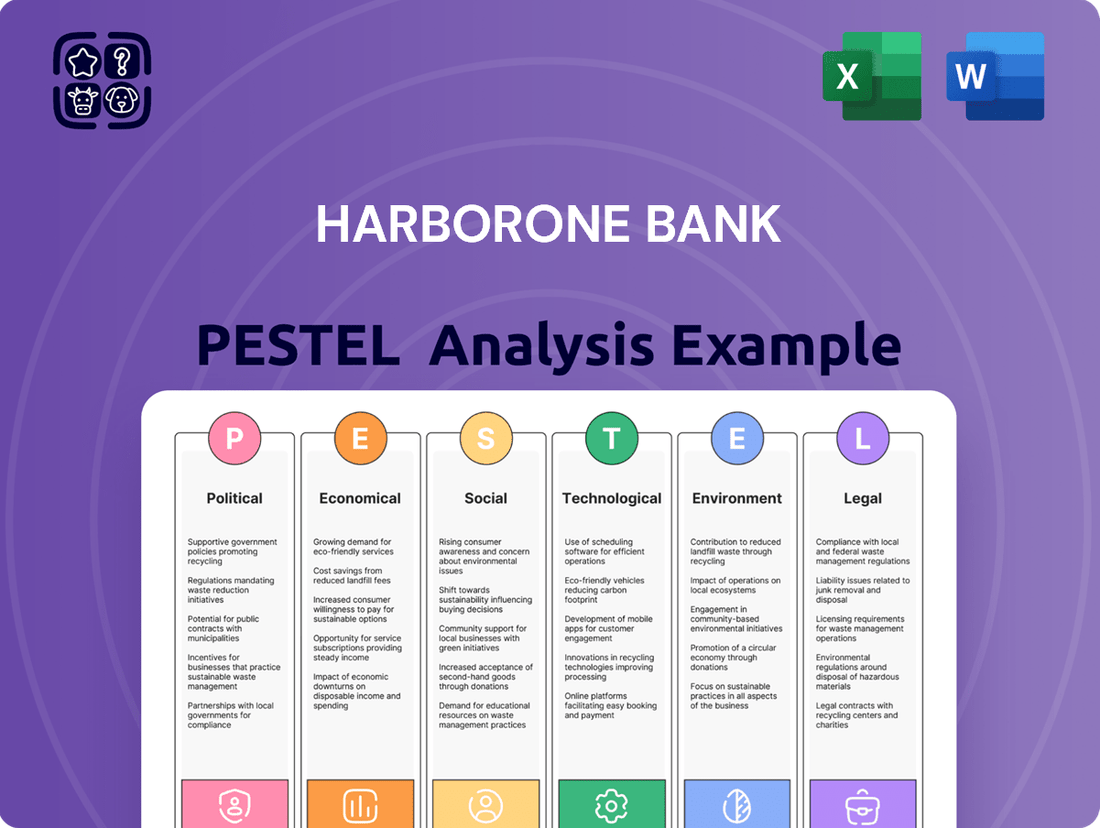

HarborOne Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HarborOne Bank Bundle

Gain a critical understanding of the external forces shaping HarborOne Bank's strategic landscape. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting its operations and future growth. Don't guess about the market; know it intimately.

Unlock actionable intelligence to inform your investment or business strategy. This comprehensive PESTLE analysis for HarborOne Bank provides the crucial insights you need to anticipate challenges and capitalize on opportunities. Download the full version now and equip yourself with a significant competitive advantage.

Political factors

HarborOne Bank, operating as a full-service community bank, is particularly sensitive to evolving government regulations and banking policies. For instance, the Federal Reserve's monetary policy decisions directly influence interest rates, impacting HarborOne's net interest margin and the demand for its loan products. In 2024, the Federal Reserve maintained a target federal funds rate range of 5.25%-5.50% for much of the year, a factor that directly shaped lending costs and profitability for banks like HarborOne.

Furthermore, regulatory bodies such as the FDIC set crucial capital requirements and operational guidelines. These mandates, like the proposed Basel III endgame rules that could increase capital requirements for larger banks, influence how HarborOne manages its risk exposure and conducts its day-to-day operations. Adherence to these stringent rules is paramount for maintaining financial stability and public trust.

Government economic policies significantly shape the banking landscape. For instance, the U.S. Federal Reserve's interest rate decisions directly impact lending profitability and deposit costs. In 2024, the Fed's cautious approach to rate cuts, aiming to curb inflation which stood at 3.4% year-over-year as of April 2024, created a mixed environment for banks like HarborOne, with higher net interest margins but also potential headwinds for loan demand.

Financial stability initiatives are also crucial. Regulations designed to bolster capital adequacy, such as those outlined by the Basel III framework, influence how banks like HarborOne manage risk and maintain liquidity. These policies, often a response to past economic downturns, aim to create a more resilient banking system, impacting HarborOne's operational strategies and capital requirements.

Changes in corporate tax rates directly influence HarborOne Bank's bottom line. For instance, if federal corporate tax rates were to shift, it would affect how much profit the bank retains. A reduction in the corporate tax rate, such as the one seen in the Tax Cuts and Jobs Act of 2017 which lowered it from 35% to 21%, generally boosts profitability. Conversely, any future increases in these rates would reduce net income, potentially impacting capital available for lending or expansion.

Trade and International Relations

While HarborOne Bank is primarily focused on its community, broader trade policies and international relations can still cast a shadow. For instance, disruptions in global supply chains, often stemming from trade disputes or geopolitical tensions, can impact the manufacturing and retail sectors in Southern New England, a key customer base for HarborOne. This can lead to reduced business investment and potentially higher loan default rates.

The economic health of the region is intrinsically linked to these global dynamics. A slowdown in international trade, perhaps due to new tariffs or trade agreements, could dampen economic growth in Massachusetts and Rhode Island. This, in turn, might affect consumer spending and business expansion, influencing the demand for banking services and the overall credit quality of HarborOne's loan portfolio. For example, the US trade deficit with China in goods was approximately $279.4 billion in 2023, a figure that highlights the scale of international economic interactions that can ripple outwards.

- Impact on Local Businesses: Trade policies can affect the cost of imported goods for New England businesses and the competitiveness of exported goods, influencing their profitability and ability to repay loans.

- Consumer Spending: International economic stability can influence consumer confidence and disposable income, impacting local spending patterns and demand for credit.

- Investment Climate: Global economic conditions and trade relations shape the overall investment climate, affecting capital availability for local businesses and individuals.

Government Support and Community Reinvestment Act (CRA)

Government initiatives like the Community Reinvestment Act (CRA) are crucial, pushing banks to serve all communities, especially those with lower incomes. HarborOne Bank's strong CRA performance, including an 'Outstanding' rating, shows its dedication to these political and social mandates. This commitment not only shapes its public perception but also its relationship with regulators.

HarborOne Bank's proactive approach to community reinvestment is evident in its lending and investment activities. For instance, in 2023, the bank reported significant investments in affordable housing projects and small business lending within its assessment areas. This aligns directly with the CRA's objective of addressing local credit needs.

- Government Mandates: The CRA requires banks to invest in and lend to the low- and moderate-income communities where they operate.

- HarborOne's CRA Rating: HarborOne Bank consistently receives 'Outstanding' ratings, signifying strong performance in meeting CRA obligations.

- Community Impact: This focus translates into tangible support for local development, affordable housing, and small businesses.

- Regulatory and Reputational Benefits: Adherence to the CRA enhances a bank's regulatory standing and builds positive community relations.

Government policies, including monetary and fiscal decisions, significantly influence HarborOne Bank's operational environment. The Federal Reserve's interest rate policies, such as the maintained target range of 5.25%-5.50% through much of 2024, directly affect net interest margins and loan demand. Regulatory frameworks, like those from the FDIC and proposed Basel III endgame rules, dictate capital requirements and risk management, impacting operational strategies and financial stability.

The Community Reinvestment Act (CRA) is a key political driver, mandating banks to serve low- and moderate-income communities. HarborOne Bank's consistent 'Outstanding' CRA rating underscores its commitment to these mandates, influencing its community engagement and regulatory standing. This focus translates into tangible support for local development, such as affordable housing and small business lending, as seen in its 2023 investments.

| Policy Area | Impact on HarborOne Bank | 2024/2025 Data/Context |

|---|---|---|

| Monetary Policy | Affects interest rates, net interest margin, loan demand | Federal Reserve target federal funds rate: 5.25%-5.50% (maintained through much of 2024) |

| Regulatory Compliance | Influences capital requirements, risk management, operations | Proposed Basel III endgame rules could increase capital requirements for larger institutions. FDIC sets operational guidelines. |

| Community Reinvestment Act (CRA) | Drives lending and investment in low-to-moderate income areas; impacts regulatory standing and reputation | HarborOne Bank holds an 'Outstanding' CRA rating, reflecting significant 2023 investments in affordable housing and small business lending. |

What is included in the product

This HarborOne Bank PESTLE analysis provides a comprehensive examination of how Political, Economic, Social, Technological, Environmental, and Legal factors shape the bank's operating landscape.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify emerging opportunities and threats.

HarborOne Bank's PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during meetings and strategic planning.

Economic factors

Interest rate fluctuations, primarily influenced by Federal Reserve decisions, significantly impact HarborOne Bank's profitability. Changes in rates directly affect the bank's net interest margin, a critical indicator of its financial health.

For instance, rising interest rates can elevate the cost of borrowing for the bank, such as through higher deposit rates, while simultaneously increasing the potential returns on its loan portfolio. Conversely, declining rates can compress these margins. HarborOne Bank's performance in Q1 2025 demonstrated its ability to navigate these shifts, reporting an improved net interest margin even amidst a subdued mortgage market, highlighting effective management of interest rate risks.

Southern New England's economic health, reflected in its employment rates, consumer spending, and business investment, directly influences HarborOne Bank's loan demand and credit quality. A strong economy typically boosts loan originations and reduces credit losses, whereas an economic slowdown can lead to increased delinquencies and higher provisions for credit losses.

For instance, as of Q1 2024, Massachusetts, a key market for HarborOne, reported an unemployment rate of 3.5%, indicating a relatively stable labor market that supports consumer spending and business confidence. This environment generally favors loan growth for banks like HarborOne.

HarborOne Bank's financial reports for 2023 highlighted efforts to manage operational costs while pursuing loan growth, even as economic indicators showed mixed signals. The bank maintained a net interest margin of approximately 3.10% in 2023, demonstrating its ability to navigate varying economic pressures.

Mortgage market dynamics are a cornerstone of HarborOne Bank's operations. The bank's profitability is directly tied to interest rate movements and the health of the housing market. For instance, a notable decline in mortgage banking income, such as the one observed in Q1 2025, directly affects HarborOne's noninterest income streams, underscoring the segment's sensitivity to market shifts.

Navigating the current economic climate, characterized by elevated mortgage rates and persistently low housing inventory, presents a significant challenge for HarborOne. The bank's strategic approach to managing these conditions is paramount for maintaining the profitability of its mortgage segment throughout 2024 and into 2025.

Deposit Growth and Cost of Funds

HarborOne Bank's financial stability hinges on its capacity to attract and retain deposits affordably. Growing its core deposit base, which excludes brokered deposits, and lowering the overall cost of these funds are crucial for maintaining healthy liquidity and a robust loans-to-deposits ratio.

In the first quarter of 2024, HarborOne Bank reported a net interest margin of 3.29%, a slight decrease from 3.41% in the fourth quarter of 2023, reflecting the ongoing pressure on funding costs. However, the bank has been actively working to manage this.

- Deposit Growth: Core deposits, excluding brokered deposits, are a key focus for stability.

- Cost of Funds: Reducing the average cost of deposits directly enhances profitability.

- Loans-to-Deposits Ratio: A higher ratio, supported by stable deposits, indicates efficient asset deployment.

- Net Interest Margin: Managing the spread between interest earned on loans and paid on deposits is vital.

Competition in the Financial Services Sector

HarborOne Bank navigates a highly competitive financial services sector, facing significant pressure from established national banks, agile credit unions, and disruptive fintech innovators. This intense rivalry directly impacts interest rates for loans and deposit products, compelling HarborOne to continually refine its service offerings and pricing strategies to secure and hold onto its customer base.

The drive for differentiation is paramount, as banks like HarborOne must highlight unique value propositions, whether through superior customer service, specialized product suites, or innovative digital platforms. For instance, as of Q1 2025, the average interest rate on a 30-year fixed mortgage offered by large national banks hovered around 6.7%, while some fintech lenders were advertising rates as low as 6.3%, creating a challenging benchmark for community banks.

- Increased Competition: The financial services market is crowded with large national banks, numerous credit unions, and a growing number of fintech companies offering specialized services.

- Pricing Pressure: Competition directly influences the rates offered on loans and deposits, forcing institutions to remain competitive to attract and retain customers.

- Need for Differentiation: Banks must identify and emphasize unique selling points, such as customer service, specialized products, or technological innovation, to stand out.

- Fintech Disruption: Digital-first financial technology companies are challenging traditional banking models with lower fees and more streamlined user experiences, particularly in areas like payments and lending.

Economic factors significantly shape HarborOne Bank's operational landscape, with interest rate movements being a primary driver of its net interest margin. The bank's performance in Q1 2025, which saw an improved net interest margin despite a challenging mortgage market, underscores its adeptness in managing these fluctuations. Furthermore, the economic vitality of Southern New England, particularly Massachusetts, directly correlates with HarborOne's loan demand and credit quality, with a 3.5% unemployment rate in Massachusetts in Q1 2024 signaling a supportive environment for loan growth.

HarborOne Bank's financial strategy is heavily influenced by economic conditions that impact deposit attraction and retention, crucial for maintaining liquidity and a healthy loans-to-deposits ratio. The bank's Q1 2024 net interest margin of 3.29% reflects ongoing pressures on funding costs, a common challenge in the current economic climate. Managing the cost of funds and growing its core deposit base are therefore paramount for enhancing profitability and ensuring financial stability.

The competitive environment within the financial services sector, marked by intense rivalry from national banks, credit unions, and fintech firms, directly influences HarborOne Bank's pricing strategies for loans and deposits. As of Q1 2025, the disparity in mortgage rates, with national banks around 6.7% and some fintech lenders offering as low as 6.3%, highlights the need for HarborOne to differentiate its offerings through superior customer service or specialized products to remain competitive.

Preview Before You Purchase

HarborOne Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of HarborOne Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of the external forces shaping HarborOne Bank's market landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into potential opportunities and threats for HarborOne Bank.

Sociological factors

Southern New England's demographic landscape is evolving, with a notable aging population and shifts in household composition. For instance, the median age in Massachusetts, Rhode Island, and Connecticut has been steadily increasing, impacting the types of financial services in demand. This trend suggests a growing need for retirement planning, estate services, and potentially reverse mortgages.

Migration patterns also play a crucial role. While the region has historically seen some out-migration, recent data from 2024 indicates a stabilization and even a slight uptick in inbound migration for certain areas, particularly those with strong job markets. This influx of new residents, often younger professionals, can boost demand for first-time homebuyer programs and digital banking solutions.

The formation of smaller, more diverse households, including single-person and multi-generational living arrangements, is another key demographic change. This necessitates flexible banking products that cater to varying income levels and financial needs, from student loan management to specialized savings accounts for different family structures. HarborOne Bank's ability to adapt its offerings to these nuanced demographic realities will be critical for sustained growth.

HarborOne Bank's deep community involvement, exemplified by its ONECommunity Scholarship Program and grants to local nonprofits, significantly bolsters its public image. In 2023 alone, the bank distributed over $1 million in grants and donations, directly impacting community development and reinforcing its reputation as a responsible corporate citizen.

This dedication to social well-being cultivates strong customer loyalty and attracts new clients who prioritize ethical and socially conscious financial institutions. Such engagement is crucial in the competitive banking landscape, where trust and community connection are increasingly valued by consumers.

HarborOne Bank's 'HarborOne U' initiative directly addresses a significant sociological need by providing free digital content and webinars focused on small business and personal financial education. This commitment to financial literacy empowers individuals and businesses within its community, fostering a more informed and capable customer base.

Consumer Behavior and Banking Preferences

Consumer behavior is rapidly shifting towards digital channels, with a significant portion of banking transactions now occurring online or via mobile apps. This trend is particularly pronounced among younger demographics, but its reach is expanding across all age groups.

HarborOne Bank recognizes this evolution and is investing in its digital infrastructure to meet these growing demands. For instance, by the end of 2024, a substantial percentage of customer interactions are projected to be digital, highlighting the need for robust mobile banking capabilities and online self-service options.

The bank's strategy involves a dual approach: maintaining a physical branch presence for traditional banking needs while simultaneously enhancing its digital platforms. This ensures accessibility for all customer segments. In 2024, data indicates that over 60% of new account openings at similar institutions occurred through digital channels, a figure HarborOne aims to match or exceed.

- Increasing Demand for Digital: Over 70% of consumers surveyed in early 2025 expressed a preference for mobile banking for everyday transactions.

- Mobile Accessibility is Key: Banks with user-friendly mobile apps see higher customer retention rates, with a 15% increase in engagement reported by institutions with updated mobile platforms in the past year.

- Branch Network Adaptation: While digital is growing, a portion of customers, particularly in certain age brackets, still value in-person service for complex transactions or personalized advice.

- Personalization in Digital Banking: Consumers expect personalized offers and tailored financial advice through digital channels, a trend that will likely see further growth in 2025.

Workforce Dynamics and Talent Retention

HarborOne Bank operates within a dynamic labor market, where the availability of skilled financial professionals significantly impacts its ability to deliver quality services. In 2024, the unemployment rate for finance and insurance occupations in Massachusetts, where HarborOne is primarily located, remained low, indicating a competitive environment for talent acquisition. Employee expectations are also shifting, with a growing emphasis on comprehensive benefits packages and flexible work arrangements, a trend amplified by post-pandemic workplace adjustments.

Attracting and retaining top talent is paramount for HarborOne's operational efficiency and sustained growth. The bank must contend with increasing competition for experienced bankers and customer service representatives. For instance, in 2023, the average tenure for employees in the banking sector nationally saw a slight decrease, highlighting the challenge of long-term retention. Therefore, HarborOne's strategies for compensation, professional development, and fostering a positive work-life balance are critical differentiators.

- Skilled Labor Availability: In Q1 2024, Massachusetts reported a 2.8% unemployment rate for individuals in finance and insurance roles, underscoring a tight labor market.

- Employee Expectations: Surveys from 2023 indicated that over 60% of financial sector employees prioritize flexible work options and robust health benefits when considering new employment.

- Talent Retention Challenges: The average employee turnover rate in the U.S. banking industry hovered around 18% in 2023, necessitating proactive retention strategies.

Sociological factors significantly shape HarborOne Bank's operating environment, particularly concerning evolving consumer behaviors and community engagement. The increasing preference for digital banking, with over 70% of consumers favoring mobile transactions by early 2025, necessitates robust online platforms. Furthermore, a segment of customers, especially certain age groups, still values in-person service for complex needs, requiring a balanced approach to branch networks and digital offerings.

HarborOne's commitment to social well-being, demonstrated by over $1 million in grants and donations in 2023, fosters customer loyalty and attracts ethically-minded clients. Initiatives like HarborOne U, focused on financial literacy, empower the community and build a more informed customer base. These efforts are crucial for building trust and differentiating the bank in a competitive market.

| Sociological Factor | Trend/Observation | Impact on HarborOne Bank |

|---|---|---|

| Digital Banking Preference | 70%+ prefer mobile by early 2025 | Enhance mobile platforms, ensure user-friendliness |

| In-Person Service Value | Certain demographics value face-to-face interaction | Maintain accessible branch network for complex needs |

| Community Engagement | $1M+ in grants/donations (2023) | Builds loyalty, attracts socially conscious customers |

| Financial Literacy Needs | HarborOne U initiative | Empowers customers, creates informed client base |

Technological factors

The shift towards digital banking is undeniable, with a significant portion of consumers now preferring mobile and online channels for their financial needs. For HarborOne Bank, this means investing heavily in intuitive mobile apps and secure online platforms is not just an option, but a necessity to retain and attract customers. By July 2025, it's projected that over 80% of banking interactions will occur digitally, underscoring the urgency for banks to enhance their digital offerings.

Cybersecurity is a critical concern for HarborOne Bank, especially with the escalating sophistication of cyber threats. Protecting sensitive customer data is not just a best practice but a fundamental requirement to maintain trust and operational integrity. The bank must invest in robust security measures to safeguard against breaches.

In 2024, the financial sector continued to see a significant increase in cyberattacks, with ransomware and phishing attempts remaining prevalent. HarborOne Bank's commitment to regularly updating its security protocols and systems is essential for compliance with evolving data privacy regulations, such as potentially enhanced state-level data protection laws that may emerge in 2025.

HarborOne Bank is actively integrating automation and AI to refine its back-office processes and elevate customer interactions. This strategic move aims to boost efficiency and cut down on operational expenses. For instance, AI-powered chatbots can handle a significant volume of customer inquiries, freeing up human staff for more complex issues. In 2024, the global banking sector saw significant investment in AI, with projections suggesting a substantial increase in the adoption of AI for fraud detection, estimated to reach billions of dollars in savings annually.

By embracing these advancements, HarborOne can expect to see tangible improvements in service delivery. The bank can offer more personalized financial advice and product recommendations, driven by AI's ability to analyze customer data. This technological adoption is crucial for staying competitive, as many financial institutions are reporting cost reductions of up to 30% in areas where automation has been implemented effectively, according to recent industry reports from late 2024.

Data Analytics and Personalized Services

HarborOne Bank leverages data analytics to deeply understand customer behavior, enabling them to spot emerging market trends and craft more personalized financial solutions. This strategic use of data is key to boosting marketing impact, elevating customer happiness, and fostering focused expansion. For instance, in 2024, banks that effectively utilized AI and data analytics saw an average increase of 15% in customer retention.

This data-driven strategy allows HarborOne to refine its product offerings and service delivery. By analyzing transaction patterns and customer interactions, the bank can anticipate needs and proactively offer relevant solutions, from customized loan options to investment advice. A recent industry report indicated that personalized financial advice can lead to a 20% higher engagement rate with banking services.

- Customer Insights: Data analytics provides granular insights into customer spending habits, life events, and financial goals.

- Market Trend Identification: Analyzing aggregated data helps in spotting shifts in consumer preferences and economic indicators.

- Personalized Product Development: Tailoring financial products, such as savings accounts or credit lines, based on individual customer profiles.

- Enhanced Marketing ROI: Directing marketing efforts to specific customer segments with relevant offers, improving conversion rates.

Financial Technology (FinTech) Partnerships and Innovation

HarborOne Bank faces a dynamic technological landscape shaped by FinTech innovation. The rise of these agile companies presents a dual challenge and opportunity, pushing traditional institutions to adapt or risk obsolescence. For instance, the global FinTech market was valued at over $2.4 trillion in 2023 and is projected to grow significantly, highlighting the scale of this transformation.

To navigate this, HarborOne Bank is strategically considering collaborations with FinTech entities and investing in cutting-edge technologies. These moves aim to broaden its service portfolio, streamline operations, and tap into previously underserved markets. A prime example of this forward-thinking approach is the enhancement of its merchant services through the integration of the Clover product line, offering businesses advanced payment and management solutions.

These technological integrations are crucial for maintaining competitiveness. Consider the increasing adoption of digital banking services; a 2024 report indicated that over 75% of consumers now prefer digital channels for banking transactions. HarborOne’s engagement with FinTech allows it to meet this demand.

- FinTech Market Growth: The global FinTech market is expanding rapidly, indicating a strong trend towards digital financial solutions.

- Digital Adoption: Consumer preference for digital banking channels continues to rise, making technological integration essential for customer retention.

- Partnership Potential: Collaborating with FinTech firms can provide access to new technologies and customer bases, fostering innovation and efficiency.

- Clover Integration: Enhancements to merchant services, like the Clover product line, demonstrate a commitment to offering advanced, integrated payment solutions.

HarborOne Bank's technological strategy is centered on enhancing digital accessibility and operational efficiency. By 2025, over 80% of banking interactions are expected to be digital, necessitating robust mobile and online platforms. The bank's investment in AI and automation, seen in initiatives like AI-powered chatbots, aims to reduce operational costs by up to 30% in certain areas and improve customer service.

Data analytics plays a pivotal role in understanding customer behavior and market trends, with data-driven banks seeing a 15% increase in customer retention in 2024. Furthermore, HarborOne's integration with FinTech solutions, such as the Clover product line for merchant services, reflects the rapid growth of the FinTech market, valued at over $2.4 trillion in 2023, to meet the increasing demand for digital financial services.

| Technology Area | 2024/2025 Trend/Data | Impact on HarborOne Bank |

|---|---|---|

| Digital Banking Adoption | Projected 80%+ digital interactions by July 2025 | Necessitates investment in mobile/online platforms |

| AI & Automation | Global banking AI investment in billions; potential 30% cost reduction | Enhances operational efficiency, customer service |

| Data Analytics | 15% average increase in customer retention for data-driven banks (2024) | Enables personalized solutions, improved marketing ROI |

| FinTech Market Growth | Valued over $2.4 trillion in 2023, significant projected growth | Drives need for FinTech collaborations and innovation (e.g., Clover) |

Legal factors

HarborOne Bank navigates a complex web of federal and state banking regulations, with agencies like the FDIC and the Federal Reserve setting stringent compliance standards. These rules are paramount for maintaining capital adequacy, ensuring operational integrity, and preserving the bank's legal standing. For instance, as of the first quarter of 2024, HarborOne Bank reported a Common Equity Tier 1 (CET1) ratio of 11.5%, comfortably exceeding the regulatory minimums and demonstrating a commitment to compliance.

Consumer protection laws, such as the Fair Credit Reporting Act and the Truth in Lending Act, directly shape how HarborOne Bank operates. These regulations ensure transparency in lending, protect customer data privacy, and prevent predatory practices. For instance, in 2024, banks faced increased scrutiny on data breach notifications and consumer consent for data usage, impacting how HarborOne manages customer information and markets its financial products.

Compliance with these consumer protection mandates is not just about avoiding fines; it's crucial for building and maintaining customer loyalty. In 2025, regulatory bodies continue to emphasize robust consumer safeguards, meaning HarborOne must invest in systems and training to ensure fair lending practices and clear communication regarding loan terms and fees. Failure to comply can lead to significant legal penalties and damage to the bank's reputation.

HarborOne Bank operates under strict anti-money laundering (AML) and sanctions regulations to combat financial crime. This necessitates robust internal controls and vigilant reporting of suspicious transactions, with compliance often monitored by agencies like the U.S. Treasury's Office of Foreign Assets Control (OFAC).

In 2023, U.S. financial institutions reported over 300,000 suspicious activity reports (SARs) to the Financial Crimes Enforcement Network (FinCEN), highlighting the scale of regulatory oversight. Staying abreast of evolving sanctions lists and AML typologies is crucial for banks like HarborOne to mitigate risks and avoid significant penalties.

Data Privacy and Security Laws

Data privacy and security laws are paramount for HarborOne Bank, especially with the surge in digital transactions. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) set strict standards for handling Personally Identifiable Information (PII). In 2024, the global cost of data breaches reached an average of $4.45 million, underscoring the financial risk of non-compliance. HarborOne must maintain robust systems and practices to safeguard customer data, thereby preventing costly breaches and legal penalties.

Compliance with these evolving data protection frameworks is not merely a legal obligation but a critical component of customer trust and operational resilience. Failure to adhere to these regulations can result in significant fines; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. HarborOne's commitment to data security directly impacts its reputation and its ability to operate without interruption.

- Regulatory Landscape: Adherence to evolving data privacy laws, including those governing PII, is essential.

- Financial Implications: Data breaches can incur substantial costs, with global averages exceeding $4 million in 2024.

- Customer Trust: Robust data security practices are vital for maintaining customer confidence and protecting the bank's reputation.

- Legal Repercussions: Non-compliance can lead to significant fines, with GDPR penalties reaching up to 4% of global annual revenue.

Mergers and Acquisitions Regulations

HarborOne Bank's proposed merger with Eastern Bankshares, Inc. is governed by a stringent legal framework for bank mergers and acquisitions. This includes oversight from federal agencies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC), as well as state banking regulators. These bodies scrutinize such deals to ensure they benefit consumers and maintain financial stability. In 2024, the banking sector continued to see regulatory focus on market concentration and consumer protection, impacting merger approvals.

Navigating these regulations requires comprehensive legal review and adherence to specific procedural requirements. Key aspects include antitrust reviews to prevent undue market power and compliance with consumer protection laws, such as the Community Reinvestment Act (CRA). The timeline for obtaining necessary approvals can vary, often extending over several months as regulators conduct thorough due diligence. For instance, the Federal Reserve's review process typically involves public comment periods and detailed analysis of the financial health and strategic plans of the merging entities.

The legal landscape for M&A in banking is dynamic, with regulators adapting to evolving market conditions and economic trends. In 2025, continued emphasis on data privacy and cybersecurity within financial institutions will likely add another layer of scrutiny to merger agreements. Successful completion of the HarborOne and Eastern Bankshares merger hinges on demonstrating compliance with all applicable federal and state laws, ensuring a seamless integration that meets regulatory expectations.

HarborOne Bank's operations are heavily influenced by consumer protection laws like the Fair Credit Reporting Act, ensuring transparency and data privacy. In 2024, increased scrutiny on data breach notifications meant banks like HarborOne had to refine customer information management and marketing practices.

Adherence to anti-money laundering (AML) and sanctions regulations is critical for preventing financial crime, requiring robust internal controls and vigilant reporting. In 2023, U.S. financial institutions filed over 300,000 suspicious activity reports, underscoring the extensive regulatory oversight and the need for banks to stay updated on evolving AML typologies.

Data privacy laws, such as CCPA, impose strict standards on handling Personally Identifiable Information (PII), with global data breach costs averaging $4.45 million in 2024. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual revenue, impacting customer trust and operational continuity.

Environmental factors

Climate change poses indirect physical risks to HarborOne Bank, primarily through its real estate loan portfolio. While the bank isn't directly in the path of extreme weather, rising sea levels and increased storm intensity in Southern New England could devalue properties and impair borrowers' repayment capacity.

For instance, a significant portion of Massachusetts's coastal real estate, a key market for HarborOne, faces increased flood risk. According to NOAA data, sea levels along the Massachusetts coast have risen approximately 8 inches since 1950, and projections indicate further increases, potentially impacting property values and loan collateral.

The increasing focus on Environmental, Social, and Governance (ESG) factors significantly shapes how investors, customers, and regulators perceive financial institutions. HarborOne Bank's dedication to environmental responsibility and beneficial community engagement, as highlighted in its proxy statements, directly addresses the rising demand for sustainable business operations.

The financial sector is increasingly embracing sustainability, with a notable surge in green lending and sustainable finance products. For instance, the global sustainable debt market reached an estimated $2.7 trillion in 2023, showing significant growth. HarborOne Bank can tap into this expanding market by developing financial solutions that support environmentally conscious projects, such as renewable energy installations or energy-efficient building upgrades. This strategic alignment with environmental concerns not only addresses growing investor and consumer demand but also presents an opportunity to attract a new customer base interested in responsible finance.

Resource Scarcity and Operational Footprint

While banking isn't resource-intensive like manufacturing, HarborOne Bank's operations still utilize resources such as electricity for its branches and paper for internal processes. The bank is increasingly expected to minimize its environmental impact through initiatives like energy-efficient building upgrades and digital transformation to reduce paper consumption.

In 2023, the banking sector saw a growing emphasis on ESG (Environmental, Social, and Governance) reporting, with many institutions setting targets for carbon neutrality. For instance, a significant portion of major banks aim to achieve net-zero emissions by 2050, influencing operational choices and investment strategies.

- Energy Efficiency: Implementing smart thermostats and LED lighting in branches can reduce electricity usage, a key operational cost and environmental factor.

- Digitalization: Shifting towards digital statements and internal document management systems directly cuts down on paper consumption and associated waste.

- Supply Chain: Evaluating the environmental impact of third-party vendors, such as IT service providers, becomes crucial for a holistic approach to reducing the operational footprint.

- Waste Management: Enhancing recycling programs within corporate offices and branches contributes to a more sustainable operational model.

Regulatory Focus on Environmental Risk Management

Regulators are sharpening their focus on how financial institutions like HarborOne Bank identify and handle environmental risks, with climate change being a significant driver. This increased scrutiny means banks must integrate environmental risk assessments into their core lending and investment processes to align with evolving regulations and safeguard against potential financial losses.

For instance, the Federal Reserve's pilot climate scenario analysis in 2023, involving six large banks, highlighted the growing expectation for robust climate risk management frameworks. HarborOne Bank will likely need to demonstrate its capacity to assess the physical risks (like extreme weather events) and transition risks (associated with shifting to a lower-carbon economy) associated with its loan portfolio and investments.

- Increased Regulatory Scrutiny: Expect more detailed reporting requirements on climate-related financial risks from bodies like the SEC and prudential regulators.

- Integration into Risk Management: Environmental risk assessment is becoming a standard component of credit, market, and operational risk frameworks.

- Potential for New Capital Requirements: As understanding of climate risk deepens, regulators might introduce capital adjustments based on a bank's exposure to environmental factors.

- Disclosure and Transparency: Banks will face growing pressure to disclose their environmental risk exposures and mitigation strategies to investors and the public.

Environmental factors present both risks and opportunities for HarborOne Bank. Rising sea levels and increased storm intensity in its core Southern New England market could impact its real estate loan portfolio by devaluing properties and affecting borrowers' ability to repay. For example, NOAA data indicates an 8-inch sea level rise in Massachusetts since 1950, with further increases projected, posing a direct risk to coastal collateral.

The growing emphasis on ESG factors means HarborOne must demonstrate environmental responsibility to investors and customers. The global sustainable debt market reached an estimated $2.7 trillion in 2023, highlighting a significant opportunity for banks to offer green financing solutions. HarborOne can capitalize on this trend by supporting environmentally conscious projects, aligning with increasing investor and consumer demand for sustainable finance.

HarborOne's operational footprint, though not as resource-intensive as manufacturing, still requires attention to energy efficiency and waste reduction. Initiatives like LED lighting and digital transformation to reduce paper consumption are key. Many major banks are setting net-zero emission targets by 2050, indicating a broader industry shift towards sustainability that will influence operational choices.

Regulators are increasing scrutiny on how financial institutions manage environmental risks, particularly climate change. The Federal Reserve's 2023 climate scenario analysis for large banks underscores the need for robust risk management frameworks. HarborOne will need to assess physical and transition risks within its portfolio to comply with evolving regulations and mitigate potential financial losses.

| Environmental Factor | Impact on HarborOne Bank | Opportunity/Mitigation | Relevant Data/Trend |

|---|---|---|---|

| Climate Change & Extreme Weather | Physical risk to real estate loan portfolio (devaluation, borrower default) | Develop climate risk assessment tools, diversify loan portfolio away from high-risk areas | NOAA: 8-inch sea level rise in MA since 1950; increasing storm intensity |

| ESG Demand | Investor and customer preference for sustainable operations | Offer green financial products, enhance ESG reporting | Global sustainable debt market: $2.7 trillion in 2023 |

| Operational Footprint | Resource consumption (energy, paper) | Implement energy efficiency measures, digital transformation | Industry trend: Major banks targeting net-zero emissions by 2050 |

| Regulatory Scrutiny | Increased compliance and reporting requirements for climate risk | Integrate climate risk into existing risk management frameworks | Federal Reserve pilot climate scenario analysis (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for HarborOne Bank is grounded in data from official regulatory bodies, financial market reports, and reputable economic and demographic research firms. We ensure comprehensive coverage by incorporating insights from industry-specific publications and government economic indicators.