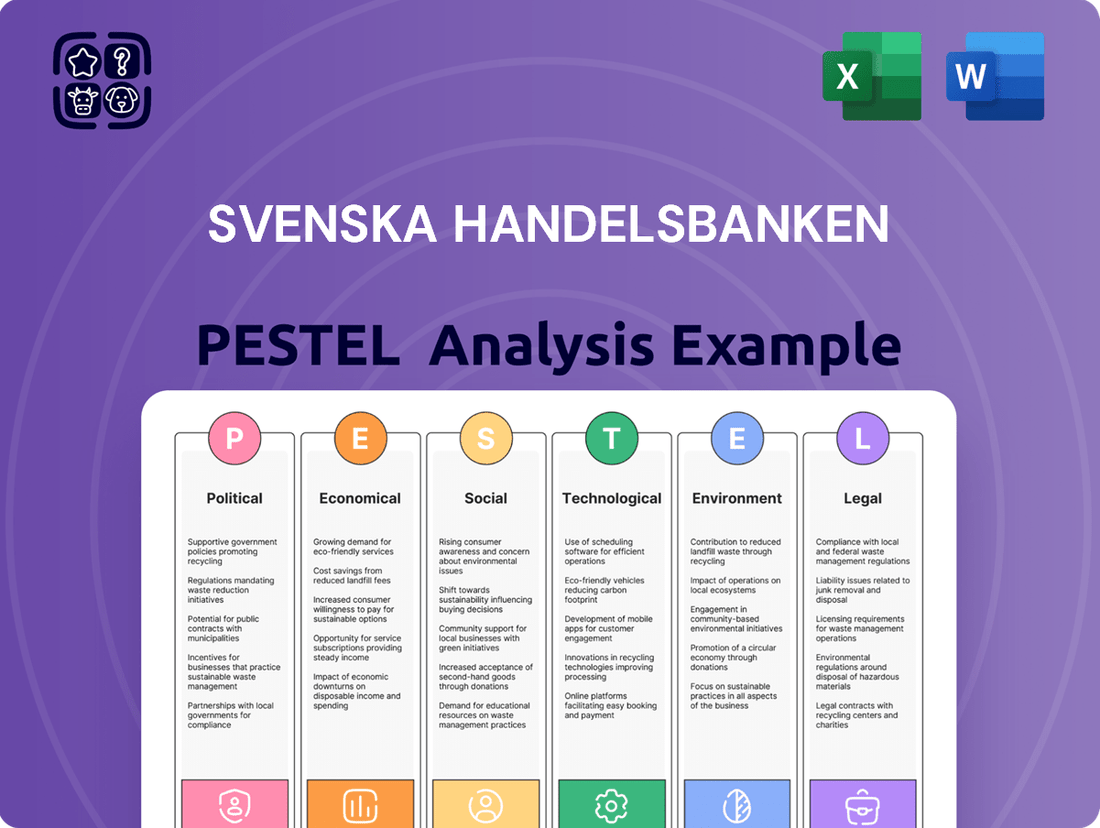

Svenska Handelsbanken PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Svenska Handelsbanken Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting Svenska Handelsbanken's strategic direction. Our comprehensive PESTLE analysis provides actionable intelligence to navigate evolving market landscapes and identify emerging opportunities. Gain a competitive edge and make informed decisions – download the full report now for immediate insights.

Political factors

Sweden's political stability, coupled with the European Union's regulatory framework, directly shapes Svenska Handelsbanken's operational landscape. A predictable environment, characterized by consistent policies, allows the bank to engage in effective long-term strategic planning and investment. For instance, the EU's ongoing efforts towards banking union and capital markets union, as seen in recent directives aimed at harmonizing financial regulations across member states, create both opportunities and compliance challenges.

Government fiscal policies, like Sweden's commitment to maintaining a relatively low budget deficit, influence economic conditions. For Svenska Handelsbanken, changes in taxation or public spending can affect consumer spending and business investment, impacting loan demand and the bank's overall credit risk exposure.

Central bank monetary policy, particularly the Riksbank's interest rate decisions, directly shapes Svenska Handelsbanken's funding costs and lending profitability. For instance, if the Riksbank maintains its policy rate, currently around 3.75% as of early 2024, it provides a stable environment for lending margins, though future hikes could increase funding expenses.

Svenska Handelsbanken must remain agile, adjusting its product offerings and strategic planning to align with Sweden's fiscal stance and the Riksbank's monetary strategy. This includes managing interest rate risk and adapting to potential shifts in credit availability driven by these macroeconomic policies.

Svenska Handelsbanken, like all global financial institutions, navigates a landscape shaped by geopolitical risks and evolving trade relations. For instance, the ongoing tensions in Eastern Europe and the broader implications for energy security and supply chains directly impact European economic stability, a core operating region for Handelsbanken. The International Monetary Fund (IMF) projected in April 2024 that global growth would remain subdued, partly due to these geopolitical fragilities, influencing cross-border capital flows and investment appetite.

Changes in major trade agreements or the imposition of new tariffs can significantly alter the economic outlook for countries where Handelsbanken has a presence. The renegotiation of trade frameworks, such as those involving the European Union and its trading partners, creates uncertainty that can affect corporate lending and investment banking activities by increasing perceived risk premiums. For example, disruptions to shipping routes or export/import policies can directly impact the profitability and operational efficiency of Handelsbanken's corporate clients.

Political Pressure on Lending and Social Responsibility

Governments globally, including in Sweden, are increasingly applying political pressure on financial institutions to align lending practices with societal goals. This often translates into directives or incentives to support sectors deemed strategically important, such as renewable energy projects or small and medium-sized enterprises (SMEs). For instance, in 2024, the Swedish government continued its focus on green transition financing, potentially influencing lending priorities for banks like Svenska Handelsbanken.

These pressures create a dual dynamic for banks: opportunities to tap into growing markets driven by policy, but also the challenge of balancing these social mandates with traditional profitability objectives. For example, while supporting green initiatives might offer long-term growth, it could also involve higher initial risk or lower immediate returns compared to established sectors.

Svenska Handelsbanken’s decentralized operational model is particularly well-suited to navigate these political pressures. This structure allows local branches to be highly responsive to regional economic needs and government initiatives, such as supporting local SMEs affected by specific policy changes, while still operating within the bank's robust, overarching ethical and financial guidelines.

- Green Financing Growth: The global sustainable finance market is projected to reach trillions by 2025, indicating a significant policy-driven opportunity for banks.

- SME Support Initiatives: Many national governments, including Sweden, have ongoing programs and guarantees to encourage bank lending to SMEs, a key focus area.

- Regulatory Adaptation: Banks must continually adapt to evolving regulatory landscapes influenced by political agendas, impacting capital requirements and lending criteria.

Anti-Money Laundering and Sanctions Regimes

Governments worldwide, including Sweden, maintain a strong political stance against financial crime, leading to increasingly rigorous anti-money laundering (AML) and sanctions regimes. This commitment necessitates substantial investment by financial institutions like Handelsbanken in sophisticated compliance technology and skilled personnel to detect and prevent illicit financial flows. Failure to comply can result in substantial fines and reputational damage, as seen with numerous global banks facing penalties for AML breaches in recent years, underscoring the critical nature of these regulations.

Handelsbanken's operational integrity and continued market access depend on its unwavering adherence to both international standards, such as those set by the Financial Action Task Force (FATF), and national legislation. For instance, the European Union's AML Directives (AMLD) are continuously updated, requiring banks to adapt their internal controls. In 2023, global financial institutions collectively paid billions in fines related to AML and sanctions violations, highlighting the significant financial and operational risks associated with non-compliance.

- Increased regulatory scrutiny: Political will to combat financial crime translates into more frequent and in-depth audits of banks' AML and sanctions compliance programs.

- Investment in technology: Banks must allocate significant capital to advanced transaction monitoring systems, artificial intelligence for fraud detection, and secure data management to meet evolving regulatory demands.

- Reputational risk: Non-compliance with AML and sanctions laws can severely damage a bank's reputation, leading to loss of customer trust and business opportunities.

- Global coordination: Political efforts to harmonize international sanctions regimes mean banks must navigate complex and often overlapping global regulatory landscapes.

Political stability in Sweden and the EU provides a predictable environment for Svenska Handelsbanken, enabling strategic planning. Government fiscal policies, like Sweden's focus on low deficits, impact consumer spending and loan demand. The Riksbank's monetary policy, with rates around 3.75% in early 2024, directly influences the bank's lending margins and funding costs.

Geopolitical risks, such as tensions in Eastern Europe, affect European economic stability and cross-border capital flows, as noted by the IMF's subdued global growth projections for 2024. Evolving trade relations and potential tariffs can alter economic outlooks for Handelsbanken's operating regions, impacting corporate clients. Political pressure to align lending with societal goals, like green transition financing in Sweden, presents both opportunities and challenges for profitability.

Governments are intensifying efforts against financial crime, leading to stricter AML and sanctions regimes. This requires significant investment in compliance technology and personnel. For instance, global financial institutions paid billions in fines for AML violations in 2023, highlighting the critical need for adherence to evolving regulations like the EU's AML Directives.

| Political Factor | Impact on Svenska Handelsbanken | Supporting Data/Examples (2024/2025) |

| Political Stability & EU Regulations | Predictable environment for strategic planning; compliance challenges from harmonization efforts. | EU's ongoing banking and capital markets union initiatives. |

| Fiscal & Monetary Policy | Influences consumer spending, loan demand, and credit risk; impacts funding costs and lending profitability. | Riksbank policy rate around 3.75% (early 2024); Swedish low budget deficit commitment. |

| Geopolitical Risks & Trade Relations | Affects economic stability in operating regions; influences capital flows and investment appetite. | IMF projected subdued global growth for 2024 due to geopolitical fragilities. |

| Societal Goal Alignment | Opportunities in green financing and SME support; challenges in balancing mandates with profitability. | Swedish government's continued focus on green transition financing (2024). |

| Financial Crime Compliance | Necessitates investment in AML/sanctions technology; risk of fines and reputational damage. | Billions in AML/sanctions fines paid by global banks in 2023; evolving EU AML Directives. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Svenska Handelsbanken, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the bank's operational landscape and strategic decision-making.

A concise Svenska Handelsbanken PESTLE analysis that highlights key external factors, serving as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

The prevailing interest rate environment, heavily influenced by central bank monetary policy, is a cornerstone economic factor for Svenska Handelsbanken. Higher interest rates generally boost net interest income by widening the gap between lending and deposit rates, whereas lower rates can compress profit margins. For instance, if the Riksbank raises its policy rate by 0.25%, it directly impacts Handelsbanken's lending and deposit pricing strategies.

Inflation directly affects Svenska Handelsbanken by eroding purchasing power, which can curb consumer spending and dampen demand for loans. For businesses, rising inflation increases operating costs, potentially impacting their ability to service debt and affecting asset valuations. For instance, Sweden's inflation rate was 4.3% in April 2024, a decrease from previous months but still a factor for businesses and consumers.

Robust economic growth is generally positive for the bank, as it typically correlates with higher credit demand and improved loan quality due to lower unemployment. Sweden's GDP growth forecast for 2024 is around 0.7%, a modest but positive figure, which can support lending activity. Stronger growth environments mean more businesses and individuals are likely to borrow, and they are better positioned to repay those loans.

Conversely, economic slowdowns or recessions pose significant risks. During such periods, credit risk escalates as businesses and individuals struggle financially, leading to potential defaults. This can reduce the bank's profitability through increased loan loss provisions and a decline in new lending opportunities. For example, if economic growth falters in 2025, Handelsbanken might see a rise in non-performing loans.

The overall health and liquidity of credit markets are paramount for Svenska Handelsbanken, directly impacting its funding accessibility and associated costs. Fluctuations in interbank lending rates, such as the Euro Interbank Offered Rate (EURIBOR), and bond market yields, like those on Swedish government bonds, are key indicators. For instance, in early 2024, the overall increase in benchmark rates reflected tighter credit conditions globally, potentially raising Handelsbanken's funding expenses.

Investor confidence significantly influences credit market stability. A high level of confidence typically translates to lower borrowing costs for banks as investors are more willing to lend. Conversely, periods of reduced confidence can lead to wider credit spreads and decreased liquidity, making it more challenging and expensive for Handelsbanken to secure the necessary funds to operate its extensive branch network and serve its diverse client base.

A stable and liquid credit market is essential for Handelsbanken to efficiently manage its balance sheet and meet its financial obligations. This allows the bank to maintain its competitive pricing for loans and deposits, thereby safeguarding its strong client relationships. The bank's reliance on wholesale funding markets means that adverse credit market conditions could directly affect its profitability and strategic growth initiatives.

Household Debt Levels and Consumer Spending

Elevated household debt levels in Sweden, particularly concerning mortgage debt, present a significant factor for Svenska Handelsbanken. As of early 2024, Swedish household debt-to-income ratios remained high, hovering around 200%, which amplifies credit risk for the bank, especially if interest rates climb or the economy falters.

Consumer spending, a direct reflection of disposable income and confidence, significantly impacts demand for Handelsbanken's core products like mortgages and personal loans. For instance, a slowdown in consumer spending, potentially driven by inflation or job market uncertainty in late 2024, could curb new lending volumes.

Handelsbanken's strategy hinges on cultivating enduring customer relationships, necessitating a thorough understanding of household financial resilience. This involves monitoring trends in savings, investment behavior, and the ability of households to service their debts amidst evolving economic conditions.

- Household Debt-to-Income Ratio: Swedish households carried a debt-to-income ratio of approximately 200% in early 2024, indicating a substantial leverage.

- Interest Rate Sensitivity: A potential increase in interest rates by the Riksbank could strain household budgets, increasing the risk of defaults on loans.

- Consumer Confidence Index: Fluctuations in consumer confidence directly correlate with demand for financial products, influencing Handelsbanken's loan origination pipeline.

- Mortgage Market Share: Handelsbanken's significant presence in the Swedish mortgage market means its performance is closely tied to the health of household balance sheets.

Real Estate Market Dynamics

The real estate market is a cornerstone of Svenska Handelsbanken's business, especially its mortgage lending. Changes in property prices, how many people want to buy homes, and how much building is happening all have a direct effect on the bank's loan quality and the risk of people not being able to pay back their mortgages. Keeping a close eye on real estate trends, both locally and nationally, is crucial for managing these risks and finding new chances for growth.

In 2024, the Swedish housing market experienced a cooling trend following interest rate hikes. For example, average housing prices in Sweden saw a slight decline of around 3-5% year-on-year in early 2024, according to data from Valueguard. This slowdown in price appreciation can impact the value of collateral for Handelsbanken's mortgage portfolio.

- Mortgage Portfolio Exposure: Handelsbanken's significant exposure to the mortgage market means that shifts in real estate values directly influence its asset quality.

- Interest Rate Sensitivity: Higher interest rates, a key factor in 2024, can dampen housing demand and increase the risk of mortgage defaults, impacting loan loss provisions.

- Construction Activity: A slowdown in new construction, potentially influenced by economic uncertainty and higher building costs in 2024-2025, could limit future loan growth opportunities in the sector.

- Regional Variations: Performance can vary significantly by region; for instance, major city markets might show different trends than rural areas, requiring tailored risk assessments.

The Swedish economy's trajectory, marked by its GDP growth and inflation rates, directly shapes Svenska Handelsbanken's operational landscape. With Sweden's GDP growth forecast around 0.7% for 2024, the bank anticipates a modest but positive environment for lending. However, inflation, which stood at 4.3% in April 2024, continues to influence consumer spending and business costs, indirectly impacting loan demand and credit quality.

Interest rate decisions by the Riksbank are a critical economic driver for Handelsbanken, influencing its net interest income. Higher rates can expand profit margins, while lower rates may compress them. For instance, a 0.25% policy rate hike by the Riksbank directly affects the bank's pricing strategies for both loans and deposits, a key consideration in the current monetary policy environment.

The health of the credit markets and overall investor confidence are vital for Handelsbanken's funding costs and liquidity. In early 2024, rising benchmark rates indicated tighter credit conditions globally, potentially increasing the bank's funding expenses. Stable credit markets are essential for the bank to maintain competitive offerings and manage its balance sheet effectively.

Household debt levels, particularly high mortgage debt in Sweden (around 200% debt-to-income ratio in early 2024), represent a significant risk factor. Consumer spending, closely tied to disposable income and confidence, directly impacts demand for the bank's products like mortgages. Handelsbanken's performance is thus intertwined with the financial resilience of Swedish households.

The real estate market's performance is paramount for Handelsbanken, given its substantial mortgage portfolio. A cooling trend in the Swedish housing market in early 2024, with average prices declining by 3-5% year-on-year, affects collateral values and loan quality. Monitoring construction activity and regional variations is also crucial for managing risk and identifying growth opportunities.

| Economic Factor | Data Point/Trend | Implication for Handelsbanken |

|---|---|---|

| GDP Growth (Sweden 2024 Forecast) | ~0.7% | Modest positive environment for lending and credit demand. |

| Inflation Rate (Sweden April 2024) | 4.3% | Influences consumer spending, business costs, and credit risk. |

| Riksbank Policy Rate | Variable (e.g., 0.25% hike) | Directly impacts net interest income and loan/deposit pricing. |

| Household Debt-to-Income Ratio (Early 2024) | ~200% | Amplifies credit risk, especially with rising interest rates. |

| Swedish Housing Market (Early 2024) | 3-5% YoY price decline | Affects collateral values and the quality of the mortgage portfolio. |

What You See Is What You Get

Svenska Handelsbanken PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Svenska Handelsbanken PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. Gain immediate access to actionable insights upon purchase.

Sociological factors

Customer demographics are evolving, with a growing emphasis on digital-first interactions from younger populations. For instance, in 2024, the proportion of banking transactions conducted online or via mobile apps continues to rise across Europe, with some estimates suggesting over 70% of retail banking customers now utilize digital channels regularly. This shift necessitates continuous investment in user-friendly digital platforms and mobile banking solutions.

Simultaneously, an aging population in many of Svenska Handelsbanken's core markets, such as Sweden and the UK, still values personal relationships and in-branch services. Data from 2024 indicates that while digital adoption is increasing across all age groups, a significant segment of customers aged 65 and over still prefer face-to-face interactions for complex financial advice or transactions. Handelsbanken's decentralized structure, with its strong local branch presence, is well-positioned to cater to these varied preferences.

Furthermore, increasing cultural diversity within customer bases requires banks to offer multilingual support and culturally sensitive financial products. By 2025, many European cities are projected to have even more diverse populations, meaning banks must adapt their communication strategies and product offerings to resonate with a broader range of cultural backgrounds and financial needs.

Societal expectations for banks are increasingly focused on ethical conduct, transparency, and genuine corporate responsibility. Customers and the public alike are scrutinizing financial institutions more than ever, demanding accountability beyond just profit.

For Svenska Handelsbanken, which prides itself on building enduring customer relationships, maintaining robust public trust is absolutely critical. A strong reputation for integrity is a cornerstone of its business model.

In 2024, for instance, surveys indicated that over 70% of consumers consider a bank's ethical practices a significant factor when choosing a financial provider. Any instance of perceived misconduct, such as data breaches or unfair lending practices, could lead to a substantial erosion of customer loyalty and brand image.

The financial literacy of a nation's population directly influences their engagement with financial institutions and their ability to manage personal wealth. In Sweden, while general financial literacy is relatively high compared to many global averages, there remains a segment of the population that could benefit from enhanced financial education. For instance, a 2023 survey by Finansinspektionen indicated that while a majority of Swedes feel confident managing their finances, a notable portion still struggles with understanding complex financial products.

Financial institutions like Svenska Handelsbanken are increasingly recognized for their role in fostering financial inclusion and providing educational resources. The expectation is that banks will actively work to reach underserved communities, offering tailored support and accessible services. This aligns with broader societal goals of reducing financial inequality and ensuring everyone has the opportunity to participate effectively in the economy.

Svenska Handelsbanken's distinctive decentralized model, with its strong emphasis on local branches, positions it uniquely to address these sociological factors. These branches can serve as crucial hubs for delivering personalized financial advice and practical education, directly engaging with customers in their communities. This localized approach can be particularly effective in building trust and making financial services more approachable for those who might otherwise feel excluded.

Workforce Demographics and Employee Expectations

The workforce demographics for Svenska Handelsbanken are shifting, with generational differences impacting expectations. For instance, in 2024, a significant portion of the global workforce comprises Millennials and Gen Z, who prioritize purpose-driven work and continuous learning. This necessitates an adaptive approach to talent management.

Employee expectations are evolving beyond traditional compensation. In 2025, there's a heightened demand for flexible work arrangements, such as hybrid models, and robust opportunities for professional development. Handelsbanken's decentralized model, which empowers local branches, can align well with these desires, fostering a greater sense of autonomy and engagement among its staff across Sweden and its international operations.

Key workforce demographic and expectation trends for Svenska Handelsbanken include:

- Generational Diversity: Increased presence of Millennials and Gen Z in the workforce, bringing new expectations regarding work-life balance and company values.

- Demand for Flexibility: Growing employee preference for hybrid and remote work options, impacting talent acquisition and retention strategies.

- Focus on Purpose and Development: Employees seeking roles that offer a sense of meaning and opportunities for skill enhancement and career growth.

- Decentralization Advantage: Handelsbanken's structure can leverage local empowerment to meet diverse employee needs and foster a strong internal culture.

Social Media Influence and Reputation Management

Social media's pervasive reach means public sentiment and customer experiences can spread with lightning speed, profoundly shaping a bank's reputation. Svenska Handelsbanken, like all financial institutions, must vigilantly monitor and engage with online conversations to safeguard its brand image and swiftly address customer feedback. For instance, during 2024, a significant percentage of customer service interactions for banks globally began on social media platforms, highlighting the need for proactive management. This digital engagement complements Handelsbanken's established relationship-centric model.

Managing online reputation is crucial, as negative sentiment can deter potential customers and impact trust. Handelsbanken's approach to integrating digital feedback into its relationship banking strategy is key. By mid-2025, it's projected that over 60% of consumer trust in financial services will be influenced by online reviews and social media sentiment.

- Social Media Reach: In 2024, it was estimated that over 4.9 billion people globally were active on social media, a number expected to grow.

- Customer Service Shift: By 2025, a substantial portion of customer service inquiries for major banks are anticipated to originate or be amplified through social media channels.

- Reputation Impact: Studies in late 2024 indicated that a single viral negative customer experience on social media could impact a bank's customer acquisition by up to 15% in the short term.

- Digital Integration: Handelsbanken's strategy aims to leverage social media not just for crisis management but as an extension of its personal banking relationships, fostering loyalty through responsive digital interaction.

Societal expectations are increasingly focused on ethical conduct and corporate responsibility, with over 70% of consumers in 2024 considering a bank's ethics when choosing a provider. Handelsbanken's strong reputation for integrity is therefore a critical asset, as negative sentiment, amplified by social media's reach, can significantly erode trust and customer loyalty by mid-2025.

Technological factors

The digital transformation in banking is accelerating, with customers increasingly preferring online and mobile channels for their financial needs. Svenska Handelsbanken, like its peers, faces the imperative to enhance its digital offerings, from everyday transactions to more complex wealth management services, to stay competitive. For instance, by the end of 2024, it's projected that over 80% of retail banking transactions in Sweden will be conducted digitally.

This digital shift directly influences branch strategy, as footfall naturally declines. Handelsbanken's focus on an omni-channel approach ensures customers can seamlessly transition between digital platforms and physical branches, providing a consistent and convenient experience. In 2024, the bank reported a continued increase in mobile banking usage, with active users growing by 7% year-over-year, underscoring the importance of these digital investments.

As banking operations increasingly migrate online, Svenska Handelsbanken faces escalating cybersecurity threats. In 2024, the global financial sector experienced a notable rise in sophisticated cyber-attacks, with ransomware and phishing remaining prevalent. Protecting sensitive customer data and maintaining financial stability requires continuous investment in advanced cybersecurity measures and robust data encryption protocols.

Compliance with evolving data privacy regulations, such as GDPR and similar frameworks globally, is paramount for Svenska Handelsbanken. Failure to adhere to these regulations can result in substantial fines and reputational damage. By prioritizing data protection, the bank not only mitigates risks but also reinforces customer trust in its digital services.

Artificial intelligence and machine learning are rapidly transforming the financial sector, offering Svenska Handelsbanken substantial opportunities. These technologies can significantly boost operational efficiency, refine risk assessment models, and create more personalized customer interactions, while also strengthening fraud detection capabilities.

For instance, Handelsbanken can integrate AI into its credit scoring processes, enhancing accuracy and speed. Furthermore, AI-powered chatbots can automate customer service, freeing up human resources for more complex tasks. Predictive analytics, driven by machine learning, can also help anticipate market trends and customer needs, providing a crucial competitive advantage.

The strategic implementation of AI is paramount for optimizing internal workflows and maintaining a leading position in the market. By embracing these advancements, Handelsbanken can unlock new levels of performance and customer satisfaction.

Fintech Competition and Collaboration

Fintech competition is intensifying, with nimble startups offering specialized services that challenge traditional banking. For Svenska Handelsbanken, this means a need to either develop its own cutting-edge solutions or partner with these fintech innovators to integrate new functionalities. By the end of 2024, global fintech investment reached an estimated $100 billion, highlighting the sector's rapid growth and disruptive potential.

Adapting to these technological shifts is crucial for maintaining market relevance. Handelsbanken must actively monitor fintech trends to ensure its service offerings remain competitive and meet evolving customer expectations. For instance, the adoption of AI in customer service and fraud detection is rapidly becoming a standard, with many banks reporting significant efficiency gains.

- Increased Competition: Fintechs are unbundling traditional banking services, offering specialized and often cheaper alternatives.

- Collaboration Opportunities: Partnering with fintechs can allow banks to quickly adopt new technologies and expand service offerings.

- Innovation Imperative: Banks must invest in their own digital transformation to keep pace with technological advancements.

- Customer Expectations: The rise of user-friendly fintech apps sets a high bar for digital banking experiences.

Infrastructure Modernization and Cloud Computing

Svenska Handelsbanken's commitment to modernizing its core banking systems and migrating to cloud-based infrastructure is crucial for enhancing scalability, flexibility, and cost-efficiency. This technological shift is vital for supporting its vast network of over 450 branches across Sweden and other markets, ensuring seamless and reliable operations. By embracing cloud computing, Handelsbanken can accelerate the rollout of innovative financial services and bolster its data analytics capabilities, providing deeper insights into customer behavior and market trends. For instance, in 2023, the bank continued its strategic investments in IT infrastructure, aiming to streamline operations and improve digital service delivery, a trend expected to intensify through 2024 and 2025.

The modernization efforts directly address the need for robust IT infrastructure to support Handelsbanken's unique decentralized operating model. Cloud adoption offers the agility to adapt to evolving customer demands and regulatory landscapes, enabling faster deployment of new features and more sophisticated risk management tools. This strategic move is projected to yield significant operational efficiencies, potentially reducing IT operational costs by a notable percentage as legacy systems are phased out and cloud-native solutions are integrated. The bank's ongoing digital transformation initiatives underscore the importance of these technological upgrades for maintaining a competitive edge in the financial sector.

- Improved Scalability: Cloud infrastructure allows Handelsbanken to easily scale its IT resources up or down based on demand, a significant advantage for a large, geographically dispersed bank.

- Enhanced Flexibility: Modern systems and cloud adoption enable quicker adaptation to new market opportunities and regulatory changes, facilitating faster service innovation.

- Cost Efficiency: Migrating to the cloud can optimize IT spending by reducing the need for extensive on-premise hardware and maintenance, leading to potential long-term savings.

- Advanced Data Analytics: Cloud platforms provide powerful tools for data processing and analysis, enabling Handelsbanken to derive greater value from its extensive customer data for personalized offerings and risk assessment.

Technological advancements are reshaping banking, pushing Svenska Handelsbanken to enhance its digital capabilities and cybersecurity. The bank's investment in cloud infrastructure and AI is crucial for operational efficiency and customer service. By 2025, it's anticipated that over 85% of banking transactions in Sweden will be digital, highlighting the need for robust online platforms.

The rise of fintechs presents both challenges and opportunities, necessitating strategic partnerships or in-house innovation. Handelsbanken's focus on an omni-channel approach, supported by increased mobile banking usage, demonstrates its adaptation to evolving customer preferences. In 2024, mobile banking users grew by 7%, underscoring this trend.

Cybersecurity remains a critical concern, with global financial institutions facing increasing threats. Handelsbanken's commitment to data protection and compliance with regulations like GDPR is vital for maintaining customer trust and financial stability. The bank's strategic IT modernization aims to improve scalability and cost-efficiency, supporting its extensive branch network and data analytics capabilities.

Legal factors

Svenska Handelsbanken navigates a complex web of banking regulations, primarily overseen by the Swedish Financial Supervisory Authority (Finansinspektionen) and the European Banking Authority (EBA). These stringent rules, including evolving Basel III and upcoming Basel IV capital requirements, directly influence the bank's capital allocation and risk management strategies. For instance, as of the first quarter of 2024, Handelsbanken reported a Common Equity Tier 1 (CET1) ratio of 19.6%, comfortably above regulatory minimums, demonstrating its robust capital position within this framework.

Svenska Handelsbanken, like all financial institutions, must navigate a complex web of anti-money laundering (AML) and know your customer (KYC) regulations. These laws mandate rigorous customer identification, ongoing transaction monitoring, and the reporting of suspicious activities to combat financial crime. Failure to comply can result in significant legal penalties and damage to the bank's reputation.

In 2023, European banks collectively faced billions in AML fines, highlighting the critical importance of robust compliance programs. Handelsbanken's ongoing investment in advanced compliance technology and comprehensive employee training is therefore essential to mitigate these substantial legal and reputational risks. This proactive approach ensures adherence to evolving regulatory landscapes.

Svenska Handelsbanken must navigate a complex web of data privacy and consumer protection laws, with the EU's General Data Protection Regulation (GDPR) being a prime example. This regulation mandates stringent controls over how customer data is handled, from collection to deletion, and non-compliance can result in substantial penalties. For instance, in 2023, the Irish Data Protection Commission fined a major tech company €1.2 billion for GDPR violations, highlighting the potential financial risks for any organization, including banks.

Beyond data privacy, consumer protection laws are critical. These laws ensure fair practices in lending, require transparency in all financial products, and establish clear processes for resolving customer disputes. Adherence to these regulations is not just about avoiding legal repercussions; it is fundamental to maintaining customer trust and the bank's reputation in the competitive financial services landscape.

Competition Law and Market Concentration

Competition laws are crucial for the financial sector, aiming to prevent monopolies and foster a fair playing field. Regulators actively scrutinize mergers, acquisitions, and market behaviors to uphold these principles.

Svenska Handelsbanken, with its significant presence, particularly in Sweden, must navigate these regulations meticulously. Ensuring its operations and market conduct are fair and do not hinder competition is paramount.

- Market Share: As of early 2024, Handelsbanken held a substantial share of the Swedish banking market, necessitating close regulatory oversight to prevent anti-competitive practices.

- Regulatory Scrutiny: European competition authorities, including the European Commission and national bodies, regularly assess banking sector consolidation and market power.

- Merger Controls: Any future mergers or acquisitions involving Handelsbanken would be subject to stringent review under EU and Swedish competition law to ensure they do not create undue market concentration.

Contract Law and Dispute Resolution

Contract law forms the bedrock of all financial services, dictating the terms of Svenska Handelsbanken's relationships with its diverse stakeholders, from individual customers to corporate partners and its own workforce. Ensuring these agreements are not only robust but also legally enforceable is paramount to the bank's stability and operational integrity.

The effectiveness and efficiency of dispute resolution mechanisms, whether through traditional court proceedings or alternative methods like mediation and arbitration, directly influence the bank's financial exposure and operational expenditures. For instance, the average cost of commercial litigation in Sweden can range significantly, impacting risk management budgets.

- Contractual Compliance: Svenska Handelsbanken must adhere strictly to Swedish contract law and relevant EU regulations to safeguard its customer agreements and supplier relationships.

- Dispute Resolution Costs: The bank's exposure to litigation or arbitration can lead to substantial legal fees and potential damages, influencing its operational cost structure. In 2023, the Swedish judiciary handled over 100,000 civil cases, highlighting the prevalence of legal disputes.

- Regulatory Enforcement: Non-compliance with contract law can result in regulatory penalties and reputational damage, underscoring the importance of meticulous legal oversight.

- Alternative Dispute Resolution (ADR): The bank's strategic use of ADR can offer cost-effective and faster resolutions compared to traditional litigation, contributing to better risk management.

Svenska Handelsbanken operates under a strict legal framework, including capital adequacy rules like Basel III and upcoming Basel IV. As of Q1 2024, its CET1 ratio was 19.6%, well above regulatory minimums, showcasing strong compliance.

The bank must also adhere to robust Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, crucial for combating financial crime. Given that European banks faced billions in AML fines in 2023, Handelsbanken's investment in compliance technology and training is vital.

Data privacy laws, particularly GDPR, significantly impact how Handelsbanken handles customer information. Non-compliance carries substantial risks, as evidenced by a €1.2 billion GDPR fine levied on a major tech company in 2023.

Consumer protection laws ensure fair practices and transparency in financial products, building customer trust. Contract law governs all relationships, with dispute resolution costs, such as those stemming from over 100,000 Swedish civil cases in 2023, impacting operational budgets.

Environmental factors

Climate change presents significant risks and opportunities for Svenska Handelsbanken. Physical risks, like extreme weather impacting collateral value, and transition risks, stemming from new regulations or market shifts towards greener industries, are increasingly critical considerations. For instance, the European Central Bank's 2024 climate stress test highlighted the potential impact of climate-related events on bank portfolios, a factor Handelsbanken must actively manage.

There's a growing imperative for Handelsbanken to embed climate risk assessments into its lending processes and to bolster its sustainable finance offerings. This includes expanding products like green bonds and sustainability-linked loans, which align with the EU's Taxonomy Regulation and growing investor demand. In 2023, the green bond market continued its robust growth, with issuance expected to remain strong through 2024, presenting a clear avenue for Handelsbanken's expansion.

The bank's adherence to Environmental, Social, and Governance (ESG) principles faces heightened scrutiny from investors, regulators, and the public. Demonstrating tangible progress in climate action, such as reducing financed emissions and increasing sustainable investments, is paramount for maintaining stakeholder trust and competitive positioning in the evolving financial landscape.

Regulators and stakeholders are increasingly demanding clearer insights into Svenska Handelsbanken's environmental, social, and governance (ESG) performance. This push for transparency means the bank must navigate and adhere to evolving reporting standards, like the EU Taxonomy and the Corporate Sustainability Reporting Directive (CSRD). These regulations require detailed disclosures about the bank's environmental footprint and its involvement in sustainable initiatives.

Compliance with these rigorous ESG reporting requirements is crucial for Svenska Handelsbanken. For instance, the CSRD, which came into full effect for large companies in 2024, mandates extensive reporting on sustainability matters, including climate-related risks and opportunities. By providing accurate and comprehensive data, Svenska Handelsbanken can bolster its reputation and appeal to a growing segment of responsible investors who prioritize sustainability in their investment decisions.

Concerns about resource scarcity, especially for energy and water, directly impact Svenska Handelsbanken's operating expenses and the sustainability of its physical presence, notably its large branch network. For instance, rising energy prices in 2024 and 2025 will continue to put pressure on the utility costs for its buildings.

Handelsbanken is actively working to reduce its environmental footprint. This involves initiatives to cut down energy use, waste generation, and emissions across its daily operations, aiming for greater efficiency in its extensive branch network and data centers.

The bank is investing in greening its office buildings and data centers to improve energy efficiency. This focus on sustainability is crucial as regulatory pressures and investor expectations for environmental, social, and governance (ESG) performance continue to grow in the European banking sector.

Reputational Risk from Environmental Incidents

Svenska Handelsbanken faces significant reputational risk tied to public perception of its environmental responsibility. Negative press or customer backlash stemming from investments in environmentally harmful industries can erode brand trust and loyalty. For instance, a 2024 report highlighted that 65% of consumers are more likely to bank with institutions demonstrating strong environmental, social, and governance (ESG) practices.

The bank must proactively manage its lending portfolio to mitigate damage. This involves rigorous assessment of the environmental impact of financed projects and ensuring these align with Handelsbanken's stated sustainability commitments. Failure to do so could lead to a decline in customer acquisition and retention, impacting overall financial performance.

- Brand Image: Public trust is paramount; negative environmental associations can tarnish Handelsbanken's reputation.

- Customer Loyalty: A growing segment of customers, estimated at over 60% by some 2024 surveys, prioritizes banking with environmentally conscious institutions.

- Portfolio Assessment: Continuous evaluation of lending practices against environmental standards is crucial for risk mitigation and maintaining stakeholder confidence.

Transition to a Green Economy and Investment Opportunities

The global transition to a green economy presents substantial investment avenues in sectors like renewable energy, sustainable infrastructure, and green technologies. For instance, by the end of 2023, global investment in clean energy reached a record $1.7 trillion, a 17% increase from 2022, highlighting the scale of this economic shift. Svenska Handelsbanken is well-positioned to facilitate this transition by offering financing for environmentally conscious projects and developing innovative financial products and services tailored to the green sector.

By aligning its operations with these evolving societal priorities, Svenska Handelsbanken can unlock new revenue streams and solidify its market standing. The bank's commitment to sustainability can attract environmentally conscious investors and clients, further enhancing its brand reputation.

- Global clean energy investment: Reached $1.7 trillion in 2023, up 17% from 2022.

- Renewable energy growth: Solar and wind power capacity additions are projected to grow significantly in the coming years, driven by policy support and cost reductions.

- Sustainable finance market: The green bond market, a key instrument for financing eco-friendly projects, saw issuance of over $600 billion in 2023.

- ESG investing trends: Assets under management in Environmental, Social, and Governance (ESG) funds continue to rise, indicating strong investor demand for sustainable investments.

Climate change and environmental regulations present both risks and opportunities for Svenska Handelsbanken. The bank must navigate physical risks from extreme weather and transition risks associated with a greener economy, as highlighted by the European Central Bank's 2024 climate stress tests. Increasing investor and regulatory demand for ESG transparency means Handelsbanken must adhere to evolving reporting standards like the CSRD, which became fully effective for large companies in 2024, ensuring detailed disclosures on its environmental impact.

The global shift towards sustainability offers significant investment opportunities in renewable energy and green technologies, with global clean energy investment reaching $1.7 trillion in 2023. Handelsbanken can capitalize on this by financing eco-friendly projects and developing green financial products, aligning with growing customer preference for environmentally conscious institutions, as indicated by 2024 consumer surveys showing over 60% favor such banks.

| Factor | Impact on Handelsbanken | Data/Trend |

|---|---|---|

| Climate Change Risks | Physical and transition risks impacting collateral and operations. | ECB 2024 climate stress tests highlight potential portfolio impacts. |

| Regulatory Compliance | Adherence to ESG reporting standards (CSRD, EU Taxonomy). | CSRD fully effective for large companies in 2024. |

| Green Economy Opportunities | Financing renewable energy and sustainable projects. | Global clean energy investment hit $1.7 trillion in 2023. |

| Consumer Preference | Demand for environmentally conscious banking. | Over 60% of consumers favor ESG-focused institutions (2024 surveys). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Svenska Handelsbanken draws from a robust blend of official Swedish government data, European Union economic reports, and leading financial market intelligence platforms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.