Healthcare Services Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthcare Services Group Bundle

Healthcare Services Group operates in a dynamic market shaped by several powerful forces. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is crucial for navigating this landscape.

The complete report reveals the real forces shaping Healthcare Services Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Healthcare Services Group, like much of the healthcare sector, grapples with significant labor shortages. This scarcity, especially for direct care workers and specialized roles, directly amplifies the bargaining power of employees. As a result, companies face upward pressure on wages, directly impacting operational costs and profitability.

The situation is further complicated by a growing reliance on temporary staffing agencies, which often come with higher overhead. Additionally, the aging workforce trend means a shrinking pool of experienced professionals, intensifying competition for talent and driving up compensation expectations. For instance, in early 2024, many healthcare support roles saw wage increases exceeding 5% year-over-year due to these persistent shortages.

Suppliers of specialized equipment, particularly those offering AI-driven robotics for laundry or advanced kitchen technology, can wield considerable bargaining power. Healthcare providers often depend on these innovations to boost efficiency and adhere to stringent regulations. For instance, the global market for healthcare robotics was projected to reach over $10 billion by 2024, indicating a strong demand for technologically advanced solutions.

The bargaining power of food and consumable goods suppliers significantly impacts Healthcare Services Group. The cost and consistent availability of essential items like food products, cleaning supplies, and specialized healthcare-grade linens are fundamental to delivering quality patient care and maintaining operational efficiency. For instance, a 5% increase in the cost of medical-grade cleaning supplies in 2024 could directly translate to higher operating expenses for the group.

When commodity prices for agricultural products or raw materials for cleaning agents experience volatility, suppliers can leverage these market shifts to demand higher prices. Furthermore, if there are limited suppliers capable of providing specific, high-quality healthcare-grade products, their bargaining power increases, potentially forcing Healthcare Services Group to accept less favorable terms or face supply shortages. Supply chain disruptions, such as those seen impacting global logistics in late 2023 and early 2024, further amplify the leverage held by these critical suppliers.

Regulatory and Compliance Software Vendors

Suppliers of regulatory and compliance software hold significant bargaining power within the healthcare services sector, particularly for entities like Healthcare Services Group. The complex and ever-evolving regulatory landscape, encompassing HIPAA, CMS mandates, and state-specific health and safety laws, makes these software solutions indispensable for operational integrity and avoiding costly penalties. For instance, the Health Insurance Portability and Accountability Act (HIPAA) compliance alone requires robust data security and privacy measures, which specialized software helps manage.

The reliance of nursing homes and assisted living facilities on these vendors for maintaining compliance is substantial. Failure to adhere to regulations can result in fines, loss of accreditation, and severe reputational damage. Consequently, Healthcare Services Group, like its peers, must invest in and maintain these critical systems, granting the software vendors leverage in pricing and contract negotiations. The market for such specialized software is also relatively concentrated, further amplifying supplier power.

- High Switching Costs: Implementing and integrating new compliance software can be complex and time-consuming, leading to high switching costs for healthcare providers.

- Essential Functionality: These software solutions are not optional; they are critical for legal operation and avoiding significant financial penalties.

- Limited Number of Specialized Vendors: The market for healthcare compliance software is often dominated by a few key players, reducing competition and increasing supplier leverage.

- Impact of Non-Compliance: In 2024, healthcare organizations faced increasing scrutiny, with regulatory bodies levying substantial fines for data breaches and compliance failures, underscoring the essential nature of these software tools.

Transportation and Logistics Services

The bargaining power of suppliers in transportation and logistics services significantly impacts Healthcare Services Group. If there's a scarcity of specialized healthcare logistics providers or if fuel prices experience sharp increases, these suppliers gain leverage. For example, in 2024, the average cost of diesel fuel saw fluctuations, impacting operational expenses for logistics companies. This can translate to higher service fees for Healthcare Services Group, potentially affecting the cost-effectiveness of their supply chain and laundry operations.

Several factors contribute to this supplier power:

- Limited Provider Options: In certain regions, the number of logistics firms equipped for healthcare-specific needs, like temperature-controlled transport or secure handling of medical supplies, might be restricted.

- Fuel Cost Volatility: Fluctuations in global oil prices directly influence the operating costs for trucking and shipping companies. According to the U.S. Energy Information Administration, diesel prices in 2024 averaged around $4.00 per gallon, a figure subject to considerable change.

- Specialized Equipment and Compliance: Maintaining fleets that meet stringent healthcare regulations and possess specialized equipment for medical deliveries requires substantial investment, which can limit the pool of qualified suppliers.

The bargaining power of suppliers for Healthcare Services Group is influenced by the availability and cost of essential goods and services. For instance, suppliers of specialized laundry equipment and chemicals can exert considerable influence due to the critical nature of these supplies for hygiene and operational efficiency, particularly as healthcare facilities increasingly adopt advanced cleaning technologies. The global market for laundry care chemicals, a key input, was expected to see steady growth through 2024, indicating consistent demand that can bolster supplier leverage.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Healthcare Services Group | Relevant 2024 Data/Trends |

| Specialized Equipment & Technology | High R&D costs, proprietary technology, limited competitors | Increased capital expenditure, potential for higher leasing/maintenance fees | Market for healthcare robotics projected to exceed $10 billion by 2024, indicating strong demand for innovative solutions. |

| Food & Consumables | Commodity price volatility, supply chain disruptions, quality standards | Higher cost of goods sold, potential for stockouts impacting service delivery | A 5% increase in medical-grade cleaning supply costs in 2024 could directly impact operating expenses. |

| Regulatory Compliance Software | Complexity of regulations, high switching costs, essential functionality | Subscription fees, mandatory upgrades, potential for lock-in | Healthcare organizations faced increasing scrutiny in 2024, with substantial fines for compliance failures. |

What is included in the product

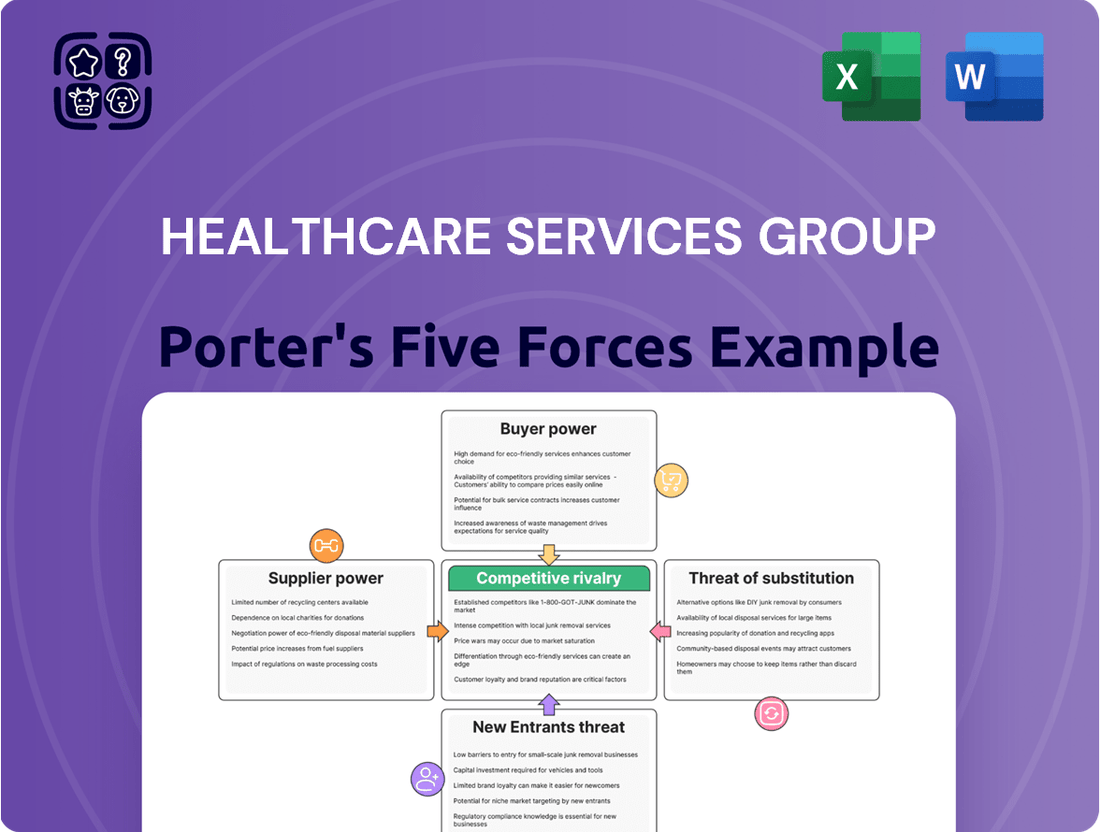

This analysis examines the competitive intensity within the healthcare services sector, focusing on how factors like buyer and supplier power, the threat of new entrants and substitutes, and existing rivalry impact Healthcare Services Group's profitability and strategic positioning.

Instantly identify and mitigate competitive threats with a visual breakdown of Healthcare Services Group's Porter's Five Forces.

Customers Bargaining Power

The bargaining power of customers in the healthcare services sector is notably influenced by facility consolidation. As nursing homes, rehabilitation centers, and assisted living facilities merge or become integrated into larger healthcare systems, their collective purchasing power gains significant traction.

This consolidation allows these larger entities to negotiate more aggressively for favorable terms, including lower prices and tailored service agreements from providers like Healthcare Services Group. For instance, in 2024, the trend of mergers and acquisitions in the healthcare industry continued, with reports indicating a growing number of multi-facility operators actively seeking volume discounts and customized service packages.

Healthcare facilities are indeed grappling with substantial financial strains. For instance, the Centers for Medicare & Medicaid Services (CMS) projected that Medicare spending for hospitals and skilled nursing facilities would increase by 3.5% in 2024, a figure that often falls short of covering escalating operational expenses like labor and supplies. This persistent cost pressure directly translates into a stronger bargaining position for these providers when negotiating with service outsourcing companies like Healthcare Services Group.

The bargaining power of customers within the healthcare services sector, particularly concerning in-house alternatives, is a significant factor for companies like Healthcare Services Group. While Healthcare Services Group offers specialized outsourced solutions, the option for healthcare facilities to manage services like housekeeping, laundry, and dining internally presents a tangible alternative. This perceived feasibility, even with its inherent complexities and potential cost increases, directly impacts the negotiating leverage of these customers.

For instance, a large hospital system might evaluate the cost and operational efficiency of bringing laundry services in-house versus continuing with an external provider. If the internal analysis suggests a potential cost saving or greater control, even if marginal, it empowers them to demand more favorable terms from their outsourced vendors. This is particularly true as the healthcare industry continues to focus on cost optimization, with many facilities actively exploring ways to reduce operational expenses. In 2024, the average hospital operating margin was around 2.5%, highlighting the constant pressure to manage costs effectively.

Switching Costs for Customers

The costs and complexities involved in switching from one outsourced service provider to another, or even moving from an outsourced model back to an in-house operation, can be substantial for healthcare facilities. These switching costs are a significant factor in determining customer bargaining power.

These costs can include the disruption to daily operations, the expense and time required for retraining staff on new procedures or systems, and the technical challenges of integrating new IT infrastructure or workflows. For instance, a hospital might face considerable downtime and potential patient care interruptions during the transition period, alongside the direct costs of new equipment or software licenses. These factors effectively lock in customers once a contract is established, thereby reducing their leverage.

- High Transition Expenses: Moving from one provider to another can incur significant costs related to data migration, system integration, and initial setup fees.

- Operational Disruption: Switching providers often leads to temporary disruptions in service delivery, impacting patient care and facility operations.

- Staff Retraining: Employees may require extensive retraining on new systems, protocols, or equipment, adding to the overall cost and time commitment.

- Contractual Obligations: Existing long-term contracts can impose penalties or fees for early termination, further increasing switching costs.

Quality and Performance Expectations

Customers in healthcare services, including hospitals and long-term care facilities, place a premium on quality, hygiene, and patient outcomes. In 2024, for instance, patient satisfaction scores continued to be a critical metric, with studies indicating that facilities consistently scoring above 85% in patient-reported outcomes often command higher contract values.

When Healthcare Services Group (HCSG) or its competitors fall short of these stringent standards, clients can exert significant pressure. This might involve demanding service enhancements, negotiating lower rates, or, more critically, switching to providers who demonstrably offer superior cleanliness, safety protocols, and overall patient care.

- High Customer Expectations: Patients and healthcare facilities prioritize impeccable hygiene and demonstrable positive patient well-being.

- Impact of Non-Compliance: Failure to meet quality benchmarks can lead to client demands for improvements or price concessions.

- Switching Behavior: Dissatisfied clients have the power to seek alternative service providers if current standards are not met.

- Competitive Differentiation: Providers excelling in quality and performance can leverage this to their advantage in contract negotiations.

The bargaining power of customers in the healthcare sector is amplified by the increasing consolidation of facilities. As more hospitals and nursing homes merge, their collective purchasing power grows, enabling them to negotiate better terms with service providers like Healthcare Services Group. This trend was evident in 2024, with a notable increase in multi-facility operators seeking volume discounts and customized service packages.

Healthcare facilities face significant financial pressures, with operational costs often outpacing reimbursement rates. For example, CMS projected a 3.5% Medicare spending increase for hospitals in 2024, which many found insufficient to cover rising expenses. This cost sensitivity strengthens their negotiating position with outsourcing companies.

The availability of in-house alternatives, even if complex, also empowers customers. A hospital system might explore bringing services like laundry in-house if it appears to offer cost savings or greater control, leading them to demand more favorable terms from external providers. In 2024, the average hospital operating margin was around 2.5%, underscoring the constant drive for cost efficiency.

Switching costs, including operational disruption and retraining, can be substantial for healthcare facilities when changing service providers. These costs can effectively lock in existing customer relationships, thereby diminishing their immediate bargaining leverage.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

| Facility Consolidation | Increases collective purchasing power | Continued M&A activity in healthcare |

| Financial Pressures | Drives demand for cost savings | Medicare spending increase (3.5%) often insufficient for rising costs |

| In-house Alternatives | Provides leverage for negotiation | Focus on cost optimization and operational control |

| Switching Costs | Can reduce immediate leverage | Disruption, retraining, integration complexities |

Same Document Delivered

Healthcare Services Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Healthcare Services Group, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It provides an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The outsourced healthcare support services market is highly fragmented, featuring a multitude of regional and national competitors vying for market share. This crowded landscape means Healthcare Services Group (HCSG) faces a broad spectrum of rivals, from large, diversified facility management companies to smaller, niche providers specializing in specific services.

This intense competition naturally drives significant price pressure. For instance, in 2024, the average contract value for janitorial and housekeeping services in healthcare facilities saw a notable increase in competition, with smaller regional players often undercutting larger national bids to secure business. This dynamic directly impacts HCSG’s profit margins, forcing them to constantly optimize operational efficiency and service delivery to remain competitive.

The housekeeping, laundry, and dining services within the healthcare sector are largely seen as interchangeable, meaning clients often prioritize cost when making choices. This commoditization fuels intense competition, as providers frequently lower prices to secure contracts, which can unfortunately squeeze profit margins for everyone involved.

While Healthcare Services Group aims for broad service offerings and operational efficiency, competitors often carve out niches. For instance, some rivals might specialize in advanced diagnostic imaging or outpatient surgical centers, leveraging unique technologies. This specialization allows them to attract specific patient demographics and potentially command premium pricing, intensifying rivalry.

The healthcare sector saw significant investment in technological advancements in 2024, with companies focusing on AI-driven diagnostics and telehealth platforms. Healthcare Services Group’s emphasis on comprehensive services is challenged by these specialized, tech-forward competitors. For example, a competitor focusing solely on robotic surgery might offer superior outcomes in that specific area, drawing patients and physicians away from more generalized providers.

Client Retention and Contract Renewals

Healthcare Services Group's competitive rivalry significantly impacts client retention and contract renewals. Maintaining existing client relationships is paramount, as competitors are aggressive in trying to win over customers. This necessitates continuous value demonstration and adaptation to evolving client needs.

The pressure to retain clients means Healthcare Services Group must consistently deliver high service levels. Failure to do so can lead to client churn, especially given the industry's competitive landscape. For instance, in the broader healthcare staffing sector, contract renewal rates can fluctuate based on service quality and pricing pressures.

- Client churn is a constant threat due to aggressive competitor poaching.

- Demonstrating ongoing value and adapting to client needs are essential for retention.

- High service levels are critical to prevent clients from switching providers.

- Contract renewal success is directly tied to a provider's ability to satisfy evolving client demands.

Geographic Reach and Scale

Healthcare Services Group's extensive operations across the United States provide a significant advantage, allowing it to serve a wide customer base. This national presence is a key factor in its competitive positioning within the healthcare services industry.

However, the company faces robust competition from regional players who often possess deeper local market knowledge and established relationships. These localized competitors can be particularly formidable in specific geographic areas, leveraging their community ties to gain an edge.

Furthermore, larger, more diversified facility management companies present a substantial competitive threat. With greater scale, broader service offerings, and potentially more substantial financial resources, these entities can exert considerable pressure on Healthcare Services Group, especially in bids for large contracts or in highly competitive markets.

- Geographic Footprint: Healthcare Services Group operates nationwide, a key differentiator.

- Regional Competitors: Strong local players challenge market share through deep community ties.

- Scale and Diversification: Larger, diversified facility management firms leverage scale and resources to compete effectively.

The competitive rivalry within the outsourced healthcare support services market is fierce, characterized by a fragmented industry with numerous players, including large diversified firms and specialized niche providers.

This intense competition drives significant price sensitivity among clients, as services like housekeeping and laundry are often viewed as commodities. In 2024, this led to increased price pressure on contracts, impacting profit margins for providers like HCSG.

While HCSG benefits from its national presence, it contends with strong regional competitors who leverage local market knowledge and established relationships, as well as larger, more resource-rich facility management companies that pose a substantial threat, particularly for large contracts.

| Competitive Factor | Impact on HCSG | 2024 Market Trend |

| Market Fragmentation | Broad spectrum of rivals | High number of regional and national players |

| Price Sensitivity | Margin pressure | Undercutting bids by smaller players |

| Service Commoditization | Focus on cost | Clients prioritize cost over brand |

| Specialization vs. Diversification | Challenge from niche tech-focused firms | AI diagnostics and telehealth gaining traction |

| Client Retention | Constant threat of churn | Aggressive poaching by competitors |

SSubstitutes Threaten

The most direct substitute for Healthcare Services Group's (HCSG) outsourced services is for healthcare facilities to handle housekeeping, laundry, and dining functions internally. This move requires substantial internal resources and specialized knowledge, making it a feasible choice for certain facilities, especially smaller operations or those prioritizing direct oversight.

While bringing these services in-house offers greater control, it often means significant capital investment in equipment and training. For instance, a mid-sized hospital might need to invest upwards of $500,000 to establish a fully functional in-house laundry facility, a cost that can be prohibitive compared to outsourcing.

Emerging technologies like advanced robotics for patient care or automated diagnostic tools pose a significant threat of substitution. For instance, AI-powered diagnostic platforms are increasingly capable of performing tasks traditionally handled by human specialists, potentially reducing the demand for certain services. In 2024, the global AI in healthcare market was valued at approximately $20.1 billion, with projections indicating substantial growth, highlighting the increasing viability of these technological substitutes.

Automated systems for administrative tasks, such as patient scheduling or billing, can also replace human administrative staff. While these initial investments can be high, they promise greater accuracy and round-the-clock availability, offering a compelling alternative to traditional labor models. This trend is further amplified by the ongoing push for operational efficiency across the healthcare sector.

The rise of alternative care models, such as home-based care and specialized outpatient clinics, presents a significant threat to traditional, large-scale healthcare providers like Healthcare Services Group. These alternatives can siphon off demand for services typically offered in hospitals or large facilities, impacting market share. For instance, the home healthcare market in the US was projected to reach $227.2 billion in 2024, indicating a strong and growing preference for care outside of institutional settings.

DIY Solutions and Specialized Software

The threat of substitutes for Healthcare Services Group is influenced by the increasing availability of DIY solutions and specialized software. For certain administrative or management tasks within facility services, healthcare providers might choose to implement off-the-shelf software or engage independent contractors instead of opting for a full-service outsourced solution.

This do-it-yourself approach, facilitated by technological advancements, can effectively substitute for specific components of Healthcare Services Group's service portfolio. For instance, in 2024, the market for healthcare management software saw significant growth, with many providers adopting cloud-based solutions for tasks like scheduling, billing, and patient record management, thereby reducing their reliance on external service providers for these functions.

- DIY Software Adoption: Healthcare facilities are increasingly utilizing specialized software for administrative and management functions, potentially reducing the need for outsourced services.

- Independent Contractors: The availability of skilled independent contractors offers an alternative for specific facility management tasks, bypassing comprehensive outsourcing.

- Cost-Effectiveness: For certain non-core functions, a DIY or contractor-based approach can present a more cost-effective solution compared to a full-service outsourcing contract.

- Technological Enablement: Advancements in technology continue to empower healthcare organizations to manage more aspects of their operations internally.

Emergence of Integrated Service Providers

The threat of substitutes for Healthcare Services Group (HCSG) is growing with the emergence of integrated service providers. These companies offer a comprehensive suite of facility management solutions, potentially encompassing everything from environmental services to non-clinical support functions. This consolidation means healthcare facilities might opt for a single vendor, bypassing specialized providers like HCSG for certain services.

For instance, a large hospital system might seek a single partner to manage laundry, dining, and facility maintenance, rather than contracting with separate entities. This trend could diminish the appeal of HCSG's focused offerings if clients prioritize the convenience and potential cost savings of an all-in-one solution. In 2024, the demand for streamlined operational efficiency in healthcare settings continues to rise, making integrated models a compelling alternative.

- Integrated Providers Offer Broader Service Portfolios

- Healthcare Facilities May Prioritize Single-Vendor Solutions

- HCSG's Specialized Services Could Face Reduced Demand

- Trend Driven by Demand for Operational Efficiency and Cost Savings

The threat of substitutes for Healthcare Services Group (HCSG) is multifaceted, encompassing both in-house capabilities and emerging technological solutions. Healthcare facilities can choose to manage services like laundry, housekeeping, and dining internally, although this often requires significant capital investment and specialized expertise. For example, establishing an in-house laundry facility could cost a mid-sized hospital upwards of $500,000. Furthermore, advancements in AI and robotics are introducing new forms of substitution, with AI in healthcare valued at approximately $20.1 billion in 2024, indicating a growing potential for technological alternatives to human-centric services.

Alternative care models, such as home-based care and specialized outpatient clinics, also represent a significant substitute threat by diverting demand from traditional healthcare settings. The US home healthcare market was projected to reach $227.2 billion in 2024, highlighting a preference for care outside of institutional environments. Additionally, the increasing availability of specialized software and independent contractors allows healthcare providers to handle administrative and management tasks internally, reducing reliance on comprehensive outsourcing solutions. The healthcare management software market, for instance, saw substantial growth in 2024, with cloud-based solutions enabling greater in-house control over functions like scheduling and billing.

| Substitute Category | Example | Estimated Market Value (2024) | Impact on HCSG |

|---|---|---|---|

| In-house Operations | Hospital-managed laundry services | N/A (Internal Cost) | Requires significant capital investment, reduces outsourcing demand |

| Technological Advancements | AI in diagnostics | $20.1 billion (Global AI in Healthcare) | Potentially reduces need for certain human-led support services |

| Alternative Care Models | Home healthcare services | $227.2 billion (US Home Healthcare Market) | Siphons demand from traditional facility services |

| DIY & Specialized Software | Cloud-based scheduling software | N/A (Segment of broader software market) | Enables internal management of administrative tasks |

Entrants Threaten

Establishing a nationwide presence in healthcare support services, like housekeeping and dining, demands significant upfront capital. Think about the costs for specialized laundry equipment, advanced cleaning technology, and the initial training for a large, skilled workforce. For instance, a new competitor might need to invest tens of millions of dollars just to build the foundational infrastructure for a regional operation, making it tough to compete with established players.

The healthcare sector is notoriously complex due to stringent regulations governing everything from patient safety and data privacy (like HIPAA in the US) to facility licensing and staffing qualifications. New companies entering this space must possess deep expertise in navigating these intricate compliance landscapes, which often requires specialized legal and operational teams. For instance, in 2024, the average cost for a new healthcare facility to obtain all necessary licenses and certifications can easily run into hundreds of thousands, if not millions, of dollars, representing a significant barrier to entry.

Healthcare Services Group, with nearly 50 years of operational history, has cultivated deep-seated, long-standing relationships with a multitude of healthcare facilities. This extensive experience has allowed them to build a robust reputation for reliability and quality service delivery within the industry.

New entrants face a significant hurdle in replicating these established connections and the trust they engender. Securing initial contracts and gaining access to facilities is considerably more difficult for companies without a proven track record and a recognized name.

Access to Skilled Labor and Training

The persistent shortage of qualified healthcare support staff presents a formidable hurdle for new companies entering the sector. Attracting, onboarding, and keeping a substantial number of employees adept at the precise requirements of healthcare settings represents a considerable impediment.

For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 23% growth for home health and personal care aides, a rate much faster than the average for all occupations, highlighting the intense competition for talent.

This difficulty in securing a competent workforce can significantly increase initial operating costs due to higher recruitment expenses and extended training periods, thereby deterring potential new entrants.

- Skilled Labor Shortage: Ongoing deficits in trained healthcare support personnel create a significant barrier for new market entrants.

- Recruitment and Training Costs: The expense and time involved in recruiting and training staff to meet specialized healthcare needs are substantial deterrents.

- High Demand for Aides: Projections indicate robust demand for roles like home health and personal care aides, intensifying competition for talent in 2024 and beyond.

Economies of Scale and Cost Advantages

Existing players in healthcare services, such as Healthcare Services Group, leverage significant economies of scale. This allows them to negotiate better prices for supplies and optimize their operational logistics, creating substantial cost advantages. For instance, in 2024, large healthcare service providers often secure discounts of 10-15% on bulk medical supplies compared to smaller, newer entrants.

New companies entering the market would find it challenging to match these cost efficiencies. Without the volume to command similar purchasing power or the established infrastructure for streamlined logistics, their per-unit costs would likely be higher. This makes competing on price a considerable hurdle, especially in a sector where cost-effectiveness is frequently a deciding factor for clients.

- Economies of Scale: Existing firms benefit from lower per-unit costs due to high-volume operations.

- Cost Advantages: Established players enjoy preferential pricing on supplies and services.

- Barriers to Entry: New entrants face higher initial operating costs, hindering price competitiveness.

- Market Sensitivity: The healthcare services market is often price-sensitive, amplifying the impact of cost disadvantages for newcomers.

The threat of new entrants in healthcare support services, like those provided by Healthcare Services Group, is moderately low. Significant capital investment is required for specialized equipment and initial workforce training, with new regional operations potentially needing tens of millions of dollars. Navigating the complex regulatory environment, including HIPAA and facility licensing, adds substantial costs, estimated in the hundreds of thousands to millions for new facilities in 2024.

Established companies benefit from strong client relationships and economies of scale, offering cost advantages through bulk purchasing discounts of 10-15% on supplies in 2024. The persistent shortage of qualified healthcare support staff, with roles like home health aides projected for 23% growth in the US, intensifies competition for talent and increases recruitment and training costs for newcomers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for specialized equipment and workforce training. | Significant financial hurdle, requiring tens of millions for regional operations. |

| Regulatory Compliance | Complex licensing, safety, and data privacy regulations. | Costs can reach hundreds of thousands to millions for new facilities in 2024. |

| Established Relationships | Long-standing trust and contracts with healthcare facilities. | Difficult for new entrants to secure initial contracts without a proven track record. |

| Labor Shortages | Scarcity of qualified healthcare support staff. | Increases recruitment costs and training time, deterring market entry. |

| Economies of Scale | Cost advantages from high-volume operations and bulk purchasing. | New entrants face higher per-unit costs, hindering price competitiveness. |

Porter's Five Forces Analysis Data Sources

Our Healthcare Services Group Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources. We leverage financial reports from publicly traded healthcare providers, market research databases, and industry-specific trade publications to capture market dynamics and competitive landscapes.