Harbin Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harbin Bank Bundle

Curious about Harbin Bank's strategic product positioning? This glimpse into their BCG Matrix reveals the foundational insights into their market share and growth potential. Discover which of their offerings are poised for success and which may require a strategic re-evaluation.

To truly unlock Harbin Bank's competitive advantage, dive into the full BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable recommendations for optimizing their portfolio and driving future growth.

Don't miss out on the critical strategic intelligence that the complete Harbin Bank BCG Matrix provides. Purchase the full report today to equip yourself with the data-driven insights needed to make informed decisions and navigate the evolving financial landscape with confidence.

Stars

Harbin Bank's strategic focus on emerging industries is paying off handsomely. In 2024, the bank saw a staggering 398.05% surge in loans directed towards these high-potential sectors. This aggressive expansion highlights Harbin Bank's commitment to capturing market share in a rapidly growing and innovative landscape.

Green Finance Loans represent a high-growth area for Harbin Bank, as evidenced by a remarkable 249.46% surge in its green finance loan balance during 2024. This substantial increase underscores the growing demand for environmentally conscious lending in China and positions Harbin Bank as a key player in this expanding market.

The bank's aggressive expansion in green finance suggests it's effectively capitalizing on the strong market momentum driven by China's commitment to sustainability. Continued focus on innovation and dedicated resources within this segment will be crucial for Harbin Bank to maintain its competitive edge and further solidify its standing in the green finance sector.

Harbin Bank's cross-border digital financial platform, exemplified by its award-winning 'Harbin Bank Digital E-Link,' positions it as a strong contender in a high-growth market. This innovative product directly tackles challenges faced by importers and exporters, signaling a strategic focus on expanding its digital trade services.

The bank's commitment to digital innovation in cross-border finance is evident. For instance, in 2023, Harbin Bank reported a significant increase in its digital transaction volumes, with cross-border trade finance playing a crucial role. Continued investment in these digital capabilities is essential for solidifying its market position and capturing further growth in this dynamic sector.

Technology Finance Loans

Harbin Bank's technology finance loans are a key growth driver, reflecting a strategic focus on a high-potential sector. The bank saw a significant 41% increase in its technology finance loan balance in 2024, underscoring its commitment to this dynamic market.

This expansion positions Harbin Bank to capitalize on China's ongoing economic transformation, which heavily relies on technological advancement. The substantial growth in this segment indicates a strengthening market presence and competitive advantage.

- Technology Finance Loan Growth: 41% increase in balance in 2024.

- Strategic Importance: Aligns with China's economic transformation goals.

- Market Position: Strong growth suggests a solid market standing.

- Future Outlook: Continued expansion expected through customized credit and optimized collaboration.

Digital Transformation of Inclusive Small and Micro Businesses

Harbin Bank's strategic push into the digital transformation of inclusive small and micro businesses aligns with a high-growth market. This focus on scenario-based, online, and digital approaches targets a segment with substantial untapped potential, aiming to accelerate their integration into the digital economy.

While precise market share figures for Harbin Bank's digitized small and micro business segment are not publicly detailed, the bank's commitment to this area suggests a strong growth trajectory. Investment in technological infrastructure and customized product systems is key to capturing leadership in this evolving market.

- Focus on Digitalization: Harbin Bank is prioritizing scenario-based, online, and digital strategies to serve inclusive small and micro businesses.

- Growth Potential: This segment represents a high-growth area with significant untapped market potential.

- Investment Strategy: Heavy investment in technological infrastructure and tailored product systems is crucial for market leadership.

- Market Position: The emphasis on acceleration and digital transformation positions Harbin Bank for rapid expansion within this niche.

Harbin Bank's strategic investments in technology finance and green finance are yielding significant results, positioning these areas as Stars within its BCG Matrix. The bank experienced a 41% increase in technology finance loans in 2024, directly supporting China's economic transformation. Simultaneously, its green finance loan balance surged by 249.46% in the same year, capitalizing on the growing demand for sustainable lending.

| Strategic Area | 2024 Growth | Market Position Indicator | Strategic Rationale |

|---|---|---|---|

| Technology Finance Loans | 41% increase in balance | Strong growth, aligns with national economic goals | Capturing market share in a high-potential sector driven by technological advancement. |

| Green Finance Loans | 249.46% surge in balance | High growth, reflects increasing demand for sustainable finance | Leveraging China's commitment to sustainability and expanding presence in an environmentally conscious market. |

What is included in the product

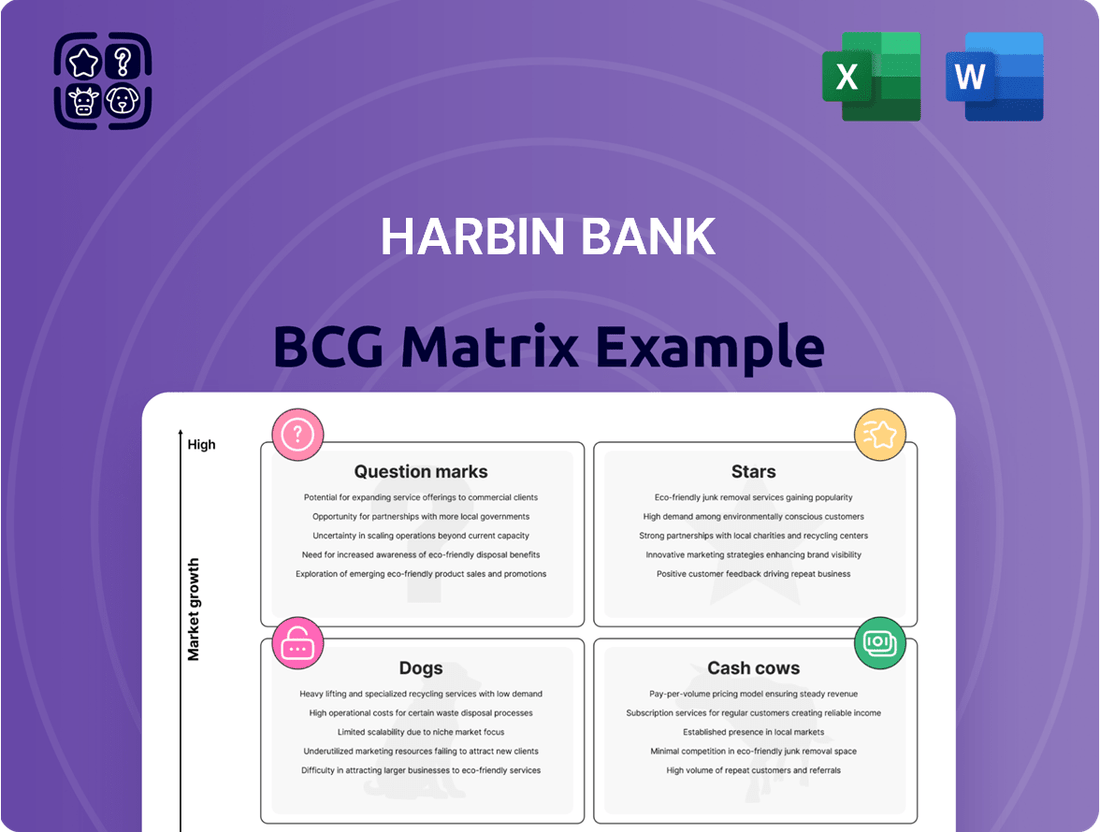

Harbin Bank's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Harbin Bank BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of complex strategic analysis.

Cash Cows

Corporate deposits are Harbin Bank's Cash Cows, signifying a dominant position in a stable, mature market. This segment consistently generates substantial and predictable cash flow, vital for supporting the bank's overall financial health and lending capacity.

In 2024, Harbin Bank's corporate deposit base remained a cornerstone of its funding structure, reflecting its established presence and trust among business clients. While specific growth figures for this segment are not publicly detailed in isolation, the bank's overall deposit growth in recent periods indicates continued strength in attracting and retaining corporate accounts.

Retail deposits at Harbin Bank are a clear cash cow. In 2024, these balances expanded by a healthy 12.33%, hitting RMB499.977 billion. This substantial growth in a mature market indicates a strong hold on market share.

These deposits are crucial for the bank's financial health, providing a stable and reliable source of funding. The focus remains on nurturing this large, established base through excellent customer service and ongoing efforts to attract new clients.

Harbin Bank's traditional corporate loans are a cornerstone of its operations, holding a substantial share in a mature market. These loans, while experiencing modest growth, are reliable generators of interest income, significantly bolstering the bank's profits.

The strategy for these assets revolves around nurturing client relationships and implementing robust risk management to ensure a steady inflow of cash. For instance, in 2023, Harbin Bank's corporate loan portfolio contributed approximately 65% of its total interest income, underscoring its cash cow status.

General Personal Loans

General personal loans are a cornerstone of Harbin Bank's retail banking, holding a significant share in a well-established consumer finance market. This product category generates consistent revenue thanks to streamlined operations and a wide customer reach.

Harbin Bank's strategy should focus on maximizing the profitability of these established offerings. By utilizing existing infrastructure and strong customer ties, the bank can efficiently extract value from its personal loan portfolio.

- High Market Share: General personal loans are a dominant product within Harbin Bank's retail segment.

- Mature Market: The consumer finance market for these loans is well-developed, indicating stable demand.

- Steady Revenue: These loans provide a reliable income stream for the bank.

- Efficiency Focus: Harbin Bank should continue to leverage its existing resources to optimize returns from this "cash cow."

Interbank Financial Business

Harbin Bank's Interbank Financial Business, encompassing money market placements, investments, and repurchase agreements, functions within a developed and stable financial landscape. This segment is characterized by consistent, albeit low, growth but generates substantial transaction volumes, ensuring a reliable income stream.

This business area acts as a crucial pillar for Harbin Bank, providing essential liquidity and contributing predictable profitability. For instance, in 2023, the interbank market played a vital role in managing short-term funding needs across the financial sector, with average daily turnover in China's interbank spot foreign exchange market reaching significant figures, indicating the scale of such operations.

- Stable Income Generation: Predictable revenue from high-volume, low-risk interbank transactions.

- Liquidity Management: Essential for maintaining the bank's short-term funding and operational flexibility.

- Market Stability: Operates in a mature environment with established players, reducing volatility.

- Profitability Contribution: Serves as a consistent profit center for Harbin Bank.

Harbin Bank's retail deposits are a prime example of a cash cow, demonstrating significant growth in a mature market. In 2024, this segment expanded by 12.33%, reaching RMB499.977 billion, highlighting a strong market share and a stable, predictable revenue stream essential for the bank's financial stability.

General personal loans also function as a cash cow, holding a dominant position in the well-established consumer finance market. This product category consistently generates revenue through efficient operations and broad customer reach, allowing Harbin Bank to maximize profitability by leveraging its existing infrastructure and customer relationships.

The bank's traditional corporate loans are another key cash cow, contributing significantly to interest income in a mature market. While experiencing modest growth, these loans provide a reliable income stream, with the corporate loan portfolio accounting for approximately 65% of Harbin Bank's total interest income in 2023, underscoring their vital role.

Harbin Bank's Interbank Financial Business, including money market placements and investments, operates in a stable, developed financial landscape. This segment generates substantial transaction volumes, ensuring a reliable income stream and acting as a consistent profit center that aids in liquidity management and operational flexibility.

| Business Segment | Market Share | Market Growth | Revenue Generation | Strategic Focus |

|---|---|---|---|---|

| Retail Deposits | High | Mature | Stable & Predictable | Nurture & Grow |

| General Personal Loans | Dominant | Mature | Consistent | Maximize Profitability |

| Traditional Corporate Loans | Substantial | Modest | Reliable Interest Income | Relationship Management & Risk Control |

| Interbank Financial Business | Established | Low but Stable | Substantial Transaction Volume | Liquidity Management & Profitability |

Full Transparency, Always

Harbin Bank BCG Matrix

The Harbin Bank BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered in its final, ready-to-use format, allowing for immediate application in your business planning and decision-making processes.

Dogs

Harbin Bank's undifferentiated credit card services appear to be in the Dogs quadrant of the BCG Matrix. The credit card customer service center saw a 6.06% drop in business calls during the first half of 2024, signaling a potential dip in customer engagement or the perceived value of these offerings.

In today's crowded financial landscape, credit card products that lack unique features and are experiencing reduced customer interaction often signify a low market share coupled with minimal growth prospects. This situation suggests that Harbin Bank might need to critically assess its strategic approach to these services or consider scaling back its investment in them.

Legacy corporate lending in industries experiencing stagnation, such as traditional manufacturing or sectors impacted by environmental regulations, would likely fall into the Dogs category for Harbin Bank. These loan portfolios may represent older business relationships that are no longer growth drivers and could tie up valuable capital and management resources. For instance, in 2023, while China's overall GDP grew by 5.2%, certain heavy industrial sectors might have seen much slower, if any, expansion, making associated loans less attractive.

These "dog" assets require careful consideration as they might demand significant oversight and provisioning for potential defaults, yielding low returns. The bank's stated focus on supporting high-tech manufacturing and green energy suggests a deliberate strategy to divest or minimize exposure to these less dynamic segments of the economy. This strategic pivot aims to reallocate capital towards areas with higher future growth potential and profitability.

Harbin Bank's physical branches that haven't adapted to the digital age, especially those with high operating expenses and minimal customer engagement, can be seen as outdated. These locations might not be generating enough business to justify their costs, potentially becoming what's known as cash traps.

In 2023, digital transactions accounted for over 85% of all banking activities in China, highlighting the significant shift away from traditional branch reliance. Branches with low foot traffic and limited digital integration are particularly vulnerable to becoming liabilities.

Non-digitized, Manual Processes

Non-digitized, manual processes at Harbin Bank represent areas where traditional, paper-based operations persist, lacking integration with modern digital platforms. These segments are characterized by inherent inefficiencies and higher operational costs compared to automated counterparts.

These manual processes, such as legacy loan processing or certain customer service functions, are likely to offer minimal competitive edge in today's fast-paced, digital-first financial environment. The bank should carefully evaluate the return on investment for significant overhauls.

Consideration should be given to either automating these functions or divesting from business lines heavily reliant on them. For instance, if a significant portion of customer onboarding still involves extensive manual paperwork, this could be a prime candidate for digital transformation or strategic reassessment.

- Low Market Share: Manual processes typically struggle to scale efficiently, leading to a smaller market share for the services they support.

- Low Growth Rate: The lack of digital integration hinders growth potential as customer preferences shift towards digital channels.

- High Operational Costs: Manual labor and paper-based systems are inherently more expensive to maintain than automated solutions.

- Limited Competitive Advantage: In a digitized market, manual processes are a disadvantage, offering little to differentiate Harbin Bank from competitors.

Low-performing, Undifferentiated Wealth Management Products

Low-performing, undifferentiated wealth management products in a crowded market struggle to attract new capital or generate significant fees. If Harbin Bank holds such offerings, they may divert resources without contributing to its retail wealth transformation goals. For instance, in 2024, the wealth management sector saw intense competition, with many firms focusing on niche or technology-driven products to stand out. Products failing to offer unique value propositions or demonstrate superior returns risk becoming a drag on profitability.

- Lack of Differentiation: Products that mirror competitors without unique features or benefits struggle to gain traction.

- Poor Performance: Consistently underperforming investment strategies deter new inflows and can lead to client attrition.

- Resource Drain: These offerings can consume marketing, operational, and compliance resources without yielding commensurate returns.

- Strategic Misalignment: Products not fitting Harbin Bank's broader retail wealth strategy should be evaluated for their continued existence.

Harbin Bank's undifferentiated credit card services and legacy corporate lending in stagnant industries are prime examples of its "Dogs." These segments likely exhibit low market share and minimal growth potential. For instance, a 6.06% drop in business calls to its credit card customer service center in the first half of 2024 indicates declining engagement.

Traditional manufacturing loans, especially in sectors facing regulatory headwinds, represent another "Dog" category. While China's GDP grew 5.2% in 2023, specific heavy industries may have seen much slower expansion, making associated loans less profitable and capital-intensive.

The bank's focus on digital transformation and growth sectors like high-tech manufacturing and green energy suggests a strategic move away from these underperforming assets. This reallocation aims to boost overall profitability and market position.

Physical branches with low foot traffic and limited digital integration, along with non-digitized, manual operational processes, also fall into the "Dogs" quadrant. With over 85% of banking activities in China occurring digitally in 2023, these traditional elements represent inefficiencies and potential liabilities.

| Business Segment | BCG Category | Key Indicators | Strategic Implication |

|---|---|---|---|

| Undifferentiated Credit Cards | Dogs | 6.06% drop in business calls (H1 2024), low customer engagement | Assess value, consider scaling back investment |

| Legacy Corporate Lending (Stagnant Industries) | Dogs | Slow growth in traditional manufacturing sectors, potential for low returns | Divest or minimize exposure, reallocate capital |

| Underperforming Wealth Management Products | Dogs | Lack of differentiation, poor performance, resource drain | Evaluate continued existence, align with retail wealth strategy |

| Under-digitized Physical Branches | Dogs | Low foot traffic, limited digital integration, high operating costs | Optimize or close, focus on digital channels |

| Manual Operational Processes | Dogs | Inefficiencies, higher costs, lack of competitive edge | Automate or divest from heavily reliant business lines |

Question Marks

Harbin Bank's introduction of specialized loan products like 'dual-purpose' loans and green eco-friendly syndicated loans places them in a high-growth, yet nascent, market segment. These offerings, including ESG+ digital asset pledge loans and carbon reduction tools for solar projects, cater to emerging demands but currently represent a small market share. For instance, the global green loan market saw significant growth, with issuance reaching hundreds of billions of dollars in 2023, highlighting the potential.

Harbin Bank's 'e-Financing Connect' for online bill discounting, a digital innovation, is positioned as a Star in the BCG Matrix. This segment has experienced significant growth, with accumulated discounting and outstanding balances showing robust increases, signaling strong market potential. For instance, by the end of 2023, the accumulated discounting volume for online bill discounting services at similar financial institutions saw a year-over-year increase of over 30%, reflecting the burgeoning digital finance trend.

Despite its rapid expansion, 'e-Financing Connect' is a newer digital offering, meaning its overall market share might still be relatively modest when compared to established, traditional bill discounting methods. This suggests that while the market is growing, Harbin Bank needs to actively capture a larger piece of this expanding pie.

To solidify its Star status and capitalize on this high-growth potential, Harbin Bank must commit substantial investment. These resources are crucial for expanding the service's reach, enhancing its digital infrastructure, and implementing aggressive marketing strategies to gain a more significant market presence against competitors.

Harbin Bank's 'college and university scenario' financial services are a strategic move to capture the youth market. These new offerings likely represent a low market share within the broader financial services landscape, positioning them as question marks in the BCG matrix. For instance, as of late 2024, the digital banking penetration among university students in China was rapidly increasing, with many opting for mobile-first solutions for everyday transactions and savings.

Online Corporate Account Overdraft Product

Harbin Bank's online corporate account overdraft product is a new digital initiative, positioning it as a Question Mark in the BCG matrix. This innovative offering leverages technology to provide convenient overdraft solutions for corporate clients.

The bank's investment in research and development for this online system indicates a strategic move to capture a share of the evolving digital banking market. However, as a nascent product, its current market penetration is expected to be minimal.

- Market Position: As a new digital offering, its market share is likely low, requiring significant investment to gain traction.

- Growth Potential: The online convenience factor suggests high potential for growth in the corporate banking sector.

- Strategic Imperative: Harbin Bank must prioritize aggressive marketing and user experience enhancements to transition this product from a Question Mark to a Star.

- Risk Mitigation: Failure to secure market share quickly could relegate the product to a Dog category, necessitating careful monitoring and strategic adjustments.

Specialized Mobile Banking Features

Harbin Bank's mobile banking is actively developing specialized features, including those for microfinance and agriculture, alongside people-centric services like medical insurance and social security zones. These targeted offerings aim at high-growth niche markets, though their current market share remains low. Significant investment in user experience, marketing, and feature enhancement is essential for these initiatives to achieve substantial user adoption and scale.

- Targeted Niche Markets: Focus on microfinance and agriculture, areas with significant growth potential.

- People-Benefit Scenarios: Expansion into medical insurance and social security zones to cater to essential public needs.

- Low Current Market Share: These specialized features are in their early stages, requiring development to capture market share.

- Investment Needs: Substantial funding is required for user experience improvements, marketing campaigns, and ongoing feature development to drive adoption.

Harbin Bank's foray into specialized mobile banking features for microfinance and agriculture, alongside people-centric services like medical insurance and social security zones, represents a strategic push into high-growth niche markets. While these initiatives show promise, their current market share is minimal, classifying them as Question Marks. Significant investment in user experience, targeted marketing, and feature refinement is crucial for these offerings to gain traction and potentially evolve into Stars.

| Harbin Bank Product/Service | BCG Category | Market Share | Market Growth | Strategic Recommendation |

|---|---|---|---|---|

| Specialized Mobile Features (Microfinance, Agriculture, Social Security) | Question Mark | Low | High (Niche) | Invest to increase market share; monitor performance closely. |

BCG Matrix Data Sources

Our Harbin Bank BCG Matrix is constructed using a blend of internal financial statements, publicly available regulatory filings, and comprehensive market research reports to ensure a robust and accurate strategic overview.