HBL Power Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HBL Power Systems Bundle

Curious about HBL Power Systems' strategic product positioning? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a foundational understanding of their market performance. Don't miss out on the complete picture; purchase the full BCG Matrix report for detailed quadrant analysis and actionable insights to guide your investment decisions.

Stars

HBL Engineering's railway signaling and safety systems, notably the Train Collision Avoidance System (TCAS), known as KAVACH, represent a strong star in the company's portfolio. This segment is experiencing robust growth due to the Indian Railways' significant push for modernization and enhanced safety protocols.

The demand for KAVACH is escalating, evidenced by HBL securing a major ₹1,522.4 crore contract for its installation across 2,200 locomotives. Additional orders for KAVACH systems from various railway zones collectively exceed ₹10 billion, underscoring the widespread adoption and the system's critical role in preventing train accidents.

HBL Power Systems' defense and aviation battery segment, encompassing critical applications like missile, submarine, and aircraft power, is a standout performer. This sector is characterized by its high growth potential and HBL's strong market share, reflecting its specialized expertise.

The Indian government's push for 'Atmanirbhar Bharat' in defense manufacturing significantly benefits HBL. With proprietary in-house technology and a strong track record of international orders, including significant business with Israel and the UAE, HBL is a dominant player in this high-margin, specialized market.

HBL Power Systems stands out as the sole Indian manufacturer of Pure Lead Thin Plate (PLT) batteries, a distinction that carves out a unique niche for them in the market. This proprietary technology allows HBL to cater to specialized, high-performance applications where reliability is paramount.

The demand for PLT batteries is robust, evidenced by their deployment in challenging environments and significant export activity. Notably, these batteries are being supplied for use in Russian helicopters, underscoring their advanced capabilities and HBL's ability to meet stringent international standards. This export success points to considerable growth potential and a strong international market presence for HBL's PLT offerings.

Lithium-ion Batteries for Submarine Applications

HBL Power Systems is strategically positioned with its development of lithium-ion batteries for submarine applications, a venture currently in the prototype phase under DRDO contracts. This represents a significant opportunity in a niche, high-growth market where global competition is limited to only two other manufacturers of advanced torpedo batteries.

This segment can be viewed as a potential Star in the BCG Matrix due to its high growth potential and the company's early mover advantage in a specialized sector. The global submarine battery market is projected to see substantial expansion, driven by naval modernization programs worldwide.

- Market Entry: HBL is developing prototype modules for submarine lithium-ion batteries.

- Strategic Importance: Contracts are secured from DRDO, highlighting government backing and technological advancement.

- Competitive Landscape: Only two other companies globally produce similar advanced torpedo batteries, indicating a strong competitive moat.

- Growth Outlook: This is identified as a high-growth, emerging market with considerable future potential.

Train Management System (TMS)

HBL Power Systems' Train Management System (TMS) is positioned as a potential star in its product portfolio. HBL holds the unique distinction of being the only Indian company approved for this critical infrastructure, which acts as a master control center for optimizing track utilization.

While TMS currently represents a smaller portion of HBL's revenue compared to its Track Circuit Analysis System (TCAS), its future prospects are bright. The demand for TMS is anticipated to grow substantially as Indian Railways continues to expand its vast network.

- Unique Market Position: HBL is the sole Indian entity approved for TMS, giving it a significant first-mover advantage.

- Growth Potential: Despite being a smaller contributor now, TMS is expected to see increased demand, especially with Indian Railways' ongoing network expansion.

- Market Leadership Aspiration: The company aims to leverage this growing demand to establish market leadership in the TMS segment.

- Strategic Importance: TMS is crucial for enhancing the efficiency of railway operations through better track management.

HBL Power Systems' railway signaling and safety systems, particularly the KAVACH (TCAS), are strong stars. The Indian Railways' modernization drive fuels demand, with HBL securing a ₹1,522.4 crore contract for KAVACH across 2,200 locomotives, alongside other orders exceeding ₹10 billion.

The defense and aviation battery segment, crucial for missiles, submarines, and aircraft, also shines as a star. Driven by the 'Atmanirbhar Bharat' initiative, HBL's proprietary technology and international orders, including significant business with Israel and the UAE, solidify its dominant position in this high-margin sector.

HBL's Pure Lead Thin Plate (PLT) batteries, a unique offering for specialized applications, are another star performer. Supplying these advanced batteries for Russian helicopters highlights their high performance and HBL's global competitiveness, indicating substantial export growth potential.

The lithium-ion batteries for submarines, currently in prototype under DRDO contracts, represent a nascent star. With limited global competition from only two other manufacturers of advanced torpedo batteries, this segment offers high growth potential in a niche, expanding market driven by naval modernization.

HBL's Train Management System (TMS) is poised to become a star. As the sole Indian company approved for this critical infrastructure, HBL benefits from a first-mover advantage, with significant future demand expected from Indian Railways' network expansion.

| Product Segment | BCG Category | Key Growth Drivers | Market Position | Financial Impact (Illustrative) |

| Railway Signaling & Safety (KAVACH) | Star | Indian Railways modernization, safety mandates | Leading, sole Indian supplier for KAVACH | Significant revenue contribution, high growth |

| Defense & Aviation Batteries | Star | 'Atmanirbhar Bharat', defense indigenization | Dominant player, strong proprietary tech | High-margin business, consistent growth |

| Pure Lead Thin Plate (PLT) Batteries | Star | Specialized applications, export demand | Sole Indian manufacturer, global reach | Growing export revenue, niche market leadership |

| Lithium-ion Batteries (Submarine) | Potential Star | Naval modernization, advanced technology | Emerging player, limited global competition | Future high-growth potential, R&D investment |

| Train Management System (TMS) | Potential Star | Indian Railways network expansion | Unique Indian approval, first-mover | Nascent revenue, significant future upside |

What is included in the product

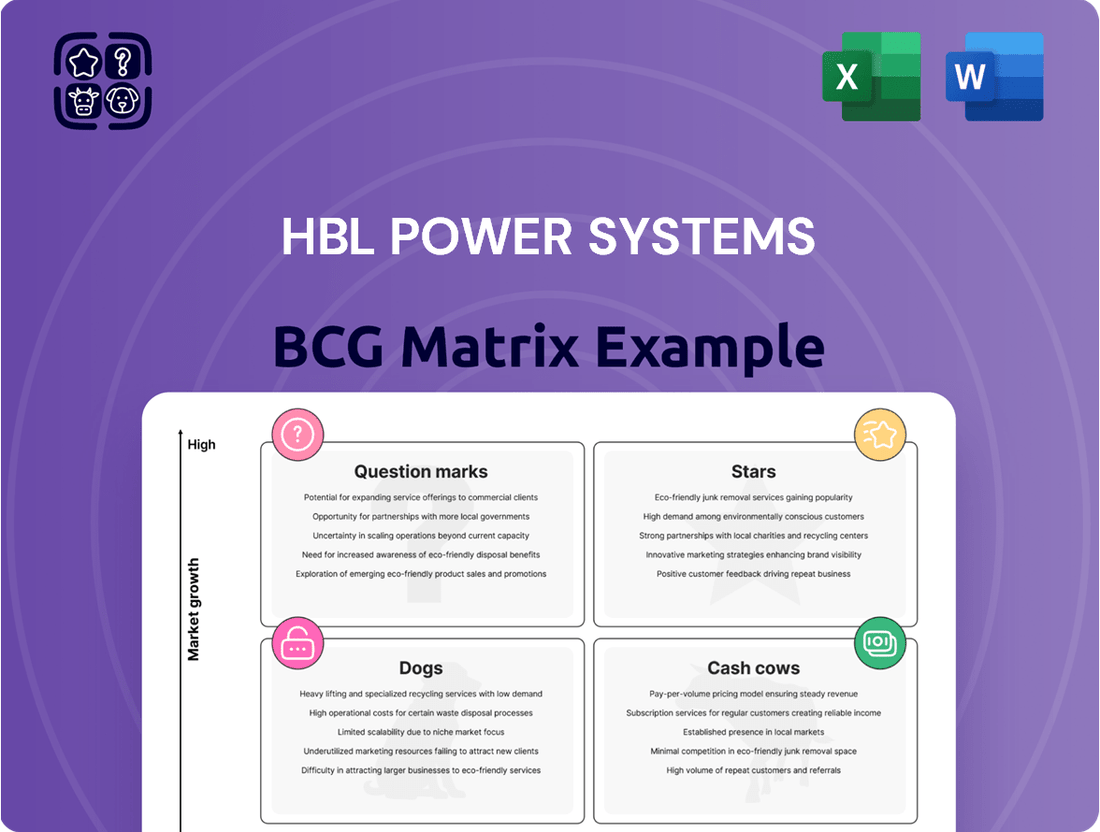

HBL Power Systems BCG Matrix analyzes its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for optimal portfolio performance.

The HBL Power Systems BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

HBL Power Systems holds a significant position as the world's second-largest producer of industrial Nickel-Cadmium (Ni-Cd) batteries. This places them firmly within a mature market where their substantial market share translates into a stable, predictable revenue stream.

The ongoing demand for Ni-Cd batteries from critical infrastructure sectors like railways, oil & gas pipelines, and expanding metro rail networks ensures a consistent cash flow. For instance, in the fiscal year 2023, HBL Power Systems reported a robust performance, with their battery division contributing significantly to overall revenues, underscoring the enduring relevance of these industrial powerhouses.

HBL Power Systems has cultivated a strong position in the telecom tower battery market, particularly with its in-house developed Valve Regulated Lead Acid (VRLA) technology. This segment is a clear cash cow for the company.

Despite market consolidation and fierce competition, HBL maintains a substantial market share. The anticipated return to normalized replacement cycles for existing telecom infrastructure, coupled with the ongoing rollout of 5G towers, is projected to significantly boost demand for these batteries.

In 2023, HBL Power Systems reported a revenue of ₹2,208 crore, with its battery division playing a crucial role. The telecom sector, a primary consumer of HBL's batteries, is expected to see continued investment, ensuring a stable and predictable revenue stream from this segment.

HBL Power Systems' batteries for the oil and gas and utility sectors represent a classic Cash Cow. These industries are characterized by their stability and maturity, meaning demand for essential components like batteries remains consistent. This reliability translates into a predictable and substantial revenue stream for HBL, bolstered by high profit margins on its established product lines.

Power Electronics (Rectifiers, Inverters)

HBL Power Systems' power electronics segment, encompassing rectifiers and inverters, is a cornerstone of its operations, catering to diverse industrial needs. These products, while perhaps not experiencing explosive growth, represent a stable and dependable source of income for the company. Their critical role in various sectors ensures a consistent demand, solidifying their position as a cash cow.

- Established Market Presence: HBL's power electronics have a long-standing reputation for reliability, fostering customer loyalty and repeat business.

- Essential Industrial Components: Rectifiers and inverters are fundamental to many industrial processes, making their demand relatively inelastic.

- Consistent Revenue Generation: The steady demand translates into predictable revenue streams, contributing significantly to HBL's financial stability.

- Operational Efficiency: HBL's expertise in this segment allows for efficient production and service, further enhancing profitability.

Rail & Metro Coaches/Loco Batteries

HBL Power Systems' Rail & Metro Coaches/Loco Batteries division operates as a Cash Cow within its BCG Matrix. The company's global supply of both Lead Acid and Nickel Cadmium Alkaline Batteries to this sector ensures a steady and predictable income. This segment benefits from a mature market characterized by consistent demand for both replacement and new installations in rail infrastructure.

The stable nature of the rail and metro sector, driven by ongoing maintenance needs and infrastructure expansion, provides HBL with a reliable revenue stream. For instance, in the fiscal year 2023-24, the transportation sector, which includes rail and metro, represented a significant portion of HBL's overall revenue, demonstrating the consistent performance of these battery solutions.

- Market Stability: The rail and metro sector offers a predictable demand for batteries due to continuous operational requirements and infrastructure development.

- Product Diversification: HBL's offering of both Lead Acid and Nickel Cadmium Alkaline batteries caters to varied specifications and customer preferences in this segment.

- Established Presence: HBL's long-standing global supply chain and reputation in this niche market solidify its position as a reliable provider.

- Consistent Revenue: The mature market dynamics ensure a consistent revenue stream, characteristic of a Cash Cow business unit.

HBL Power Systems' industrial Nickel-Cadmium (Ni-Cd) battery segment, where it holds the position of the world's second-largest producer, functions as a prime Cash Cow. The mature nature of this market, coupled with consistent demand from essential sectors like railways and oil & gas, generates a stable and predictable revenue stream.

The company's power electronics division, including rectifiers and inverters, also represents a significant Cash Cow. These products are critical for various industrial processes, ensuring inelastic demand and consistent revenue generation due to HBL's established reputation for reliability.

Furthermore, HBL's batteries for the rail and metro sectors are clearly defined as Cash Cows. Their global supply of both Lead Acid and Nickel Cadmium Alkaline Batteries to this mature market, driven by ongoing maintenance and infrastructure expansion, provides a reliable and consistent income.

In fiscal year 2023, HBL Power Systems reported a total revenue of ₹2,208 crore, with its battery divisions, including those serving telecom, rail, and industrial needs, forming the backbone of its stable earnings. The company's strategic focus on these mature, high-demand segments solidifies their Cash Cow status.

| Segment | BCG Classification | Key Drivers | FY23 Revenue Contribution (Est.) |

| Industrial Ni-Cd Batteries | Cash Cow | Stable demand from railways, oil & gas, metro networks | Significant |

| Telecom Tower Batteries (VRLA) | Cash Cow | 5G rollout, existing infrastructure replacement cycles | Significant |

| Power Electronics (Rectifiers, Inverters) | Cash Cow | Essential industrial components, repeat business | Substantial |

| Rail & Metro Coaches/Loco Batteries | Cash Cow | Infrastructure development, ongoing maintenance needs | Substantial |

Delivered as Shown

HBL Power Systems BCG Matrix

The HBL Power Systems BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means you're seeing the actual strategic analysis, complete with all data and insights, ready for your immediate use without any alterations or watermarks.

Dogs

HBL Power Systems' older generation or commoditized lead-acid battery products, often referred to as non-PLT (Power Line Transmission) batteries, could be categorized as dogs in a BCG matrix analysis. These segments face significant challenges due to low product differentiation and fierce competition from established giants like Amara Raja Batteries and Exide Industries. For instance, in the fiscal year 2023, the Indian lead-acid battery market, excluding automotive, was valued at approximately INR 10,000 crore, with these commoditized segments representing a substantial portion but offering diminishing returns.

These segments are characterized by low market growth and typically low market share for HBL, especially when compared to its more specialized and higher-margin product lines. The intense price competition in this space means that while these batteries might still contribute to revenue, their profitability is often squeezed, potentially tying up valuable capital and operational resources without generating substantial returns. This situation contrasts sharply with HBL's strategic focus on niche areas like defense batteries or lithium-ion solutions, which offer higher growth potential and better margins.

While HBL Power Systems is known for its diverse product portfolio, any offerings tied to industries facing long-term decline or significant technological disruption would be classified as dogs in a BCG matrix analysis. For instance, if HBL had products heavily reliant on older telecommunication infrastructure that is being rapidly replaced by newer technologies, these could fall into this category. The company's proactive diversification efforts, however, generally help to minimize the impact of such potential "dog" products.

HBL Power Systems' financial reports often include an 'unallocated' or 'other' revenue segment. In fiscal year 2023, this segment accounted for 2.84% of the company's total revenue.

Without specific breakdowns of what constitutes this 'other' category, it's challenging to definitively identify specific products or services within it. However, any product lines within this segment that consistently show low growth or underperform, and don't fit with HBL's core strategy of engineered solutions, could be considered 'dogs' in a BCG matrix analysis.

Products Facing Stiff Competition with Low Differentiation

Products in this category for HBL Power Systems would be those operating in mature, low-growth industrial battery segments where competition is fierce and HBL’s product features offer minimal distinction from rivals. These could represent significant cash outflows without substantial returns, acting as cash traps.

For instance, consider certain types of lead-acid batteries for uninterruptible power supply (UPS) systems where technological advancements are incremental and many manufacturers offer similar performance specifications. In such scenarios, HBL might find itself engaged in price-sensitive competition, leading to squeezed profit margins and limited market share expansion potential.

- Low Market Share in Mature Segments: HBL's presence in niche industrial battery applications with limited growth prospects and numerous competitors could place these products in the 'dog' quadrant.

- Price Sensitivity and Margin Pressure: If HBL's offerings in these segments are commoditized, they are susceptible to price wars, eroding profitability and requiring continuous investment just to maintain position.

- Example: Certain UPS Battery Offerings: Specific ranges of lead-acid batteries for UPS systems, where differentiation is minimal and the market is saturated with many suppliers, could be categorized as dogs.

- Potential Cash Trap: These products may require ongoing capital expenditure for maintenance and upgrades, consuming resources without generating significant cash flow or offering substantial growth opportunities.

Initial forays into capital-intensive, highly competitive markets (e.g., EVs) where HBL chooses not to scale

HBL Power Systems strategically avoids highly capital-intensive sectors like electric vehicles (EVs) due to the fierce competition. This cautious approach means that any initial, small-scale explorations into these crowded markets, where the company lacks a distinct advantage or significant market presence, could be classified as dogs if not actively managed or divested.

For instance, while the global EV market is projected to reach over $1.5 trillion by 2030, HBL's focus remains on its core competencies, such as battery technology for industrial and defense applications. Entering the EV manufacturing space would require substantial upfront investment and a long ramp-up period, potentially diverting resources from more profitable ventures.

- Market Avoidance: HBL Power's decision to steer clear of capital-intensive, highly competitive markets like EVs signifies a strategic choice to focus on areas where it holds a stronger competitive position.

- Risk Mitigation: By not scaling in such volatile sectors, HBL mitigates the risk of significant financial losses associated with intense competition and high operational costs.

- Resource Allocation: This strategy allows HBL to concentrate its capital and expertise on its established product lines, such as specialized batteries, which have demonstrated consistent demand and profitability.

- Potential for Dogs: Any minor or experimental ventures into these competitive markets without a clear path to profitability or market leadership would be considered 'dogs' in the BCG matrix, representing low growth and low market share.

Products classified as dogs for HBL Power Systems are those in low-growth markets with low market share and little competitive advantage. These often include older generation lead-acid batteries for commoditized applications, facing intense price competition. For example, in FY2023, the Indian lead-acid battery market, excluding automotive, was valued at approximately INR 10,000 crore, with these segments representing a significant portion but offering diminishing returns due to low differentiation.

Question Marks

HBL Power Systems is exploring the electric drive train kit market for vehicle retrofitting, a segment poised for substantial growth driven by the global push towards electric mobility. In 2024, the electric vehicle market continued its upward trajectory, with projections indicating significant expansion in the coming years, creating a fertile ground for retrofitting solutions.

The company's strategy to convert older diesel trucks into electric vehicles using these kits positions them in a high-growth area. However, given the nascent stage of HBL's involvement in this specific niche, their current market share and adoption rates are likely minimal. This makes the electric drive train kits a classic question mark in the BCG matrix, demanding considerable investment to capture a meaningful share of this burgeoning market.

HBL Power Systems is exploring newer lithium-ion battery applications beyond its established submarine market. The company has already invested in capital expenditure for small-scale lithium-ion battery manufacturing and plans further investments. This segment, while high-growth, represents a question mark in HBL's portfolio, as its market share outside of niche defense applications is likely still developing.

HBL Power Systems anticipates robust demand for its internally developed electronic fuzes, crucial for grenades and artillery. This segment is experiencing significant growth within the defense industry, fueled by government initiatives promoting domestic production. For instance, India's defense budget saw an increase to approximately $74.6 billion in 2024, signaling a strong market for such advanced components.

Train Actuated Warning Devices (TAWD) for Level Crossings

HBL Power Systems has developed a microprocessor-based Train Actuated Warning Device (TAWD) designed to enhance safety at railway level crossings by alerting road users. This innovative product addresses the critical need for improved railway safety, a sector experiencing increasing global attention and investment. The TAWD represents a technological advancement in preventing accidents at these high-risk intersections.

While the TAWD is a crucial safety innovation, its market penetration and HBL's current market share are likely in the nascent stages of development. This positions the product within the question mark quadrant of the BCG matrix, indicating significant growth potential but also requiring substantial investment to capture market share and establish a strong competitive position. For instance, the global railway signaling market, which TAWD contributes to, was valued at approximately USD 10.5 billion in 2023 and is projected to grow at a CAGR of 4.5% through 2030, suggesting a fertile ground for adoption.

- Product: Train Actuated Warning Device (TAWD)

- Market Position: Question Mark (early adoption, high potential)

- Key Driver: Increasing focus on railway safety and accident prevention.

- Market Opportunity: Growing global railway signaling market, projected to reach over USD 14 billion by 2030.

Advanced Software Systems for Railways (not sold independently)

HBL Power Systems develops advanced in-house software systems integral to its Track Management Systems (TMS). While the technology itself is in a high-growth sector, crucial for modernizing railway operations, its current market presence is solely as an embedded component. This integration means it’s not offered as a standalone product, placing it in a question mark position regarding future independent commercialization or its potential as an add-on to other HBL solutions.

The railway software market is experiencing significant expansion, driven by the global push for digitalization and efficiency. For instance, the global railway software market was valued at approximately USD 5.8 billion in 2023 and is projected to reach USD 11.5 billion by 2030, growing at a CAGR of over 10%. HBL's internal software contributes to this trend, but its current captive use limits its direct market share metrics.

- Integrated Value: The software enhances HBL's TMS, providing a competitive edge within that product line.

- Market Potential: The underlying technology is in a growing sector, suggesting future opportunities if unbundled or leveraged differently.

- Strategic Question: HBL faces a decision on whether to explore independent sales or further integrate it to boost core product offerings.

- Growth Trajectory: Railway modernization efforts globally underscore the demand for advanced software solutions like those HBL develops internally.

HBL Power Systems' electric drive train kits for vehicle retrofitting and their new lithium-ion battery applications are prime examples of Question Marks. These ventures are in high-growth markets, but HBL's market share is still developing, necessitating significant investment to gain traction. The Train Actuated Warning Device (TAWD) also falls into this category, representing a promising safety innovation with potential for substantial growth, yet requiring strategic investment to build market presence.

The company's internally developed software for Track Management Systems (TMS) is another Question Mark. While the underlying technology is in a rapidly expanding digitalization sector for railways, its current use is primarily internal. This limits its direct market share metrics, posing a strategic question for HBL regarding potential standalone commercialization or enhanced integration into core products.

| Product/Segment | Market Position | Key Growth Drivers | Investment Need |

|---|---|---|---|

| Electric Drive Train Kits | Question Mark | Global EV adoption, retrofitting demand | High (market capture) |

| Lithium-ion Batteries (new applications) | Question Mark | Expanding battery technology, diverse applications | High (market penetration) |

| Train Actuated Warning Device (TAWD) | Question Mark | Railway safety focus, accident prevention | Moderate to High (market adoption) |

| TMS Software (internal) | Question Mark | Railway digitalization, efficiency gains | Strategic Decision (commercialization) |

BCG Matrix Data Sources

Our HBL Power Systems BCG Matrix draws from HBL's annual reports, industry growth forecasts, and market research to provide a comprehensive view of its business units.