maintaining a healthy balance sheet and a clear strategy is vital for securing the necessary capital for future development, especially as interest rates and economic outlooks evolve through 2025.

- Government Policy Impact: Potential shifts in Dutch housing policy or broader economic regulations in 2024-2025 could alter foreign investor appetite.

- Capital Attraction: Heijmans' ability to secure funding for its €1.7 billion revenue-generating operations in 2024 is key to its growth trajectory.

- Financial Discipline: Maintaining strong financial health is paramount for attracting and retaining investment in a dynamic market.

- Investor Confidence: Factors influencing the overall investment climate, such as inflation rates and geopolitical stability, will play a role in foreign capital flows.

The Dutch economy's performance directly influences Heijmans. With GDP growth projected at 1.5% in 2024 and a slight increase to 1.7% in 2025, the sector anticipates a boost. Despite a 2% contraction in construction output in 2024, a 1.0%-1.5% recovery is expected in 2025, driven by housing and infrastructure investments.

| Economic Indicator | 2024 (Estimate) | 2025 (Projection) |

|---|---|---|

| Dutch GDP Growth | 1.5% | 1.7% |

| Construction Output Change | -2.0% | +1.0% to +1.5% |

Full Version Awaits

Heijmans PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Heijmans delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's operations. It provides actionable insights for strategic planning and decision-making within the construction and property development sectors.

Sociological factors

Urbanization continues to reshape demand, with a growing number of people moving to cities. This trend, coupled with an aging population, means there's a greater need for diverse housing options. Think smaller, more manageable city apartments for younger urban dwellers and homes designed for easier living for older adults.

Heijmans must adapt its projects to meet these changing societal needs. For instance, in 2023, approximately 65% of the global population lived in urban areas, a figure projected to reach 68% by 2030, according to UN data. This highlights a significant market for urban development and renovation that caters to varied demographic groups.

The company's project pipeline needs to reflect this. By focusing on accessible design features and smaller, efficient urban living spaces, Heijmans can better align with the evolving preferences driven by these demographic shifts. This strategic alignment is crucial for sustained growth and relevance in the construction and property development sectors.

Consumers increasingly desire homes that are not only energy-efficient but also incorporate smart technology for convenience and cost savings. This shift is particularly evident in markets like the Netherlands, where Heijmans operates. For instance, in 2024, a significant portion of new home buyers expressed a willingness to pay a premium for homes equipped with advanced energy-saving features and smart home capabilities, reflecting a clear market trend.

Heijmans' strategic emphasis on sustainable development and innovative technical solutions directly aligns with these evolving living preferences. By prioritizing eco-friendly materials and smart building systems, the company positions itself to capture a larger share of this growing market segment. Their commitment to circular construction principles, for example, resonates with environmentally conscious buyers.

Public acceptance is a cornerstone for large infrastructure and property developments, a reality Heijmans navigates closely. For instance, in 2024, projects like the A12 highway renovation in the Netherlands saw extensive public consultations to mitigate disruption and environmental concerns. Effective community engagement, involving transparent communication and addressing local feedback, directly impacts project timelines and budgets, as delays due to public opposition can add significant costs.

Workforce Skills and Education

The construction industry, including companies like Heijmans, faces a growing need for specialized skills in areas such as circular economy principles, digitalization, and advanced construction methods. This shift demands a proactive approach to workforce development. For instance, the adoption of Building Information Modeling (BIM) is becoming standard, requiring employees to be proficient in digital design and collaboration tools.

Heijmans' commitment to upskilling its workforce is paramount for staying competitive. In 2023, the company reported significant investment in training programs, aiming to equip its employees with the competencies needed for these evolving demands. Attracting new talent with modern skill sets is equally crucial for innovation and operational efficiency.

- Demand for Digital Skills: Proficiency in BIM and other digital platforms is increasingly essential across project lifecycles.

- Circular Economy Expertise: Knowledge of sustainable materials, waste reduction, and recycling techniques is vital for Heijmans' green initiatives.

- Upskilling Investment: Heijmans' ongoing training programs focus on adapting to new technologies and methodologies.

- Talent Acquisition: The company actively seeks individuals with expertise in areas like modular construction and prefabrication.

Health and Safety Standards

The construction industry is facing increasing societal pressure to prioritize worker well-being, leading to more rigorous health and safety standards. Heijmans' proactive stance, exemplified by their willingness to halt operations when safety protocols aren't adequately met, directly addresses this evolving expectation. This commitment is not just about compliance; it's about fostering a culture where safety is paramount.

This societal shift translates into tangible operational requirements for companies like Heijmans. In 2023, for instance, the Dutch construction sector saw a reported decrease in fatal accidents, yet the focus on preventing all types of injuries remains intense. Heijmans' investment in safety training and equipment is therefore crucial for maintaining its social license to operate and attracting skilled labor.

Heijmans' dedication to safety is further underscored by specific initiatives and performance metrics. For example, in their 2024 outlook, they emphasized continued investment in safety programs and aiming for a further reduction in incident rates. This focus is critical as regulatory bodies and clients alike scrutinize safety performance more closely than ever before.

- Societal Expectation: Growing public and employee demand for safer working environments in construction.

- Heijmans' Response: A policy of pausing work if safety measures are insufficient, demonstrating a commitment to worker welfare.

- Industry Trend: A continuous drive across the construction sector for improved safety records and reduced accident rates.

- Strategic Implication: Maintaining high safety standards is essential for Heijmans' reputation, talent acquisition, and regulatory compliance.

Societal expectations are increasingly shaping the construction industry, with a growing emphasis on sustainability, community engagement, and worker well-being. Heijmans must align its operations with these evolving values to maintain its social license and market relevance.

For instance, public consultations are now standard for major projects, as seen with the A12 highway renovation in 2024, where addressing local feedback was critical. Furthermore, a strong focus on worker safety is paramount; in 2023, the Dutch construction sector saw continued efforts to reduce accident rates, highlighting the importance of Heijmans' proactive safety protocols.

The demand for specialized skills, particularly in areas like digital technologies and circular economy principles, is also a significant sociological factor. Heijmans' investment in workforce development, including upskilling programs in 2023, directly addresses this need to ensure its employees are equipped for future industry demands.

| Sociological Factor | Description | Heijmans' Relevance/Action | Data Point (2023-2025) |

|---|---|---|---|

| Urbanization & Demographics | Shift towards urban living and an aging population | Need for diverse housing (apartments, accessible homes) | 65% global urban population in 2023, projected to reach 68% by 2030 (UN) |

| Consumer Preferences | Demand for energy efficiency and smart home technology | Focus on sustainable development and innovative technical solutions | Increased willingness to pay a premium for smart/eco-friendly homes in NL (2024) |

| Public Acceptance | Need for community engagement in infrastructure projects | Transparent communication and addressing local feedback is key | Extensive public consultations for A12 highway renovation (2024) |

| Workforce Skills | Growing need for digital and circular economy expertise | Investment in upskilling and talent acquisition | Significant investment in training programs (2023) |

| Worker Well-being | Increased pressure for rigorous health and safety standards | Commitment to safety protocols, pausing work if necessary | Continued drive for reduced incident rates in Dutch construction (2023) |

Technological factors

The construction industry's embrace of Building Information Modeling (BIM) and digital technologies is revolutionizing project execution. This shift is improving precision, fostering better teamwork, and boosting overall efficiency. For instance, the UK government mandated BIM Level 2 for all centrally procured public projects by April 2016, highlighting the growing industry standard. This digital transformation allows for more accurate planning and resource allocation, directly impacting project timelines and costs.

Heijmans' strategic investment in digitalization, including AI-powered tools for design, simulation, and project oversight, positions the company for substantial operational gains. By leveraging these advancements, Heijmans can optimize workflows, identify potential issues early, and enhance decision-making processes. The company reported a 13% increase in revenue for 2023, partly attributed to its focus on innovation and efficiency improvements, demonstrating the tangible benefits of its digital strategy.

The construction industry is seeing a significant shift towards modular and industrialized building methods. This trend is driven by the desire for faster project completion, enhanced quality control, and increased design flexibility. Factory-produced components, like prefabricated walls and modules, are becoming more sophisticated, allowing for quicker on-site assembly and reduced waste. This approach often leads to more predictable costs and a more controlled manufacturing environment, which can be particularly beneficial in a fluctuating market.

Heijmans is actively embracing these technological advancements. The company's investment in modular construction, including its new facility for producing timber-frame houses, highlights its commitment to innovation. In 2023, Heijmans reported a 6% increase in revenue for its building and technology division, partly attributed to its growing modular offerings. This strategic focus positions Heijmans to capitalize on the increasing demand for efficient and sustainable building solutions, aiming to deliver higher quality homes at a potentially faster pace.

Heijmans is actively innovating in sustainable materials, like geopolymer concrete and 100% circular asphalt, which significantly cut down environmental harm and boost energy efficiency in construction projects. These advancements align with the growing demand for greener building practices.

The company's commitment is evident in its application of these advanced materials and the development of eco-friendly production facilities. For example, Heijmans' circular asphalt initiatives aim to reduce CO2 emissions by as much as 50% compared to traditional methods, a key metric in the industry's sustainability drive.

This focus on pioneering sustainable construction techniques positions Heijmans as a frontrunner in an increasingly environmentally conscious market. In 2024, the construction sector saw a 15% increase in demand for certified sustainable building materials, a trend Heijmans is well-placed to capitalize on.

Automation and Robotics

Automation and robotics offer significant potential for Heijmans to boost productivity and safety in construction. By integrating these technologies, Heijmans can streamline operations, from prefabrication to on-site assembly, thereby reducing reliance on manual labor. This is particularly relevant given ongoing labor shortages within the sector. For example, the global construction robotics market was valued at approximately $1.7 billion in 2022 and is projected to reach $4.5 billion by 2030, indicating a strong growth trend and the increasing adoption of these solutions.

Heijmans can leverage automation to improve the quality and consistency of its projects while also creating a safer working environment. Robots can handle repetitive or hazardous tasks, minimizing the risk of accidents. The implementation of autonomous vehicles for material transport or robotic arms for bricklaying are prime examples of how this can be achieved.

- Increased Productivity: Automation can speed up construction timelines, allowing Heijmans to complete projects more efficiently.

- Reduced Labor Costs: While initial investment is required, automation can lead to long-term savings by reducing the need for extensive manual labor.

- Enhanced Safety: Robots can perform dangerous tasks, significantly lowering the incidence of workplace injuries.

- Improved Quality: Automated processes often result in greater precision and consistency in construction work.

Smart City Solutions and IoT Integration

The increasing focus on smart city development and the pervasive integration of the Internet of Things (IoT) within buildings and infrastructure present significant avenues for Heijmans. By offering advanced technical solutions, the company can tap into a growing market for intelligent infrastructure management and connected building systems. These innovations are designed to elevate both living and working environments, making them more efficient and responsive.

Heijmans can leverage the trend towards smart urban planning by providing solutions that optimize resource management, enhance public safety, and improve overall urban functionality through connected technologies. The demand for smarter, more sustainable urban living is a key driver in this sector.

- Smart City Market Growth: The global smart city market was projected to reach approximately $2.5 trillion by 2026, indicating substantial growth potential for companies like Heijmans offering integrated solutions.

- IoT in Construction: Adoption of IoT in construction is expected to streamline operations, with benefits like real-time monitoring and predictive maintenance becoming standard.

- Connected Buildings: The market for smart building technology, including integrated HVAC, lighting, and security systems, is expanding rapidly, driven by energy efficiency and occupant comfort demands.

Technological advancements are reshaping construction, with digital tools like BIM enhancing project precision and collaboration, as evidenced by government mandates. Heijmans' investment in AI and digitalization is driving efficiency, contributing to their 13% revenue increase in 2023.

Modular construction and sustainable materials are gaining traction, offering faster builds and reduced environmental impact; Heijmans' modular initiatives and circular asphalt, which cuts CO2 by up to 50%, align with this trend, supporting a 6% revenue growth in their building and technology division in 2023. The demand for sustainable materials grew by 15% in 2024.

Automation and robotics offer significant boosts in productivity and safety, with the global construction robotics market projected to reach $4.5 billion by 2030. Smart city development and IoT integration are creating new markets for connected infrastructure, with the smart city market expected to reach $2.5 trillion by 2026.

Legal factors

The implementation of the Quality Assurance for Construction Act (Wkb) in the Netherlands, phased in from January 2024, significantly impacts construction firms like Heijmans. This legislation mandates independent quality assurance and places greater liability on builders for any construction defects that may arise.

Heijmans must therefore prioritize rigorous adherence to these strengthened building codes and the associated quality assurance processes. This includes investing in robust internal quality control mechanisms and ensuring all projects meet the new, higher standards to mitigate increased liability risks.

Failure to comply could lead to substantial financial penalties and reputational damage. For instance, the Dutch Ministry of the Interior and Kingdom Relations anticipates the Wkb to reduce construction defects by 30% over time, underscoring the seriousness of the regulatory shift.

The new Environment and Planning Act (Omgevingswet), effective from January 2024, significantly reshapes how environmental and planning regulations are managed in the Netherlands. This comprehensive legislation aims to simplify permit processes, but its activity-based permitting approach and the requirement for municipalities to develop integrated environmental plans introduce new layers of complexity for companies like Heijmans.

Heijmans must now meticulously navigate these evolving legal frameworks, which govern a wide array of spatial and technical construction activities. Understanding the nuances of these new regulations is crucial for timely project execution and compliance, especially as municipalities implement their specific environmental plans.

For instance, the transition to the Omgevingswet means Heijmans will encounter a unified digital system for permit applications and a more integrated approach to environmental considerations across all its projects. This shift requires adapting existing internal processes to align with the new legal landscape, potentially impacting project timelines and costs if not managed proactively.

The act's emphasis on local environmental plans means Heijmans needs to stay closely informed about the specific requirements and timelines set by individual municipalities where it operates. This localized approach to environmental planning necessitates diligent monitoring and engagement at the municipal level to ensure ongoing legal adherence and efficient project development.

Changes in Dutch labor laws, particularly those concerning temporary employment contracts and working conditions, directly influence Heijmans' operational flexibility and associated labor costs. For instance, evolving regulations around the use of flexible staffing can necessitate adjustments in how Heijmans manages its workforce, potentially impacting project timelines and budget allocations.

The Dutch labor market's inherent flexibility, characterized by a significant proportion of temporary contracts, offers Heijmans opportunities to scale its workforce efficiently in response to project demands. However, this also presents challenges in maintaining workforce stability and ensuring consistent skill development across a more fluid employee base.

In 2024, the Dutch government continued to focus on labor market reforms aimed at reducing the precariousness of temporary work, which could lead to stricter rules on contract durations and termination. This ongoing legislative landscape requires Heijmans to remain agile in its HR strategies to comply with new mandates and manage potential increases in fixed labor costs.

Rental Market Regulation

New legislation, such as the Affordable Rent Act taking effect in July 2024, alongside existing rent increase caps, directly influences Heijmans' approach to property development and investment, especially within the mid-range rental market. This means strategies for developing rental properties must be adjusted to align with these regulatory changes. For instance, the extended rent increase caps, which limit annual rent hikes, could reduce projected yields for new developments.

Heijmans will need to navigate these legal frameworks carefully. For example, the Affordable Rent Act aims to stabilize rental prices, potentially impacting the profitability of new build-to-rent projects.

- Affordable Rent Act (July 2024): Aims to control rental price increases, affecting revenue projections for rental properties.

- Extended Rent Increase Caps: Limits annual rent hikes, impacting the financial viability of mid-range rental developments.

- Regulatory Compliance Costs: Heijmans may incur additional costs to ensure new developments meet evolving rental market regulations.

- Market Recalibration: Strategies for rental property development and investment will require adjustments to account for these legal impacts.

Public Procurement and Tender Rules

Government tenders and public-private partnership (PPP) frameworks impose strict legal requirements, frequently incorporating sustainability mandates. Heijmans' success in winning significant infrastructure and public building contracts hinges on its compliance with these intricate procurement regulations and its effectiveness in competitive bidding processes. For instance, in 2023, the Dutch government continued to emphasize green procurement, with sustainability considerations playing a crucial role in tender evaluations.

Heijmans' competitive edge in public tenders is directly tied to its understanding and application of these legal frameworks. Adherence to rules regarding transparency, fair competition, and contract execution is paramount.

- Compliance with sustainability criteria in tenders: Many public procurement procedures in the Netherlands, particularly for large infrastructure projects, now mandate specific environmental performance indicators, such as reduced CO2 emissions or the use of recycled materials.

- Impact of PPP legislation on project bidding: The legal structure of PPPs dictates how projects are financed, built, and maintained, influencing the risk allocation and contractual obligations Heijmans must navigate.

- Competitive bidding strategies: Heijmans must develop robust strategies to differentiate its bids, showcasing not only cost-effectiveness but also innovation, quality, and adherence to all legal and sustainability stipulations.

- Regulatory changes affecting procurement: Staying abreast of evolving public procurement laws, including potential updates to EU directives or national legislation, is critical for maintaining a competitive advantage.

The Dutch construction sector is heavily regulated, with new legislation like the Quality Assurance for Construction Act (Wkb) and the Environment and Planning Act (Omgevingswet) impacting Heijmans from January 2024. These laws introduce stricter quality controls, increased builder liability, and a unified approach to environmental planning, requiring Heijmans to adapt its operational and compliance strategies. Furthermore, evolving labor laws in 2024 aim to reduce precarious work, potentially increasing fixed labor costs and requiring agile HR management.

New rental market regulations, including the Affordable Rent Act effective July 2024, alongside existing rent increase caps, will shape Heijmans' property development strategies by limiting potential yields on rental properties. The company must also navigate complex government tender and public-private partnership (PPP) frameworks, which increasingly integrate sustainability mandates and require meticulous adherence to procurement laws to secure public contracts.

| Legal Factor | Impact on Heijmans | Key Legislation/Regulation | Effective Date | 2024/2025 Data/Trend |

| Construction Quality & Liability | Increased compliance burden, higher potential liability for defects. | Quality Assurance for Construction Act (Wkb) | Phased from January 2024 | Expected to reduce construction defects by 30% |

| Environmental & Planning | Need to adapt to unified digital systems and integrated local environmental plans. | Environment and Planning Act (Omgevingswet) | January 2024 | Simplifies permit processes but introduces new complexities. |

| Labor Law | Potential for increased fixed labor costs and need for agile HR strategies. | Focus on reducing precarious temporary work | Ongoing reforms in 2024 | Stricter rules on contract durations and termination anticipated. |

| Rental Market Regulation | Impacts revenue projections and requires recalibration of rental property development strategies. | Affordable Rent Act, Rent Increase Caps | Affordable Rent Act: July 2024 | Limits annual rent hikes, potentially reducing projected yields. |

| Public Procurement & PPP | Mandatory sustainability criteria and adherence to complex bidding processes. | Government Tender Frameworks, PPP Legislation | Ongoing | Emphasis on green procurement and adherence to EU directives. |

Environmental factors

The Netherlands has set ambitious goals, aiming for a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels, with a strong push towards climate neutrality by 2050. This national agenda directly impacts Heijmans, requiring a fundamental shift in construction methodologies to reduce the carbon footprint of its projects. For its direct operations, Heijmans has committed to achieving climate neutrality by 2040.

Heijmans' commitment is further solidified by its approved Science Based Targets initiative (SBTi) for CO2 reduction. These targets align with the Paris Agreement, aiming to limit global warming to well-below 2 degrees Celsius. This strategic alignment means Heijmans must integrate sustainable materials, energy-efficient designs, and circular economy principles throughout its value chain, affecting everything from sourcing to waste management.

The Dutch government's ambitious target of a fully circular economy by 2050 significantly impacts Heijmans, particularly within the resource-intensive construction sector. This directive necessitates a strategic shift towards prioritizing material reuse, advanced recycling techniques, and the responsible sourcing of sustainable building materials.

The current low circularity rate for building materials in the Netherlands, estimated to be around 15% in 2023, presents Heijmans with a substantial challenge. However, this also creates a fertile ground for innovation, encouraging the development of new business models and construction methods centered on circularity.

The persistent nitrogen crisis in the Netherlands significantly impacts construction, potentially causing project delays and increased costs due to stricter nature protection regulations. Heijmans faces challenges with legal hurdles affecting approvals, especially for major infrastructure projects.

For instance, in 2024, the Dutch government continued to grapple with reducing nitrogen emissions, with ongoing debates and policy adjustments impacting the construction sector's ability to obtain permits. This means Heijmans must proactively assess and mitigate the ecological footprint of its developments to navigate these regulatory complexities.

Adapting strategies to incorporate nature-inclusive construction and sustainable material sourcing becomes crucial. This proactive approach helps in not only complying with evolving environmental laws but also in potentially unlocking new market opportunities for eco-friendly building solutions.

Water Management and Quality

Heijmans operates within an environment where water management and quality are increasingly critical. Regional water authorities in the Netherlands are significantly boosting investments, with total expenditures projected to reach €1.8 billion in 2024, aiming to improve water quality and manage water resources more effectively. This focus on balance, safe usage, and overall water health presents tangible new project opportunities for Heijmans, particularly in infrastructure development and environmental engineering.

The company's strategic approach to water management directly supports the Netherlands' ambitious environmental objectives, such as achieving good ecological status for 90% of its surface waters by 2027. Heijmans' commitment to sustainable water solutions, including flood protection and wastewater treatment infrastructure, aligns with these national goals.

- Increased Investment: Dutch water authorities are set to spend approximately €1.8 billion on water management in 2024.

- Regulatory Alignment: Heijmans' water management strategies support the national goal of improving water quality across the country.

- Opportunity Focus: Investments in water infrastructure create new project avenues for Heijmans.

- Sustainability Drive: The company's vision for water aligns with broader Dutch environmental protection targets.

Waste Management and Pollution Reduction

Minimizing construction waste and actively reducing pollution are paramount environmental objectives for Heijmans. These efforts are crucial for fostering a cleaner built environment and aligning with increasingly stringent environmental regulations. The company is investing in innovative solutions to tackle these challenges head-on.

Heijmans is making significant strides in developing groundbreaking technologies, such as achieving 100% circular asphalt. This means old asphalt is being reused entirely, drastically cutting down on raw material consumption and waste. Furthermore, their commitment extends to the use of sustainable concrete, which often incorporates recycled materials and reduces the carbon footprint associated with traditional cement production.

- Circular Asphalt Technology: Heijmans' development of 100% circular asphalt aims to eliminate construction waste from road resurfacing projects, a significant environmental achievement.

- Sustainable Concrete Use: The company's focus on sustainable concrete alternatives reduces embodied carbon and reliance on virgin resources in building projects.

- Pollution Reduction Initiatives: These innovations directly contribute to reducing air and soil pollution typically associated with demolition and construction activities.

- Environmental Compliance and Leadership: By prioritizing waste and pollution reduction, Heijmans positions itself as an environmentally responsible leader in the construction sector.

Heijmans faces significant environmental pressures, including the Dutch government's goal of a 55% greenhouse gas reduction by 2030 and climate neutrality by 2050, which directly influences its construction practices and operational targets. The company's commitment to approved Science Based Targets initiative (SBTi) for CO2 reduction underscores its alignment with global climate goals.

The drive towards a circular economy by 2050 presents both challenges and opportunities, especially given the low 15% circularity rate for building materials in the Netherlands in 2023, pushing Heijmans to innovate in material reuse and sustainable sourcing.

Furthermore, the ongoing nitrogen crisis in the Netherlands continues to pose regulatory hurdles and potential project delays, necessitating proactive ecological footprint mitigation strategies and a focus on nature-inclusive construction.

Heijmans is also capitalizing on increased investments in water management, with Dutch water authorities budgeting €1.8 billion for 2024 to improve water quality and resource management, creating new project opportunities aligned with national environmental objectives.

| Environmental Factor | Key Data Point | Heijmans Impact/Action |

| Climate Change Mitigation | Netherlands: 55% GHG reduction by 2030 (vs 1990) | Heijmans aiming for climate neutrality in operations by 2040; SBTi approved targets. |

| Circular Economy | Netherlands: Circular economy by 2050; Building material circularity ~15% (2023) | Focus on material reuse, recycling, and sustainable sourcing; developing 100% circular asphalt. |

| Nitrogen Crisis | Ongoing regulatory impact on construction permits | Proactive assessment and mitigation of ecological footprints; focus on nature-inclusive construction. |

| Water Management | Dutch water authorities investment: €1.8 billion (2024) | Opportunities in infrastructure and environmental engineering; alignment with water quality goals. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on comprehensive data from leading financial institutions, governmental bodies, and reputable market research firms. We integrate insights from economic indicators, regulatory updates, and technological advancements to provide a holistic view.