HarborOne Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HarborOne Bank Bundle

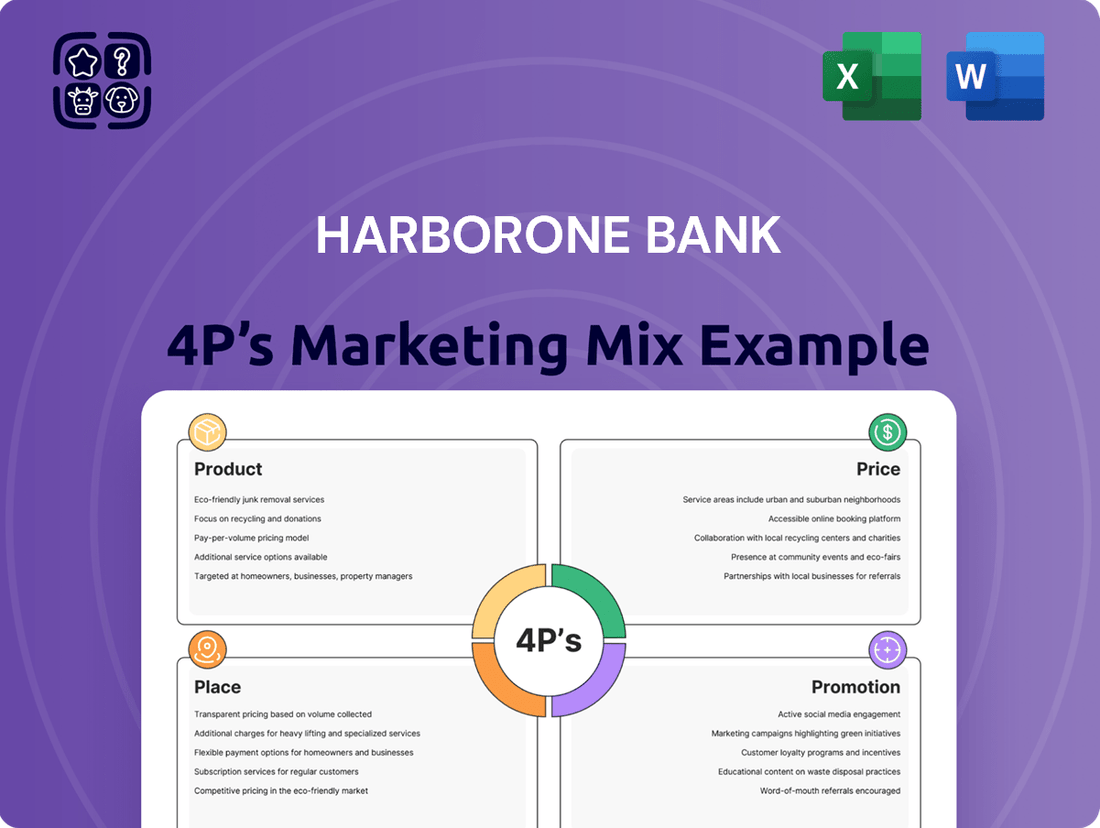

Discover the strategic brilliance behind HarborOne Bank's marketing efforts! This analysis delves into their product offerings, competitive pricing, accessible distribution, and impactful promotions, revealing how they connect with customers.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for HarborOne Bank. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

HarborOne Bank's Product strategy for business banking is robust, offering a comprehensive suite of solutions. This includes specialized checking and savings accounts designed to cater to the unique financial demands of businesses, ensuring operational efficiency and growth.

These business accounts come equipped with essential digital tools, such as 24/7 online and mobile banking, facilitating seamless account management. Features like bill pay, ACH/payroll processing, wire transfers, and check protection services (Positive Pay) are integrated to streamline financial operations for businesses.

For instance, HarborOne Bank's commitment to digital accessibility is evident, with many of its business checking accounts offering unlimited transactions and competitive interest rates as of early 2024. This focus on digital functionality and value-added services directly addresses the need for efficient and accessible financial management for its business clientele.

HarborOne Bank offers a robust suite of lending products designed to fuel business growth. This includes flexible business lines of credit, ideal for managing day-to-day working capital needs, and term loans for more significant investments like equipment purchases. For larger capital expenditures, commercial real estate financing is readily available.

As an SBA Preferred Lender, HarborOne Bank streamlines the application process for Small Business Administration loans, making it easier for entrepreneurs to access crucial funding. This designation underscores their commitment to supporting small businesses, a vital sector for economic development. In 2024, SBA loan approvals saw a notable increase, with over $44 billion disbursed nationally through various SBA programs, highlighting the continued demand for these government-backed financing options.

HarborOne Bank's Cash Management Services are designed to boost business efficiency and security. These offerings, including remote deposit capture and ZEscrow for streamlined subaccount management, empower companies to gain greater control over their finances.

The bank provides essential tools like wire and ACH services for swift electronic transactions, alongside lockbox services to accelerate payment processing. This focus on optimizing cash flow and fraud mitigation is crucial for businesses navigating the dynamic economic landscape of 2024-2025.

Digital Banking and Security Features

HarborOne Bank's digital banking and security features are designed for ultimate convenience and protection. Their online and mobile platforms offer businesses seamless access to manage their finances, anytime, anywhere. This focus on digital accessibility is crucial in today's fast-paced environment, with a significant portion of banking transactions now occurring digitally.

Key security measures are integrated to build trust and safeguard client assets. This includes real-time transaction alerts, allowing users to monitor activity instantly. Furthermore, customers have control over their online access security, enabling them to manage permissions and settings proactively. Secure tokens provide an extra layer of authentication, significantly reducing the risk of unauthorized access.

- Real-time Alerts: Proactive notifications for all account activity.

- Online Access Control: Empowering users to manage their digital security settings.

- Secure Tokens: Multi-factor authentication for enhanced login protection.

- Mobile & Online Platforms: Convenient and secure financial management tools.

The demand for secure and accessible digital banking solutions continues to grow. In 2024, it's estimated that over 80% of consumers prefer digital channels for their banking needs, highlighting the importance of robust online security features like those offered by HarborOne Bank.

Educational Resources and Business Support

HarborOne Bank actively invests in its community's financial literacy through its 'HarborOne U' platform. This initiative provides accessible, free digital content and live webinars covering crucial small business and personal finance topics. By offering insights into business planning, cash flow management, growth strategies, and cybersecurity, HarborOne demonstrates a tangible commitment to fostering business success.

The 'Voyage for Business' program, specifically, underscores this dedication by equipping entrepreneurs with knowledge vital for navigating the modern economic landscape. For instance, in 2024, small businesses continued to face challenges with digital transformation and economic uncertainty, making educational resources on these fronts particularly valuable. HarborOne's proactive approach ensures clients are better prepared.

- Free Digital Content: Accessible online resources covering business planning and financial management.

- Webinars and Recordings: Live and on-demand sessions on growth strategies and cyber protection.

- Focus on Small Business: Tailored educational support for entrepreneurs.

- Beyond Traditional Banking: Commitment to client success through knowledge sharing.

HarborOne Bank's product offerings for businesses are comprehensive, encompassing specialized deposit accounts, a full spectrum of lending solutions including SBA loans, and advanced cash management services. These products are designed to enhance operational efficiency, facilitate growth, and ensure financial security.

The bank's digital platform provides 24/7 access to essential banking tools, reinforcing its commitment to convenience and accessibility. This digital focus is crucial, as an estimated 80% of consumers preferred digital channels for banking in 2024.

HarborOne Bank also prioritizes client education through initiatives like 'HarborOne U', offering free resources on financial management and business growth, directly addressing the challenges faced by small businesses in the current economic climate.

| Product Category | Key Features | Target Business Need | 2024/2025 Relevance |

|---|---|---|---|

| Deposit Accounts | Specialized checking/savings, unlimited transactions (select accounts), competitive interest rates | Operational efficiency, managing daily finances | Supports businesses seeking cost-effective and flexible banking in a fluctuating interest rate environment. |

| Lending Solutions | Lines of credit, term loans, commercial real estate financing, SBA loans | Working capital, capital expenditures, business expansion | Crucial for businesses seeking funding for growth, with SBA loan demand remaining high nationally. |

| Cash Management | Remote deposit capture, ZEscrow, wire/ACH, lockbox services | Streamlining transactions, accelerating payments, fraud mitigation | Essential for optimizing cash flow and enhancing security in a digital-first business landscape. |

| Digital Banking & Security | Online/mobile banking, real-time alerts, secure tokens, access control | Convenience, accessibility, asset protection | Addresses the growing demand for secure and user-friendly digital financial management tools. |

What is included in the product

This analysis provides a comprehensive examination of HarborOne Bank's Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals and stakeholders.

This HarborOne Bank 4P's Marketing Mix Analysis acts as a pain point reliever by clearly outlining strategies to address customer acquisition challenges and improve brand perception.

Place

HarborOne Bank's extensive branch network is a cornerstone of its marketing strategy, primarily serving individuals, families, and businesses across Southern New England. This physical presence is critical for building trust and offering convenient access to financial services.

With 30 full-service banking centers strategically located throughout Massachusetts and Rhode Island, HarborOne ensures that customers have accessible physical touchpoints for their banking needs. As of early 2024, this network facilitated millions of customer interactions annually, underscoring its importance in customer retention and acquisition within its core geographic markets.

HarborOne Bank strategically positions commercial lending offices in vital business centers such as Boston, MA, and Providence, RI, complementing its branch presence. These specialized locations are designed to directly address the unique financing requirements of small to medium-sized businesses and real estate investors operating within these key metropolitan markets.

HarborOne Bank's robust digital banking platforms, including its online and mobile applications, are a cornerstone of its marketing mix. These digital tools allow businesses to seamlessly manage accounts, execute transactions, and access a wide array of banking services from virtually anywhere. This remote capability offers significant convenience, extending financial management beyond traditional banking hours and physical branch limitations.

In 2024, the demand for sophisticated digital banking solutions continues to surge, with businesses increasingly prioritizing platforms that offer efficiency and accessibility. HarborOne's investment in these technologies ensures clients can maintain control over their finances and operations with ease, a crucial factor in today's fast-paced business environment.

Mobile Banking App for On-the-Go Access

The HarborOne Mobile App provides businesses with essential banking tools, accessible through their smartphones or web browsers. This allows for convenient, on-the-go financial management, a crucial element for modern businesses. In 2024, mobile banking adoption continued its upward trend, with a significant percentage of small businesses reporting increased usage for daily transactions.

Key features of the app empower users with:

- Real-time balance and transaction information

- Bill payment capabilities

- Fund transfer options

- Mobile check deposit

Appointment Scheduling for Personalized Service

HarborOne Bank enhances customer engagement through its appointment scheduling tool, offering flexibility for in-person, phone, or Zoom consultations. This feature directly addresses the 'People' aspect of the marketing mix by facilitating direct interaction with banking professionals, ensuring a personalized approach to service delivery.

This digital convenience is particularly valuable for businesses seeking tailored financial advice. For instance, in 2024, digital appointment booking systems across the banking sector saw a significant uptick, with many institutions reporting over 60% of customer service inquiries being initiated digitally, reflecting a strong preference for accessible and scheduled interactions.

- Personalized Consultations: Customers can book time with specific banking experts for tailored advice.

- Flexible Channels: Appointments are available in-person, over the phone, or via video conferencing (Zoom).

- Business Focus: The service is designed to help businesses connect efficiently with banking professionals.

- Digital Convenience: Streamlines the process of seeking financial guidance and support.

HarborOne Bank's physical presence, its "Place" in the 4Ps, is defined by its 30 branches across Massachusetts and Rhode Island, alongside specialized commercial lending offices in Boston and Providence. This network, serving Southern New England, facilitated millions of customer interactions in early 2024, reinforcing its role in customer acquisition and retention within these key markets.

Full Version Awaits

HarborOne Bank 4P's Marketing Mix Analysis

The preview shown here is the actual HarborOne Bank 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown covers Product, Price, Place, and Promotion strategies tailored for HarborOne Bank, offering immediate actionable insights.

Promotion

HarborOne Bank employs targeted business bonus offers as a key promotional strategy to draw in new business checking account clients. These incentives, like a potential $1,000 bonus, aim to make the switch appealing.

Beyond the cash incentive, these promotions often bundle complimentary cash management services for an introductory period. This added value encourages businesses to explore HarborOne's broader financial solutions.

HarborOne Bank actively promotes its relationship banking model, emphasizing a deep understanding of each business's unique needs to craft personalized financial solutions. This commitment fosters long-term partnerships built on trust and collaboration.

This client-centric approach is a cornerstone of their strategy, aiming to move beyond transactional banking to become a valued financial partner. Their focus on service and integrity underpins these relationships, aiming for mutual growth and success.

HarborOne Bank champions financial literacy and business acumen through its dedicated educational platforms, HarborOne U and Voyage for Business. These initiatives provide a wealth of free digital resources, including webinars and recorded sessions, covering essential topics like robust business planning, effective cash flow management, and actionable growth strategies. This commitment positions HarborOne not just as a financial institution, but as a valuable partner invested in the success of its business clients.

Digital Marketing and Online Presence

HarborOne Bank actively promotes its digital marketing and online presence, highlighting the convenience and security of its mobile app and online banking platform. These digital tools offer essential features like online account management, bill pay, and mobile deposit, making banking accessible anytime, anywhere.

The bank emphasizes its commitment to digital security through readily available online documentation, reassuring customers about the safety of their financial transactions. This focus on digital convenience and robust security is a key component of their customer acquisition and retention strategy.

- Digital Convenience: Online account management, bill pay, and mobile deposit are central to HarborOne's digital strategy.

- Security Emphasis: Online documentation and security features are promoted to build customer trust.

- Mobile App Usage: As of late 2024, a significant portion of HarborOne's customer base utilizes the mobile app for daily banking needs, reflecting strong adoption rates.

- Online Engagement: The bank consistently updates its digital platforms with new features and security protocols to enhance user experience and engagement.

Community Engagement and Local Focus

HarborOne Bank actively promotes its identity as a full-service community bank by deeply engaging in local support through diverse initiatives. This dedication to community service, which has resulted in high customer satisfaction ratings, acts as a significant promotional tool, fostering trust and enhancing its reputation within Massachusetts and Rhode Island.

Their commitment is evident in tangible actions; for instance, in 2023, HarborOne Bank contributed over $1.5 million to various community organizations and initiatives across its operating regions. This focus on local impact is a core element of their strategy, differentiating them from larger, less localized financial institutions.

- Community Investment: HarborOne's 2023 community contributions exceeded $1.5 million.

- Local Focus: Primary service areas are Massachusetts and Rhode Island.

- Reputation Building: Community engagement directly translates to enhanced trust and brand loyalty.

- Customer Acquisition: High ratings stemming from community support attract new customers seeking a community-oriented bank.

HarborOne Bank leverages targeted business bonuses, such as a potential $1,000 offer, to attract new business checking clients, making account switching more appealing. Complementary cash management services are often included, encouraging exploration of their wider financial offerings.

The bank promotes its relationship banking model, emphasizing personalized solutions and a deep understanding of client needs to foster long-term partnerships. Educational platforms like HarborOne U and Voyage for Business offer free resources to boost client financial literacy and business acumen.

HarborOne Bank highlights its digital convenience and security, with a robust mobile app and online platform facilitating account management, bill pay, and mobile deposits. By late 2024, a substantial portion of their customer base actively uses the mobile app for daily banking, demonstrating strong digital adoption.

Their identity as a community bank is reinforced through significant local support, exemplified by over $1.5 million contributed to community organizations in 2023. This local commitment, particularly in Massachusetts and Rhode Island, builds trust and attracts customers seeking a community-focused financial partner.

Price

HarborOne Bank distinguishes itself by offering highly competitive interest rates across its business lending portfolio. This includes substantial financial solutions like term loans and lines of credit, with the bank supporting financing needs up to $500,000.

For small to medium-sized businesses, the BusinessOne program provides a streamlined application process for loans ranging from $10,000 to $100,000. These loans benefit from rapid decision-making, often within 48 hours, and feature attractive starting rates at Prime +2.00%, ensuring businesses can access capital quickly and affordably.

HarborOne Bank offers adaptable payment schedules for its business loans, including interest-only options on lines of credit. This flexibility helps businesses manage cash flow more effectively, especially during initial growth phases or periods of fluctuating revenue. For instance, an interest-only period can reduce immediate principal repayment burdens, freeing up capital for operational needs.

Commercial real estate financing at HarborOne Bank includes fixed-rate terms extending up to 10 years, providing predictability in borrowing costs. Furthermore, amortization periods can stretch to 25 years, allowing for lower monthly payments by spreading the loan repayment over a longer duration. This structure is particularly beneficial for businesses acquiring or developing property, enabling more manageable debt service.

HarborOne Bank is waiving cash management service fees for eligible new business checking accounts opened before December 31, 2025, provided they maintain an average daily balance of $15,000. This promotion directly addresses the 'Price' element of the marketing mix by offering a tangible cost reduction. For instance, typical cash management fees can range from $25 to $100 or more per month, meaning this waiver could save a new business between $300 and $1,200+ in its first year.

No Monthly Maintenance Fees on Select Business Checking Accounts

HarborOne Bank's pricing strategy includes offering no monthly maintenance fees on select business checking accounts, such as the Business Value Checking. This is a significant draw for businesses looking to control expenses. For instance, by waiving a typical $15-$30 monthly fee, businesses can retain more capital for growth.

This pricing tactic directly addresses the cost-consciousness of small and medium-sized enterprises. By removing a common banking overhead, HarborOne makes its services more accessible and appealing. This can be particularly impactful in the current economic climate, where efficiency is paramount.

- No Monthly Maintenance Fees: Select accounts, like Business Value Checking, eliminate this common business banking cost.

- Minimum Opening Deposit: A low barrier to entry, often around $100, ensures accessibility.

- No Minimum Balance Requirement: This feature provides flexibility, allowing businesses to manage cash flow without penalty.

- Cost Savings for Businesses: Eliminating monthly fees can save businesses hundreds of dollars annually, improving operational efficiency.

Discounted Rates on Merchant and Payroll Services

HarborOne Bank is currently offering attractive promotional pricing on key business services as part of its marketing strategy. For new business banking clients, this translates into significant cost reductions on essential operational tools, aiming to attract and retain a broader customer base in the competitive financial landscape.

These discounted rates are specifically focused on merchant and payroll services, crucial components for many businesses. For instance, new customers can access Clover Merchant Services with a nominal monthly rental fee of just $.01 for select point-of-sale hardware. Additionally, the setup fee for Paychex payroll services is reduced by $200, directly lowering the barrier to entry for efficient payroll management.

- $.01 monthly rental on select Clover POS hardware

- $200 discount on Paychex setup fees

- Limited-time offer for new business banking customers

- Aimed at reducing operational costs for businesses

HarborOne Bank's pricing strategy is built around accessibility and cost savings for businesses. By waiving cash management fees for eligible new accounts maintaining a $15,000 average daily balance until December 31, 2025, they offer tangible savings, potentially $300 to $1,200+ annually. Select accounts, like Business Value Checking, also eliminate monthly maintenance fees, a significant cost reduction for many SMEs.

Further enhancing their price competitiveness, HarborOne offers promotional rates on essential services. New clients can secure Clover Merchant Services hardware for a minimal $.01 monthly rental fee on select units. Additionally, a $200 discount on Paychex setup fees lowers the initial investment for vital payroll management.

| Service | Pricing Detail | Benefit |

|---|---|---|

| Cash Management Fees | Waived for eligible accounts meeting $15K daily balance (until 12/31/2025) | Annual savings of $300-$1,200+ |

| Business Value Checking | No monthly maintenance fees | Reduces operational overhead |

| Clover POS Hardware | $.01 monthly rental on select units | Lowers initial hardware cost |

| Paychex Setup Fees | $200 discount | Reduces barrier to payroll services |

4P's Marketing Mix Analysis Data Sources

Our HarborOne Bank 4P's Marketing Mix Analysis is built using a blend of official company communications, including annual reports and investor presentations, alongside market research and competitive analysis. We also incorporate data from industry publications and public financial disclosures to ensure a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.