Haverty Furniture Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haverty Furniture Bundle

Haverty Furniture faces significant competitive pressures, particularly from the threat of new entrants and the bargaining power of buyers in the furniture market. Understanding these dynamics is crucial for navigating the industry. Ready to move beyond the basics? Get a full strategic breakdown of Haverty Furniture’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly impacts the furniture industry. If a few dominant manufacturers control key materials or finished products, their leverage over companies like Haverty Furniture grows, potentially driving up costs. This is especially true for specialized components that define Haverty's premium brand image.

Haverty Furniture's emphasis on quality and a wide array of styles means that if their suppliers provide highly differentiated or proprietary inputs, those suppliers gain significant bargaining power. This is particularly true for unique designs or patented components that are essential to Haverty's product line and lack easy substitutes. For example, if a key supplier offers exclusive upholstery fabrics or specialized wood treatments that define Haverty's premium collections, that supplier can command better terms.

Switching suppliers for Haverty Furniture isn't a simple flip of a switch. It can involve substantial costs, like retooling manufacturing equipment, setting up new quality control protocols, and managing potential disruptions to their existing supply chain. These expenses make it less appealing for Haverty to jump ship even if prices from a current supplier increase.

The higher these switching costs, the more leverage existing suppliers hold over Haverty. For instance, if a key fabric supplier demands a price hike, Haverty might be hesitant to find a new one if the cost of vetting and integrating a new supplier outweighs the savings. This dynamic applies across the board, from those providing raw lumber to manufacturers of finished upholstery.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers presents a significant challenge for Haverty Furniture. If key component suppliers or even finished furniture manufacturers possess the capability and motivation to enter the retail market directly, they could open their own showrooms or bolster their direct-to-consumer online sales channels. This move would diminish Haverty's dependence on these suppliers, simultaneously granting the suppliers increased leverage in price and terms negotiations.

For example, a large furniture manufacturer could leverage its existing production scale and brand recognition to establish its own retail presence, directly competing with Haverty. This could lead to a scenario where suppliers dictate terms rather than being dictated to. In 2024, the furniture industry continued to see a rise in direct-to-consumer (DTC) models, with many manufacturers exploring or expanding these avenues to capture a larger share of the profit margin, a trend that directly impacts retailers like Haverty.

- Supplier Capability: Manufacturers with established brand recognition and efficient production lines are better positioned for forward integration.

- Incentive to Integrate: Capturing higher retail margins and gaining direct customer relationships are strong motivators for suppliers.

- Market Impact: Successful forward integration by suppliers can lead to increased competition and reduced bargaining power for retailers like Haverty.

Importance of Haverty to Suppliers

Haverty's significance to its suppliers directly impacts their bargaining power. If Haverty constitutes a substantial portion of a supplier's revenue, that supplier is more likely to offer competitive pricing and favorable contract terms to retain the business. For instance, if a key furniture component manufacturer derives 20% of its annual sales from Haverty, they have a vested interest in maintaining a strong relationship.

Conversely, when Haverty represents a minor client for a large-scale supplier, the supplier's leverage increases. In such scenarios, the supplier is less dependent on Haverty's volume, allowing them to dictate terms more assertively. This dynamic is particularly relevant in the furniture industry where consolidation among suppliers can lead to fewer, larger players with greater market influence.

Consider the case of a major mattress manufacturer supplying Haverty. If this manufacturer also supplies a significant number of other large retailers, Haverty's order volume might be a smaller percentage of their total output. This reduces Haverty's ability to negotiate aggressively on price or delivery schedules, as the supplier can easily reallocate production to other clients.

- Supplier Dependence: A supplier's reliance on Haverty's business is a key determinant of their bargaining power.

- Revenue Share: The percentage of a supplier's total revenue generated from Haverty influences negotiation leverage.

- Market Concentration: The number and size of alternative suppliers available to Haverty affect supplier power.

- Haverty's Purchasing Volume: The sheer scale of Haverty's orders can shift bargaining power towards the retailer.

The bargaining power of suppliers to Haverty Furniture is a critical factor in its profitability. When suppliers are concentrated, offer unique inputs, or face low switching costs for Haverty, their power increases, potentially driving up costs for the retailer. Conversely, Haverty's substantial purchasing volume and the availability of alternative suppliers can diminish supplier leverage.

In 2024, the furniture industry continued to experience supply chain volatility, with some raw material prices, like lumber and certain metals, seeing fluctuations that could empower suppliers. For example, disruptions in global shipping and manufacturing hubs in Asia in late 2023 and early 2024 meant that suppliers of specialized components or finished goods from these regions could command higher prices due to increased lead times and logistical challenges.

Haverty's reliance on specific, high-quality materials for its premium product lines means that suppliers of these differentiated inputs hold considerable sway. If a supplier provides exclusive upholstery fabrics or patented hardware that are integral to Haverty's brand appeal, they are in a strong position to negotiate favorable terms.

| Factor | Impact on Haverty | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power | Ongoing consolidation in some raw material sectors |

| Input Differentiation | Unique inputs grant suppliers leverage | Key for Haverty's premium product lines |

| Switching Costs | High costs empower existing suppliers | Retooling and quality control integration are significant hurdles |

| Forward Integration Threat | Suppliers entering retail can dictate terms | Rise of DTC models in 2024 increased this threat |

| Haverty's Dependence on Supplier | Low dependence strengthens supplier power | Major suppliers may have many clients, reducing Haverty's influence |

What is included in the product

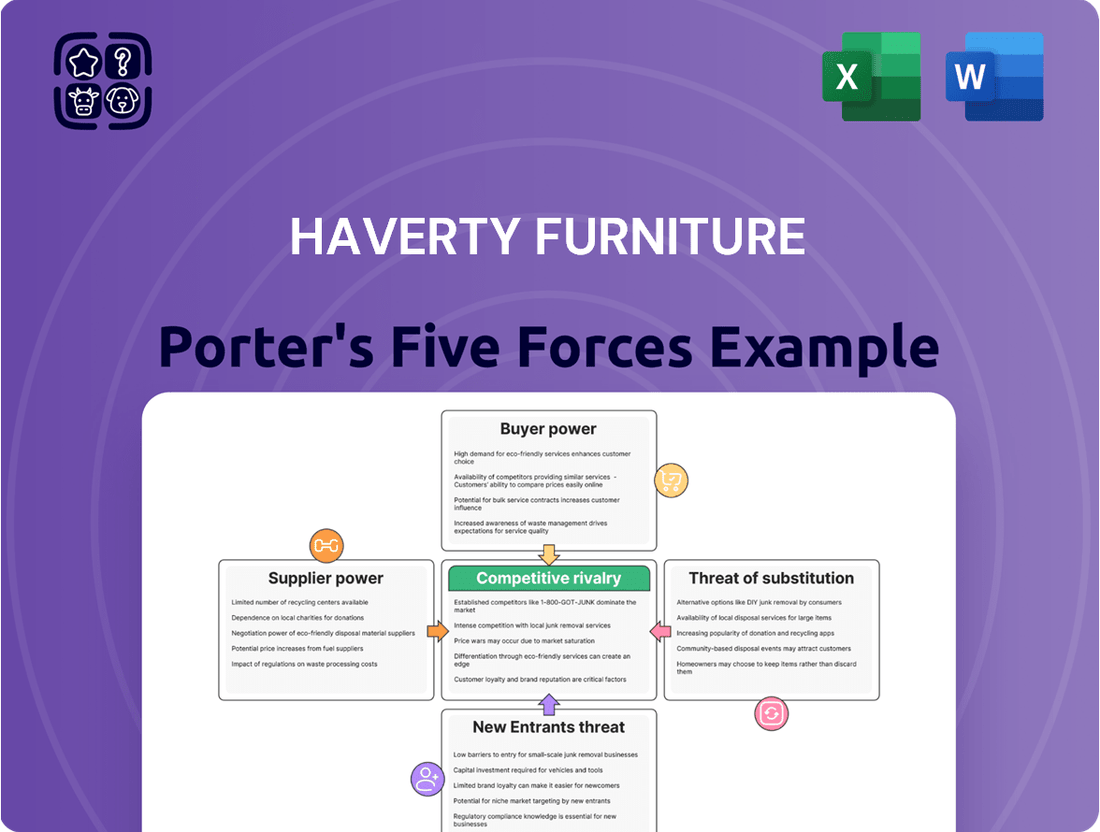

A Haverty Furniture Porter's Five Forces Analysis reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the furniture retail industry.

Instantly identify and address competitive threats with a clear, actionable breakdown of each Porter's Five Force, empowering strategic adjustments.

Gain a comprehensive understanding of market pressures, allowing for proactive mitigation of risks and identification of new opportunities.

Customers Bargaining Power

Customers in the furniture market, especially for items that are not essential, tend to be very sensitive to price. This is especially true when the economy isn't doing well or when prices are generally going up. For instance, in 2023, consumer spending on durable goods like furniture saw shifts as inflation persisted, impacting household budgets.

While Haverty's customers often look for good quality home furnishings, they are still likely to consider price. The furniture market is quite competitive, with many options available. This means Haverty has to make sure its prices are attractive to keep customers choosing them over rivals.

This price sensitivity puts pressure on Haverty to maintain competitive pricing. If prices are too high, customers might look elsewhere, potentially affecting Haverty's ability to achieve higher profit margins on its sales.

The furniture market is incredibly crowded, with customers having a vast selection of retailers to choose from. This includes everything from large chains like IKEA and Ashley Furniture to smaller, independent boutiques and high-end designer showrooms. In 2024, the online furniture market alone saw significant growth, with many direct-to-consumer brands offering competitive pricing and convenience.

This abundance of choices, coupled with the increasing popularity of online marketplaces and even second-hand furniture platforms, means customers can easily find alternatives if Haverty's prices or product selection don't meet their expectations. For instance, the resale market for furniture is booming, offering budget-friendly options that directly compete with new purchases.

Customers today wield significant power due to unprecedented access to information. Online reviews, price comparison tools, and digital showrooms empower consumers to thoroughly research furniture products, compare pricing across numerous retailers, and understand competitor offerings. This heightened transparency allows them to make more informed purchasing decisions and confidently negotiate for better value, directly impacting furniture retailers like Haverty Furniture.

Differentiation of Haverty's Products and Services

Haverty's strategy to differentiate its furniture through quality, a wide array of styles, and complimentary interior design services directly counters customer bargaining power. When customers perceive these offerings as unique and highly valuable, their sensitivity to price diminishes, effectively weakening their leverage.

Key differentiators for Haverty include their commitment to customer service and personalized in-home design consultations. These services add significant value beyond the product itself, fostering customer loyalty and reducing the likelihood of customers switching to competitors based solely on price.

- Quality Materials and Craftsmanship: Haverty emphasizes durable materials and construction, aiming to build a reputation for longevity that commands a premium and reduces price sensitivity.

- Diverse Style Selection: Offering a broad spectrum of furniture styles, from traditional to contemporary, allows Haverty to appeal to a wider customer base and cater to specific aesthetic preferences, making their offerings less substitutable.

- Interior Design Services: Complimentary design consultations provide added value, assisting customers in making choices and creating cohesive living spaces, which can increase customer commitment and reduce their focus on price alone.

Switching Costs for Customers

For most furniture purchases, the financial and logistical hurdles for customers to switch retailers are quite low. Consumers can readily compare prices and styles across numerous brick-and-mortar stores and online platforms without significant effort or expense.

However, Haverty Furniture may experience a degree of soft switching cost stemming from the emotional investment customers make in selecting furniture that fits their personal style and home aesthetic. The convenience and perceived value of Haverty's in-home design services or personalized consultations can also foster customer loyalty, making a complete switch less appealing for those who have utilized these offerings.

- Low Financial Switching Costs: Customers face minimal upfront costs when changing furniture providers.

- Ease of Comparison: The retail landscape allows for easy price and product comparisons.

- Emotional Investment: Personal taste and the effort to find suitable pieces can create a soft barrier.

- Value of Services: Haverty's design assistance can increase customer stickiness.

Customers possess significant bargaining power in the furniture sector due to the wide availability of alternatives and price sensitivity, especially for non-essential items. In 2024, the online furniture market continued its expansion, presenting consumers with numerous direct-to-consumer brands offering competitive pricing and convenience, further amplifying customer leverage.

Haverty counters this by emphasizing quality, diverse styles, and complimentary interior design services. These differentiators aim to build customer loyalty and reduce the focus on price alone, as seen with their personalized consultations, which add value beyond the product itself.

The low financial switching costs for customers, coupled with the ease of comparing prices and products across various platforms, mean customers can easily find alternatives. However, the emotional investment in finding the right style and the value derived from Haverty's design services can create soft barriers to switching.

| Factor | Impact on Haverty | Mitigation Strategy |

|---|---|---|

| Price Sensitivity | High, especially during economic downturns. Consumer spending on durable goods like furniture adjusted in 2023 due to inflation. | Competitive pricing, value-added services. |

| Availability of Substitutes | Extensive, from large chains to online DTC brands and resale markets. The online furniture market saw significant growth in 2024. | Product differentiation, brand loyalty programs. |

| Information Availability | High due to online reviews, comparison tools, and digital showrooms. | Highlighting unique selling propositions, customer testimonials. |

| Switching Costs | Generally low financially, but soft costs exist through emotional investment and service utilization. | Enhancing customer experience, personalized services. |

Preview Before You Purchase

Haverty Furniture Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Haverty Furniture's Porter's Five Forces Analysis, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the furniture industry. This comprehensive analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The furniture retail sector is intensely competitive, with a broad spectrum of companies. Major national players such as Ashley HomeStore, IKEA, and Wayfair compete alongside numerous smaller, independent shops and pure online retailers, creating a dynamic and challenging environment for Haverty Furniture.

The U.S. furniture market is anticipated to see growth, but its pace is influenced by economic stability and housing market trends. Consumer spending on discretionary items like furniture can be sensitive to these economic shifts.

A moderate industry growth rate, while positive, can heighten competitive pressures. Companies may find themselves vying more intensely for market share when the overall expansion is not robust.

For instance, the U.S. furniture and bedding stores sector experienced a sales increase of approximately 3.1% in 2023, reaching an estimated $124.3 billion. While this indicates growth, a projected slower growth rate of around 2.5% for 2024 suggests continued, if not intensified, rivalry among players like Haverty Furniture.

Haverty Furniture aims to stand out by offering a wide array of styles and emphasizing quality craftsmanship and design consultation services. However, many rivals are also actively differentiating themselves, often through aggressive pricing strategies, exclusive product collections, or by enhancing their online presence and e-commerce capabilities. For instance, in 2024, the furniture industry saw continued investment in digital platforms, with many retailers expanding their online catalogs and virtual showroom options to capture market share.

Exit Barriers for Competitors

Haverty Furniture, like many in the retail sector, faces competitive rivalry intensified by high exit barriers. Significant investments in physical showrooms and extensive distribution networks represent substantial fixed assets. These assets make it financially challenging for underperforming competitors to simply close up shop and leave the market.

This situation can prolong the presence of struggling businesses, leading to increased price competition and aggressive promotional tactics as companies fight to maintain market share and revenue. For instance, in 2023, the furniture retail sector saw an average operating margin of around 4.5%, indicating that even small shifts in pricing or sales volume can significantly impact profitability and encourage companies to stay in the game despite losses.

- High Fixed Assets: Showrooms and distribution centers represent sunk costs, making exit difficult.

- Market Persistence: Unprofitable competitors may remain active due to these barriers.

- Intensified Rivalry: Prolonged market presence fuels price wars and aggressive sales tactics.

Fixed Costs and Capacity Utilization

Furniture retailers like Haverty Furniture typically face substantial fixed costs. These include expenses for maintaining large showrooms, managing extensive inventory, and operating complex logistics networks. For instance, in 2024, retail rent and property taxes remain significant overheads for brick-and-mortar stores.

To offset these high fixed costs, companies like Haverty must achieve high capacity utilization. This means selling a large volume of furniture to spread the fixed costs over more units. This pressure often drives aggressive pricing strategies and frequent promotional sales to boost customer traffic and sales volume.

- High Fixed Costs: Showroom leases, inventory holding, and distribution networks represent major fixed expenses for furniture retailers.

- Capacity Utilization Drive: Retailers are motivated to maximize sales to cover these fixed costs, leading to competitive pressures.

- Pricing and Promotions: To achieve higher sales volumes, furniture companies frequently engage in price reductions and special offers.

- Impact on Rivalry: This dynamic intensifies competition as firms vie for market share by offering attractive deals.

Competitive rivalry in the furniture sector remains a significant force for Haverty Furniture. The presence of numerous national, regional, and online competitors, each vying for consumer attention, means differentiation is key. For instance, in 2024, the furniture market continues to see aggressive online marketing and diverse product offerings from players like Wayfair and direct-to-consumer brands, forcing established retailers to adapt.

Haverty, like its peers, must navigate a landscape where competitors often employ price-based strategies to capture market share, especially given the industry's sensitivity to economic conditions. The U.S. furniture and bedding stores sector's projected 2.5% growth in 2024, following a 3.1% increase in 2023, indicates a market that is expanding but still requires substantial effort to gain ground.

The high fixed costs associated with brick-and-mortar retail, such as showroom maintenance and inventory, compel furniture companies to push for sales volume. This often translates into frequent promotions and discounts, intensifying the competitive pressure on all players, including Haverty Furniture, to maintain profitability and market presence.

| Competitor Type | Key Strategy Example (2024) | Impact on Rivalry |

|---|---|---|

| National Retailers (e.g., Ashley HomeStore) | Broad product assortment, extensive store network | Sets benchmark for scale and accessibility |

| Online Pure-Plays (e.g., Wayfair) | Vast online selection, efficient logistics, digital marketing | Drives e-commerce innovation and price transparency |

| Specialty/Boutique Stores | Unique designs, personalized service, premium positioning | Appeals to niche segments, challenges broad-market appeal |

| Discount Retailers | Aggressive pricing, frequent sales events | Puts pressure on margins for all competitors |

SSubstitutes Threaten

Customers have a wide array of options for home furnishing and decoration that don't involve buying new furniture from companies like Haverty. They might repurpose or update their current pieces, embark on DIY projects to personalize their spaces, or even embrace minimalist lifestyles that reduce the need for extensive furnishings. These alternatives fulfill the same core desire for attractive and functional living environments.

In 2024, the trend towards upcycling and DIY home decor saw significant growth, with online platforms and social media showcasing millions of creative transformations. This indicates a strong consumer interest in personalized and cost-effective decorating solutions, directly impacting the demand for new furniture purchases.

The cost of alternative solutions can be significantly lower than purchasing new furniture from a specialty retailer like Haverty. For instance, the used furniture market, which saw substantial growth in 2024 with many consumers seeking value, offers a budget-friendly approach. Many second-hand furniture platforms reported increased sales volumes, with some seeing year-over-year growth exceeding 15% by late 2024.

Options like furniture rentals are also gaining traction, particularly among younger demographics and those in transitional housing situations. Rental services often provide flexible payment plans and the ability to swap pieces, which can be more appealing than a large upfront purchase. In 2024, the furniture rental market continued its expansion, with reports indicating a steady rise in subscription-based models.

Furthermore, consumers can opt for more economical ways to update their living spaces, such as re-arranging existing furniture, DIY refurbishing projects, or purchasing accent pieces from mass-market retailers. These strategies allow individuals to achieve a refreshed look without the significant investment required for high-end furniture, directly impacting demand for premium providers like Haverty.

While Haverty focuses on quality, the appeal of substitutes, like vintage or upcycled furniture, can be strong. For instance, the resale market for furniture has seen significant growth, with platforms like Chairish reporting a 30% increase in sales in 2023, highlighting consumer interest in unique and often more affordable alternatives.

Aesthetic preferences are subjective; some consumers find the charm and character of pre-owned or repurposed items more appealing than mass-produced new furniture. This perception can directly impact demand for Haverty's offerings, especially when these substitutes are perceived as equally or more stylish.

Changing Consumer Preferences and Lifestyles

Shifting consumer tastes and living habits pose a significant threat. For instance, a growing preference for minimalism and a focus on experiences rather than accumulating physical goods can directly impact the demand for furniture. Many consumers are also opting for smaller living spaces, which naturally reduces the need for extensive furniture sets.

Furthermore, the rise of alternative consumption models directly substitutes traditional furniture ownership. Rental furniture services and subscription-based models offer flexibility and lower upfront costs, presenting a compelling alternative for consumers who may not want to commit to purchasing furniture outright.

Consider these key trends:

- Minimalism: A growing segment of consumers actively seeks to reduce possessions, directly impacting the volume of furniture purchased.

- Smaller Living Spaces: Urbanization and changing housing trends mean many consumers have less space, leading to a demand for multi-functional or smaller furniture pieces, or simply less furniture overall.

- Experiences Over Goods: The "experience economy" sees consumers prioritizing travel, dining, and entertainment, potentially diverting spending away from durable goods like furniture.

- Rental and Subscription Services: Companies offering furniture rental or subscription plans provide a direct substitute for purchasing, especially appealing to younger demographics or those in transitional living situations.

Technological Advancements in Home Furnishing

Technological advancements are increasingly presenting substitutes for traditional home furnishings. Smart home technology and virtual reality (VR) tools, for instance, allow consumers to visualize and plan their living spaces digitally. This can reduce the need for physical purchases if existing items can be re-imagined or if digital solutions offer sufficient aesthetic satisfaction.

- Digital Visualization Tools: Platforms like IKEA Place or Wayfair's View in Room utilize augmented reality (AR) to let customers see furniture in their own homes before buying, potentially lowering impulse purchases.

- Virtual Staging: Real estate professionals increasingly use virtual staging to furnish empty properties, showcasing potential without the need for actual furniture, thereby reducing demand for temporary or display furnishings.

- DIY and Upcycling Trends: Online tutorials and platforms promoting DIY furniture creation or upcycling existing items offer cost-effective and personalized alternatives to buying new. In 2024, searches for DIY home decor projects saw a significant uptick.

The threat of substitutes for Haverty Furniture is substantial, driven by a growing consumer preference for cost-effectiveness and personalization. Many customers are exploring alternatives like upcycling, DIY projects, and the robust used furniture market, which saw significant growth in 2024. These options fulfill the desire for attractive living spaces without the premium price tag of new furniture.

Furniture rental services are also gaining traction, offering flexibility and lower upfront costs, particularly appealing to younger demographics. This trend directly challenges traditional ownership models. For instance, by late 2024, several furniture rental platforms reported year-over-year sales increases exceeding 15%, indicating a strong shift in consumer behavior.

The availability of budget-friendly options, from mass-market retailers to second-hand marketplaces, provides consumers with numerous ways to refresh their homes. These substitutes often cater to evolving tastes, such as minimalism, and changing living situations, directly impacting demand for new, higher-priced furniture.

While Haverty emphasizes quality, the allure of unique, pre-owned, or repurposed items is undeniable. The resale market, which saw platforms like Chairish report a 30% sales increase in 2023, highlights a consumer willingness to embrace alternatives that offer both character and value.

| Substitute Category | 2024 Trend/Data Point | Impact on Haverty |

|---|---|---|

| Used Furniture Market | Sales growth exceeding 15% for some platforms by late 2024 | Direct price competition, reduced demand for new items |

| DIY & Upcycling | Significant uptick in online searches for DIY projects in 2024 | Reduced need for new furniture purchases, focus on personalization |

| Furniture Rental/Subscription | Continued expansion of subscription-based models | Alternative to ownership, appealing to flexible consumer needs |

| Resale Market (e.g., Chairish) | 30% sales increase in 2023 | Offers unique, often more affordable, alternatives |

Entrants Threaten

Entering the traditional furniture retail space, particularly with a brick-and-mortar model akin to Haverty Furniture, demands significant upfront capital. This includes substantial outlays for prime real estate, stocking a diverse inventory, and establishing efficient distribution channels. For instance, in 2024, the average cost to open a mid-sized furniture store could easily range from $500,000 to over $2 million, depending on location and scale.

These considerable capital requirements serve as a formidable barrier to entry for potential new competitors. The sheer financial commitment needed to establish a competitive presence, from securing prime retail locations to managing extensive inventory and logistics, deters many smaller or less-funded entities from entering the market, thereby protecting established players like Haverty.

Haverty Furniture benefits immensely from its brand loyalty and established reputation, cultivated over more than a century. This long-standing presence has made the Haverty name synonymous with quality and dependable service in the furniture industry.

For any new competitor aiming to enter this market, replicating Haverty's level of trust and brand recognition would require substantial investment in marketing and a considerable amount of time.

This makes it a significant hurdle for new entrants to effectively capture market share from an already deeply entrenched and trusted brand like Haverty.

Haverty Furniture Company boasts a significant advantage through its established network of showrooms and robust supply chain relationships. New competitors would find it difficult to replicate this extensive physical presence and secure prime retail locations, a crucial element for customer accessibility in the furniture market.

Building efficient logistics and forging reliable partnerships with furniture manufacturers are also significant hurdles for new entrants. In 2023, Haverty reported approximately $967 million in net sales, underscoring the scale of operations required to compete effectively and the capital investment needed to establish comparable distribution capabilities.

Economies of Scale

Haverty Furniture, like many established retailers, benefits significantly from economies of scale. This means their larger operational size allows for lower per-unit costs in key areas such as purchasing inventory, executing marketing campaigns, and managing their distribution network. For instance, in 2023, furniture retailers with higher sales volumes often secured better bulk discounts from manufacturers, a crucial advantage in a sector with tight margins. This cost efficiency enables them to maintain competitive pricing, a vital factor for consumers, especially in the current economic climate.

New entrants to the furniture market face a substantial hurdle in achieving comparable economies of scale. Starting with a smaller footprint, they cannot leverage the same purchasing power as established giants like Haverty. This disparity in cost structure puts them at an immediate disadvantage, making it harder to compete on price. For example, a new online-only furniture store in 2024 might find it challenging to match the landed cost of goods that a national chain like Haverty can achieve due to its established supplier relationships and volume commitments.

- Economies of Scale: Established furniture retailers like Haverty Furniture leverage bulk purchasing power, leading to lower per-unit costs for inventory and materials.

- Marketing Efficiency: Larger companies can spread marketing expenses over a broader customer base, reducing the cost per acquisition compared to smaller, newer competitors.

- Distribution Network: Existing players often have more efficient and cost-effective distribution and logistics networks, built over years of operation.

- Competitive Pricing: The cost savings from economies of scale allow established firms to offer more competitive pricing, creating a barrier for new entrants who cannot match these efficiencies.

Government Regulations and Policies

While the furniture industry isn't as intensely regulated as some others, new entrants to the market, including those aiming to compete with established players like Haverty Furniture, must still contend with a range of government regulations and policies. These can include local zoning laws that dictate where businesses can operate, building codes that must be adhered to for store construction and safety, and consumer protection regulations designed to ensure fair business practices. Navigating these requirements can add significant upfront costs and time delays for new companies.

Furthermore, shifts in trade policies present a notable threat. For example, changes in tariffs on imported furniture components or finished goods can significantly impact the cost structure of new entrants, especially those that rely on international supply chains. In 2024, for instance, ongoing discussions around global trade agreements and potential tariffs on goods from major manufacturing hubs could introduce substantial unpredictability. This can make it challenging for new businesses to forecast their profitability and competitive pricing strategies.

- Zoning Laws: Local ordinances can restrict where furniture stores can be established, impacting site selection and accessibility.

- Building Codes: Compliance with safety and construction standards adds to the initial capital investment for new entrants.

- Consumer Protection: Regulations regarding product safety, warranties, and advertising must be followed, increasing operational complexity.

- Trade Policies: Tariffs and import/export regulations can directly affect the cost of goods and the viability of certain supply chains for new furniture businesses.

The threat of new entrants for Haverty Furniture is moderate. Significant capital investment is required for real estate, inventory, and distribution, with new store openings potentially costing upwards of $500,000 to over $2 million in 2024. Established brand loyalty and extensive supply chain networks also present considerable hurdles for newcomers aiming to compete with Haverty's century-long presence and operational scale.

Porter's Five Forces Analysis Data Sources

Our Haverty Furniture Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports from firms like IBISWorld, financial disclosures from Haverty's investor relations website, and broader economic indicators to assess competitive pressures.