Healthcare Services Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthcare Services Group Bundle

Healthcare Services Group operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for strategic planning and identifying potential growth opportunities or risks. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for Healthcare Services Group. Discover how technological advancements, environmental regulations, and the legal landscape are impacting the company's operations and future trajectory. Download the full version now to unlock strategic intelligence and make informed decisions.

Political factors

Government healthcare policies, especially those concerning Medicare and Medicaid reimbursement rates, are crucial for the financial health of healthcare facilities, which are Healthcare Services Group's main customers. For example, in 2024, the Centers for Medicare & Medicaid Services (CMS) proposed a 2.5% increase for skilled nursing facilities, a figure that directly influences how much these facilities can spend on outsourced services.

Shifts in how these facilities are funded or how payments are structured can alter their budgets, impacting their capacity to engage with service providers like Healthcare Services Group. The Biden-Harris administration's emphasis on improving nursing home quality and imposing new staffing requirements, such as the proposed minimum staffing ratio of 3.48 hours per resident day, could raise operating expenses for these facilities, potentially affecting their discretionary spending on non-clinical support.

The healthcare sector, particularly long-term care, faces significant regulatory oversight. New rules and more rigorous enforcement from agencies like the Centers for Medicare and Medicaid Services (CMS) mean Healthcare Services Group (HCSG) clients must adhere to tougher compliance standards. For instance, CMS proposed a 2.5% payment update for skilled nursing facilities in fiscal year 2025, signaling continued focus on operational efficiency and patient care quality, which directly impacts HCSG's service delivery.

The broader political climate, particularly national elections and potential changes in administration, introduces significant uncertainty for Healthcare Services Group. For instance, the upcoming 2024 US presidential election could lead to shifts in healthcare priorities, impacting regulatory frameworks and funding streams for long-term care. This necessitates a proactive approach to monitoring policy developments that could influence the group's operational landscape and client services.

State-Level Healthcare Legislation

Beyond federal mandates, state-specific legislation and regulations significantly shape the healthcare services landscape. Each state can implement its own unique laws concerning staffing ratios, operational standards, and quality of care benchmarks, creating a complex patchwork for companies to navigate. Healthcare Services Group, for instance, must continuously adapt its service delivery and compliance frameworks to align with these varying state requirements.

This dynamic regulatory environment is exemplified by recent legislative actions. For example, new long-term care laws enacted in states like Massachusetts and Georgia in 2024 directly impact how facilities operate and are reimbursed, necessitating strategic adjustments for providers like Healthcare Services Group. Understanding and responding to these state-level nuances is critical for maintaining operational efficiency and market competitiveness.

- State-Specific Regulations: Healthcare Services Group must comply with a diverse array of state laws governing staffing, operations, and quality of care.

- Legislative Impact: New laws in states such as Massachusetts and Georgia (2024) are already influencing long-term care facility operations and compliance.

- Adaptability Required: Companies need to tailor their strategies to meet the unique requirements of each state's regulatory framework.

Public Health Initiatives and Preparedness

Government-backed public health campaigns, particularly those addressing infectious diseases or chronic conditions, directly shape the services Healthcare Services Group (HCSG) offers. For instance, increased funding for vaccination programs or preventative screenings in 2024-2025 would likely boost demand for HCSG's diagnostic and administrative support services.

In the wake of recent global health events, preparedness and response protocols are now a significant focus. HCSG's capacity to help clients adhere to evolving infection control standards, such as enhanced sanitation mandates or specific patient handling procedures, is crucial. This directly impacts their operational efficiency and client retention.

The financial commitment to public health infrastructure is also a key political factor. For example, the U.S. government allocated approximately $1.5 trillion to healthcare spending in 2023, with a significant portion directed towards public health initiatives. Future allocations in 2024-2025 could further influence the market for HCSG's services, particularly if they align with government priorities like expanding access to care or improving health outcomes in underserved communities.

- Increased government investment in public health infrastructure, projected to grow by 5-7% annually through 2025, directly benefits healthcare service providers.

- Mandates for enhanced infection control, implemented in response to pandemic preparedness, require healthcare facilities to invest in new technologies and training, creating opportunities for HCSG.

- Policy shifts favoring preventative care and wellness programs, supported by government funding, can drive demand for HCSG's patient engagement and health management solutions.

- The Centers for Disease Control and Prevention (CDC) has outlined a strategic plan for 2025 focusing on strengthening public health systems, which will likely necessitate increased support from service providers like HCSG.

Government policies, particularly those from CMS regarding reimbursement rates for skilled nursing facilities, directly impact Healthcare Services Group's client base. For instance, CMS proposed a 2.5% payment update for skilled nursing facilities in fiscal year 2025, a figure that influences clients' spending capacity on outsourced services.

The Biden-Harris administration's focus on improving nursing home quality, including proposed minimum staffing ratios, could increase operational costs for facilities. This may affect their budgets for services like those provided by Healthcare Services Group.

Political shifts, such as the 2024 US presidential election, introduce uncertainty regarding future healthcare regulations and funding. This necessitates continuous monitoring of policy developments that could influence the long-term care sector.

State-level legislation also plays a significant role, with varying requirements for staffing, operations, and quality of care. For example, new long-term care laws enacted in Massachusetts and Georgia in 2024 demand strategic adaptation from providers.

| Political Factor | Impact on Healthcare Services Group | Example/Data (2024-2025) |

|---|---|---|

| Reimbursement Rates (CMS) | Affects clients' ability to pay for services | Proposed 2.5% increase for SNFs (FY 2025) |

| Staffing Mandates | Increases operational costs for clients | Proposed 3.48 hours/resident day minimum staffing |

| Election Uncertainty | Potential shifts in regulatory and funding landscapes | 2024 US Presidential Election outcomes |

| State-Specific Legislation | Requires tailored compliance strategies | New laws in MA & GA impacting long-term care operations (2024) |

What is included in the product

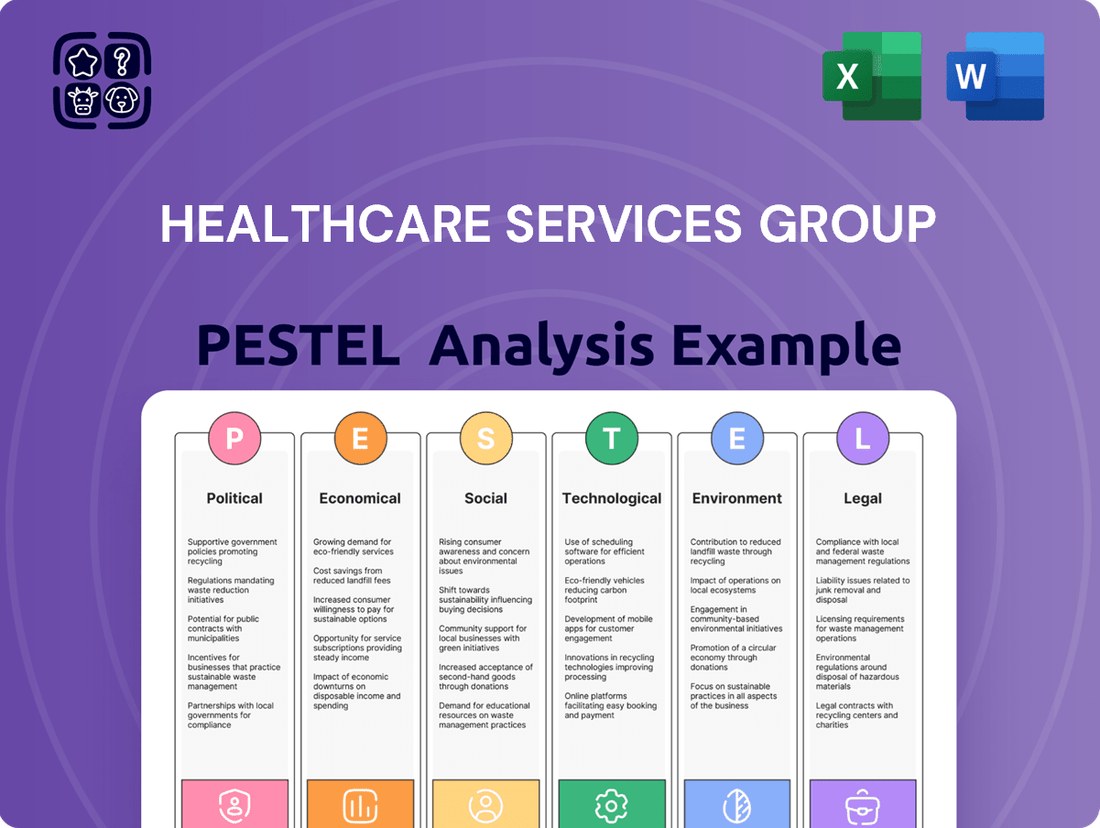

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the Healthcare Services Group, providing a comprehensive overview of the external landscape.

It offers actionable insights into market dynamics and regulatory shifts, empowering strategic decision-making for stakeholders.

Provides a concise version of the Healthcare Services Group PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to identify and address external challenges.

Helps support discussions on external risks and market positioning by offering a clear, summarized PESTLE analysis of Healthcare Services Group, enabling proactive strategy development.

Economic factors

Healthcare spending continues its upward trajectory, with global health expenditure expected to reach $10.1 trillion by 2025, a significant increase from previous years. This growth directly impacts the financial landscape for healthcare providers, influencing their operational budgets and their need for efficient service management.

Reimbursement models are evolving, with a notable shift towards value-based care initiatives. For example, the Centers for Medicare & Medicaid Services (CMS) continues to expand programs that reward quality outcomes over sheer volume of services. This puts pressure on facilities to optimize their spending and demonstrate efficiency.

Healthcare Services Group's value proposition is amplified in this environment. By offering cost-effective outsourced solutions, the company can help clients navigate these complex reimbursement landscapes and manage escalating healthcare costs, ensuring their financial viability.

Healthcare Services Group (HCSG) is significantly impacted by ongoing labor shortages and escalating costs within the healthcare industry, particularly in long-term care. These challenges directly affect HCSG's ability to deliver services efficiently, as personnel represent a substantial portion of its operational expenses.

To attract and retain essential staff for housekeeping, laundry, and dining services, HCSG must contend with rising wages and the necessity of offering competitive benefits packages. This pressure on labor expenses can compress operating margins, underscoring the critical need for HCSG to implement robust and efficient workforce management strategies.

For instance, in 2024, the Bureau of Labor Statistics projected continued growth in healthcare support occupations, yet also highlighted persistent shortages in areas like certified nursing assistants (CNAs), a common role indirectly supported by HCSG's services. This dynamic forces companies like HCSG to invest more heavily in recruitment and retention, potentially increasing the average hourly wage for its employees to remain competitive in the market.

Inflationary pressures significantly impact Healthcare Services Group's (HCSG) operational costs. Rising prices for essential supplies, from cleaning agents to specialized laundry materials and dietary components, directly translate into higher expenses for their housekeeping, laundry, and dietary services. For instance, the Consumer Price Index (CPI) for medical supplies saw a notable increase in early 2024, reflecting broader inflationary trends.

While the rate of inflation has moderated from its peaks, the persistence of elevated costs poses a challenge to HCSG's profitability. If these higher operational expenses cannot be effectively passed on to clients through contract adjustments or offset by internal efficiencies, profit margins will inevitably shrink. This dynamic necessitates a keen focus on strategic procurement and rigorous cost management practices to safeguard financial health.

Economic Downturns and Financial Strain on Clients

Economic downturns present a significant risk to Healthcare Services Group (HCSG) as financial strain on healthcare facilities can lead to client bankruptcies or closures. This directly impacts HCSG's revenue streams and collection capabilities. For instance, the closure of nursing homes, a key client segment, due to mounting financial pressures, as seen in recent years, underscores this vulnerability. HCSG must actively monitor the financial health of its client base to mitigate credit risks.

The impact of economic slowdowns is amplified by the specific financial challenges within the long-term care sector. A report from the American Health Care Association and National Center for Assisted Living indicated that nearly 80% of nursing homes were operating at a loss or breaking even in late 2023, a trend that continued into early 2024. This widespread financial distress among potential clients means HCSG faces a higher probability of contract terminations or payment delays.

- Increased Risk of Client Insolvency: Economic contractions heighten the likelihood of healthcare facilities, particularly nursing homes, facing insolvency, directly threatening HCSG's contract revenue.

- Collection Challenges: Financial distress among clients can lead to extended payment cycles and an increased need for aggressive collection efforts, impacting HCSG's working capital.

- Sector-Specific Vulnerabilities: The long-term care industry, a core market for HCSG, has shown significant financial fragility, with many facilities operating on thin margins or at a loss, exacerbated by economic downturns.

- Strategic Importance of Risk Management: Proactive monitoring of client financial health and robust credit risk management are crucial for HCSG to navigate the economic uncertainties affecting its customer base.

Growth in Outsourcing Trends

Despite economic headwinds, the healthcare sector is increasingly turning to outsourcing for non-clinical functions. This strategic shift is driven by a desire to enhance operational efficiency and allow medical facilities to concentrate on patient care, creating a substantial economic opening for companies like Healthcare Services Group.

The company's value proposition hinges on its capacity to deliver tangible cost reductions and demonstrable quality enhancements through its outsourced service model. This ability is crucial for securing new contracts and fueling revenue expansion in the competitive healthcare market.

For instance, the global healthcare outsourcing market was valued at approximately $285 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2030. This robust growth underscores the economic opportunity.

- Increased Demand for Specialized Services: Healthcare providers are outsourcing niche functions like revenue cycle management, IT support, and patient engagement to specialized firms.

- Focus on Core Competencies: Outsourcing allows hospitals and clinics to redirect internal resources and management attention towards clinical operations and patient outcomes.

- Cost Optimization: In an environment of rising healthcare costs, outsourcing offers a pathway to reduce overheads and improve financial performance.

- Technological Advancements: The integration of advanced technologies by outsourcing providers can offer greater efficiency and better data analytics than in-house solutions.

Global healthcare spending is projected to hit $10.1 trillion by 2025, a clear indicator of the sector's economic significance and continued expansion. This growth fuels demand for efficient operational support, benefiting companies like HCSG that offer specialized services.

The persistent labor shortage in healthcare, particularly for support roles, drives up wages and benefits costs. For HCSG, this means increased expenses for housekeeping, laundry, and dining staff, necessitating strategic workforce management to maintain profitability amidst rising labor expenditures.

Inflationary pressures continue to impact HCSG's operational costs, with rising prices for essential supplies like cleaning agents and dietary components. While inflation may moderate, sustained higher costs require rigorous cost management and potential contract adjustments to protect profit margins.

Economic downturns pose a significant risk, as financial strain on healthcare facilities, especially nursing homes, can lead to insolvencies and payment delays. The long-term care sector's financial fragility, with many facilities operating at a loss, exacerbates HCSG's exposure to client financial distress and contract terminations.

| Economic Factor | Impact on HCSG | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Healthcare Spending Growth | Increased demand for outsourced services | Global health expenditure projected at $10.1 trillion by 2025. |

| Labor Shortages & Wage Inflation | Higher operational costs for staffing | Continued growth in healthcare support occupations, with rising average hourly wages. |

| Inflationary Pressures | Increased costs for supplies and materials | Persistent elevated prices for cleaning agents, laundry, and dietary items (CPI for medical supplies saw increases in early 2024). |

| Economic Downturns/Recessions | Increased risk of client insolvency and payment delays | ~80% of nursing homes operating at a loss or break-even in late 2023/early 2024. |

| Outsourcing Trend | Growth opportunity for HCSG | Global healthcare outsourcing market valued at ~$285 billion in 2023, with projected CAGR >10%. |

What You See Is What You Get

Healthcare Services Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Healthcare Services Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its operations and strategic decisions.

Sociological factors

The United States is experiencing a significant demographic shift, with the population aged 65 and older projected to reach 73.1 million by 2030, a substantial increase from 54.1 million in 2019. This aging trend, heavily influenced by the Baby Boomer generation entering retirement age, directly fuels a growing demand for specialized healthcare services.

This demographic expansion translates into a sustained and increasing need for nursing homes, rehabilitation centers, and assisted living facilities, all core components of Healthcare Services Group's (HCSG) operational focus. The growing number of individuals requiring ongoing care, often managing multiple chronic conditions, ensures a robust and expanding market for HCSG's essential support services.

A significant societal shift towards 'aging in place' means more seniors want to stay in their own homes. This preference directly impacts the demand for traditional institutional care, potentially slowing the growth of new nursing homes or assisted living facilities.

While Healthcare Services Group (HCSG) primarily operates within facilities, this trend could indirectly affect their business by influencing the pace of new construction or occupancy rates in certain markets. For instance, a 2024 AARP survey indicated that 77% of adults aged 50 and older want to remain in their own homes for as long as possible.

However, the need for skilled nursing and specialized care facilities persists for those who do require them. HCSG's focus on providing essential services within these settings remains crucial, as the demand for high-quality care in these environments continues, especially as the Baby Boomer generation ages.

Family structures are indeed changing, and this directly impacts the demand for professional care. In 2024, the U.S. Census Bureau data indicated a continued trend of smaller household sizes and an increase in single-parent households, meaning fewer adult children are available to provide informal care for aging parents. This demographic shift is a significant driver for the growth in the senior living and healthcare services sector.

The availability of informal caregivers, often family members, is shrinking. A 2025 AARP report highlighted that the number of unpaid family caregivers is projected to decline significantly by 2030, placing greater strain on formal care systems. This shortage directly translates to increased reliance on companies like Healthcare Services Group, which offer essential support services for long-term care facilities.

Health and Wellness Consciousness

Societal focus on health and wellness is significantly reshaping expectations for healthcare facilities. This trend means residents and their families are increasingly prioritizing environments that promote well-being, not just basic care. For Healthcare Services Group, this translates into a demand for amenities that go beyond medical services, such as appealing communal spaces and nutritious food options, directly impacting their service delivery model.

This heightened awareness is driving higher standards for living conditions, pushing facilities to invest in upgrades to attract and retain residents. For instance, a 2024 survey indicated that 70% of prospective residents consider the overall living environment and dining experience as crucial factors when choosing a healthcare facility. This pressure means Healthcare Services Group must continually adapt its offerings to meet these evolving consumer demands, ensuring their facilities are seen as desirable places to live and recover.

- Increased Demand for Holistic Well-being: Residents expect more than just medical attention; they seek environments that support mental, social, and physical health.

- Focus on Dining Quality: Nutritious and appealing food is becoming a key differentiator, with many facilities reporting increased resident satisfaction scores linked to improved culinary programs.

- Environment as a Health Factor: Cleaner, more aesthetically pleasing, and comfortable living spaces are recognized as contributing positively to resident health outcomes and overall quality of life.

Diversity and Inclusion in Healthcare Settings

Societal expectations are increasingly prioritizing diversity, equity, and inclusion (DEI) within all service industries, including healthcare. This shift directly influences how healthcare facilities, like those managed by Healthcare Services Group, must approach resident care and staff management. For instance, a 2024 survey indicated that 78% of consumers believe companies should actively promote DEI, a sentiment that extends strongly to healthcare providers.

Healthcare Services Group needs to ensure its operational practices and workforce reflect this growing demand for inclusivity. This means actively fostering an environment that is respectful and accommodating to all residents, regardless of their background, including specific considerations for LGBTQ+ individuals. Failing to do so not only risks reputational damage but also alienates a significant portion of the potential resident and employee base.

The company's commitment to DEI is also a key component of its broader social responsibility. As of early 2025, financial markets are increasingly factoring ESG (Environmental, Social, and Governance) performance into investment decisions, with social factors often playing a crucial role. Companies demonstrating strong DEI initiatives are often viewed as more sustainable and better managed.

- Resident Rights: Ensuring all residents feel safe, respected, and have their individual needs met, including cultural and personal identity considerations.

- Staff Composition: Building a diverse workforce that mirrors the resident population and brings varied perspectives to care delivery.

- Inclusive Policies: Implementing and enforcing policies that explicitly prohibit discrimination and promote equitable treatment for all staff and residents.

- Community Engagement: Partnering with community organizations that support diverse populations to better understand and serve their needs.

Societal expectations for healthcare services are evolving, with a growing emphasis on resident well-being and a positive living environment. This includes a demand for improved dining experiences and aesthetically pleasing facilities, influencing how companies like HCSG must adapt their service models to meet these rising consumer standards.

The increasing focus on diversity, equity, and inclusion (DEI) within healthcare is paramount. Companies must ensure their operations and workforce are inclusive, reflecting resident populations and adhering to evolving social responsibility expectations, which are increasingly scrutinized by investors.

The trend of aging in place, where 77% of adults aged 50 and older in 2024 preferred to stay home, presents a nuanced challenge. While it may slow the growth of institutional care, the persistent need for specialized services for those requiring them ensures a continued market for HCSG's core offerings.

| Sociological Factor | Impact on Healthcare Services Group (HCSG) | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Aging Population | Increased demand for specialized care services. | US population aged 65+ projected to reach 73.1 million by 2030. |

| Aging in Place Preference | Potential indirect impact on facility occupancy/growth. | 77% of adults 50+ prefer to age in place (2024 AARP survey). |

| Shrinking Informal Caregiver Pool | Greater reliance on formal care systems. | Projected decline in unpaid family caregivers by 2030 (2025 AARP report). |

| Focus on Well-being & Dining | Demand for enhanced amenities and environments. | 70% of prospective residents consider living environment and dining crucial (2024 survey). |

| DEI Expectations | Need for inclusive policies and diverse workforce. | 78% of consumers believe companies should promote DEI (2024 survey). |

Technological factors

Automation and robotics are significantly reshaping facility management within healthcare. The adoption of technologies for tasks like cleaning, laundry, and food preparation promises to boost efficiency and combat persistent labor shortages. For instance, by 2024, the global robotics market in healthcare is projected to reach over $10 billion, indicating a strong trend towards automation.

Healthcare Services Group can capitalize on these advancements to streamline its operations, ensuring more consistent service delivery and potentially lowering labor expenses. This extends to exploring artificial intelligence for administrative functions, including payroll processing and benefits management, which could free up human resources for more patient-centric roles.

Advanced data analytics are transforming how healthcare support service providers like Healthcare Services Group (HCSG) operate. By digging into data from housekeeping, laundry, and dining, HCSG can pinpoint exactly where to boost efficiency and cut costs. For instance, analyzing patient satisfaction scores alongside housekeeping schedules can reveal opportunities to improve both service delivery and operational flow.

HCSG's ability to leverage data analytics directly impacts its value proposition to clients. Demonstrating measurable improvements in areas like reduced waste in dining services or faster laundry turnaround times, backed by data, strengthens client relationships and competitive positioning. This data-driven approach is key in a market where clients increasingly demand tangible results and cost-effectiveness.

The company's commitment to technology upgrades in data management and analysis is a strategic imperative. As of early 2024, the healthcare industry's focus on value-based care and operational excellence means that providers who can effectively utilize data for continuous improvement will lead the market. HCSG's investment in these capabilities is therefore crucial for sustained growth and client retention.

While Healthcare Services Group (HCSG) primarily offers on-site support, the expanding telehealth and remote monitoring landscape presents indirect influences. The growing adoption of hybrid care models, where patients receive care both at home and in facilities, could create new avenues for HCSG to align its services. For instance, HCSG's dietary and environmental services could play a crucial role in supporting patient health and well-being within these evolving care delivery systems.

AI for Predictive Analytics and Personalized Care

Artificial intelligence (AI) is rapidly transforming healthcare, offering powerful tools for predictive diagnostics and the creation of highly personalized care plans. For a company like Healthcare Services Group, this translates into significant opportunities for operational improvement and enhanced resident well-being.

AI can optimize staffing by forecasting resident needs and predicting peak demand periods, ensuring adequate coverage without overstaffing. Furthermore, it can predict equipment maintenance needs, minimizing downtime and associated costs. The ability to tailor dietary plans based on individual resident data, considering allergies, preferences, and health conditions, represents a major step towards truly personalized service delivery.

- AI adoption in healthcare is projected to reach $10.4 billion in 2024, growing to $102.7 billion by 2028, indicating substantial investment and development.

- Studies suggest AI can improve diagnostic accuracy by up to 15% in certain medical fields.

- Personalized medicine, often powered by AI, is expected to grow significantly, with market projections indicating a compound annual growth rate (CAGR) of over 10% through 2027.

Cybersecurity and Data Privacy

As Healthcare Services Group (HCSG) continues to integrate technology, the imperative for strong cybersecurity and data privacy escalates. The company, managing a significant volume of sensitive resident and client data, must adhere to stringent regulations such as HIPAA. Failure to protect against cyber threats can severely damage trust and operational continuity.

The increasing sophistication of cyber threats poses a significant risk to healthcare providers. For instance, ransomware attacks in the healthcare sector saw a substantial rise, with the average cost of a data breach reaching $10.10 million in 2023, according to IBM's Cost of a Data Breach Report. HCSG's commitment to safeguarding personal health information (PHI) is therefore critical.

- Regulatory Compliance: Ensuring all data handling practices meet or exceed HIPAA and other relevant data protection laws is non-negotiable for HCSG.

- Threat Mitigation: Implementing advanced security measures, including encryption, regular vulnerability assessments, and employee training, is essential to combat evolving cyber threats.

- Reputational Risk: A data breach can lead to significant reputational damage, impacting client acquisition and retention, underscoring the importance of robust data privacy protocols.

- Operational Resilience: Secure systems are fundamental to maintaining uninterrupted service delivery and protecting sensitive operational data.

Technological advancements are fundamentally altering healthcare support services. Automation, particularly in areas like cleaning and food preparation, addresses labor shortages and boosts efficiency, with the global healthcare robotics market projected to exceed $10 billion by 2024. AI is optimizing operations, from staffing to personalized dietary plans, with AI in healthcare expected to reach $10.4 billion in 2024. Robust cybersecurity is paramount, as healthcare data breaches cost an average of $10.10 million in 2023, highlighting the need for stringent data protection.

| Technology Area | 2024 Projection/Data | Impact on HCSG | Key Data Point |

|---|---|---|---|

| Automation & Robotics | Global Healthcare Robotics Market > $10 billion | Increased efficiency, reduced labor costs | Addresses labor shortages |

| Artificial Intelligence (AI) | AI in Healthcare Market $10.4 billion | Optimized operations, personalized services | Improves diagnostic accuracy by up to 15% |

| Data Analytics | Focus on value-based care | Enhanced service delivery, cost reduction | Drives measurable improvements |

| Cybersecurity | Average Data Breach Cost $10.10 million (2023) | Ensures data privacy, maintains trust | HIPAA compliance is critical |

Legal factors

Healthcare Services Group operates within a highly regulated environment, making strict adherence to federal, state, and local healthcare regulations paramount. This includes navigating complex mandates from the Centers for Medicare & Medicaid Services (CMS), particularly for long-term care facilities. These regulations impact everything from staffing ratios and quality of care to essential operational standards in areas like housekeeping, laundry, and dining services.

Failure to comply with these stringent healthcare regulations can result in significant financial penalties and severe reputational damage, directly affecting patient trust and market standing. For instance, in 2024, CMS continued to emphasize quality reporting and patient safety measures, with potential fines for non-compliance escalating. Staying abreast of evolving legal frameworks and ensuring robust internal compliance programs are therefore critical for operational success and long-term sustainability.

Healthcare Services Group, as a major employer, is significantly influenced by evolving labor laws. For instance, the federal minimum wage remains $7.25 per hour, but many states and cities have implemented higher rates, with California's minimum wage set to reach $16.00 per hour in 2024. These wage regulations directly impact the group's labor costs, requiring careful financial planning and operational adjustments to maintain profitability.

Overtime regulations and worker safety standards also play a crucial role. Compliance with Occupational Safety and Health Administration (OSHA) standards, for example, necessitates ongoing investment in training and equipment to prevent workplace injuries. Failure to adhere to these mandates can result in substantial fines, further impacting the company's bottom line and operational efficiency.

Healthcare Services Group's operations, particularly in dietary and housekeeping, are heavily influenced by rigorous food safety and sanitation regulations. These rules, enforced by bodies like the FDA and local health departments, dictate everything from food handling procedures to waste disposal, directly impacting patient safety and operational costs. Failure to comply can lead to significant fines and reputational damage, making adherence a critical business imperative.

Contractual Obligations and Client Liabilities

Healthcare Services Group's operations are heavily influenced by contractual agreements with healthcare facilities. These contracts often contain detailed service level agreements and specific clauses regarding liability, which can include indemnification for certain types of risks. For instance, in 2024, a significant portion of revenue for many healthcare service providers was tied to long-term contracts, making adherence to these terms paramount.

Managing these contractual obligations effectively is critical for mitigating financial and legal exposure. This includes careful review of indemnification clauses, which can shift responsibility for specific losses to the service provider. The potential for client bankruptcies or ongoing legal disputes further complicates this landscape, as these events can directly impact payment streams and create unforeseen liabilities.

- Contractual Dependence: Healthcare Services Group relies on contracts with healthcare facilities, defining service standards and liability.

- Liability Management: Key focus on managing indemnification clauses and other liability-related terms within contracts.

- Client Financial Health: The financial stability of clients, including their risk of bankruptcy, directly affects the Group's financial security.

- Legal Dispute Impact: Legal disputes involving clients can introduce significant operational and financial challenges.

Data Privacy and HIPAA Compliance

Healthcare Services Group must navigate a complex legal landscape, with data privacy being paramount. The Health Insurance Portability and Accountability Act (HIPAA) mandates stringent protection for protected health information (PHI). Recent legislative shifts, particularly concerning reproductive health care privacy, add further layers of compliance scrutiny for all entities handling sensitive patient data.

Failure to comply can result in severe penalties. For instance, HIPAA violations can lead to fines ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses, as per the Department of Health and Human Services. This underscores the critical need for robust data security protocols and ongoing legal review of all data handling practices.

- HIPAA Enforcement: In 2023, the Office for Civil Rights (OCR) settled multiple HIPAA cases, collecting over $5 million in settlements for breaches and privacy violations.

- State-Level Privacy Laws: Beyond federal regulations, states like California with the California Privacy Rights Act (CPRA) impose additional data privacy obligations that healthcare providers must integrate into their compliance strategies.

- Reproductive Health Data: Emerging legal frameworks specifically address the privacy of reproductive health information, requiring careful consideration of how this data is collected, stored, and shared.

The legal environment significantly shapes Healthcare Services Group's operations, demanding strict adherence to a myriad of regulations. These include CMS mandates for quality of care and operational standards, as well as labor laws impacting minimum wage and overtime, with states like California setting higher minimums, reaching $16.00 per hour in 2024. Furthermore, OSHA standards for worker safety and FDA regulations for food safety necessitate continuous investment and compliance efforts to avoid substantial fines and reputational damage.

Contractual agreements with healthcare facilities are a cornerstone of the Group's business, often stipulating service levels and liability terms, including indemnification. The financial health of these clients, and the potential for legal disputes, directly influence the Group's financial security and create potential liabilities. Data privacy, governed by HIPAA and increasingly by state-specific laws like California's CPRA, is also critical, with HIPAA violations carrying fines up to $50,000 per violation, underscoring the need for robust data security protocols.

| Regulatory Area | Key Mandates/Impacts | 2024/2025 Relevance |

| Healthcare Regulations (CMS) | Quality reporting, patient safety, operational standards | Continued emphasis on quality metrics; potential for escalating fines for non-compliance. |

| Labor Laws | Minimum wage, overtime, worker safety (OSHA) | State minimum wage increases (e.g., CA at $16.00/hr in 2024); ongoing OSHA compliance investment. |

| Food Safety & Sanitation (FDA) | Food handling, waste disposal, sanitation standards | Direct impact on patient safety and operational costs; strict enforcement by health departments. |

| Data Privacy (HIPAA, CPRA) | Protection of PHI, data security protocols | HIPAA fines up to $50k/violation; state laws like CPRA add complexity; focus on reproductive health data privacy. |

Environmental factors

Healthcare facilities, including those served by Healthcare Services Group, are significant waste generators, encompassing both general refuse and specialized medical waste. Strict environmental regulations govern the segregation, treatment, and disposal of this waste to prevent contamination and safeguard public health.

For Healthcare Services Group's housekeeping and laundry operations, compliance with these mandates is critical. For instance, in 2023, the US Environmental Protection Agency (EPA) continued to emphasize stringent adherence to the Resource Conservation and Recovery Act (RCRA) for hazardous medical waste, with fines for non-compliance potentially reaching tens of thousands of dollars per violation.

Healthcare Services Group's operations, particularly its extensive laundry and dining services within large healthcare facilities, inherently demand significant energy. This energy consumption directly impacts the company's environmental footprint, making energy management a critical operational consideration.

The company's focus on optimizing energy usage in its service delivery model is a key strategy for mitigating its environmental impact. By implementing energy-efficient practices, Healthcare Services Group aims to reduce its overall carbon emissions.

In line with global sustainability objectives, Healthcare Services Group is committed to reducing its operational greenhouse gas emissions. This commitment reflects a broader industry trend towards environmental responsibility in the healthcare support services sector.

Healthcare Services Group's reliance on laundry services makes water usage a critical environmental factor. These operations are inherently water-intensive, directly impacting the company's environmental footprint.

Growing concerns about water scarcity, particularly in drought-prone regions, could lead to stricter regulations and increased operational costs for water-intensive businesses like Healthcare Services Group. For instance, California, a significant market, implemented mandatory water restrictions during recent droughts, affecting businesses across sectors.

Proactive adoption of water-saving technologies, such as high-efficiency washing machines and water recycling systems in their laundry facilities, is crucial. This not only aligns with environmental stewardship but also offers potential cost savings, as seen by companies that have reduced their water bills by 15-20% through such implementations.

Chemical Use and Hazardous Materials Management

Healthcare Services Group's operations, particularly in housekeeping and laundry, inherently involve the use of cleaning chemicals and potentially hazardous materials. Compliance with stringent environmental regulations governing the storage, handling, and disposal of these substances is paramount for protecting staff and the ecosystem. For instance, the EPA's Resource Conservation and Recovery Act (RCRA) sets strict guidelines for hazardous waste management, impacting how these materials are processed.

A forward-thinking approach involves actively seeking and integrating eco-friendly and less toxic chemical alternatives. This not only mitigates environmental risks but can also lead to cost savings through reduced waste disposal fees and potentially lower consumption rates. By 2024, many healthcare facilities are reporting a significant shift towards green cleaning products, with some aiming for a 30% reduction in hazardous chemical usage by 2025.

Key considerations for Healthcare Services Group include:

- Regulatory Compliance: Adhering to federal and state laws like RCRA and OSHA's Hazard Communication Standard ensures safe practices.

- Sustainable Sourcing: Prioritizing suppliers who offer certified environmentally friendly cleaning agents.

- Employee Training: Implementing robust training programs on the safe handling and disposal of all chemicals.

- Waste Reduction: Developing strategies to minimize chemical waste through efficient usage and proper storage.

Sustainability Initiatives and Corporate Social Responsibility

The healthcare sector, including companies like Healthcare Services Group, faces growing pressure to integrate robust sustainability initiatives and corporate social responsibility (CSR) into their operations. This heightened focus means that environmental practices are increasingly scrutinized by investors, regulators, and the public. Demonstrating a genuine commitment to environmental stewardship, such as ambitious emissions reduction targets and the adoption of greener operational practices, is becoming crucial for enhancing corporate reputation and attracting clients who prioritize sustainability.

For Healthcare Services Group, this translates into opportunities to differentiate itself. For instance, many healthcare providers are setting targets to reduce their carbon footprints. A recent survey of healthcare executives indicated that 78% believe sustainability initiatives positively impact their organization's brand image. Companies are investing in energy-efficient facilities, waste reduction programs, and sustainable supply chains. For example, some healthcare systems are aiming for net-zero emissions by 2040, a trend likely to influence industry benchmarks.

- Growing ESG Investment: Environmental, Social, and Governance (ESG) investing continues to surge, with global sustainable investment assets projected to reach $50 trillion by 2025, influencing capital allocation towards environmentally conscious companies.

- Regulatory Scrutiny: Governments worldwide are implementing stricter environmental regulations, including potential carbon pricing mechanisms and waste management mandates, which directly impact operational costs and compliance for healthcare service providers.

- Patient and Stakeholder Demand: A significant portion of patients and employees now factor a company's environmental record into their choices, with studies showing over 60% of consumers are willing to pay more for sustainable products and services.

- Operational Efficiency Gains: Implementing greener practices, such as energy-efficient lighting and water conservation, can lead to substantial cost savings, with some organizations reporting up to 15% reduction in utility expenses.

Environmental factors significantly shape the operational landscape for Healthcare Services Group. The company must navigate stringent regulations concerning waste management, particularly for medical waste, with non-compliance potentially incurring substantial fines, as exemplified by EPA enforcement actions. Energy consumption in laundry and dining services is a key area for environmental impact reduction, driving the adoption of energy-efficient practices to lower carbon emissions.

Water usage in laundry operations presents another critical environmental consideration, especially in regions facing water scarcity, which can lead to increased operational costs and regulatory pressures. Consequently, investing in water-saving technologies is becoming essential for both environmental stewardship and cost efficiency.

The use of cleaning chemicals necessitates strict adherence to hazardous material handling and disposal regulations. A proactive approach involves transitioning to eco-friendly alternatives, which aligns with growing industry trends and can yield cost savings. The broader healthcare sector is experiencing increased demand for robust sustainability initiatives and CSR, with environmental performance increasingly influencing corporate reputation and client acquisition.

The surge in ESG investing, with sustainable investment assets projected to reach $50 trillion by 2025, underscores the financial imperative for environmental consciousness. Furthermore, patient and stakeholder preferences are increasingly factoring in a company's environmental record, with a significant percentage willing to favor sustainable services.

| Environmental Factor | Impact on Healthcare Services Group | Data/Trend (2023-2025) |

|---|---|---|

| Waste Management | Compliance with medical waste regulations is crucial; fines for non-compliance can be substantial. | EPA emphasizes RCRA compliance; fines can reach tens of thousands per violation. |

| Energy Consumption | High energy use in laundry/dining impacts carbon footprint; efficiency is key for reduction. | Focus on energy-efficient practices to reduce carbon emissions. |

| Water Usage | Water-intensive laundry operations face risks from scarcity and regulations. | California's drought restrictions impacted businesses; water-saving tech can cut bills by 15-20%. |

| Chemical Usage | Safe handling and disposal of cleaning chemicals are regulated; eco-friendly alternatives are preferred. | Shift towards green cleaning products; aim for 30% reduction in hazardous chemical use by 2025. |

| Sustainability & ESG | Reputation and client acquisition are influenced by environmental practices; ESG investment is growing. | ESG assets projected to reach $50 trillion by 2025; 78% of healthcare execs see positive brand impact from sustainability. |

PESTLE Analysis Data Sources

Our Healthcare Services Group PESTLE Analysis is built upon a robust foundation of data sourced from leading industry associations, government health agencies, and reputable market research firms. We integrate insights from regulatory updates, economic performance indicators, and technological advancements to provide a comprehensive view.