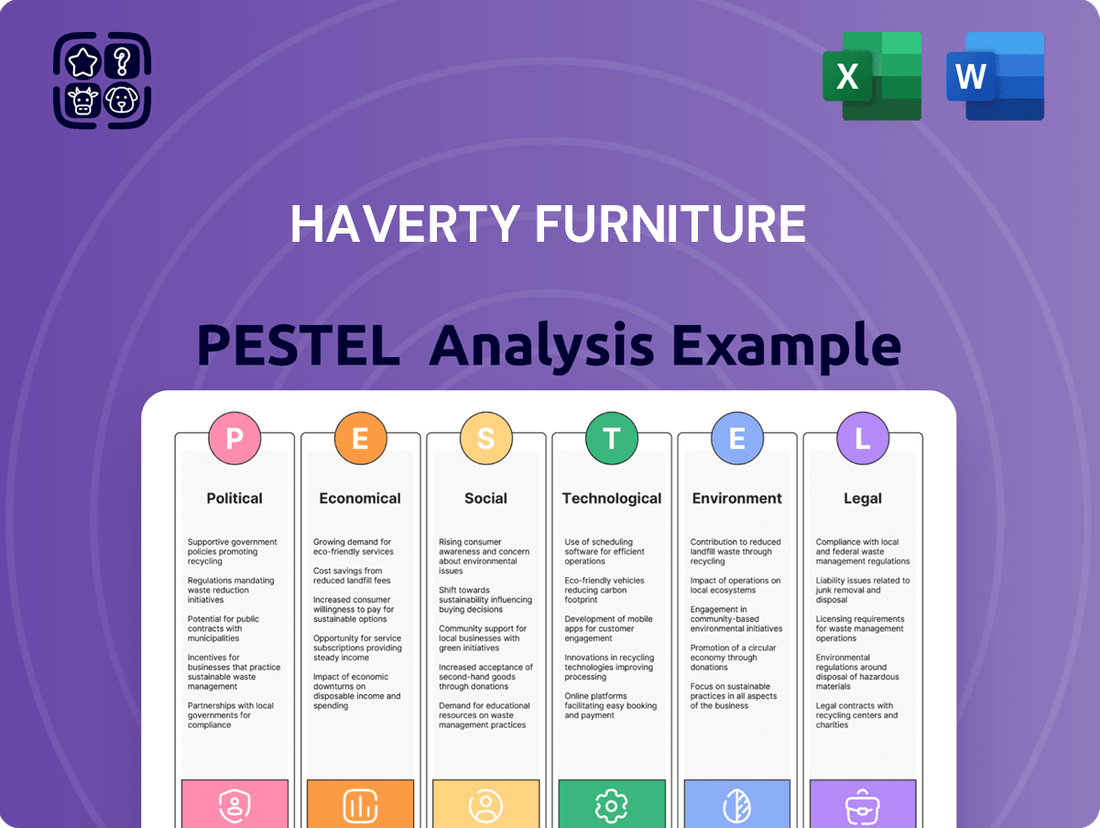

Haverty Furniture PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haverty Furniture Bundle

Navigate the complex external forces shaping Haverty Furniture's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends create both challenges and opportunities for the company. This expert-crafted report provides actionable intelligence to inform your strategic decisions.

Gain a competitive edge by delving into the technological advancements and environmental considerations impacting the furniture industry. Our PESTLE analysis for Haverty Furniture offers a deep dive into these critical external factors. Download the full version now and unlock the insights you need to stay ahead.

Political factors

Changes in international trade policies, including tariffs on imported furniture and raw materials, can significantly impact Haverty Furniture's sourcing costs and pricing strategies. For example, in early 2024, discussions around potential new tariffs on goods from Vietnam, a key furniture manufacturing hub, have raised concerns about increased import expenses.

These shifts can lead to higher operational costs for Haverty, potentially forcing adjustments in their product pricing to maintain profit margins. The company's ability to adapt its supply chain and sourcing strategies in response to evolving trade agreements will be crucial for its financial performance in the coming years.

Government policies significantly shape the housing market, which in turn impacts furniture demand. For instance, the Federal Reserve's monetary policy, including its stance on interest rates, is a key driver. Lower interest rates, as anticipated by many economists for 2024 and 2025, can make mortgages more affordable, encouraging new home construction and purchases.

This increased housing activity directly translates to greater demand for home furnishings. Initiatives aimed at boosting housing availability, such as streamlining zoning laws or offering tax credits for developers, can further accelerate construction. As more homes are built and sold, companies like Haverty Furniture stand to benefit from a broader customer base seeking to furnish these new spaces.

Consumer protection laws significantly shape Haverty Furniture's operational landscape. Regulations mandating product safety, clear labeling, and defined consumer rights directly influence product design, manufacturing processes, and marketing strategies. For instance, compliance with furniture stability standards, such as those potentially influenced by discussions around acts like the STURDY Act in 2024, and adherence to limits on hazardous materials like lead in finishes or formaldehyde in composite woods, are paramount. Failure to comply can lead to substantial legal penalties and erode consumer confidence.

Taxation Policies

Changes in corporate tax rates directly impact Haverty Furniture's bottom line and its ability to compete on price. Similarly, shifts in sales tax can influence consumer purchasing decisions for furniture, a typically discretionary purchase.

For 2025, Haverty Furniture projects an effective tax rate of 26.5%. This figure is important for financial forecasting, though it excludes the effects of specific one-time tax events and any newly enacted tax laws.

- Corporate Tax Impact: Fluctuations in corporate tax rates can alter Haverty Furniture's net income and cash flow.

- Sales Tax Influence: Varying sales taxes across different states affect the final price consumers pay, potentially impacting demand.

- 2025 Tax Outlook: The company anticipates an effective tax rate of 26.5% for 2025, excluding discrete items and new legislation.

Labor Laws and Employment Regulations

Changes in labor laws, such as minimum wage increases, directly affect Haverty's operating expenses. For instance, the federal minimum wage remains at $7.25 per hour, but many states and cities have enacted higher rates. In 2024, numerous states, including California and New York, continued to implement phased increases, pushing their minimum wages well above the federal level. This necessitates adjustments in staffing models and compensation strategies across Haverty's retail and distribution centers.

Employment regulations, including those related to overtime pay, benefits, and worker classification, also shape Haverty's human resource management. Stricter enforcement of these regulations can lead to increased compliance costs. For example, the U.S. Department of Labor's ongoing focus on wage and hour violations means companies like Haverty must ensure accurate record-keeping and adherence to overtime rules, particularly for hourly employees in customer-facing and warehouse roles.

- Minimum Wage Impact: State minimum wages in key Haverty markets, like Texas and Florida, have seen gradual increases, impacting entry-level wages.

- Overtime Regulations: Evolving interpretations of overtime eligibility for salaried employees could necessitate adjustments to compensation structures.

- Worker Classification: Scrutiny of independent contractor versus employee status in the gig economy might influence how Haverty manages certain operational roles.

Government policies, particularly those influencing the housing market, directly correlate with furniture demand. Lower interest rates, anticipated for 2024 and 2025, make mortgages more accessible, stimulating new home construction and sales. This uptick in housing activity translates to increased demand for home furnishings as more people furnish new or recently purchased residences. Furthermore, government initiatives to boost housing supply, such as streamlined zoning laws, can further accelerate this positive cycle for furniture retailers like Haverty.

Trade policies and tariffs represent a significant political factor for Haverty Furniture. Tariffs on imported furniture or raw materials can escalate sourcing costs and necessitate price adjustments. For instance, in early 2024, concerns arose regarding potential new tariffs on goods from Vietnam, a major furniture manufacturing country, highlighting the direct impact on import expenses. The company's agility in adapting its supply chain and sourcing strategies to navigate changing trade agreements is crucial for maintaining financial health.

Corporate and sales tax regulations directly affect Haverty Furniture's profitability and competitive pricing. For 2025, Haverty projects an effective tax rate of 26.5%, a key figure for financial planning, excluding one-time events or new tax legislation. Shifts in these tax structures can influence consumer spending on discretionary items like furniture.

Labor laws, including minimum wage adjustments, directly impact Haverty's operational costs. Many states and cities have raised their minimum wages above the federal $7.25 per hour, as seen with phased increases in California and New York during 2024. This trend requires ongoing adjustments to compensation and staffing models across Haverty's operations. Additionally, employment regulations concerning overtime and worker classification demand strict adherence to prevent compliance issues and associated costs.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Haverty Furniture, covering political, economic, social, technological, environmental, and legal aspects to identify strategic opportunities and threats.

A clear, actionable PESTLE analysis for Haverty Furniture, designed to simplify complex external factors into manageable insights for strategic decision-making.

This Haverty Furniture PESTLE analysis offers a concise overview, enabling teams to quickly identify and address potential market challenges and opportunities.

Economic factors

Consumer confidence is a significant driver for Haverty Furniture, as furniture purchases are often discretionary. While consumer confidence saw some fluctuations, the U.S. Consumer Confidence Index stood at 102.0 in May 2024, indicating a degree of caution among consumers.

Disposable income directly impacts the ability of consumers to afford larger purchases. As of the first quarter of 2024, U.S. real disposable personal income saw an increase, suggesting some potential for increased spending, though inflation remains a factor.

Looking ahead, a projected recovery in global furniture consumption for 2025 and 2026, particularly in Asia-Pacific, could offer a positive backdrop for the broader market, potentially benefiting companies like Haverty through indirect demand shifts and overall economic uplift.

The residential real estate sector significantly influences furniture demand. Factors like home sales volume, new construction starts, and mortgage interest rates are key indicators.

For 2025, a projected 9% uptick in home sales is anticipated, with a further 13% increase expected in 2026. This growth, combined with stabilizing mortgage rates, suggests a favorable environment for furniture retailers.

Inflationary pressures and rising interest rates directly affect consumer spending on discretionary items like furniture. As of early 2024, persistent inflation has eroded purchasing power, while the Federal Reserve's benchmark interest rate, which has been elevated to combat inflation, makes financing larger purchases less attractive. This environment creates a dual challenge for Haverty Furniture: consumers have less disposable income, and borrowing costs for both customers and the company are higher.

The impact of these macroeconomic trends is evident in the furniture market. High interest rates, in particular, have a dampening effect on sales of big-ticket items. Many consumers rely on financing for furniture purchases, and when those financing costs increase, demand typically softens. Industry analysts anticipate this slowdown in furniture sales to continue until there's a noticeable decline in interest rates, suggesting a period of cautious consumer behavior.

Supply Chain Costs and Disruptions

The cost and reliability of global supply chains significantly impact Haverty Furniture's cost of goods sold. Fluctuations in freight expenses and raw material prices directly influence profitability.

The furniture industry continues to grapple with ongoing supply chain complexities. These challenges can affect inventory levels and delivery timelines, posing risks to sales and customer satisfaction.

- Freight Costs: Global shipping rates, while having eased from pandemic peaks, remain a critical factor. For instance, the Drewry World Container Index, which tracks major trade routes, saw rates fluctuate throughout 2024, indicating continued volatility compared to pre-pandemic levels.

- Material Prices: The cost of lumber, textiles, and metals, essential for furniture production, has experienced upward pressure due to various global economic factors and resource availability.

- Disruption Impact: Port congestion and labor shortages, though less severe than in 2021-2022, can still lead to delays and increased operational expenses for companies like Haverty.

Competition and Market Growth

The furniture retail sector is highly competitive, with Haverty Furniture facing rivals ranging from large national chains to smaller independent stores and online-only retailers. This intense competition directly impacts Haverty's ability to capture and maintain market share, influencing its revenue streams and overall growth trajectory. The market's health is therefore a critical consideration.

The global furniture market is projected to expand, showing a positive outlook for companies like Haverty. Specifically, the market is anticipated to grow from an estimated $768.36 billion in 2024 to $822.53 billion in 2025. This growth is fueled by evolving consumer preferences, including a demand for flexible furniture designs and a rising emphasis on sustainable manufacturing and materials.

- Market Growth Projection: The global furniture market is expected to increase from $768.36 billion in 2024 to $822.53 billion in 2025.

- Key Growth Drivers: Demand for flexible furniture designs and sustainable practices are significant contributors to market expansion.

- Competitive Impact: Intense competition within the furniture sector necessitates strategic positioning for Haverty Furniture to capitalize on market growth and protect its share.

Economic factors significantly shape the furniture market, influencing consumer spending and operational costs for companies like Haverty Furniture. Key indicators such as consumer confidence and disposable income directly impact purchasing decisions, while broader trends like inflation and interest rates create a challenging financial landscape.

The residential real estate market, including home sales and mortgage rates, also plays a crucial role in driving furniture demand. A projected increase in home sales for 2025 and 2026, coupled with stabilizing mortgage rates, suggests a more favorable environment for furniture retailers.

Supply chain dynamics, including freight costs and material prices, continue to affect the cost of goods sold and inventory management. Despite some easing from pandemic highs, volatility in shipping rates and raw material costs remain a concern for the industry.

The global furniture market is showing positive growth, projected to expand from $768.36 billion in 2024 to $822.53 billion in 2025, driven by evolving consumer preferences for flexible and sustainable products.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Haverty Furniture |

|---|---|---|---|

| U.S. Consumer Confidence Index | 102.0 (May 2024) | Anticipated to remain steady or slightly improve | Influences discretionary spending on furniture. |

| U.S. Real Disposable Personal Income | Increased in Q1 2024 | Expected to continue moderate growth | Supports consumer ability to afford furniture. |

| Global Furniture Market Growth | $768.36 billion | $822.53 billion | Indicates overall market expansion and opportunity. |

| U.S. Home Sales Projection | Steady | +9% | Drives demand for new furnishings. |

| Interest Rates | Elevated | Stabilizing or gradual decrease | Affects financing costs for consumers and businesses. |

Preview the Actual Deliverable

Haverty Furniture PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This Haverty Furniture PESTLE Analysis provides a comprehensive overview of the external factors impacting the company, including Political, Economic, Social, Technological, Legal, and Environmental considerations. It's designed to offer actionable insights for strategic planning.

Sociological factors

Consumer lifestyles are undergoing significant shifts, impacting furniture preferences. The trend towards smaller living spaces, particularly in urban centers, is driving demand for multifunctional and space-saving furniture solutions. For instance, a 2024 report indicated that 65% of new housing starts in major metropolitan areas are apartments or condos, highlighting this need.

Beyond space efficiency, consumers are increasingly valuing quality and durability. This means a greater emphasis on well-made, long-lasting furniture pieces that offer better long-term value. This preference is reflected in consumer surveys from late 2024, where over 70% of respondents stated that durability was a key factor in their furniture purchasing decisions.

Demographic shifts are significantly reshaping the furniture market. The growing influence of millennials, who represent a substantial portion of consumer spending power, is a key factor. This generation, often dealing with student debt and the high cost of living, is showing a notable preference for more affordable options, including reused and refurbished furniture. In 2024, reports indicated that over 60% of millennials consider sustainability and affordability when making furniture purchases.

Concurrently, the aging baby boomer population is also creating distinct market trends. As many in this demographic downsize their homes, there's an increased demand for smaller, more adaptable furniture pieces. This trend also fuels the secondhand market, as boomers often sell or donate their existing, larger furniture items. The resale furniture market, valued at billions globally, is expected to see continued growth driven by these demographic movements.

The ongoing surge in online shopping and consumers' increasing comfort with digital interactions are fundamentally reshaping Haverty Furniture's approach to reaching customers. This trend means that a robust omnichannel strategy, seamlessly blending online and physical store experiences, is no longer optional but essential for success.

Consumers are increasingly using the internet to research furniture purchases, heavily leaning on detailed product descriptions, high-quality images, and peer reviews before making a decision. This digital-first research phase is critical for Haverty to capture customer attention and build trust.

Projections indicate continued growth in e-commerce for furniture. For instance, the U.S. furniture and bedding market's online share was estimated to be around 20% in early 2024, a figure expected to climb as digital adoption deepens across demographics.

Home Decor and Design Trends

The demand for biophilic design, incorporating elements like plants and natural light, is growing, with studies showing a significant increase in consumer interest for sustainable and nature-inspired home furnishings. This trend directly impacts Haverty's product development, pushing for more pieces made from reclaimed wood and organic textiles.

Smart furniture, featuring integrated charging ports, adjustable settings, and even built-in lighting, is another key trend. By late 2024, the smart home market is projected to reach over $150 billion globally, indicating a strong consumer appetite for technology-enhanced living spaces, which Haverty can leverage.

- Biophilic Design: Increased consumer preference for natural materials and indoor greenery.

- Smart Furniture: Growing market for integrated technology in home furnishings, with global market value expected to exceed $150 billion by end of 2024.

- Sustainability: Consumers are actively seeking eco-friendly and ethically sourced products, influencing material choices and supply chain considerations.

Sustainability and Ethical Consumption

Consumers are increasingly scrutinizing the environmental and social impact of their purchases, making sustainability a key factor in furniture buying decisions. This trend is evident in the growing demand for furniture crafted from recycled materials, sustainably harvested wood, and those produced with fair labor practices. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's sustainability efforts when making purchasing choices, with many willing to pay a premium for eco-friendly options.

Haverty Furniture, like other players in the home furnishings sector, is responding to this shift by emphasizing its commitment to responsible sourcing and manufacturing. This includes showcasing furniture made with materials like reclaimed wood and organic cotton, and highlighting partnerships with suppliers who adhere to ethical labor standards. The company's efforts aim to align with evolving consumer values, recognizing that ethical consumption is no longer a niche market but a mainstream expectation.

- Consumer Demand: Over 60% of consumers in 2024 stated sustainability is a purchasing consideration.

- Willingness to Pay: A significant portion of consumers are willing to pay more for sustainable furniture.

- Material Focus: Growing preference for recycled, reclaimed, and sustainably sourced wood.

- Ethical Sourcing: Increased importance placed on fair labor practices throughout the supply chain.

Societal values are shifting, with a growing emphasis on experiences over possessions and a desire for personalized living spaces. This influences how consumers approach furniture purchases, seeking pieces that reflect their individuality and lifestyle. The rise of the 'creator economy' also means more people are working from home, driving demand for comfortable and functional home office setups.

The increasing awareness of mental well-being is translating into a demand for home environments that promote relaxation and comfort. This translates to preferences for softer textures, calming color palettes, and furniture that supports a hygge lifestyle. Reports from early 2025 indicate a 15% year-over-year increase in searches for 'cozy home' and 'stress-relief furniture'.

Cultural trends, such as the appreciation for artisanal craftsmanship and unique, handcrafted items, are also impacting the furniture market. Consumers are increasingly looking for furniture with a story, moving away from mass-produced goods towards items that offer a sense of authenticity and connection. This is reflected in the growing popularity of independent furniture makers and vintage markets.

| Sociological Factor | Impact on Haverty Furniture | 2024/2025 Data/Trend |

|---|---|---|

| Personalization | Demand for customizable furniture options. | Surveys show 55% of consumers prefer customizable furniture. |

| Wellness & Comfort | Increased demand for ergonomic and aesthetically pleasing home office furniture. | Home office furniture sales grew by 18% in 2024. |

| Authenticity & Craftsmanship | Opportunity to highlight unique designs and quality materials. | Interest in handcrafted furniture has risen by 20% since 2023. |

Technological factors

Haverty Furniture's commitment to developing and optimizing its e-commerce platform is paramount for delivering a smooth online customer journey. This focus directly supports their omnichannel strategy, a key differentiator in the competitive furniture market.

The company's online capabilities are designed to integrate seamlessly with its physical stores, offering customers flexibility in browsing, purchasing, and delivery. This integrated approach is increasingly important as consumers expect consistent experiences across all touchpoints.

In 2023, Haverty reported that its e-commerce segment continued to be a significant driver of growth, reflecting the broader trend of digital transformation in retail. While specific figures for 2024/2025 are still emerging, the company's ongoing investments suggest a continued emphasis on enhancing digital infrastructure and user experience to capture market share.

Augmented Reality (AR) and Virtual Reality (VR) are transforming how customers interact with furniture. By allowing shoppers to virtually place furniture in their own living spaces, these technologies significantly reduce the uncertainty of online purchases. This enhanced visualization helps bridge the gap between digital browsing and the tangible experience of seeing furniture in situ, boosting customer confidence and potentially lowering return rates.

Haverty Furniture is increasingly leveraging data analytics to understand what customers want. By analyzing purchase history and browsing behavior, they can offer personalized product recommendations, which is a key strategy for boosting sales. For instance, in 2024, companies that effectively used customer data saw an average increase in sales conversion rates of 10-15% compared to those who didn't.

Artificial intelligence is at the forefront of this personalization push. AI-powered tools can now provide tailored design advice and suggest furniture that perfectly matches a customer's existing decor or stated preferences. This enhanced customer experience not only drives immediate sales but also significantly improves customer loyalty and retention rates.

Supply Chain Automation and Logistics

Technological advancements are significantly reshaping the furniture retail landscape, particularly in supply chain automation and logistics. Haverty Furniture, like its peers, can leverage innovations in warehouse robotics and advanced inventory management systems to boost efficiency and cut costs. For instance, the global warehouse automation market was valued at approximately $4.5 billion in 2023 and is projected to grow substantially, with many furniture companies exploring these solutions to streamline operations.

Automated production systems are also poised to transform the furniture market. These systems can lead to faster production cycles, improved product consistency, and potentially lower manufacturing expenses. By 2025, it's anticipated that a significant portion of furniture manufacturing will incorporate some level of automation, impacting how quickly and cost-effectively goods can be brought to market.

- Warehouse Automation: Investments in automated guided vehicles (AGVs) and robotic picking systems are becoming more common to speed up order fulfillment.

- Inventory Management: Real-time tracking through RFID and advanced analytics help reduce stockouts and overstocking, improving capital efficiency.

- Logistics Optimization: AI-powered route planning and fleet management software are being adopted to lower transportation costs and delivery times.

- Production Efficiency: Automated assembly lines and 3D printing technologies are starting to impact custom furniture production and prototyping.

Smart Furniture Integration

The increasing integration of technology into furniture, like built-in charging stations and adjustable lighting, is reshaping consumer expectations and opening doors for new product development. Haverty Furniture can capitalize on this trend by expanding its offerings in smart furniture. For instance, the smart home market, which encompasses smart furniture, is projected to reach $177 billion by 2025, indicating substantial growth potential.

Major furniture retailers are actively expanding their smart furniture collections, signaling a significant market opportunity. This includes features like integrated Bluetooth speakers, Wi-Fi connectivity, and even voice-activated controls. As of early 2024, several leading furniture brands have reported a noticeable uptick in consumer interest and sales for their smart furniture lines, with some seeing double-digit percentage growth in this category.

- Growing Smart Home Market: The global smart home market is expected to reach $177 billion by 2025, demonstrating a strong consumer appetite for connected living solutions.

- Retailer Expansion: Key competitors are increasing their smart furniture inventory, pushing the innovation curve and setting new industry benchmarks for tech-enabled home furnishings.

- Consumer Demand for Convenience: Features like wireless charging and adjustable lighting are becoming standard expectations, driving demand for furniture that seamlessly blends technology with comfort.

- Product Development Opportunities: Haverty can leverage this trend by developing innovative furniture pieces that incorporate advanced technological features, potentially leading to premium pricing and increased market share.

Technological advancements are fundamentally reshaping how consumers discover, purchase, and experience furniture. Haverty's investment in its e-commerce platform and omnichannel strategy is crucial for meeting evolving customer expectations. The company's focus on digital integration aims to provide a seamless journey from online browsing to in-store interaction.

Emerging technologies like Augmented Reality (AR) and Virtual Reality (VR) are directly addressing the online purchase uncertainty by allowing customers to visualize furniture in their homes, potentially reducing returns. Furthermore, data analytics and AI are enabling personalized recommendations, a strategy that saw conversion rate increases of 10-15% for data-savvy companies in 2024.

Operational efficiency is also being boosted by technology. Warehouse automation, valued at approximately $4.5 billion in 2023, and AI-driven logistics are streamlining supply chains. By 2025, automation in furniture manufacturing is expected to become more widespread, impacting production speed and cost-effectiveness.

The integration of technology directly into furniture pieces, such as charging stations, is another key trend. The smart home market, including smart furniture, is projected to reach $177 billion by 2025, highlighting a significant opportunity for companies like Haverty to innovate and expand their product lines to meet this growing consumer demand for convenience and connectivity.

Legal factors

Haverty Furniture, like all furniture retailers, must adhere to stringent product safety regulations. This includes federal and state standards for furniture stability, flammability, and the absence of hazardous materials such as lead and formaldehyde. For instance, the STURDY Act, enacted in late 2023, specifically targets furniture tip-over prevention, requiring more robust testing and labeling for dressers and other furniture items.

The U.S. Consumer Product Safety Commission (CPSC) plays a crucial role by establishing and enforcing mandatory safety standards designed to prevent injuries and fatalities associated with consumer products, including furniture. Non-compliance can lead to significant penalties, product recalls, and damage to brand reputation, impacting sales and consumer trust.

Haverty Furniture must navigate a complex web of environmental regulations, impacting everything from manufacturing to material sourcing. Compliance with laws concerning waste disposal and emissions is paramount.

The U.S. Environmental Protection Agency (EPA) sets stringent standards, such as those limiting formaldehyde emissions in composite wood products, a key material in furniture manufacturing. For instance, the EPA's Formaldehyde Emission Standards for Composite Wood Products, implemented in 2024, requires manufacturers to adhere to specific emission limits.

Furthermore, regulations on hazardous air pollutants from surface coatings, like Volatile Organic Compounds (VOCs) in paints and finishes, directly affect Haverty's product development and operational costs. The EPA's National Emission Standards for Hazardous Air Pollutants (NESHAP) for wood furniture manufacturing, last updated in 2023, mandates specific control technologies and work practices to reduce these emissions.

Haverty Furniture must navigate a complex landscape of advertising and marketing laws, ensuring all claims are truthful and substantiated. This means accurately representing product features, pricing, and financing options across all channels, including their website and in-store displays.

Failure to comply can result in significant penalties. For instance, the Federal Trade Commission (FTC) actively enforces truth-in-advertising standards, and in 2023 alone, the FTC initiated numerous actions against companies for deceptive marketing practices, highlighting the critical importance of adherence.

Data Privacy and Security Laws

Haverty Furniture, like many retailers, faces increasing scrutiny and evolving regulations around customer data privacy. With a growing online footprint, safeguarding sensitive information collected through e-commerce and loyalty programs is paramount. Failure to comply with laws such as the California Consumer Privacy Act (CCPA) and potential future federal privacy legislation could result in significant fines and reputational damage. For instance, in 2023, companies faced an average of $5.7 million in data breach costs, highlighting the financial implications of inadequate security measures.

Ensuring robust data security practices is not just a legal obligation but a cornerstone of maintaining customer trust. Haverty's commitment to privacy directly impacts its ability to retain customers and attract new ones in an increasingly data-conscious market. The company must adapt to new privacy frameworks, such as those being developed in response to advancements in AI and data analytics, to remain compliant and competitive.

- Data Privacy Compliance: Adherence to CCPA and emerging federal privacy laws is essential for Haverty Furniture.

- Customer Trust: Strong data protection builds and maintains customer confidence in the brand.

- Legal Penalties: Non-compliance can lead to substantial fines, impacting financial performance.

- Evolving Landscape: Staying ahead of new privacy regulations is critical for long-term operational integrity.

Import/Export Regulations and Trade Compliance

Haverty Furniture must meticulously adhere to customs regulations, import duties, and international trade agreements to effectively manage its global supply chain, particularly with sourcing from various countries. For instance, in 2024, the U.S. International Trade Commission reported that tariffs on imported furniture components can significantly impact cost of goods sold, with some categories seeing increases of up to 15% depending on origin and trade agreements in place.

The evolving landscape of trade policy, especially with potential shifts under a new U.S. administration, introduces further unpredictability. This means Haverty needs to be agile in adapting to changes in import quotas, tariffs, and bilateral trade agreements that could affect the cost and availability of raw materials and finished goods. A recent analysis from the U.S. Chamber of Commerce in early 2025 highlighted that uncertainty around trade pacts can lead to a 5-10% fluctuation in import costs for sectors heavily reliant on international sourcing.

- Customs Compliance: Strict adherence to all import/export documentation and procedures is critical to avoid delays and penalties.

- Tariff Management: Monitoring and strategizing around import duties, which can vary significantly based on product origin and trade agreements, is essential for cost control.

- Trade Agreement Impact: Understanding and leveraging international trade agreements can provide competitive advantages, while changes to these agreements can introduce risk.

- Regulatory Adaptability: The company must remain prepared to adjust its supply chain and sourcing strategies in response to evolving trade policies and regulations.

Haverty Furniture must navigate a complex web of labor laws, including minimum wage requirements, workplace safety standards, and employee classification rules. The Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay, with state laws often mandating higher rates; for example, many states increased their minimum wage in January 2024. Compliance with the Occupational Safety and Health Administration (OSHA) standards is also critical, with fines for violations potentially reaching thousands of dollars per incident, as seen in OSHA's 2023 enforcement actions.

Furthermore, laws governing employee benefits, such as health insurance under the Affordable Care Act (ACA) and retirement plans, add to the legal and administrative burden. The National Labor Relations Act (NLRA) protects employees' rights to organize and bargain collectively, requiring careful management of employee relations and union interactions. Recent trends in 2024 show increased unionization efforts across retail sectors, making adherence to NLRA provisions even more vital for companies like Haverty.

Environmental factors

Consumer demand for eco-friendly products and increasing regulatory pressures are pushing the furniture industry towards sustainable material sourcing. This includes the use of materials like reclaimed wood, bamboo, and recycled metals, reflecting a broader shift in environmental consciousness.

Haverty Furniture, through its HVTerra program initiated in 2010, actively addresses these trends by emphasizing sustainable practices in its product sourcing. This program underscores the company's commitment to environmental responsibility within its supply chain.

Haverty Furniture's operational energy footprint, encompassing its showrooms and distribution centers, is a significant environmental factor. In 2023, the company continued its commitment to enhancing energy performance, building on previous efforts. These initiatives include widespread adoption of LED lighting across its retail locations and the implementation of more sophisticated energy management systems to monitor and optimize consumption.

Haverty Furniture, like many in the retail sector, faces increasing pressure to adopt robust waste management and recycling programs. In 2024, the EPA reported that the furniture and furnishings sector generated approximately 9.7 million tons of municipal solid waste (MSW) in the US. This highlights the significant environmental footprint of the industry, making responsible practices essential for minimizing impact.

The company's commitment to sustainability is reflected in its efforts towards reducing industrial waste. By focusing on durable designs, Haverty aims to extend product lifecycles, aligning with the principles of a circular economy. This approach not only lessens the volume of discarded items but also promotes resource efficiency throughout the value chain.

Carbon Footprint Reduction

Haverty Furniture, like many in the retail sector, faces growing pressure to minimize its environmental impact. This includes a significant focus on reducing its carbon footprint throughout its operations. The company is actively exploring ways to cut greenhouse gas emissions, from the sourcing of raw materials and manufacturing processes to the logistics of getting furniture to customers' homes.

Manufacturers are increasingly adopting sustainable production methods to achieve these reductions. This often involves optimizing energy use in factories, utilizing more eco-friendly materials, and improving the efficiency of transportation networks. For instance, many furniture companies are investing in cleaner fleets or consolidating shipments to lessen their impact.

A key area of focus for businesses like Haverty is the entire supply chain. This means looking at everything from the lumber harvested for furniture frames to the packaging materials used. Many companies are setting targets for emission reductions. For example, some major retailers have committed to achieving net-zero emissions by specific dates, driving innovation in sustainable practices across their supply chains. By 2024, many companies are reporting progress on their sustainability goals, with a notable increase in the use of recycled materials and renewable energy sources in their operations.

- Supply Chain Emissions: Efforts are underway to decrease greenhouse gas emissions from manufacturing and transportation.

- Sustainable Production: Manufacturers are prioritizing eco-friendly practices and material sourcing.

- Logistics Optimization: Companies are looking at ways to make delivery routes more efficient and reduce fuel consumption.

- Material Sourcing: Increased use of recycled and sustainably harvested materials is a growing trend.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly furniture is a significant environmental factor shaping Haverty Furniture's operations. This growing preference for sustainability directly impacts product design, material sourcing, and marketing efforts.

A notable trend is the increasing demand for furniture with green certifications. For instance, in Europe, a substantial percentage of consumers actively seek out and prioritize furniture that meets environmental standards. This highlights a clear market signal for Haverty to integrate more sustainable practices and offerings.

This shift in consumer values means Haverty must adapt its product development to include more recycled, renewable, and responsibly sourced materials. Marketing strategies will also need to emphasize these eco-conscious attributes to resonate with this expanding customer segment.

- Growing Preference: Consumers are increasingly choosing furniture with reduced environmental impact.

- Green Certifications: A significant market driver, especially in regions like Europe, where certified eco-friendly furniture is highly valued.

- Strategic Impact: Influences Haverty's product development, material sourcing, and marketing campaigns.

- Market Opportunity: Presents an avenue for Haverty to differentiate itself and capture market share by aligning with sustainability trends.

The furniture industry faces increasing scrutiny regarding its environmental footprint, prompting a shift towards sustainable practices. Haverty Furniture, through initiatives like its HVTerra program, is responding to this by emphasizing eco-friendly material sourcing and reducing its operational impact. By 2024, the EPA highlighted that the furniture sector generated approximately 9.7 million tons of municipal solid waste in the US, underscoring the need for robust waste management and recycling programs within companies like Haverty.

Consumer demand for green-certified products is a significant environmental factor influencing Haverty Furniture's strategy. This trend is particularly strong in regions like Europe, where a substantial percentage of consumers actively seek out environmentally responsible furniture options. Consequently, Haverty is adapting its product development and marketing to highlight sustainable attributes, aiming to capture market share by aligning with these evolving consumer values.

| Environmental Factor | Haverty's Response/Industry Trend | Relevant Data/Impact |

|---|---|---|

| Sustainable Material Sourcing | Emphasis on reclaimed wood, bamboo, recycled metals (HVTerra program) | Consumer demand for eco-friendly products driving this shift. |

| Energy Consumption | LED lighting adoption, improved energy management systems | Reducing operational energy footprint across showrooms and distribution centers. |

| Waste Management & Recycling | Focus on durable designs, circular economy principles | Industry generated 9.7 million tons of MSW in the US (2024 EPA data), highlighting the need for responsible practices. |

| Carbon Footprint Reduction | Exploring cleaner fleets, consolidated shipments, sustainable production methods | Manufacturers investing in cleaner energy and optimized transportation networks to cut greenhouse gas emissions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Haverty Furniture is built on a comprehensive review of data from government agencies, industry associations, and reputable market research firms. We integrate economic indicators, consumer spending reports, and regulatory updates to provide a thorough understanding of the external factors influencing the furniture retail sector.