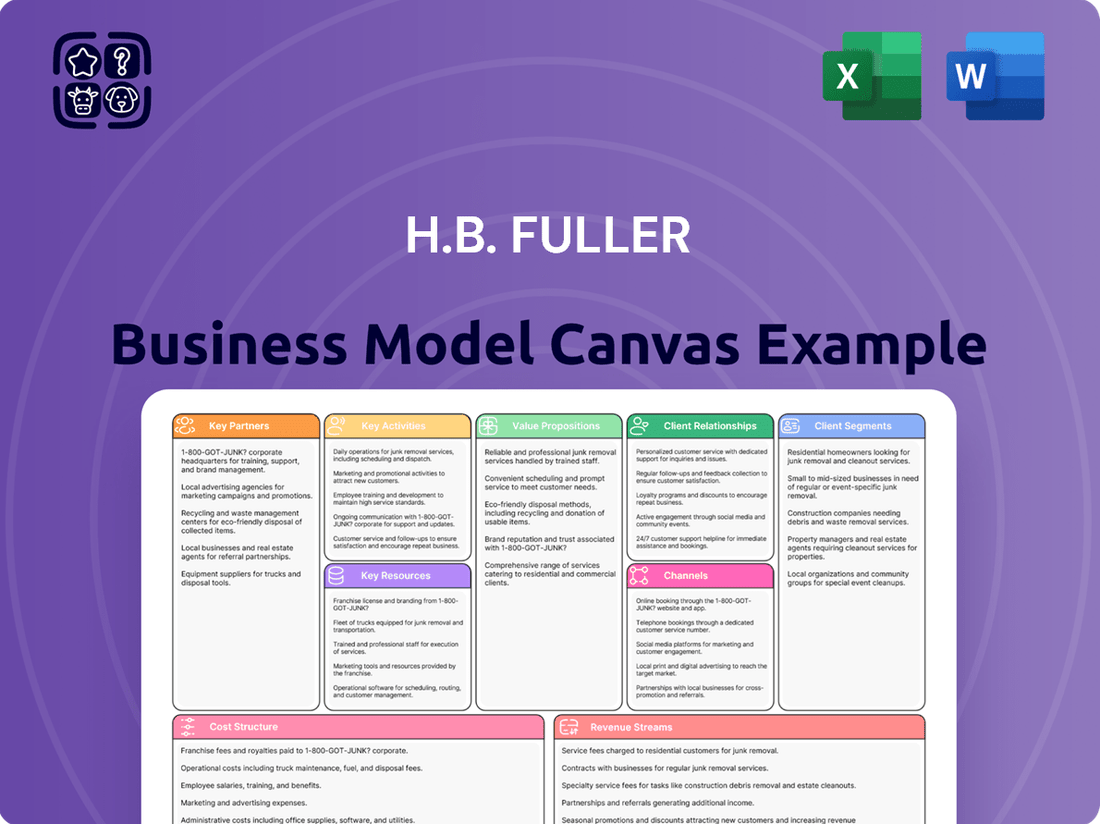

H.B. Fuller Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H.B. Fuller Bundle

Unlock the full strategic blueprint behind H.B. Fuller's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into H.B. Fuller’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how H.B. Fuller operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out H.B. Fuller’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in H.B. Fuller’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

H.B. Fuller's success hinges on its extensive network of raw material suppliers, who provide the essential components that make up roughly 75% of the company's cost of sales.

These partnerships are critical for securing a steady and economical supply of petroleum and natural gas derivatives, which are fundamental building blocks for their wide array of adhesive and sealant solutions.

For example, in fiscal year 2023, H.B. Fuller reported that raw material costs represented a significant portion of their expenses, underscoring the importance of these supplier relationships.

Maintaining robust supplier relationships helps H.B. Fuller build resilience within its supply chain and effectively manage the inherent price fluctuations associated with these key commodities.

H.B. Fuller actively collaborates with technology partners and leading research institutions to drive innovation in adhesive technology. This strategic approach is crucial for developing advanced, high-performance, and sustainable adhesive solutions that meet evolving market demands.

These partnerships foster co-creation, allowing H.B. Fuller to rapidly develop novel products and applications. A significant focus is placed on sustainability, with collaborations aimed at enhancing the environmental profile of customers' end products, such as creating adhesives for fully recyclable packaging solutions and improving the energy efficiency of building materials.

For example, in 2024, H.B. Fuller announced a partnership with a leading university's materials science department to explore bio-based adhesive formulations. This initiative directly supports their commitment to increasing the use of renewable raw materials in their product portfolio, aiming for a significant percentage of their revenue to come from sustainable solutions by 2030.

H.B. Fuller actively cultivates relationships with key distribution and channel partners, such as Formerra, to significantly broaden its market presence. These collaborations are crucial for efficiently delivering H.B. Fuller's adhesive solutions to a wider customer base, particularly across North America.

These strategic alliances enable H.B. Fuller to tap into localized market knowledge and provide enhanced technical support. This is vital for serving the diverse needs of industries like construction, packaging, and hygiene, ensuring customers receive tailored solutions and expert assistance.

For example, Formerra, a leading distributor of specialty chemicals and plastics, plays a pivotal role in extending H.B. Fuller's reach. In 2024, Formerra's extensive network allows H.B. Fuller to access a multitude of customers it might otherwise struggle to reach directly.

Industry Associations and Standards Bodies

H.B. Fuller actively collaborates with key industry associations, such as the Adhesive and Sealant Council (ASC). This engagement is vital for staying abreast of evolving industry trends and contributing to the development of best practices within the adhesives and sealants sector.

Adherence to recognized standards, like those set by the Science Based Targets initiative (SBTi), underscores H.B. Fuller's dedication to sustainability. For instance, in 2023, many companies intensified their focus on emissions reduction targets, aligning with global climate goals.

These strategic partnerships serve multiple purposes for H.B. Fuller:

- Influence Industry Direction: Participate in shaping standards and advocating for policies that support innovation and responsible growth in the chemical industry.

- Enhance Credibility: Demonstrate a commitment to sustainability and ethical operations through alignment with recognized environmental and scientific frameworks.

- Foster Innovation: Gain insights into emerging technologies and market needs, driving the development of new adhesive solutions.

- Promote Best Practices: Share and adopt leading practices in areas such as product safety, environmental performance, and operational efficiency.

Acquisition Targets and Divestiture Partners

H.B. Fuller actively cultivates strategic relationships with potential acquisition targets and divestiture partners to refine its business scope and enhance profitability. This proactive approach allows the company to shed non-core assets and acquire businesses that align with its long-term growth objectives.

A notable recent example is H.B. Fuller's divestiture of its global non-retail consumable flooring business to Pacific Avenue Capital Partners. This strategic move, completed in early 2024, aimed to sharpen the company's focus on its core adhesives and sealants segments, particularly within the building and construction markets where it sees significant growth potential. By streamlining its operations, H.B. Fuller can better allocate resources to innovation and market expansion.

These partnerships are crucial for H.B. Fuller's dynamic portfolio management strategy.

- Acquisition Targets: H.B. Fuller identifies and pursues companies that offer synergistic product lines, expanded market reach, or advanced technologies in adhesives, sealants, and specialty chemicals.

- Divestiture Partners: The company partners with entities capable of effectively managing and growing divested business units, ensuring a clean exit that maximizes value and allows H.B. Fuller to concentrate on its strategic priorities.

- Portfolio Optimization: Through these relationships, H.B. Fuller continuously evaluates and adjusts its business portfolio to ensure it is aligned with market trends and its core competencies.

- Strategic Realignment: The sale of its flooring business in 2024 to Pacific Avenue Capital Partners exemplifies this strategy, enabling a sharper focus on its adhesives and sealants core.

H.B. Fuller actively engages with key industry associations and sustainability initiatives to shape industry direction and enhance its credibility. For instance, their participation in the Science Based Targets initiative (SBTi) in 2023 demonstrates a commitment to environmental responsibility, aligning with global climate goals and fostering innovation through shared best practices.

What is included in the product

This Business Model Canvas outlines H.B. Fuller's strategy for delivering adhesive solutions, focusing on diverse customer segments like construction and electronics through a robust global network.

It details their value propositions, revenue streams, and key resources, reflecting real-world operations and competitive advantages in the specialty chemicals market.

H.B. Fuller's Business Model Canvas offers a structured approach to pinpointing and addressing customer pain points by clearly defining value propositions and customer relationships.

Activities

H.B. Fuller's commitment to Research and Development is central to its business, driving the creation of advanced adhesive, sealant, and specialty chemical solutions. This continuous innovation pipeline is crucial for staying competitive and meeting evolving market demands.

A significant portion of their R&D efforts, around 60% in recent years, is dedicated to enhancing the sustainability of their products. This focus reflects a broader industry trend and a strategic imperative for H.B. Fuller to offer environmentally responsible solutions.

The company excels at developing customized products designed to meet the unique specifications of individual customers. This bespoke approach allows H.B. Fuller to forge strong partnerships and provide tailored value across diverse industries.

H.B. Fuller's core activities revolve around the global manufacturing and production of a diverse portfolio of adhesive solutions. This complex operation requires significant investment in facilities, technology, and skilled labor to create products that serve numerous industries, from packaging and construction to hygiene and electronics.

A key strategic initiative currently underway is a multi-year plan to optimize the company's manufacturing footprint. By 2030, H.B. Fuller aims to consolidate its operations, reducing the number of manufacturing facilities from 82 to 55. This consolidation is designed to streamline processes, enhance operational efficiency, and achieve substantial cost savings across its global network.

H.B. Fuller's core activities revolve around managing a sophisticated global supply chain and logistics network to ensure timely product delivery across diverse markets. This intricate operation is fundamental to their ability to serve customers worldwide with their adhesive solutions.

A significant undertaking by the company is the streamlining of its North American planning and logistics. This initiative aims to consolidate operations by reducing the number of warehouses from 55 to around 10 by the close of 2027.

This strategic consolidation is projected to yield substantial improvements in operational efficiency and lead to significant cost reductions. For instance, reducing warehouse footprint often correlates with lower inventory holding costs and optimized transportation routes.

These efforts underscore H.B. Fuller's commitment to enhancing its operational backbone, directly impacting its ability to compete effectively and deliver value to its global customer base.

Sales, Marketing, and Technical Support

H.B. Fuller's key activities revolve around driving demand and ensuring customer success through a multi-faceted approach to sales, marketing, and technical support. The company employs direct sales forces globally, catering to various industries and customer needs. For instance, in 2023, their sales and marketing initiatives helped them achieve revenue of $3.7 billion, showcasing the reach of their customer engagement efforts.

Leveraging an extensive network of channel partners is also a critical activity, expanding their market penetration and product accessibility. This dual approach allows H.B. Fuller to effectively connect with a broad customer base, from large industrial clients to smaller, specialized manufacturers. Their marketing strategies focus on highlighting the performance and application benefits of their adhesive solutions.

A significant component of these key activities is providing comprehensive technical support. This includes offering specialized solutions tailored to specific customer challenges and delivering hands-on technical assistance to ensure optimal product application and performance. This commitment to support is vital for customer retention and for demonstrating the value proposition of their advanced adhesive technologies.

- Global Sales Force: Direct engagement with diverse customer segments across various industries worldwide.

- Channel Partner Network: Strategic utilization of partners to broaden market reach and product availability.

- Specialized Solutions: Development and promotion of tailored adhesive solutions addressing unique customer needs.

- Technical Assistance: Providing expert support to ensure effective product application and performance optimization, contributing to customer satisfaction and loyalty.

Strategic Portfolio Management and Acquisitions/Divestitures

H.B. Fuller actively refines its business portfolio through strategic acquisitions and divestitures, aiming to concentrate on lucrative, specialized application areas. This ongoing strategic realignment involves reorganizing existing business units. A notable example is the creation of the Building Adhesive Solutions (BAS) division, designed to enhance focus and growth in this key market segment. Simultaneously, the company divests non-core assets, such as its flooring business, to streamline operations and reinvest capital in higher-potential ventures.

These strategic moves are crucial for H.B. Fuller's long-term performance, allowing it to pivot towards segments with greater profitability and innovation potential. For instance, the company’s 2023 results showed a continued emphasis on specialty products, contributing to a more robust financial profile. The divestiture of less strategic units frees up resources and management attention, enabling greater investment in areas like advanced adhesives for electronics and sustainable packaging solutions.

- Focus on High-Margin Specialties: H.B. Fuller's portfolio management prioritizes segments offering higher profit margins.

- Divestiture of Non-Core Assets: The sale of businesses like the flooring segment allows for capital reallocation and strategic focus.

- Reorganization for Growth: The formation of dedicated units like Building Adhesive Solutions (BAS) enhances market penetration and product development.

- Strategic Acquisitions: The company actively seeks acquisitions that complement its existing strengths and expand its reach into new, specialized markets.

H.B. Fuller's key activities encompass the global manufacturing and distribution of a wide array of adhesives, sealants, and specialty chemical products. They focus on innovation, developing customized solutions, and optimizing their operational footprint through strategic consolidation. This includes streamlining their manufacturing facilities and North American logistics network to improve efficiency and reduce costs.

The company's sales and marketing efforts are geared towards driving demand and ensuring customer success. They utilize a direct sales force and a robust network of channel partners to reach diverse customer segments globally. A significant aspect of this is providing extensive technical support to ensure optimal product application and performance, reinforcing customer relationships.

Portfolio management is another critical activity, involving strategic acquisitions and divestitures to concentrate on high-growth, specialized application areas. This realignment, including the formation of divisions like Building Adhesive Solutions, aims to enhance focus and profitability by reinvesting in promising ventures and divesting non-core assets.

| Key Activity | Description | Recent Data/Focus Area |

|---|---|---|

| Manufacturing & Production | Global production of adhesives, sealants, and specialty chemicals. | Consolidating manufacturing footprint from 82 to 55 facilities by 2030. |

| Supply Chain & Logistics | Managing global logistics for timely product delivery. | Streamlining North American warehouses from 55 to ~10 by end of 2027. |

| Sales, Marketing & Technical Support | Driving demand and ensuring customer success through direct sales and partner networks. | Achieved $3.7 billion in revenue in 2023, with strong emphasis on technical assistance. |

| Portfolio Management | Strategic acquisitions and divestitures to focus on specialized, high-margin areas. | Divested flooring business; created Building Adhesive Solutions (BAS) division. |

| Research & Development | Creating advanced adhesive, sealant, and specialty chemical solutions. | ~60% of R&D focused on product sustainability. |

Full Document Unlocks After Purchase

Business Model Canvas

The H.B. Fuller Business Model Canvas you see here is the actual, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct preview of the final deliverable, showcasing the exact structure and content. Once your order is processed, you will gain full access to this professionally prepared document, ready for immediate use and modification. Rest assured, what you preview is precisely what you will own and download, ensuring transparency and eliminating any surprises.

Resources

H.B. Fuller's intellectual property, particularly its patents and proprietary adhesive and sealant formulations, forms a cornerstone of its business. These unique chemical compositions and application technologies are not just assets; they are the very essence of the company's competitive edge, allowing for the creation of highly specialized and effective solutions for diverse industries.

This robust IP portfolio empowers H.B. Fuller to develop high-performance, customized products that meet specific customer needs. For instance, in 2023, the company continued to invest in R&D, focusing on innovative adhesive technologies for sectors like electronics and sustainable packaging, underscoring the ongoing importance of these proprietary formulations.

H.B. Fuller's extensive global manufacturing and R&D infrastructure is a cornerstone of its business model. This network spans 45 countries, featuring numerous manufacturing facilities and cutting-edge R&D centers. This widespread presence allows for localized production, ensuring products are tailored to regional demands and reducing transportation costs.

In 2024, H.B. Fuller continued to optimize this infrastructure, including strategic consolidation efforts to enhance efficiency. This global footprint is vital for delivering products efficiently and fostering continuous innovation across diverse international markets. The company invests significantly in these facilities to maintain its competitive edge and meet evolving customer needs.

H.B. Fuller's approximately 7,500 global employees are a cornerstone of its business model, providing the skilled workforce and technical expertise needed to thrive. This diverse team includes chemists, engineers, and specialized technicians who bring deep knowledge to the company's operations.

The collective technical acumen and collaborative spirit of these employees are critical for H.B. Fuller's success. They are instrumental in creating sophisticated adhesive solutions, delivering exceptional customer service, and spearheading the company's innovation efforts.

Established Brand Reputation and Customer Relationships

H.B. Fuller's brand reputation, forged since its founding in 1887, is a cornerstone of its business model, signifying reliability and consistent innovation within the global adhesives market. This extensive history has cultivated a deep well of trust among customers, positioning the company as a go-to provider for critical bonding solutions.

The company's success is significantly bolstered by its deeply entrenched, collaborative customer relationships. These aren't just transactional exchanges; they are partnerships that often involve co-development of new adhesive technologies tailored to specific client needs. This approach fosters long-term loyalty and creates a valuable intangible asset that is difficult for competitors to replicate.

- Established Brand Reputation: H.B. Fuller, founded in 1887, leverages over a century of experience to assure customers of quality and performance in its adhesive products.

- Customer-Centric Approach: The company prioritizes building strong, collaborative relationships, often engaging in joint development projects with key clients to create bespoke adhesive solutions.

- Intangible Asset Value: These deep customer connections represent a significant intangible asset, contributing to customer retention and providing valuable market insights for future product development.

- Market Leadership: H.B. Fuller's reputation for innovation and reliability in the adhesives industry supports its market leadership across diverse sectors, from packaging to electronics.

Global Supply Chain and Distribution Network

H.B. Fuller's extensive global supply chain and distribution network is a foundational element of its business model. This intricate web of sourcing, logistics, and delivery channels is crucial for maintaining operational efficiency and customer satisfaction. In 2024, the company continued to refine these processes to ensure timely delivery of adhesives and sealants to a diverse customer base across numerous industries.

The network's optimization directly impacts H.B. Fuller's ability to manage costs and respond to market demands. By strategically locating manufacturing facilities and distribution hubs, the company minimizes transit times and associated expenses. This global reach allows them to serve customers in over 100 countries, a testament to the network's robustness.

- Global Reach: H.B. Fuller operates manufacturing sites and distribution centers strategically positioned worldwide to serve its diverse customer base efficiently.

- Sourcing Capabilities: The company leverages strong relationships with a broad base of raw material suppliers to ensure consistent availability and competitive pricing.

- Logistics Expertise: Efficient management of transportation, warehousing, and inventory across international borders is paramount for timely product delivery.

- Customer Proximity: Distribution networks are designed to place products close to key customer manufacturing operations, reducing lead times and enhancing service.

H.B. Fuller's access to critical raw materials and its efficient procurement processes are vital components of its business model. The company's ability to secure consistent supplies of essential chemicals and polymers at competitive prices directly influences its production costs and product availability.

In 2024, H.B. Fuller continued to focus on diversifying its supplier base and exploring alternative material sourcing to mitigate supply chain risks and maintain cost competitiveness. This strategic approach ensures the uninterrupted flow of materials needed for its extensive product lines, supporting its global operations and customer commitments.

The company's strong supplier relationships, coupled with its purchasing power, allow for favorable terms and reliable delivery schedules. This operational efficiency is key to meeting the demands of industries that rely on timely adhesive and sealant solutions, reinforcing H.B. Fuller's position as a dependable partner.

Value Propositions

H.B. Fuller excels at crafting highly specialized, custom-tailored adhesive and sealant solutions. These are meticulously designed to meet the exact performance needs across a vast array of industries and specific applications. This commitment to bespoke solutions, with over half of their product stock keeping units (SKUs) being custom-tailored, directly tackles and resolves complex customer challenges.

H.B. Fuller's commitment to sustainability is a core value proposition, allowing customers to create more environmentally friendly end products. This includes developing adhesives and sealants that facilitate recyclable packaging, contribute to energy-efficient building materials, and support the production of electric vehicles.

A significant portion of H.B. Fuller's innovation pipeline is dedicated to these green initiatives. In 2024, approximately 60% of the company's new product development efforts were focused on sustainable solutions, demonstrating a clear alignment with pressing global environmental objectives and market demand for eco-conscious products.

H.B. Fuller's adhesive solutions are engineered to boost customer efficiency by optimizing manufacturing processes. Their technical support actively guides clients in streamlining production lines, often resulting in faster cycle times and reduced material waste. For instance, by implementing Fuller's advanced bonding technologies, manufacturers can achieve quicker assembly, directly contributing to increased output and lower operational costs. This focus on process improvement translates into tangible productivity gains for their clientele.

Technical Expertise and Collaborative Problem-Solving

H.B. Fuller leverages its profound technical expertise to co-create solutions with clients. They actively partner with customers, guiding them through every stage from initial concept to market-ready products.

This collaborative ethos means H.B. Fuller doesn't just sell adhesives; they engineer precise solutions for specific, often complex, real-world problems. For instance, in 2023, the company reported that its innovation pipeline, driven by customer collaboration, contributed significantly to its revenue growth, with new product introductions accounting for a substantial portion of sales.

- Deep Technical Knowledge: H.B. Fuller employs a global team of scientists and engineers with specialized knowledge in various adhesive technologies and applications.

- Customer-Centric Development: The company actively involves customers in the product development process, ensuring solutions are tailored to their unique needs and operational environments.

- End-to-End Partnership: Collaboration extends from initial ideation and formulation to testing, scale-up, and ongoing technical support, ensuring seamless integration and performance.

- Market Responsiveness: By working closely with customers, H.B. Fuller stays ahead of evolving market demands and anticipates future challenges, enabling proactive solution development.

Global Reach and Reliable Supply

H.B. Fuller's global reach is a cornerstone of its value proposition, ensuring customers can access its innovative adhesive solutions wherever they operate. With operations spanning over 140 countries, the company leverages a consolidated global manufacturing and distribution network to guarantee dependable product availability.

This extensive footprint translates directly into reliable supply chains for businesses worldwide. For instance, in 2024, H.B. Fuller continued to invest in optimizing its logistics and production facilities to meet increasing global demand efficiently. This commitment ensures that multinational clients receive consistent service and product delivery, a critical factor in maintaining their own operational continuity.

The company's global presence also means localized technical support is readily available. This access to expertise helps customers optimize product application and solve challenges specific to their regional markets, further solidifying the value of a reliable global partner.

- Global Presence: Operations in over 140 countries.

- Consolidated Footprint: Integrated manufacturing and distribution for efficiency.

- Reliable Supply: Consistent access to products for customers worldwide.

- Worldwide Support: Localized technical assistance available globally.

H.B. Fuller's value proposition is built on delivering highly specialized adhesive and sealant solutions, with over half of their SKUs being custom-tailored to solve unique customer challenges across diverse industries. They also champion sustainability, developing eco-friendly products that aid in creating recyclable packaging, energy-efficient buildings, and electric vehicles, with around 60% of their 2024 new product development focused on these green initiatives. Furthermore, their expertise enhances customer efficiency by optimizing manufacturing processes, leading to faster assembly and reduced waste, a benefit evidenced by the significant revenue contribution of new product introductions driven by customer collaboration in 2023.

| Value Proposition | Key Differentiator | Impact/Metric |

|---|---|---|

| Customized Solutions | Over 50% of SKUs are custom-tailored | Addresses specific, complex customer needs |

| Sustainability Focus | 60% of 2024 R&D on green initiatives | Enables eco-friendly end products for customers |

| Efficiency Enhancement | Process optimization and technical support | Faster cycle times, reduced waste, increased output |

| Collaborative Innovation | Co-creation from concept to market | New product introductions drive significant revenue |

| Global Reach & Reliability | Operations in 140+ countries | Dependable product availability and localized support |

Customer Relationships

H.B. Fuller prioritizes strong customer connections via specialized technical sales and support teams. These teams actively engage with clients, deeply understanding their unique requirements and offering expert application advice. This direct interaction is key to resolving any product-related challenges, ultimately boosting performance and ensuring client contentment.

In 2024, H.B. Fuller continued to emphasize this customer-centric approach. Their technical sales force, comprising hundreds of specialists globally, works hand-in-hand with customers. This dedicated support system was instrumental in the successful rollout of new adhesive solutions across various industries, from electronics to packaging, reflecting a tangible commitment to partnership and problem-solving.

H.B. Fuller deeply engages in collaborative innovation, partnering with customers on co-development initiatives. This involves shared research and development to craft bespoke adhesive solutions, directly supporting customers in bringing their own product innovations to life and tackling intricate technical hurdles.

In 2024, H.B. Fuller highlighted its commitment to co-creation, noting that a substantial portion of its new product pipeline is driven by direct customer collaboration. These partnerships not only yield tailored adhesive technologies but also foster stronger, more integrated customer relationships.

H.B. Fuller actively cultivates long-term, strategic partnerships with its most important customers. This approach transcends simple product transactions, positioning Fuller as a valued advisor deeply embedded in their clients' innovation processes.

By integrating into customers' product development cycles and supply chains, H.B. Fuller fosters a collaborative environment that drives mutual growth and solidifies customer loyalty. This deep integration allows for tailored solutions and anticipates future needs.

For instance, in 2024, H.B. Fuller reported that a significant portion of its revenue was generated from its top-tier strategic accounts, highlighting the success of this partnership-focused strategy. This focus on long-term relationships contributes to enhanced customer retention and predictable revenue streams.

Customer Training and Education

H.B. Fuller enhances customer relationships through robust training and education programs focused on product application, safety, and best practices. This commitment empowers clients to derive maximum value from their adhesive solutions.

By ensuring correct usage, H.B. Fuller minimizes potential issues and fosters customer confidence. For instance, in 2024, the company continued its global outreach with digital and in-person training sessions, reaching thousands of customers across various industries, from automotive to packaging.

- Product Application Mastery: Training ensures customers can effectively utilize H.B. Fuller’s diverse adhesive portfolio for optimal performance in their specific manufacturing processes.

- Safety and Compliance Focus: Educational modules address safe handling, storage, and disposal of chemical products, aligning with industry regulations and promoting workplace safety.

- Best Practice Implementation: Customers learn advanced techniques and industry insights to improve efficiency, reduce waste, and enhance the quality of their end products through informed application.

- Technical Support Integration: Training often serves as a conduit for deeper technical support, allowing customers to troubleshoot and optimize their adhesive systems with expert guidance.

Digital Engagement and Feedback Mechanisms

H.B. Fuller is actively investing in digital platforms to streamline customer interactions and boost transparency in transactional processes. This focus on digital engagement aims to make doing business with Fuller more efficient and predictable for its clients.

The company is implementing enhanced feedback mechanisms to foster stronger customer relationships. A prime example is their customer innovation awards program, which not only encourages new ideas but also acknowledges and rewards successful joint ventures and product development efforts.

- Digital Platforms: H.B. Fuller is enhancing its digital presence to improve customer experience and operational efficiency, including advancements in order tracking and supply chain visibility.

- Feedback Mechanisms: The company utilizes customer innovation awards to drive collaboration and recognize valuable customer contributions, fostering a sense of partnership.

- Transparency: Efforts are underway to increase transparency throughout the customer journey, from initial inquiry to final product delivery, building trust and improving satisfaction.

- Customer Engagement: By integrating digital tools and soliciting feedback, H.B. Fuller aims to build deeper, more collaborative relationships with its diverse customer base across various industries.

H.B. Fuller cultivates deep customer relationships through expert technical support, collaborative innovation, and strategic, long-term partnerships. They invest in training, digital platforms, and feedback mechanisms to enhance engagement and deliver tailored solutions, driving mutual growth and loyalty.

In 2024, H.B. Fuller's global technical sales force, comprising hundreds of specialists, actively engaged with customers to address specific needs, contributing to the successful launch of new adhesive solutions. A significant portion of their new product pipeline in 2024 was driven by direct customer collaboration, underscoring the success of their co-creation strategy.

| Aspect | Description | 2024 Relevance |

|---|---|---|

| Technical Sales & Support | Specialized teams provide expert application advice and problem-solving. | Hundreds of global specialists actively engaged with customers for new product rollouts. |

| Collaborative Innovation | Co-development initiatives craft bespoke adhesive solutions. | Substantial portion of new product pipeline driven by customer collaboration. |

| Strategic Partnerships | Positioning as a valued advisor embedded in clients' innovation processes. | Significant revenue generated from top-tier strategic accounts. |

| Training & Education | Programs focus on product application, safety, and best practices. | Global digital and in-person sessions reached thousands of customers. |

Channels

H.B. Fuller heavily relies on its global direct sales force to connect with major industrial clients and important accounts. This approach is crucial for building strong relationships and understanding the intricate needs of these customers. Their sales teams are equipped to provide tailored solutions and direct technical advice, which is essential for specialized product applications.

This direct channel enables H.B. Fuller to offer in-depth customer insights and foster collaborative development of adhesive solutions. For example, in 2024, the company continued to emphasize its direct sales efforts in emerging markets, aiming to replicate the success seen in more established regions. This strategy supports their ability to deliver high-performance adhesives that meet stringent industry standards.

H.B. Fuller utilizes a robust network of third-party distributors to effectively reach a wider customer base, especially smaller and mid-sized businesses. This strategy is particularly valuable in geographic areas where establishing a direct sales force would be less cost-effective or practical.

These partnerships are crucial for expanding market penetration and ensuring localized support for customers. For instance, collaborations with distributors like Formerra allow H.B. Fuller to offer its adhesive solutions and technical expertise to a broader range of industries and regions, enhancing customer accessibility and service quality.

In 2024, H.B. Fuller continued to emphasize these channel partnerships as a key component of its growth strategy. The company reported that its distribution channels played a significant role in its performance, contributing to an increased market share in various segments by providing on-the-ground support and inventory management.

H.B. Fuller is exploring e-commerce platforms, particularly for its more standardized adhesive solutions and for reaching smaller, more fragmented customer segments. This move aims to streamline the purchasing process, making it easier for customers to reorder frequently used products. By 2024, the global e-commerce market for industrial supplies was projected to reach over $1 trillion, highlighting a significant opportunity for B2B companies to adopt digital sales channels.

Strategic Alliances and Joint Ventures

H.B. Fuller leverages strategic alliances and joint ventures as crucial channels for market expansion and technology acquisition. These collaborations allow the company to efficiently enter new geographic regions or specialized industry segments, reducing initial investment risks and accelerating market penetration. For example, in 2024, H.B. Fuller announced a joint venture to enhance its presence in the growing Asian adhesives market, aiming to capitalize on localized manufacturing and distribution networks. This strategy also provides access to complementary technologies, enabling the development of innovative adhesive solutions that might be challenging to achieve independently.

These partnerships serve as effective conduits for introducing new products and fostering market development. By teaming up with established players or niche specialists, H.B. Fuller can gain immediate access to customer bases and distribution channels, streamlining the go-to-market process. The company's focus on these collaborative channels is evident in its ongoing efforts to integrate acquired businesses, treating them as extensions of its existing channel strategy. In 2023, H.B. Fuller reported that its strategic partnerships contributed to a significant uptick in new product adoption rates within key emerging markets, underscoring their role in driving growth.

- Market Entry and Expansion: Strategic alliances enable H.B. Fuller to enter new geographic markets or penetrate existing ones more deeply, often by partnering with local entities that possess established distribution networks and market knowledge.

- Technology Access: Joint ventures can provide access to cutting-edge technologies or specialized expertise, facilitating the development of advanced adhesive solutions for diverse applications.

- Product Introduction and Sales: These partnerships act as direct channels for launching new adhesive products, leveraging the combined reach and customer relationships of the alliance partners to drive sales and market acceptance.

- Risk Mitigation: Collaborating through joint ventures and alliances can share the financial and operational risks associated with entering new markets or developing new technologies.

Industry Trade Shows and Conferences

H.B. Fuller actively participates in global industry trade shows and conferences, a vital channel for showcasing innovations and engaging with stakeholders. For instance, in 2024, the company likely exhibited at key events like the European Coatings Show or the Adhesives & Bonding Expo, demonstrating its latest adhesive technologies and solutions. These platforms are instrumental in generating qualified leads and fostering direct relationships with both new prospects and established clients.

These gatherings are more than just exhibition spaces; they are strategic touchpoints for H.B. Fuller to highlight its technical expertise and product performance. By presenting case studies and engaging in technical discussions, the company reinforces its position as an industry leader. For example, presentations on sustainable adhesive solutions or advancements in high-performance bonding gained significant traction at 2024 industry events.

- Global Reach: Participation in events like LIGNA in Germany or the American Coatings Show in the US allows H.B. Fuller to connect with a diverse international customer base.

- Lead Generation: Trade shows are a primary source for identifying and capturing new business opportunities, with many companies reporting a significant percentage of their annual leads originating from these events.

- Customer Engagement: Direct interaction at conferences allows for immediate feedback on product offerings and a deeper understanding of customer needs, crucial for product development.

- Brand Visibility: Consistent presence at major industry forums enhances brand recognition and reinforces H.B. Fuller's commitment to innovation and customer support.

H.B. Fuller's channel strategy is multifaceted, combining direct sales with expansive third-party distribution networks to serve a broad customer spectrum. E-commerce is emerging as a key avenue for standardized products, while strategic alliances facilitate market entry and technological advancement. Participation in industry events further bolsters brand visibility and lead generation.

Customer Segments

Packaging Industry Manufacturers represent a core customer segment for H.B. Fuller, encompassing producers of diverse packaging formats like flexible films, rigid containers, and corrugated boxes. These businesses rely on H.B. Fuller's specialized adhesives to ensure the integrity and functionality of their products across numerous applications.

Within this segment, H.B. Fuller particularly serves manufacturers focused on food and beverage packaging, where adhesive performance is critical for safety and shelf-life. The booming e-commerce sector also drives demand, with adhesives needed for secure sealing of shipping boxes and protective packaging solutions.

A significant trend H.B. Fuller addresses is the industry's push for sustainability. Their adhesive solutions are increasingly designed to support recyclability and the use of recycled content in packaging materials, aligning with regulatory pressures and consumer preferences.

In 2023, the global packaging market was valued at over $1 trillion, with flexible packaging and corrugated boxes representing substantial portions, underscoring the scale of H.B. Fuller's addressable market within this segment.

Hygiene and health product manufacturers represent a vital customer base for H. Fuller. Companies producing items like disposable diapers, feminine hygiene products, and medical devices rely heavily on specialized adhesives. These adhesives are critical for ensuring product performance, user comfort, and the overall safety of sensitive applications.

H. Fuller's adhesive solutions play a key role in the construction of these products. For instance, in disposable diapers, their adhesives are used for securing absorbent cores, fastening tabs, and creating leak barriers, contributing to dryness and comfort. In feminine care, adhesives are essential for product integrity and discreet wear.

The medical device sector also benefits significantly from H. Fuller's offerings. Adhesives are used in wound dressings, surgical tapes, and various disposable medical equipment, where biocompatibility, secure adhesion, and patient comfort are paramount. The global market for medical adhesives was projected to reach over $12 billion by 2024, underscoring the importance of this segment.

H.B. Fuller serves manufacturers in the automotive, transportation, electronics, and general durable goods assembly sectors. This includes makers of cars, trucks, caravans, and motor homes, all relying on advanced bonding solutions. The company’s adhesives are crucial for structural integrity and efficient product assembly in these demanding industries.

Within this segment, H.B. Fuller is particularly focused on emerging needs in electric vehicles (EVs) and solar energy systems. Their high-performance adhesives enable lighter, stronger, and more durable designs essential for EV battery packs and solar panel construction. In 2024, the global automotive adhesives market was valued at approximately $9.8 billion, with a significant portion driven by lightweighting and electrification trends, areas where H.B. Fuller actively competes.

Construction and Infrastructure Sector

Customers in the construction and infrastructure sector are a vital part of H.B. Fuller's business model, encompassing a broad range of applications. This includes commercial roofing, where their adhesives and sealants are crucial for durability and weather resistance. They also serve the building envelope market, providing solutions for insulation and sealing to enhance energy efficiency.

The flooring segment relies on H.B. Fuller for adhesives that ensure strong, long-lasting installations. Furthermore, general construction projects, from residential to large-scale infrastructure, utilize their diverse portfolio of specialty chemicals and bonding solutions. In 2024, the global construction market was valued at approximately $13.2 trillion, highlighting the significant demand for materials and solutions that H.B. Fuller provides.

- Construction Applications: Commercial roofing, building envelope, flooring, and general construction sectors.

- Product Offerings: Sealants, adhesives, and specialty chemicals tailored for building materials and project needs.

- Market Impact: Solutions contribute to infrastructure development and the growing demand for energy-efficient construction.

- Industry Relevance: H.B. Fuller's products are integral to the performance and longevity of numerous building components and projects.

Woodworking and Furniture Manufacturers

H.B. Fuller serves a crucial customer segment in woodworking and furniture manufacturers, encompassing businesses that create everything from home cabinetry to large-scale furniture pieces.

These manufacturers rely on specialized adhesives to ensure the structural integrity and visual appeal of their wood-based products. H.B. Fuller's solutions are integral to bonding wood components, laminates, and veneers, directly impacting product quality and longevity.

The demand for high-performance woodworking adhesives remains robust. For instance, the global woodworking adhesives market was valued at approximately USD 5.5 billion in 2023 and is projected to grow, indicating continued reliance on these essential materials by this sector.

- Key Applications: Furniture assembly, cabinetry construction, panel lamination, and decorative surfacing.

- Value Proposition: Enhanced durability, improved aesthetic finishes, and efficient production processes through reliable bonding solutions.

- Market Relevance: The furniture and furnishings market, a primary consumer of these wood products, saw global retail sales exceeding USD 700 billion in 2023, highlighting the scale of this customer base.

- Innovation Focus: Development of low-VOC (volatile organic compound) adhesives to meet increasing environmental regulations and consumer demand for sustainable products.

H.B. Fuller's customer base extends to the aerospace and defense industries, where specialized adhesives and sealants are critical for high-performance applications. These sectors demand materials that can withstand extreme conditions, ensure structural integrity, and meet stringent safety regulations.

Within aerospace, H.B. Fuller's products are utilized in aircraft manufacturing for bonding composite materials, sealing fuel tanks, and interior component assembly. For defense, their solutions are integral to the production of vehicles, equipment, and protective gear, where reliability and durability are paramount.

The global aerospace adhesives and sealants market alone was estimated to be around $2.5 billion in 2023, with a significant portion driven by new aircraft production and MRO (maintenance, repair, and overhaul) activities. The increasing complexity of aircraft designs and the growing use of lightweight composite materials continue to fuel demand for advanced bonding solutions.

Cost Structure

Raw materials represent H.B. Fuller's most substantial cost. In fiscal year 2024, these materials made up roughly 75% of the company's total cost of sales. This highlights the significant dependency on the availability and pricing of these essential inputs for the adhesives manufacturer.

The volatile nature of petroleum and natural gas derivatives directly influences H.B. Fuller's profitability. When these commodities experience scarcity or inflationary pressures, the cost of raw materials rises, creating a direct and significant impact on the company's overall earnings.

H.B. Fuller's manufacturing and production costs are substantial, reflecting the global scale of its operations. These expenses encompass labor, the energy and utilities needed to power its facilities, and the depreciation of its extensive plant and equipment. For instance, in fiscal year 2023, the company reported cost of goods sold of $2.7 billion, a significant portion of which is directly tied to these manufacturing inputs.

The company is actively working to optimize its manufacturing footprint, a strategic initiative designed to curb these significant operational expenditures. By consolidating its manufacturing facilities, H.B. Fuller aims to achieve better capacity utilization, thereby driving down the per-unit cost of production and improving overall efficiency. This ongoing effort is crucial for maintaining competitiveness in the adhesives market.

H.B. Fuller allocates significant financial resources to Research & Development (R&D), recognizing it as a crucial cost driver for their business model. This investment is directly tied to their strategy of innovation and the creation of novel adhesive and sealant solutions.

In 2023, H.B. Fuller's R&D expenses amounted to $168.2 million, representing 3.3% of their net revenue. This substantial outlay underscores their commitment to developing next-generation products, particularly those focused on sustainability and performance enhancements to meet evolving market demands.

These R&D expenditures are essential for H.B. Fuller to maintain its competitive advantage in the global adhesives market. By continuously introducing new and improved products, the company aims to address specific customer challenges and capture emerging market opportunities.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses at H.B. Fuller encompass the costs tied to selling products, marketing efforts, managing distribution channels, and the general overhead of running the corporation. These are the essential, non-manufacturing costs that keep the business operating and reaching its customers. For example, the salaries of sales teams, advertising campaigns, and the administrative staff all fall under this umbrella.

H.B. Fuller is actively working to make its SG&A structure more efficient. This strategic focus aims to reduce these costs as a percentage of revenue, thereby boosting the company's bottom line. This initiative is happening in parallel with efforts to consolidate manufacturing operations, a dual approach to improving overall financial performance.

In 2024, H.B. Fuller reported SG&A expenses of approximately $820 million, representing about 23% of its total net revenue. This figure reflects ongoing investments in market presence and operational support.

- Sales and Marketing: Costs associated with promoting and selling H.B. Fuller's adhesive solutions globally.

- General and Administrative: Expenses covering corporate functions, including finance, human resources, and legal.

- Distribution Costs: Expenses related to getting products from manufacturing sites to customers.

- Efficiency Initiatives: Ongoing projects to streamline SG&A and reduce overhead as a percentage of sales.

Logistics and Supply Chain Costs

H.B. Fuller's cost structure is significantly impacted by its logistics and supply chain operations. These expenses encompass warehousing, inventory management, and the transportation of raw materials and finished goods across its extensive global network. Given the company's worldwide reach, these costs are inherently substantial, reflecting the complexities of moving products efficiently and reliably to diverse markets.

In a strategic move to optimize its operational footprint and reduce overhead, H.B. Fuller is actively working on streamlining its North American warehousing. This initiative is projected to yield considerable annualized cost savings by consolidating facilities and improving the efficiency of its distribution channels. For instance, such a consolidation in 2023 contributed to a notable improvement in their operating margin, demonstrating the direct financial benefit of these logistical adjustments.

The company's commitment to enhancing supply chain efficiency is a key element of its cost management strategy. By reducing the number of North American warehouses, H.B. Fuller aims to lower fixed costs associated with facility maintenance, staffing, and utilities. This strategic realignment is expected to lead to a more agile and cost-effective supply chain, ultimately bolstering profitability.

Key cost drivers within H.B. Fuller's logistics and supply chain include:

- Transportation Expenses: Costs associated with freight, shipping, and fuel for moving materials and products globally.

- Warehousing Costs: Expenses related to storing inventory, including rent, utilities, labor, and inventory management systems.

- Inventory Holding Costs: The cost of capital tied up in inventory, plus expenses for insurance, taxes, and potential obsolescence.

- Supply Chain Technology: Investments in software and systems for tracking, planning, and optimizing supply chain operations.

H.B. Fuller's cost structure is dominated by raw materials, which accounted for approximately 75% of its cost of sales in fiscal year 2024. Fluctuations in petroleum and natural gas prices significantly impact these material costs.

Manufacturing and production expenses, including labor and utilities, are also substantial. In fiscal year 2023, the cost of goods sold reached $2.7 billion, reflecting these operational outlays. The company is optimizing its manufacturing footprint to reduce these costs.

Research and Development (R&D) is a key investment area, with $168.2 million spent in 2023, representing 3.3% of net revenue, to drive innovation. Selling, General, and Administrative (SG&A) expenses were around $820 million in 2024, about 23% of net revenue, supporting sales and operations.

Logistics and supply chain costs, including warehousing and transportation, are significant due to the company's global operations. Streamlining North American warehousing is a strategic initiative aimed at reducing these expenses and improving efficiency.

| Cost Category | FY 2023 (Millions USD) | FY 2024 (Millions USD) | % of Net Revenue (FY 2024 Est.) |

| Raw Materials | ~ $2,025 (Est. 75% of $2.7B COGS) | ~ $2,025 (Est. 75% of $2.7B COGS) | ~ 75% |

| Manufacturing/Production | (Included in COGS) | (Included in COGS) | (Included in COGS) |

| R&D Expenses | $168.2 | $175 (Est.) | ~ 3.3% |

| SG&A Expenses | ~ $780 (Est.) | $820 | ~ 23% |

| Logistics/Supply Chain | (Included in COGS/SG&A) | (Included in COGS/SG&A) | (Significant, ongoing optimization) |

Revenue Streams

H.B. Fuller's core revenue engine is the sale of its diverse portfolio of adhesives, sealants, and functional coatings. These products serve a broad spectrum of industrial sectors, from packaging and hygiene to electronics and construction, as well as consumer markets.

For fiscal year 2024, this primary revenue stream generated approximately $3.57 billion in net revenue for the company. This figure highlights the significant market demand and H.B. Fuller's strong position in supplying essential bonding and sealing solutions across numerous applications.

Beyond its foundational adhesives and sealants, H.B. Fuller diversifies its income through sales of specialty chemical products. These are meticulously developed for distinct, often high-performance, applications across various sectors.

The company's focus on these niche solutions allows for premium pricing, as they address specific customer needs with unique chemical formulations. For instance, in 2023, H.B. Fuller's Construction Adhesives segment, which includes many specialty offerings, saw robust performance, contributing significantly to the company's overall revenue picture.

H.B. Fuller generates revenue through three primary business segments: Hygiene, Health and Consumable Adhesives; Engineering Adhesives; and Building Adhesive Solutions. This diversification allows the company to serve a broad range of industries and customer needs.

In the second quarter of 2025, the Hygiene, Health and Consumable Adhesives segment was the largest contributor to the company's revenue, representing 44% of the total. This indicates a strong market position in areas like packaging, hygiene products, and consumer goods.

The Engineering Adhesives segment accounted for 31% of H.B. Fuller's revenue in Q2 2025. This segment likely includes specialized adhesives for demanding applications in industries such as electronics, automotive, and aerospace, demonstrating the company's technical capabilities.

Rounding out the revenue streams, the Building Adhesive Solutions segment brought in 25% of the total revenue in Q2 2025. This segment focuses on adhesives for construction, renovation, and building materials, highlighting H.B. Fuller's presence in the infrastructure and construction markets.

Geographic Sales Contributions

H.B. Fuller's revenue streams are significantly shaped by its geographic sales contributions, demonstrating a global presence. The Americas represent its most substantial market, underscoring its strong foothold in North and South America.

In 2024, the Americas region was the primary revenue driver, contributing 53% of H.B. Fuller's total sales. This significant portion highlights the company's deep market penetration and customer base within these territories.

The EIMEA (Europe, India, Middle East, and Africa) region followed, accounting for 29% of sales in 2024. This indicates a robust, though secondary, revenue stream from a diverse and economically significant geographical spread.

The Asia-Pacific region contributed 18% of total sales in 2024. While the smallest contributor among the three, this segment still represents an important and growing market for H.B. Fuller's adhesive solutions.

- Americas: 53% of total sales (2024)

- EIMEA: 29% of total sales (2024)

- Asia-Pacific: 18% of total sales (2024)

New Product Sales

H.B. Fuller’s commitment to innovation is a key driver of its financial performance, with a substantial portion of its income stemming from newly launched products. This strategy highlights the effectiveness of its research and development efforts. These newer offerings are crucial for staying competitive and meeting evolving customer needs in the adhesives market.

In 2024, a notable 22% of H.B. Fuller's total revenue was generated from products introduced within the preceding five years. This figure underscores the company's ability to consistently bring successful new solutions to market, demonstrating a strong return on its R&D investments.

- New Product Revenue Contribution: Approximately 22% of H.B. Fuller's 2024 revenue originated from products launched within the last five years.

- R&D Investment Impact: This significant percentage validates the company's investment in research and development, translating innovation into tangible sales.

- Market Responsiveness: Success with new products indicates H.B. Fuller's agility in responding to market demands and technological advancements.

H.B. Fuller's revenue streams are primarily built on the sale of adhesives, sealants, and coatings across various industries. The company also generates income from specialty chemical products tailored for specific high-performance applications, often commanding premium pricing. This diversified approach allows H.B. Fuller to capture revenue from both broad industrial needs and niche market demands.

The company's performance is also segmented by its three core business units: Hygiene, Health and Consumable Adhesives; Engineering Adhesives; and Building Adhesive Solutions. These segments collectively drove the company's financial results, with each contributing a distinct share to the overall revenue. For instance, in the second quarter of 2025, Hygiene, Health and Consumable Adhesives represented 44% of revenue, Engineering Adhesives 31%, and Building Adhesive Solutions 25%.

Geographic sales also play a critical role in H.B. Fuller's revenue generation, with the Americas being the largest market. In 2024, the Americas accounted for 53% of total sales, followed by EIMEA (Europe, India, Middle East, and Africa) at 29%, and Asia-Pacific at 18%. This global distribution highlights the company's widespread market presence and its ability to serve diverse regional demands.

Innovation is a significant revenue driver, with approximately 22% of H.B. Fuller's 2024 revenue coming from products launched within the last five years. This demonstrates the company's success in research and development and its capacity to introduce new, market-responsive solutions.

| Revenue Stream | 2024 Contribution (Approximate) | Key Focus Areas |

|---|---|---|

| Adhesives, Sealants, Coatings | Core Revenue Driver | Packaging, Hygiene, Electronics, Construction, Consumer |

| Specialty Chemical Products | Niche, High-Performance Applications | Specific customer needs, premium pricing |

| Hygiene, Health and Consumable Adhesives | 44% (Q2 2025) | Packaging, hygiene products, consumer goods |

| Engineering Adhesives | 31% (Q2 2025) | Electronics, Automotive, Aerospace |

| Building Adhesive Solutions | 25% (Q2 2025) | Construction, Renovation, Building Materials |

| Geographic Sales - Americas | 53% (2024) | North and South America |

| Geographic Sales - EIMEA | 29% (2024) | Europe, India, Middle East, Africa |

| Geographic Sales - Asia-Pacific | 18% (2024) | Asia-Pacific region |

| New Product Revenue | 22% (2024) | Products launched within the last five years |

Business Model Canvas Data Sources

The H.B. Fuller Business Model Canvas is meticulously constructed using a blend of internal financial reports, extensive market research on adhesives and sealants, and strategic insights from industry experts. These diverse data streams ensure a comprehensive and accurate representation of the company's operational framework and market position.