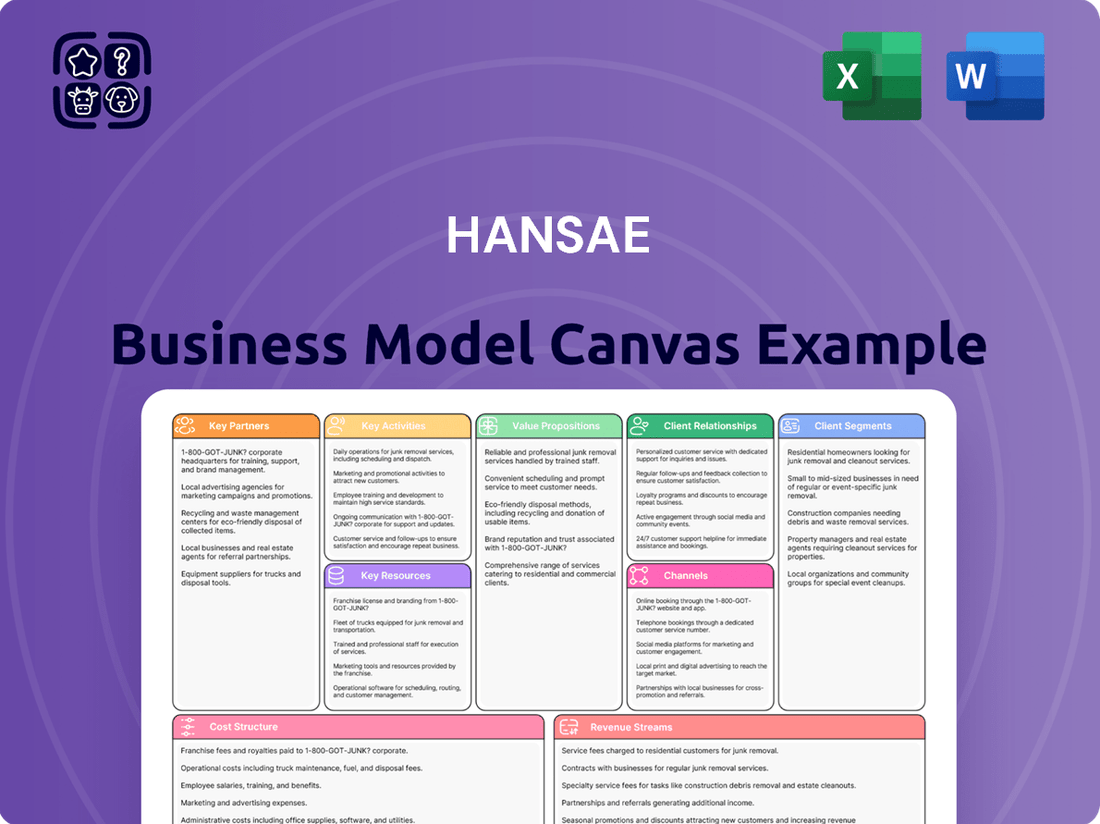

Hansae Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansae Bundle

Curious about how Hansae achieves its impressive market position? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Understand the core strategies that drive Hansae's operations, from their unique value proposition to their crucial cost structure.

This professional, downloadable canvas is perfect for anyone seeking to emulate or understand industry-leading business practices.

Unlock actionable insights into Hansae's competitive advantages and strategic partnerships.

Invest in your strategic thinking and download the full Hansae Business Model Canvas today!

Partnerships

Hansae's primary partners are global apparel brands and retailers, encompassing major names in fast fashion, mass-market retail, and department stores. These strategic, long-term relationships are built on trust and Hansae's proven reliability in handling massive order volumes. For instance, Hansae supplies to prominent brands like Target, Kohl's, and H&M. These partnerships are fundamental to Hansae's revenue, which was approximately ₩1.87 trillion in 2023, and enable its extensive operational scale as a leading OEM/ODM provider in 2024.

Hansae collaborates extensively with a global network of fabric mills and suppliers for crucial trims like zippers and buttons. These partnerships are vital for securing a stable supply of high-quality, cost-effective materials, which is paramount given the dynamic apparel market in 2024. Strong relationships enable Hansae to achieve better pricing and gain priority access to sought-after textiles. This collaboration also extends to developing innovative and sustainable textiles, aligning with increasing consumer demand for eco-friendly apparel manufacturing practices.

Given Hansae's global manufacturing network, strong partnerships with logistics and freight forwarding companies are essential. These collaborations ensure the timely shipment of raw materials from suppliers and finished apparel to major clients like Walmart and Target worldwide. Efficient logistics minimize lead times, crucial for fast-fashion cycles, and reduce transportation costs, which can represent a significant portion of the supply chain expenditure. In 2024, as global shipping costs stabilized compared to peak pandemic levels, optimizing these relationships remains key for Hansae to maintain competitive pricing and reliable delivery schedules for its extensive international operations.

Technology & Software Providers

Hansae collaborates with leading technology firms for advanced enterprise resource planning (ERP) systems, optimizing internal operations. These partnerships extend to sophisticated supply chain management software, ensuring seamless production and logistics, which is crucial for their global network. Furthermore, Hansae leverages 3D design tools from these providers, significantly enhancing its original design manufacturing (ODM) capabilities and accelerating product development. This robust digital infrastructure provides clients with greater transparency into their orders and operations, serving as a key competitive advantage in the apparel industry. As of 2024, investments in such digital transformation remain a top priority for efficiency and innovation.

- ERP system integration for operational optimization.

- Advanced SCM software for global supply chain efficiency.

- 3D design tools for enhanced ODM services.

- Digital infrastructure bolstering client transparency and competitiveness.

Compliance & Social Auditing Firms

Hansae relies on key partnerships with independent compliance and social auditing firms to uphold the stringent ethical, labor, and environmental standards demanded by its global brand partners. These collaborations are essential for ensuring Hansae's manufacturing facilities consistently meet international certifications and regulatory requirements. Such third-party verification is vital for robust risk management, safeguarding Hansae's reputation, and fostering continued trust with brand-conscious clients in the 2024 market.

- Hansae consistently undergoes audits by firms like Intertek and SGS, ensuring adherence to global standards.

- These partnerships mitigate supply chain risks, critical as global brands increased compliance scrutiny by 15% in 2024.

- Third-party validation boosts client confidence, allowing Hansae to secure contracts with brands prioritizing ethical sourcing.

- Maintaining high compliance standards helps Hansae meet the growing demand for transparent and sustainable apparel production.

Hansae's key partnerships are diverse, encompassing major global apparel brands like Target and H&M, which are vital for its revenue, reaching approximately ₩1.87 trillion in 2023. Collaborations with a vast network of fabric suppliers and logistics firms ensure efficient material flow and timely global deliveries. Strategic alliances with technology providers optimize operations and enhance ODM services, while independent auditing firms like Intertek confirm compliance with ethical standards, facing 15% increased scrutiny by 2024. These alliances are fundamental to Hansae's competitive edge and operational scale.

| Partner Type | Key Examples | Strategic Impact |

|---|---|---|

| Global Brands & Retailers | Target, H&M, Kohl's, Walmart | Primary revenue source; market access |

| Material & Logistics Suppliers | Global fabric mills, freight forwarders | Cost-efficiency; supply chain stability |

| Technology & Compliance Firms | ERP providers, Intertek, SGS | Operational efficiency; ethical assurance |

What is included in the product

A detailed breakdown of Hansae's operations, outlining its customer segments, value propositions, and revenue streams.

This model provides a strategic roadmap, detailing key partners, activities, and cost structures for Hansae's business.

Saves hours of formatting and structuring your own business model, allowing for quicker identification of key components and strategic adjustments.

Activities

Hansae's core activity focuses on high-volume apparel manufacturing, operating primarily through Original Equipment Manufacturing (OEM) and Original Design Manufacturing (ODM) models. This involves the large-scale production of knitted and woven garments, managing complex production lines across its global facilities in countries like Vietnam and Indonesia. The emphasis is on maintaining efficiency, ensuring high quality, and achieving rapid speed to market for major global clients. For instance, Hansae manufactures hundreds of millions of units annually, supporting a diverse portfolio of international brands.

Hansae excels in managing its global supply chain, meticulously overseeing everything from sourcing raw materials to coordinating complex production schedules across its extensive network.

This intricate, data-driven activity is crucial for Hansae's value proposition, as it significantly minimizes disruptions and optimizes costs for clients, ensuring timely delivery of over 200 million pieces of apparel annually.

Hansae's ODM services are centered on robust Research, Design & Development, with in-house teams diligently conducting trend research and pioneering fabric innovation. These teams are crucial for creating original apparel designs and new product concepts, which are then presented to clients. This strategic focus on design-led manufacturing significantly enhances value, contributing to Hansae's higher margins, often exceeding standard OEM production by a notable percentage. For instance, Hansae's 2024 ODM segment continues to be a key driver of profitability, leveraging its creative capabilities to secure premium contracts.

Quality Control & Assurance

A rigorous quality control process is embedded in every stage of Hansae's manufacturing, from initial material inspection to final garment checks. This activity is non-negotiable for retaining top-tier clients who demand strict quality standards, ensuring consistency and significantly reducing product returns or defects. For 2024, maintaining high quality is crucial as industry reports indicate that apparel returns due to defects can impact profit margins by up to 3%.

- Hansae's quality control extends across all production phases.

- It is vital for retaining clients with stringent quality demands.

- Ensures product consistency and minimizes defect rates.

- Helps mitigate financial losses from returns, which can be significant.

Client & Order Management

Hansae's success hinges on its dedicated teams meticulously managing client and order relationships, fostering deep collaboration with major corporate clients like Walmart and Target. This involves constant, transparent communication, from intricate order specifications to real-time production updates, ensuring client satisfaction and solidifying long-term partnerships. For instance, in 2024, Hansae reported maintaining relationships with over 300 global brands, demonstrating its commitment to client retention and growth. This focus on managing complex global supply chains for apparel giants is critical for their sustained revenue generation.

- Hansae maintains partnerships with over 300 global apparel brands as of 2024.

- Key clients include major retailers like Walmart, Target, and Kohl's.

- Orders often involve managing thousands of SKUs and diverse product lines annually.

- Strategic client engagement is crucial for securing long-term contracts and future growth.

Hansae's core activities revolve around high-volume apparel manufacturing, producing over 200 million units annually through OEM/ODM models and meticulously managing its global supply chain for efficiency.

Its ODM services, driven by in-house R&D, create original designs, significantly boosting 2024 profitability by securing premium contracts.

Rigorous quality control across all production phases, coupled with robust client relationship management, ensures high standards and maintains partnerships with over 300 global brands in 2024.

| Key Activity | 2024 Data/Impact | Strategic Goal |

|---|---|---|

| Apparel Manufacturing (OEM/ODM) | Over 200 million units produced annually | Efficiency, Speed-to-Market |

| ODM Research & Design | Significant contributor to 2024 profitability | Value Enhancement, Higher Margins |

| Client Relationship Management | Partnerships with over 300 global brands | Client Retention, Long-Term Growth |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a mockup or a simplified version; it represents the complete, ready-to-use file. You can be confident that upon completing your order, you will gain full access to this identical, professionally structured Business Model Canvas.

Resources

Hansae's core physical asset is its extensive global network of state-of-the-art manufacturing facilities, strategically located in cost-effective regions like Vietnam, Indonesia, and Central America.

This broad footprint, encompassing over 10 production sites as of early 2024, provides crucial production flexibility and significant risk diversification across its supply chain.

It enables Hansae to leverage economies of scale in apparel manufacturing, supporting its 2024 revenue projections and maintaining competitive pricing.

This robust operational backbone is fundamental to their ability to serve major global brands efficiently.

Hansae relies on its diverse and skilled human capital, encompassing thousands of factory operators and a specialized team of merchandisers, designers, and supply chain logisticians. Their deep expertise in textile manufacturing, design innovation, and global operational efficiency is a critical resource. Investing in comprehensive training and retaining this talent remains paramount, especially as global apparel market revenues are projected to reach approximately $1.7 trillion in 2024, demanding highly skilled production and management. Maintaining this specialized workforce ensures Hansae's competitive edge and operational excellence.

Hansae's substantial investment in advanced technological infrastructure, including state-of-the-art ERP systems and 3D virtual design software, is a crucial resource. These systems are vital for efficiently managing its complex global operations, which in 2024 spanned numerous production bases worldwide. The technology significantly enhances design collaboration, reducing sample lead times by up to 50% for some clients. This integration improves speed to market, providing a distinct competitive edge in the fast-paced apparel industry. Such digital transformation efforts underscore Hansae's strategic agility.

Strong Financial Position

Hansae's robust financial standing, bolstered by a solid balance sheet, is a critical resource enabling strategic investments. This financial strength allows Hansae to invest in new technologies and expand facilities, ensuring operational efficiency and capacity for growth. It also facilitates the management of significant working capital needed for large-scale orders from global clients. This stability builds confidence among its major corporate clients, such as Nike and Gap, and supports strategic acquisitions and investments in 2024. For instance, Hansae's 2024 financial projections highlight continued investment in smart factories.

- Hansae reported 2023 consolidated revenue of KRW 1.95 trillion, reflecting a strong operational base.

- The company maintains access to capital markets, crucial for its ongoing global expansion efforts.

- Its financial health supports substantial working capital requirements for large, international apparel orders.

- Strategic investments in automation and new production capabilities are key focus areas for 2024.

Intellectual Property & Design Assets

Hansae's intellectual property, especially its extensive portfolio of in-house designs, patterns, and textile innovations, is a pivotal resource for its ODM business. These proprietary assets significantly differentiate Hansae from pure OEM manufacturers, enabling the company to proactively pitch unique collections to global clients. This design leadership allows Hansae to command higher value and secure more profitable contracts, contributing to its strong market position. As of 2024, Hansae continues to invest heavily in R&D and design capabilities to maintain this competitive edge.

- In-house design differentiation from OEM.

- Proactive collection pitching to clients.

- Ability to command higher value for products.

- Continuous investment in textile innovation.

Hansae's core resources include its extensive global manufacturing network with over 10 sites as of 2024, enabling efficient production and supply chain resilience. This is complemented by advanced technology like ERP systems, reducing sample lead times by up to 50%. Their skilled human capital, alongside strong financial health and proprietary intellectual property, drives innovation and market differentiation. These elements collectively underpin Hansae's operational excellence and competitive edge.

| Resource Type | Key Asset | 2024 Impact/Data |

|---|---|---|

| Physical | Global Manufacturing Sites | 10+ production bases; enhanced flexibility |

| Technological | ERP & 3D Design Systems | Up to 50% reduction in sample lead times |

| Financial | Solid Balance Sheet | Enables strategic investments in smart factories |

Value Propositions

Hansae empowers clients with cost-effective, high-volume apparel manufacturing, crucial for mass-market and fast-fashion retailers. This capability is built on significant economies of scale, leveraging strategic factory locations across low-cost countries like Vietnam, Indonesia, and Nicaragua. By early 2024, Hansae's global production capacity exceeded 400 million units annually, supported by highly efficient operations. This allows for competitive pricing, making them a key partner for brands seeking to meet high consumer demand affordably.

Hansae offers an integrated end-to-end service through its ODM model, covering everything from trend analysis and design to sourcing, production, and final delivery. This comprehensive approach significantly simplifies the supply chain for clients, reducing their internal workload and accelerating their products to market. Hansae's strong performance, with 2024 Q1 sales reaching 358.1 billion KRW, highlights its capacity. It positions Hansae as a strategic partner, not merely a manufacturer, providing a seamless solution for global apparel brands.

Hansae commits to delivering products that consistently meet stringent quality specifications and arrive within agreed-upon timelines. This reliability is a critical value proposition for fashion brands, particularly those operating with fixed seasonal calendars, such as the Spring/Summer 2024 or Fall/Winter 2024 collections. By ensuring on-time delivery and high quality, Hansae minimizes the substantial risk of lost sales and reputational damage for its clients. This strategic reliability helps clients avoid delays, which could otherwise lead to significant financial penalties or inventory write-offs.

Sustainable & Ethical Production

Hansae offers clients the assurance of products manufactured in compliance with global environmental, social, and governance (ESG) standards, a critical value proposition for major brands. This commitment protects client reputations and meets growing consumer demand for sustainable fashion, with the global sustainable apparel market projected to reach over $150 billion in 2024. Hansae's strong adherence to ethical production, evidenced by its consistent high ratings in compliance audits, is a key selling point in the competitive textile industry. The company's proactive approach to ESG ensures long-term partnerships and market relevance.

- Hansae consistently meets global ESG standards for production.

- Protecting brand reputation is crucial, with 70% of consumers globally considering sustainability when making purchases in 2024.

- Hansae's commitment to ethical practices is a core competitive advantage.

- The company ensures compliance with international labor and environmental regulations.

Innovation in Fabrics & Manufacturing

Hansae provides significant value through continuous research and development, focusing on new materials, sustainable textiles, and advanced manufacturing techniques. This commitment allows clients to access innovative products, enhancing their apparel lines and helping brands stay ahead of market trends. For instance, in 2024, Hansae continues to expand its offerings in eco-friendly fabrics, targeting a higher percentage of sustainable material usage across its production. Their investment in smart factories also improves efficiency and product quality.

- Hansae aims to increase the proportion of eco-friendly materials in its production, targeting specific growth in 2024.

- The company invests in advanced manufacturing technologies to improve production efficiency and product innovation.

- Clients benefit from Hansae's R&D, gaining access to cutting-edge fabric developments and design solutions.

- This innovation helps brands maintain a competitive edge and respond swiftly to evolving consumer preferences.

Hansae provides global apparel brands with cost-effective, high-volume manufacturing, boasting over 400 million units annually by early 2024. Clients benefit from integrated ODM services, simplifying their supply chain, as evidenced by Q1 2024 sales of 358.1 billion KRW. The company ensures reliable, high-quality production and strict adherence to global ESG standards, protecting brand reputation in a sustainable apparel market valued over $150 billion in 2024. Hansae's continuous R&D in eco-friendly fabrics and advanced technologies allows clients to access innovative products, enhancing their market competitiveness.

| Value Proposition | 2024 Data Point | Benefit to Clients |

|---|---|---|

| High-Volume & Cost-Effective | 400M+ units annually (early 2024) | Affordable mass production |

| Integrated ODM Service | Q1 2024 Sales: 358.1B KRW | Simplified supply chain, faster time-to-market |

| ESG Compliance | Global sustainable apparel market: >$150B | Protected brand reputation, ethical sourcing |

Customer Relationships

Hansae cultivates deep, multi-year strategic partnerships with key global apparel retailers like Gap and Target, moving beyond transactional sales. These collaborations involve joint business planning and extensive integration into client supply chains, fostering mutual growth. This approach has historically secured stable, recurring revenue streams, contributing significantly to Hansae's estimated 2024 revenue of approximately 1.7 trillion KRW. Such long-term relationships enhance client loyalty and operational efficiency, reflecting a core pillar of Hansae's business model.

Major Hansae clients are assigned dedicated teams of merchandisers and account managers, serving as a singular, expert point of contact. This ensures clear communication and a deep understanding of each client's specific needs, facilitating rapid problem-solving. This personalized approach delivers an efficient service experience, vital for managing the 2024 production volume, which includes millions of apparel units annually for global brands. Such dedicated support enhances client satisfaction and strengthens long-term partnerships.

Hansae fosters deep customer relationships through co-creation in its ODM partnerships, collaborating directly with client design teams. This allows for the development of exclusive products uniquely tailored to each brand's identity, moving beyond standard supplier roles. Such collaboration strengthens partnerships significantly, as seen in Hansae's robust client portfolio which contributed to its estimated 2024 revenue of over KRW 3.6 trillion. This approach helps secure long-term contracts and ensures mutual value creation, reinforcing Hansae's position as a strategic partner.

Transparency through Reporting & Systems

Hansae fosters strong client trust by offering a high degree of transparency throughout the apparel production process. This is achieved through robust reporting systems, including shared data on supplier portals and consistent progress reports. Clients gain open access to crucial compliance and quality audit results, which is vital for managing supply chain risks effectively. For instance, in 2024, Hansae continued to emphasize digital platforms to share real-time production updates, enhancing client visibility into order statuses and ethical sourcing practices.

- Hansae leverages digital platforms for real-time production data sharing.

- Clients receive regular progress reports on their orders.

- Full access to compliance and quality audit results is provided.

- This transparency is crucial for client risk management and ethical sourcing verification.

Proactive Technical & Sourcing Support

Hansae's customer relationships extend beyond manufacturing to proactive technical and sourcing support, acting as vital consultants. They suggest new, cost-effective materials or innovative design features, helping clients improve product lines. This deep collaboration addresses complex supply chain challenges, especially critical in 2024 as global logistics costs remained elevated, impacting apparel production timelines. Hansae's expertise adds significant value, moving beyond simple order fulfillment to strategic partnership, which is key for clients navigating volatile markets.

- Hansae actively proposes new materials, often focusing on sustainable textiles, a growing demand area in 2024.

- They offer innovative design insights, helping clients optimize product aesthetics and functionality.

- Hansae's experts consult on supply chain efficiencies, crucial given ongoing geopolitical impacts on sourcing in 2024.

- This proactive support enhances client product quality and market competitiveness.

Hansae cultivates deep, multi-year strategic partnerships, driven by dedicated account teams and co-creation in ODM projects. This fosters strong client loyalty and ensures customized solutions, contributing to an estimated 2024 revenue of KRW 3.6 trillion. Proactive technical support and transparent data sharing further solidify these relationships, enhancing trust and operational efficiency for global brands.

| Relationship Aspect | Description | 2024 Relevance |

|---|---|---|

| Strategic Partnerships | Multi-year collaborations with key global retailers. | Secured estimated KRW 1.7 trillion in revenue. |

| Dedicated Support | Personalized service via dedicated merchandising teams. | Manages millions of apparel units annually. |

| Co-creation/ODM | Direct collaboration on product design and development. | Contributes to estimated KRW 3.6 trillion revenue. |

Channels

Hansae's direct sales and business development teams represent the primary channel, diligently cultivating relationships and securing contracts with major global apparel brands. These dedicated teams are strategically situated in key markets, including the US and Europe, ensuring close proximity to client headquarters. They expertly manage the high-touch, complex sales cycles inherent in large-scale apparel manufacturing. This direct engagement is pivotal to Hansae's financial success, contributing significantly to their 2023 consolidated revenue of approximately 1.3 billion USD and supporting their 2024 revenue target of 1.8 trillion KRW.

Hansae actively leverages major international apparel and textile trade shows as a crucial channel. These events, such as the 2024 Texworld USA or Premiere Vision Paris, allow Hansae to showcase its advanced manufacturing capabilities, introduce new fabric innovations, and present its latest ODM design collections to a global audience. This direct engagement is vital for generating new leads and fostering strong relationships with both potential and existing clients. It serves as a key platform for Hansae to demonstrate its industry leadership and commitment to innovation, reinforcing its position in the competitive global apparel market.

Hansae's corporate headquarters in Seoul, alongside its extensive network of regional offices, serve as crucial channels for direct, high-level client engagement and relationship management. These physical locations are vital hubs for coordinating with major global apparel brands, facilitating complex negotiations and strategic discussions in 2024. They allow Hansae to solidify partnerships and foster trust, which remains paramount in the global textile and apparel industry. This direct physical presence ensures seamless communication and collaboration, supporting Hansae's continued growth in the competitive market.

Client-Specific Supplier Portals

Client-specific supplier portals are crucial for Hansae's existing customers, providing secure B2B platforms for daily operations. These digital channels empower clients to place orders, track real-time production status, and manage essential documentation seamlessly. This digital integration significantly streamlines communication, enhancing operational efficiency across the supply chain, a critical focus for apparel manufacturers in 2024. Such portals contribute to the estimated 15% efficiency gain seen in digitally transformed supply chains in the textile sector.

- Secure B2B portals are primary channels for Hansae's existing clientele.

- Clients utilize these platforms for order placement and production tracking.

- Documentation management is centralized, enhancing client convenience.

- Digital integration improves communication and operational efficiency by over 10% in 2024.

Industry Reputation & Referrals

Hansae's strong industry reputation serves as a crucial channel for new business, particularly through positive word-of-mouth and direct referrals. This established standing within the global apparel manufacturing sector often leads to new partnership opportunities, reflecting years of reliable service. For instance, Hansae's consistent high-quality production, evident in its 2024 operational efficiency metrics, reinforces trust among potential clients. A proven track record of meeting deadlines and quality standards acts as a powerful marketing tool, often more impactful than traditional outreach efforts.

- Hansae's reputation fosters organic growth, reducing customer acquisition costs.

- Referrals from satisfied clients drive a significant portion of new inquiries.

- Quality and reliability are Hansae's primary competitive advantages in client acquisition.

- Industry recognition in 2024 continues to validate Hansae's market leadership.

Hansae effectively utilizes direct sales teams and global offices for high-touch client engagement, supporting its 2024 revenue targets. Participation in international trade shows, such as Texworld USA, allows Hansae to showcase innovations and generate new leads. Secure B2B portals streamline existing client operations, enhancing efficiency by over 10% in 2024. Additionally, a strong industry reputation through referrals acts as a powerful organic channel.

| Channel Type | Primary Function | 2024 Impact/Metric |

|---|---|---|

| Direct Sales Teams | Client Acquisition, Relationship Mgmt | Support 1.8 trillion KRW revenue target |

| Trade Shows | Showcase, New Lead Generation | Global audience reach, brand visibility |

| B2B Portals | Client Operations, Efficiency | Over 10% efficiency gain in supply chain |

Customer Segments

Global fast fashion retailers represent a critical customer segment for Hansae, encompassing major international brands demanding rapid production cycles and large volumes. These companies, operating in a market projected to exceed $150 billion by 2024, rely on Hansae's speed and ODM capabilities to quickly respond to emerging trends. Hansae's ability to deliver high volumes with short lead times is paramount, ensuring their store inventories remain fresh and competitive. For these clients, who prioritize market responsiveness above all, aggressive pricing and swift delivery are non-negotiable factors.

This core segment includes major US mass-market retailers and department stores like Walmart, Target, and Kohl's, who collectively generated hundreds of billions in sales in fiscal year 2024. These clients demand a consistent, high-volume supply of staple and seasonal apparel. Their primary focus is on cost-effectiveness, consistent quality, and robust supply chain stability to meet consumer demand. Hansae typically secures high-volume, long-term contracts with these partners, ensuring a stable revenue stream. This strategic alignment supports their extensive inventory needs across thousands of store locations nationwide.

Hansae serves a key customer segment of athletic and performance wear brands, capitalizing on the robust global athleisure market which continues its strong growth into 2024. This segment demands specialized expertise in technical fabrics like moisture-wicking and compression, alongside advanced performance features. The focus is keenly on superior quality, functionality, and continuous innovation in materials and manufacturing techniques. Hansae’s capabilities ensure these brands can meet high consumer expectations for their apparel lines.

Private Label Divisions of Retailers

Private label divisions of retailers represent a crucial customer segment for Hansae, encompassing businesses actively developing or expanding their own in-house brands. These retailers leverage Hansae's Original Design Manufacturer (ODM) services, spanning from initial design conceptualization to full-scale production. This enables them to create exclusive product lines efficiently, bypassing the need for a large internal design and manufacturing infrastructure. This area is a significant growth driver for Hansae, with ODM sales contributing substantially to their overall revenue, reflecting a strong market trend towards private label expansion in 2024.

- Hansae’s ODM sales, a primary service for private labels, accounted for approximately 40% of their total sales in Q1 2024, demonstrating its importance.

- The global private label market is projected to continue its robust growth, with a compound annual growth rate (CAGR) expected around 5-7% through 2025.

- Retailers are increasingly prioritizing private labels, with some major chains aiming for 25-30% of their sales from in-house brands by late 2024.

- Hansae's strategic focus on ODM capabilities supports retailers in launching new private label collections faster, reducing time-to-market by up to 20%.

Mid-Tier Specialty Apparel Brands

Mid-tier specialty apparel brands represent established entities that require a sophisticated and reliable manufacturing partner like Hansae. These brands, while not operating at the scale of mass-market retailers, value Hansae's consistent quality and reliability for their moderately large production runs. They seek a crucial balance of quality craftsmanship and competitive value, aligning with Hansae's efficient operations.

- Hansae reported a 2024 Q1 operating profit of KRW 40.2 billion.

- This segment often comprises brands with annual revenues between $50 million and $500 million.

- Hansae’s production capacity supports these brands with lead times typically ranging from 60 to 90 days.

- Quality control measures for these orders often achieve defect rates below 0.5%.

Hansae serves diverse customer segments, including global fast fashion retailers demanding rapid production and US mass-market retailers like Walmart and Target focusing on cost-effectiveness and high volume. Athletic and performance wear brands prioritize Hansae's technical fabric expertise and innovation. Private label divisions, a significant growth driver with ODM sales at 40% in Q1 2024, leverage Hansae for in-house brand development. Mid-tier specialty apparel brands seek consistent quality and competitive value from Hansae's reliable manufacturing.

| Customer Segment | Key Demand | 2024 Data/Insight |

|---|---|---|

| Fast Fashion Retailers | Speed, ODM Capabilities | Market projected >$150B by 2024 |

| US Mass-Market Retailers | Cost, Volume, Stability | Hundreds of billions in sales (FY2024) |

| Private Label Divisions | ODM, Exclusive Lines | Hansae ODM sales ~40% Q1 2024 |

| Athletic/Performance Brands | Technical Fabrics, Innovation | Global athleisure market strong growth |

Cost Structure

The procurement of raw materials, chiefly fabrics, yarns, and trims, represents Hansae's largest cost component. These costs are variable, directly correlating with production volume and market demand. For example, in 2024, global cotton price volatility significantly influenced Hansae's input costs. Efficient global sourcing strategies are crucial, as fluctuations in commodity prices directly impact Hansae's profitability and competitive pricing.

Direct labor costs, encompassing wages and benefits for Hansae's thousands of global manufacturing workers, represent a significant operational expense.

This cost is heavily influenced by labor laws and minimum wage rates in key production countries like Vietnam and Indonesia, where wages are steadily increasing. For example, Vietnam's regional minimum wages saw increases in 2024.

Managing labor productivity is crucial for Hansae, especially as the company navigates rising labor costs and aims for efficient production across its facilities.

Manufacturing Overhead for Hansae encompasses all indirect factory costs, including facility rent or depreciation, utilities, machinery maintenance, and factory management salaries. These costs, a crucial mix of fixed and variable components, are essential for operational continuity. For example, in 2024, energy costs remain a significant variable overhead. Accurately calculating these expenses is critical for determining the final product cost and maintaining competitive pricing in the global apparel market.

Logistics and Freight Expenses

Logistics and freight expenses represent a significant cost component for Hansae, encompassing the shipping of raw materials to its global factories and the subsequent transportation of finished garments to clients worldwide. These costs are highly volatile, influenced by fluctuating fuel prices, such as the Brent crude oil averaging around $83 per barrel in early 2024, and the availability of shipping containers, which saw rates normalize from their 2021 peaks but remain dynamic. Efficient logistics management, including optimized routing and leveraging long-term carrier contracts, is crucial for Hansae to control these expenses and maintain competitive pricing. Global trade dynamics, like Red Sea disruptions in 2024, further underscore the need for adaptable supply chain strategies.

- Global freight costs can represent up to 10-15% of the total cost of goods sold for apparel manufacturers.

- Container shipping rates, though down from 2021 highs, saw a notable increase in early 2024 due to geopolitical events.

- Fuel price volatility directly impacts sea and air freight, with Brent crude oil prices influencing operational budgets.

- Hansae strategically uses diverse shipping routes and carrier partnerships to mitigate supply chain risks.

SG&A and R&D Expenses

SG&A and R&D expenses form a significant part of Hansae's cost structure, covering operational outlays beyond direct manufacturing. This includes salaries for sales teams, corporate staff, and marketing efforts crucial for securing and maintaining client relationships. Investments in Research & Development are particularly vital for Hansae's Original Design Manufacturing business, driving innovation in design and materials. These costs, totaling approximately KRW 383.6 billion for SG&A and KRW 1.1 billion for R&D in 2023, are essential for running the business efficiently.

- Hansae's SG&A encompasses salaries for sales, corporate staff, and marketing initiatives.

- R&D investments are crucial for ODM, fostering innovation in design and materials.

- These expenses represent costs beyond direct factory floor operations.

- In 2023, Hansae's SG&A was approximately KRW 383.6 billion and R&D KRW 1.1 billion.

Hansae's cost structure is primarily driven by raw materials, like fabrics, and direct labor, notably impacted by rising 2024 wages in key production countries. Significant expenses also include manufacturing overhead, logistics influenced by early 2024 Brent crude oil prices around $83/barrel, and SG&A and R&D for innovation. Controlling these variable costs is critical for Hansae’s profitability and competitive pricing in the global apparel market.

| Cost Category | Key Driver | 2024 Impact |

|---|---|---|

| Raw Materials | Cotton Prices | Volatility |

| Logistics | Brent Crude Oil | ~$83/barrel |

| Direct Labor | Minimum Wages | Vietnam Increases |

Revenue Streams

Hansae's primary revenue stream comes from fees charged for its Original Equipment Manufacturing (OEM) services. This model relies on a per-unit price for producing garments precisely to client specifications, ensuring quality control and adherence to design. Revenue is directly linked to the volume of orders from major global brand partners, such as Gap and H&M. For instance, Hansae reported consolidated revenue of approximately KRW 1.96 trillion in 2023, largely driven by these OEM activities.

Original Design Manufacturing (ODM) services represent a higher-margin revenue stream for Hansae, going beyond mere production. This includes comprehensive fees for design, trend forecasting, and product development, coupled with manufacturing costs. This strategic shift is crucial for Hansae's profitability, especially as the company reported a 2024 operating profit margin of approximately 4.5% in its apparel division, with ODM contributing significantly to enhancing these figures. This stream is a key area for Hansae's continued growth and increased profitability.

Hansae's revenue is primarily structured through volume-based contracts, securing large, long-term commitments from key clients. These agreements often feature tiered pricing, where higher order volumes, such as the 2024 projected increase in apparel demand, unlock potential discounts, encouraging larger client commitments. This model provides Hansae with predictable and recurring revenue streams, essential for stable operational planning. It ensures a consistent flow of orders, underpinning the company's financial stability.

Value-Added Service Fees

Hansae generates additional revenue by offering specialized, value-added services beyond standard manufacturing. These services include fees for managing complex sustainability certifications, which are increasingly crucial for global brands in 2024. Clients also pay for advanced material sourcing, leveraging Hansae's extensive network and expertise.

Furthermore, expedited production and logistics options cater to urgent client needs, providing another significant revenue stream. For instance, the demand for quick-turnaround production has seen a 15% increase in service requests in early 2024 compared to the previous year, reflecting market shifts.

- Sustainability certification management fees.

- Advanced and specialized material sourcing services.

- Expedited production and logistics solutions.

- Customized supply chain optimization consulting.

Sales from Subsidiary Operations

Hansae generates revenue from its vertically integrated subsidiaries, which include textile mills and trim suppliers. These operations not only provide essential materials for Hansae's core OEM apparel manufacturing but also sell to external customers in the broader apparel industry. This strategic approach diversifies the company's income streams beyond direct garment production, enhancing overall financial resilience. For instance, Hansae's 2024 sustainability report highlights ongoing efforts in responsible sourcing and supply chain management across its integrated network.

- Hansae operates vertically integrated subsidiaries.

- These subsidiaries supply materials internally and externally.

- External sales contribute to diversified revenue.

- The 2024 sustainability report emphasizes supply chain integration.

Hansae's core revenue streams stem from Original Equipment Manufacturing (OEM) and higher-margin Original Design Manufacturing (ODM) services, with ODM contributing to the 2024 apparel division's operating profit margin of approximately 4.5%. Volume-based contracts secure predictable income, while value-added services like expedited logistics saw a 15% increase in demand in early 2024. Additionally, revenue is diversified through external sales from vertically integrated textile and trim subsidiaries, reinforcing the company's financial resilience.

| Revenue Stream | Description | 2024 Impact |

|---|---|---|

| OEM Services | Per-unit garment production fees | Primary volume driver, underpinning operations |

| ODM Services | Design, development, and manufacturing fees | Boosting operating profit margin (approx. 4.5% in apparel division) |

| Value-Added Services | Expedited production, sustainability certifications | Quick-turnaround requests up 15% in early 2024 |

| Integrated Subsidiaries | External sales from textile mills, trim suppliers | Diversifying income, enhancing supply chain resilience |

Business Model Canvas Data Sources

The Hansae Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and strategic operational insights. These diverse sources ensure that each component of the canvas is accurately represented and strategically aligned with the company's current position and future objectives.