HarborOne Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HarborOne Bank Bundle

HarborOne Bank operates in a dynamic financial landscape where understanding competitive pressures is paramount. Our initial analysis highlights the significant influence of buyer power and the moderate threat of new entrants within the banking sector.

The complete report reveals the real forces shaping HarborOne Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

HarborOne Bank's funding sources, primarily depositors and wholesale markets, represent its key suppliers. The bank's strength in attracting and retaining deposits at competitive rates directly influences its cost of funds and overall profitability.

Favorable conditions with these funding suppliers were evident in Q4 2024, when HarborOne saw an increase in average deposits, excluding brokered ones. Concurrently, the bank experienced a reduction in its borrowing costs, signaling a robust and advantageous relationship with its capital providers.

HarborOne Bank, like many community banks, depends on technology and software providers for its essential operations, from digital banking to core systems and cybersecurity. The bargaining power of these suppliers can range from moderate to high, particularly when they offer specialized or deeply integrated solutions that are difficult to replace. For instance, in 2024, the financial technology sector saw significant consolidation, with some vendors acquiring competitors, potentially increasing their market leverage over banks that rely on their platforms.

This reliance on a limited number of vendors for critical functions can create a situation where HarborOne faces increased costs or reduced flexibility if these suppliers wield substantial bargaining power. A 2023 report indicated that IT spending by regional banks increased by an average of 8% year-over-year, partly driven by the need to upgrade core systems and enhance cybersecurity, highlighting the ongoing investment and potential vendor influence in this area.

The availability of skilled employees, especially in financial technology, lending, and risk management, is vital for HarborOne Bank. A competitive job market, particularly for specialized roles, can drive up wages and make it harder to find and keep the best people.

This dynamic directly impacts HarborOne, as a shortage of talent in key areas like cybersecurity professionals or experienced loan officers can significantly increase labor costs. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that wages for financial managers saw a 6.5% increase year-over-year, reflecting a tightening labor market in specialized financial fields.

Regulatory and Compliance Services

The banking sector's stringent regulatory environment means HarborOne Bank must rely on specialized legal, auditing, and compliance service providers. These suppliers possess considerable bargaining power due to the critical nature of their expertise and the high stakes of regulatory adherence. For instance, in 2024, the global regulatory compliance market was valued at over $50 billion, highlighting the significant investment banks make in these essential services.

This reliance translates into potential cost pressures for HarborOne. The specialized knowledge and certifications required by these firms limit the pool of qualified providers, further concentrating their bargaining strength. Consequently, the fees charged by these regulatory and compliance service providers can represent a substantial operational expense for the bank.

- High Demand for Expertise: Banks require highly specialized knowledge in areas like anti-money laundering (AML) and Know Your Customer (KYC) regulations, which few firms possess.

- Limited Supplier Pool: The number of accredited and experienced regulatory consultants and auditors is relatively small, giving them leverage.

- Cost of Non-Compliance: The severe penalties for regulatory breaches empower suppliers, as banks are willing to pay premium prices to ensure compliance.

- Industry Trends: As regulations evolve, such as those related to data privacy and cybersecurity, the demand for updated compliance services intensifies, strengthening supplier positions.

Branch Network and Real Estate Lessors

HarborOne Bank maintains a physical presence with its branch network across Southern New England. The lessors of these real estate locations possess a degree of bargaining power, especially when properties are situated in highly sought-after areas. This can translate into higher rental expenses and more stringent lease agreements for the bank.

The banking industry, including institutions like HarborOne, is actively engaged in optimizing its physical footprint. This involves a strategic rationalization and modernization of banking centers, a move aimed at better managing occupancy costs and adapting to evolving customer preferences. For instance, many banks have been consolidating branches or redesigning them to be more efficient, which can influence negotiations with property owners.

- Branch Network: HarborOne operates a significant number of physical branches in Southern New England, its primary service area.

- Real Estate Lessor Power: Lessors of prime real estate locations can exert influence on rental rates and lease terms, impacting the bank's operational costs.

- Industry Trend: The ongoing trend of branch rationalization and modernization in banking aims to control real estate expenses and improve operational efficiency.

HarborOne Bank's key suppliers include depositors, wholesale funding markets, technology providers, and specialized service firms. The bank's ability to secure favorable terms from these suppliers directly impacts its cost of funds and operational efficiency.

In 2024, HarborOne experienced a reduction in borrowing costs alongside an increase in deposits, indicating strong supplier relationships. However, reliance on specialized fintech and compliance services presents potential cost pressures due to market consolidation and the critical nature of these services.

The bargaining power of suppliers is influenced by factors such as the availability of specialized talent, the concentration of vendors in critical technology areas, and the high cost of regulatory non-compliance. For instance, a 6.5% year-over-year wage increase for financial managers in 2024 highlights the competitive labor market.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on HarborOne Bank | 2024 Data/Trends |

|---|---|---|---|

| Depositors & Wholesale Funding | Ability to attract and retain funds at competitive rates | Influences cost of funds and profitability | Reduced borrowing costs observed |

| Technology & Software Providers | Specialization, integration, market consolidation | Potential for increased costs, reduced flexibility | Fintech sector consolidation noted |

| Skilled Labor (e.g., IT, Risk) | Talent availability, demand for specialized skills | Drives up labor costs, impacts recruitment | 6.5% wage increase for Financial Managers |

| Regulatory & Compliance Services | Expertise, limited supplier pool, cost of non-compliance | Significant operational expense, potential cost pressures | Global compliance market > $50 billion |

| Real Estate Lessors | Location desirability, lease terms | Impacts rental expenses and operational costs | Branch rationalization trends |

What is included in the product

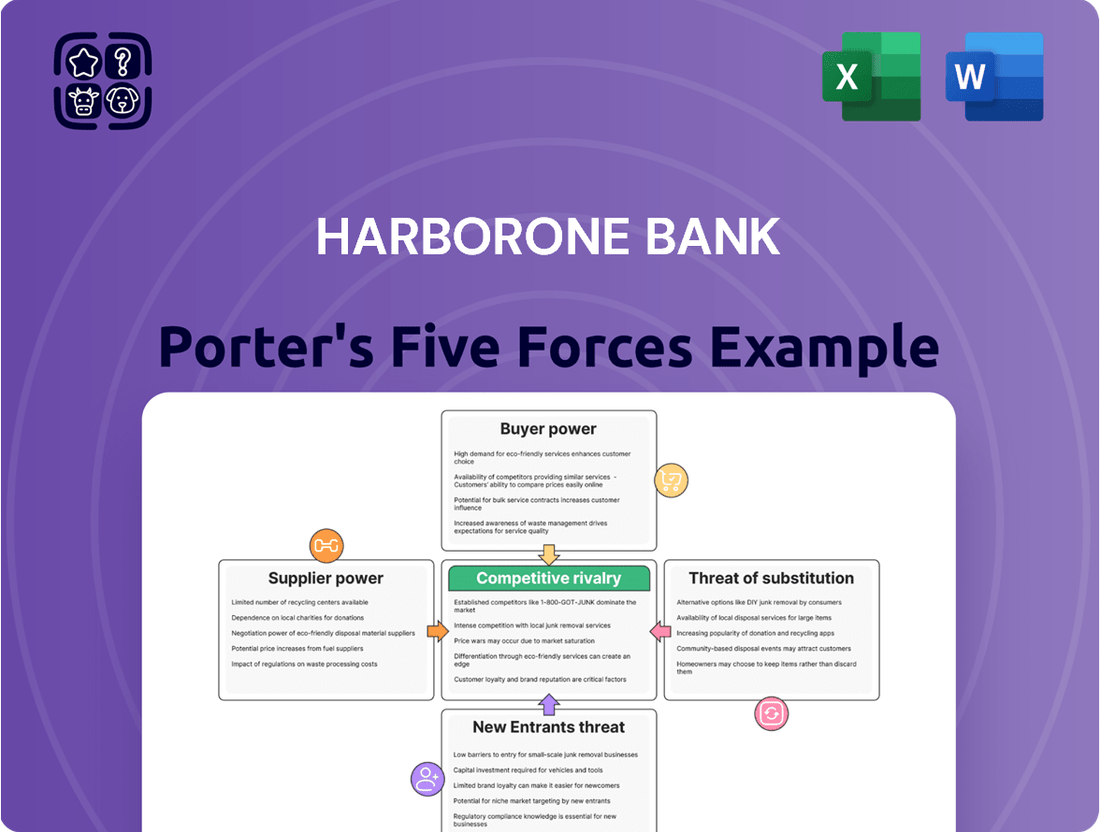

This analysis meticulously examines the competitive landscape for HarborOne Bank, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and the overall attractiveness of the banking industry.

Instantly understand strategic pressure with a powerful spider/radar chart, allowing HarborOne Bank to visualize and address competitive threats effectively.

Customers Bargaining Power

Deposit customers, both individuals and businesses, hold a moderate level of bargaining power. This power is amplified in competitive markets where customers can readily switch to institutions offering more attractive interest rates or superior services. For instance, in early 2024, the Federal Reserve's monetary policy decisions significantly influenced deposit rates across the banking sector, giving customers more leverage to seek higher yields.

Borrowers, especially those seeking substantial commercial loans or mortgages, wield considerable bargaining power in today's competitive lending landscape. They can easily shop around, comparing rates and terms from various institutions, which naturally pressures lenders like HarborOne Bank to offer more attractive conditions.

HarborOne Bank's significant exposure to commercial real estate loans, a sector often characterized by large transaction sizes, means it's particularly susceptible to these borrower-driven negotiations. For instance, in 2024, the average commercial real estate loan size can easily run into millions, giving sophisticated borrowers substantial leverage.

The bargaining power of digital platform users is a significant factor for banks like HarborOne. As more consumers embrace online and mobile banking, their ability to switch to digital-only banks or fintech alternatives grows. This ease of access means customers can readily compare offerings and demand better features and pricing, putting pressure on traditional institutions to innovate.

In 2024, the digital banking landscape is highly competitive. For instance, the number of U.S. consumers using mobile banking apps has continued its upward trend, with projections indicating over 80% of banking customers will be active mobile users by the end of the year. This widespread adoption empowers users, as they can easily shift their accounts to platforms offering superior user experience, lower fees, or more advanced digital tools, such as HarborOne's own 'HarborOne U' platform.

Small Business and Commercial Clients

Small and mid-size businesses, a core demographic for HarborOne Bank, possess considerable bargaining power, particularly when seeking commercial lending and sophisticated treasury management solutions. These clients often value personalized service and a strong banking relationship, but their ability to negotiate terms can be significant.

HarborOne Bank's strategic imperative to grow its commercial loan portfolio and deepen client relationships is a direct response to this customer leverage. By fostering loyalty and providing tailored services, the bank aims to reduce the likelihood of clients switching to competitors for better terms.

- Customer Leverage: Small and mid-size businesses can negotiate terms for loans and treasury services, impacting HarborOne's profitability.

- Relationship Banking Strategy: HarborOne focuses on building strong relationships to retain these clients and mitigate their bargaining power.

- Commercial Loan Growth: The bank's emphasis on commercial lending growth is designed to attract and satisfy business clients, thereby increasing stickiness.

Community and Municipalities

As a community bank, HarborOne Bank’s relationships with municipalities represent a significant source of deposits and specialized lending opportunities. These governmental entities, due to their public nature and often substantial financial holdings, possess considerable bargaining power. For instance, in 2024, many municipalities actively sought competitive rates on municipal deposits, with some larger cities leveraging their deposit volumes to negotiate more favorable terms on treasury management services.

Municipalities frequently employ formal bidding processes for banking services. This structured approach allows them to solicit proposals from multiple institutions, directly comparing offerings and pricing. Their ability to shift substantial funds between banks based on these bids grants them leverage to secure better interest rates on deposits and more advantageous terms on loans or other financial products. This can also influence the bank's commitment to specific community investment or service initiatives as part of the negotiation.

Consider the bargaining power of customers through these lenses:

- Municipal Deposit Leverage: Municipalities can command better rates on substantial deposit balances, influencing a bank's cost of funds.

- Formal Bidding Processes: Public sector clients often use competitive bidding, forcing banks to offer their most attractive terms.

- Community Engagement Influence: The size and public profile of municipal clients can allow them to negotiate for enhanced community support or specific service offerings from their banking partners.

The bargaining power of customers for HarborOne Bank is generally moderate but can be significant, particularly for larger clients or in competitive market segments. This power stems from the ease with which customers can switch banks, especially with the proliferation of digital banking options and the readily available comparison of interest rates and service fees. In 2024, the banking landscape continues to favor customers who are informed and willing to shop around for the best deals.

Deposit customers, both individuals and businesses, hold a moderate level of bargaining power. This power is amplified in competitive markets where customers can readily switch to institutions offering more attractive interest rates or superior services. For instance, in early 2024, the Federal Reserve's monetary policy decisions significantly influenced deposit rates across the banking sector, giving customers more leverage to seek higher yields.

Borrowers, especially those seeking substantial commercial loans or mortgages, wield considerable bargaining power in today's competitive lending landscape. They can easily shop around, comparing rates and terms from various institutions, which naturally pressures lenders like HarborOne Bank to offer more attractive conditions. In 2024, the average commercial real estate loan size can easily run into millions, giving sophisticated borrowers substantial leverage.

The bargaining power of digital platform users is a significant factor for banks like HarborOne. As more consumers embrace online and mobile banking, their ability to switch to digital-only banks or fintech alternatives grows. In 2024, over 80% of banking customers are active mobile users, empowering them to easily shift accounts to platforms offering superior user experience or lower fees.

Small and mid-size businesses, a core demographic for HarborOne Bank, possess considerable bargaining power, particularly when seeking commercial lending and sophisticated treasury management solutions. These clients often value personalized service and a strong banking relationship, but their ability to negotiate terms can be significant, impacting HarborOne's profitability if not managed through relationship banking strategies.

As a community bank, HarborOne Bank’s relationships with municipalities represent a significant source of deposits and specialized lending opportunities. These governmental entities, due to their public nature and often substantial financial holdings, possess considerable bargaining power, frequently employing formal bidding processes to secure better interest rates on deposits and more advantageous terms on loans or other financial products.

| Customer Segment | Bargaining Power Level (2024) | Key Drivers of Power | Impact on HarborOne Bank |

|---|---|---|---|

| Individual Depositors | Moderate | Interest rate sensitivity, availability of online/mobile banking alternatives, ease of switching. | Pressure on deposit rates, need for competitive product offerings. |

| Business Depositors (SMEs) | Moderate to High | Need for specialized treasury services, relationship banking expectations, comparison of fees and rates. | Negotiation on service fees, potential for switching for better terms, emphasis on relationship management. |

| Commercial Borrowers (Large) | High | Large loan sizes, ability to solicit multiple bids, market competition among lenders, real estate market dynamics. | Pressure on loan pricing and covenants, need for competitive lending solutions, risk management in CRE. |

| Municipalities | High | Substantial deposit volumes, formal bidding processes, public sector procurement rules, community investment expectations. | Negotiation on deposit rates and treasury service fees, potential for influencing community engagement initiatives. |

Preview the Actual Deliverable

HarborOne Bank Porter's Five Forces Analysis

This preview showcases the complete HarborOne Bank Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

HarborOne Bank navigates a fiercely competitive landscape in Southern New England, a region populated by a diverse array of financial institutions. This includes established traditional banks, member-focused credit unions, and increasingly, agile digital-only banks that challenge conventional banking models.

The sheer number of players is significant. For instance, as of early 2024, the Federal Deposit Insurance Corporation (FDIC) data indicates hundreds of FDIC-insured institutions operating within the broader New England region, many of which have a strong presence or overlap with HarborOne's core markets.

This density of competitors, ranging from national powerhouses with extensive resources to smaller, specialized community banks, creates an environment where differentiation and customer retention are paramount. HarborOne must constantly adapt to attract and keep customers amidst this crowded marketplace.

Competitive rivalry in the banking sector is intense, with institutions like HarborOne Bank actively pursuing market share. This drive is evident in their strategic focus on growing their commercial loan portfolios and aggressively expanding their deposit base. For instance, as of the first quarter of 2024, many regional banks reported significant increases in net interest income, a direct result of successful loan growth strategies amidst fluctuating interest rate environments.

HarborOne's emphasis on client deposit growth is a key tactic to fuel its commercial loan expansion, directly addressing the competitive pressure to maintain and grow its market presence. This dual strategy allows the bank to secure funding for lending while simultaneously increasing its overall share of customer relationships and assets under management.

Banks like HarborOne Bank compete by offering a broad spectrum of financial products and services. This includes everyday essentials like checking and savings accounts, alongside more significant offerings such as personal loans, mortgages, and commercial lending for businesses.

HarborOne Bank distinguishes itself by providing value beyond basic banking. Initiatives like HarborOne U, which offers educational resources, and strong community support programs serve as key differentiators. For example, in 2023, HarborOne Bank reported total assets of $4.8 billion, demonstrating its scale within the competitive landscape.

Interest Rate Environment and Margin Pressure

The banking sector is characterized by intense competition, particularly in attracting deposits and originating loans. This competitive rate environment, amplified by fluctuating interest rates, directly squeezes net interest margins for institutions like HarborOne Bank. Banks are constantly navigating the delicate balance between offering attractive deposit rates to secure funding and setting competitive loan rates to capture market share and generate profitable business.

This pressure is evident in the market dynamics. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate, leading many banks to adjust their deposit rates to remain competitive. This dynamic forces continuous evaluation of pricing strategies to avoid losing customers to higher-yielding alternatives while ensuring loan portfolios remain attractive and profitable.

- Competitive Rate Environment: Banks must offer attractive rates on deposits to attract and retain customers, which can increase funding costs.

- Margin Pressure: Fluctuating interest rates directly impact the difference between interest earned on loans and interest paid on deposits, squeezing net interest margins.

- Balancing Act: Institutions like HarborOne Bank must strategically balance deposit acquisition costs with competitive lending rates to ensure profitability and growth.

- Market Dynamics: In 2024, the Federal Reserve's monetary policy decisions significantly influenced the interest rate landscape, intensifying competition among banks for both depositors and borrowers.

Mergers and Acquisitions Activity

The banking industry in New England is characterized by ongoing consolidation, directly influencing competitive dynamics. This trend is exemplified by HarborOne Bank's planned merger with Eastern Bankshares, Inc., a significant event set to conclude in the fourth quarter of 2025. This combination will create a larger regional player, altering the competitive balance among banks operating in Massachusetts and surrounding areas.

The impact of such mergers extends to the intensity of rivalry. As institutions combine, they often gain greater scale and market share, potentially leading to more aggressive pricing strategies or enhanced service offerings to capture a larger portion of the customer base. This consolidation means fewer, but larger, competitors, which can intensify the struggle for market dominance.

Key data points illustrating this trend include:

- The proposed merger between HarborOne Bank and Eastern Bankshares, Inc. is valued at approximately $2.1 billion in stock.

- Upon completion, the combined entity will boast over $24 billion in assets and $19 billion in deposits.

- This transaction is expected to create the largest mutual-to-stock conversion in U.S. banking history.

HarborOne Bank faces intense rivalry from numerous financial institutions in its operating regions, including large national banks, regional players, and credit unions. This dense competitive environment necessitates continuous innovation and customer-centric strategies to maintain market share.

The banking sector's competitive nature is further amplified by a dynamic interest rate environment, forcing institutions like HarborOne to carefully balance deposit rates and lending strategies to manage profitability. For example, in early 2024, banks adjusted deposit offerings in response to Federal Reserve policy, highlighting the constant need to remain competitive on pricing.

Consolidation trends, such as the planned merger of HarborOne Bank with Eastern Bankshares, Inc. (valued at approximately $2.1 billion), are reshaping the competitive landscape by creating larger entities with increased market power and potentially more aggressive strategies.

This merger, expected to finalize in late 2025, will result in a combined entity with over $24 billion in assets, directly impacting the competitive intensity for other regional banks.

| Competitor Type | Examples | Impact on HarborOne |

| National Banks | JPMorgan Chase, Bank of America | Offer extensive resources, broad product ranges, and strong brand recognition. |

| Regional Banks | M&T Bank, People's United Bank (now part of M&T) | Directly compete for market share in similar geographic areas with comparable service offerings. |

| Credit Unions | Boston Firefighters Credit Union, Jeanne D'Arc Credit Union | Focus on member benefits and community ties, often offering competitive rates. |

| Digital Banks | Ally Bank, SoFi | Challenge traditional models with lower overhead and often higher deposit yields. |

SSubstitutes Threaten

Credit unions present a notable substitute threat to HarborOne Bank. These member-owned institutions often attract customers by offering competitive rates and lower fees, leveraging their non-profit structure. In 2023, credit unions saw significant growth, with total assets reaching over $2.1 trillion in the US, indicating their increasing market presence and ability to draw customers away from traditional banks.

Furthermore, the rise of non-bank lenders, encompassing online mortgage providers and specialized commercial finance companies, intensifies this threat. These entities provide agile and often tailored financing solutions, directly competing with HarborOne's loan products. For instance, the online mortgage sector alone has captured a substantial portion of the housing market, with some reports indicating it accounts for over 60% of all mortgage originations, demonstrating the significant reach of these substitutes.

Fintech companies, with their innovative digital payment platforms and mobile apps, present a significant threat of substitution to traditional banking services. These platforms, like PayPal and Venmo, are increasingly popular for person-to-person transactions and even merchant payments, offering speed and ease of use that can bypass traditional bank channels. For instance, the global digital payments market was valued at over $7.5 trillion in 2023 and is projected to grow substantially, indicating a strong customer preference for these convenient alternatives.

For individuals and businesses with substantial assets, dedicated investment firms and wealth management services present a significant substitute for traditional banking products. These specialized entities often provide a broader array of investment options, including alternative investments and sophisticated portfolio management, which can be more attractive than standard bank offerings.

These firms differentiate themselves through highly personalized financial planning and advisory services, catering to the unique needs and goals of high-net-worth clients. For instance, many wealth management firms in 2024 reported managing trillions in assets under management, demonstrating their capacity to attract and retain significant capital away from traditional banking channels.

Direct Online Banking and Neobanks

The proliferation of direct online banks and neobanks, operating without the overhead of physical branches, poses a significant threat of substitution for traditional banks like HarborOne. These digital-first institutions often attract customers by offering more competitive interest rates on savings accounts and lower or no fees on checking accounts. For instance, by early 2024, several neobanks were consistently offering APYs on savings well above the national average, which hovered around 0.45% for traditional savings accounts.

This competitive pricing strategy directly challenges the established banking models. Customers seeking higher yields on their deposits or lower transaction costs find these digital alternatives highly appealing, especially younger demographics and those comfortable managing their finances entirely online. The reduced operational costs for neobanks allow them to pass savings onto consumers, creating a compelling value proposition.

- Digital-only banks offer higher interest rates on deposits compared to traditional banks.

- Neobanks often have lower fee structures due to reduced overhead costs.

- This trend challenges the traditional branch-based banking model.

- Customer preference for digital convenience and better rates drives this substitution.

Alternative Funding Sources for Businesses

Businesses increasingly tap into alternative funding channels, diminishing their dependence on traditional bank loans. This shift presents a significant threat of substitutes for commercial banking services, as companies can access capital through diverse avenues.

In 2024, the global crowdfunding market continued its robust expansion, projected to reach over $200 billion. Venture capital investments also remained a strong alternative, with tech startups alone attracting over $150 billion in the first three quarters of 2024, demonstrating a clear pathway for businesses to secure funding outside of bank lending.

- Crowdfunding: Platforms like Kickstarter and Indiegogo enable businesses to raise capital directly from a large number of individuals, bypassing traditional financial institutions.

- Venture Capital (VC) and Private Equity (PE): These investment firms provide capital to businesses with high growth potential in exchange for equity, offering substantial funding rounds.

- Bond Issuance: Larger, established companies can issue corporate bonds to raise debt financing from investors in the capital markets.

- Peer-to-Peer (P2P) Lending: Online platforms connect businesses directly with individual lenders, offering an alternative to bank loans.

The threat of substitutes for HarborOne Bank is multifaceted, encompassing credit unions, non-bank lenders, fintech companies, and alternative investment channels. These alternatives often offer competitive pricing, greater convenience, or specialized services that can draw customers away from traditional banking.

Credit unions, for example, continue to gain traction, with US credit unions holding over $2.1 trillion in assets as of 2023. Fintech innovations, particularly in digital payments, are also reshaping customer behavior, with the global digital payments market exceeding $7.5 trillion in 2023. These trends highlight a clear shift in consumer preferences towards more agile and often lower-cost financial solutions.

Businesses also have a growing array of funding options beyond traditional bank loans. In 2024, the global crowdfunding market was projected to surpass $200 billion, while venture capital continued to be a significant source of capital, with tech startups alone securing over $150 billion in the first three quarters of 2024. This diversification of funding sources directly challenges the market share of commercial banking services.

| Substitute Category | Key Characteristics | Market Data/Example (2023-2024) | Impact on HarborOne Bank |

|---|---|---|---|

| Credit Unions | Member-owned, competitive rates, lower fees | US Credit Union Assets: >$2.1 trillion (2023) | Attracts deposit and loan customers seeking value. |

| Non-Bank Lenders | Agile, tailored financing, online presence | Online Mortgage Originations: >60% market share (estimated) | Captures market share in mortgage and specialized lending. |

| Fintech/Digital Payments | Speed, convenience, innovative platforms | Global Digital Payments Market: >$7.5 trillion (2023) | Disrupts transaction services, payment processing. |

| Wealth Management Firms | Personalized planning, alternative investments | Assets Under Management (AUM): Trillions (2024) | Attracts high-net-worth individuals and their assets. |

| Alternative Business Funding | Crowdfunding, VC, P2P lending | Crowdfunding Market: >$200 billion projected (2024) Tech Startup VC Funding: >$150 billion (Q1-Q3 2024) |

Reduces reliance on traditional business loans. |

Entrants Threaten

The banking sector, including institutions like HarborOne Bank, faces significant hurdles due to stringent regulatory frameworks. New entrants must navigate complex licensing procedures, adhere to capital adequacy ratios, and establish robust compliance systems, all of which demand substantial upfront investment and ongoing operational expense. For instance, in 2024, the Federal Reserve’s capital requirements, such as the Common Equity Tier 1 (CET1) ratio, necessitate that banks maintain a specific percentage of their risk-weighted assets as high-quality capital, a significant barrier for startups.

Established institutions like HarborOne Bank leverage decades of cultivating strong brand recognition and deep customer trust. This ingrained loyalty presents a significant barrier for newcomers aiming to disrupt the market. For instance, in 2024, the average customer tenure at traditional banks often exceeds 10 years, reflecting the difficulty new entrants face in acquiring and retaining customers.

Existing banks, like HarborOne, often leverage significant economies of scale. This allows them to spread operational, technological, and marketing costs over a larger customer base, leading to lower per-unit costs. For instance, in 2024, many large regional banks reported substantial cost savings through branch network consolidation and digital platform investments, enabling them to offer more competitive loan and deposit rates.

New entrants face a considerable hurdle in matching these cost advantages. Without the established infrastructure and customer volume, startups may find it difficult to achieve the same operational efficiencies. This cost disadvantage can make it challenging for new players to compete on price with established institutions like HarborOne, potentially limiting their market penetration.

Access to Funding and Deposit Base

New entrants into the banking sector, like HarborOne Bank might face, grapple with the significant hurdle of building a robust and diverse deposit base. This is the lifeblood of any bank, funding its lending operations and overall stability. Without an established brand or widespread physical presence, attracting and retaining customer deposits in a crowded market presents a considerable challenge.

Consider the landscape in 2024: the banking industry continues to see consolidation, making it harder for smaller, newer institutions to compete for customer funds. For instance, while specific new entrant deposit acquisition costs aren't readily published, established banks often leverage promotional rates and extensive marketing campaigns, resources that are typically scarce for startups. This makes securing a substantial and reliable deposit base a slow and costly endeavor.

The threat is amplified by several factors:

- Difficulty in attracting retail deposits: Without a long history or a large branch network, new banks struggle to draw in individual savers who often prioritize convenience and familiarity.

- Competition from online-only banks: Digital-first competitors can often offer more attractive rates due to lower overhead, further intensifying the competition for deposits.

- Reliance on wholesale funding: Initially, new banks may need to rely more heavily on more expensive wholesale funding sources, impacting their profitability and competitiveness.

- Regulatory hurdles: Meeting capital requirements and other regulatory demands for deposit insurance can be substantial for new entities.

Technological Infrastructure and Innovation Costs

While new entrants can adopt cutting-edge technology, establishing a robust, secure, and scalable banking infrastructure demands significant capital outlay. For instance, modern core banking systems and advanced cybersecurity measures can cost millions, creating a high initial barrier.

The relentless pace of innovation in financial services, driven by evolving customer demands and the constant threat of cyberattacks, necessitates ongoing investment. Banks like HarborOne must continually upgrade their platforms and security protocols to remain competitive and compliant, a costly endeavor for newcomers.

- High Capital Investment: Building a secure and scalable banking technology infrastructure can cost tens of millions of dollars.

- Continuous Innovation Costs: Annual spending on technology upgrades and cybersecurity can represent a significant percentage of operating expenses for established players.

- Regulatory Compliance: Meeting stringent regulatory requirements for data security and privacy adds further to the infrastructure costs for any new entrant.

The threat of new entrants for HarborOne Bank is moderately high, primarily due to the significant regulatory and capital requirements that act as substantial barriers. While technology can lower some entry costs, the need for extensive compliance, building customer trust, and achieving economies of scale remain formidable challenges for newcomers in 2024.

New banks must overcome high upfront costs for technology infrastructure and regulatory compliance, often running into millions of dollars. For example, implementing a secure core banking system and meeting cybersecurity mandates in 2024 can easily exceed $10 million. This financial burden, coupled with the difficulty of attracting deposits against established brands, significantly limits the number of viable new entrants.

| Barrier | Estimated Cost (2024) | Impact on New Entrants |

|---|---|---|

| Regulatory Compliance & Licensing | $1M - $5M+ | High upfront investment, prolonged setup time |

| Core Banking Technology Infrastructure | $5M - $20M+ | Significant capital outlay, ongoing maintenance costs |

| Customer Acquisition (Deposit Base) | $500 - $1000 per account | Intense competition, high marketing spend required |

| Brand Building & Trust | Years of consistent service | Difficult to replicate, long-term effort |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for HarborOne Bank leverages data from industry-specific market research reports, financial statements of publicly traded banks, and regulatory filings from the FDIC and other relevant authorities. This ensures a comprehensive understanding of competitive dynamics within the banking sector.