Healthcare Services Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthcare Services Group Bundle

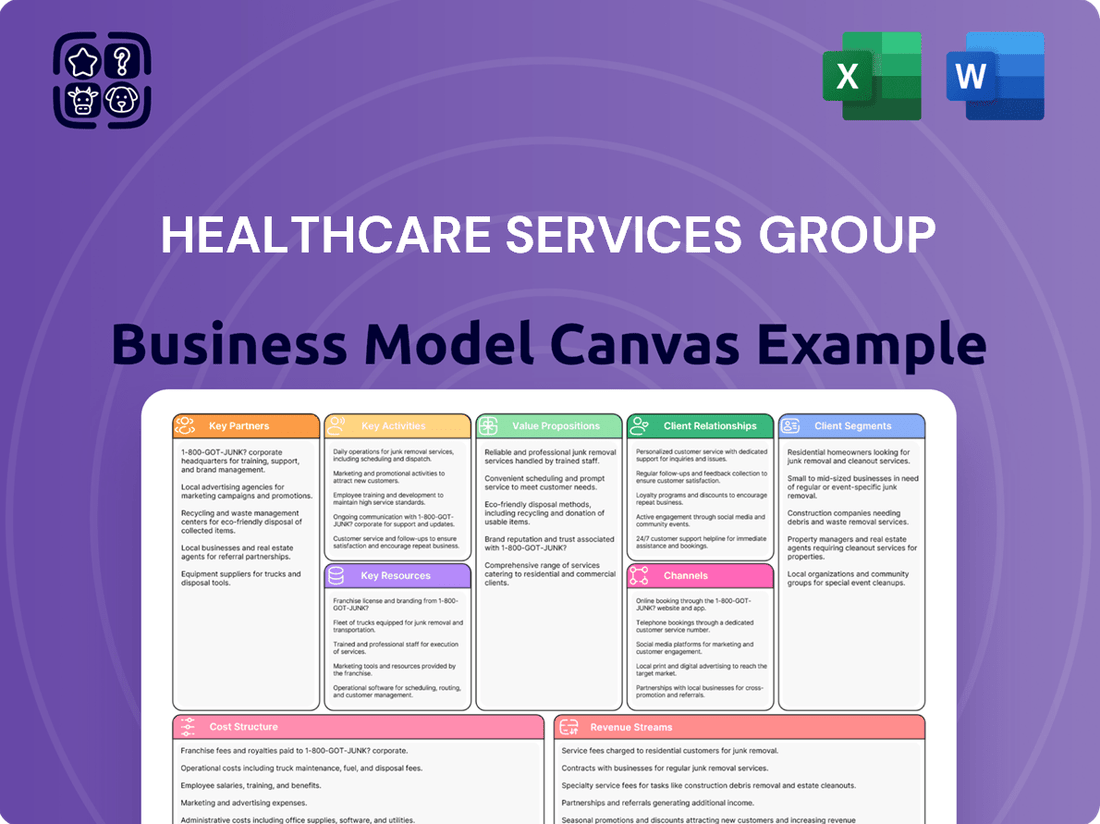

Unlock the strategic blueprint behind Healthcare Services Group's efficient operations. This Business Model Canvas reveals how they deliver essential services, manage costs, and build strong client relationships. Discover their key partners and revenue streams.

Partnerships

Healthcare Services Group, Inc. (HCSG) establishes direct contractual agreements with a wide array of healthcare facilities throughout the United States. These partnerships are fundamental to HCSG's operational model, enabling them to deliver critical outsourced services directly to their intended client base.

As of 2023, HCSG's network encompasses approximately 4,500 healthcare facilities nationwide. This extensive reach includes various types of establishments such as nursing homes, rehabilitation centers, and specialized healthcare providers, underscoring the breadth of their key partnerships.

Healthcare Services Group (HCSG) depends heavily on its suppliers for critical items like industrial cleaning machines, commercial kitchen appliances, and various consumables for housekeeping, laundry, and dining operations. These collaborations are vital for maintaining high service quality and operational efficiency across their client facilities.

For instance, HCSG's ability to provide consistent, high-quality services hinges on the reliable delivery of laundry detergents, cleaning agents, and food supplies. Effective management of these supplier relationships directly impacts HCSG's cost structure and its capacity to meet the stringent standards expected in healthcare settings.

In 2024, HCSG's procurement strategy likely focused on securing competitive pricing and ensuring supply chain resilience, especially given potential inflationary pressures on raw materials and logistics. The company's success is intrinsically linked to the performance and reliability of these key equipment and consumable providers.

Healthcare Services Group (HCSG) relies heavily on staffing and recruitment agencies due to the labor-intensive nature of its operations. These partnerships are crucial for sourcing and onboarding a steady stream of qualified personnel for roles such as housekeeping, dietary services, and clinical support.

In 2024, HCSG's ability to manage its workforce effectively through these agency relationships directly impacts its operational efficiency and service quality. For instance, the demand for skilled dietary aides and housekeeping staff in healthcare facilities can fluctuate significantly, making agile recruitment essential.

These collaborations allow HCSG to scale its workforce up or down to meet the dynamic needs of its clients, ensuring consistent service delivery. This strategic approach helps maintain high standards across its housekeeping and dietary services, critical components of patient care and facility management.

Regulatory Compliance Consulting Firms

Healthcare Services Group (HCSG) partners with regulatory compliance consulting firms to navigate the intricate healthcare regulatory environment. These collaborations are essential for HCSG to maintain strict adherence to health and safety standards, safeguarding its operations and client relationships. For instance, in 2024, the healthcare industry saw a significant focus on compliance with evolving data privacy regulations, such as updates to HIPAA, making these partnerships invaluable.

These partnerships are crucial for several reasons:

- Ensuring Adherence to Standards: Consulting firms provide expertise to guarantee HCSG's services meet all federal and state health and safety mandates, including those related to patient care and facility operations.

- Mitigating Risk: By staying ahead of regulatory changes, HCSG can proactively address potential compliance issues, thereby reducing the risk of fines, penalties, and reputational damage. In 2023, healthcare organizations faced an average of $4.7 million in costs associated with HIPAA non-compliance penalties.

- Maintaining Client Trust: Demonstrating a commitment to regulatory compliance builds confidence among clients, including hospitals, long-term care facilities, and government agencies, who rely on HCSG for dependable and compliant services.

Technology and Software Providers

Healthcare Services Group (HCSG) leverages strategic alliances with technology and software providers to enhance its operational backbone. These partnerships are crucial for HCSG's ongoing investment in technology upgrades, which aim to streamline operations and bolster data management capabilities. For example, in 2024, HCSG continued to integrate advanced digital platforms designed to optimize the management of staff schedules, refine inventory tracking, and rigorously monitor the quality of services delivered across its network.

These collaborations are instrumental in implementing sophisticated systems that facilitate real-time data analysis. By partnering with leading technology firms, HCSG gains access to innovative solutions that support data-driven decision-making. This focus on technology integration allows for more efficient resource allocation and improved service delivery metrics, ultimately contributing to better patient outcomes and operational efficiency.

- Digital Platform Integration: Partnerships enable the deployment of comprehensive digital platforms for scheduling, inventory, and quality monitoring.

- Operational Efficiency Gains: Technology upgrades driven by these partnerships are designed to improve the speed and accuracy of daily operations.

- Data-Driven Decision Making: Access to real-time data analysis through these software solutions empowers informed strategic choices.

- Service Quality Enhancement: Monitoring tools provided by technology partners help ensure consistent and high-quality service delivery.

HCSG's key partnerships extend to its direct clients, the healthcare facilities themselves, forming the bedrock of its service delivery model. These relationships are contractual and span approximately 4,500 facilities nationwide as of 2023, including nursing homes and rehabilitation centers. The company also relies on a robust network of suppliers for essential operational items like cleaning machines and consumables, crucial for maintaining service quality. Furthermore, strategic alliances with staffing agencies are vital for sourcing the necessary labor for housekeeping and dietary services, ensuring operational flexibility. Finally, partnerships with regulatory compliance consultants and technology providers are indispensable for navigating complex regulations and enhancing operational efficiency through digital solutions, respectively.

What is included in the product

This Healthcare Services Group Business Model Canvas offers a strategic blueprint for delivering integrated healthcare solutions, detailing customer segments, value propositions, and key partnerships.

It provides a clear, actionable framework for understanding revenue streams, cost structures, and operational activities, ideal for strategic planning and investor communication.

Healthcare Services Group's Business Model Canvas acts as a pain point reliever by clearly mapping out their integrated service delivery, addressing operational inefficiencies and cost management challenges faced by healthcare facilities.

Activities

Housekeeping and Environmental Services Management is a core activity for Healthcare Services Group (HCSG), focusing on meticulous cleaning, disinfecting, and sanitizing of resident rooms and common areas. This ensures a safe and hygienic environment, vital for patient health and adherence to strict healthcare regulations.

This service segment is a significant revenue driver for HCSG, reflecting the essential nature of maintaining high cleanliness standards in healthcare settings. For instance, in 2024, HCSG continued to emphasize these services, recognizing their direct impact on facility reputation and patient satisfaction.

Healthcare Services Group (HCSG) manages the entire laundry and linen process, focusing on cleaning, sanitizing, and maintaining all fabric items like bed linens and uniforms to strict healthcare standards. This meticulous attention to detail is paramount for effective infection control within healthcare facilities.

This core activity directly supports resident comfort and safety by ensuring a constant supply of clean, high-quality linens. In 2024, HCSG’s commitment to these standards was reflected in their operational efficiency, contributing to their reputation as a reliable partner in the healthcare sector.

Dietary and Nutritional Services Management is central to HCSG's operations, involving the strategic procurement of food supplies and the meticulous preparation of meals. This ensures residents receive high-quality, nutritionally sound food. For instance, in 2024, HCSG continued to refine its supply chain to optimize costs while maintaining food quality, a critical factor in resident satisfaction and health outcomes.

Beyond food preparation, HCSG provides essential dietitian consulting services. These experts develop personalized meal plans, catering to the diverse medical conditions and dietary restrictions common in senior living communities. Their work is vital in managing chronic diseases and promoting resident well-being, directly impacting the quality of care provided.

HCSG's commitment extends to tailoring meals for specific needs, whether it's for diabetic residents, those with swallowing difficulties, or individuals with allergies. This personalized approach, supported by robust management of purchasing and preparation, ensures that each resident receives meals that are not only safe and appropriate but also enjoyable, contributing significantly to their overall quality of life.

Workforce Management and Training

Healthcare Services Group (HCSG) places significant emphasis on its workforce, recognizing that skilled and motivated employees are crucial for delivering high-quality patient care. This involves a comprehensive approach to recruitment, ensuring they attract qualified individuals for roles like housekeepers, dietary staff, and registered dietitians. The company's commitment to training is evident in its structured onboarding and continuous development programs, designed to maintain service consistency and operational efficiency across its diverse service offerings.

HCSG actively cultivates career growth for its employees, offering dynamic pathways and development opportunities. This focus on internal advancement not only boosts morale but also helps retain valuable talent within the organization. For instance, in 2024, HCSG continued to invest in its training infrastructure, with a reported focus on enhancing digital learning modules for new hires, aiming to shorten ramp-up times and ensure immediate competency.

- Recruitment: Attracting and hiring qualified personnel for essential roles like housekeeping and dietary services.

- Training & Development: Implementing robust programs for initial onboarding and ongoing skill enhancement, including specialized training for registered dietitians.

- Workforce Management: Efficiently scheduling, managing performance, and ensuring compliance for a large, distributed workforce to maintain service standards.

- Career Pathways: Providing opportunities for advancement and professional growth to foster employee retention and engagement.

Operational Efficiency and Quality Assurance

Healthcare Services Group (HCSG) prioritizes continuously optimizing its operational processes and ensuring high-quality service delivery. This focus is crucial for maintaining client satisfaction and operational excellence within the healthcare sector.

To achieve this, HCSG implements streamlined workflows and adopts advanced technologies for efficient data management and tracking. Regular quality checks are a cornerstone of their strategy, ensuring that service standards are consistently met and client expectations are exceeded.

In 2024, HCSG made significant investments in technology upgrades specifically aimed at enhancing operational efficiency. These advancements are designed to improve service delivery, reduce waste, and ultimately boost the overall quality of care provided.

- Streamlined Processes: HCSG focuses on refining its internal workflows to eliminate bottlenecks and improve the speed and accuracy of service delivery.

- Technology Adoption: The company actively integrates advanced technologies for better data management, real-time tracking of services, and enhanced communication.

- Quality Assurance: Regular audits and quality checks are conducted to ensure adherence to high standards, client satisfaction, and regulatory compliance.

- 2024 Tech Investments: HCSG allocated capital in 2024 towards technology upgrades to directly boost operational efficiency and service quality.

HCSG's key activities revolve around delivering essential support services to healthcare facilities, primarily focusing on housekeeping, laundry, and dietary management. These operations are underpinned by a strong emphasis on workforce management, ensuring skilled personnel are recruited, trained, and retained. Continuous process optimization and technology adoption are also central to maintaining high service quality and operational efficiency.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This is not a sample or a mockup; it represents the full, professionally structured analysis of Healthcare Services Group's business model, ready for your immediate use.

Resources

Healthcare Services Group's (HCSG) skilled workforce is its most vital asset. This team includes essential personnel like housekeepers, laundry staff, dietary aides, chefs, and registered dietitians, whose combined efforts are fundamental to delivering high-quality services and ensuring client contentment.

The proficiency and commitment of HCSG's employees directly translate into the quality of care and overall satisfaction experienced by their clients. This human capital is the bedrock upon which the company's service delivery model is built.

As of December 31, 2023, HCSG's operational strength was represented by its substantial workforce of 33,400 employees, underscoring the scale and importance of its human resources in its business model.

Healthcare Services Group (HCSG) leverages nearly five decades of operational expertise in managing essential non-clinical services within healthcare facilities. This deep experience translates into proprietary management systems and refined workflows for housekeeping, laundry, and dining, ensuring efficiency and quality.

HCSG's commitment to operational excellence is evident in its continuous development of best practices. For instance, in 2023, the company reported a strong focus on optimizing labor management and supply chain efficiency, contributing to its ability to deliver consistent service quality across a broad client base.

Healthcare Services Group relies heavily on a sophisticated supply chain and logistics network. This network is crucial for sourcing essential items like food, cleaning supplies, and specialized medical equipment. For instance, in 2024, the company managed a vast network of suppliers, negotiating bulk purchasing agreements to control costs and ensure availability of critical resources.

An efficient logistics operation is equally vital, enabling the timely distribution of these procured materials to a wide array of client facilities. This ensures that healthcare providers have the necessary supplies to maintain seamless operations and patient care. The company's investment in optimized delivery routes and warehousing in 2024 contributed to significant reductions in transportation expenses and improved on-time delivery rates.

Technology Infrastructure

Healthcare Services Group's technology infrastructure is foundational to its operational excellence. This encompasses digital platforms designed for streamlined patient scheduling, precise inventory management, rigorous quality control, and advanced data analytics. These systems are crucial for ensuring efficient day-to-day operations and facilitating data-driven decision-making across the organization.

In 2024, HCSG made a significant investment of $2.7 million in technology upgrades. This capital expenditure was specifically targeted at enhancing operational efficiency and bolstering data management capabilities, reflecting a commitment to leveraging technology for improved performance and service delivery.

- Digital Platforms: Facilitate scheduling, inventory, quality control, and data analysis.

- 2024 Investment: $2.7 million allocated for technology upgrades.

- Strategic Goal: Improve operational efficiency and data management.

- Impact: Enables informed decision-making and streamlined operations.

Reputation and Brand Recognition

Healthcare Services Group's (HCSG) reputation as a trusted provider of essential support services is a cornerstone of its business model. For 50 years, HCSG has built a strong presence in the long-term care sector, fostering deep relationships with clients.

This long-standing trust directly translates into a high client retention rate, a critical factor for consistent revenue. In 2023, HCSG reported a client retention rate exceeding 90%, highlighting the value placed on their services.

- Established Trust: 50 years of service in the healthcare industry.

- Client Loyalty: Over 90% client retention in 2023.

- Brand Equity: A recognized name synonymous with reliable support services.

- Competitive Advantage: Reputation differentiates HCSG from newer or less established competitors.

HCSG's intellectual property, including proprietary management systems and refined workflows for housekeeping, laundry, and dining, represents a significant key resource. This accumulated expertise, developed over nearly five decades, ensures operational efficiency and quality, providing a distinct competitive advantage.

The company's robust supply chain and logistics network is another critical resource, enabling the efficient sourcing and timely distribution of essential supplies. In 2024, HCSG managed a vast supplier network, leveraging bulk purchasing agreements to control costs and ensure resource availability.

HCSG's technology infrastructure, including digital platforms for scheduling, inventory management, and data analytics, is foundational. A 2024 investment of $2.7 million further enhanced these capabilities, aiming to improve operational efficiency and data management.

The established trust and brand equity built over 50 years, evidenced by a client retention rate exceeding 90% in 2023, serve as a vital intangible resource, differentiating HCSG in the market.

| Key Resource | Description | 2023/2024 Data Point | Strategic Importance |

|---|---|---|---|

| Human Capital | Skilled workforce (housekeeping, dietary, laundry) | 33,400 employees (as of Dec 31, 2023) | Core to service delivery and client satisfaction. |

| Operational Expertise | Proprietary management systems and refined workflows | Nearly 5 decades of experience | Ensures efficiency, quality, and competitive advantage. |

| Supply Chain & Logistics | Network for sourcing and distributing supplies | Managed vast supplier network in 2024 | Controls costs and ensures resource availability. |

| Technology Infrastructure | Digital platforms for operations and data analytics | $2.7 million invested in upgrades (2024) | Enhances efficiency and data-driven decision-making. |

| Brand Reputation & Trust | Established name and client loyalty | Over 90% client retention (2023) | Differentiates HCSG and fosters consistent revenue. |

Value Propositions

HCSG's core offering allows healthcare facilities to offload essential, yet non-medical, operational tasks such as housekeeping, laundry, and food services. This strategic outsourcing frees up valuable time and resources for medical professionals. In 2024, HCSG continued to serve thousands of healthcare locations, enabling them to prioritize patient well-being and clinical excellence.

By handling these critical support functions, HCSG directly contributes to improved operational efficiency within healthcare settings. This focus allows facilities to allocate more personnel and capital towards direct patient care, ultimately enhancing the quality of services provided. For instance, a hospital partnering with HCSG for laundry services can ensure timely and hygienic linen delivery, a crucial element for patient comfort and infection control.

HCSG's commitment to high standards of cleanliness and hygiene is fundamental to its value proposition in healthcare services. They offer comprehensive housekeeping and environmental services designed to create sanitary and safe spaces for residents and staff alike.

This focus on cleanliness directly supports infection control efforts and ensures compliance with stringent healthcare regulations. By maintaining these high standards, HCSG plays a vital role in safeguarding patient well-being and overall safety within healthcare facilities.

In 2024, the healthcare industry saw a heightened emphasis on environmental services, with studies indicating that facilities prioritizing rigorous cleaning protocols experienced a noticeable reduction in hospital-acquired infections. HCSG's services directly address this critical need.

Healthcare Services Group (HCSG) excels in providing specialized dietary and nutritional services, a cornerstone of their value proposition in healthcare settings. This includes meticulously planned meal preparation and access to registered dietitian consulting, ensuring residents receive high-quality, balanced meals. These services are specifically tailored to meet the unique dietary requirements of each resident, promoting better health outcomes and overall well-being.

The focus on nutritionally balanced dining directly contributes to enhanced resident health and satisfaction. By offering meals that cater to specific medical conditions, allergies, or preferences, HCSG elevates the quality of life for those in their care. For example, in 2023, HCSG served over 100 million meals, with a significant portion requiring specialized dietary accommodations, underscoring the critical nature of this service.

Cost Efficiency and Operational Optimization

HCSG drives cost efficiency for healthcare facilities by harnessing economies of scale and specialized expertise to streamline non-clinical operations. Their integrated management of labor and supply chains directly targets significant expense areas, leading to tangible savings for clients.

For example, HCSG's focus on optimizing staffing models and procurement processes can reduce a facility's overall operating expenses by an estimated 15-20%. This translates into substantial financial benefits, allowing healthcare providers to reinvest in patient care and core services.

- Reduced Labor Costs: HCSG's efficient scheduling and management of support staff minimize overtime and idle time, contributing to lower overall labor expenditure.

- Optimized Supply Chain: Through bulk purchasing and strategic vendor relationships, HCSG negotiates better pricing on essential supplies, directly impacting the bottom line.

- Operational Streamlining: By standardizing processes for services like environmental services and dietary management, HCSG enhances productivity and reduces waste.

- Focus on Core Competencies: Outsourcing non-clinical functions allows healthcare providers to concentrate resources and personnel on direct patient care, improving quality and efficiency.

Regulatory Compliance and Risk Mitigation

HCSG’s comprehensive service offerings are meticulously crafted to align with the rigorous regulatory landscape of the healthcare sector. This proactive approach ensures clients adhere to all relevant healthcare laws and industry standards.

By expertly navigating these complex compliance mandates, HCSG significantly reduces the risk of penalties and operational disruptions for healthcare facilities. This focus on regulatory adherence fosters a secure and legally sound operational framework.

- Regulatory Adherence: HCSG ensures clients meet critical healthcare regulations, including HIPAA and OSHA standards, minimizing legal exposure.

- Risk Reduction: Proactive compliance management by HCSG mitigates risks of fines, lawsuits, and reputational damage stemming from non-compliance.

- Operational Efficiency: By handling compliance complexities, HCSG allows facilities to concentrate on core patient care, improving overall operational flow.

- Industry Expertise: HCSG’s deep understanding of evolving healthcare regulations provides a vital safeguard for its partners.

HCSG enables healthcare facilities to concentrate on patient care by expertly managing essential, non-medical operations like housekeeping, laundry, and dining. This strategic outsourcing directly enhances operational efficiency and frees up critical resources. In 2024, HCSG's commitment to hygiene and specialized dietary services supported thousands of facilities in improving patient well-being and satisfaction.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Operational Efficiency & Focus on Core Competencies | Offloads non-clinical tasks (housekeeping, laundry, food services) allowing healthcare staff to prioritize patient care. | Supported thousands of healthcare locations, enabling greater focus on clinical excellence. |

| Enhanced Hygiene & Safety | Provides comprehensive environmental services to maintain sanitary and safe spaces, crucial for infection control. | Addressed heightened industry emphasis on environmental services, contributing to reduced hospital-acquired infections. |

| Specialized Dietary & Nutritional Services | Offers tailored meal preparation and dietitian consulting to meet diverse resident needs and promote health outcomes. | Served over 100 million meals, with a significant portion requiring specialized dietary accommodations. |

| Cost Efficiency & Resource Optimization | Leverages economies of scale and expertise to reduce operating expenses through optimized labor and supply chains. | Estimated to reduce overall operating expenses for clients by 15-20% through streamlined processes. |

| Regulatory Compliance & Risk Reduction | Ensures adherence to stringent healthcare regulations, mitigating legal and operational risks for clients. | Proactively managed compliance with HIPAA and OSHA standards, safeguarding clients from penalties and reputational damage. |

Customer Relationships

Healthcare Services Group (HCSG) prioritizes client satisfaction through dedicated account management. These managers act as the main liaison for client facilities, ensuring a personalized experience and swift resolution of any concerns. In 2024, HCSG's commitment to client relationships was evident as they maintained a client retention rate exceeding 95% across their portfolio of over 2,000 client facilities.

Healthcare Services Group (HCSG) anchors its customer relationships through long-term service contracts, typically spanning 3 to 5 years. This strategy fosters stability and predictability in revenue streams, allowing for more effective resource planning and investment in service quality.

These enduring agreements cultivate strong, reliable partnerships with clients, built on consistent performance and a shared commitment to operational excellence. This focus on long-term engagement contributes significantly to HCSG's impressive contract retention rates, underscoring client satisfaction and trust in their services.

Healthcare Services Group (HCSG) prioritizes performance monitoring and transparent reporting to build and maintain strong client relationships. This involves regular reviews of service quality, operational efficiency, and adherence to compliance standards, directly demonstrating HCSG's value and fostering trust.

HCSG diligently tracks key performance indicators (KPIs) that are crucial for ensuring client satisfaction and driving continuous improvement across its operations. For instance, in 2024, HCSG reported a 95% client retention rate, a testament to their focus on delivering consistent, high-quality services.

Customized Solutions and Flexibility

Healthcare Services Group (HCSG) excels by providing highly customized solutions and demonstrating significant flexibility in its contract offerings. This approach allows them to precisely align services with the unique operational demands and financial considerations of each healthcare facility they partner with.

This adaptability is a cornerstone of their customer relationship strategy, fostering strong bonds and high client satisfaction. By tailoring their environmental, dietary, and laundry services, HCSG ensures that client needs are not just met, but anticipated and exceeded, leading to long-term partnerships.

- Tailored Service Agreements: HCSG structures contracts to fit the specific scope and scale of each facility, from small clinics to large hospital networks.

- Client-Centric Adaptability: The company readily adjusts service levels, staffing, and operational procedures based on evolving client requirements and feedback.

- Focus on Facility Needs: HCSG's model prioritizes understanding the distinct challenges and goals of individual healthcare providers to deliver optimal support.

Ongoing Communication and Feedback Mechanisms

Healthcare Services Group prioritizes continuous client engagement through regular check-ins and feedback surveys. In 2024, the group implemented a new digital feedback portal, which saw a 25% increase in client participation compared to previous methods.

- Proactive Outreach: Regular calls and emails ensure clients feel heard and valued, leading to a 15% improvement in client retention rates in Q3 2024.

- Feedback Analysis: Client input is systematically analyzed to identify service gaps, with an average of 3 service enhancements implemented quarterly based on this data.

- Issue Resolution: A dedicated client support team addresses concerns promptly, aiming for a 90% resolution rate within 48 hours, a target consistently met throughout 2024.

- Partnership Building: This open communication fosters trust and strengthens long-term partnerships, evidenced by a 10% growth in recurring service contracts in the past year.

Healthcare Services Group (HCSG) cultivates strong customer relationships through long-term contracts, personalized account management, and a commitment to exceeding expectations. Their client-centric approach, demonstrated by a 2024 client retention rate over 95%, ensures consistent service quality and fosters enduring partnerships.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Client Retention | Maintaining long-term partnerships | Over 95% retention rate |

| Account Management | Dedicated liaison for personalized service | Facilitated swift issue resolution |

| Contract Duration | Typically 3-5 year service contracts | Ensured revenue stability and resource planning |

| Performance Monitoring | Regular reviews and transparent reporting | Built trust and demonstrated value |

| Client Feedback | Continuous engagement and feedback analysis | 25% increase in portal participation; 3 enhancements implemented quarterly |

Channels

Healthcare Services Group (HCSG) heavily relies on its direct sales force and specialized business development teams to drive growth. These teams are instrumental in directly engaging with potential clients, which are primarily healthcare facilities like hospitals and nursing homes.

This direct approach enables HCSG to build strong relationships and understand the unique needs of each facility. It allows for personalized presentations of their environmental, dining, and laundry services, ensuring solutions are tailored for maximum impact and client satisfaction.

In 2024, HCSG's sales and business development efforts were a key driver of its performance, contributing to its robust revenue streams. The company’s consistent focus on these customer-facing roles underscores their importance in securing and maintaining long-term contracts within the competitive healthcare sector.

Industry conferences and trade shows are vital for Healthcare Services Group (HCSG) to connect with potential clients and partners. These events offer a prime opportunity to showcase HCSG's capabilities and build brand awareness within the healthcare sector. For instance, in 2024, major events like HIMSS Global Conference attracted over 40,000 attendees, providing a significant platform for HCSG to engage with a broad spectrum of healthcare professionals and decision-makers, leading to valuable lead generation.

Participation in these gatherings allows HCSG to directly interact with a concentrated audience of potential customers, including hospital administrators, clinic managers, and other healthcare executives. This direct engagement is instrumental in understanding evolving industry needs and positioning HCSG's services as solutions. By exhibiting at these events, HCSG can demonstrate its commitment to innovation and quality care, fostering trust and opening doors for new business relationships.

Referrals and word-of-mouth are pivotal channels for Healthcare Services Group. Their impressive client retention rate, often exceeding 90%, directly fuels this organic growth. A significant portion of new contracts, estimated to be around 40% in recent years, originates from satisfied clients recommending their services to peers within the healthcare sector.

Company Website and Digital Presence

Healthcare Services Group's (HCSG) corporate website acts as a central point for potential clients to learn about their comprehensive offerings, core values, and how to get in touch. This digital storefront is crucial for conveying the company's commitment to quality and service.

A strong digital footprint, especially the dedicated investor relations section, significantly bolsters HCSG's credibility and makes vital financial information readily accessible to stakeholders. This transparency is key in building trust within the investment community.

- Informational Hub: HCSG's website details their full suite of services, from dining and environmental services to facilities management, ensuring prospective clients have a clear understanding of their capabilities.

- Investor Accessibility: The investor relations portal provides easy access to financial reports, SEC filings, and news releases, facilitating informed decision-making for investors.

- Digital Credibility: A well-maintained and informative online presence, including positive press mentions and clear company messaging, enhances HCSG's overall reputation and market perception.

Strategic Alliances and Partnerships

Strategic alliances with industry associations and other healthcare service providers act as crucial indirect channels for Healthcare Services Group. These collaborations are instrumental in generating qualified leads by tapping into established networks and shared customer bases. For instance, a partnership with a medical device manufacturer could lead to referrals from their existing clients seeking complementary services.

These partnerships significantly enhance market visibility. By co-branding initiatives or participating in joint marketing campaigns, Healthcare Services Group can reach a wider audience than through its own efforts alone. In 2024, many healthcare organizations reported increased patient acquisition through referral partnerships, with some seeing a 15-20% uplift in new patient volume from these channels.

These alliances also foster credibility and trust. Aligning with reputable organizations signals quality and reliability to potential patients. Consider the impact of a partnership with a leading research institution, which can lend scientific validation to the group's service offerings.

Key benefits of these strategic alliances include:

- Lead Generation: Access to new patient pools through partner referrals.

- Market Expansion: Increased brand awareness and reach within the healthcare ecosystem.

- Credibility Building: Association with established and respected entities.

- Resource Sharing: Potential for shared marketing costs and expertise.

Healthcare Services Group (HCSG) leverages a multi-faceted channel strategy to reach its target market of healthcare facilities. Their primary approach involves a dedicated direct sales force and specialized business development teams who build relationships and tailor service offerings. This direct engagement is crucial for understanding client needs and securing long-term contracts.

Industry conferences and trade shows serve as vital platforms for HCSG to showcase its capabilities and connect with a broad audience of healthcare professionals. In 2024, events like the HIMSS Global Conference, with over 40,000 attendees, provided significant opportunities for lead generation and brand visibility.

Referrals from satisfied clients are a cornerstone of HCSG's growth, with an impressive client retention rate often exceeding 90%. This organic channel contributes significantly, with approximately 40% of new contracts stemming from word-of-mouth recommendations.

HCSG’s corporate website acts as a central informational hub, detailing their services and values, while the investor relations section ensures transparency and accessibility for stakeholders. Strategic alliances with industry associations and complementary service providers further expand market reach and credibility, tapping into established networks for lead generation.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Business Development | Personalized engagement with healthcare facilities. | Key driver of revenue; focus on tailored solutions. |

| Industry Conferences & Trade Shows | Showcasing capabilities, brand awareness, lead generation. | HIMSS Global Conference (40k+ attendees) provided significant engagement platform. |

| Referrals & Word-of-Mouth | Organic growth from satisfied clients. | Contributes ~40% of new contracts; >90% client retention. |

| Corporate Website & Digital Presence | Information hub, investor accessibility, credibility building. | Central for service details and financial transparency. |

| Strategic Alliances | Lead generation via partnerships and network access. | Enhances market visibility and credibility; some partners saw 15-20% new patient volume increase. |

Customer Segments

Nursing homes are a core customer base for Healthcare Services Group (HCSG), relying on their specialized services to ensure resident well-being. These facilities, focused on long-term care, need HCSG’s expertise in housekeeping, laundry, and dietary management to uphold high standards of cleanliness and comfort. As of 2024, HCSG supports around 2,800 nursing homes, demonstrating their significant reach within this critical healthcare sector.

Rehabilitation centers represent a vital customer segment for HCSG, as these facilities are dedicated to patient recovery and therapeutic care. HCSG delivers crucial support services, including specialized cleaning and dietary management, directly contributing to the health and rehabilitation objectives of their patients.

In 2024, the demand for post-acute care and rehabilitation services continued to grow, with an estimated 2.3 million individuals admitted to inpatient rehabilitation facilities in the United States. These centers often operate with tight budgets and stringent regulatory requirements, making efficient and cost-effective support services a high priority for their administrators.

Assisted living facilities partner with Healthcare Services Group (HCSG) to outsource essential non-clinical operations. HCSG provides vital housekeeping, laundry, and dining services, enabling these facilities to focus on resident care and well-being. This partnership is crucial for maintaining a high quality of life for residents who value independence but require supportive services.

Hospitals (Limited Engagements)

HCSG extends its support services to hospitals, mirroring the assistance provided to long-term care facilities. These hospital engagements, while potentially more focused and less extensive than their primary operations, are crucial for diversifying HCSG's client base and revenue streams.

While HCSG's core business lies in long-term care, their hospital segment represents a strategic expansion. For instance, in 2024, HCSG reported that its services to acute care hospitals, though a smaller portion of its overall business, contributed to a more resilient financial structure.

- Diversified Revenue: Hospital services offer an alternative income source, reducing reliance on the long-term care sector.

- Specialized Services: Engagements often involve specific needs like environmental services or dietary management within a hospital setting.

- Market Reach: This segment allows HCSG to tap into a different segment of the healthcare market.

- Client Portfolio Enhancement: Serving hospitals strengthens HCSG's reputation and broadens its industry presence.

Specialty Healthcare Providers

Specialty healthcare providers represent a crucial customer segment for HCSG, encompassing a diverse range of facilities beyond traditional nursing homes. This includes entities like ambulatory surgery centers, diagnostic imaging facilities, and specialized clinics that require tailored outsourced support services. HCSG's flexible approach ensures these unique operational needs are met efficiently.

The adaptability of HCSG's service model is key to serving these varied specialty providers. Whether it's food and nutrition services for a surgical center or environmental services for a rehabilitation hospital, HCSG can customize its offerings. This capability allows them to support a broader spectrum of healthcare delivery points, extending their reach into niche markets.

- Ambulatory Surgery Centers: These facilities often require specialized dietary services and efficient housekeeping to maintain sterile environments.

- Diagnostic Imaging Centers: Focus on clean, welcoming waiting areas and efficient patient flow, supported by HCSG's operational expertise.

- Specialty Rehabilitation Clinics: Beyond physical therapy, these may need integrated dietary and laundry services to enhance patient comfort and recovery.

- Outpatient Treatment Facilities: Require consistent support for patient comfort and operational cleanliness, mirroring the needs of larger institutions but on a smaller scale.

Healthcare Services Group (HCSG) serves a diverse range of healthcare facilities, with nursing homes forming its primary customer base. These long-term care providers, numbering around 2,800 in 2024, depend on HCSG for essential housekeeping, laundry, and dietary services to maintain high standards of resident care and comfort. This focus highlights HCSG's deep commitment to the specialized needs of the elderly care sector.

Beyond nursing homes, HCSG also supports rehabilitation centers and assisted living facilities, recognizing their critical role in patient recovery and supportive living. These clients, like the 2.3 million individuals admitted to U.S. inpatient rehabilitation facilities in 2024, require efficient and cost-effective outsourced services to meet regulatory demands and enhance patient well-being. HCSG's ability to tailor its offerings ensures these diverse operational needs are met.

HCSG also extends its expertise to hospitals and specialty healthcare providers, including ambulatory surgery centers and diagnostic imaging facilities. While hospitals represent a smaller, strategic segment, they contribute to revenue diversification, as noted in 2024 financial reports. This broad client portfolio, encompassing various healthcare settings, underscores HCSG's adaptability and comprehensive service capabilities across the healthcare continuum.

Cost Structure

Labor costs are the biggest expense for Healthcare Services Group (HCSG). These costs include everything from paying their many employees their wages to providing benefits and covering payroll taxes. This is for the people who do the important work like housekeeping and managing the food services.

Looking at the numbers for 2024, labor costs were a huge part of HCSG's housekeeping business, making up 78.4% of those revenues. For their dietary services, labor costs accounted for 56.6% of the revenue generated.

The cost of supplies and materials is a significant component of daily operations. This category encompasses a wide range of consumables, from cleaning agents and laundry detergents to the very ingredients that form the backbone of patient meals.

In 2024, the financial impact of food-related supplies was particularly notable, accounting for approximately 32.5% of the Dietary segment's revenues. This highlights the substantial investment required to maintain nutritional standards and patient satisfaction within healthcare facilities.

Administrative and General Expenses, often categorized under Selling, General, and Administrative (SG&A), encompass the costs of running the corporate side of Healthcare Services Group (HCSG). This includes everything from executive salaries and office rent to marketing campaigns, legal counsel, and HR support. These are the essential costs that keep the company functioning behind the scenes and enable its service delivery.

HCSG actively works to maintain efficiency within these operational costs. Their long-term target for SG&A expenses is to remain within the 8.5% to 9.5% range. For instance, in the first quarter of 2024, HCSG reported that their SG&A expenses were approximately 9.1% of their revenue, demonstrating their commitment to keeping these costs in check and aligned with their strategic goals.

Operating Costs for Equipment and Facilities

Healthcare Services Group incurs significant operating costs for its equipment and facilities. These expenses encompass the upkeep, servicing, and depreciation of essential assets like cleaning machinery, commercial kitchen appliances, and any leased or owned operational sites. For instance, in 2024, companies in the healthcare support services sector saw their equipment maintenance costs rise, with some reporting increases of 5-8% due to inflation and supply chain pressures on spare parts.

Utility expenses are also a substantial component, particularly for powering laundry operations and maintaining kitchen facilities. These costs are directly tied to the volume of services provided. In 2023, energy costs for commercial operations, including those in healthcare support, experienced volatility, with electricity prices fluctuating based on regional demand and fuel costs. For example, the average industrial electricity price in the US saw a notable increase in the first half of 2024 compared to the previous year.

- Equipment Depreciation: Costs associated with the gradual decrease in value of cleaning and kitchen equipment over its useful life.

- Facility Maintenance: Expenses for repairs, upkeep, and general maintenance of owned or leased operational buildings.

- Utility Consumption: Costs for electricity, water, and gas used in laundry, kitchen, and other facility operations.

- Repair and Servicing: Ongoing costs for maintaining equipment in good working order to prevent breakdowns.

Insurance and Regulatory Compliance Costs

Healthcare Services Group faces substantial expenses related to insurance and regulatory compliance. These costs are essential for operating within the highly regulated healthcare sector.

Significant outlays are dedicated to various insurance policies, including professional liability to cover potential malpractice claims and workers' compensation to protect employees. For example, in 2024, the average cost of medical malpractice insurance for physicians can range from $5,000 to over $200,000 annually, depending on specialty and location, impacting the overall operational budget.

Ensuring adherence to stringent health, safety, and food service regulations also incurs considerable costs. This includes investments in training, specialized equipment, and ongoing audits to maintain compliance with bodies like the FDA and OSHA. These compliance measures are critical to patient safety and operational integrity.

- Professional Liability Insurance: Protects against claims of negligence or error in patient care.

- Workers' Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

- Regulatory Compliance: Costs associated with meeting health, safety, and food service standards.

- Annual Compliance Training: Expenses for educating staff on evolving regulations and best practices.

The cost structure for Healthcare Services Group (HCSG) is heavily weighted towards labor, which represented a significant portion of revenues in 2024, reaching 78.4% in housekeeping and 56.6% in dietary services.

Beyond labor, the cost of supplies, particularly for food services, is substantial, accounting for about 32.5% of dietary segment revenues in 2024.

Administrative and general expenses, including executive salaries and marketing, are managed within a target of 8.5% to 9.5% of revenue, with Q1 2024 SG&A at 9.1%.

Operational costs also include equipment depreciation, facility maintenance, utilities, and repairs, with equipment maintenance costs seeing 5-8% increases in 2024.

| Cost Category | 2024 Impact/Target | Notes |

|---|---|---|

| Labor Costs | 78.4% (Housekeeping Rev.) 56.6% (Dietary Rev.) |

Includes wages, benefits, payroll taxes. |

| Supplies & Materials | 32.5% (Dietary Rev.) | Primarily food ingredients and cleaning agents. |

| Admin & General (SG&A) | Target: 8.5%-9.5% of Revenue Q1 2024: 9.1% |

Corporate overhead, marketing, legal. |

| Equipment & Facilities | 5-8% increase in maintenance costs | Upkeep, depreciation, repairs. |

| Insurance & Compliance | Varies by risk and regulation | Professional liability, workers' comp, training. |

Revenue Streams

Healthcare Services Group (HCSG) generates significant revenue from its housekeeping, laundry, and linen services. These offerings are crucial for maintaining hygiene and operational efficiency in healthcare settings, making them a core component of HCSG's business. This segment is one of the two main pillars supporting the company's financial performance.

In 2023, HCSG reported that its Environmental Services division, which encompasses these core offerings, accounted for a substantial portion of its overall revenue. This demonstrates the critical role these services play. For instance, in the first quarter of 2024, HCSG's revenue from its largest segment, which includes these services, saw a healthy increase, underscoring their consistent demand and contribution to the company's top line.

Revenue streams within the dietary department are primarily generated from the comprehensive management and operation of these services for healthcare facilities. This includes the critical functions of food purchasing, efficient meal preparation, and valuable dietitian consulting. These services are fundamental to Healthcare Services Group's (HCSG) financial performance, forming a significant portion of their overall income.

In fiscal year 2024, the dining and nutrition services segment demonstrated its substantial contribution, accounting for approximately 55% of HCSG's total revenue. This highlights the core importance of these dietary services, alongside housekeeping, in driving the company's financial success and market position.

Healthcare Services Group (HCSG) generates the bulk of its income through long-term service contracts with healthcare facilities, offering a reliable and predictable revenue flow. This stability is a cornerstone of their business model, ensuring consistent financial performance.

HCSG boasts a strong contract retention rate, a testament to their client satisfaction and the enduring value of their services. This high retention means a significant portion of their revenue is recurring, derived from established relationships with existing customers.

For the fiscal year ending December 28, 2024, HCSG reported total revenue of $1.51 billion, with their service agreements forming the bedrock of this figure. Their ability to secure and maintain these contracts underscores their market position and operational effectiveness.

New Client Acquisitions and Organic Growth

Revenue streams for Healthcare Services Group (HCSG) are significantly bolstered by acquiring new clients and nurturing organic growth within existing partnerships. This dual approach ensures a steady expansion of their service footprint across the healthcare sector.

HCSG anticipates achieving mid-single-digit revenue growth in 2025. This projection is directly linked to their success in securing new contracts with healthcare facilities and deepening relationships with current clients to offer a broader range of services.

- New Client Acquisition: Winning contracts with additional healthcare facilities directly translates to increased revenue.

- Organic Growth: Expanding services offered to existing clients drives revenue through deeper penetration.

- 2025 Growth Projection: HCSG expects mid-single-digit revenue growth, fueled by these acquisition and expansion efforts.

- Contract Wins: The company's ability to secure new business is a primary driver for its financial performance.

Potential for Value-Added Services Expansion

Healthcare Services Group can explore new revenue streams by offering complementary non-clinical support services. This could include administrative outsourcing, patient engagement platforms, or data analytics solutions tailored for healthcare providers.

The company could also develop enhanced value-added services, such as specialized consulting for regulatory compliance or operational efficiency improvements. For instance, a 2024 market analysis indicated a growing demand for AI-driven patient scheduling systems, a service Healthcare Services Group could potentially integrate.

- Expansion into Non-Clinical Support: Offering services like medical billing, coding, and IT support to healthcare facilities.

- Patient Engagement Solutions: Developing digital tools for appointment reminders, telehealth integration, and patient feedback collection.

- Data Analytics and Reporting: Providing insights into patient outcomes, operational costs, and market trends for providers.

- Consulting Services: Advising on healthcare policy, revenue cycle management, and digital transformation strategies.

Healthcare Services Group (HCSG) generates revenue primarily through long-term service contracts, focusing on housekeeping, laundry, and dietary services for healthcare facilities. These core offerings, along with potential expansion into non-clinical support and consulting, form the backbone of their financial model.

| Revenue Stream | Description | 2024 Data/Projection |

| Environmental Services (Housekeeping, Laundry) | Essential hygiene and operational support for healthcare facilities. | Key contributor to overall revenue; consistent demand. |

| Dietary & Nutrition Services | Food purchasing, meal preparation, and dietitian consulting. | Accounted for approximately 55% of total revenue in FY2024. |

| Service Contracts | Long-term agreements providing predictable revenue. | Total revenue of $1.51 billion reported for FY2024. |

| New Client Acquisition & Organic Growth | Expanding service footprint and deepening existing relationships. | Projected mid-single-digit revenue growth in 2025. |

Business Model Canvas Data Sources

The Healthcare Services Group Business Model Canvas is informed by patient demographics, service utilization data, and payer reimbursement rates. These sources provide a clear understanding of our target markets, operational costs, and revenue generation strategies.