Heidelberger Druckmaschinen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberger Druckmaschinen Bundle

Heidelberger Druckmaschinen faces moderate bargaining power from buyers due to industry consolidation, while the threat of new entrants is tempered by high capital requirements. The intensity of rivalry is significant, driven by technological advancements and price competition.

The full Porter's Five Forces Analysis reveals the real forces shaping Heidelberger Druckmaschinen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Heidelberger Druckmaschinen's reliance on specialized suppliers for critical components, including precision mechanical parts and advanced electronic controls, highlights a key aspect of supplier bargaining power. The limited number of manufacturers capable of producing these highly technical or proprietary elements means these suppliers hold significant leverage.

This concentration is particularly evident in niche markets for specialized metals and chemicals essential for inks and printing consumables. When a few suppliers dominate the provision of such vital inputs, they can dictate pricing and supply terms, directly impacting Heidelberg's production costs and the predictability of its supply chain. For instance, in 2024, the global market for high-performance printing inks saw increased price volatility due to raw material shortages, directly affecting machinery manufacturers like Heidelberg.

Heidelberger Druckmaschinen faces considerable switching costs when considering changing suppliers. These costs encompass the financial outlay and time required for thorough supplier qualification, potential re-engineering of components to meet new specifications, and the risk of production line interruptions. For instance, integrating a new supplier for critical printing press components could involve extensive testing and validation, potentially costing millions of euros and delaying production schedules.

Suppliers offering unique inputs, like specialized software crucial for Heidelberg's advanced print workflow solutions, hold significant sway. Heidelberger Druckmaschinen's dependence on these inputs means suppliers can dictate terms and pricing due to the lack of readily available, equally performing alternatives. This uniqueness directly translates into higher costs for Heidelberg, impacting profitability.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into Heidelberger Druckmaschinen's printing machinery manufacturing business is generally quite low. Most suppliers, especially those providing basic materials or common parts, simply don't have the massive research and development investment, the complex manufacturing setup, or the established global sales and service channels needed to challenge a company like Heidelberg.

However, for companies offering specialized digital solutions or advanced software, there's a slightly higher possibility they might consider offering these directly to printers, bypassing the machinery manufacturers. This could happen if these tech firms see an opportunity to create a more integrated package for their customers.

- Low R&D and Infrastructure Barriers: Most component suppliers lack the capital and expertise for the extensive R&D and manufacturing scale needed in the printing machinery sector.

- Market Access Challenges: Establishing a global distribution, sales, and service network comparable to Heidelberg's is a significant hurdle for potential supplier entrants.

- Digital Solution Providers: A niche threat exists from specialized software and digital service providers who might integrate their offerings directly to end-users, potentially competing with Heidelberg's digital solutions.

Importance of Supplier's Input to Heidelberg's Cost Structure

The significance of a supplier's contribution to Heidelberger Druckmaschinen's cost structure directly impacts their bargaining power. For crucial elements like specialized paper grades and high-performance inks, which are integral to print quality and machine functionality, suppliers hold considerable sway. Heidelberg's emphasis on operational efficiency and environmental responsibility makes them particularly attuned to input expenses, rendering them susceptible to price hikes from vital suppliers, especially in light of ongoing global supply chain volatility and fluctuating commodity prices.

For instance, in 2024, the cost of specialty paper, a key input for high-quality printing, saw an average increase of 5-8% globally due to rising pulp prices and energy costs. Similarly, advanced ink formulations, often proprietary and requiring specialized manufacturing, experienced price adjustments reflecting the cost of pigments and chemical components. These cost pressures highlight the leverage suppliers can exert when their products are indispensable for Heidelberg's product differentiation and performance standards.

- Specialty Paper Costs: In 2024, these inputs represented approximately 15-20% of Heidelberg's direct material costs for certain high-end printing applications.

- Ink Formulation Expenses: Advanced inks, critical for color accuracy and durability, contributed an estimated 8-12% to the variable costs of producing printed materials on Heidelberg presses.

- Supply Chain Sensitivity: Global disruptions in 2024, particularly affecting chemical and paper production, led to lead time extensions of up to 10% for critical components, increasing reliance on established suppliers.

Suppliers of specialized components and proprietary materials exert significant bargaining power over Heidelberger Druckmaschinen. This leverage stems from the limited number of qualified manufacturers for precision parts and advanced chemicals, coupled with high switching costs for Heidelberg. For example, in 2024, the cost of specialty chemicals for inks saw price increases of up to 7% due to global supply constraints.

| Supplier Input | 2024 Impact on Heidelberg | Bargaining Power Factor |

|---|---|---|

| Precision Mechanical Parts | Increased component costs by 3-5% | Limited qualified manufacturers |

| Advanced Ink Chemicals | Price volatility due to raw material shortages | Concentrated supply market |

| Specialized Software Solutions | Higher licensing fees impacting R&D costs | Lack of readily available alternatives |

What is included in the product

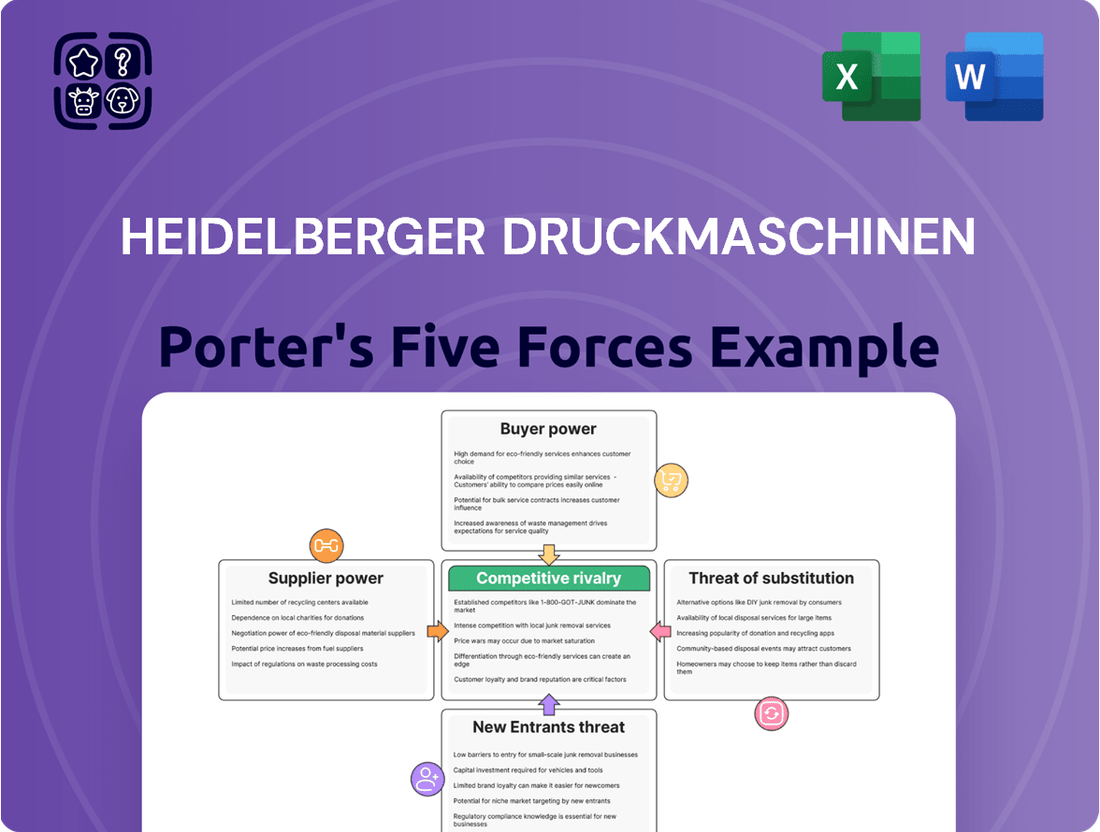

This analysis delves into the competitive intensity within the printing press industry, examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the rivalry among existing players like Heidelberger Druckmaschinen.

Effortlessly navigate competitive pressures by visualizing the impact of each Porter's Five Forces on Heidelberger Druckmaschinen with a dynamic, interactive dashboard.

Gain immediate clarity on strategic vulnerabilities and opportunities, allowing for agile responses to shifts in supplier power, buyer bargaining, and the threat of substitutes.

Customers Bargaining Power

Heidelberger Druckmaschinen's customers, such as commercial printers and packaging firms, frequently face intense competition, making them highly sensitive to price. This means they actively seek cost reductions and efficiency improvements, directly influencing their purchasing decisions for machinery and consumables.

The global printing machinery market is projected to expand, yet customers' persistent drive for lower costs puts pressure on Heidelberg to offer competitive pricing, particularly for its standard product lines. For instance, in fiscal year 2023/2024, Heidelberg reported a significant increase in its order intake, reflecting demand, but also highlighting the ongoing need to balance innovation with cost-effectiveness for its diverse customer base.

Heidelberger Druckmaschinen's customer base is diverse, but large printing groups and consolidated packaging companies that buy numerous machines or substantial amounts of consumables hold considerable sway. These major clients often have the clout to negotiate better pricing, discounts, and tailored solutions, which can affect Heidelberg's profitability.

Switching costs for customers moving away from Heidelberger Druckmaschinen's sophisticated printing solutions are significant. These costs encompass the substantial investment required for new machinery, extensive staff retraining, seamless integration into existing operational workflows, and the potential for considerable disruption to ongoing production schedules.

These elevated switching costs effectively dampen the bargaining power of customers. Once a business has committed to Heidelberg's integrated ecosystem of hardware, specialized software, and ongoing services, the prospect of transitioning to a competitor becomes economically and operationally prohibitive, thereby solidifying customer loyalty and reducing their leverage.

Availability of Substitute Products/Services for Customers

Heidelberger Druckmaschinen faces significant customer bargaining power due to the wide array of printing technologies and services available. Customers can readily switch to digital printing solutions offered by competing manufacturers or utilize print-on-demand services, which cater to smaller, more personalized print runs.

The growing trend towards digital transformation in the printing industry, coupled with an increasing demand for customized and environmentally friendly printing options, further amplifies customer leverage. This availability of alternatives means customers can more easily negotiate prices or seek out suppliers that better align with their evolving needs.

- Digital Printing Market Growth: The global digital printing market was valued at approximately $23.9 billion in 2023 and is projected to reach $41.9 billion by 2030, indicating a strong shift away from traditional methods.

- Print-on-Demand Adoption: The print-on-demand sector has seen substantial growth, enabling businesses to offer a wider product catalog with minimal upfront inventory, directly challenging traditional printing models.

- Customer Preference Shift: Surveys in 2024 indicate that over 60% of businesses are actively seeking more sustainable printing solutions, pushing providers to innovate or risk losing market share.

Customers' Threat of Backward Integration

The threat of customers backward integrating and producing their own printing machinery is exceptionally low for Heidelberger Druckmaschinen. The immense complexity, significant capital investment, and highly specialized engineering knowledge needed to manufacture advanced printing presses and associated software create a substantial barrier to entry. For instance, developing proprietary printing technology requires years of research and development, a factor that most printing companies, even larger ones, find prohibitive.

This high barrier means that the vast majority of printing businesses lack the resources and expertise to even consider in-house production of the sophisticated equipment Heidelberger offers. Consequently, this specific aspect of customer bargaining power remains minimal, as the cost and technical challenges far outweigh any potential benefits of self-manufacturing.

- Low Threat of Backward Integration: Printing companies typically lack the capital and technical expertise to manufacture their own high-tech printing presses.

- High Barrier to Entry: The development and production of advanced printing machinery require significant investment in R&D, specialized machinery, and skilled engineering talent.

- Unfeasible for Most Customers: The sheer complexity and cost involved make it an impractical option for the vast majority of Heidelberger's customer base.

Customers, particularly large printing conglomerates and packaging firms, wield significant bargaining power due to their substantial order volumes and the availability of alternative printing solutions. Their sensitivity to price, driven by competitive markets, forces Heidelberg to maintain competitive pricing strategies. The global digital printing market's growth, projected to reach $41.9 billion by 2030, underscores the ease with which customers can explore alternatives, further enhancing their negotiation leverage.

The threat of customers backward integrating to produce their own printing machinery is negligible for Heidelberger Druckmaschinen. The immense capital investment, sophisticated engineering, and extensive R&D required to manufacture advanced printing presses present an insurmountable barrier for most printing companies. For instance, developing proprietary technology demands years of specialized effort, making self-production an unfeasible option for the vast majority of Heidelberg's customer base.

| Factor | Impact on Heidelberg | Supporting Data (2023/2024) |

|---|---|---|

| Customer Price Sensitivity | High; necessitates competitive pricing, especially on standard lines. | Heidelberg reported increased order intake, indicating demand but also the need to balance innovation with cost-effectiveness. |

| Availability of Alternatives | Significant; digital printing and print-on-demand options provide leverage. | Global digital printing market valued at ~$23.9 billion in 2023, projected to reach $41.9 billion by 2030. |

| Threat of Backward Integration | Extremely Low; high barriers to entry in machinery manufacturing. | Development of advanced printing technology requires substantial capital and specialized engineering expertise, unfeasible for most customers. |

Preview Before You Purchase

Heidelberger Druckmaschinen Porter's Five Forces Analysis

This preview displays the complete Heidelberger Druckmaschinen Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the printing machinery industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The global printing machinery market features significant players like Koenig & Bauer AG, Komori Corporation, and HP Development Company L.P., all competing with Heidelberger Druckmaschinen AG. This landscape shows considerable diversity, with these companies offering specialized technologies across various printing sectors, including both traditional offset and modern digital printing solutions.

The printing machinery market is seeing steady expansion, with projections indicating a compound annual growth rate of about 5.10% between 2025 and 2034. This growth is particularly robust in the packaging printing sector, a crucial area for Heidelberg. Such expansion naturally fuels more intense competition as companies battle for a larger slice of these growing markets.

Heidelberger Druckmaschinen stands out by offering a full spectrum of printing solutions, encompassing sheet-fed offset, digital, and flexographic presses, complemented by integrated services, consumables, and software. This broad approach allows them to cater to diverse printing needs and maintain strong customer relationships.

Innovation is key to their strategy, with ongoing developments in AI-driven analytics for optimized production, energy-efficient workflows to reduce operational costs for clients, and sustainability initiatives. For instance, their Heidelberg Subscription model, launched in 2020 and further developed, offers customers access to printing technology and services on a usage-based fee, reflecting a shift towards service-oriented innovation.

In 2024, the printing industry continues to see a push for digital transformation and enhanced sustainability. Heidelberg's commitment to these areas, including investments in R&D for smarter printing solutions, directly addresses market demands for higher efficiency and reduced environmental impact, thereby strengthening their competitive position.

Exit Barriers

The printing machinery sector, including players like Heidelberger Druckmaschinen, faces substantial exit barriers. These stem from the immense capital investment in specialized manufacturing plants and advanced machinery. For instance, the cost of a modern printing press can easily run into millions of euros, making it difficult to recoup such investments if a company decides to exit.

Furthermore, the industry relies on a highly skilled workforce, encompassing engineers, technicians, and specialized operators. The cost and time involved in training and retaining this talent create another layer of commitment, discouraging quick departures. Companies are thus incentivized to persevere even when facing market downturns, leading to sustained competitive pressure.

These high exit barriers mean that even struggling firms are likely to remain active participants, intensifying competition. This can manifest in aggressive pricing strategies or increased efforts to innovate and capture market share, as companies fight to remain viable. For example, in 2023, the global printing machinery market experienced a moderate growth rate, yet the underlying fixed costs remained a significant factor for established players.

- High Capital Investment: Significant upfront costs for specialized machinery and manufacturing facilities.

- Specialized Workforce: Reliance on highly skilled labor, making workforce divestment costly.

- Ongoing R&D Commitments: Continuous investment in research and development to stay competitive.

- Industry Persistence: Companies tend to stay in the market despite challenges due to these barriers, fueling rivalry.

Strategic Commitments of Competitors

Competitors in the printing machinery sector are demonstrating robust strategic commitments, particularly by investing heavily in digital transformation, automation, and the development of sustainable solutions. This focus signals a clear intent to capture future market share and leadership.

Heidelberger Druckmaschinen is actively pursuing its strategy to evolve into a systems integrator, especially within the packaging segment. Furthermore, the company is strategically expanding into new technology-driven markets, notably making a significant move into the defense sector, aiming to diversify its revenue streams and leverage its technological expertise.

- Digital Transformation: Competitors are channeling resources into digital printing technologies and integrated software solutions to enhance efficiency and customer offerings.

- Automation and Robotics: Significant investments are being made in automated workflows and robotic integration to streamline production processes and reduce operational costs.

- Sustainability Initiatives: Companies are prioritizing the development of eco-friendly printing solutions, including energy-efficient machinery and recyclable materials, responding to growing environmental concerns and regulatory pressures.

- Market Diversification: Strategic moves into adjacent or new sectors, such as Heidelberger Druckmaschinen's entry into the defense industry, highlight a competitive drive to unlock new growth avenues beyond traditional printing markets.

The competitive rivalry within the printing machinery industry is intense, driven by a few dominant global players, including Heidelberger Druckmaschinen AG. These companies are not only vying for market share in traditional printing but are also heavily investing in digital transformation and sustainable solutions to stay ahead.

This heightened competition is fueled by significant investments in innovation, with companies like Heidelberg focusing on AI-driven analytics and energy-efficient workflows. The market's projected growth, especially in packaging, further intensifies this rivalry as firms strive to capture emerging opportunities.

The strategic commitments of competitors, such as expanding into new sectors like the defense industry, underscore the aggressive nature of this rivalry. This diversification aims to secure new revenue streams and leverage existing technological expertise in a bid to maintain a competitive edge.

The industry's high exit barriers, stemming from substantial capital investments and the need for specialized workforces, ensure that established players remain committed, thus perpetuating a dynamic and often fierce competitive landscape.

| Competitor | Key Focus Areas | 2024 Strategic Emphasis |

|---|---|---|

| Heidelberger Druckmaschinen AG | Digital transformation, packaging solutions, service integration, defense sector expansion | Strengthening subscription models, R&D in smart printing, sustainability |

| Koenig & Bauer AG | Security printing, packaging, digital printing solutions | Automation, digitalization, market expansion in emerging economies |

| Komori Corporation | Offset printing, digital printing, packaging and commercial printing | Productivity enhancement, sustainability, integrated solutions |

| HP Development Company L.P. | Digital printing, inkjet technology, 3D printing | Innovation in digital workflows, expanding into new applications |

SSubstitutes Threaten

The most significant substitute threat to traditional printing machinery, such as that produced by Heidelberger Druckmaschinen, arises from the continuous evolution of digital technologies and workflows. Digital communication, online advertising, and paperless solutions are increasingly replacing physical print across many sectors.

While digital alternatives pose a broad challenge, the printing industry itself is seeing digital printing emerge as a key substitute within specialized segments. For instance, in high-quality packaging and commercial printing, digital printing offers a growing alternative that Heidelberg is actively investing in and developing.

The global digital printing market was valued at approximately USD 20.5 billion in 2023 and is projected to reach USD 34.7 billion by 2028, demonstrating a compound annual growth rate of around 11.1% during this period, according to industry reports from 2024.

Digital printing technologies present a significant threat of substitution for traditional offset printing, particularly for short runs and personalized print jobs. While digital offers lower upfront costs and faster turnaround for these specific niches, it often struggles to match the cost-efficiency and quality of offset for high-volume, long-run projects. For instance, in 2024, the cost per page for short-run digital printing can be substantially higher than offset when quantities exceed a few thousand copies, making the price-performance trade-off highly application-dependent.

The perceived value of digital substitutes is directly tied to their ability to meet specific customer needs. For businesses requiring rapid production of marketing materials or customized packaging, digital printing's flexibility is a key advantage. However, for sectors like high-quality book publishing or large-scale commercial printing where consistent color fidelity and bulk production efficiency are paramount, offset printing remains the preferred choice, highlighting the nuanced nature of this substitution threat.

Switching from traditional printing to fully digital solutions presents considerable hurdles for Heidelberg's customers. These include retooling workflows, retraining staff, and potentially overhauling marketing and content distribution strategies. Such a fundamental shift often entails significant upfront capital expenditure and operational adjustments, making the transition costly.

For print businesses themselves, moving away from established printing technologies to embrace exclusively digital alternatives would necessitate substantial investments in new hardware and software, alongside comprehensive employee retraining programs. These factors contribute to high switching costs, as businesses must weigh the expense of acquiring new capabilities against the perceived benefits of digital adoption.

Buyer Propensity to Substitute

Heidelberger Druckmaschinen faces a growing threat from substitutes as buyers increasingly shift from print to digital media. This trend is fueled by environmental considerations, the demand for rapid information sharing, and the expansion of e-commerce platforms. For instance, digital advertising spend globally is projected to reach over $600 billion in 2024, significantly impacting traditional print advertising markets.

Despite this shift, print retains its importance in specific sectors. Packaging, in particular, continues to rely heavily on print for branding and physical product presence. In 2023, the global packaging market was valued at approximately $1.18 trillion, with printed packaging forming a substantial component of this value.

- Digitalization: Growing preference for digital content over printed materials, driven by convenience and cost-effectiveness.

- Environmental Concerns: Increased awareness of the environmental impact of paper production and printing processes encourages a move towards digital alternatives.

- E-commerce Growth: The boom in online retail reduces the need for printed catalogs and marketing materials for many businesses.

- Print's Niche Strength: Print remains vital for high-value applications like luxury packaging, security printing, and certain forms of branding where tactile experience is paramount.

Growth of Digital-Only Solutions and Services

The rise of digital-only solutions like online publishing, e-books, and digital marketing platforms poses a significant substitute threat to traditional print. These digital alternatives offer immediate access and engaging, interactive experiences that print media struggles to match. For instance, the global e-book market was valued at approximately USD 15.02 billion in 2023 and is projected to grow, showcasing the increasing consumer preference for digital content.

Heidelberger Druckmaschinen actively addresses this threat by investing in and promoting its digital printing technologies. The company also focuses on developing integrated software solutions designed to facilitate hybrid print-digital strategies, allowing customers to combine the strengths of both mediums. This strategic pivot is crucial as businesses increasingly seek omnichannel communication approaches.

Key aspects of this threat include:

- Digital Content Consumption: Growing consumer preference for instant access and interactive features found in digital formats over traditional print.

- Cost-Effectiveness of Digital: Digital solutions often present a lower per-unit cost for distribution and content updates compared to print runs.

- Environmental Concerns: Some consumers and businesses may favor digital options due to perceived environmental benefits over paper production and distribution.

- Heidelberg's Response: Strategic investment in digital printing and software solutions to enable hybrid print-digital workflows, such as the Heidelberg Primefire and Versafire product lines which cater to short-run, personalized digital printing needs.

The threat of substitutes for traditional printing, like that from Heidelberger Druckmaschinen, is substantial due to the rise of digital media and communication. Digital platforms offer immediate delivery and interactivity, often at a lower cost for certain applications. For example, global digital advertising spending was projected to exceed $600 billion in 2024, directly competing with print advertising revenue.

Within the printing industry itself, digital printing is a key substitute for offset printing, especially for shorter runs and personalized items. While digital printing offers flexibility and faster turnaround for these specific niches, it may not always match the cost-efficiency of offset for high-volume jobs. The global digital printing market was valued at approximately USD 20.5 billion in 2023 and is expected to grow significantly.

| Substitute Type | Key Characteristics | Impact on Traditional Print | Heidelberg's Position |

| Digital Media & Communication | Immediacy, interactivity, broad reach, lower distribution cost | Reduces demand for print advertising, publications, and direct mail | Investing in digital solutions and hybrid workflows |

| Digital Printing Technologies | Short runs, personalization, variable data printing, faster setup | Competes in commercial printing, packaging, labels, and publications | Offers Primefire and Versafire series for digital printing |

| E-books & Digital Publishing | Portability, searchability, multimedia integration | Displaces demand for physical books and magazines | Focus on print's enduring value in specific segments |

Entrants Threaten

The printing machinery sector, especially for sophisticated offset and digital presses, necessitates enormous capital outlays. These investments cover crucial areas like research and development, state-of-the-art manufacturing plants, and establishing extensive global distribution and service networks. For instance, developing a new high-speed digital printing press can easily cost hundreds of millions of euros. This sheer financial hurdle significantly deters potential new competitors from entering the market.

Heidelberger Druckmaschinen, as an established player, leverages substantial economies of scale in its manufacturing processes, raw material procurement, and ongoing research and development efforts. These inherent cost advantages present a significant barrier for any potential new entrants aiming to compete effectively on price.

Newcomers would find it exceedingly difficult to match the cost efficiencies that Heidelberger has cultivated over years of operation and market presence. Without a comparable initial market share and production volume, achieving similar operational efficiencies would be nearly impossible, thus hindering their ability to undercut established pricing structures.

Heidelberger Druckmaschinen benefits from a deeply entrenched brand loyalty built on decades of delivering quality, innovation, and reliability. This strong reputation makes it challenging for new entrants to gain traction. For instance, in fiscal year 2023/2024, Heidelberger Druckmaschinen reported a significant order intake, demonstrating continued customer confidence in their established offerings.

Access to Distribution Channels

New companies entering the printing press market face significant challenges in securing access to established global distribution and service networks. Heidelberger Druckmaschinen, for instance, has cultivated a comprehensive infrastructure encompassing sales, installation, ongoing maintenance, and the crucial supply of consumables. This intricate network is fundamental to ensuring the seamless operation and support of its sophisticated printing machinery.

Building or acquiring a comparable level of infrastructure represents a substantial capital investment for any potential new entrant. For example, establishing a global service network similar to Heidelberger's would likely require billions in investment for facilities, trained personnel, and logistics. This high barrier to entry significantly limits the threat from new competitors who lack such pre-existing capabilities.

Heidelberger’s existing distribution channels also provide a competitive advantage by ensuring prompt and efficient delivery of machinery and spare parts. This reliability is a key factor for customers in the printing industry who depend on minimal downtime. New entrants would struggle to match this speed and reach without considerable time and financial commitment.

- High Capital Investment: New entrants need to invest heavily in building global sales, service, and logistics networks.

- Established Infrastructure: Heidelberger Druckmaschinen benefits from a mature and extensive distribution and support system.

- Customer Reliance: Printing businesses depend on reliable and rapid access to maintenance and consumables, a strength of established players.

- Barriers to Entry: The cost and complexity of replicating Heidelberger's distribution network create a significant deterrent for new market participants.

Expected Retaliation from Existing Players

Any new company entering the printing machinery sector, especially in segments where established players like Heidelberger Druckmaschinen have a strong presence, can anticipate significant pushback. This retaliation could manifest as aggressive price cuts to make the new entrant's offerings less competitive.

Incumbents might also ramp up their research and development spending, aiming to out-innovate any new competitor and render their technology obsolete quickly. For example, Heidelberger Druckmaschinen has consistently invested in digital printing technologies, a trend that will likely continue, making it harder for newcomers without similar capabilities.

- Aggressive Pricing: Existing firms may lower prices to deter new entrants.

- Accelerated Innovation: Increased R&D spending by incumbents to maintain a technological edge.

- Enhanced Customer Service: Offering superior support and training to retain existing customers.

- Strategic Acquisitions: Incumbents might acquire promising startups to neutralize them as competitors.

The threat of new entrants in the printing machinery sector, particularly for sophisticated offset and digital presses, is significantly mitigated by Heidelberger Druckmaschinen's established strengths. The immense capital required for research, manufacturing, and global distribution networks acts as a formidable barrier. For instance, developing advanced printing technology can cost hundreds of millions of euros, a sum few new players can readily muster.

Porter's Five Forces Analysis Data Sources

Our Heidelberger Druckmaschinen Porter's Five Forces analysis is built upon a foundation of verified data, including the company's annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant regulatory filings.