Heidelberger Druckmaschinen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberger Druckmaschinen Bundle

Heidelberger Druckmaschinen's BCG Matrix offers a powerful lens to understand its product portfolio. Discover which of their innovative printing solutions are market Stars, generating significant growth, and which are Cash Cows, providing stable revenue. Ready to unlock the full strategic advantage?

Purchase the complete Heidelberger Druckmaschinen BCG Matrix to gain a detailed quadrant-by-quadrant breakdown, identifying potential Dogs to divest and Question Marks ripe for investment. This is your essential guide to optimizing their market position and driving future success.

Stars

Heidelberger Druckmaschinen AG's Packaging Solutions segment is a robust growth engine for the company, consistently demonstrating impressive incoming orders. In fiscal year 2023/24, this segment played a pivotal role, contributing significantly to Heidelberg's financial performance and showcasing its strategic importance.

The demand for sustainable packaging solutions globally, coupled with robust growth in emerging markets like China, fuels the expansion of Heidelberg's Packaging Solutions. China's packaging print volumes are experiencing annual increases, creating a fertile ground for Heidelberg's offerings.

Heidelberg is strategically enhancing its product range within this segment, particularly with large format presses designed for folding carton production. This proactive portfolio expansion reinforces Heidelberg's market leadership and its commitment to capitalizing on anticipated future growth.

Heidelberger Druckmaschinen (Heidelberg) is strategically investing in the industrial digital commercial printing sector, aiming to capture growth in this expanding market. Their collaboration with Canon and the introduction of new digital presses like the Jetfire 50 highlight this commitment. This push diversifies Heidelberg's portfolio beyond traditional offset printing, addressing the increasing demand for digital solutions offering greater flexibility and speed.

Heidelberg's integrated workflow and automation software solutions are a prime example of their strategic move towards the Stars quadrant in the BCG matrix. By heavily investing in software that boosts efficiency, automation, and robotics throughout the print production process, they are directly addressing the industry's need for modernization. These AI-driven analytics and end-to-end solutions are vital for print shops aiming to meet evolving customer demands.

Print Solutions Segment (High-Growth Areas)

Heidelberg's Print Solutions segment shows star potential in specific high-growth areas, particularly those boosted by drupa trade fair orders and strategic regional expansions. The company's focus on highly automated sheetfed technologies is driving growth in profitable niches, a key indicator of star performance.

In 2024, Heidelberg reported a significant increase in order intake, especially from Europe and the Americas, reflecting the success of its targeted growth strategy. This strong performance in key markets, coupled with the ongoing development of innovative printing solutions, positions these areas as stars within the BCG matrix.

- Strong Order Intake: Heidelberg experienced robust order growth in 2024, particularly from European and American markets, indicating high demand for its advanced printing solutions.

- Technological Advancement: The company's investment in and rollout of highly automated sheetfed technologies are creating competitive advantages in niche markets.

- Regional Expansion: Heidelberg is effectively leveraging its global footprint to capitalize on diverse regional market dynamics, driving growth in key territories.

- Drupa Impact: Orders secured during the drupa trade fair in 2024 have significantly contributed to the positive performance and star-like trajectory of specific Print Solutions offerings.

Advanced Consumables and Services

Heidelberg's Advanced Consumables and Services represent a significant shift towards a lifecycle business model. This segment focuses on delivering enhanced value and operational efficiency to their extensive customer base. By leveraging a vast installed machine base connected through cloud technology, Heidelberg is increasingly offering services like predictive maintenance and remote diagnostics.

This strategic evolution is bolstered by continuous innovation in consumables, with a particular emphasis on aligning with growing sustainability trends. These advancements are key drivers for high growth potential within this business area, solidifying Heidelberg's market leadership in support of its sophisticated machinery.

- Lifecycle Business Focus: Heidelberg is transitioning to a model where consumables and services are integral to the entire machine lifecycle, aiming for higher customer value.

- Digitalization and Connectivity: A substantial installed base of cloud-connected machines enables advanced services like predictive maintenance and remote support.

- Sustainability Integration: Ongoing innovation in consumables is increasingly focused on eco-friendly solutions, aligning with market demands and regulatory pressures.

- Growth Potential: The combination of advanced services and sustainable consumables positions this segment for significant market growth and leadership.

Heidelberg's Print Solutions segment is showing star potential, particularly in areas driven by technological advancements and strong market demand. The company's focus on highly automated sheetfed technologies is creating significant advantages in profitable niches.

In 2024, Heidelberg reported a notable increase in order intake, especially from Europe and the Americas, underscoring the success of their growth strategy. Orders from the drupa trade fair also significantly bolstered the performance of specific Print Solutions, reinforcing their star-like trajectory.

The company's investment in and rollout of advanced, highly automated sheetfed technologies are key drivers for growth in these high-potential areas. This strategic focus, combined with effective regional expansion, solidifies Heidelberg's position in these segments.

Heidelberg's Print Solutions segment, especially in automated sheetfed technologies, is a star performer. Strong order intake in 2024, particularly from Europe and the Americas, and significant contributions from drupa orders highlight this segment's growth trajectory.

| Segment Area | Key Strengths | 2024 Performance Indicators | BCG Classification |

|---|---|---|---|

| Automated Sheetfed Technologies | High automation, niche market leadership | Strong order growth (Europe & Americas), drupa order impact | Star |

| Digital Commercial Printing | Innovation (Jetfire 50), Canon collaboration | Diversifying portfolio, increasing demand for digital | Potential Star/Question Mark |

| Packaging Solutions | Robust incoming orders, sustainable focus | Significant contributor to fiscal year 2023/24 performance | Star |

| Advanced Consumables & Services | Lifecycle model, cloud connectivity, sustainability | High growth potential, increased customer value | Potential Star |

What is included in the product

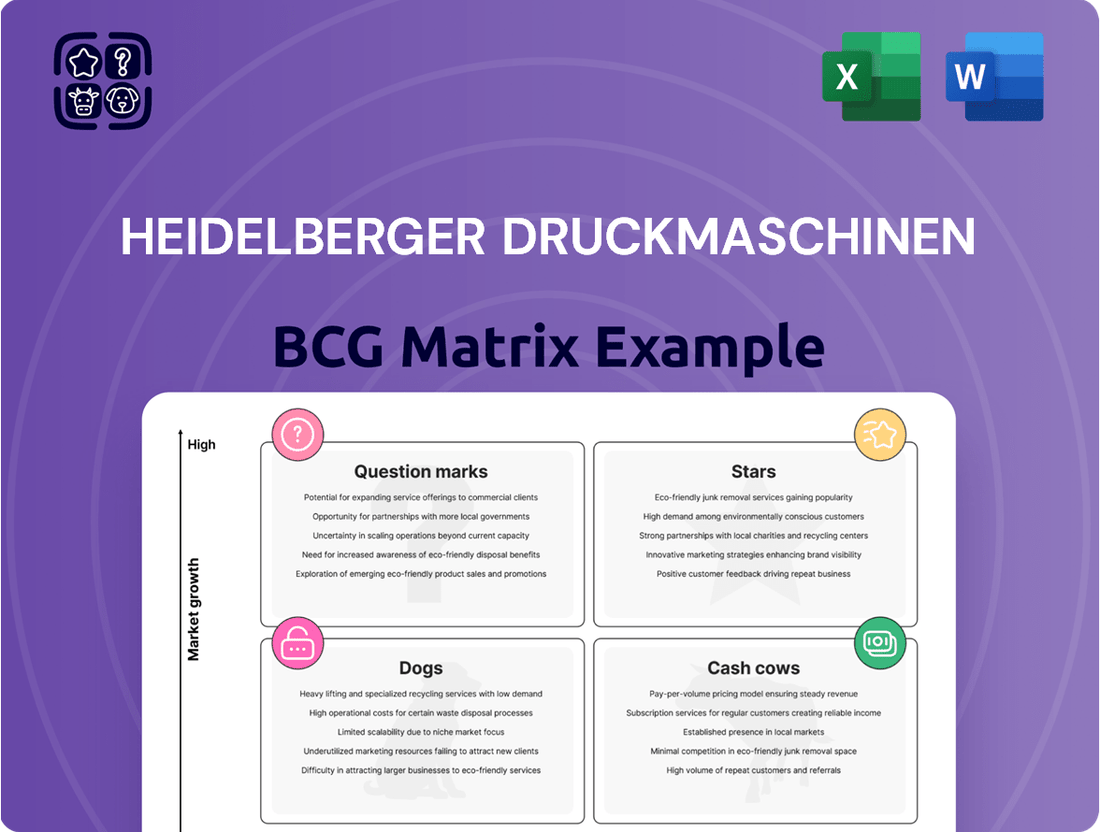

This BCG Matrix analysis highlights Heidelberger Druckmaschinen's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic insights on investment, holding, or divestment decisions for each quadrant.

The Heidelberger Druckmaschinen BCG Matrix provides a clear, quadrant-based overview of their business units, simplifying strategic decision-making.

This visual tool helps alleviate the pain of complex portfolio analysis by presenting actionable insights in an easily digestible format.

Cash Cows

Heidelberg Druckmaschinen holds a dominant position in the global sheet-fed offset press market, boasting a substantial installed base. This mature segment, while not experiencing rapid growth, is a reliable source of income.

The company benefits from consistent revenue streams generated by replacement parts, essential maintenance services, and the ongoing sale of consumables for these presses. This predictable cash flow is a hallmark of a cash cow business.

With a vast existing customer network, Heidelberg enjoys a stable and predictable revenue base. The need for significant new investment to simply maintain its market share is minimal, allowing profits to be reinvested elsewhere.

Heidelberger Druckmaschinen's traditional service and spare parts business acts as a robust cash cow. Its extensive global network supporting a vast installed base of printing machines generates consistent, recurring revenue. This model is akin to the classic 'razor and blade' strategy, ensuring financial stability even when new equipment sales fluctuate.

The high profitability of this segment stems directly from the critical need for these services to maintain machine uptime and ensure the longevity of customer investments. For instance, in fiscal year 2023/24, Heidelberg reported that its service business contributed significantly to overall profitability, with a substantial portion of the company's EBITDA being generated from this area, underscoring its role as a reliable income stream.

Heidelberg's Standardized Consumables Portfolio acts as a robust cash cow within its business structure. This segment includes essential items like inks, plates, and blankets, crucial for the operation of their offset printing machines, generating consistent and reliable revenue.

The company benefits from a significant market share in these necessary consumables for its installed base of machinery. This strong position means customers depend on Heidelberg for these products, ensuring a predictable income stream.

These consumables require minimal investment for growth, allowing them to contribute substantially to Heidelberg's overall cash flow. For instance, in fiscal year 2023/24, consumables and services represented a significant portion of Heidelberg's net sales, underscoring their role as a stable revenue driver.

Established Flexographic Presses for Packaging

Heidelberg's established flexographic presses, especially those designed for packaging, are a cornerstone of their business. These machines operate in a mature market, meaning they've found their niche and consistently bring in steady income. This stability allows Heidelberg to leverage these products for reliable cash flow without needing to invest heavily in exploring new territories.

These flexographic presses are key contributors to Heidelberg's financial health. They represent a significant portion of the company's revenue generation in the packaging sector. For instance, the packaging printing market, where these presses are dominant, saw continued growth, with global market size estimates reaching approximately USD 1.1 trillion in 2024, driven by consumer demand and e-commerce. Heidelberg's established presence in this segment ensures they capture a good share of this expanding pie.

- Market Dominance: Heidelberg's flexographic presses hold a strong position in the packaging printing segment.

- Stable Revenue: These machines generate consistent and predictable cash flow for the company.

- Low Investment Needs: They require minimal new market development, focusing on optimizing existing operations.

- Profitability Driver: Their reliable performance directly contributes to Heidelberg's overall profitability.

Prepress and Postpress Solutions (Established Lines)

Heidelberg's prepress and postpress solutions represent established lines within their portfolio, acting as significant cash cows. These offerings are critical components of the entire print production process, seamlessly integrating with their core printing press machinery. Their high market share in this mature segment ensures a reliable and consistent stream of revenue.

These solutions are frequently bundled with new press sales or offered as essential upgrades, creating a predictable demand. For instance, in fiscal year 2023/24, Heidelberg reported a robust performance in its Print Solutions segment, which encompasses these offerings, demonstrating their continued financial strength.

- Established Market Presence: Heidelberg holds a dominant position in the prepress and postpress market, a testament to decades of innovation and customer trust.

- Consistent Revenue Generation: The mature nature of the print industry, coupled with the essential role of these solutions, guarantees steady cash flow for Heidelberg.

- Bundling and Upgrade Opportunities: Integrating these products with core press sales and offering them as upgrades maximizes their revenue potential and customer stickiness.

- Strategic Importance: These cash cows provide the financial stability needed for Heidelberg to invest in new technologies and growth areas.

Heidelberg's service and consumables business functions as a prime cash cow. This segment, vital for maintaining their extensive installed base of printing presses, generates consistent and predictable recurring revenue. For fiscal year 2023/24, Heidelberg highlighted the significant contribution of its service business to overall profitability, with a substantial portion of the company's EBITDA originating from this area, confirming its role as a stable income generator.

The company's standardized consumables portfolio, including inks and plates, also acts as a powerful cash cow. Heidelberg benefits from a considerable market share in these essential items for its existing machinery, ensuring a predictable income stream. These consumables require minimal investment for expansion, thereby contributing significantly to Heidelberg's free cash flow, with consumables and services representing a notable percentage of net sales in fiscal year 2023/24.

Heidelberg's established flexographic presses, particularly those for packaging, are solid cash cows. Operating in a mature market, these machines consistently generate steady income. This stability allows Heidelberg to leverage these products for reliable cash flow without substantial new investment. The packaging printing market, where these presses are prominent, is projected to continue its growth, with global market size estimates around USD 1.1 trillion in 2024, ensuring Heidelberg's continued revenue capture.

Full Transparency, Always

Heidelberger Druckmaschinen BCG Matrix

The Heidelberger Druckmaschinen BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be fully editable and ready for immediate integration into your business planning and presentations. You'll gain access to the complete, professionally formatted report, empowering you to make informed decisions based on Heidelberger Druckmaschinen's market positioning.

Dogs

Certain older or less efficient sheet-fed offset presses from Heidelberg may be classified as Dogs in the BCG matrix. Their market share is likely shrinking as the printing industry increasingly adopts newer, more automated, or digital technologies. Customers might also be opting for more affordable used equipment, further pressuring sales of these legacy models.

Heidelberger Druckmaschinen's legacy niche products, those highly specialized items from its past, often fall into the Dogs category if they no longer fit the company's strategic pivot towards packaging, digital printing, and services. These products, while perhaps serving a small, dedicated customer base, typically exhibit minimal market demand and yield low returns. For instance, certain older sheetfed offset presses designed for very specific, now-declining print applications might fit this description.

The financial implications of maintaining these niche legacy products are often unfavorable. They can drain valuable resources, both financial and human, that could be reinvested in growth areas like digital solutions or sustainable packaging printing technologies. While specific figures for individual legacy product lines are not publicly disclosed, Heidelberg's 2024 financial reports indicate a strategic focus on divesting or phasing out non-core assets to streamline operations and enhance profitability in its core segments.

Underperforming regional operations or partnerships within Heidelberger Druckmaschinen (Heidelberg) would fall into the Dogs category of the BCG Matrix. These are segments operating in low-growth markets that are not gaining significant traction or market share. For instance, if a specific European market, characterized by a mature printing industry with minimal expansion, sees Heidelberg’s operations consistently lagging behind competitors, it would be a prime example.

Such underperforming units demand considerable management focus and financial resources, yet they yield meager returns. In 2024, while Heidelberg’s overall performance showed resilience, specific regional challenges, perhaps related to outdated technology adoption or intense local competition in a saturated market, could exemplify these Dog segments. These operations might require strategic divestment or a significant overhaul to avoid draining company resources.

Outdated Software or Workflow Solutions

Outdated software or workflow solutions that aren't integrated into Heidelberg's digital ecosystem and have been replaced by newer technologies often find themselves in the Dogs quadrant of the BCG matrix. These legacy offerings typically have a low market share and face limited growth prospects as the industry moves towards more advanced, connected systems.

These older solutions might only generate modest revenue through ongoing maintenance, and their long-term viability is questionable, suggesting they could eventually be phased out entirely. For instance, a standalone pre-press software from the early 2010s, once a market leader, might now struggle to compete with cloud-based, AI-driven workflow platforms that offer greater efficiency and integration.

- Low Market Share: Many legacy software solutions for print workflows have been overtaken by integrated digital platforms.

- Low Growth Prospects: The demand for standalone, older software is declining as the industry prioritizes connected, automated solutions.

- Minimal Revenue: These products primarily generate revenue from maintenance contracts, which are unlikely to grow significantly.

- Potential for Phase-Out: Heidelberg may eventually discontinue support for these outdated systems to focus on its modernized digital offerings.

Non-Core, Divested or Phased-Out Ventures

Heidelberger Druckmaschinen has strategically divested or is phasing out ventures that no longer align with its core business or exhibit low growth potential. These actions are part of a broader restructuring and cost-reduction initiative aimed at enhancing profitability and focusing resources on more promising areas. For instance, the company's continued focus on its digital printing solutions and services reflects a strategic shift away from legacy or underperforming segments.

These divested or phased-out ventures, fitting into the 'Dogs' category of the BCG Matrix, represent areas where Heidelberg is reducing its investment and market presence. This strategic pruning allows the company to concentrate on its 'Stars' and 'Cash Cows' to maximize overall financial performance. The company's commitment to digital transformation, including investments in its Prinect software and Bograma solutions, underscores this portfolio optimization.

- Divestment of Non-Core Assets: Heidelberg has previously divested certain non-core business units to streamline operations.

- Phased Exit of Low-Growth Ventures: Ventures with limited market share and growth prospects are being systematically phased out.

- Focus on Digitalization: Resources are being reallocated towards high-growth digital printing and service offerings.

- Portfolio Optimization for Profitability: These strategic exits are designed to improve overall company profitability and efficiency.

Products or business units classified as Dogs within Heidelberger Druckmaschinen's portfolio are those with a low market share in a slow-growing or declining industry. These offerings typically generate minimal profits and may even require ongoing investment to maintain. Heidelberg's strategic decisions often involve divesting or phasing out such segments to reallocate resources to more promising areas.

For instance, certain older sheetfed offset presses designed for niche, now-declining print applications would fit this category. These legacy products often face dwindling demand as the printing industry shifts towards digital and packaging solutions. Heidelberg's 2024 financial reports highlight a deliberate strategy to streamline operations by exiting or reducing focus on these less profitable, legacy segments.

The financial burden of supporting these Dog products can be significant, diverting capital and management attention from growth opportunities. While specific figures for individual legacy product lines are not public, Heidelberg's overall strategy in 2024 has been to focus on digital printing, services, and packaging, indicating a move away from such low-return segments.

Underperforming regional operations or outdated software solutions that have low market share and limited growth prospects also fall into the Dogs category. These segments require careful management and may eventually be phased out to improve overall company performance and profitability.

Question Marks

Heidelberger Druckmaschinen's (Heidelberg) strategic move into the defense sector through its partnership with VINCORION positions this venture as a classic Question Mark in the BCG Matrix. This entry targets a high-growth, high-margin market for advanced power control systems in military applications.

The defense sector presents a significant opportunity for diversification, but Heidelberg currently holds a negligible market share. This necessitates considerable investment in research, development, and market penetration to build a strong foothold and capitalize on the sector's potential.

The Amperfied electromobility business represents Heidelberg's strategic diversification into the burgeoning electric vehicle charging market. This sector is characterized by rapid expansion and significant technological evolution, positioning Amperfied as a potential high-growth opportunity.

However, as a relatively new entrant in a competitive landscape, Amperfied likely holds a modest market share. This places it squarely in the Question Mark category of the BCG matrix, necessitating substantial ongoing investment to scale operations, enhance its technological offering, and capture a more significant portion of the market.

The success of Amperfied hinges on Heidelberg's ability to effectively channel resources into research and development, strategic partnerships, and market penetration efforts. Achieving profitability will depend on overcoming initial market entry challenges and establishing a strong competitive position within the electromobility ecosystem.

Heidelberg is venturing into high-precision plant engineering and robotics, offering its expertise to external clients. This strategic move targets high-growth industrial sectors, leveraging the company's established technological prowess.

These new ventures currently represent a small market share for Heidelberg in these specific third-party applications. Significant investment is required to establish a stronger foothold and capture potential growth in these nascent areas.

Cutting-Edge AI and Digital Transformation Platforms (Early Stage)

Heidelberg's cutting-edge AI and digital transformation platforms, like SHIFT 2025, are positioned as Question Marks in the BCG Matrix. These initiatives operate in dynamic, high-growth markets driven by rapid technological advancement.

While the potential is significant, market adoption and Heidelberg's current market share are still in their nascent stages. This necessitates substantial investment in research and development, alongside dedicated market development efforts to capture future growth.

- Market Potential: AI and digital transformation in printing are experiencing rapid growth, with the global AI in manufacturing market projected to reach $20.8 billion by 2026, growing at a CAGR of 36.8%.

- Investment Needs: Significant R&D and market development are crucial for these early-stage platforms to gain traction and establish a strong market position.

- Uncertainty: Despite high growth potential, the success of these ventures is not guaranteed, reflecting the inherent risks of Question Mark products.

New Geographic Market Expansions with Nascent Presence

New geographic market expansions with a nascent presence, while not explicitly categorized as a distinct "question mark" in a traditional BCG sense for Heidelberg, represent strategic ventures into areas with high growth potential but currently limited market share. These are akin to question marks because they demand significant investment to establish a foothold and determine future success.

For instance, if Heidelberg were to target a region experiencing rapid industrialization and a burgeoning print market, such as certain parts of Southeast Asia or Africa, these would be considered nascent markets. The company would need to allocate substantial resources for building out sales networks, establishing service centers, and adapting products to local needs. This is a high-risk, high-reward scenario, typical of question mark strategies.

Heidelberg's global diversification means they are always evaluating such opportunities. For example, in 2024, the company continued its focus on emerging markets. While specific details on entirely new, unpenetrated markets are not always publicly disclosed with BCG matrix implications, their strategy involves identifying regions with strong GDP growth forecasts and increasing demand for advanced printing solutions.

- Emerging Market Focus: Heidelberg's strategic initiatives in 2024 included deepening their presence in regions with significant untapped print market potential.

- Investment Requirements: Establishing a foothold in these nascent markets necessitates substantial capital expenditure in sales infrastructure, technical support, and localized marketing efforts.

- Growth Potential: These expansions target areas projected to experience robust economic and industrial growth, indicating a strong future demand for printing technology.

- Risk and Reward: Successfully penetrating these new territories offers the potential for significant market share gains and long-term revenue growth, albeit with inherent risks associated with market entry.

Heidelberg's ventures into new sectors and markets, such as defense technology via VINCORION and electromobility with Amperfied, are classic Question Marks. These areas offer high growth potential but currently represent a small market share for the company, requiring significant investment to establish a strong competitive position.

The success of these nascent businesses, including AI and digital platforms and expansion into new geographic regions, hinges on substantial R&D, strategic partnerships, and effective market penetration efforts. Heidelberg's 2024 strategy included deepening its presence in emerging markets, underscoring the commitment to these high-potential, yet uncertain, ventures.

These Question Mark initiatives demand considerable capital for development and market entry, reflecting the inherent risks and rewards associated with capturing future growth in dynamic industries. The company's ongoing evaluation of opportunities in regions with strong GDP growth forecasts highlights this strategic approach.

The global AI in manufacturing market, for example, was projected to reach $20.8 billion by 2026, growing at a CAGR of 36.8%, illustrating the significant market potential Heidelberg aims to tap into with its AI and digital transformation platforms.

| Venture Area | Market Growth Potential | Heidelberg's Current Market Share | Investment Needs | Strategic Focus |

| Defense Technology (VINCORION) | High | Negligible | High (R&D, Market Penetration) | Establish Foothold |

| Electromobility (Amperfied) | High | Modest | High (Scaling, Technology Enhancement) | Capture Market Share |

| AI & Digital Transformation | High | Nascent | High (R&D, Market Development) | Gain Traction |

| New Geographic Markets | High (Emerging Economies) | Nascent | High (Infrastructure, Localization) | Deepen Presence |

BCG Matrix Data Sources

Our Heidelberger Druckmaschinen BCG Matrix is constructed using a blend of financial disclosures, market growth data, and competitor analysis. This ensures a robust understanding of each business unit's position within the industry.