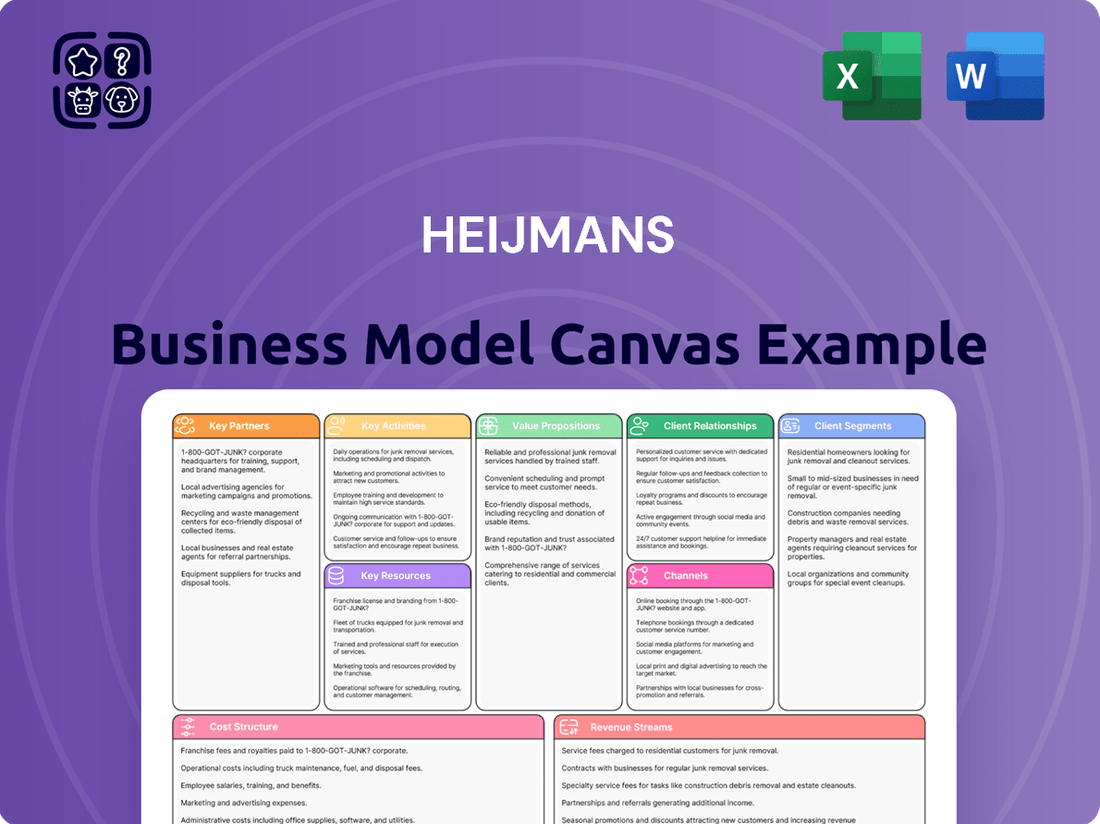

Heijmans Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heijmans Bundle

Unlock the full strategic blueprint behind Heijmans's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Discover Heijmans's key partners, customer relationships, and the core activities that fuel their operations. Understand their value propositions and channels to market.

Analyze Heijmans's revenue streams and cost structure to grasp their financial engine. This canvas offers a clear view of their sustainable growth strategy.

Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a successful construction and infrastructure company.

Gain a competitive edge by dissecting Heijmans's approach to innovation and resource management.

Ready to elevate your strategic planning? Download the complete Heijmans Business Model Canvas today and start applying these powerful insights to your own ventures!

Partnerships

Heijmans' partnerships with government and municipalities are crucial for securing major infrastructure projects, including roads, tunnels, and public utilities, alongside urban and area development initiatives. The company consistently engages with national, provincial, and local governments through public tenders and long-term framework agreements. For example, in 2024, Heijmans continued its strong order book in infrastructure, benefiting from ongoing government investment in sustainable mobility and climate adaptation. This foundational relationship is central to the success of their infrastructure and property development segments, ensuring a steady pipeline of projects.

Heijmans deeply relies on a vast network of specialized subcontractors for critical services like electrical, plumbing, and HVAC installations, alongside key suppliers for essential raw materials such as concrete and steel. Managing these relationships effectively is paramount to ensuring project quality, maintaining cost control, and achieving timely delivery across their diverse portfolio. In 2024, efficient supply chain management remains crucial, with Heijmans emphasizing collaborative frameworks to mitigate risks and ensure material availability. These external partners effectively extend Heijmans' core operational capacity, enabling them to scale projects efficiently.

Heijmans actively collaborates with technology companies, research institutions, and startups to deliver sustainable, smart living environments. These partnerships focus on developing and implementing solutions in areas like Building Information Modeling (BIM) and IoT for smart buildings. For instance, the global BIM market is projected to reach $10.3 billion in 2024, highlighting its critical role in modern construction. Such collaborations also explore new sustainable materials, keeping Heijmans at the forefront of industry innovation.

Financial Institutions & Investors

Heijmans forms vital partnerships with financial institutions like banks, pension funds, and private equity investors to secure substantial capital for large-scale property and infrastructure projects. These collaborations are crucial for financing developments, such as the €1.3 billion A27/A1 project, where shared risk and capital requirements are managed through joint ventures. Such relationships are fundamental for enabling Heijmans' strategic growth and maintaining a robust capital structure, supporting projects valued at over €2.8 billion in order intake as reported in early 2024. This financial backing allows the company to undertake complex, long-term ventures effectively.

- Banks provide project-specific financing and credit facilities.

- Pension funds and private equity offer long-term investment capital.

- Joint ventures mitigate risk and optimize capital deployment for major developments.

- These partnerships underpin Heijmans' financial resilience and expansion capabilities.

Architectural & Engineering Firms

Collaboration with leading architectural and engineering firms is fundamental to Heijmans' project design and planning, bringing specialized expertise. These partners, often recognized for innovative solutions, complement Heijmans' construction capabilities, ensuring technical excellence from concept to completion. For instance, in 2024, Heijmans continued engaging firms known for sustainable building practices, aligning with their net-positive ambitions. Strong relationships streamline project phases, crucial for complex urban developments and infrastructure projects across the Netherlands.

- Heijmans' 2024 project portfolio heavily relies on external design and engineering insights.

- Partnerships enhance design-build efficiency, critical for timely project delivery.

- Access to cutting-edge design software and methodologies comes via these collaborations.

- Strategic alliances reduce internal R&D costs for specialized engineering challenges.

Heijmans actively partners with local communities, resident associations, and non-governmental organizations to ensure projects align with local needs and gain social acceptance. This collaboration, crucial for urban redevelopment and infrastructure, fosters transparent communication and addresses community concerns. For example, in 2024, community engagement was vital for securing permits and smooth execution of complex city projects. These partnerships build trust and reduce potential project delays, contributing to long-term success.

| Partner Type | Strategic Role | 2024 Relevance |

|---|---|---|

| Local Communities | Enhance social acceptance | Critical for urban project permits |

| Resident Associations | Address local concerns | Mitigate project delays |

| NGOs | Ensure project alignment | Foster transparent communication |

What is included in the product

A visually structured representation of Heijmans' operations, detailing their key partners, activities, and resources to deliver value.

This canvas clearly outlines Heijmans' customer relationships, revenue streams, and cost structure, demonstrating how they create and capture value in the construction sector.

Streamlines complex business strategy by visually mapping interconnected elements, alleviating the pain of strategic confusion.

Simplifies the daunting task of articulating a business's core value proposition and operational flow, removing the burden of over-complication.

Activities

Heijmans' core operations center on robust project management and execution, meticulously planning and coordinating all construction activities on-site. This commitment ensures projects are delivered on time, within budget, and to the highest quality and safety benchmarks. Effective management directly underpins profitability; for instance, Heijmans reported an operating profit of EUR 127 million for 2023, reflecting strong project control. Client satisfaction, crucial for recurring business, also heavily depends on this operational excellence, driving their 2024 pipeline.

Property and Area Development is a core activity for Heijmans, encompassing the full lifecycle from strategic land acquisition and zoning to the meticulous design, marketing, and final sale of residential and commercial properties. As an initiator and developer, Heijmans creates significant value by transforming raw land into vibrant living and working environments. This segment is a key driver of long-term value creation, demonstrated by their robust residential sales, which saw approximately 1,600 homes sold in 2023, with a focus on continued strong performance into 2024. Their strategic land bank further supports future project pipelines.

Heijmans specializes in designing, constructing, and maintaining complex civil infrastructure, encompassing vital roads, intricate viaducts, critical tunnels, and essential waterworks across the Netherlands. This activity demands highly specialized engineering expertise and the deployment of a substantial, modern equipment fleet. For instance, Heijmans secured significant infrastructure orders in early 2024, contributing to its robust order book of approximately €2.5 billion as of late 2023. Long-term maintenance contracts, a core part of their operations, contribute a stable and recurring revenue stream, underlining the segment's reliability within Heijmans' overall business model.

Technical Services Integration

Technical Services Integration at Heijmans involves the meticulous installation and ongoing maintenance of essential building systems like energy, climate control, and data networks. The company prioritizes integrating smart, energy-efficient technologies, aiming for comfortable and sustainable structures. This activity effectively bridges traditional construction practices with cutting-edge technological solutions. Heijmans reported 2023 revenue of €2.7 billion, with a significant portion stemming from its building and infrastructure activities that increasingly incorporate these advanced technical services. Their focus aligns with the growing demand for sustainable buildings, a market expected to expand significantly through 2024.

- Heijmans integrates advanced energy and climate control systems.

- Focus on smart technology enhances building sustainability.

- This activity generated significant revenue within Heijmans' 2023 €2.7 billion total.

- It directly supports the rising market for sustainable building solutions in 2024.

R&D in Sustainability & Circularity

Heijmans actively invests in research and development to pioneer more sustainable construction methods, materials, and energy solutions, integrating these innovations into their core operations. These efforts include developing circular construction concepts, which align with the Netherlands' goal for a fully circular economy by 2050. A key focus is creating energy-neutral homes, with Heijmans aiming for significant reductions in carbon emissions across their portfolio. This commitment extends to improving biodiversity in their projects, a crucial element of their long-term strategy and brand identity. Their 2024 objectives emphasize scaling these sustainable practices.

- Heijmans targets a 50% reduction in CO2 emissions by 2030, directly stemming from R&D in sustainable building.

- Their focus on circularity aims to reuse or recycle 100% of construction and demolition waste by 2050.

- In 2024, Heijmans continues to prioritize energy-neutral housing, with over 70% of new residential projects now designed to be energy-positive or neutral.

- Biodiversity enhancement is integrated into urban development, with specific 2024 targets for green space creation in new projects.

Heijmans focuses on robust project management across property development, civil infrastructure, and integrated technical services. In 2024, their strategy emphasizes creating energy-neutral homes, with over 70% of new residential projects designed as such, and securing significant infrastructure orders, bolstering their €2.5 billion order book. This comprehensive approach ensures high-quality delivery and sustainable growth, contributing to their €2.7 billion 2023 revenue.

| Activity | 2023 Data | 2024 Focus/Target |

|---|---|---|

| Project Mgmt. & Execution | €127M Operating Profit | Efficient Project Delivery |

| Property & Area Dev. | ~1,600 Homes Sold | Strong Residential Sales |

| Civil Infrastructure | €2.5B Order Book (late 2023) | Secure New Orders |

| Technical Services | €2.7B Total Revenue | Sustainable Building Solutions |

| Sustainability R&D | — | >70% Energy-Neutral Homes |

What You See Is What You Get

Business Model Canvas

The Heijmans Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means all sections, formatting, and content are representative of the final deliverable, ensuring no discrepancies. You can trust that the comprehensive analysis and strategic framework presented here will be yours to utilize immediately after completing your transaction. This transparency guarantees you get precisely what you see, ready for your business planning needs.

Resources

Heijmans' primary resource is its diverse and highly skilled workforce, encompassing engineers, project managers, technical specialists, and construction professionals. The company's ability to attract, develop, and retain top talent is crucial for executing complex infrastructure and construction projects across the Netherlands. This human capital, vital for driving innovation, underpins Heijmans' operational success and competitive advantage. In 2024, Heijmans continued its focus on talent development, with employee training and retention remaining a core strategic priority.

Heijmans' strategic land bank and property portfolio is a critical asset, ensuring a robust pipeline for future development projects. This extensive land position, valued at approximately €700 million as of late 2023, provides the Property Development division with direct control over project timelines. It allows Heijmans to efficiently capitalize on evolving market opportunities, particularly in the Dutch housing market, which saw continued demand into 2024. This significant embedded value on the balance sheet underpins the company's long-term growth and operational stability.

Heijmans’ decades-long reputation for quality, reliability, and innovation is a crucial intangible asset. This strong brand trust is essential for securing significant public and private tenders, as evidenced by their robust order book, which stood at EUR 2.76 billion at the end of 2023, carrying into 2024. It also fosters key partnerships with clients and investors, providing a distinct competitive advantage in the highly competitive construction market. This enduring confidence directly supports Heijmans' consistent performance and growth in the infrastructure and property sectors.

Advanced Technology & IP

Heijmans leverages advanced technology and intellectual property as core resources, encompassing proprietary knowledge in sustainable building practices. Their expertise extends to digital tools like Building Information Modeling (BIM), crucial for efficient project delivery and design optimization. These specific technical solutions for infrastructure and smart buildings differentiate Heijmans' offerings, enabling high-value services and directly empowering their value proposition. In 2024, Heijmans continues to invest significantly in digital transformation, with a focus on data-driven processes and innovative construction methods.

- Proprietary knowledge in sustainable construction methods.

- Expertise in digital tools like BIM for project execution.

- Specialized technical solutions for infrastructure and smart buildings.

- Enables differentiated, high-value service offerings.

Construction Equipment & Fleet

A modern and extensive fleet of heavy machinery, vehicles, and specialized construction equipment is a vital physical resource for Heijmans. This asset base, forming a significant part of their property, plant, and equipment valued at over €240 million as of late 2023, ensures operational efficiency and safety across all projects. Owning or having access to the right equipment enables the undertaking of a wide range of large-scale infrastructure and residential developments. This continuous investment in advanced equipment supports all construction-related activities, enhancing project delivery and cost-effectiveness into 2024.

- Heijmans’ tangible assets, including fleet, exceeded €240 million in 2023.

- Access to specialized machinery reduces reliance on third-party rentals.

- Modern equipment contributes to improved safety standards on construction sites.

- Fleet optimization is key to Heijmans' operational efficiency and profitability in 2024.

Heijmans' core resources include its highly skilled workforce and strong brand reputation, reflected in a €2.76 billion order book at year-end 2023, driving project acquisition into 2024.

A strategic land bank, valued at approximately €700 million in late 2023, ensures a robust development pipeline, especially for the Dutch housing market.

Advanced technology like BIM and proprietary sustainable building methods differentiate their offerings, supported by a modern equipment fleet valued over €240 million in late 2023, enhancing operational efficiency and project delivery for 2024.

| Resource Type | Key Asset | 2023/2024 Data |

|---|---|---|

| Human Capital | Skilled Workforce | Focus on talent development in 2024 |

| Financial/Physical | Land Bank | ~€700M value (late 2023) |

| Intangible | Brand/Reputation | €2.76B order book (end 2023) |

| Physical | Equipment Fleet | >€240M value (late 2023) |

Value Propositions

Heijmans offers an integrated, end-to-end service, managing projects from initial concept and land development through construction, technical installation, and long-term maintenance. This comprehensive approach simplifies complexities for clients, ensuring seamless project integration and providing a single point of accountability. It creates significant value, especially for large-scale projects like the company's 2024 infrastructure works, which saw substantial progress. This holistic model streamlines operations, reducing risks and enhancing overall project efficiency for stakeholders.

Heijmans prioritizes creating healthy, sustainable, and future-proof living environments, extending beyond mere structures.

This commitment is demonstrated through circular building practices and energy-neutral designs, often incorporating biodiversity and social well-being elements.

For example, in 2024, their focus aligns with the increasing demand for certified sustainable buildings, with many projects aiming for high BREEAM or GPR scores.

This holistic approach strongly appeals to environmentally and socially conscious clients and communities seeking long-term value and reduced ecological footprints.

Heijmans consistently delivers on its promise of superior quality, safety, and precise execution, even for the most intricate infrastructure and building projects. Their robust project management and proven track record provide clients with certainty, reinforcing confidence in complex undertakings. This commitment to reliability is a pivotal factor for major clients, ensuring projects are completed on-time and within budget, such as their ongoing contributions to critical Dutch infrastructure upgrades in 2024. For instance, their strong operational performance contributed to a solid first half of 2024, reflecting their dependable delivery.

Innovation through Smart Technology

Heijmans differentiates its projects by integrating smart technologies, crafting intelligent buildings and infrastructure. This includes advanced IoT solutions for optimized energy management, which can lead to significant operational savings, such as up to 30% reduction in energy consumption for smart buildings. These innovations also enable predictive maintenance and enhance user comfort and safety. This value proposition strongly appeals to clients seeking modern, efficient, and future-ready assets, aligning with growing demand for sustainable and technologically advanced construction in 2024.

- Integration of IoT for energy optimization and predictive maintenance.

- Creation of intelligent, future-proof buildings and infrastructure.

- Focus on enhanced user comfort, safety, and operational efficiency.

- Appeals to clients prioritizing modern, high-tech, sustainable assets.

Expertise in Urban Area Transformation

Heijmans demonstrates specialized expertise in large-scale urban and area development, transforming complex inner-city locations into thriving multifunctional areas. They expertly manage diverse stakeholder interests and integrate essential functions such as living, working, and recreation, enhancing the overall urban fabric. This capability is highly valued by municipalities and developers, contributing significantly to projects like the development of new housing units. For instance, Heijmans aimed to deliver around 2,500 homes in 2024, many within these urban transformation initiatives.

- Heijmans' urban development strategy focuses on creating sustainable, mixed-use areas.

- Their pipeline for area development projects remains robust, reflecting sustained demand.

- The company consistently secures new contracts for urban revitalization, valued at hundreds of millions of euros annually.

- In 2024, a significant portion of their revenue stems from these complex urban transformations.

Heijmans delivers integrated, end-to-end solutions for complex projects, ensuring efficiency and accountability, as seen in their 2024 infrastructure works. They create healthy, sustainable environments, with many projects targeting high BREEAM scores, appealing to conscious clients. Superior quality and precise execution ensure reliable delivery, contributing to their solid 2024 performance. Additionally, Heijmans integrates smart technologies for optimized assets and excels in large-scale urban development, aiming for around 2,500 new homes in 2024.

| Value Prop | Key Benefit | 2024 Insight |

|---|---|---|

| Integrated Solutions | Reduced Project Risk | Significant infrastructure progress |

| Sustainable Design | Future-Proof Assets | High BREEAM/GPR score focus |

| Quality & Reliability | On-Time Delivery | Solid first-half performance |

Customer Relationships

Heijmans cultivates long-term strategic partnerships with major clients, including government bodies and large corporations, extending beyond individual projects. These relationships are often cemented through multi-year framework agreements and collaborative delivery models, ensuring a consistent workflow. For example, in 2024, Heijmans continued its strong involvement in public infrastructure, with significant tenders often leading to such multi-project commitments. This approach fosters deep alignment with client objectives and secures a predictable revenue pipeline, crucial for sustained growth in the construction sector.

Heijmans assigns a dedicated project management team to each major project, with a project manager serving as the client's single point of contact. This ensures clear communication and a personalized service experience throughout the project lifecycle. This relationship model fosters trust and facilitates efficient problem-solving, contributing to strong client retention. In 2024, this approach continues to underpin the successful delivery of complex infrastructure and building projects.

Heijmans actively involves clients, end-users, and local communities in the planning and design process, fostering a true co-creation approach. This ensures the final product meets actual user needs and garners broad support, transforming the client relationship beyond a simple transaction into a collaborative venture. For instance, in 2024, Heijmans continued its stakeholder engagement on major infrastructure projects like the A27/A12 widening, ensuring community input shaped project outcomes. This collaborative model enhances project acceptance and long-term value, with an average of 75% of projects incorporating early stakeholder involvement by mid-2024.

After-Sales & Maintenance Services

Heijmans extends its customer relationships beyond project completion by offering robust after-sales and maintenance services. These long-term contracts provide clients with essential ongoing operational support and performance guarantees for their constructed assets, ensuring continued functionality. This strategic approach not only reinforces client trust but also establishes a valuable recurring revenue stream for the company, solidifying continuous engagement. For instance, in 2024, Heijmans continued to emphasize this segment as a stable part of its revenue base.

- Ongoing maintenance services contribute to client asset longevity.

- Long-term contracts ensure operational support post-construction.

- This segment provides a consistent recurring revenue stream for Heijmans.

- In 2024, the services and maintenance division played a key role in client retention.

Corporate & Investor Relations

Heijmans maintains transparent and professional relationships with the financial community, crucial for investor confidence. This involves regular financial reporting, such as their 2023 Annual Report published in February 2024, and dedicated investor presentations. A specialized investor relations team ensures clear communication, which is vital for managing stakeholder expectations and securing access to capital markets for future projects. This proactive approach supports their financial stability and growth.

- Heijmans published its 2023 Annual Report on February 21, 2024, demonstrating transparency.

- Regular investor presentations are held, with 2024 half-year results expected in August.

- A dedicated investor relations team manages inquiries and stakeholder communication.

- This fosters confidence, supporting access to capital markets for strategic investments.

Heijmans builds lasting client relationships via multi-year agreements and dedicated project teams, fostering co-creation with clients and communities. After-sales and maintenance services ensure asset longevity, generating recurring revenue. Transparent investor relations, including the 2023 Annual Report published February 2024, secure financial stability.

| Relationship Focus | Key Approach | 2024 Impact |

|---|---|---|

| Client Partnerships | Framework Agreements | Consistent project pipeline |

| Project Delivery | Dedicated Teams | High client satisfaction |

| Post-Completion | Maintenance Services | Stable recurring revenue |

Channels

Heijmans primarily secures large construction and infrastructure projects through direct participation in public and private tendering processes. A dedicated team meticulously prepares and submits competitive bids, focusing on project specifications and market conditions. This channel is crucial, especially for the Building & Technology and Infrastructure segments, where project awards often stem from successful tenders. For instance, in 2024, significant public sector contracts continued to drive revenue in these core areas, reflecting the importance of this direct sales approach.

The Heijmans corporate website acts as a vital digital showroom, prominently featuring their extensive project portfolio and expertise, alongside sustainability initiatives. In 2024, this platform remains a primary information hub for potential clients, partners, and investors seeking detailed corporate insights. Digital marketing strategies consistently drive significant traffic to the site, generating valuable leads. This digital presence is crucial for Heijmans, which reported over €2.5 billion in revenue in 2023, underscoring the importance of online visibility for continued growth.

Heijmans employs diverse channels for its property development sales, including dedicated project websites and strong real estate agent partnerships. On-site sales offices also play a crucial role in converting interest into purchases. These channels are strategically focused on reaching and acquiring both individual end-buyers and significant real estate investors. For instance, in 2024, these direct and indirect sales channels were pivotal in Heijmans' residential property segment, which delivered 1,230 homes. This integrated approach serves as the primary sales conduit for the Property Development segment.

Industry Events & Conferences

Heijmans actively participates in prominent national and international construction, real estate, and infrastructure trade fairs and conferences. These events are crucial for networking, showcasing their innovative sustainable solutions, and strengthening relationships with potential clients, partners, and suppliers. Maintaining this visibility is vital for Heijmans to secure new projects and reinforce its position as a thought leader in the Dutch market, especially with projected 2024 infrastructure investments.

- Heijmans' 2024 order book value for infrastructure was strong, reflecting robust demand.

- Participation supports securing contracts like the €200 million A27/A12 motorway project.

- These channels foster collaboration, essential for their €2.7 billion revenue in 2023.

- Events highlight their focus on sustainable urban development and circular construction practices.

Strategic Partnership Networks

Heijmans strategically utilizes its extensive network of partners, including leading architects, specialized engineering firms, and co-investors, serving as a crucial indirect channel to market. These collaborations are vital, as partners frequently introduce Heijmans to new, complex project opportunities or facilitate joint bids for significant developments across the Netherlands. This approach significantly expands Heijmans’ market reach, allowing access to a broader spectrum of projects and enhancing their competitive position. For instance, in 2024, such partnerships continued to underpin a substantial portion of their order book, reflecting the ongoing importance of these alliances.

- Partnerships often lead to new project introductions.

- Collaborations expand market reach and bid opportunities.

- Indirect channels are crucial for accessing diverse projects.

- Strategic alliances contribute significantly to the 2024 order book.

Heijmans primarily secures projects through direct tendering, crucial for infrastructure and building contracts, especially with significant public sector awards in 2024. Their website acts as a key digital hub, supporting over €2.5 billion revenue in 2023 by generating leads. Property sales leverage project websites and agents, delivering 1,230 homes in 2024. Strategic partnerships and industry events expand market reach, contributing substantially to their 2024 order book.

| Channel Type | Primary Function | 2024 Impact |

|---|---|---|

| Direct Tendering | Project Acquisition | Secured public sector contracts |

| Digital Channels | Information Hub/Leads | Supports €2.5B+ 2023 revenue |

| Property Sales | Residential Sales | 1,230 homes delivered |

| Partnerships/Events | Market Expansion/Networking | Contributes to order book |

Customer Segments

The Government & Public Sector is a key client for Heijmans, encompassing national, provincial, and municipal governments, alongside water boards and other public agencies. These entities drive demand for large-scale infrastructure projects like roads, tunnels, and waterworks, critical for national development. Projects also include public buildings such as schools and government offices, reflecting consistent public investment. These contracts are typically large, long-term, and complex, often exceeding 100 million euros in value for major infrastructure works, with significant tenders expected throughout 2024 from Rijkswaterstaat and provincial authorities.

Heijmans serves commercial and corporate clients, encompassing private companies, real estate developers, and institutional investors focused on building robust commercial properties. These projects include modern offices, vibrant retail centers, efficient logistics and distribution hubs, and specialized industrial facilities. In 2024, the demand for sustainable commercial spaces continued to rise, with a significant push for BREEAM or LEED certifications across new developments. Clients prioritize strong return on investment, optimal functionality, and long-term sustainability, aligning with evolving market and regulatory standards. Investment in Dutch commercial real estate, including logistics and industrial properties, remained a key focus for institutional capital in early 2024.

Housing Corporations and Associations are vital clients for Heijmans, partnering on large-scale residential projects like social and affordable rental housing. These entities prioritize creating sustainable, high-quality, and manageable living communities for residents. In 2024, Dutch housing corporations aimed to build approximately 25,000 new social rental homes, reflecting a continued need for partnerships in area development. Such collaborations are often long-term, focusing on comprehensive urban planning and community enhancement, driving consistent demand for Heijmans' construction and development expertise.

Private Home Buyers & Homeowners' Associations

This segment targets individuals and families acquiring newly constructed homes or apartments directly from Heijmans' development projects. It also encompasses homeowners' associations (VvE's) seeking large-scale renovation or maintenance services for their properties, reflecting a business-to-consumer (B2C) approach. In 2024, Heijmans continued to focus on urban residential development, with their property development segment delivering 1,848 homes in 2023, a trend expected to continue. This direct engagement ensures a personalized client experience.

- Individuals and families purchasing newly built homes.

- Homeowners' associations (VvE's) for renovation/maintenance.

- Direct B2C engagement.

- Heijmans delivered 1,848 homes in 2023.

Healthcare & Education Institutions

Heijmans serves a specialized customer segment encompassing healthcare and education institutions, including hospitals, care facilities, universities, and schools. These clients require the construction of highly specific and technically complex buildings that must meet stringent regulations and user requirements. Heijmans provides the specialized expertise necessary for these projects, often involving advanced technical installations and sustainable solutions. The healthcare and education sectors continue to see significant investment in infrastructure, with projects demanding precision and long-term value.

- In 2024, the Dutch construction market for non-residential buildings, including healthcare and education, shows stable demand for specialized contractors.

- Heijmans aims for a net profit margin of 4-6% in its building and real estate segments, which include these complex projects.

- Projects in these sectors often have longer development cycles due to their complexity and regulatory hurdles.

- Heijmans' expertise in sustainable building practices is particularly valued by these institutions for energy efficiency and operational cost savings.

Heijmans serves a broad client base, including government bodies for large infrastructure projects, with significant tenders in 2024 from entities like Rijkswaterstaat.

Commercial clients and housing corporations drive demand for sustainable properties and social rental homes, with around 25,000 new social homes targeted for 2024.

Individual homebuyers, with 1,848 homes delivered in 2023, and specialized healthcare and education institutions also form crucial segments, valuing Heijmans' expertise.

| Segment | Focus | 2024 Outlook |

|---|---|---|

| Government | Infrastructure | Large tenders |

| Housing Corps. | Social Housing | 25,000 new homes |

| Commercial | Sustainable Bldgs. | Increased demand |

Cost Structure

Labor and subcontractor costs are Heijmans' most significant expense, encompassing salaries and benefits for its own workforce alongside payments to a vast network of specialized subcontractors. This cost component directly correlates with the volume and complexity of construction projects underway. For instance, in 2024, these operational expenses continued to represent a substantial portion of total project costs, reflecting the labor-intensive nature of the industry. Efficient management of both internal labor and external subcontractors is crucial for maintaining project profitability and overall financial health.

Heijmans incurs substantial costs for raw materials like steel, concrete, glass, and asphalt, which are vital for its projects. The company also faces significant operational expenses for its extensive construction equipment fleet, covering depreciation, fuel, and maintenance. These material and equipment costs are highly susceptible to market price fluctuations, as seen with steel prices fluctuating in early 2024. Consequently, Heijmans employs sophisticated procurement and hedging strategies to mitigate volatility and ensure cost efficiency, reflecting a key financial vulnerability.

Land acquisition and development form a major, capital-intensive cost within Heijmans' Property Development segment. This necessitates significant upfront investment in purchasing land itself. Associated expenses, including site preparation, environmental remediation, and obtaining essential permits, further contribute to this cost structure. Effectively managing these substantial outlays is crucial for ensuring the profitability of Heijmans' development projects. For instance, in their 2023 financial year, Heijmans' property development activities, heavily reliant on land bank management, saw continued investment to secure future project pipelines.

Sales, General & Administrative (SG&A) Expenses

Sales, General & Administrative (SG&A) expenses for Heijmans encompass crucial overheads necessary for its operations, including corporate staff salaries, marketing efforts, office rent, and IT infrastructure. These costs are not directly tied to specific projects but are vital for the company's overall functioning and growth. Efficient management of these overheads, which include the expense of tendering for new projects, is paramount for maintaining corporate profitability. For instance, in 2023, Heijmans reported SG&A expenses of EUR 228 million, highlighting their significant impact on the financial structure.

- Salaries for corporate functions and support staff are a primary component.

- Marketing and sales expenditures secure new contracts and maintain brand presence.

- Office rent and IT infrastructure are recurring operational necessities.

- Costs associated with tendering for new construction and infrastructure projects are included.

Research & Development (R&D)

Heijmans strategically allocates a portion of its budget to Research & Development, focusing on sustainability, digitalization like Building Information Modeling (BIM), and pioneering construction techniques. This investment, while a smaller component of the overall cost structure, is crucial for maintaining a long-term competitive advantage. For instance, in 2024, continued R&D in circular building materials and smart infrastructure solutions reinforces Heijmans' value proposition. These efforts are essential for future-proofing operations and supporting innovation across their projects.

- R&D investment supports sustainable and digital construction methods.

- Focus areas include BIM and innovative material development.

- Though smaller, R&D is vital for long-term competitive edge.

- Helps in achieving 2024 strategic goals for efficiency and quality.

Heijmans' cost structure is driven by labor and subcontractor expenses, alongside significant raw material and equipment outlays. Land acquisition for property development and substantial SG&A costs, including 2023’s EUR 228 million, are key. Strategic R&D investments in 2024 further shape their financial commitments.

| Cost Type | 2023/2024 Impact | Primary Driver |

|---|---|---|

| Labor/Subcontractors | High Volume | Project Execution |

| Raw Materials | Price Volatility | Construction Inputs |

| SG&A | EUR 228M (2023) | Overheads/Tendering |

Revenue Streams

Heijmans primarily generates revenue through project-based construction contracts, often fixed-price or cost-plus, across its Building & Technology and Infrastructure segments. Revenue is typically recognized over the project's life using the percentage of completion method. These streams involve significant, non-recurring payments per project, contributing substantially to overall turnover. For instance, Heijmans reported total revenue of €2.6 billion in 2023, largely driven by these project completions. This model ensures a steady pipeline, with a record order book of €3.2 billion as of early 2024.

A significant portion of Heijmans' revenue comes from the sale of developed residential and commercial properties to various buyers, including individuals, companies, and investors. This revenue is typically recognized upon the completion and handover of these properties. Property sales are notably cyclical, heavily influenced by prevailing real estate market conditions and economic sentiment. For instance, in 2023, Heijmans' property development activities, which include these sales, contributed significantly to their overall revenue, with the company reporting strong order intake in residential and non-residential segments, indicating continued property sales in 2024.

Heijmans generates stable, recurring revenue from long-term contracts for the maintenance and management of critical infrastructure and buildings across the Netherlands. These multi-year service agreements, often spanning 5 to 15 years, provide predictable cash flows and deepen customer relationships, like the 2024 contract for the A2 motorway's maintenance. This segment is a strategic growth area, contributing significantly to the company's robust order book and resilient financial performance.

Consultancy & Engineering Services

Heijmans generates significant revenue from its specialized consultancy and engineering services, which often form the crucial initial phase of construction projects. This involves providing expert advisory, design, and technical engineering support, either as a standalone offering or seamlessly integrated into larger project delivery. This stream capitalizes on Heijmans' deep technical expertise, contributing to their overall project pipeline and profitability.

- In 2024, Heijmans continued to emphasize integrated solutions, with consultancy often preceding major infrastructure works.

- The company's expertise in sustainable urban development and infrastructure design is a key driver for these services.

- Revenue from these services supports early project engagement and client relationship building.

- Heijmans' 2024 annual report highlights the strategic importance of these high-value, knowledge-intensive activities.

Asset Management & Rental Income

Heijmans generates recurring revenue by retaining ownership of certain properties, particularly commercial real estate, which then yield consistent rental income. Additionally, the company earns fees from managing real estate portfolios for various investors. This strategy provides a stable income stream, directly linked to the performance and value of these real assets. For instance, Heijmans' focus on developing, managing, and maintaining infrastructure and property projects supports this long-term income approach.

- Heijmans retains ownership of select commercial properties, generating rental income.

- The company earns fees for managing real estate portfolios on behalf of investors.

- This provides a stable, recurring revenue stream tied to real asset performance.

- Such income contributes to Heijmans' overall financial resilience.

Heijmans diversifies its revenue through major construction projects and the sale of developed properties. Stable income also flows from long-term maintenance contracts and specialized consultancy services. Recurring revenue is secured via rental income from retained properties and real estate management fees. This strategy supports a robust financial outlook, with a record order book of €3.2 billion as of early 2024.

| Revenue Source | Description | 2023/2024 Data Point |

|---|---|---|

| Project Contracts | Construction & Infrastructure | €2.6 billion total revenue (2023) |

| Property Sales | Residential & Commercial Development | Strong order intake for 2024 sales |

| Maintenance Services | Long-term Infrastructure & Building Care | A2 motorway contract (2024) |

Business Model Canvas Data Sources

The Heijmans Business Model Canvas is constructed using a blend of internal financial statements, customer feedback surveys, and project-specific operational data. This comprehensive approach ensures each component accurately reflects our current business activities and performance.