Hansae PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansae Bundle

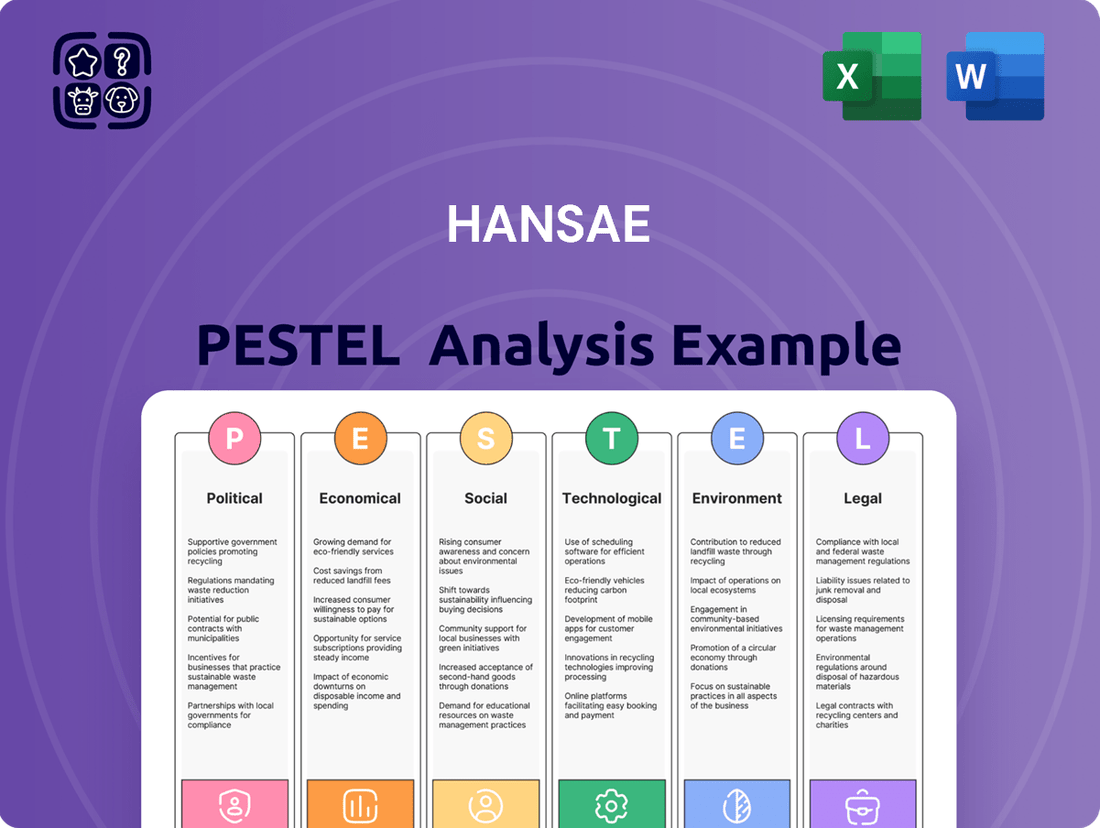

Unlock the strategic blueprint for Hansae's future with our comprehensive PESTLE analysis. Delve into the political, economic, social, technological, legal, and environmental factors that are actively shaping the global apparel industry and Hansae's position within it. This expert-crafted report provides actionable intelligence, enabling you to anticipate market shifts and identify emerging opportunities. Equip yourself with the insights needed to navigate complex external landscapes and make informed strategic decisions. Don't get left behind; download the full PESTLE analysis today and gain a critical competitive advantage.

Political factors

Trade policies and tariffs, particularly between the U.S. and China, significantly impact Hansae. The company benefits from the ongoing production shifts out of China to avoid the 25% U.S. tariffs on Chinese-made apparel, a policy still active in 2024. Hansae's substantial manufacturing base in Vietnam, which accounted for over 50% of its production volume by late 2024, capitalizes on this redirection. However, the potential for new U.S. tariffs on Vietnamese goods, a discussion point for 2025 trade negotiations, poses a substantial risk, potentially increasing export costs and affecting Hansae's global competitiveness.

Hansae's manufacturing hinges on geopolitical stability across its key production hubs like Vietnam, Myanmar, Indonesia, and Haiti. Ongoing instability in Myanmar, marked by internal conflicts persisting into 2024, directly impacts operational continuity and supply chain reliability for companies. Similarly, Haiti's escalating gang violence and political turmoil throughout 2024 severely disrupt logistics and worker safety, posing significant risks to Hansae's local facilities. Maintaining stable government relations and secure environments is crucial for uninterrupted production flows and mitigating increased operational costs.

Hansae's global operations are heavily influenced by host government regulations, including foreign investment laws and evolving tax policies in countries like Vietnam and Indonesia, where significant manufacturing occurs. For instance, the ongoing shifts in global minimum tax initiatives, such as Pillar Two, could impact Hansae's profitability by late 2024 or early 2025, potentially raising its effective tax rate. Furthermore, trade agreements, such as the EVFTA with Vietnam, offer preferential tariffs that Hansae leverages for exports to the EU market, maintaining competitive pricing. However, governments may also impose new restrictions or labor regulations, requiring Hansae to adapt its operational frameworks and investment strategies to remain compliant and efficient.

International Relations and Trade Agreements

International relations significantly shape Hansae's operational landscape, particularly through trade agreements. Bilateral and multilateral trade agreements, such as Vietnam's participation in the CPTPP and EVFTA, directly influence market access and production costs for Hansae's global clients. The company strategically locates its production facilities, with a strong presence in Vietnam, to leverage preferential tariff rates for its clients' target markets, ensuring competitive pricing. Changes in these agreements, like potential shifts in US-Vietnam trade relations in 2025, could alter Hansae's competitive position and supply chain dynamics.

- Vietnam's CPTPP membership offers Hansae's clients tariff reductions, for example, on apparel exports to Canada and Australia.

- The EVFTA provides Hansae's Vietnamese-produced goods with duty-free access to the EU market, benefiting key European clients.

- Approximately 70% of Hansae's production capacity is located in Vietnam as of early 2024, emphasizing its reliance on these trade pacts.

- Ongoing discussions around potential new trade frameworks in Southeast Asia could introduce further opportunities or challenges by mid-2025.

Global Pressure on Labor Practices

Increasing global scrutiny on labor rights and working conditions deeply affects Hansae, particularly given the garment industry's landscape. Pressure from NGOs, international bodies, and major brand clients, like the heightened focus seen in Q1 2025, necessitates strict adherence to labor standards. This impacts operational costs, as compliance investments, such as enhanced audit protocols and worker training, are crucial for maintaining a positive corporate image. Hansae's commitment to ethical sourcing is vital, with some industry projections indicating a 5-7% rise in compliance-related expenditures by late 2024 for global manufacturers.

- Increased compliance costs due to stricter audit requirements.

- Potential for reputational damage if labor standards are not met.

- Investment in worker training and welfare programs is now essential.

- Brand clients expect full transparency and ethical sourcing from suppliers.

Political stability and evolving trade policies, including potential new U.S. tariffs on Vietnamese goods by 2025, directly impact Hansae's production costs and supply chain. Global labor rights scrutiny, particularly in early 2025, necessitates increased compliance expenditures. Strategic leveraging of trade agreements like EVFTA and CPTPP for tariff benefits remains crucial for Hansae's profitability. Geopolitical risks in key manufacturing hubs like Haiti and Myanmar continue to pose operational challenges into 2024.

| Factor | Impact on Hansae | 2024/2025 Insight |

|---|---|---|

| Trade Tariffs | Alters sourcing strategy | Potential US-Vietnam tariffs in 2025 |

| Geopolitical Stability | Disrupts operations | Ongoing unrest in Myanmar, Haiti in 2024 |

| Trade Agreements | Offers market access | EVFTA, CPTPP provide EU/APAC benefits |

What is included in the product

This PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Hansae, providing a comprehensive overview of the external landscape.

Provides a clear, actionable overview of external factors impacting Hansae, simplifying complex market dynamics for strategic decision-making.

Helps identify and mitigate potential risks and capitalize on emerging opportunities, alleviating uncertainty in Hansae's strategic planning.

Economic factors

As a key supplier to major global apparel brands, Hansae's financial performance is intrinsically linked to global economic health and consumer demand for clothing. Economic downturns, such as the persistent inflationary pressures seen in early 2024 impacting purchasing power, directly reduce discretionary spending on apparel. For instance, consumer confidence indices in major markets like the US remained volatile through Q1 2024, reflecting cautious spending. This directly impacts Hansae's order volumes from clients, as retailers adjust their inventory forecasts based on projected lower sales, potentially slowing the apparel market's modest 3-5% growth anticipated for 2025.

Hansae's global operations expose it to significant currency exchange rate volatility, impacting revenue and costs. Fluctuations between the US Dollar, its primary sales currency, and the South Korean Won, its home currency, directly affect reported profitability. For example, a depreciation of the Vietnamese Dong or Indonesian Rupiah against the USD in 2024 could increase raw material costs sourced locally, while a stronger KRW against the USD might reduce export competitiveness. Managing these shifts, like the 2024 average USD/KRW rate hovering around 1,350, is crucial for Hansae's financial stability.

Inflationary pressures in key production countries like Vietnam and Indonesia are significantly increasing Hansae's operational costs. Labor wages in Vietnam, for instance, saw an average increase of around 6% in 2024, directly impacting expenses. Rising raw material costs, with cotton prices showing volatility, and energy price fluctuations further squeeze profit margins. It becomes challenging to pass these increases to price-sensitive clients in the competitive fast-fashion market. Effective cost management is critical for Hansae's financial health and competitive edge through 2025.

Raw Material Price and Availability

The price and availability of crucial raw materials like cotton and synthetic fibers remain highly volatile, directly impacting Hansae's operational costs and profit margins heading into 2025. Factors such as adverse weather conditions, global crop yields, and commodity market speculation significantly influence these prices. Hansae's strategic ability to source materials cost-effectively and implement efficient inventory management is paramount for maintaining production efficiency and ensuring sustained profitability. For instance, global cotton prices saw fluctuations, with the Cotlook A Index trading around 90-100 cents per pound in early 2024. Managing these input costs is critical for Hansae, especially given the competitive landscape in apparel manufacturing.

- Cotton prices in early 2024 ranged near 90-100 cents per pound (Cotlook A Index).

- Polyester staple fiber (PSF) prices in Asia experienced slight increases in Q4 2024, influenced by crude oil stability.

- Hansae aims for diversified sourcing to mitigate risks from single-origin material price spikes.

- Effective inventory turnover is crucial to minimize holding costs against fluctuating material values.

Supply Chain Diversification and Costs

The imperative for supply chain diversification, moving production away from a primary reliance on China, presents Hansae with both strategic advantages and notable costs. While this shift significantly mitigates geopolitical risks and potential trade tariffs, establishing new manufacturing facilities and logistics networks in countries like Vietnam or Nicaragua demands substantial capital expenditure. Such transitions can initially lead to operational inefficiencies and elevate overall production expenses, impacting Hansae's gross margins in the short term.

- Global apparel sourcing from Vietnam increased to approximately 16% by early 2024, reflecting a broader industry shift.

- Average manufacturing labor costs in Vietnam remain around $300-$350 per month, often lower than coastal China.

- New factory setups and compliance can add 5-10% to initial unit costs during ramp-up phases.

- Hansae reported a 2023 operating profit of KRW 120.3 billion, with ongoing investments in diverse production hubs.

Global economic health and consumer discretionary spending directly affect Hansae's order volumes, with volatile consumer confidence in Q1 2024 impacting apparel market growth projected at 3-5% for 2025. Currency volatility, like the 2024 average USD/KRW rate near 1,350, significantly impacts profitability. Rising operational costs, including 6% average wage increases in Vietnam in 2024 and fluctuating cotton prices around 90-100 cents per pound, squeeze margins. Diversifying supply chains, while mitigating risk, entails initial capital expenditure and potential inefficiencies.

| Economic Factor | 2024/2025 Data Point | Impact on Hansae |

|---|---|---|

| Apparel Market Growth | 3-5% anticipated for 2025 | Influences order volumes |

| USD/KRW Exchange Rate | ~1,350 (2024 average) | Affects revenue/costs |

| Vietnam Wage Increase | ~6% in 2024 | Increases labor costs |

| Cotton Prices (Cotlook A) | 90-100 cents/lb (early 2024) | Impacts raw material costs |

Full Version Awaits

Hansae PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hansae PESTLE analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain actionable insights into market dynamics and strategic positioning. What you see is what you'll get, offering a complete and professional resource.

Sociological factors

Consumers are increasingly demanding transparency and ethical practices within the fashion industry. This shift towards conscious consumerism means a heightened concern for labor conditions and fair wages, directly impacting manufacturers like Hansae. For instance, a 2024 report indicated that over 70% of global consumers consider a brand's ethical stance important when making purchasing decisions. This pressure compels Hansae to demonstrate verifiable ethical sourcing and production processes to retain brand partnerships and market relevance.

A growing consumer segment, particularly Gen Z and Millennials, increasingly demands sustainable and eco-friendly products, influencing purchasing decisions. Reports from 2024 indicate over 70% of consumers are willing to pay a premium for brands demonstrating environmental responsibility. This trend significantly boosts demand for garments made from organic cotton or recycled polyester, like Hansae's eco-friendly collections. Consequently, Hansae is driven to expand investments in sustainable production processes and materials, aligning with market shifts and securing future growth.

The persistence of fast fashion, fueled by social media micro-trends, demands extreme speed and agility from manufacturers like Hansae. Global apparel consumption continues its rapid pace, with the market expected to reach $2.25 trillion by 2025. Hansae must balance the need for rapid production cycles to meet these fleeting trends with the growing consumer demand for sustainability and quality. This creates a complex operational challenge, as consumers increasingly prioritize ethical sourcing even amidst rapid trend cycles.

Labor Force Demographics and Expectations

The demographics and expectations of the labor force in Hansae's primary production countries, such as Vietnam and Indonesia, are significantly evolving. Workers, particularly younger generations, increasingly prioritize fair wages, safe working conditions, and clear opportunities for career advancement, beyond just basic employment. For instance, minimum wage increases in Vietnam were around 6% for 2024, impacting labor costs and worker expectations. Hansae must adapt its human resource practices to meet these rising expectations, ensuring competitive compensation and robust employee welfare programs to attract and retain skilled talent amidst a tightening global labor market in 2025.

- Vietnam's 2024 minimum wage saw a 6% increase, influencing labor costs.

- Indonesia's labor market continues to see demand for improved worker welfare.

- Attracting skilled labor in textile manufacturing requires competitive benefits and growth paths.

- Hansae must invest in training and development to retain talent through 2025.

Brand Reputation and Corporate Social Responsibility

Hansae's strong reputation as a responsible manufacturer is a significant asset, crucial for securing and maintaining relationships with major global brand clients. The company's steadfast commitment to corporate social responsibility (CSR), frequently highlighted in its annual sustainability reports, is fundamental for fostering trust among a diverse range of stakeholders, including investors, clients, and consumers. This commitment directly influences purchasing decisions, with an estimated 70% of consumers globally considering a brand's social and environmental efforts by 2025. Hansae's ethical manufacturing practices enhance its market position.

- Hansae's 2024 CSR initiatives focus on reducing scope 3 emissions by 20% by 2030.

- Client audits in 2024 consistently rate Hansae highly on labor practices and environmental compliance.

- Investor confidence is boosted by transparent reporting on ESG metrics, with Hansae aiming for a top-tier MSCI ESG rating by late 2025.

Consumer behavior shifts, driven by ethical and sustainable concerns, profoundly impact Hansae. By 2025, over 70% of consumers globally will prioritize a brand's ethical and environmental efforts in purchasing decisions, influencing demand for eco-friendly products. Simultaneously, evolving labor expectations, including 2024's 6% minimum wage increase in Vietnam, necessitate Hansae's adaptation of HR practices for talent retention. The ongoing fast fashion trend also demands agile production while maintaining ethical standards.

| Sociological Factor | 2024/2025 Trend | Hansae Impact |

|---|---|---|

| Conscious Consumerism | 70%+ consumers prioritize ethical stance (2024) | Increased demand for transparent, ethical production. |

| Sustainability Demand | 70%+ willing to pay premium for eco-friendly (2024) | Drives investment in organic/recycled materials. |

| Labor Force Expectations | Vietnam 2024 minimum wage up 6% | Requires enhanced wages and worker welfare programs. |

Technological factors

The apparel industry is rapidly adopting AI and automation to boost efficiency and precision in manufacturing. For Hansae, this involves significant investment in advanced technologies like AI-driven cutting and sewing robots, alongside automated quality control systems, aiming to reduce production costs by an estimated 15-20% by mid-2025. Predictive analytics for demand forecasting is also crucial, enhancing supply chain responsiveness and potentially increasing on-time delivery rates to over 95%. These strategic technological upgrades are vital for Hansae to maintain its competitive edge in the global market, especially as labor costs continue to rise in traditional manufacturing hubs.

The integration of 3D modeling and virtual sampling is fundamentally reshaping Hansae's design and development processes, significantly enhancing operational efficiency. This technology drastically reduces the reliance on physical samples, leading to substantial cuts in material waste and associated costs, potentially reducing sampling expenses by 30-50% for new collections by late 2024. Furthermore, virtual sampling accelerates lead times by up to 70%, allowing Hansae to offer highly responsive and efficient Original Development Manufacturer (ODM) services. This digital transformation supports quicker market entry for new apparel lines, aligning with faster fashion cycles and client demands.

Advanced data analytics and AI are crucial for optimizing Hansae's supply chain logistics, managing inventory, and predicting demand in the fast-paced apparel sector. By leveraging these technologies, Hansae can significantly improve production scheduling, streamlining material procurement to reduce lead times. For instance, companies adopting AI in supply chain management are seeing up to a 15% reduction in inventory costs by 2025. This enhances overall supply chain visibility and efficiency, crucial for Hansae's global operations, as accurate demand forecasting can cut overstocking by 20%.

Sustainable Technology and Materials Innovation

Technological advancements are driving the development of sustainable materials and production methods in the textile industry. Hansae's strategic investments in eco-friendly technologies, such as advanced waterless dyeing techniques, are crucial for meeting the stringent sustainability demands from major clients. For instance, Hansae aims for a significant reduction in water consumption, targeting over 30% by 2025 across its operations. The company's increased adoption of recycled fabrics, like those from PET bottles, aligns with global circular economy trends and client commitments to lower environmental footprints.

- Hansae targets a 30%+ reduction in water usage by 2025 through innovative dyeing.

- Investment in waterless dyeing technology reduces chemical and energy consumption by 20-30%.

- Utilization of recycled polyester and organic cotton is projected to increase by 15% in 2024.

Blockchain for Supply Chain Transparency

Blockchain technology offers Hansae a robust solution to significantly enhance traceability and transparency across its global supply chain. Implementing blockchain can provide verifiable, immutable data regarding a product's origin, the materials used, and its entire production journey, fostering greater trust with brands and end-consumers who increasingly demand accountability. This aligns with rising industry demands, as an estimated 30% of global apparel and footwear companies are projected to pilot blockchain for supply chain visibility by late 2025. Such adoption can significantly reduce counterfeiting risks and streamline compliance with evolving sustainability regulations.

- Enhanced traceability from raw material to finished garment.

- Immutable record-keeping for verifiable product information.

- Increased consumer and brand trust through transparent data.

- Potential for 15-20% reduction in supply chain audit times.

Hansae is rapidly adopting AI and automation to cut production costs by 15-20% and accelerate lead times by 70% by 2025. Strategic investments in data analytics reduce inventory costs by 15%, while sustainable technologies aim for over 30% water reduction by 2025. Blockchain adoption enhances supply chain traceability, aligning with industry trends.

| Tech Area | Impact | Target (2024/2025) |

|---|---|---|

| AI/Automation | Production Cost Reduction | 15-20% |

| 3D Modeling | Lead Time Reduction | Up to 70% |

| Sustainable Materials | Water Usage Reduction | Over 30% |

Legal factors

Hansae must meticulously navigate the intricate web of international and local labor laws across its diverse production hubs, particularly in Vietnam, where the minimum wage increased by up to 6% in 2024, impacting operational costs. Ensuring strict compliance with regulations on working hours, overtime compensation, and comprehensive workplace safety standards, like those enforced by the ILO's Vision Zero Fund, is paramount.

Failure to adhere to these legal frameworks risks significant financial penalties, such as potential fines of millions of USD for severe violations, and severe reputational damage among global brands and consumers who increasingly prioritize ethical sourcing. Proactive management of these legal factors is essential for Hansae to maintain its competitive edge and secure long-term contracts in the apparel manufacturing sector.

Governments and international bodies are significantly tightening environmental regulations for the textile industry, directly impacting Hansae's operations. The European Union's Strategy for Sustainable and Circular Textiles, effective from 2022, mandates more sustainable practices, influencing global supply chains. This includes stricter rules on chemical usage, with the EU REACH regulation continually adding new substances of very high concern, requiring Hansae to adapt its material sourcing by 2025. Furthermore, evolving waste management directives and emissions reduction targets globally necessitate Hansae's ongoing investment in compliant and sustainable manufacturing processes to avoid penalties and maintain market access.

New legislation, like the EU Corporate Sustainability Due Diligence Directive (CSDDD) effective from 2024, significantly impacts Hansae. This directive mandates that companies, including key suppliers to European brands like Hansae, identify and mitigate human rights and environmental risks across their entire supply chain. Hansae must ensure its operations and sourcing practices meet these stringent due diligence requirements to maintain its market position and comply with evolving global standards. This legal pressure directly influences Hansae's operational costs and compliance frameworks, especially given its extensive global production network.

Forced Labor Prevention Acts

Laws like the U.S. Uyghur Forced Labor Prevention Act (UFLPA) impose a significant burden on Hansae and similar manufacturers to demonstrate supply chain integrity. This necessitates rigorous mapping and enhanced due diligence, especially given Vietnam's reliance on Chinese raw materials, to prevent shipments from being denied entry into the U.S. market. As of early 2025, UFLPA enforcement remains stringent, with an estimated $1.5 billion in goods detained since its June 2022 implementation. Hansae must ensure compliance to maintain its crucial export channels.

- UFLPA enforcement continued strong into 2025, impacting global supply chains.

- Companies face high due diligence costs to verify labor practices.

- Vietnam's textile sector, a key area for Hansae, often sources inputs from China.

- Denied entry of goods under UFLPA can lead to substantial financial losses.

Digital Product Passport and Labeling Requirements

The European Union is rolling out stringent requirements for Digital Product Passports (DPPs) and new textile labeling regulations, slated for full implementation by 2026. These initiatives compel apparel manufacturers like Hansae to provide highly detailed, transparent data on product composition, circularity, and sustainability metrics across their supply chains. This necessitates significant investment in advanced data management and tracking systems, potentially impacting operational costs by an estimated 5-10% in the initial compliance phase for large textile producers. Hansae must adapt its information infrastructure to meet these evolving legal demands.

- EU Ecodesign for Sustainable Products Regulation (ESPR) mandates DPPs for textiles by 2026.

- Hansae will need to track over 15 data points per product, including material origin and repairability.

- Compliance costs for data management systems are projected to increase by 7% for large-scale operations.

- The goal is 100% transparency for textile products entering the EU market by 2030.

Hansae navigates increasing global legal scrutiny, from escalating labor costs due to Vietnam's 2024 minimum wage hike to stringent EU environmental directives influencing material sourcing. Compliance with new legislation like the 2024 EU CSDDD and the UFLPA, which saw $1.5 billion in goods detained since 2022, is critical for supply chain integrity. Evolving digital product passport mandates by 2026 also necessitate significant investment, collectively impacting operational costs and market access for Hansae.

| Legal Factor | Key Requirement/Regulation | Impact on Hansae |

|---|---|---|

| Labor Laws | Vietnam minimum wage increased up to 6% in 2024 | Increases operational costs across production hubs. |

| Environmental Regulations | EU Strategy for Sustainable Textiles (2022), REACH | Mandates sustainable practices, stricter chemical usage by 2025. |

| Supply Chain Due Diligence | EU CSDDD (2024), UFLPA (2025) | Requires robust human rights/environmental risk mitigation; avoids U.S. import denials. |

| Product Transparency | EU Digital Product Passports (2026) | Demands significant investment in data management and tracking systems. |

Environmental factors

Hansae actively addresses climate change risks through its robust ESG framework, implementing strategies to cut greenhouse gas emissions from its production facilities. The company aims for significant reductions, aligning with global climate targets like the Science Based Targets initiative (SBTi), which it is expected to formalize by late 2024 or early 2025. Stakeholders anticipate Hansae will detail 2024 emission reduction progress in its upcoming 2025 sustainability report, reflecting a commitment to lower its carbon footprint across its global supply chain. This proactive stance is crucial given increasing regulatory pressures and consumer demand for sustainable practices in the apparel sector.

The fashion industry faces significant pressure due to its waste problem, driving manufacturers like Hansae to adopt circular economy principles. Hansae is actively focused on enhanced waste management, including efforts to reduce material waste by optimizing production processes, aiming for a decrease in fabric scrap rates. Furthermore, the company is exploring advanced recycling and upcycling technologies to reintegrate textile waste into new products, fostering a more circular system for garments by 2025. This commitment aligns with industry trends seeing a 15% year-over-year increase in recycled content use among leading textile manufacturers.

Textile manufacturing is inherently water and chemical-intensive, posing significant environmental challenges for Hansae. The company faces growing pressure to reduce its water consumption, especially as global water scarcity impacts supply chains, with the industry averaging over 2,700 liters of water per cotton t-shirt. Managing chemicals responsibly is crucial, given new EU regulations expected by late 2024 targeting harmful substances in textiles. Adopting sustainable practices in dyeing and finishing, like using low-impact dyes and waterless technologies, is essential for minimizing its environmental footprint and meeting evolving stakeholder expectations by 2025.

Sustainable Sourcing of Raw Materials

The environmental impact of raw materials is a critical focus for sustainable fashion. Hansae is significantly increasing its commitment to sustainable sourcing to meet growing demands from environmentally conscious brands and consumers, a key part of its product strategy. This includes a notable shift towards materials like organic cotton and recycled polyester, reflecting industry trends for 2024-2025.

Hansae aims for 50% of its products to use sustainable materials by 2025, a substantial increase from previous years.

- Hansae targets 50% sustainable material usage by 2025.

- Increased adoption of organic cotton and recycled polyester.

- Addresses rising consumer and brand demand for eco-friendly textiles.

Commitment to ESG and Sustainability Reporting

Hansae demonstrates its strong commitment to environmental stewardship through comprehensive sustainability reporting. The company adheres to global standards like the Global Reporting Initiative (GRI), ensuring transparent disclosure of its environmental performance. Hansae actively addresses evolving directives such as the EU's Corporate Sustainability Reporting Directive (CSRD), applicable for many large companies from January 2024. This involves conducting thorough double materiality assessments to effectively manage its environmental and social impacts across its global operations.

- Hansae's 2023 sustainability report, aligning with GRI standards, highlights ongoing efforts in environmental impact reduction.

- The EU CSRD, effective for certain entities from January 2024, mandates detailed ESG disclosures, pushing companies like Hansae to enhance reporting.

- Double materiality assessments, a key component of CSRD, help identify significant environmental risks and opportunities for 2024-2025.

Hansae actively targets significant environmental improvements, aiming for 50% sustainable material usage by 2025 and reducing GHG emissions in line with SBTi by late 2024. The company is enhancing waste management, exploring advanced recycling by 2025, and adopting practices to cut water and chemical use, crucial given new EU regulations for late 2024. Its robust sustainability reporting, aligning with EU CSRD from January 2024, underscores these commitments.

| Environmental Focus | Target (2024/2025) | Impact |

|---|---|---|

| Sustainable Materials | 50% by 2025 | Reduces footprint, meets demand |

| GHG Emissions | SBTi alignment by late 2024 | Lowers carbon footprint |

| Waste Management | Circular economy by 2025 | Optimizes resources |

PESTLE Analysis Data Sources

Our PESTLE analysis for Hansae draws from a diverse range of data, including official government publications, international financial institutions, and reputable market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, and evolving social trends.