H.B. Fuller Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H.B. Fuller Bundle

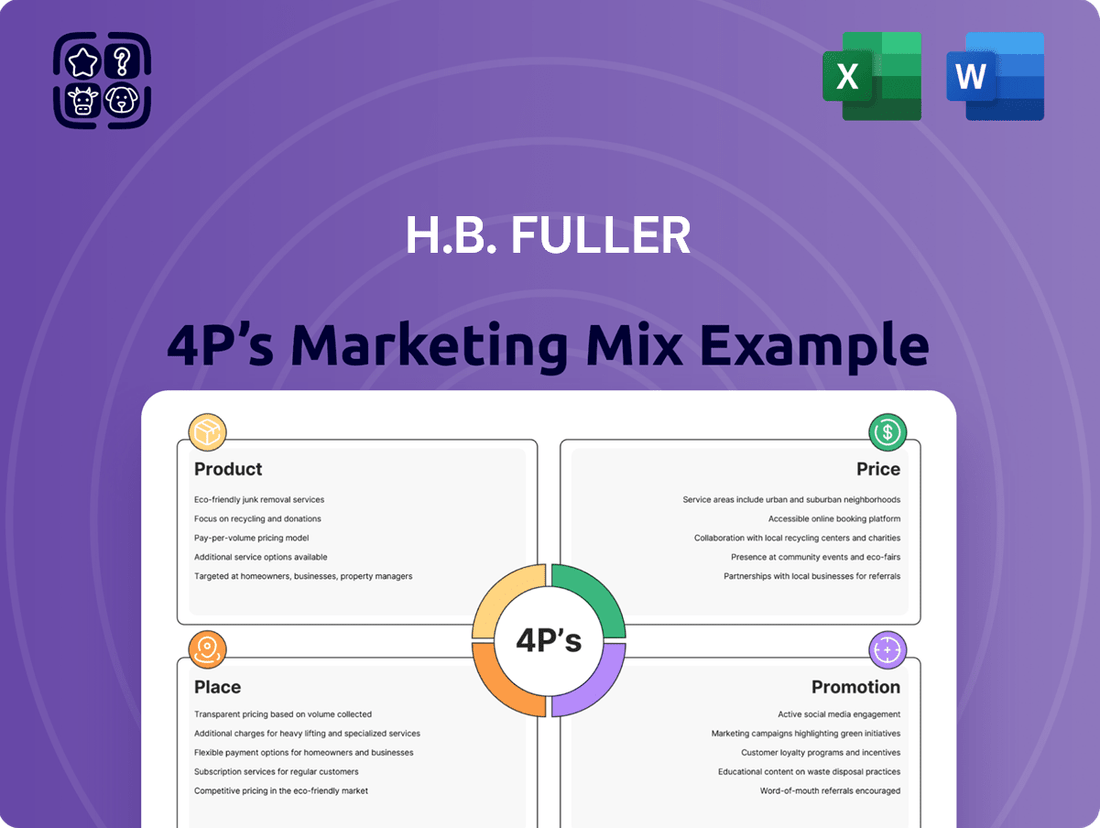

Dive deep into H.B. Fuller's strategic brilliance with our comprehensive 4Ps Marketing Mix Analysis. Uncover how their innovative product development, competitive pricing, extensive distribution network, and targeted promotional campaigns create a powerful market presence.

This isn't just a summary; it's your roadmap to understanding H.B. Fuller's success. Gain actionable insights into how each element of their marketing mix – Product, Price, Place, and Promotion – is meticulously crafted to drive growth and customer loyalty.

Save yourself countless hours of research. Our ready-made, editable analysis provides a structured, professional breakdown perfect for business professionals, students, and consultants seeking a competitive edge.

Get immediate access to a detailed examination of H.B. Fuller's marketing strategy, presented in a format that's both informative and easily adaptable for your own projects or presentations.

Elevate your understanding of effective marketing. Purchase the full H.B. Fuller 4Ps Marketing Mix Analysis and unlock the secrets behind their industry leadership today!

Product

H.B. Fuller boasts a vast portfolio of adhesives and sealants, covering diverse technologies like hot melt, water-based, urethane, and epoxy. This broad offering is crucial for numerous global industries, from electronics and automotive to packaging and construction. For instance, in 2024, the global adhesives and sealants market was projected to reach over $70 billion, highlighting the demand for such specialized chemical solutions.

H.B. Fuller's product strategy heavily emphasizes sustainability, with around 60% of new product development aimed at improving customer product sustainability. This focus translates into solutions for key growth areas like recyclable packaging, energy-efficient construction, and electric vehicle components.

Examples such as the Millennium PG-1 EF ECO2 roofing adhesive showcase their dedication to environmentally conscious innovation, directly addressing the market's demand for reduced environmental footprints.

The Swift®melt 1850 bio-based adhesive further illustrates this commitment, offering a sustainable alternative for various applications and aligning with global ESG (Environmental, Social, and Governance) trends. This proactive approach positions H.B. Fuller to capture value in markets increasingly driven by eco-friendly solutions.

H.B. Fuller excels in providing high-performance adhesives, specifically designed for challenging environments where exceptional bond strength and longevity are critical. This focus allows them to command premium pricing and achieve higher profit margins.

The company actively refines its product offerings, shifting its strategic emphasis toward specialized, higher-margin adhesive solutions. This portfolio transformation is a key driver for their growth and profitability.

Leveraging deep technical expertise, H.B. Fuller partners with clients to co-create bespoke adhesive formulations. These tailored solutions address specific industry demands and accelerate innovation, as seen in their work within the electronics sector where advanced materials are essential.

Award-Winning Technologies

H.B. Fuller's commitment to innovation is a cornerstone of its product strategy, consistently earning industry recognition. The company secured the Adhesive and Sealant Council (ASC) Innovation Award in both 2023 and 2024, a testament to its cutting-edge solutions.

These prestigious awards specifically celebrated advancements like TPx thermoplastic encapsulants, crucial for enhancing the durability and performance of solar modules. Furthermore, EV Protect 4006, designed for lithium-ion batteries in electric vehicles, demonstrates their forward-thinking approach to emerging market needs.

This consistent acknowledgment of their technological achievements reinforces H.B. Fuller's position as a leader in developing advanced adhesive and sealant technologies.

- 2023 ASC Innovation Award Winner

- 2024 ASC Innovation Award Winner

- TPx thermoplastic encapsulants for solar modules

- EV Protect 4006 for lithium-ion batteries

Customer-Centric Development

H.B. Fuller's product development is fundamentally driven by the customer. Their focus isn't just on creating adhesives, but on solving tangible problems for their clients and helping them achieve greater success. This commitment is evident in their collaborative approach, which spans the entire journey from initial idea generation through to the final production stages.

This deep customer engagement allows H.B. Fuller to foster innovations that have a real impact, often reshaping entire industries and enhancing the quality of everyday products. For instance, their adhesive solutions have been instrumental in advancing sustainable packaging, a key demand in the 2024-2025 market, with global sustainable packaging market expected to reach $461.7 billion by 2030. By directly addressing evolving consumer preferences and the dynamic needs of various industries, H.B. Fuller solidifies its position as a trusted partner.

Their customer-centric model ensures that their product portfolio remains relevant and impactful. This proactive development strategy is crucial in a market where innovation cycles are accelerating and specific needs, such as those in electric vehicle battery assembly, are rapidly emerging. In 2023, H.B. Fuller reported strong growth, with net revenue reaching $3.7 billion, underscoring the effectiveness of their market-aligned strategies.

- Customer Collaboration: Engages clients from concept to completion to ensure solutions meet precise needs.

- Industry Impact: Drives innovation that transforms industries and improves end-user products.

- Market Responsiveness: Directly addresses evolving consumer demands and industry trends.

- Partnership Focus: Builds strong, long-term relationships through value-added solutions.

H.B. Fuller's product strategy centers on a diverse and innovative portfolio of adhesives and sealants. Their offerings span various technologies, catering to critical industries like automotive, electronics, and packaging, reflecting the robust global demand for such solutions, with the adhesives and sealants market projected to exceed $70 billion in 2024.

A significant emphasis is placed on sustainability, with a substantial portion of new product development aimed at enhancing customer product sustainability, particularly in areas like recyclable packaging and electric vehicle components. This focus is exemplified by products like the Millennium PG-1 EF ECO2 roofing adhesive and the Swift®melt 1850 bio-based adhesive, aligning with growing ESG trends.

The company consistently earns industry recognition for its innovation, securing ASC Innovation Awards in 2023 and 2024 for advancements such as TPx thermoplastic encapsulants for solar modules and EV Protect 4006 for lithium-ion batteries, underscoring their commitment to cutting-edge technology.

H.B. Fuller's product development is deeply customer-driven, involving close collaboration from concept to completion to solve specific industry challenges. This customer-centric approach ensures their portfolio remains relevant and impactful, driving growth as seen in their $3.7 billion net revenue reported in 2023.

| Product Focus Area | Key Innovation/Example | Market Relevance (2024/2025) | Award Recognition |

|---|---|---|---|

| Sustainability | Millennium PG-1 EF ECO2 roofing adhesive | Growing demand for eco-friendly construction materials | |

| Electric Vehicles | EV Protect 4006 for lithium-ion batteries | Rapid expansion of the EV market | 2024 ASC Innovation Award Winner |

| Renewable Energy | TPx thermoplastic encapsulants for solar modules | Increased investment in solar energy solutions | 2023 ASC Innovation Award Winner |

| Packaging | Swift®melt 1850 bio-based adhesive | Consumer demand for sustainable packaging (market projected to reach $461.7 billion by 2030) |

What is included in the product

This analysis offers a comprehensive examination of H.B. Fuller's marketing mix, detailing their Product innovation, Pricing strategies, Place (distribution) channels, and Promotion tactics.

Simplifies H.B. Fuller's marketing strategy by presenting the 4Ps in a clear, actionable format, alleviating the pain of complex planning.

Offers a concise overview of H.B. Fuller's 4Ps, making it easy to identify and address potential marketing challenges.

Place

H.B. Fuller boasts an impressive global footprint, operating in over 140 countries. This expansive reach allows them to cater to a wide array of customers across key regions like the Americas, Europe, India, the Middle East, Africa (EIMEA), and the Asia Pacific. Their extensive network is a significant asset in their marketing mix, enabling broad market penetration and diverse revenue streams.

H.B. Fuller leverages a dual approach to distribution, combining direct sales teams with an extensive network of distributors. This hybrid model ensures their specialized adhesive solutions reach a diverse customer base efficiently. For instance, in 2023, the company reported that its distribution channels played a significant role in its global sales performance, reaching customers across various industrial sectors.

Their strategy is highly targeted, focusing on delivering specialized solutions rather than a one-size-fits-all approach. This means H.B. Fuller tailors its distribution to the specific needs of industries like electronics, automotive, and construction. This granular focus allows them to effectively serve niche markets, reinforcing their position as a solutions provider.

The accessibility of their products is paramount. By strategically placing products through these channels, H.B. Fuller ensures customers can acquire what they need, when and where they need it. This operational efficiency enhances customer satisfaction and supports robust sales potential, as evidenced by their consistent revenue growth in key markets throughout 2024 projections.

H.B. Fuller is actively consolidating its manufacturing and logistics operations as a core part of its strategy. This involves a substantial, multi-year plan to streamline its global footprint. The company intends to reduce its manufacturing facilities from 82 down to 55 by the year 2030.

Furthermore, H.B. Fuller is targeting a significant reduction in its North American warehouse count, aiming to decrease from 55 to just 10 facilities by 2027. This aggressive consolidation effort is designed to boost capacity utilization and operational efficiency.

The strategic rationale behind this consolidation is to drive down costs and improve overall service delivery to customers. By optimizing its network, H.B. Fuller expects to realize substantial savings and enhance its responsiveness in the market.

Geographic Business Unit Structure

H.B. Fuller strategically structures its global operations into distinct business units, each targeting specific market segments. This allows for specialized expertise and tailored approaches to diverse customer needs across various industries. For instance, the company operates units like Hygiene, Health and Consumable Adhesives, and Engineering Adhesives, reflecting this focused approach. The recent reorganization of Building Adhesive Solutions (BAS) further underscores their commitment to optimizing regional market penetration and specialized service delivery.

This geographic and product-focused business unit framework is crucial for H.B. Fuller’s marketing mix. It enables the company to deeply understand and respond to the unique dynamics of regional markets while developing highly specialized adhesive solutions. This structure supports targeted growth strategies and efficient resource allocation, ensuring that each unit can effectively address its specific market challenges and opportunities. In 2023, H.B. Fuller reported net revenue of $3.7 billion, with segment reporting indicating the significant contributions of these specialized units to overall financial performance.

- Hygiene, Health and Consumable Adhesives: Focuses on markets requiring specialized formulations for sensitive applications.

- Engineering Adhesives: Caters to industries demanding high-performance bonding solutions for durable goods and electronics.

- Building Adhesive Solutions (BAS): A reorganized unit to enhance focus on construction and infrastructure markets.

- Regional Market Adaptation: The structure facilitates customized product offerings and marketing efforts to align with local regulations and consumer preferences.

Portfolio Realignment and Divestitures

H.B. Fuller's strategic portfolio realignment, marked by the divestiture of its Flooring business in early fiscal year 2025, underscores a commitment to optimizing capital allocation. This strategic maneuver directs investment toward segments offering higher profit margins and accelerated growth within the adhesives sector. The company reported approximately $3.7 billion in net revenue for fiscal year 2023, providing a benchmark against which future growth from focused segments will be measured.

These divestitures are integral to enhancing operational efficiency and strengthening H.B. Fuller's market position. By shedding non-core assets, the company sharpens its focus on core competencies and areas with greater potential for value creation. This strategic pruning allows for more concentrated resources on innovation and expansion in key adhesive markets.

The divestiture of the Flooring business is a concrete step in this ongoing strategy. It aligns with H.B. Fuller's broader objective to concentrate on markets characterized by strong secular tailwinds and higher profitability. Such strategic portfolio adjustments are crucial for maintaining competitive advantage and driving long-term shareholder value.

- Divestiture of Flooring Business: Completed at the start of fiscal year 2025, signaling a shift in strategic focus.

- Capital Allocation Strategy: Prioritizing higher-margin and faster-growing segments within the adhesives industry.

- Market Positioning: Actions aimed at streamlining operations and enhancing competitive standing.

- Fiscal Year 2023 Revenue: Approximately $3.7 billion, serving as a baseline for evaluating future performance of core businesses.

H.B. Fuller's place strategy emphasizes a global yet segmented approach. They operate in over 140 countries, reaching diverse markets across the Americas, EIMEA, and Asia Pacific, ensuring broad accessibility. This expansive network underpins their ability to serve varied customer needs efficiently.

The company is actively streamlining its physical footprint, planning to reduce manufacturing facilities from 82 to 55 by 2030 and North American warehouses from 55 to 10 by 2027. This consolidation aims to boost efficiency and reduce costs.

H.B. Fuller structures its operations into specialized business units, such as Hygiene, Health and Consumable Adhesives and Engineering Adhesives, allowing for targeted market penetration and tailored solutions. The recent divestiture of its Flooring business in early fiscal year 2025 further refines this strategy, concentrating resources on higher-margin, growth-oriented segments.

| Strategic Initiative | Target | Timeline | Rationale |

|---|---|---|---|

| Manufacturing Facility Consolidation | Reduce from 82 to 55 | By 2030 | Improve capacity utilization, drive down costs |

| North American Warehouse Consolidation | Reduce from 55 to 10 | By 2027 | Enhance operational efficiency and responsiveness |

| Portfolio Optimization | Divestiture of Flooring Business | Early FY2025 | Focus on higher-margin and faster-growing segments |

What You Preview Is What You Download

H.B. Fuller 4P's Marketing Mix Analysis

The preview you see here is the exact same H.B. Fuller 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This means you're getting the complete, ready-to-use content without any surprises or missing information. You can be confident that the detailed breakdown of Product, Price, Place, and Promotion for H.B. Fuller is precisely what you'll download immediately after completing your order.

Promotion

H.B. Fuller heavily emphasizes sustainability reporting as a core element of its marketing strategy. Their commitment to environmental, social, and governance (ESG) principles is clearly communicated through their annual Sustainability Report.

The 2024 Sustainability Report, released in June 2025, demonstrates how deeply sustainability is woven into the fabric of their innovation, operations, and overall company culture. This report acts as a crucial promotional piece, highlighting their dedication to pioneering sustainable solutions and actively reducing their environmental footprint.

For instance, the 2024 report detailed a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2020 baseline, showcasing tangible progress in their environmental stewardship. This focus on quantifiable achievements in sustainability resonates with stakeholders increasingly prioritizing responsible corporate practices.

H.B. Fuller's brand mission, 'Connecting What Matters,' is central to their promotional efforts. This mission highlights how their adhesive solutions improve the quality, safety, and performance of everyday items, directly impacting consumers and industries alike.

The company's messaging consistently links their specialized chemical products to tangible benefits and societal contributions. For instance, in 2024, H.B. Fuller reported a significant portion of its revenue derived from products enabling sustainable packaging and improved energy efficiency, underscoring the 'matters' aspect of their mission.

H.B. Fuller actively fosters customer collaboration through its Customer Innovation Recognition Programs, exemplified by the 2025 Customer Innovation Awards. This initiative highlights customers who leverage H.B. Fuller's adhesive solutions to achieve significant advancements. These awards recognize breakthroughs in areas like sustainability and efficiency, demonstrating the tangible impact of their partnership.

The program effectively showcases real-world applications of H.B. Fuller's technology, acting as powerful testimonials. By celebrating customer successes, H.B. Fuller not only validates its product performance but also deepens its relationships with key partners. This strategic approach reinforces customer loyalty and drives further co-innovation.

Active Investor Relations and Public Communications

H.B. Fuller actively engages its stakeholders through a comprehensive investor relations program. This includes regular dissemination of financial results, strategic initiatives, and forward-looking statements via earnings calls, press releases, and annual reports. For instance, their Q1 2025 earnings call provided insights into the company's performance and strategic priorities.

The company's commitment to transparency is evident in its consistent communication. Their Q2 2025 results, announced in June 2025, highlighted key financial metrics and operational achievements, reinforcing their dedication to keeping investors and the market well-informed about their progress and future trajectory.

- Regular Financial Reporting: H.B. Fuller consistently publishes quarterly and annual financial reports, ensuring timely updates for investors.

- Strategic Communications: The company utilizes earnings calls and press releases to convey strategic direction and outlook.

- Investor Engagement: Active participation in investor conferences and roadshows further strengthens their investor relations efforts.

- Transparency in Outlook: Providing a clear outlook on future performance helps manage stakeholder expectations.

Digital Presence and Industry Engagement

H.B. Fuller actively cultivates its digital footprint, utilizing its official website and LinkedIn to connect with customers and industry peers. This online presence serves as a hub for company news, product showcases, and thought leadership, reinforcing their expertise in adhesives and sealants. For instance, in 2024, their digital content strategy focused on highlighting sustainable solutions, aligning with growing market demand.

Beyond digital engagement, H.B. Fuller demonstrates significant industry involvement. Their participation in key trade shows and affiliations with industry associations, such as the Adhesive and Sealant Council (ASC), underscores their commitment to the sector. A notable achievement in 2024 was receiving the ASC Innovation Award, a testament to their ongoing contributions to advancing adhesive technologies.

The company's industry engagement strategy includes:

- Active participation in major industry conferences and exhibitions, presenting research and new product developments.

- Membership and leadership roles in relevant trade associations, influencing industry standards and best practices.

- Leveraging digital platforms like LinkedIn for targeted content distribution and audience interaction, with a notable increase in engagement metrics observed throughout 2024.

- Recognitions such as the ASC Innovation Award, validating their technological advancements and market leadership.

H.B. Fuller's promotional strategy is deeply rooted in showcasing its commitment to sustainability and connecting this to its core mission. The 2024 Sustainability Report, released in mid-2025, serves as a key promotional tool, detailing a 15% reduction in Scope 1 and 2 emissions against a 2020 baseline. Their brand message, Connecting What Matters, is reinforced by highlighting how their products contribute to sustainable packaging and energy efficiency, with a significant portion of their 2024 revenue linked to these solutions.

Price

H.B. Fuller utilizes strategic pricing as a key driver for expanding its profit margins. The company is committed to disciplined pricing practices to effectively manage fluctuating market conditions.

This focus on pricing strategy is designed to help H.B. Fuller achieve its financial objectives, including growing gross margins into the mid-30s. Such strategic actions directly support their aim for an adjusted EBITDA margin exceeding 20% consistently.

H.B. Fuller implements responsive pricing strategies to directly counter the impact of fluctuating input costs. The company's pricing policies are designed to adapt swiftly to changes in raw material expenses and supply chain disruptions.

A clear example of this responsiveness occurred in April 2025 when H.B. Fuller implemented a price increase of 5-8% for its North America Adhesives division. This adjustment was a direct response to escalating feedstock costs, demonstrating the company's commitment to managing profitability in the face of unfavorable raw material developments.

This proactive approach allows H.B. Fuller to effectively mitigate the financial strain caused by increased raw material expenses, ensuring the company's ability to maintain its profit margins and continue operations smoothly.

H.B. Fuller employs value-based pricing, particularly in specialized markets, where its adhesive solutions offer significant performance, efficiency, and sustainability benefits. This strategy allows them to price products based on the tangible value they deliver to customers, rather than just production costs. For instance, adhesives that reduce manufacturing downtime or improve product durability command premium pricing.

The company actively targets higher-margin, faster-growing segments. In 2024, they continued to emphasize innovation in areas like electric vehicles and sustainable packaging, where the demand for advanced adhesive technologies is strong. These specialized applications often justify higher price points due to their critical role in product functionality and market competitiveness.

For example, their advanced bonding solutions for lightweighting in automotive applications, a key growth area, allow for significant fuel efficiency gains. This translates to substantial cost savings for automakers, supporting H.B. Fuller's ability to price these solutions at a premium that reflects their direct impact on customer operational expenses and environmental targets.

Competitive Market Dynamics

H.B. Fuller navigates a highly competitive market, where maintaining pricing discipline is crucial. Their pricing strategies are constantly influenced by evolving market demand, the pursuit of volume growth, and the pricing actions of competitors. For instance, in 2024, the adhesives market saw continued pressure from global economic shifts, requiring flexible pricing models.

To remain competitive and achieve market share gains, H.B. Fuller actively monitors market conditions. This includes tracking raw material costs, which significantly impact their pricing structure. In Q1 2025, the company reported that fluctuating petrochemical prices presented ongoing challenges, necessitating strategic price adjustments to balance cost pressures with market competitiveness.

- 2024 Revenue: H.B. Fuller reported approximately $3.7 billion in revenue for the fiscal year 2024, reflecting ongoing market penetration and product demand.

- Pricing Strategy Focus: Emphasis remains on value-based pricing, particularly for specialized adhesive solutions, while maintaining competitive price points for commodity products.

- Market Share Objective: The company aims to grow its market share in key segments, such as construction and packaging, by offering innovative products with differentiated pricing.

- Competitor Analysis: Continuous monitoring of key competitors' pricing and product offerings is a cornerstone of H.B. Fuller's adaptive pricing strategy.

Long-Term Financial Objectives Influence Pricing

H.B. Fuller's pricing strategy is deeply intertwined with its long-term financial goals. Key objectives, such as achieving specific Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) margins and driving consistent revenue growth, directly shape how the company prices its adhesive solutions. For instance, the company has consistently aimed for mid-to-high teens EBITDA margins.

The company's strategic focus on portfolio optimization, which involves divesting lower-margin businesses and investing in higher-growth, higher-margin segments, directly impacts its pricing power. By streamlining its product offerings and concentrating on areas where it holds a competitive advantage, H.B. Fuller can implement pricing actions that support its profitability targets. This strategic pruning aims to enhance overall financial performance and shareholder value.

Furthermore, H.B. Fuller's commitment to manufacturing cost efficiencies plays a crucial role in its pricing decisions. By reducing production expenses through process improvements and supply chain management, the company is better positioned to offer competitive pricing without sacrificing its profit margins. This operational discipline allows for greater flexibility in responding to market dynamics and customer demands, ensuring sustainable profitability.

The company's ability to execute effective pricing actions is a direct result of these underlying financial and operational strategies. These actions are not taken in isolation but are carefully considered to align with H.B. Fuller's overarching mission of achieving sustainable growth and profitability in the global adhesives market. This holistic approach ensures that pricing contributes positively to the company's financial health.

- EBITDA Margin Target: Mid-to-high teens.

- Revenue Growth Strategy: Focus on high-growth, high-margin segments.

- Cost Management: Continuous efforts in manufacturing and supply chain optimization.

- Portfolio Actions: Strategic divestitures and acquisitions to enhance profitability.

H.B. Fuller's pricing strategy is a dynamic tool, balancing competitive pressures with the need to achieve ambitious margin targets, aiming for mid-to-high teens EBITDA margins. The company strategically increases prices, such as the 5-8% hike in North America Adhesives in April 2025, to offset rising feedstock costs, demonstrating a commitment to profitability. This approach ensures that pricing directly supports their financial objectives, including a desired adjusted EBITDA margin exceeding 20%.

Value-based pricing is a cornerstone, especially in specialized markets where H.B. Fuller's advanced adhesive solutions provide tangible benefits like reduced manufacturing downtime. This allows for premium pricing on products crucial for sectors like electric vehicles and sustainable packaging, key growth areas identified for 2024. For instance, their automotive lightweighting adhesives offer significant cost savings to manufacturers, justifying higher price points.

The company actively monitors market conditions, including competitor pricing and raw material fluctuations, to maintain pricing discipline. In Q1 2025, petrochemical price volatility underscored the need for swift, strategic price adjustments. This continuous market analysis helps H.B. Fuller achieve its objective of growing market share in segments like construction and packaging through differentiated, competitive pricing.

| Metric | 2024 Data | 2025 Outlook/Action |

|---|---|---|

| Revenue | ~$3.7 billion | Continued market penetration and demand growth |

| EBITDA Margin Target | Mid-to-high teens | Focus on high-margin segments and cost efficiencies |

| North America Adhesives Price Adjustment | N/A | 5-8% increase implemented April 2025 due to feedstock costs |

| Key Growth Segments | Electric Vehicles, Sustainable Packaging, Automotive Lightweighting | Emphasis on advanced adhesive solutions with premium pricing potential |

4P's Marketing Mix Analysis Data Sources

Our H.B. Fuller 4P's Marketing Mix Analysis is constructed from a comprehensive review of official company disclosures, including SEC filings, investor presentations, and annual reports. We also incorporate insights from their corporate website, press releases, and detailed industry reports to capture their strategic product offerings, pricing structures, distribution networks, and promotional activities.