Haverty Furniture Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haverty Furniture Bundle

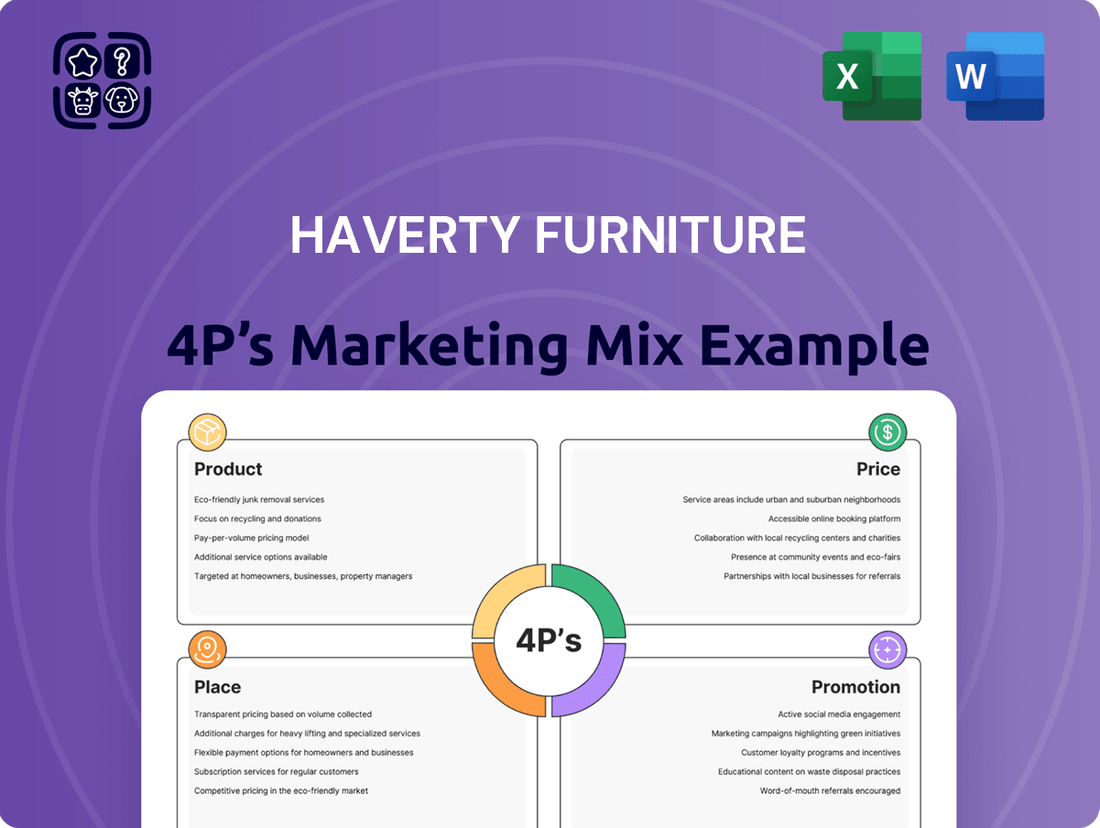

Haverty Furniture strategically leverages its product offerings, competitive pricing, accessible distribution, and targeted promotions to connect with its customer base. This initial glimpse into their 4Ps reveals a cohesive approach to market engagement.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Haverty Furniture. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Haverty Furniture's diverse product offering is a cornerstone of its marketing mix, featuring a wide array of residential furniture and accessories. This extensive selection caters to a broad spectrum of customer tastes and home décor styles, ensuring a comprehensive solution for furnishing living spaces. The company aims to be a one-stop shop for quality home furnishings.

In 2024, Haverty continued to emphasize its broad product assortment, which includes everything from sofas and dining sets to bedroom furniture and decorative accents. This commitment to diversity allows them to appeal to a wide demographic, from first-time homeowners to those looking to update their existing residences. The breadth of their catalog is designed to meet varied aesthetic and functional requirements.

A substantial part of Haverty's furniture selection is offered under its exclusive Havertys brand. This approach allows the company to directly influence product design, features, and value, ensuring alignment with their quality and fashion standards. In 2023, proprietary brands often represent a significant portion of revenue for furniture retailers, contributing to higher margins and brand differentiation.

Haverty Furniture's premium bedding lines, featuring brands like Sealy, Serta, and Tempur-Pedic, significantly enhance their product offering. This strategy allows them to present a complete home furnishing solution, appealing to a broader customer base seeking quality sleep products. In 2024, the mattress market saw continued growth, with premium segments showing resilience, indicating a positive environment for these high-quality offerings.

Integrated Interior Design Services

Haverty Furniture distinguishes its product by offering integrated interior design services, a key element in its marketing mix. This service assists customers in furnishing and decorating their homes, adding significant value to their purchasing experience. Design consultants play a crucial role, contributing to the company's overall success.

These design services elevate Haverty's value proposition by providing expert advice. This guidance empowers customers to make confident decisions and visualize how furniture will integrate into their living spaces. The impact of these services is substantial, as evidenced by their contribution to the company's financial performance.

- Product Differentiation: Integrated interior design services set Haverty apart.

- Value Enhancement: Expert guidance helps customers visualize and choose furniture.

- Financial Impact: Design consultants accounted for 33.4% of Haverty's written business in Q2 2025.

Quality, Fashion, Value, and Service Focus

Haverty's product strategy is deeply rooted in offering customers a compelling blend of quality, fashion-forward design, and exceptional value. This commitment is evident in their carefully curated merchandise mix, which aims to satisfy diverse customer tastes while maintaining a strong emphasis on durability and style. The company's proactive approach to product selection, including the introduction of new items, directly supports their financial performance.

This focus on delivering superior product attributes has demonstrably benefited Haverty's bottom line. For the fiscal year ending December 31, 2023, the company reported a net sales increase of 3.5% to $1.06 billion. Crucially, gross profit margins saw an improvement, reflecting the success of their product strategy in commanding favorable pricing and managing costs effectively.

Haverty's dedication to staying ahead of consumer trends is a key differentiator. They actively monitor market shifts and customer feedback to inform their product development and selection processes. This dynamic approach ensures their offerings remain relevant and appealing, contributing to their ability to achieve positive financial results in a competitive market.

- Quality Focus: Haverty prioritizes durable materials and construction in its furniture selections.

- Fashion Forward: The company continuously updates its product lines to reflect current interior design trends.

- Value Proposition: Haverty aims to provide aesthetically pleasing and well-made furniture at competitive price points.

- Service Integration: Product quality and selection are complemented by a strong emphasis on customer service throughout the buying journey.

Haverty's product strategy centers on a broad, curated selection of residential furniture and accessories, with a strong emphasis on proprietary brands like Havertys. This approach allows for quality control and margin enhancement. The company also strategically includes premium bedding brands, further broadening its appeal and offering a more complete home solution.

The integration of free interior design services significantly differentiates Haverty's product offering, adding substantial value. This service helps customers visualize and select furniture, directly impacting sales and customer satisfaction. In Q2 2025, these design consultants were responsible for 33.4% of Haverty's written business, highlighting their crucial role in the product's success.

Haverty's commitment to quality, fashion-forward design, and value drives its product mix, which contributed to a 3.5% net sales increase to $1.06 billion in fiscal year 2023. This focus on superior product attributes and staying ahead of trends ensures their offerings remain relevant and financially successful in a competitive market.

| Key Product Aspects | Description | Financial Impact/Data |

| Product Assortment | Wide range of residential furniture and accessories, including exclusive Havertys brands. | Supports appeal to diverse demographics. |

| Brand Strategy | Emphasis on proprietary brands for quality control and higher margins. | Proprietary brands often represent significant revenue for furniture retailers. |

| Service Integration | Free interior design services enhance product value and customer experience. | Design consultants accounted for 33.4% of Haverty's written business in Q2 2025. |

| Sales Performance | Focus on quality, fashion, and value drives sales growth. | Net sales increased 3.5% to $1.06 billion in FY 2023. |

What is included in the product

This analysis provides a comprehensive overview of Haverty Furniture's marketing mix, detailing their strategies across Product, Price, Place, and Promotion.

It offers a deep dive into how Haverty Furniture positions itself in the market, ideal for understanding their competitive strategies.

Simplifies Haverty's marketing strategy by presenting the 4Ps as solutions to customer pain points, making complex decisions clearer.

Place

Haverty Furniture boasts an impressive physical presence with 129 showrooms strategically located across 17 states, predominantly in the Southern and Midwestern US. This extensive network is crucial for allowing customers to engage directly with their merchandise. These showrooms are the primary venues where potential buyers can touch, feel, and visualize furniture in person, fostering a more confident purchasing decision.

Haverty Furniture is strategically expanding its physical footprint, aiming to open an average of five new stores annually. The company has allocated approximately $24.0 million in capital expenditures for 2025, specifically targeting new store openings, renovations, and existing store expansions.

This expansion effort is designed to capitalize on prime locations, including former 'big box' retail spaces, and to re-establish a strong presence in significant markets like Houston, Texas. This move signifies a commitment to long-term market penetration and growth, even amidst challenging economic environments.

Haverty's backs its stores with a strong logistics setup, featuring regional distribution centers and dedicated home delivery hubs. This integrated approach is key to managing inventory effectively and getting products to customers on time.

The company strives for an average delivery window of three to five days for items currently in stock. This commitment to reliable service is designed to boost customer happiness and loyalty.

Growing Online Presence

Haverty Furniture actively cultivates a robust online presence, positioning its website as a vital extension of its brick-and-mortar locations. This digital storefront offers innovative tools, including a 3-D room planner and upholstery customization options, significantly enhancing customer convenience and engagement.

The company recognizes the evolving retail landscape and continues to invest in its digital channels. In 2024, online sales represented about 3.0% of Haverty's total revenue. This figure underscores the ongoing strategic imperative to optimize the online experience, aiming to increase sales conversion rates and align with contemporary consumer purchasing behaviors.

- Website as a Digital Showroom: Offers immersive tools like 3-D room planning.

- Customization Capabilities: Upholstery personalization enhances product appeal.

- Online Sales Contribution: Accounted for approximately 3.0% of total sales in 2024.

- Strategic Focus: Continued investment in digital channels to drive online growth.

Customer-Centric Accessibility

Haverty Furniture's 'Place' strategy focuses on making shopping easy and convenient for its main customers, who are often homeowners in suburban areas. They achieve this by carefully choosing showroom locations in key regions and backing them up with a robust online presence and dependable delivery services. This approach ensures customers can find and receive Haverty's products conveniently, boosting sales and customer happiness.

In 2024, Haverty Furniture operates over 100 showrooms across 16 states, primarily in the Southeast and Midwest United States, strategically targeting suburban demographics. Their commitment to accessibility is further demonstrated by their investment in e-commerce, with online sales accounting for a growing portion of their revenue. This dual approach, combining physical retail presence with digital convenience, is crucial for reaching a broad customer base.

- Physical Showrooms: Over 100 locations in 16 states, strategically placed for suburban accessibility.

- Online Presence: A strong e-commerce platform complements physical stores, facilitating convenient browsing and purchasing.

- Logistics and Delivery: Efficient supply chain management ensures timely delivery to customer homes, enhancing the overall customer experience.

Haverty Furniture's 'Place' strategy emphasizes accessibility through a combination of physical showrooms and a robust online presence. The company operates 129 showrooms across 17 states, primarily in the Southern and Midwestern US, ensuring customers can interact with products directly. This physical footprint is complemented by a growing e-commerce platform, which accounted for approximately 3.0% of total revenue in 2024, offering digital tools like a 3-D room planner.

| Metric | 2024 Data | 2025 Projection |

|---|---|---|

| Number of Showrooms | ~129 | ~134 (5 new openings) |

| States with Presence | 17 | 17+ |

| Online Sales % of Total Revenue | ~3.0% | Targeting growth |

| Capital Expenditure for Expansion | N/A | $24.0 million |

Full Version Awaits

Haverty Furniture 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Haverty Furniture's Product, Price, Place, and Promotion strategies, offering a clear understanding of their market approach. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use.

Promotion

Haverty Furniture actively engages its customer base through targeted marketing and advertising. The company's Q2 2025 financial reports indicate a significant uptick in spending on television and interactive marketing channels, demonstrating a commitment to reaching consumers where they are most engaged.

These strategic campaigns are designed to build brand awareness and clearly communicate Havertys' unique value proposition. By highlighting product benefits and key differentiators, the company aims to persuade potential customers and drive purchasing decisions.

Haverty Furniture's in-store design consultant engagement is a pivotal promotional strategy. These consultants are instrumental in fostering customer relationships and driving sales by offering personalized guidance.

In the second quarter of 2025, these design consultants were responsible for a significant 33.4% of all written business. This statistic underscores their direct impact on the company's revenue and customer acquisition.

This hands-on approach not only facilitates the purchasing journey for customers but also builds invaluable trust and loyalty, differentiating Haverty in a competitive market.

Haverty's actively leverages its rich history through significant brand initiatives. For instance, its 140th-anniversary campaign in Q1 2025 was a notable success, driving over $8 million in sales primarily through well-executed email marketing.

These celebratory efforts go beyond immediate revenue generation; they are crucial for reinforcing Haverty's brand heritage and fostering deeper customer loyalty. Such campaigns underscore the company's long-standing commitment to its customer base.

Public Relations and Community Involvement

Haverty Furniture actively cultivates a positive brand image and strengthens community ties through strategic public relations and involvement. These initiatives go beyond product promotion, aiming to build trust and demonstrate corporate citizenship.

In May 2025, Haverty Furniture participated in Military Appreciation Month events, highlighting their commitment to honoring service members. Furthermore, a partnership with Tempur-Pedic supported The Joel Fund, a charity dedicated to providing resources for children with cancer, showcasing a commitment to health and well-being.

These community engagement efforts are not new for Haverty. Previously, the company partnered with the Atlanta Animal Shelter, demonstrating a broader dedication to social responsibility and animal welfare. Such actions resonate with consumers who increasingly value companies that contribute positively to society.

The company's public relations strategy focuses on:

- Brand Enhancement: Building a favorable reputation through visible community support.

- Community Partnerships: Collaborating with non-profits and organizations to address social needs.

- Corporate Social Responsibility: Demonstrating ethical business practices and a commitment to societal well-being.

- Customer Connection: Fostering deeper relationships with customers by aligning with shared values.

Investor Relations and Financial Communications

Haverty Furniture actively engages the financial community through various channels. This includes regular earnings conference calls, detailed investor presentations, and strategic participation in industry conferences. These efforts are designed to provide transparency regarding operational performance, ongoing strategic initiatives, and the company's future outlook.

This proactive communication directly targets financial stakeholders, aiming to build and maintain investor confidence. By offering clear insights into the business, Haverty seeks to attract and retain the capital necessary for growth and operational success.

For example, in their Q1 2024 earnings call, Haverty highlighted a focus on strategic inventory management and continued investment in their omni-channel capabilities. The company's investor relations website provides access to SEC filings, earnings releases, and investor kits, facilitating easy access to critical financial data for analysis.

- Investor Outreach: Haverty utilizes earnings calls, investor days, and industry conferences to connect with financial analysts and investors.

- Transparency: Communications focus on detailing operational results, strategic direction, and future growth prospects.

- Capital Attraction: Effective financial communication is key to fostering investor trust and securing necessary capital.

- Data Accessibility: Key financial reports and presentations are readily available on the company's investor relations portal.

Haverty Furniture's promotional efforts are multifaceted, encompassing advertising, personal selling, and public relations. Their Q2 2025 advertising spend saw a notable increase in television and interactive channels, aiming to boost brand visibility and communicate value. The effectiveness of their in-store design consultants is a key driver, responsible for 33.4% of written business in Q2 2025, highlighting the impact of personalized sales approaches.

Price

Haverty's employs a value-oriented pricing strategy, positioning its furniture and accessories in the middle to upper-middle price segments. This approach is carefully calibrated to appeal to its core demographic: well-educated homeowners with middle to upper-middle incomes who appreciate quality and style.

The company's pricing reflects the perceived value of its durable and fashionable home furnishings, aiming for a sweet spot that is competitive in the market while ensuring healthy profit margins. This strategy underscores Haverty's commitment to delivering tangible value that aligns with consumer expectations for lasting home decor.

Haverty Furniture demonstrates a commitment to robust gross profit margins, achieving 61.2% in the first quarter of 2025 and 60.8% in the second quarter. Management anticipates these margins to remain strong, projecting a full-year 2025 range of 60.0% to 60.5%. This stability is a testament to their strategic approach to product assortment, merchandise selection, and efficient management of freight expenses, showcasing pricing power even amidst market volatility.

Haverty's pricing strategy is closely tied to its promotional cadence, meaning prices are adjusted to align with sales events and marketing campaigns. This allows them to offer attractive discounts, a common tactic in the furniture industry where sales like Presidents' Day or Black Friday can see significant price drops, such as potential 20-30% off select items, to drive volume.

This dynamic pricing helps Haverty capture customer interest through special offers, but it requires careful management to ensure profitability isn't eroded. For instance, during competitive periods like the 2024 holiday season, retailers often engage in price wars, forcing adjustments to remain competitive and avoid losing market share.

Consideration of External Economic Factors

Haverty Furniture's pricing is deeply affected by broader economic trends. For instance, persistent inflationary pressures throughout 2023 and into early 2024 have squeezed household budgets, making consumers more price-sensitive. This economic backdrop, characterized by uncertainty and elevated interest rates, directly impacts discretionary spending on big-ticket items like furniture.

The housing market's performance is another critical external factor. A soft housing market, with slower sales and potentially declining home values, often leads to reduced consumer confidence and a pullback in spending on home furnishings. Haverty must navigate this environment by strategically adjusting its pricing and promotional offers to encourage sales without sacrificing necessary margins.

- Inflationary Impact: Consumer Price Index (CPI) for furniture and bedding saw a notable increase in 2023, impacting raw material costs and consumer purchasing power.

- Interest Rate Environment: The Federal Reserve's benchmark interest rate remained elevated through early 2024, increasing the cost of financing for consumers and potentially dampening demand for financed purchases.

- Housing Market Slowdown: Existing home sales experienced a contraction in 2023 compared to previous years, signaling a potential headwind for furniture retailers reliant on new homeowners.

- Consumer Confidence: Fluctuations in consumer confidence indices during 2023 and early 2024 directly correlate with spending intentions on non-essential goods like furniture.

Capital Management and Shareholder Returns

Haverty Furniture demonstrates a commitment to shareholder returns through prudent capital management. The company's robust balance sheet, notably featuring no outstanding debt and substantial credit access, positions it advantageously for strategic financial decisions. This financial strength underpins their capacity to offer competitive pricing and invest in growth initiatives, all while consistently rewarding shareholders.

The company's dedication to returning value is evident in its dividend policy. For instance, during the first half of 2025, Haverty's distributed $10.4 million in quarterly cash dividends to its investors. This consistent payout reflects a stable financial performance and a focus on providing tangible returns.

- No Outstanding Debt: Haverty's maintains a debt-free capital structure, enhancing financial flexibility.

- Significant Credit Availability: Ample credit lines provide resources for strategic investments and operational needs.

- Consistent Shareholder Returns: The company prioritizes returning capital through dividends and potential share repurchases.

- Dividend Payouts: In H1 2025, $10.4 million was paid in quarterly cash dividends.

Haverty's pricing strategy is a careful balance of value, quality, and market competitiveness, aiming for the mid-to-upper price tiers. This positioning resonates with their target demographic of educated homeowners who prioritize durability and style. The company's ability to maintain strong gross profit margins, projected at 60.0% to 60.5% for the full year 2025, demonstrates effective merchandise selection and cost management, allowing for competitive pricing while ensuring profitability.

Promotional activities are integral to Haverty's pricing, with prices often adjusted for sales events. This dynamic approach, common in the furniture sector, can involve discounts of 20-30% during key periods, driving sales volume. However, this necessitates careful margin management, especially during competitive seasons like the 2024 holiday period, where price adjustments are crucial to maintain market share.

External economic factors significantly influence Haverty's pricing decisions. Inflationary pressures in 2023-2024 made consumers more price-sensitive, impacting discretionary spending on items like furniture. Similarly, a slowdown in the housing market, with fewer existing home sales in 2023, can reduce demand, prompting strategic pricing and promotional adjustments to stimulate sales without compromising profit margins.

Haverty's financial health, including its debt-free status and substantial credit availability, supports its pricing flexibility and shareholder returns. The company distributed $10.4 million in quarterly cash dividends in the first half of 2025, reflecting financial stability and a commitment to rewarding investors, which indirectly supports their pricing power by signaling a well-managed business.

| Metric | Q1 2025 | Q2 2025 (Projected) | Full Year 2025 (Projected) |

|---|---|---|---|

| Gross Profit Margin | 61.2% | 60.8% | 60.0% - 60.5% |

| Dividend Payout (H1 2025) | $10.4 million | ||

| Debt Status | None Outstanding | ||

4P's Marketing Mix Analysis Data Sources

Our Haverty Furniture 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.