HBL Power Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HBL Power Systems Bundle

Unlock the critical external factors shaping HBL Power Systems's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the forces that will dictate future growth and potential challenges. Equip yourself with actionable intelligence to refine your investment or business strategy. Download the full PESTLE analysis now and gain a significant competitive advantage.

Political factors

The Indian government's robust support for domestic manufacturing through initiatives like 'Make in India' and 'Atmanirbhar Bharat' creates a highly favorable landscape for HBL Power Systems. These policies are designed to decrease import dependency and stimulate local production, directly benefiting HBL's core businesses in specialized batteries and industrial electronics.

These government programs offer tangible benefits, including production-linked incentives (PLI) and favorable policies that encourage local sourcing and value addition within India. For instance, the PLI scheme for battery manufacturing, introduced in 2021, aims to attract significant investment and boost domestic capacity, directly aligning with HBL's strategic growth objectives.

India's defense budget for the fiscal year 2024-2025 has seen a notable increase, signaling a robust commitment to modernizing its armed forces. This enhanced allocation is particularly focused on bolstering indigenous defense production capabilities.

A significant portion of the capital outlay within this budget is specifically designated for domestic procurement. This strategic direction presents substantial opportunities for companies like HBL Power Systems, which plays a crucial role in supplying specialized products, such as customized lithium-ion battery packs, to the defense sector.

The Indian Railways is experiencing a significant push for modernization and expansion, with the Union Budget 2024-2025 allocating a record ₹2.55 lakh crore for capital expenditure. This substantial investment is channeled into crucial areas like network electrification, track commissioning, and the implementation of advanced signaling systems such as Kavach, India's indigenously developed automatic train protection system.

These ambitious infrastructure development plans present a direct opportunity for HBL Power Systems. As a prominent supplier of essential railway signaling equipment and robust battery backup solutions, the company is well-positioned to capitalize on the increased demand stemming from these large-scale government projects. The ongoing rollout of Kavach, for instance, requires extensive signaling and communication infrastructure, areas where HBL has established expertise.

Policies for Battery and EV Manufacturing

Government policies are strongly backing domestic battery and EV manufacturing. The Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell Battery Storage is a key driver, alongside customs duty exemptions on essential minerals and manufacturing equipment. These measures are designed to cut down on imports and build a strong local battery industry.

These initiatives directly benefit HBL Power Systems by encouraging investment in new cell manufacturing plants and supporting its existing battery operations. For instance, the PLI scheme aims to attract significant investment, with targets set to achieve a manufacturing capacity of 50 GWh of ACC and 20 GWh of niche ACC by 2025-26, as per the Ministry of Heavy Industries.

- PLI Scheme for ACC Battery Storage: Aims to boost domestic manufacturing capacity.

- Customs Duty Exemptions: Lowering costs for critical raw materials and capital goods.

- Reduced Import Reliance: Fostering self-sufficiency in the EV battery supply chain.

- Ecosystem Development: Creating a robust local industry for battery production.

Growth in Telecommunications Infrastructure

India's telecommunications sector is experiencing a robust growth phase, fueled by government initiatives like the National Digital Communications Policy 2018, which aims to attract substantial investment. The push for 5G deployment and enhanced broadband connectivity is a key driver, creating a strong demand for reliable power backup solutions. HBL Power Systems, with its expertise in battery technology, is well-positioned to capitalize on this expansion.

The government's vision extends to significantly increasing annual investment in the telecom sector, with a focus on domestic manufacturing. Projects such as BharatNet, which aims to connect rural areas with high-speed internet, further amplify the need for robust infrastructure, including dependable power sources. This presents a direct opportunity for HBL Power Systems to supply critical components.

By 2025, India anticipates a substantial increase in telecom infrastructure, with an estimated investment of $100 billion projected. This includes the widespread rollout of 5G services and the expansion of fiber optic networks across the country. HBL Power Systems' product portfolio, particularly its advanced battery solutions, directly aligns with the power requirements of this expanding digital ecosystem.

The growth in telecommunications infrastructure directly translates into increased demand for specialized power solutions. HBL Power Systems is poised to benefit from this trend through its established presence in providing batteries for telecom towers and other critical network infrastructure. The company's ability to offer reliable and efficient power backup is crucial for maintaining network uptime amidst this rapid expansion.

Government policies significantly bolster domestic manufacturing, especially in defense and railways. The 2024-2025 Indian defense budget's increased allocation for indigenous procurement directly benefits HBL Power Systems' specialized battery offerings for military applications.

Furthermore, the record ₹2.55 lakh crore capital expenditure for Indian Railways in the 2024-2025 budget, focusing on modernization and systems like Kavach, creates substantial demand for HBL's signaling equipment and backup power solutions.

The push for 5G and enhanced broadband, backed by initiatives like the National Digital Communications Policy, is projected to attract $100 billion in telecom investment by 2025, driving demand for HBL's battery technologies in this sector.

| Government Initiative | Focus Area | Impact on HBL Power Systems | Relevant Data/Target |

|---|---|---|---|

| Make in India / Atmanirbhar Bharat | Domestic Manufacturing | Favorable landscape for specialized batteries and industrial electronics. | Decreasing import dependency. |

| PLI Scheme for ACC Battery Storage | Battery Manufacturing | Encourages investment in new cell manufacturing plants. | Target: 50 GWh ACC capacity by 2025-26. |

| Indian Railways Modernization | Infrastructure Development | Demand for signaling equipment and battery backup solutions. | 2024-25 Capital Expenditure: ₹2.55 lakh crore. |

| National Digital Communications Policy | Telecom Expansion | Demand for reliable power backup for 5G and broadband. | Projected Telecom Investment: $100 billion by 2025. |

What is included in the product

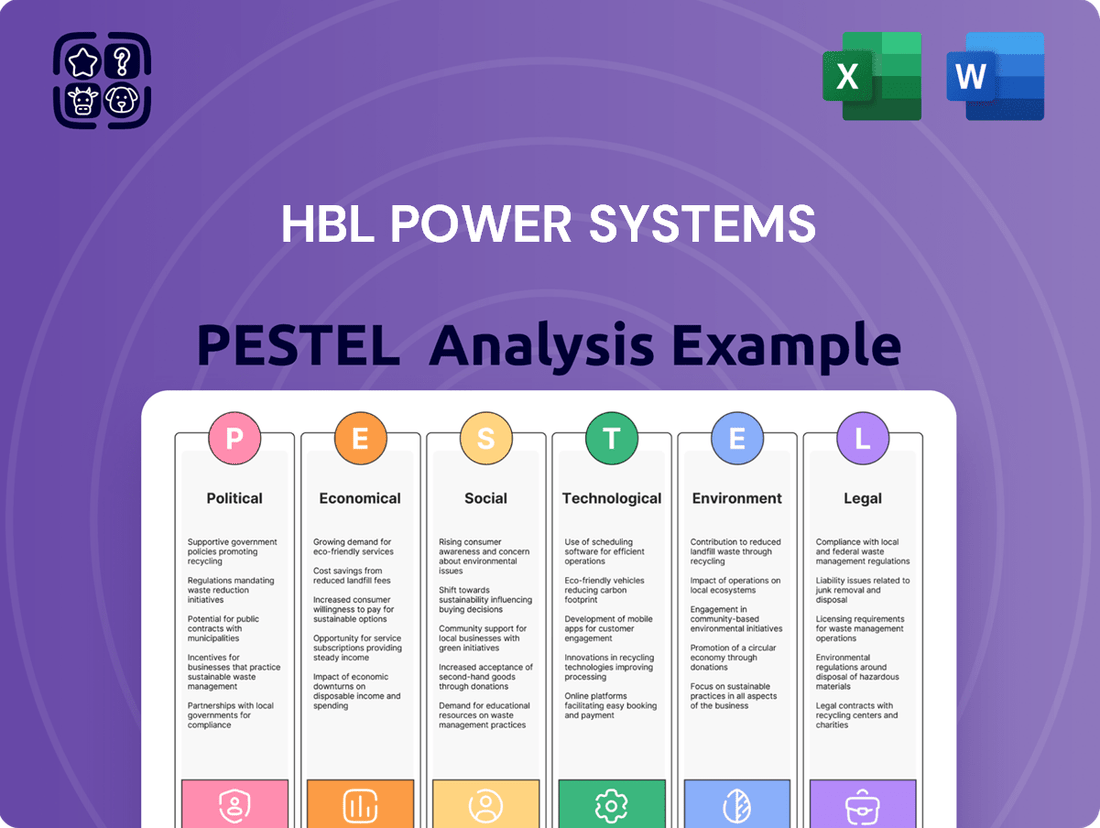

This PESTLE analysis of HBL Power Systems examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic direction.

It provides a comprehensive overview of external forces, highlighting potential threats and opportunities for HBL Power Systems to navigate in its operating environment.

Provides a concise version of the HBL Power Systems PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy reports.

Helps support discussions on external risk and market positioning for HBL Power Systems, acting as a pain point reliever by clarifying complex factors for strategic planning.

Economic factors

India's economy is set for robust expansion in fiscal year 2024-25, with projections indicating it will be one of the fastest-growing major economies globally. This strong performance makes India an attractive destination for foreign investment and a significant contributor to worldwide economic momentum.

This positive economic trajectory is expected to boost demand for products and services within sectors where HBL Power Systems operates, such as defense, railways, and industrial applications. A growing economy generally means more infrastructure development and increased industrial activity, which directly benefits companies like HBL Power Systems.

Sectors crucial to HBL Power Systems, like railways, defense, and power electronics, are seeing significant capital expenditure. Indian Railways' capital outlay has nearly doubled in the last five years, reaching approximately ₹2.40 lakh crore in FY2024, a substantial increase from previous years.

The power electronics market in India is also experiencing robust growth, projected to reach $100 billion by 2025, fueled by the demand for energy-efficient solutions and government initiatives like Make in India.

This sustained investment across these key sectors creates substantial market opportunities for HBL's specialized products, particularly in areas like battery systems for railways and defense applications, and power solutions for the growing electronics industry.

India's manufacturing sector is on a strong growth trajectory, with projections indicating it could reach $1 trillion by the fiscal year 2025-26. This expansion is fueled by significant new investments and strategic policy shifts, creating a robust domestic market for industrial goods.

Government initiatives, such as the Production Linked Incentive (PLI) schemes, are actively boosting manufacturing momentum. These policies are designed to encourage domestic production and attract foreign investment, directly benefiting sectors like industrial batteries and electronics, which HBL Power Systems operates within.

HBL Power Systems' Financial Performance

HBL Power Systems demonstrated robust financial health in the quarter ending March 2024, with profitability and liquidity showing marked improvement. This positive trend occurred even as net sales experienced a slight dip, underscoring enhanced operational efficiency and cost management.

The company has also provided an updated earnings forecast, projecting a significant uptick in sales for fiscal year 2025 and continuing into subsequent years. This forward-looking guidance signals a confident outlook on future growth and sustained financial performance.

- Profitability Improvement: The company's improved profitability in Q4 FY24 indicates effective cost control and potentially higher-margin product sales.

- Liquidity Enhancement: Stronger liquidity suggests better short-term financial stability and the capacity to meet immediate obligations.

- Sales Guidance: The projected increase in sales for FY25 and beyond points to anticipated market demand and successful business development strategies.

- Operational Efficiency: The combination of improved profitability despite sales fluctuations highlights gains in operational efficiency.

Raw Material and Supply Chain Dynamics

The cost and availability of essential raw materials, particularly those critical for battery production such as lithium, cobalt, and nickel, represent significant economic factors for HBL Power Systems. Global price volatility and supply chain disruptions directly influence manufacturing expenses and profit margins.

India's push to boost domestic production and recycling aims to lessen import dependence, but external market forces remain a key consideration. For instance, the price of lithium carbonate saw substantial fluctuations throughout 2023 and into early 2024, impacting battery manufacturing costs worldwide.

- Lithium Price Trends: Lithium carbonate prices, which peaked significantly in late 2022, experienced a notable correction in 2023, though remained elevated compared to pre-2021 levels, presenting ongoing cost management challenges.

- Cobalt and Nickel Volatility: The markets for cobalt and nickel, also vital for battery chemistries, have been subject to geopolitical influences and supply constraints, leading to price unpredictability.

- Supply Chain Resilience: Efforts to diversify supply chains and invest in domestic sourcing and recycling are crucial for HBL to mitigate the economic impact of global raw material availability.

India's economy is projected to grow robustly in FY2024-25, positioning it as a leading global growth engine. This economic expansion fuels demand across sectors like defense and railways, which are key markets for HBL Power Systems.

Significant capital expenditure in Indian Railways, reaching approximately ₹2.40 lakh crore in FY2024, and a power electronics market expected to hit $100 billion by 2025, highlight substantial opportunities.

HBL Power Systems reported improved profitability and liquidity in Q4 FY24, alongside a positive sales forecast for FY25, indicating strong operational efficiency and market confidence.

Raw material costs, particularly for lithium, cobalt, and nickel, remain a critical economic factor due to global price volatility, impacting manufacturing expenses.

| Economic Factor | Data Point/Trend | Impact on HBL Power Systems |

|---|---|---|

| GDP Growth (FY2024-25) | Projected robust growth, one of the fastest globally | Increased demand for HBL's products in key sectors |

| Indian Railways Capex | ~₹2.40 lakh crore in FY2024 | Boosts demand for railway signaling and battery solutions |

| Power Electronics Market | Projected $100 billion by 2025 | Growth opportunities in energy-efficient solutions |

| Lithium Prices | Volatile, with corrections but remaining elevated | Affects battery manufacturing costs and profit margins |

Preview the Actual Deliverable

HBL Power Systems PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting HBL Power Systems.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive PESTLE analysis for HBL Power Systems.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the HBL Power Systems' operating environment.

Sociological factors

Societal trends increasingly favor self-reliance and domestic sourcing, directly impacting procurement in key industries. The Indian government's robust 'Make in India' and 'Atmanirbhar Bharat' (Self-Reliant India) campaigns are actively shaping consumer and industrial purchasing behaviors, particularly within strategic sectors like defense and railways.

This nationalistic sentiment translates into a tangible preference for locally manufactured products. For companies like HBL Power Systems, which specializes in batteries and power systems, this societal shift is a significant advantage, positioning them favorably as a domestic producer capable of meeting critical national needs.

Societal focus on sustainability is intensifying, with a growing demand for eco-friendly products and services. This shift directly benefits companies like HBL Power Systems, whose battery technologies are crucial for the burgeoning electric vehicle (EV) and renewable energy sectors. For instance, global EV sales are projected to reach over 30 million units by 2024, a significant jump from previous years, highlighting the market's embrace of greener transportation.

This heightened environmental consciousness translates into a stronger market for HBL's lithium-ion batteries and energy storage systems. As industries and consumers actively seek to reduce their carbon footprint, the demand for reliable and efficient battery solutions is set to surge. In 2023, the global energy storage market was valued at approximately $150 billion and is expected to grow substantially in the coming years, underscoring the favorable environment for HBL's offerings.

India's rapid urbanization, with an estimated 35% of its population living in cities by 2024, is a major driver for HBL Power Systems. The government's focus on developing smart cities and upgrading existing infrastructure, including transportation networks and power grids, directly translates into increased demand for HBL's specialized batteries and power solutions. This trend is expected to continue, as projects like the Smart Cities Mission aim to create sustainable and efficient urban environments.

The expansion of modern infrastructure, such as high-speed rail and advanced telecommunications networks, further boosts the need for reliable and high-performance power systems. For instance, the ongoing development of the Indian Railways' electrification and signaling projects, which saw significant capital outlay in the 2024-25 budget, requires robust battery technologies for uninterrupted operation. This societal shift towards more connected and technologically advanced living spaces underpins HBL's market opportunity.

Skill Development and Employment Generation

Government initiatives promoting skill development and job creation in manufacturing are directly impacting companies like HBL Power Systems. India's ambition to be a manufacturing powerhouse necessitates a readily available, skilled workforce. This focus ensures that firms can expand their operations and drive innovation, aligning with national employment targets.

The availability of a skilled workforce is a critical enabler for HBL Power Systems' growth and its ability to innovate. As India pushes towards becoming a global manufacturing hub, the emphasis on vocational training and upskilling programs directly addresses the need for qualified personnel in sectors like battery manufacturing and power electronics. This plays a pivotal role in HBL's capacity to scale production and maintain a competitive edge.

- Skilled Workforce Availability: The Indian government's National Skill Development Corporation (NSDC) aims to train millions of individuals annually, with a significant portion targeted towards manufacturing trades.

- Employment Generation Targets: Initiatives like 'Make in India' and Production Linked Incentives (PLI) schemes are designed to boost manufacturing output, thereby creating substantial employment opportunities.

- Industry-Academia Collaboration: Increased partnerships between educational institutions and industries are fostering specialized training programs, ensuring graduates possess industry-relevant skills for companies like HBL.

- Contribution to GDP: The manufacturing sector's contribution to India's GDP is targeted to increase significantly by 2025, underscoring the importance of skilled labor for economic growth.

Digital Transformation and Connectivity Needs

India's digital transformation is accelerating, fueled by a surge in internet users and the ongoing 5G rollout. By the end of 2024, the number of internet subscribers in India is projected to exceed 900 million, with 5G services rapidly expanding. This societal shift creates a substantial demand for dependable power solutions, directly benefiting HBL Power Systems' offerings in power electronics and telecom infrastructure, as uninterrupted connectivity becomes essential for both personal and business activities.

The increasing reliance on digital services, from e-commerce to remote work, necessitates a robust power backbone. HBL's expertise in battery technology and power management systems is crucial for maintaining this digital infrastructure. For instance, the growth in data centers, a key component of digital connectivity, is expected to see significant investment in the coming years, directly correlating with the need for reliable backup power solutions that HBL provides.

- Digital Adoption: Over 70% of India's population is expected to have internet access by 2025, driving demand for connected devices and services.

- 5G Expansion: As 5G coverage expands, the need for enhanced network infrastructure, including reliable power sources for base stations, will grow substantially.

- E-commerce Growth: India's e-commerce market is booming, projected to reach $350 billion by 2028, requiring stable power for logistics and online platforms.

Societal trends favoring self-reliance and domestic sourcing, bolstered by government initiatives like 'Make in India,' directly benefit HBL Power Systems as a local manufacturer. The increasing demand for sustainable and eco-friendly products, particularly in the electric vehicle (EV) and renewable energy sectors, aligns perfectly with HBL's battery technologies, as global EV sales are projected to exceed 30 million units by 2024.

India's rapid urbanization, with an estimated 35% of its population living in cities by 2024, drives demand for HBL's power solutions for smart cities and infrastructure upgrades. Furthermore, the digital transformation, marked by over 900 million internet subscribers by the end of 2024 and expanding 5G, necessitates reliable power for telecom infrastructure and data centers, areas where HBL excels.

The availability of a skilled workforce, supported by government skill development programs, is crucial for HBL's manufacturing capabilities and innovation. The manufacturing sector's targeted contribution to India's GDP by 2025 further emphasizes the importance of this skilled labor pool.

| Sociological Factor | Impact on HBL Power Systems | Supporting Data/Trend (2024/2025) |

| Nationalism & Domestic Sourcing | Increased preference for locally manufactured products. | 'Make in India' and 'Atmanirbhar Bharat' campaigns actively shaping purchasing behavior. |

| Sustainability Focus | Growing demand for eco-friendly products, especially batteries. | Global EV sales projected over 30 million units by 2024; Global energy storage market valued ~ $150 billion in 2023. |

| Urbanization & Infrastructure Development | Demand for power solutions in smart cities and transportation. | Estimated 35% of India's population in cities by 2024; Indian Railways' electrification projects. |

| Digital Transformation | Need for reliable power for telecom and data centers. | Over 900 million internet subscribers projected by end of 2024; 5G rollout expanding. |

| Skilled Workforce Availability | Supports manufacturing expansion and innovation. | National Skill Development Corporation (NSDC) aims to train millions annually; Manufacturing sector's GDP contribution targeted to increase by 2025. |

Technological factors

The battery sector is seeing incredibly fast progress, especially with lithium-ion and newer battery chemistries. This rapid change creates both chances and hurdles for HBL Power Systems.

HBL is putting money into new factories to make lithium-ion cells and electric drivetrains. This move is to meet the increasing demand from the electric vehicle (EV) and energy storage sectors, marking a move away from their older lead-acid and nickel-cadmium batteries.

For instance, the global lithium-ion battery market was valued at approximately $65 billion in 2023 and is projected to reach over $250 billion by 2030, showing a significant growth trajectory that HBL aims to capitalize on.

Indian Railways is making significant strides in modernizing its infrastructure, with a substantial focus on upgrading signaling systems. This includes the widespread adoption of Electronic Interlocking (EI) and the deployment of the indigenously developed Kavach automatic train protection system. These advancements are crucial for enhancing safety and boosting operational efficiency across the network.

HBL Power Systems, a key player in supplying railway signaling equipment, is well-positioned to capitalize on these technological shifts. The company's expertise in providing reliable signaling solutions directly aligns with the railway sector's push for greater automation and improved safety standards, creating a favorable market environment for its products and services.

The Indian power electronics market is surging, projected to reach USD 12.9 billion by 2027, a significant jump from USD 5.8 billion in 2022, according to Mordor Intelligence. This expansion is fueled by the booming renewable energy sector, the rapid adoption of electric vehicles (EVs), and increasing industrial automation. HBL Power Systems, with its established capabilities in rectifiers, inverters, and other power conversion solutions, is strategically positioned to benefit from this demand.

HBL's deep understanding of power electronics allows it to cater to the growing need for efficient energy management across diverse sectors. For instance, the company's solutions are crucial for the grid integration of renewable energy sources like solar and wind, as well as for the charging infrastructure required for the burgeoning EV market. This technological expertise directly translates into opportunities for HBL to provide critical components for a cleaner and more electrified economy.

Integration of Renewable Energy Solutions

The global shift towards renewable energy, particularly solar and wind power, demands advanced power electronics for efficient conversion, seamless grid integration, and intelligent energy management. HBL Power Systems' expertise in these areas positions them to capitalize on this trend.

India's ambitious targets, such as achieving carbon neutrality in its railway operations and significantly expanding its renewable energy capacity to 500 GW by 2030, underscore the immense growth potential for companies like HBL. Their battery and power electronics solutions are directly applicable to these evolving energy landscapes.

- Renewable Energy Integration: HBL's power electronics are vital for converting and managing energy from sources like solar and wind.

- Indian Energy Goals: India's commitment to 500 GW renewable energy by 2030 and carbon-neutral railways creates substantial market opportunities.

- Product Relevance: HBL's battery technologies and power management systems are crucial for the infrastructure supporting these green energy initiatives.

Research and Development in Defense Electronics

Continuous research and development (R&D) is crucial for HBL Power Systems, especially given its significant contributions to the defense sector. The company’s ability to innovate and adapt to evolving military requirements directly impacts its competitive edge and market position.

The Indian government’s commitment to bolstering its indigenous defense capabilities, exemplified by initiatives like the Innovations for Defence Excellence (iDEX) scheme, provides a strong impetus for companies like HBL. This focus on domestic innovation encourages the development of sophisticated and specialized electronic solutions tailored for challenging operational conditions.

For instance, the Indian Ministry of Defence's budget for FY2024-25 saw a notable increase, with capital outlay for modernization and R&D playing a key role. This financial backing translates into opportunities for HBL to invest in cutting-edge technologies, ensuring its product portfolio remains at the forefront of defense electronics.

- Increased Defense Budget: India's defense budget for FY2024-25 reached approximately ₹6.2 lakh crore, signaling substantial government investment in defense modernization and R&D.

- iDEX Scheme Impact: The iDEX initiative has facilitated numerous collaborations, with over 300 contracts signed by mid-2024, fostering a vibrant ecosystem for defense tech startups and established players like HBL.

- Focus on Indigenous Development: Government policies actively promote the development of a self-reliant defense industrial base, creating a demand for advanced, indigenously developed electronic systems.

- Technological Advancement: HBL’s R&D efforts are directed towards areas such as advanced battery technologies, power management systems, and communication electronics, critical for modern defense platforms.

Technological advancements are reshaping HBL Power Systems' operational landscape, particularly in battery technology and power electronics. The company is strategically investing in lithium-ion cell and electric drivetrain manufacturing to meet the burgeoning demand from the electric vehicle (EV) and energy storage sectors.

HBL's expertise in power electronics is crucial for integrating renewable energy sources and supporting the expanding EV charging infrastructure. The Indian power electronics market is projected to reach USD 12.9 billion by 2027, a significant increase from USD 5.8 billion in 2022, highlighting HBL's growth potential.

Furthermore, HBL's commitment to research and development, especially within the defense sector, is vital for maintaining its competitive edge. India's increased defense budget for FY2024-25, reaching approximately ₹6.2 lakh crore, coupled with initiatives like iDEX, creates substantial opportunities for HBL to develop advanced indigenous electronic solutions.

Legal factors

The Battery Waste Management Amendment Rules 2025, introduced by the Ministry of Environment, Forest and Climate Change, are set to reshape operations for battery producers like HBL Power Systems. These amendments bolster the Extended Producer Responsibility (EPR) system.

Key changes include mandatory digital labeling for improved traceability and simplified procedures for battery waste collection, recycling, and disposal. For instance, the framework aims to increase the collection rate of end-of-life batteries, with targets expected to be detailed in upcoming government notifications, potentially mirroring successful models seen in European Union directives where collection rates often exceed 45% for certain battery types.

Government procurement policies, particularly those favoring domestic manufacturing, significantly influence HBL Power Systems. The 'Make in India' initiative, for instance, aims to boost local production and could offer HBL a competitive edge in securing contracts, especially within the defense and railway sectors where government spending is substantial. For example, in the 2023-24 fiscal year, India's defense budget stood at approximately ₹5.94 lakh crore, with a considerable portion earmarked for domestic procurement.

Adherence to specific government procurement manuals and procedures is crucial for HBL to successfully bid for and win contracts. These guidelines often detail requirements for quality, delivery timelines, and indigenous content, all of which are critical for companies like HBL operating in these regulated industries. Navigating these complex frameworks ensures compliance and builds trust with government agencies.

HBL Power Systems operates within a landscape shaped by government initiatives designed to bolster the manufacturing sector. Schemes like the Production Linked Incentive (PLI) for advanced manufacturing, which saw significant allocations in the 2023-24 Union Budget, offer direct financial support and regulatory advantages for domestic production. For instance, the PLI scheme for the automotive sector, relevant to HBL's battery solutions, aims to enhance India's manufacturing capabilities and export potential.

Navigating these regulations is crucial for HBL to capitalize on benefits such as tax reductions, subsidies, and other incentives aimed at increasing the manufacturing sector's contribution to India's Gross Domestic Product (GDP). The government's focus on 'Make in India' continues to drive policy, with recent policy updates in 2024 emphasizing localization and technological advancement in key manufacturing areas, directly impacting companies like HBL.

Environmental Compliance and Standards

HBL Power Systems navigates a complex web of environmental regulations extending beyond waste disposal. Compliance with manufacturing process standards, emission controls, and the management of hazardous substances is paramount. While some battery-specific rules, like relaxed marking for hazardous substances, might ease certain burdens, the overarching legal framework demands rigorous environmental stewardship. For instance, India's updated battery management rules, effective from 2023 and evolving through 2024, outline specific responsibilities for manufacturers regarding collection, recycling, and safe disposal, impacting HBL's operational footprint.

The company's adherence to these evolving legal mandates is critical for maintaining its license to operate and for its long-term sustainability. Failure to comply can result in significant penalties and reputational damage. Key areas of focus include:

- Emissions Control: Meeting air and water quality standards for manufacturing facilities.

- Hazardous Material Handling: Strict protocols for the storage, use, and disposal of chemicals and battery components.

- Product Lifecycle Management: Compliance with regulations governing the end-of-life management of batteries, including recycling targets.

- Reporting and Auditing: Regular submission of environmental performance data and readiness for regulatory audits.

Telecommunications and Railway Sector Regulations

HBL Power Systems navigates a complex legal landscape, particularly within the telecommunications and railway sectors. These industries demand strict adherence to a multitude of regulations, including specific technical standards, stringent safety protocols, and essential licensing prerequisites. For instance, the recent Telecom Act 2023, with its phased implementation, requires HBL to continuously update its operational procedures and product designs to align with new mandates.

Furthermore, ongoing railway safety initiatives, such as those driven by the Ministry of Railways, impose evolving compliance burdens. These initiatives often involve upgrades to signaling systems and power solutions, directly impacting HBL's product development and maintenance strategies. Failure to comply can lead to penalties, operational disruptions, and reputational damage, making proactive regulatory engagement a critical business imperative.

Key legal factors impacting HBL include:

- Compliance with the Telecom Act 2023: This includes adapting to new spectrum allocation rules and service quality benchmarks that may influence demand for HBL's power solutions in telecom infrastructure.

- Adherence to Railway Safety Standards: Meeting updated safety certifications for components used in railway signaling and communication systems is paramount, with potential for stricter requirements in 2024-2025.

- Licensing and Approval Processes: Securing and maintaining necessary licenses for operating in both sectors, which can involve lengthy approval cycles and specific technical qualifications.

- Data Protection and Cybersecurity Regulations: As digital integration increases in both sectors, HBL must comply with evolving data privacy laws impacting its service delivery and product offerings.

The Battery Waste Management Amendment Rules 2025 significantly impact HBL Power Systems by strengthening Extended Producer Responsibility (EPR) and mandating digital labeling for better battery traceability. These rules aim to boost the collection and recycling rates of end-of-life batteries, potentially aligning with EU directives that see collection rates exceeding 45% for certain battery types.

Government procurement policies, especially those promoting domestic manufacturing through initiatives like 'Make in India', offer HBL a competitive advantage. The substantial Indian defense budget, approximately ₹5.94 lakh crore in FY 2023-24, highlights the opportunity for domestic suppliers like HBL.

HBL must also navigate evolving environmental regulations beyond waste management, focusing on emissions control, hazardous material handling, and product lifecycle management, with updated rules from 2023-2024 emphasizing manufacturer responsibilities.

Compliance with sector-specific laws like the Telecom Act 2023 and stringent railway safety standards is critical, requiring HBL to adapt product designs and operational procedures to meet new mandates and certifications, with potential for stricter requirements anticipated for 2024-2025.

Environmental factors

The Battery Waste Management Amendment Rules 2025 significantly impact producers like HBL Power Systems by mandating extended producer responsibility for battery lifecycles. This includes establishing robust collection, recycling, and reprocessing systems to meet defined targets, ensuring compliance is key for environmental stewardship and circular economy principles.

Meeting these stringent regulations necessitates substantial investment in specialized waste management infrastructure and advanced recycling technologies. For instance, the global battery recycling market is projected to reach $20.5 billion by 2027, highlighting the scale of investment required and the growing emphasis on sustainable practices within the industry.

India's commitment to decarbonization, including Indian Railways' goal of carbon neutrality by 2030 and a national target of 500 GW renewable energy capacity by 2030, presents a significant environmental driver. This push creates a substantial market for HBL Power Systems' energy storage and power electronics, crucial for integrating renewables and enhancing energy efficiency.

The Indian government's aggressive push for electric vehicles (EVs), aiming to cut carbon emissions and decrease dependence on fossil fuels, significantly benefits HBL Power Systems' battery segment. This policy shift directly fuels demand for the advanced battery solutions HBL specializes in, particularly for EV applications.

The burgeoning EV market, projected to grow substantially, demands continuous innovation in battery technology. HBL's strategic focus on developing and manufacturing high-performance, eco-friendly EV batteries is crucial for its product roadmap and manufacturing capabilities, aligning with market needs and environmental regulations.

India's Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, with a budget of INR 10,000 crore for 2024-2025, is a key driver. This initiative, alongside production-linked incentive schemes for battery manufacturing, creates a favorable environment for companies like HBL to scale up production and invest in next-generation battery chemistries.

Corporate Sustainability and ESG Focus

There's a growing emphasis on corporate responsibility, particularly concerning Environmental, Social, and Governance (ESG) principles. This trend is shaping how businesses operate, with stakeholders increasingly scrutinizing their environmental impact and ethical practices. For a company like HBL Power Systems, this means a heightened expectation to integrate sustainability into its core manufacturing and supply chain operations.

HBL Power Systems, as a significant player in its industry, faces pressure to adopt greener manufacturing processes and actively work towards reducing its carbon footprint. This aligns with global environmental goals and investor demands for sustainable business models. For instance, many investors are now prioritizing companies with strong ESG ratings, influencing capital allocation decisions.

- Sustainable Manufacturing: Companies are expected to invest in energy-efficient technologies and waste reduction programs.

- Carbon Footprint Reduction: Targets for lowering greenhouse gas emissions are becoming standard, with many companies setting net-zero goals.

- Ethical Sourcing: Ensuring that raw materials are procured from suppliers who adhere to ethical labor and environmental standards is crucial.

- Stakeholder Expectations: Investors, customers, and employees are increasingly demanding transparency and action on ESG issues.

Resource Efficiency and Pollution Control

Environmental regulations are increasingly pushing manufacturers towards greater resource efficiency and waste reduction. For HBL Power Systems, especially in its battery production, this means a constant need to adopt cleaner technologies and meet strict pollution control standards to operate sustainably.

This focus on sustainability is critical, as companies like HBL are under growing pressure to minimize their ecological footprint. For instance, the global battery market, a key sector for HBL, is expected to see significant growth, making efficient resource management even more vital.

- Resource Efficiency: HBL needs to invest in technologies that reduce raw material consumption and energy usage per unit of battery produced.

- Pollution Control: Adherence to emission standards for manufacturing processes, particularly concerning battery materials, is paramount.

- Waste Management: Implementing robust waste reduction and recycling programs for production byproducts is essential for compliance and sustainability.

- Sustainable Sourcing: Ensuring that the raw materials used in battery production are sourced responsibly and with minimal environmental impact is becoming a key consideration.

Environmental regulations are increasingly pushing manufacturers towards greater resource efficiency and waste reduction, with India's Battery Waste Management Amendment Rules 2025 mandating extended producer responsibility. This necessitates substantial investment in specialized waste management infrastructure and advanced recycling technologies, as the global battery recycling market is projected to reach $20.5 billion by 2027.

India's commitment to decarbonization, including a national target of 500 GW renewable energy capacity by 2030, and the aggressive push for electric vehicles (EVs) through schemes like FAME, with a budget of INR 10,000 crore for 2024-2025, create a significant market for HBL Power Systems' energy storage solutions.

There's a growing emphasis on ESG principles, with stakeholders increasingly scrutinizing environmental impact and ethical practices, leading to heightened expectations for companies like HBL to integrate sustainability into their core operations and reduce their carbon footprint.

HBL Power Systems needs to invest in energy-efficient technologies, adhere to emission standards, implement robust waste reduction programs, and ensure responsible sourcing of raw materials to meet these growing environmental demands and stakeholder expectations.

PESTLE Analysis Data Sources

Our PESTLE analysis for HBL Power Systems is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in credible and current information.